Good morning, it's Paul here with the SCVR for Wednesday.

Estimated timing - the main report needs to be up by noon. Then I'll add some more stuff mid-afternoon later, after the Chancellor's statement. Today's report is now finished.

.

Summer Statement from Rishi Sunak

The Chancellor of the Exchequer is scheduled to announce a mini budget today. It's being broadcast live on the BBC Parliament channel, from 12:35, after Prime Ministers Questions.

Unfortunately that clashes with a company Zoom meeting I have from noon onwards, so will have to do that thing of having two screens on at the same time, and leave it to my system 1 brain to ensure that I focus on the most important thing, which seems to be triggered by key words of interest when multi-tasking.

As usual, it's been widely leaked to the press, which are suggesting these main measures;

Stamp Duty holiday - said to be effective immediately, and exempting residential property transactions from Stamp Duty for the first £500k, and possibly a reduced rate above that. Speculation is this would be for 6-12 months. The purpose is obvious, and very necessary - to kick-start housing sales, which have dropped considerably. The wider benefit to the economy is that people often spend on home improvements when they move house. I think this is an excellent idea, and it's something we've discussed here before as being a step which would boost the housing market.

Shares which might benefit from this? Housebuilders, estate agents (I like Foxtons (LON:FOXT) for recovery purposes, and it has refinanced already). It might give a lift to DIY-related companies, possibly?

Kickstart jobs scheme - this is apparently a new scheme to pay the wages of 16-24 year olds claiming Universal Credit. This new scheme sounds a much better idea than the furlough scheme, which just pays people to be idle, only deferring a lot of redundancies & slowing down the re-opening of the economy. All at vast cost.

Shares which might benefit from this jobs scheme? Obvious ones are hospitality sector, and retail, which both employ a lot of young people. We'll have to scrutinise the detail, to see how it would work. Could this scheme have an unintended consequence of encouraging companies to make furloughed staff redundant, then re-employ them at the Govt's expense, once they start claiming Universal Credit, and hence become eligible to work on the new kickstart jobs scheme?

[Sources for the above are The Telegraph, and CityAM]

Sky News suggests that other measures could include a vouchers scheme, to encourage the public to spend more in town centres, in retail and restaurants. Possible tax breaks for those sectors are mooted. More infrastructure spending, and other green projects are likely to feature. Tax rises? Seen as unlikely at this stage, as that could snuff out recovery.

NB. this is (apparently well-briefed) press speculation at this stage. We'll have to wait and see what the Chancellor actually says. I'll update this section accordingly afterwards.

Clearly this is a Government which is highly interventionist, and high spending - not exactly what was expected, but I think it's the best way to deal with this crisis. Particularly since, so far, all the debt issued to fund this huge deficit, has been created electronically by the Bank of England using QE.

In my opinion, Rishi Sunak has created an excellent impression so far, of being unusually competent for a Chancellor. He's also got highly relevant knowledge & experience, unlike fairly clueless predecessors like George Osborne, and Gordon Brown, neither of whom demonstrated much knowledge or understanding - as you would expect from people who had little to no relevant financial/commercial training or experience. Sunak is very different, he seems to properly understand his brief, and is capable of explaining policy with deep knowledge & understanding. That's just my personal opinion, and is obviously subjective. In an apparently shambolic Govt, at least the finance man seems to know what he's doing!

A jobs scheme to mitigate short term unemployment sounds very sensible to me. Therefore, in macro terms, the more money the UK Govt throws at measures to alleviate the economic damage of lockdown, then the greater chance we have of something more like a V-shaped economic recovery. That's important to bear in mind when making decisions over our portfolios.

As always though, it's all educated guesswork, and nobody really knows what's actually going to happen.

.

Please see tomorrow's report here (I'm writing this bit from the future!) for my notes on the actual mini budget announced.

.

Boohoo (LON:BOO)

200p (down 24%) - mkt cap £2.4bn

The share price rout continues, following allegations that a Leicester-based supplier seems to have been operating a sweatshop, paying below minimum wage, and not protecting workers from covid.

I wrote a section in Monday's report here. The share price had fallen to 300p by then (from a start of about 400p). Imagine my amazement that today, it has just gone slightly below 200p! I see this as a cracking buying opportunity, so I'm buying as we speak.

The issues raised are serious, but as I've mentioned before, the garment sector is notorious for not knowing where production is actually happening, because manufacturers subcontract so much. BOO confirms this today in another announcement, saying that the garments in question were actually made in Morocco, not Leicester! They were just being repackaged in Leicester (probably changing them from boxed to hanging, at a guess).

Today's second defence statement from BOO contains a lot of tangible stuff they are doing to sort out this problem.

