Good morning, it's Paul here with the SCVR for Wednesday.

Timing - I've started early again today, so should be mostly done by 1pm. Today's report is now finished.

Agenda -

Headlam (LON:HEAD) - operational update - business as usual

Topps Tiles (LON:TPT) - Q1 (13 wks to 26 Dec 2020) trading update

Clipper Logistics (LON:CLG) - slightly confusing trading update

.

US Senate Elections

I was up most of the night following the US Senate elections in Georgia, because that could be important for the US market, determining whether President Biden is able to push through massive stimulus & infrastructure programs, and tax rises for companies & the wealthy. Or whether a Republican Senate could block or tame his policies. Opinion seemed to be divided amongst US commentators, on which outcome would be good for the economy and stock markets, so I ended up retiring rather confused.

Monthly GDP - UK

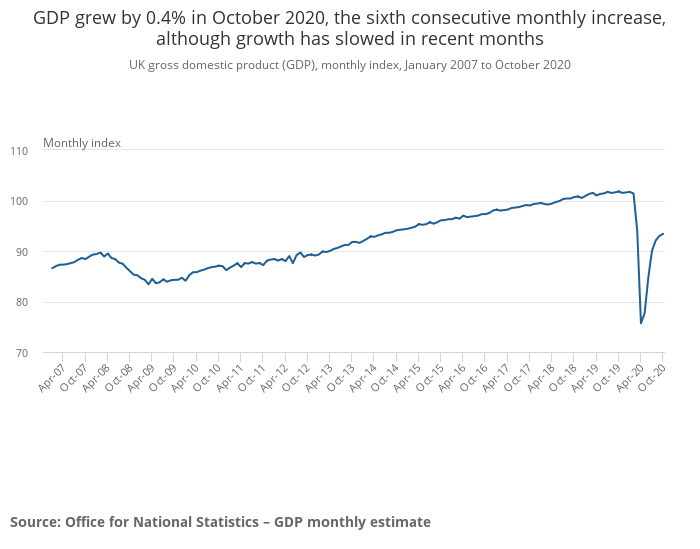

Whilst browsing the ONS website last night, waiting for something to happen in America, I happened to come across an interesting graph (see below) re UK GDP, measured monthly. This runs from Jan 2007 to Oct 2020.

You can see the first dip for the financial crisis from mid-2008 to mid-2009. Compare that with the unprecedented stoppage of the economy due to covid/lockdown 1, in early 2020, with a massive plunge down in GDP, with about a quarter of GDP vanishing from high to low.

.

However, the graph then more recently clearly shows a V-shaped recovery in GDP. It wasn't all the way back up by end Oct 2020 (where the data runs out), but it had recovered most of the way.

I admit to being sceptical about the possibility of a V-shaped recovery, back in mid-2020, but I was wrong, and a V-shaped recovery is what has actually happened. That's what the stock market recovery told us would happen, and the market was right. I wish I'd looked more closely at GDP data last summer, as that might have stopped me continuing to fruitlessly short the indices over summer 2020, which was an expensive mistake (albeit funded by profits from earlier very effective hedging).

As mentioned yesterday, it's always better to focus on what is actually happening, rather than having a theory as to what should happen, and blindly sticking to that conviction.

Lockdown 3

Is bound to have some negative impact on GDP early this year, before it should bounce back again as restrictions are eased. I'm not at all convinced by the prophets of doom. To my mind, mass vaccinations are such a game-changer, that my base case scenario is for an easing of restrictions in Mar/Apr 2021, and then a strong recovery as pent-up demand is released. That comes with the caveat that I reserve the right to change my mind at any time, if the facts or probabilities change.

The big danger is a virus mutation that negates vaccines. We need to keep alert to that. If virus numbers start going up again after having initially fallen by say March/April 2021, then I wouldn't hesitate to put on another index short, as a hedge, and ask questions later.

It will be very interesting to see what companies say about how they are handling lockdown 3. As mentioned yesterday, aside from sectors which are most distraught (hospitality/leisure, non-essential retailers, and travel), most other sectors know the drill by now, and should be able to continue trading without too much disruption. Hence this really should be a lot less severe than lockdown 1, when stoppages were much more widespread.

Quantative Easing & MMT (Modern monetary theory)

Government is continuing to throw money around in an astonishing way, all funded by QE of course. Hence the many people saying that we are cursing future generations to huge debts, are completely wrong, if you check the facts.

.

