Morning folks!

A couple of interesting RNS announcements to cover today.

In the US last night, we had further entertainment from Elon Musk at Tesla ($TSLA), who tweeted: "Am considering taking Tesla private at $420. Funding secured."

It looked like it was probably a joke to me (and to others), but Musk went on to write a blog post on Tesla's website about it. From a legal point of view, it can be expensive to joke about these things.

Tesla's share price increased by 11% to close at $380 last night, not far off its all-time highs. Stormy weather in Shortville.

Today we have:

- Share (LON:SHRE) - interim results. I'm conducting an interview with the company shortly.

- TT electronics (LON:TTG) - half-year report

- Innovaderma (LON:IDP) - appointment of CEO. Roots haircare brand to be ranged in Tesco.

- SCS (LON:SCS) - trading in line with expectations

- Stock Spirits (LON:STCK) - H1 results

Share (LON:SHRE)

- Share price: 26p (unch.)

- No. of shares: 144 million

- Market cap: £37 million

This is a stockbroker many of you will be familiar with as clients. It trades as The Share Centre.

I've just finished an interview with Richard Stone (CEO) and Mike Birkett (CFO).

My impression of the company hasn't changed. It seems to be providing clients with a very nice service, and is one of the safer brokers.

Beaufort clients will be keen to study their new service provider, as Share won the transfer of 15,000 Beaufort accounts in what must have been a competitive process.

Combining the Beaufort transfer with two other agreements, Share will soon be welcoming 38,000 new customers for a total of £1.5 billion in new assets under administration (AuM).

AuM is making serious headway. From £4.3 billion a year ago, it now stands at £5 billion and that is with the additional £1.5 billion still to arrive. This should translate to significantly greater revenues.

The Share Centre is not the cheapest out there when it comes to execution-only dealing, but it does have an excellent net promoter score (better than all other execution-only dealers) and has picked up a couple of awards for customer service and client satisfaction. So I suppose in some sense you must get what you pay for!

Share also offers ways for clients to access a preferential dealing commission of £7.50 per trade, which is competitive with the no-frills brokers. I would have no problem paying that sort of rate myself. On the other hand, its standard rate (1% of trade value) strikes me as expensive in today's environment.

As an investment proposition, Share's balance sheet is rock solid, but margins and earnings are weak.

The company's profitability has been held back for several years by low interest rates and also by its cost base.

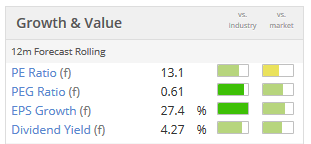

I've put together a table comparing some KPIs from Share's performance last year with Jarvis Securities (LON:JIM), a stockbroker where I am a client:

As you can hopefully see, SHRE and JIM's cost per employee is approximately the same at £41k/£42k.

On the other hand, JIM's revenue per employee is more than double that of SHRE.

To put it another way, JIM achieved half of SHRE's revenue using only one quarter of the staff numbers.

And speaking from experience as a client, I've never had the impression that JIM is under-staffed.

Today's results show a continuation of the theme of heavy costs at SHRE, not helped by the regulatory burdens that have been a pain for everyone in the sector. 15% growth in revenues is overpowered by an 18% increase in costs.

This leads to an operating loss of £520k, offset by investment gains from the company's strategic holdings in London Stock Exchange (LON:LSE) and Euroclear.

The outlook is more positive, management having plans in place "to substantially increase the scale of the business", both organically and through more acquisitions and partnerships.

Immediate growth in client numbers can be anticipated with 38,000 clients and £1.5 billion in fresh AuM already locked in, as I mentioned earlier.

We can also hope for improved interest income in the years ahead. Share's H1 interest increased by more than 150% thanks to the BoE rate hike last year, more relaxed rules around how long money can be lent out for, and bigger customer deposits.

The recent BoE hike should improve this source of income again, at no additional cost to Share. Even 25bps makes a big difference when we are talking about >£400 million of client deposits.

Some may feel that this is a sneaky way for stockbrokers to generate revenue, but in fact it is completely standard. And Share is probably more conservative than its peer group in the manner in which it does it.

Putting it all together, I'm happy to leave this on my watchlist. I have no qualms whatsoever about Share's ethos or mission, but it needs to deliver on profitability to become an interesting investment proposition. Hopefully we can start to see this as AuM and client numbers continue to grow. As things stand at the moment, there is not much earnings support for the current market cap.

TT electronics (LON:TTG)

- Share price: 256.5p (+17%)

- No. of shares: 163 million

- Market cap: £418 million

We've covered this electronics equipment provider several times previously in the SCVR.

This includes coverage of last year's interim report.

Last year, TT reported organic revenue growth of 5% for the six months.

This year, organic growth has slowed to just 3%. Thanks to acquisitions, total revenue is up 12%.

Quality

Admirably, the company uses ROIC (return on invested capital) as a KPI and this creeps up to 11.2% from 10.6% (and 9.2% the previous year). Not huge, but acceptable and moving in the right direction.

Similarly, margins are improving. The underlying operating margin is not super high-quality at 7.5%, but it's good that management are highlighting it.

The very large 45% jump in underlying operating profit has been "largely driven by operational leverage and better efficiency". Excellent.

