Good morning from Paul & Graham!

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps up to about £700m. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

Paul’s Section:

Somero Enterprises (LON:SOM)

385p (down 3%)

Market cap £215m

Somero sells & supports laser-guided concrete screeding machines, to lay perfectly flat floors, for use mainly in warehouses.

Finncap says these results are in line with expectations.

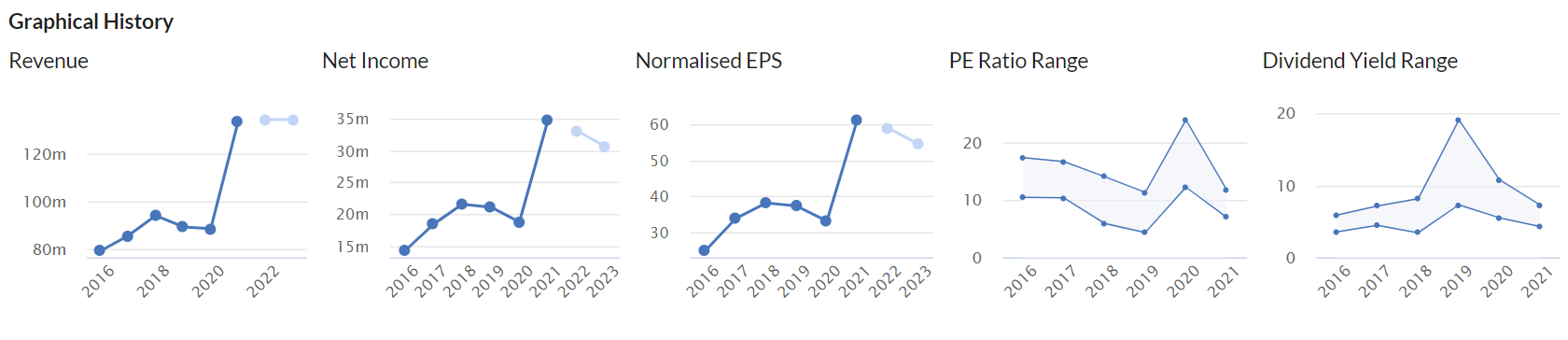

Revenue of $133.6m - matching the outstanding performance of the prior year.

Profit before tax fell to $40.8m, down 9%, due to higher overheads (already known) - note the very high profit margin.

Adj diluted EPS $0.55 (down from $0.61 prior year) - converts into sterling at £1 = $1.183 to 46.5p = PER of only 8.3x which looks strikingly cheap to me, for a high quality business generating a high profit margin, and copious cashflows.

Dividends - are generous, with the ordinary divi $0.2778, and a supplemental divi of $0.077. The StockReport is showing a forecast yield of 7.4%, which is clearly very attractive.

Buybacks have also been done, reducing the share count slightly.

Outlook - there’s more detail, but this is the key part -

…With all factors considered, 2023 revenues are expected to be comparable with 2022, and with targeted added resources 2023 EBITDA is expected to be down modestly from 2022, and with 2023 working capital investment expected to remain elevated, year-end 2023 cash is expected to be at a comparable level to year-end 2022.

It also mentions shortages of concrete in the USA, which doesn’t help for a company selling concrete screeding machines, but is probably only temporary.

Forecast - many thanks to Finncap for updating us. It has trimmed its FY 12/2023 EPS forecast down by 5%, to $0.532, which converts to 45p = PER of 8.6x which looks strikingly cheap, if forecast numbers are achieved. I think Somero has a good track record of usually being quite conservative in its outlook comments.

My opinion - another excellent set of numbers, from this high quality company.

The main downside risk is that we might have seen peak earnings, and the future may see lower profits, and maybe even a profit warning if demand slips as 2023 progresses. The worry is obviously that higher interest rates in the US especially (Somero’s main market) could cause a recession in construction. My argument would be that a PER of 8.6x is already pricing in a significant fall in earnings, but that probably wouldn’t stop the share price falling lower still, if a profit warning were issued. That could also trigger a reduction in divis.