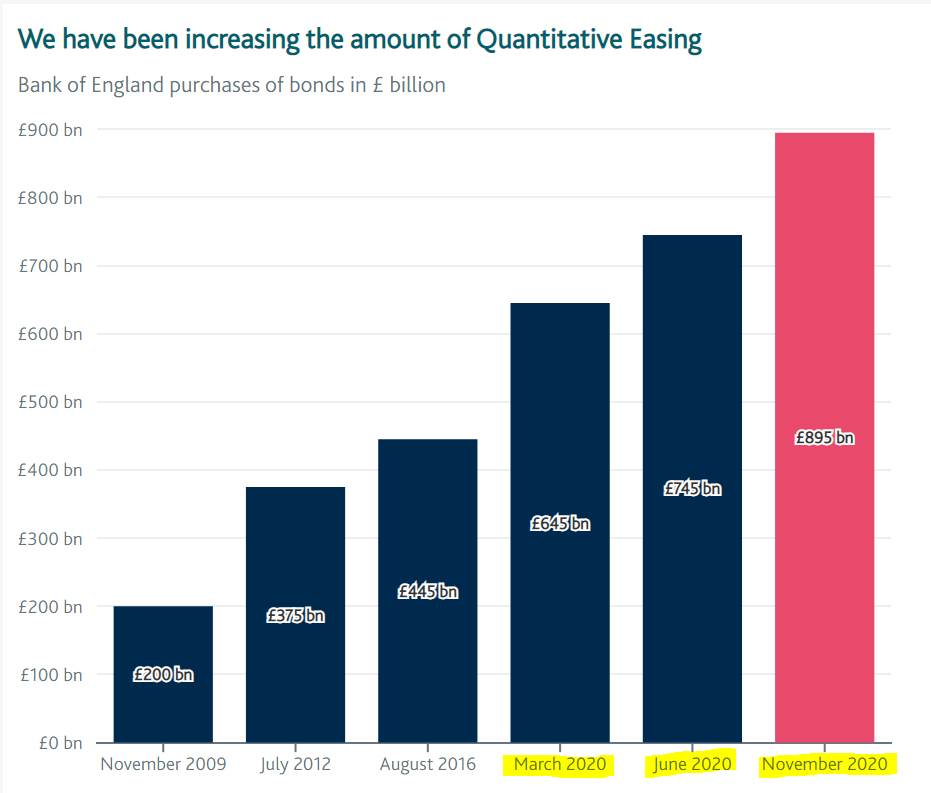

.

This graph from the Bank of England's website shows all QE to date (electronic sterling created out of thin air). It shows a steady progression, but that's misleading because the x-axis has been compressed. I've highlighted the dates. As you can see, the BoE did £450bn of QE in 2020, after covid had emerged. That's roughly the same as forecasts for the current fiscal year's deficit. In other words, the massive covid spending has cost future generations precisely zero. All Gilt issuance have been funded by money printing.

Hardly any journalists, commentators, or politicians seem to understand this, but it's utterly crucial. At this point in time, we do not have to worry about the National Debt at all. In fact, it is not £2,100bn, or almost 100% of GDP as reported in yesterday's papers. If you take off the £895bn of Gilts owned by the Bank of England (a branch of Govt, since it was nationalised just after WWII), then Gilts outstanding are actually relatively manageable at £1.2 trn, or about 60% of GDP.

The servicing cost is getting cheaper all the time too, as new Gilts are issued to roll over old ones, the interest rate on the new ones is ultra-low. Given that the Govt is buying up all of its own newly issued debt, then it can set the interest rate at whatever it likes. Market sentiment towards Gilts doesn't actually matter. Therefore, as long as QE keeps working, then we don't have to worry about interest rates rising either. What a bizarre situation, but that's the current reality. I might as well throw away all my old economics textbooks, because something different is happening right now.

It's quite obvious from their actions that the Treasury, Bank of England, and Rishi Sunak all understand Modern Monetary Theory, and are happy to print as much money as is needed. I'll come back to the topic of MMT in future reports, as it's fascinating. The boss, Ed, got me to read "The Deficit Myth" by Stephanie Kelton, as an introduction to MMT. It's a riveting, and sometimes infuriating read! Hence highly recommended, as it challenges everything I thought I knew about economics.

I'm not yet a convert to MMT, but Kelton makes a very strong case for it, and so far, it is working in the real world. She's right that the entire National Debt could be extinguished instantly, by creating enough QE to buy up the whole lot! That is undeniably true. I had already worked that out myself, and pointed it out here last year when commenting on QE. Hence why should we worry about Govt debt?

