Good morning, it's Paul here.

Apologies, I ran out of time & mental bandwidth yesterday afternoon, and couldn't finish the section on VP Group.

7-8am quick views

Card Factory (LON:CARD)

Card Factory, the UK's leading specialist retailer of greeting cards, dressings and gifts, announces a trading update for the quarter ended 30 April 2019 to coincide with its Annual General Meeting to be held later today.

I reviewed the most recent accounts (FY 01/2019) here, concluding positively that this is a highly cash generative, good quality business, paying excellent & sustainable (in my view) high dividends. Stockopedia's computers like it too - a high StockRank of 94.

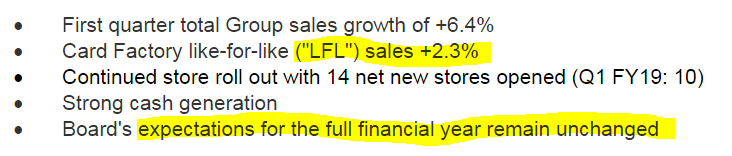

Key points are self-explanatory;

Weak prior year comparator period - how refreshing to see a company be honest, and admit this in an RNS. This boosts my level of trust in management.

- Total 979 stores - must be nearing saturation in the UK? Maybe not, as 50 new stores planned for this year

- CardFactory.co.uk - good start to the year (no figures given)

- Getting Personal - still struggling

- Net debt of £151.3m up 2.4% on a year earlier

Outlook comments sound reassuring;

Card Factory has seen a positive start to the year. Considering the uncertain macro outlook and the continuation of challenging consumer conditions, and with the key trading periods still to come, the Board expects LFL sales for the year to be marginally positive, with full year profit expectations remaining unchanged....

"Overall, Card Factory remains in a strong position, continuing to grow market share, with lessening cost headwinds and a platform for medium term growth."

My opinion - it's clearly doing something right, to be generating positive LFL sales, in an environment of falling shopper footfall (although that's likely to stabilise at some point, we just don't know when).

I particularly like the comment about "lessening cost headwinds"

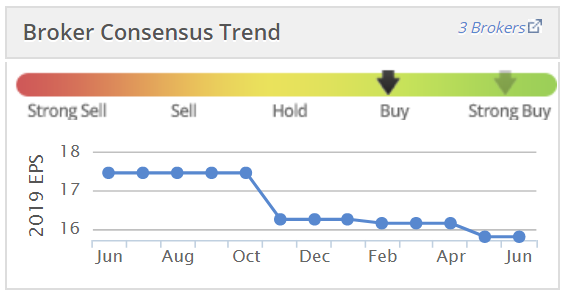

Valuation - at 193p currently, the PER is just over 11. That feels good value, for a robust business paying a big divi yield. Although how much upside is there, given that earnings have been falling in recent years? EPS was c.20p in 2015-2018, but now seems to have settled around 17p (2019 actual, and 2020-21 forecast).

The main reason to hold is for the excellent divis. I continue to believe these are sustainable, from excellent cashflows.

This business is clearly a strong survivor on the high street, and should benefit from falling rents on lease renewals, offsetting other cost increases.

A thumbs up from me. I don't hold personally, as I only see limited potential upside on the share price. For income seekers however, it makes more sense to hold this long term.

Main report

Intercede (LON:IGP)

Share price: 40p (up c.7% today)

No. shares: 50.5m (potential 7.3m additional shares if convertible loans convert into equity)

Market cap: £20.2m

(at the time of writing, I hold a long position in this share)

Intercede, the leading specialist in digital identity, credential management and secure mobility, today announces its preliminary results for the year ended 31 March 2019.

This is one of my favourite shares, so I've spent most of the morning poring over its results statement. There's tons of positive stuff in the commentary. I might publish my annotated copy of the results statement, to save typing it all up.

Key financial points;

- Revenues up 10% to £10.1m

- Costs slashed, as new product development refocused on core product

- Very convincing turnaround, as profit after tax of £528k reported, compared with an equivalent loss of £3.8m last year.

