Good evening/morning, it's Paul here again.

Let's start today (Weds) with a few leftovers from yesterday.

Once I've toned down some of the comments from last night, then I'll move on to the biggest story of the day - a shorting attack on Burford Capital (LON:BUR) - looks very interesting.

Estimated time of completion today, is c. 6pm.

Gattaca (LON:GATC)

Share price: 145p (down 3% yesterday, at market close)

No. shares: 32.1m

Market cap: £46.5m

Gattaca plc (LSE-AIM: GATC), the UK's leading specialist Engineering and Technology recruitment business, today provides the following trading update for the 12 months ended 31 July 2019.

I noticed that Gattaca's share price dipped sharply in the morning after this update, but recovered to almost flat on the day. Although, as with so many companies I report on, the liquidity is so minuscule that price movements are almost meaningless in the short term. Only 79k shares changed hands in total yesterday.

This sounds rather encouraging;

Underlying PBT is expected to be slightly above market expectations and net debt also lower than expected levels.

The company bolded the whole thing, and I can't work out how to get rid of the bolding. The key words are clearly slightly above expectations.

Divisional analysis is given, but I find this rather over-complicated. Maybe the company and its advisers could come up with a better format for presenting this information in future? What about some pie charts?

Net debt - this has impressed me - that the company is completely open about a favourable factor affecting cashflow;

Net debt of around £25m (July 2018: £40.8m) benefitted significantly from the year end falling at the most opportune day for working capital receipts and payments. Nevertheless, allowing for this factor, net debt was below expectations.

Isn't that refreshingly honest? A firm thumbs up for this.

Directorspeak - sounds reassuring;

"The Group delivered NFI growth both in UK Engineering and our International businesses, partially offset by UK Technology where we are refocusing on profitable business. These improvements will flow through to profit before tax.

In addition net debt has come in comfortably below expectations, despite the exceptional restructuring and other costs incurred in the year.

We are making good progress improving the business and I am confident that the actions we are taking will continue to position us well for the future."

Valuation - the latest Equity Development note has put in 24.0p for adj diluted EPS for FY 07/2019. At 145p, that's a PER of 6.0 - looking cheap.

Balance sheet - looks fine to me. I know other commentators have worried about the net debt. However, this overlooks a substantial debtor book. At the most recent interim balance sheet, the bank debt (gross) was about £41m, but that was secured by a receivables book of £90m. So in reality, the bank isn't taking any risk at all, because if the business were to instantly cease, the receivables would turn into more than enough cash within 3 months, to repay all the bank debt, and leave plenty of cash surplus. That's the litmus test of whether bank lending is risky, and it's really not at all risky here.

My opinion - what interests me about both Gattaca, and Staffline (in which I have a long position), is that overseas companies in the same sector are buying up strategic stakes. What does that tell us? That they're cheap, and there could be takeover bids in the pipeline. That seems a good reason to look at these two in more detail.

Peel Hotels (LON:PHO)

De-listing in progress - I've given this more thought, and it could be an interesting special situation, for property & distressed debt experts only. The shares are set to de-list in Sept 2019.

However, the company owns some nice smaller hotels, and the book value is way above the bank debt. I know two of the hotels, and they're pretty good.

The crux here is to find out what the hotels are actually worth, on the open market? It could be that they might be worth above the bank debt. Possibly well above, which I suspect might be the case. An orderly disposal of one or more hotels could then reduce the bank debt to a modest level.

The Norfolk Royale hotel, in Bournemouth, for example, is on a large site, near the sea. It has a habit of going bust in recessions - indeed I worked (at a very junior level) on the Price Waterhouse Administrative Receivership of this hotel, and others, in the early 1990s, when "Leading Leisure" went bust. The banks lost confidence in Leading Leisure when it turned out that they had parallel accounting systems, producing different results as required, for shareholders, banks, and the auditors. Sounds a bit like Patisserie Valerie today. Although interest rates were sky high back then, so banks foreclosed on a lot of good businesses that could have been saved.

I never made it into even the medium level at PW, so I was posted to a backwater, called the Portland Heights Hotel, when Leading Leisure went bust. The locals all came in to the bar, and took the p@*$ out of me as I was doing a stocktake, e.g. "Ooh have you counted these matches, I think there might be one missing!", it was quite funny actually, so I went along with it. Also quipping back at them that, "If as many of you had used this bar in the past as you are today, then maybe the hotel wouldn't have gone bust?!"

My more confident colleagues were posted to more glamorous places like the Norfolk Royale, in Bournemouth. I never did ascertain why a landmark hotel in Bournemouth, was named "Norfolk Royale"? Maybe the owner became confused about the south coast, and East Anglia?

Are Peel Hotels freehold, or leasehold? Also, remember that old buildings need constant maintenance capex - which can swallow up available cashflow.