I doubt very much whether any social media boycott is likely to do anything more than temporary damage, because that's what has always happened before. The social media generation love to be outraged at all sorts of things, most of which they quickly forget about. They're mostly hypocrites anyway. Are they supporting charities that help poor people survive, once they've lost their livelihoods in a garment factory? I'd be surprised if even 1% do so. Actually, it might be closer to 2%, as that figure has cropped up before with translating online outrage into action - e.g. about 2% of flyers contribute to carbon offset schemes for each flight.

Anyway, I started buying at 220p this morning, and carried on buying as the price fell. Average now 209.4p - I think that's a terrific price, and the action being taken by BooHoo announced on Monday, and more this morning, looks comprehensive. Let's see what happens!

EDIT: Remember that the shorts have to buy back, so they become unwilling, forced buyers, once the share price rebounds enough to scare them! So it's now very much a battle between shorts & longs. Bring it on! End of edit.

.

Mpac (LON:MPAC)

267.5p (up 10%) - mkt cap £53.2m

This share caught my eye before covid struck, as it was putting out repeated forecast upgrades. I summarised its last covid update here on 27 March, which sounded quite reassuring, but I decided that the lack of visibility precluded me from buying some shares. Pity, as it's risen 22% since then.

Mpac Group plc, a global leader in 'Make, Pack, Monitor and Service' high speed packaging and automation solutions issues a COVID-19 and operating update ahead of the release, on 3 September 2020, of its unaudited results for the six months ended 30 June 2020.

Summarising the main points;

All sites remained open

Travel restrictions have impacted timing of sales, mitigated by using home working, digital comms (presumably Zoom or Teams), etc

This sounds encouraging;

Pleasingly, our customers remain active and we continue to win original equipment and service orders with noticeable resilience in the Healthcare sector and in the Americas region.

In addition, as global travel restrictions ease, we anticipate customer visits and levels of qualified opportunities will increase during the second half of the year.

Our order book going into the second half of 2020 of £45.4m remains strong (30 June 2019: £39.9m) and to date, no orders have been cancelled due to COVID-19.

That's impressive. I'm not familiar with the term "qualified opportunities". How does that differ from ordinary opportunities?

Costs have been cut, but a "Fast Recovery Plan" has been drawn up - very sensible. I do worry that companies which rushed to slash costs, might have actually damaged their future prospects.

Liquidity looks fine - it already had a strong balance sheet, which is one of the reasons I like this share. Cash of £23.0m at 30 June 2020 is up by 22% on the position 6 months ago. Although remember that companies are deferring some payments, so other creditors might have gone up. There are no concerns over solvency, hence little danger of being diluted in an equity fundraising.

Debtor days - remain at pre-covid levels. This is very good, and an important point. Many companies might be struggling to collect in receivables, but not here.

My opinion - this is a good update, very reassuring.

Visibility remains somewhat limited, although the strong order book is encouraging. I also like the fact that MPAC serves sectors which are essential (including food, healthcare), thus making it more defensive in a crisis.

I should probably put some of these in my portfolio, but don't have any spare funds at the moment. Overall though, it looks a decent company, worth a closer look. We're flying a bit blind in terms of forecasts though.

.

.

Craneware (LON:CRW)

1660p (down 1%) - mkt cap £445m

Craneware (AIM: CRW.L), the market leader in Value Cycle solutions for the US healthcare market, provides an update on trading to date for the year ended 30 June 2020.

"Value Cycle solutions" - what a lousy self-description.

FY 06/2020 - revenue flat at $71.4m. Adj EBITDA (yuk) of £24.5m (up 2% on LY).