I do worry about future inflation though, as that could bring the whole thing down in ruins, as reckless money printing has in the past (e.g. Weimar Germany, Zimbabwe, and many others).

More on the topic of MMT & QE in the future, as it's fascinating, and very much sets the scene for continued bullish stock markets. Who knows, at some point maybe mainstream journalists might start to understand the subject matter they write about? No sign of that yet though. Alarmist headlines & articles about supposedly ballooning national debt play to the crowd better maybe?

Kelton makes this point very well in her book, describing a meeting she had with a US Senator, in her role as an economic adviser. After much effort, she persuaded the Senator of the reality that currency-issuing Govts could run deficits without having to worry about how to fund them, within reasonable limits (the productive capacity of the economy being the limiting factor - go beyond that, and it triggers inflation). The Senator agreed with her analysis, but then bluntly told her he couldn't possibly sell that message to the electorate! Hence the narrative has to remain about being careful in managing the finances, not being reckless, balancing the books, etc. That's what electorates want to hear. What Govts are actually doing, is the complete opposite of what they're saying! MMT is clearly already Government policy in most major economies now, but Govts don't dare to tell their electorates! I wonder if we'll see some highly publicised, but economically trivial tax rises, to keep the narrative of fiscal prudence going for electoral purposes?

.

Headlam (LON:HEAD)

Share price: 372p (up 4%, at 08:17)

No. shares: 85.1m

Market cap: £316.6m

(I hold)

Headlam Group plc (LSE: HEAD), Europe's leading floorcoverings distributor, confirms that its operations in the UK and Continental Europe affected by current lockdowns will remain open for the duration of the lockdown periods.

There's a bit more detail in this announcement, which can be summarised as saying that the business will continue operating as normal.

Trading update - to be published on 21 Jan 2021.

My opinion - this is a smashing value share I reckon. See the archive for my previous comments. In a nutshell, it has a lovely balance sheet with tons of freehold property. Also the business model is sound - an outsourced warehouse/distributor for carpet retailers, which can't possibly carry large ranges of carpets themselves. It should return to EPS of pre-covid levels, c.30-40p with patience, which makes the shares look cheap at probably about 10x recovered earnings. At this valuation, I can imagine a bidder might try to grab it, so it's high up my list of possible takeover targets.

I'm generally ignoring broker forecasts at the moment, and instead valuing companies usually on their pre-covid earnings, because I think there's likely to be a full recovery in time. Or adjusting those historic earnings, if something has changed (e.g. disposals/acquisitions, deep cost-cutting, etc).

Historically, Headlam has paid generous dividends. Hence buying now should lock in a good, growing, sustainable yield. A good share for income seekers I reckon.

As always, I've no idea what the short term share price is likely to do, but I give this share a thumbs up, for people who want to own a solid business long-term, with secure finances, at an entry point that I still view as attractive. As always, that's just my personal opinion, it's up to you to do your own research.

In the short term, I imagine that HEAD's customers are likely to be impacted by lockdown, but that's probably only a few months, and we've seen that home improvements are an area that has been boosted by previous lockdowns.