Overall, I don’t know what the future holds, but I can see strikingly good value in this share, if current forecasts are met. Therefore it has to be a thumbs up from me, but it’s up to you to decide whether you want to play it safe, watching from the sidelines, depending on what your macro view is. Or whether you’re happy to just hold this share long-term, and collect in the generous divis whilst you wait to see how performance pans out. That involves accepting the risk of a possible profit warning, as with all shares. Other announcements this week do seem to be pointing towards a slowdown in activity in some sectors.

Lots of attractive numbers here, and look at the quality scores below!

.

Headlam (LON:HEAD)

317p (down 2%)

Market cap £255m

Headlam (LSE: HEAD), the UK's leading floorcoverings distributor, today announces its Final Results for the year ended 31 December 2022 (the 'Period'), and an update on current trading.

Many achievements despite very challenging industry headwinds in the year

I’m impressed with the profit figures in the table below, given that macro conditions have been quite tough in 2022, with inflation surging, and the cost of living challenges, especially in the final quarter (mini budget chaos).

Note that the adjustments actually reduce underlying profit, which is unusual, as they’re usually stripping out costs and boosting profits. This is explained in the commentary as being a net credit from an insurance claim following a fire.

Dividends - this is a nicely cash generative business most of the time. Note below the interesting pattern of rising divis, interrupted by each financial crisis (in 2008, and then again from the 2020 pandemic).

I’ve also highlighted the generous 17.7p special dividend, paid in May 2022 -

So this share is mainly of interest to value/income investors, and I’ve always liked it for that reason. Also the balance sheet is lovely, with lots of freehold property assets, and little to no debt most of the time.

It’s a simple business, distributing carpets & similar, with obvious attractions for smaller carpet retailers effectively using it as an outsourced warehouse, to give them a wide range of products that they couldn’t possibly store themselves. Plus buying power from the considerable scale that HEAD benefits from.

HEAD is the UK market leader, although there is a fast-growing competitor Likewise (LON:LIKE) run by HEAD’s former CEO. I am a bit worried that LIKE could curtail HEAD’s further growth, by taking market share, and maybe eroding margins too. I had a chat with LIKE’s CEO recently, and it seems a credible competitor.

Outlook/current trading sounds OK, and I particularly like the big freehold property asset backing here -

²Company-compiled consensus market expectations for revenue and underlying profit before tax, on a mean basis, are available on the Company's website at www.headlam.com.

Balance sheet - looks fantastic, with over £200m NTAV, so a double tick in this box! This supports most of the market cap, excellent downside protection for investors, and this means that solvency or dilution should not ever be problems.

Broker forecasts - annoyingly, there’s nothing available to me. This really does need to be addressed by the company, as it’s an obvious oversight.

Although to be fair, this page on HEAD’s website is helpful to private investors -

Also, the Stockopedia broker forecasts graph is (as always) tremendously useful, and it shows a recent moderation in forecasts, which I like - as this means a lower target, hence less risk of a profit warning in what is likely to be another challenging macro year in 2023 -

Valuation - how should we value HEAD shares? That’s part art, part science! Personally I would use a PER of say 10-12 times, and 2023 forecast EPS of about 30p. So I arrive at 300-360p range for this share, which is on a pretty prudent basis, and ignores future upside from a recovering economy.

At 317p per share, the share price is near the bottom end of my price range, which indicates to me that this share is attractively good value, but not amazingly cheap (as it was last autumn).

My opinion - it’s a thumbs up from me. This is a nice business, with attractively cheap shares in my opinion. Not madly exciting, but it should continue to provide a decent income via a generous dividend yield.

To summarise -

Bull points

- Decent 2022 performance despite macro headwinds.

- Fantastic balance sheet, almost fully supporting the market cap with NTAV

- Could attract a financial buyer possibly?

- Good self-help measures in recent years, to make it more efficient.