Property specialists might want to look at this one again. It doesn't look bust to me, and there could be hidden value in the property portfolio. Worth a look, for specialists only. And of course people who are prepared to own shares in a private company after it de-lists.

Boohoo (LON:BOO)

Share price: 240p (up 4% yesterday)

No. shares: 1,160.7m

Market cap: £2.8bn

Acquisition of Karen Millen & Coast

BooHoo has bought the brand names, and online business, of these two excellent brands, straight out of administration.

Therefore, for the avoidance of doubt, there won't be any liabilities relating to open or closed shops. A nice clean deal. It's amazing to me that so many brands which were highly successful in the 1990s, when I worked in this sector, are now dropping like flies.

Strategy -

The Group believes that the online business of these brands are highly complementary additions to its scalable multi-brand platform and their acquisition extends the Group's offer as part of its vision to lead the fashion e-commerce market globally.

In its most recent financial year to February 2019, unaudited management information shows that direct online sales from the websites of Karen Millen and Coast totalled £28.4m.

My opinion - these are great brands, and BooHoo is demonstrating here how much smarter they are than the buffoon Mike Ashley - who buys up failing store chains, with lease problems, etc..

BooHoo just buy the clean brands only, with no baggage, then put the online operations through its existing logistics operation.

A few years ago, I explained in these reports (look back!) why BooHoo was a better business than Asos. Everyone thought I was crazy. Now BooHoo is valued more than Asos, and makes great profits - whereas Asos has never made any significant free cashflow.

I'm kicking myself for having had the insight, but not backed my own judgement for long enough (I sold BOO way too soon). Never mind.

Buying back into something that you sold a long time ago for a fraction of the current price, is so difficult. However, in my view, the best thing to do now, in this sector, for large businesses, is to buy Boohoo (LON:BOO) and Next (LON:NXT) . Why? Because they are both doing multi-brand, online fashion retail so well, and so profitably, at close to 10% operating margin. Whereas Asos is basically operating around breakeven - which is a pretty rubbish business.

BooHoo has until now focused entirely on the younger customer. Its move today, to buy up more mature brands, will be an interesting test of whether it can broaden its appeal to wider customers. If so, then BooHoo could continue growing strongly, and become one of (maybe the) top online fashion retailers, not just in the UK, but globally. All rather exciting. I must bite the bullet, and buy back into BOO shares.

Burford Capital (LON:BUR)

Share price: 555p (down c.51% today at 13:03)

No. shares: 218.6m

Market cap: £1,213.2m

Muddy Waters shorting dossier - this has been published today, but rumours of its impending publication were doing the rounds yesterday, thus achieving a double whammy - sharp fall in share price yesterday, and another, bigger fall today.

Amazingly, this share is down almost three-quarters, on its peak in Aug 2018.

Statement re share price movement- this RNS was issued by Burford, first thing at 07:01 this morning. It basically says that everything is fine. It comments that yesterday's sharp share price fall was due to a shorting attack. The company attacks shorting generally, and says it is "strongly suspicious" that "actionable misconduct" may have occurred - implying that it might go after the shorters, legally.

Statement re US research firm document - another statement from Burford, issued at 09:21. This specifically mentions the Muddy Waters document. Burford says it will review the report, and respond as rapidly as possible.

It then just reiterates the key points from its earlier statement, as follows;

• Burford's cash position and access to liquidity is strong. To be sure, Burford will need to take on additional external capital to continue its growth as it has done successfully throughout its history, but this is a cause for celebration, not for alarm, because it means the business is growing rapidly. We have discussed our capital structure at length in the past. Burford has a wide variety of capital sources available to it and significant ability to manage its cash outflows, and has over $400 million of cash and cash equivalents on hand as of 5 August 2019.

• Burford's returns are robust. In fact, our litigation finance returns rose to their highest-ever levels as of 30 June 2019.

• Burford uses the same IFRS accounting that is used widely across the financial services industry and has used consistent accounting policies for many years. Burford has been audited by Ernst & Young since 2010 with clean audit opinions every year.

• In addition to our audited IFRS reporting, Burford provides cash-based investment reporting in extraordinary detail, including providing line-by-line investment detail about every litigation finance investment we have ever made. We just put the latest installment of that reporting on our website yesterday. We are transparent about how we analyse and report on that data; our approach has been consistent for many years.

It's going to take me a while to read & digest the Muddy Waters report, so please bear with me...

Right, that was painful, but I've now read the Muddy Waters shorting dossier. With these shorting dossiers, we always have to be mindful of the fact that they are designed to shatter investor confidence in the target company. The purpose is to cause the biggest possible fall in share price, so that traders who have (prior to publication) opened short positions, can profit from the resulting panic, and buy back at a much lower price.

Muddy Waters (run by Carson Block) has a strong track record of identifying accounting problems or fraud. Here's the Wikipedia pagefor Muddy Waters, which is worth a look.