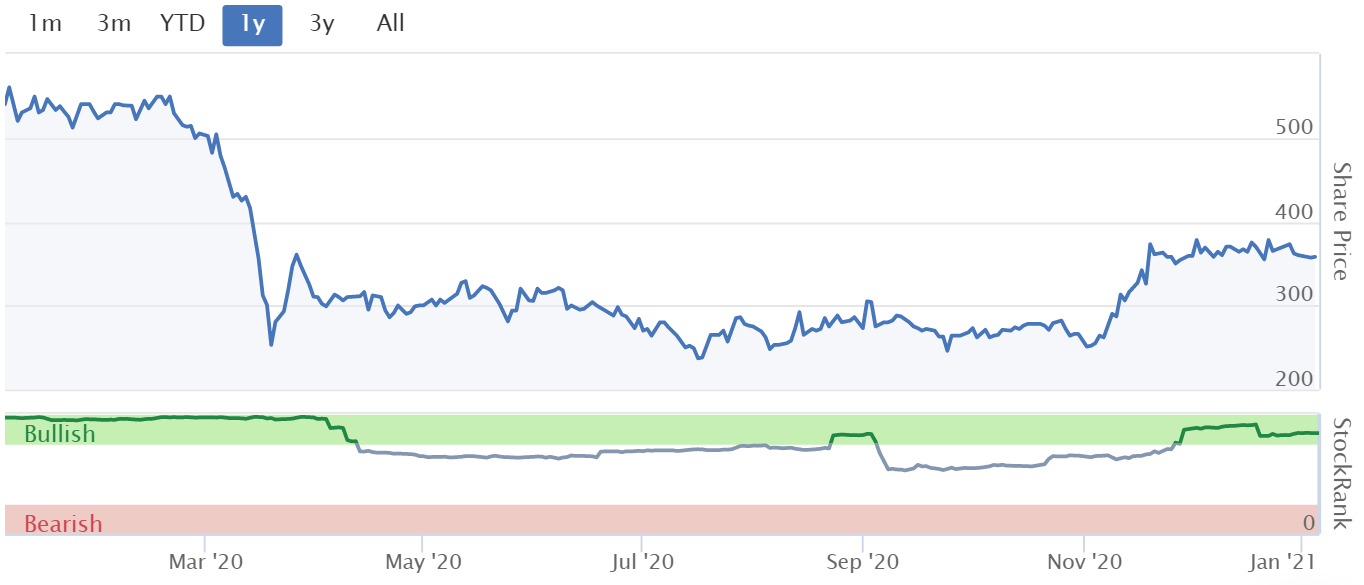

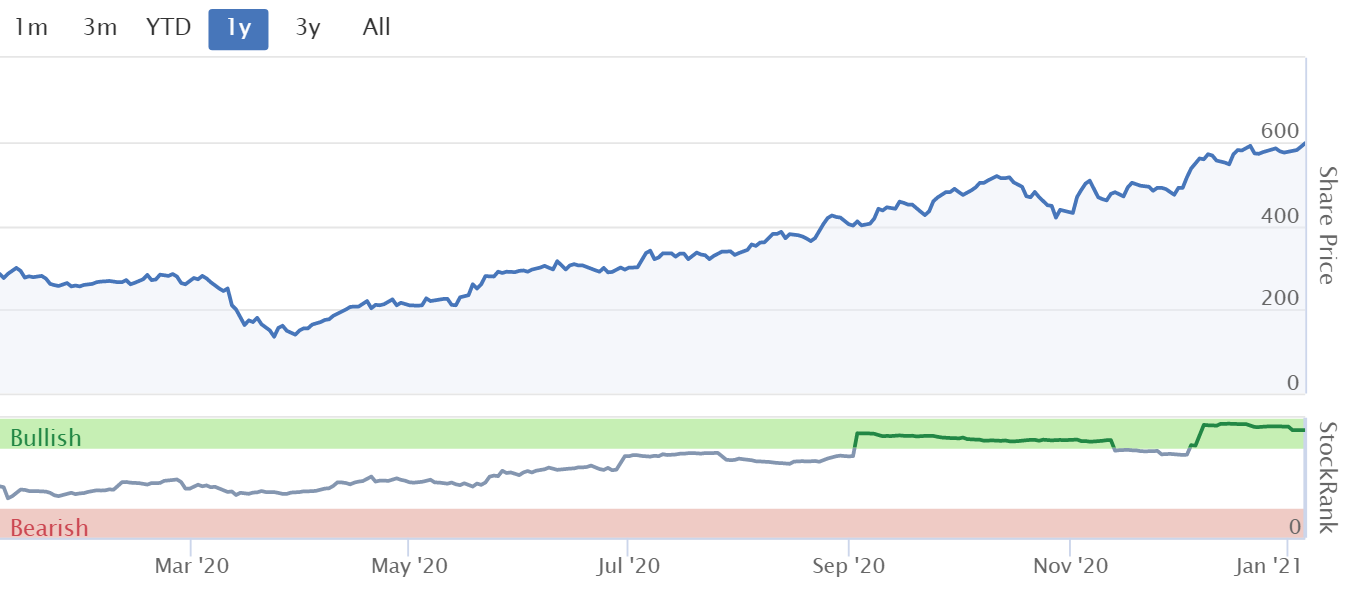

It seems to me that this share should, in time, recover to pre-covid levels, which could give us 50% upside from here. I really don't understand why it has lagged behind other cyclical shares, with a rather muted recovery, as you can see from the 1-year chart below. Possibly some catching-up might occur at some stage?

.

.

Topps Tiles (LON:TPT)

57.6p (flat, at 09:27) - mkt cap £112m

Topps Tiles Plc ("Topps" or the "Group"), the UK's leading tile specialist, announces a trading update for the 13 week period ended 26 December 2020.

To refresh my memory, here are my notes from the year end (FY 09/2020) trading update, published on 30 Sept 2020.