- Generous divis/buybacks (forecast yield c.5.6%) - good for income seekers.

- Has demonstrated resilience in recent years, and pricing power (passing on cost increases).

- Modest valuation.

Bear points

- Competitive threat from fast-growing Likewise (LON:LIKE)

- Continuing cost pressures, eg 6% staff pay rise, and energy cost price fix expiring.

- General macro pressure might suppress demand, possibly?

If I've missed anything from those lists, then post a comment below! Thanks.

Musicmagpie (LON:MMAG)

34p (down 10%)

Market cap £36m

musicMagpie, a circular economy pioneer specialising in refurbished consumer technology and disc media in both the UK and US, announces its audited full year results for the year ended 30 November 2022 ("FY22").

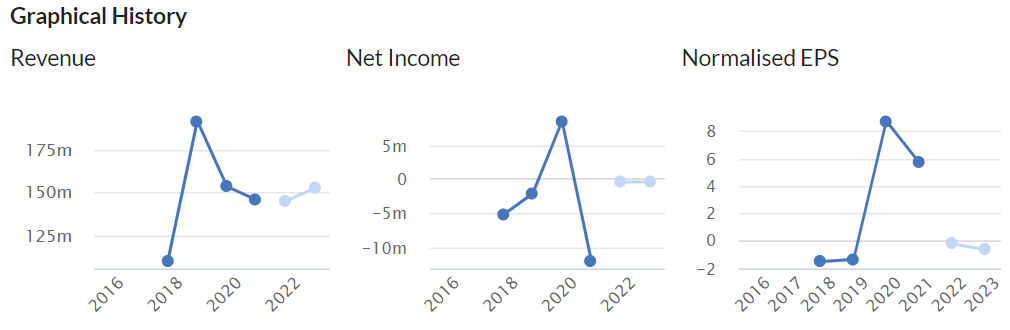

I’ve previously been very sceptical about this share, and perplexed as to why the shares have more than 4-bagged from autumn’s 10p lows. Maybe there was something good going on behind the scenes?

Today’s poor figures reinforce my scepticism. A few key numbers -

EBITDA almost halved to £6.5m. But EBITDA is meaningless here, since the company is a heavy capitaliser of internal costs, with £4.6m development spend capitalised in the year.

Loss before tax of £(1.5)m.

Heavy tax charge (when it should be a credit), which is mainly due to tax on excessively generous previous share options.

Debt rising, due to a horrible business model of buying up old phones, paying for them, then renting them out. So it requires cash spending up-front, which is being funded by bank debt (very unusual to see a bank prepared to lend like this).

Notes to the accounts show that quite a lot of customers default, which then results in handsets being written off. Hardly surprising, after all this must be a service for people who can’t get hold of a phone any other way.

Debt rising, as more bank debt is drawn down to fund the purchases of more mobile phones, and the legacy business is not generating a return.

Inadequate equity, NTAV is only £7m. So the bank is funding the capex, which is risky, if/when they get cold feet.

Going concern note reassures that it should remain within bank facility, and covenants, so gives itself a clean report on this.

Outlook is mostly waffle, but implies that Q1 (Dec-Feb) has been tough, but no figures provided. Short term outlook is described as “challenging”.

My opinion - this looks awful to me. It’s loss-making, and running up bank debt to buy old phones to rent out to customers who sometimes default on the agreements (and presumably keep the handset?)

There’s a weakish balance sheet, dependent on growing bank debt, no divis (or any likelihood of them), and weak outlook comments.

Overall, this strikes me as an accident waiting to happen, and I wouldn’t touch it.

What’s the upside case? It seems to be positive talk (but no actual numbers to back this up) about the business improving due to the rental income growing. If it does manage to move into decent profitability, then there could be an investment case here, but brokers are not forecasting profitability, so holders must be hoping that MMAG will beat forecasts. Otherwise there wouldn't be any case at all to buy or hold this share, on existing forecasts.