Cash flow

Last year, there was a big and favourable working capital movement that produced an extraordinary cash conversion rate of 128%.

This year, we again see that underlying operating profit is more than fully converted to cash in the first six months of the year (105% conversion rate).

Outlook for the full year is ahead of prior expectations.

The strategy is working:

Our strategy to position ourselves in structural growth markets benefitting from increasing electrification is resulting in a much stronger business with higher growth and higher margins.

It made two important acquisitions during the six-month period, and has a history of acquisition activity, and this will necessarily complicate the accounts somewhat.

The underlying profit is £14.6 million, after making a series of adjustments to the actual operating profit of £7.7 million.

As is often the case, I would personally be inclined to take a stricter view than the company does and therefore would not allow all of these adjustments when it comes to making my own valuation.

Maybe something in the region of £10 million+ is a good, conservative estimate of underlying operating profit.

Summary - still looks and feels like a solid business that is performing well and successfully executing its acquisition strategy. Not much organic growth to shout about lately so it's more of a bet on management's deal-making and integration ability, and the overall strategic vision.

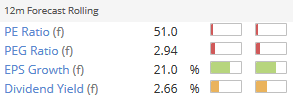

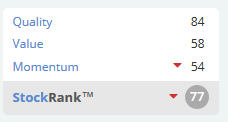

Momentum might pick up after today, and Quality should also be on the rise with improving ROIC. Perhaps the StockRank can grow in enthusiasm:

Innovaderma (LON:IDP)

- Share price: 131.5p (+18.5%)

- No. of shares: 14 million

- Market cap: £19 million

Appointment of CEO and Roots to be ranged in Tesco

I covered this stock in some detail at its trading statement in July, so won't repeat what I said then.

We have a double-barrelled piece of good news. The search for a CEO has culminated in one of the company's non-exec Directors being hired for the role.

Separately, the Roots haircare brand (for hair loss reduction) has gained access to over 400 Tesco stores.

This would appear to confirm suspicions that Roots is the most exciting brand right now among IDP's portfolio, after IDP's core brand Skinny Tan missed order expectations in H2 of FY 2018.

I like this sector and have previously considered investing in IDP. It might be worth looking at this again.

SCS (LON:SCS)

- Share price: 212.5p (-1%)

- No. of shares: 40 million

- Market cap: £85 million

ScS, one of the UK's largest retailers of upholstered furniture and floorings, today issues the following trading update for the 52 weeks ended 28 July 2018 (the "Year") ahead of announcing its preliminary results on 2 October 2018.

Trading is in line with expectations.

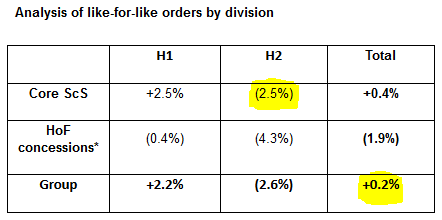

The "softer trading environment", and the weather, made for a weak H2. This means that full-year like-for-like orders are approximately unchanged, as expected:

CEO comment:

"I am pleased to announce that the Group has traded in line with the Board's expectations for the year, an encouraging result given the challenging retail environment. We believe this demonstrates the increasingly resilient nature of our business and the success of our value proposition.

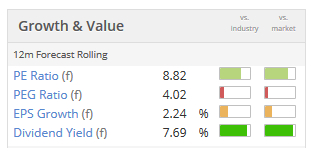

This is another very cheap retailer. The Value Rank is 95 and the overall StockRank is 99.

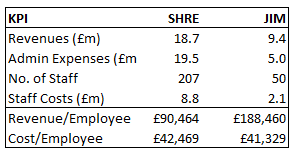

Some value stats:

I already have a share in this category in my portfolio (United Carpets (LON:UCG) ), and I don't particularly want to own another one.

The market is pricing many traditional retailers for disaster, and the contrarian in me is happy to bet against that view with a certain, limited portion of my portfolio.

But if I did not already have sufficient exposure to the sector, SCS (LON:SCS) would make for an interesting candidate. It has generated superb free cash flow and reported a cash balance of £52 million (>60% of its market cap), with no borrowings, at its most recent interim results.

Stock Spirits (LON:STCK)

- Share price: 211.75p (+2%)

- No. of shares: 200 million

- Market cap: £423 million

Results for the six months ended 30 June 2018

Stock Spirits Group PLC ("Stock Spirits" or the "Company" or the "Group"), a leading owner and producer of premium branded spirits and liqueurs that are principally sold in Central and Eastern Europe, announces its results for the six months ended 30 June 2018.

I've never covered this one before. Might take a quick look at it before signing off for the day.

- reporting in Euros, revenues are up 5.3% to €124 million

- operating margin is ok at 14%, and operating profit is growing faster than revenues - good. Operating profit up by nearly 10% to €18 million

- modest debt load of < €39 million, low net debt/EBITDA multiple

Competitive positioning appears strong:

At the end of June our total market volume share YTD was 26.8% versus 24.7% last year, and YTD value share was 27.2% versus 25.7% last year. We have started to outperform our main competitor in this period, whilst the third main player in the market has increased its downward trend.Outlook: the group is "on track" with its results.

My view: interested to learn more about this. Looks too cheap for a branded spirits company with the percentage market share mentioned above.

All done! See you next time.

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.