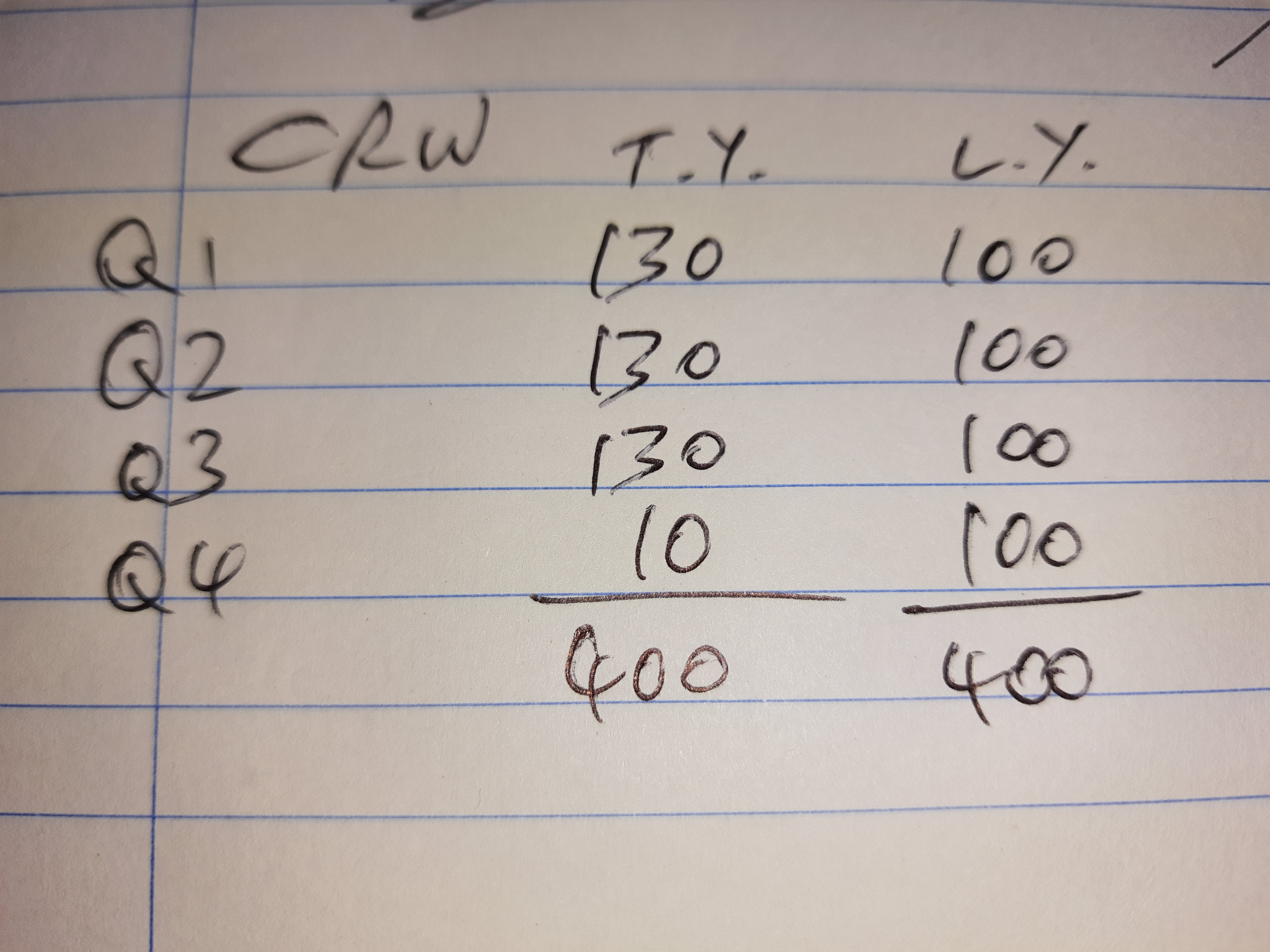

It seems to have gone badly wrong in Q4 (Apr-Jun 2020), because Q1-Q3 saw revenues up >30% vs LY. For that to have become flat for the full year, means Q4 must have been awful. I've done back of the envelope sums, ignoring seasonality, and it looks like Q4 sales could be down as much as 90% on LY. Here are my incredibly crude workings;

.

Liquidity - looks ample, excessive even, with net cash of $47.6m, plus an undrawn $50m borrowing facility.

Divis - intends to pay one, the forecast yield is about 1.7% - not bad in these ultra low interest rate times, especially if it is a safe divi that can be paid in a time of crisis like this.

Outlook - a bit waffly, but the core bit says;

The Company continues to benefit from high levels of recurring revenue, accounting for approximately 85% of revenues in any year. We enter the new financial year with an annuity revenue base of over $65m. We continue to have sales discussions with hospitals across the US and are cautiously optimistic we are seeing the first signs of sales cycles slowly normalising; however, we remain cognisant of the ongoing macro uncertainties.

If 85% of sales are recurring, then how come Q4 sales collapsed so much? Maybe I've misunderstood something? If so, let me know, and I'll correct the article.

My opinion - this share has been on my interesting but too expensive list for years. Maybe the UK stock market sees the US healthcare software market as a sexy space to operate? Possibly it's seen as a bid target. It's certainly noteworthy that a UK (Scottish) company has had success in winning US hospital contracts. I've heard it's very difficult for non-US companies to crack the US market, in any sector.

Overall - potentially interesting, but performance seems to have been very poor in Q4, which unnerves me a bit.

Right, I have to take a break now for a Zoom meeting, then focus on the Chancellor's mini budget. I'll report back later this afternoon.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.