It’s so difficult to interpret trading updates at the moment, because of lockdowns coming & going, different in various regions, etc. Closures then may result in pent-up demand, hence a rebound in trading afterwards.

Q1 (Oct, Nov & Dec) trading reported today looks strong -

Retail like-for-like sales increased by 19.9% in the first 13 weeks of the current financial year (2020: decreased by 5.4%), with good growth in sales across both of our main customer groups, professional fitters and homeowners

Current lockdown -

TPT can continue to trade, as its products are exempt from closure - good

Although this bit worries me, as it sounds a bit over-zealous. I wonder who has given them the advice? Surely letting customers browse the aisles, but restricting numbers, would be safe, but not damage business so much?

However, under the current lockdown rules for England we are currently being advised to close our tile aisles in stores to prevent browsing. Customers can transact at the trade counter or through our online channel with direct delivery or click & collect.

We expect to see an impact on sales during the period of tighter restrictions and trading margins will come under some pressure due to the additional delivery costs associated with higher levels of online sales….

While the latest lockdown restrictions will impact sales, at this stage it is very difficult to estimate the level of impact or how long this may last.

Commercial sales - “more protracted recovery” than the core business. Performance is in line with plan, and expecting to make progress in 2021. Optimistic medium term. So this potential growth area doesn’t look madly exciting for the time being anyway.

Balance sheet update sounds quite good. I’m happy with the balance sheet at Topps. It’s not brilliant, but I think it’s adequate to get through another tough patch likely in Jan-Mar 2021. Last reported NAV was only £14.1m, but that’s hurt by IFRS 16 entries which net off to a deficit of £(17.9)m. Eliminating the IFRS 16 entries, takes NTAV up to £32m, which I think is adequate.

My opinion - I’m not sure about TPT. I’d say there’s no insolvency risk, so it’s safe, and it has demonstrated the ability to trade through more difficult conditions in lockdown 1. It didn’t need to raise fresh equity in 2020, which is an important point, unlike some others (e.g. Dfs Furniture (LON:DFS) ) which had to dilute shareholders in order to keep going.

Its target of increasing market share from 17% to 20% by 2025 doesn’t sound very ambitious to me. Maybe it’s a mature business, that could be near to the maximum market share it’s realistically possible to achieve?

Are online competitors a threat? After all, buying tiles just needs a sample of 1 tile sent through the post, tiles are not really like a sofa where customers need to touch & sit on it, to feel the quality.

It’s got a strong Q1 in the bag (Oct-Dec 2020), and it sounds like Q2 is likely to be poor. Then probably a rebound in Q3 & Q4, possibly? That seems a likely outcome to me.