MW's dossier seems to have (at least for now) shattered confidence in Burford. As I'm writing this, the shares are down about 60% today, to just 450p. You can see the extent of the damage from the 3 year chart below. All the gains of the last 3 years have been wiped out in 2 days.

With a drop of this size, it's tempting to catch the falling knife, and hope for a bounce. Although after reading the dossier, I've decided not to take a position either way, long or short.

What does the dossier say?

I'm not going to detail every point, as if you're interested, you can just read the dossier, which is 25 pages, so not particularly daunting. Although some of it is quite difficult to follow if, as in my case, you're not familiar with the company or its sector (litigation funding).

Main points that caught my eye;

- Muddy Waters (MW) main thrust is the the accounting looks aggressive.

- Dependence on just 4 key cases (out of over a thousand) for bulk of the reported profits

- Allegation of a loss-making case being "bailed out" through a deal with major shareholder, Invesco

- Rapid turnover of senior finance staff. Current CFO is CEO's wife!

- Alleged wrongly, or late reporting of some loss-making cases

- Inflating ROIC statistics - examples given of specific cases, using a variety of accounting tricks (again this is all just what MW is alleging, I'm not offering any view on it myself)

- Selling parts of a big case (Petersen) shortly before year end, to boost profits

- Booking profits, but allegedly not properly accruing for future costs linked to some cases

- MW re-works the ROIC figures, to exclude the 4 big cases, which drops ROIC in H1 2019 from 70%, to just 11%. MW suggests this is evidence that Burford does not have a broad spread of highly profitable cases, but actually relies on just 4 big cases

- MW alleges that Burford could be seen as insolvent

My opinion - What do I make of it all? Well, I think the dossier comes from a good source, and raises very specific accounting questions, and gives specific examples involving particular legal cases. Having been challenged in this way, I think Burford needs to respond fully, to the specifics of the points raised. Giving general reassurance, and threatening legal action, is not good enough, and I think actually makes Burford look weak.

I don't agree that Burford looks insolvent - that's stretching it too far, based on the last balance sheet.

Booking profits in advance of cash collection is a perfectly reasonable accounting treatment, providing it's applied in a prudent way. The nature of the business is that receivables are high, and should be collected in at a later date, when cases are settled. As is often the case though, a very high receivables book might contain stuff that is questionable.

This share has never appealed to me, mainly because I don't understand how it can report such gigantic profits & growth. The figures just looked too good to be true.

It seems as if Burford does have a case to answer, in terms of the specific allegations made in the MW dossier. Let's see what their considered response is, which I imagine is likely to come in the next few days.

Personally, I'm not going to get involved. This one is for traders only now, at least for the time being. When things sell off this much, they often have a nice bounce for a few weeks. If Burford is able to successfully defend itself, then the share price might recover. Remember the shorters have to buy back in the open market too, so that helps the price recover.

It will be fascinating to see how this pans out, but for me, I'm watching from the sidelines.

EDIT: Burford has put out a third RNS today, this time at 15:30, saying that the MW "report's criticisms are without merit". Also it says that a more detailed response will be issued "as soon as practicable". There will then be an investor conference call. Finally, the CEO and CIO have said they intend to purchase BUR shares personally.

I'll reserve judgement until the detailed response is published.

Walker Greenbank (LON:WGB)

Share price: 83p (down 3.5% today, at 15:58)

No. shares: 71.0m

Market cap: £58.9m

This update was published yesterday.

Walker Greenbank PLC (AIM: WGB), the luxury interior furnishings group, is pleased to announce its pre-close trading update for the six months ended 31 July 2019.

The summary says;

Whist trading conditions continue to be challenging, performance in the half year was in line with the Board's expectations.

I find that when companies mention challenging market conditions, it introduces risk that a profit warning might be in the pipeline for later this year, perhaps?

- Looking through the detail, strong brand licensing revenue (up 25.3% in total, or 12.2% for core licensing revenues) seems to be offsetting weaker physical sales.

- Cost-saving initiatives should produce £2m p.a. future savings, c.£1m this year. Not bad going.

- Net cash unchanged in last 6 months, focusing on working capital.

- Outlook - expectations unchanged, but visibility limited (by e.g. Brexit)

My opinion - I feel there is good value in this share. It's an obvious candidate for a potential takeover bid from across the pond. The balance sheet looks fine to me (although note the £9.7m pension deficit) , and it pays a 3.3% divi.

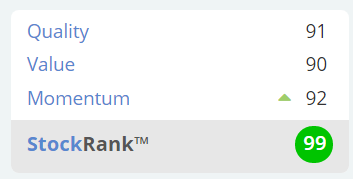

Stockopedia likes it too;

I'll sign off for today. What an interesting day!

I know Burford is (or maybe was) a popular share with PIs, so I hope none of our readers here have been too badly affected by the plunging share price. Do you think it's likely to recover or not? I'm interested to hear subscriber opinions.

Regards, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.