Maybe the business will do well in future, I don’t know? It did have a good burst of profitability in the pandemic, resulting in it listing in 2021 (possibly the worst year on record for over-priced, poor quality floats?). Profits have since collapsed, and it’s now loss-making.

There’s a webinar on IMC tomorrow, so I’ll tune in to hear the positive story, as maybe I’ve missed something in the numbers that is more encouraging?

A typical chart below from a 2021 float!

Graham’s Section:

Restaurant (LON:RTN)

Share price: 41.86p

Market cap: £320m

This is the group behind Wagamama’s, Frankie & Benny’s, and a variety of other restaurants and pubs.

Shareholders have had a traumatic experience:

Let’s take a look at these full-year results for FY 2022, and see the outlook for 2023.

Results highlights:

Sales £883m (up from £637m)

Adjusted PBT £20m on a pre-IFRS 16 basis

The statutory unadjusted loss is £87m

Net debt (excluding leases) is £186m. Net debt including leases is £582m.

Which profit number to use? The company presents six different adjusted profit numbers, depending on which costs and expenses are included and whether or not IFRS 16 is implemented. This is before we even get into the unadjusted profit numbers.

My suggestion would be to look at pre-IFRS 16 adjusted operating profit (£44.5m) or post-IFRS 16 adjusted PBT (£30.7m). Both of these numbers strike me as reasonable indicators of underlying profit.

Note that the first one is before interest costs, while the second one is after interest costs.

Then we have to find out what the adjustments are. By far the largest adjustment is a £114m impairment that writes down the values of both the company’s leases and its fixed assets. The other exceptional items, in aggregate, are of relatively little importance.

The impairment has been made necessary by lower forecast future earnings expectations, predominately in our Leisure division, due to significant inflationary and cost-of-living pressures in the near-term.

Trading performance - sales at Wagamama, pubs and concessions are all said to have outperformed their respective market benchmarks (vs 2019 comparatives).

Frankie & Benny’s, along with the other smaller restaurant chains, are included in TRG’s “Leisure” business - the one that has just seen a huge impairment.

This business saw no like-for-like sales growth in 2022, and was therefore 5% below the market:

The Leisure business is in a highly contested market segment and is the component of our portfolio most exposed to changes in wider consumer sentiment, and therefore Leisure's trading performance has been the most directly impacted by the cost-of-living pressures.

Current trading and outlook

Like-for-like sales in the Leisure business are down 4% in early 2023, compared to the same period last year. The other divisions are all doing significantly better than that:

RTN says it has been “a very encouraging start to the trading year”, and they leave FY 2023 expectations unchanged.

Looking further ahead, they want to reduce net debt/EBITDA to below 1.5x within three years (it is currently 2.2x, using pre-IFRS 16 numbers).

Additionally, they are “continually reviewing our longer-term strategic options and will update shareholders as appropriate”. This could refer to anything, but my view is that they could perhaps think about raising equity.

CEO comment:

"We've delivered a strong operating performance for the year in a market which has continued to pose a number of headwinds for casual dining operators…

We have a clear plan to increase EBITDA margins over the next three years and deliver significant value for all our stakeholders."

Going concern note - the Directors say that sales would have to fall by 7.4% vs. their base case scenario before there would be a risk of breaching loan covenants, and that this assumes no mitigating actions taken to prevent the covenant breach.

The decline in sales would have to be double that amount, in order to cause a covenant breach that the company could not avoid through mitigating actions.

Balance sheet - the company officially has equity of £380m, but this includes intangible assets of £604m. Therefore, net tangible assets are negative £224m.

This figure includes the impact of leases, which are strongly negative after their “right-of-use” assets were written down.

Strip out the impact of leases on the balance sheet and we have net tangible assets of negative £66m.

Checking the footnotes, I see that bank interest paid in 2022 was £21m.

My view

I think this company should probably think about raising more equity.

It will be a bitter pill to swallow for shareholders, after already going through two equity raises (in 2020 and 2021) for the purpose of improving the balance sheet.