- Profit after tax is the most meaningful number, due to nearly £1.0m in R&D tax credits being received each year, a highly material benefit

To simplify things, here's my bull/bear summary;

- Bull points

- Amazing quality of clients - hence validating quality of product

- New mgt (Apr 2018 new CEO) delivering ahead of plan - moved into profit a year early

- Development spend of £2.85m all expensed through P&L, none capitalised

- Recurring revenues about half of total. Forecast by broker at £6.3m in FY 03/2020

- Geographic expansion underway - first orders in S E Asia through partner, more expected

- Experts in a specialist niche - 1,000 man years of experience

- Takeover potential from USA - which is 69% of total sales. See below for sample customers - astonishing for a tiny AIM-listed company with only £20m market cap

- Priority under new management is sales/profit growth

- Computer security is a great space to be in - as many organisations need to address data breaches through weak passwords

- Forecasts look modest to me - scope to exceed expectations, judging from very positive narrative today

- New management credibility enhanced, by over-delivering on their plan to date

- Operational gearing - gross margin is almost 100%, so explosive upside if sales really start to grow strongly. That may not happen of course, and there have been false dawns before

- Major customers placing follow-on orders, which proves the product & service are good

Bear case

- False dawns before - revenues rose, but then fell backwards a few years ago

- Balance sheet receivables look high - I will do more checking on this

- Convertible loans are a nuisance, c.£5m debt effectively. Interest cost is 8%, payable quarterly. Conversion price (at option of holder) is 68.8125p. Repayable Dec 2021, so not an immediate issue, but would be nice to get these paid off

- Lumpy licence revenues, makes profit potentially volatile

- Large contract win on last day of financial year - without this, figures would have looked poor

- Highly illiquid shares - hence very difficult to get in or out

- "A number of challenges remain", and "distractions that have interfered with this focus in recent past" - what does this mean, and what are these unspecified problems?

Client list - Intercede products are deployed in 90 places worldwide. So a fairly focused product, with major organisations. Check out the astonishing list of clients below, reported in today's RNS. This is the main reason I bought Intercede shares some time ago;

Sample Customers:

US Department of Homeland Security

Boeing

Wells Fargo

Deutsche Telekom

Kuwait Public Authority for Civil Information

Airbus

US Nuclear Regulatory Commission

Booz Allen Hamilton

US Social Security Administration

Lockheed Martin

United Health Group

Northrop Grumman

UK Government Ministry of Defence

ANZ,

Handelsbanken

REWE

BASF

Coutts

Australian Government Department of Defence

Swedbank

RDW

US Federal Aviation Administration.

Given the above, I'm amazed a larger (probably American) software group hasn't bought Intercede. If that happened, it could be at a big premium - that's what I'm hoping for!