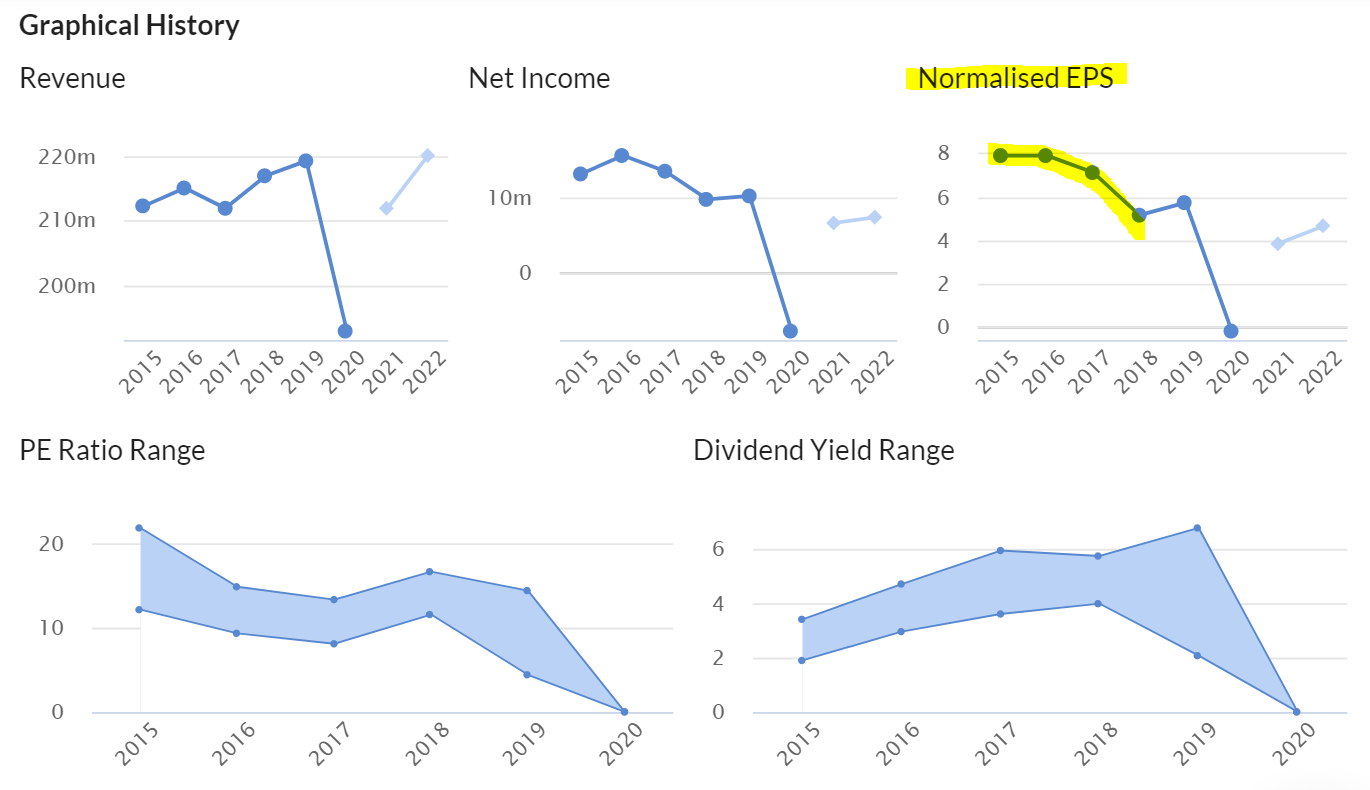

The trouble is, TPT was under pressure before covid, EPS was declining. Therefore it’s difficult to get excited about it. Sure, earnings should recover from the losses of FY 09/2020, but I don’t see anything much exciting happening after that. Possibly back to 5-7p EPS in future if we’re lucky?

There could be some medium term upside on the share price, but I think there might be better opportunities elsewhere. Hence I’m fairly lukewarm on TPT, unless something changes for the better.

.

.

Clipper Logistics (LON:CLG)

594p (up 1%) - mkt cap £604m

Clipper Logistics plc ("Clipper", the "Company", or the "Group"), a leading provider of value-added logistics solutions, e-fulfilment and returns management services, is pleased to announce that it has experienced unprecedented levels of activity in its logistics operations in both the UK and continental Europe over the Black Friday and Christmas periods.

Revenues up 50% on LY, for Nov & Dec 2020 - faster rate of growth than +27.9% in H1 (6m to 31 Oct 2020)

Ecommerce fulfilment doing well as expected, but so is conventional business

Strong pipeline of new business opportunities

Outlook - “Excellent level of confidence in the year ahead”

This bit has confused me somewhat, and I think should have been explained more fully;

Whilst additional revenue will not necessarily have a proportionate impact on operating profit given Clipper's contract mechanisms, this level of activity gives Management an excellent level of confidence in the year ahead.

Can any readers shed light on this? I’ve put a call in to the company’s advisers, so will report back if I’m able to get any clarification. I wonder if some contracts might have fixed monthly pricing, regardless of volumes, or use volume estimates?

Nothing is said about performance relative to market expectations, which usually implies that trading is in line. The tone of today’s announcement, and the rapid growth, does suggest to me that it could beat expectations possibly, for FY 04/2021?

Valuation - I can’t find any broker research notes, so can only use the 20.6p broker consensus forecast shown on the StockReport. That implies a PER of nearly 29, which looks a bit pricey for a logistics company, even allowing for the fact it operates in a growing area of eCommerce fulfilment. Holders must be anticipating that it’s likely to beat that forecast by maybe 10-20%, to justify the current price.

My opinion - the valuation looks well up with events, maybe a bit ahead. But that depends what the FY 04/2021 results end up looking like.

There’s also the issue of whether 2020 has been a bumper year due to covid lockdowns? Could that have brought forward some growth from future years? I wonder how much profit has been made on the covid-related PPE contracts? Press reports indicate that little cost control seems to have been applied by the authorities!

Personally I’m not interested in chasing CLG shares any higher. I think it’s had a great run, and a PER of about 20 is as high as I would pay, not 29 times current year earnings. A good business, but too pricey for me.

.

.

All done for today. Troubling scenes on TV in Washington.

See you tomorrow.

Regards, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.