However, I suspect that the balance sheet still needs fixing.

The company has benefited from some interest rate caps but the interest costs are still very significant relative to their profitability, and I fear that trading is only going to become more difficult unless there is a quick turnaround for the consumer.

So I’m going to have to take a negative stance on these shares, primarily due to the horrible balance sheet and the lack of obvious competitive advantages (particularly for the Leisure business).

I also note the varied career history of Restaurant Group’s current CEO and I wonder how long it will be until he moves on to his next high-paid position.

Tclarke (LON:CTO)

Share price: 153p (+5%)

Market cap: £67m

I took a dim view of this company’s November trading statement, which was a serious profit warning despite the positive language used.

The January trading statement was again extremely positive, but the overall change to EPS estimates at the company’s broker was slightly negative.

Today, the company publishes full-year results for 2022 and the 2023 earnings estimates are unchanged.

Highlights from the results:

Revenue +30% to £426m

Operating profit +31% to £11.5m

PBT +32% to £10.3m

After battling through the complications at RTN, it’s a relief to find a company whose results are simple: no adjustments, and no “alternative” presentations of profits. Lovely!

This is a building services / engineering group. It's a sector which I have often described as being accident-prone (from a financial point of view) and so I look for companies in the sector to have a net cash position. TClarke has this with net cash at year-end of £7.5m.

It also discloses average month end cash of £2.6m, a much lower number but at least it’s an improvement on last year (2021: average month end cash of negative £2.9m).

I also think that we can give a small-cap company some credit for even disclosing this number, when many companies don’t bother. Usually, investors are left in the dark as to whether or not the year-end cash figure is unusual or has been window-dressed!

Data centres - TClarke has a particular emphasis on growing its work relating to data centres, and has seen data centre revenues grow from £39m in 2021 to £129m in 2022. This alone can account for the majority of net revenue growth during the year.

Forward order book - £555m, up 4% versus the prior year. It does look like the pace of revenue growth is going to slow down, which is inevitable if the forward order book isn’t growing very fast.

2023 revenues are expected to come in at £500m, which would be an important milestone and another record-breaking year for the group, but also a more moderate pace of growth (17%) compared to 2022 (30%).

CEO comment:

The Group is in fantastic shape. We have an excellent order book of high quality projects across a wide range of sectors. The business is supported by our strong balance sheet, which continues to grow, with net assets increasing by 46% compared with 2021.

Operating profit margin is 2.7%, a decent result for TClarke and a reminder of the incredibly low margins this industry generates.

The company’s goal is to increase this crucial metric further to 3%, and it appears that the CEO has an appropriate focus on margins over winning higher revenues at any cost:

Our order book has been replenished whilst maintaining our disciplined and selective bidding approach to opportunities, which is even more crucial in times of economic uncertainty; this business is not driven by winning projects that do not have the opportunity to return an acceptable margin.

I also note that 90% of projects are with repeat clients and/or principal contractors: a nice sign of customer satisfaction and loyalty.

Outlook is ambitious for the medium-term:

We see the period beyond 2023 as an opportunity to lay the foundations for an even stronger TClarke with the business ideally positioned and focused on delivering the most high tech and engineering rich projects for our clients, whilst building our existing balance sheet strength, enabling all stake holders to share in the continuing success of TClarke.

My view

There is a lot to like about this:

Net cash position

Focused on further improving its operating margin

Growth is organic

Excellent revenue growth

No “funny business” in the accounts.

Cheap - see below.

So what’s not to like?

Personally, I still think that the manner in which November’s profit warning was announced was questionable.

Apart from that, it also comes down to how comfortable you are investing in this sector, and probably also your view on the industries served by TClarke: will data centres provide a reliable long-term revenue stream, or will the company need to find other sources of revenue growth before too long?

I’m tempted to give it the green light but I’m personally very wary of this sector, as I find that small changes in expenses can have huge effects on bottom line profits. So I’ll stay neutral. But if you like this sector, then you may like TClarke.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.