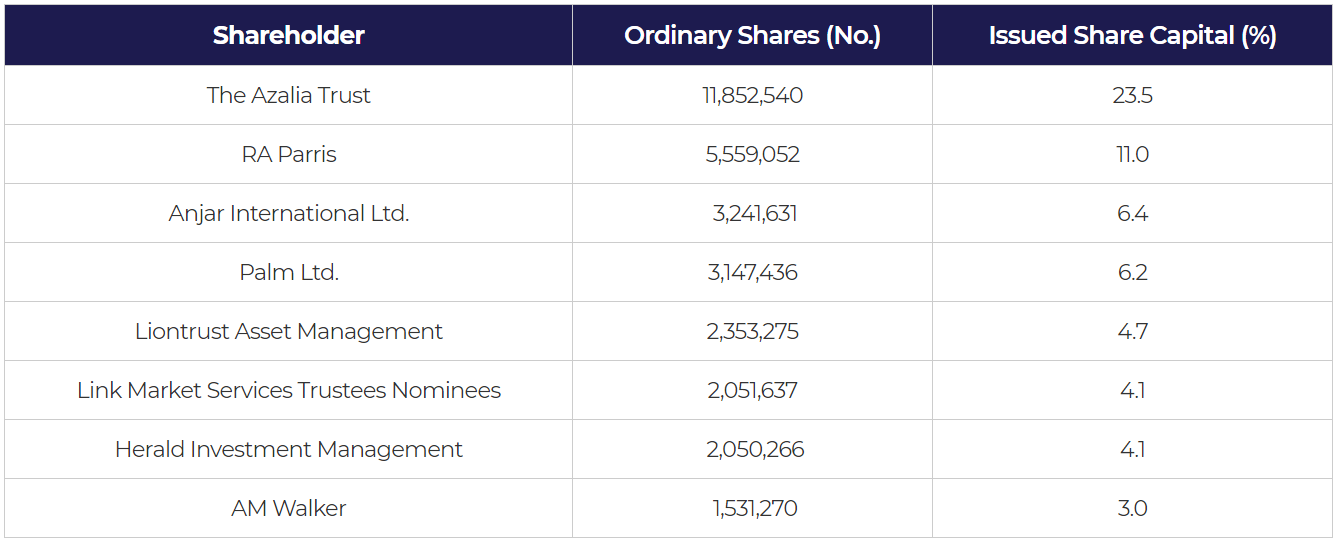

Shareholders - 63% of the shares are held by >3%, as shown below. This is from the company's website, updated on 18 Feb 2019;

The Azalia Trust - largest shareholder - is connected to a Director, Jacques Tredoux.

RA Parris is the founder, and former boss.

The above shareholdings structure ensures that nobody could swoop on the company and buy it on the cheap.

My opinion - I'm very pleased with the progress made to date.

It's obviously a higher risk share, due to lumpy revenues, lack of liquidity (which means you can't easily get out, if something goes wrong). However, it's the upside potential that really interests me. You only have to look back on the chart, to see the valuation this company commanded when it was delivering strong growth. New management seems to have a credible plan to get things back on track, and that amazing client list seems unique for a company this small.

It doesn't need to raise cash any time soon, so all in all, I think this could potentially be very interesting.

10-year chart below. Bear in mind that the share count has only risen about 10% since 2013, so if things go really well, c.200p could be possible again, perhaps? What are the chances of that happening? No idea! That depends how well (or not) the management execute.

** BREAKING NEWS **

GAME Digital (LON:GMD)

Lowball takeover bid from Sports Direct, at 30p.

They've acquired a block of shares, and now own 38.49% of the company. So going over 30% has triggered a bid under the takeover rules.

It says this is final, and the offer price won't be increased.

This is a lousy price, and means that, if successful, Sports Direct will get all the upside from the new BELONG format.

I speculated about Sports Direct buying the whole thing some time ago, but didn't imagine the offer price would be as low as 30p.

I imagine this bid could succeed, as there must be plenty of stake bulls, who would welcome a liquidity event to dispose of larger holdings that can't be sold through the market, due to lack of liquidity.

Pity, as the new BELONG format looked quite good.

A higher competing offer looks extremely unlikely, as Sports Direct has a blocking shareholding effectively, plus is intertwined with GMD on the JV re BELONG store roll out.

Therefore the logical thing to do, in my view, would be to accept the 30p offer.

Flowtech Fluidpower (LON:FLO)

Many thanks to reader "Luthrin" who flagged up a trading update from this group, released annoyingly during market hours, at c.08:46. This is a very annoying practice, which some companies adopt, in an attempt to issue the news simultaneously to the market, and the people actually at the AGM.

Since most small cap AGMs might only have 1 or 2 shareholders physically present, it makes no sense at all to inconvenience the thousands of other shareholders by announcing a trading update when most will be busy doing other things, and may not see it.

I know a lot of PRs and brokers read my reports, so please would you all urge clients to put out trading updates at 07:00 only. If a profit warning may be necessary, then urge clients to hold the board meeting, and inform the broker, after the market has closed. Then issue the RNS in the morning, at 7 am.

Back to FLO. Today is says;

"I am pleased with the progress that the new Management team has made in 2019. The focus on cost and working capital management combined with investing in our people and systems is clearly proving to be an appropriate strategy to adopt. This will provide a platform for our future growth ambitions, both through organic means and, at an appropriate time, further suitable acquisition activity.

In our Q1 trading update released in April we reported that revenue during the first three months of the current year increased by 14%, 4% of which was through organic means. The business has continued to achieve organic growth in the subsequent two-month period.

The Directors remain confident about the future; we expect our underlying performance to deliver another year of solid progress and we look forward to providing our next Trading Update for Q2 in early July. Overall our trading is in line with market expectations."

That sounds fine. A cynic might point out that the second paragraph doesn't state what level of organic growth is was achieved in the most recent 2 months.

In line with expectations is nice, but the bar has been lowered several times;

My opinion - I reviewed the last full year figures in some detail here on 16 Apr 2019.

Nothing much has changed since then.

Jolly good, that's me done for the day. See you tomorrow!

Regards, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.