Good morning, it's Paul here with the SCVR for Wednesday.

Today's report is now finished.

I finished off yesterday's report - here is the link - in the evening, with new sections on;

Gaming Realms (LON:GMR)

Zytronic (LON:ZYT)

Porvair (LON:PRV)

Ideagen (LON:IDEA)

.

On to today's company announcements, as follows;

Sdi (LON:SDI) - Interim results (done)

Creightons (LON:CRL) - Half year report (done)

Dialight (LON:DIA) - a trading update that tells us hardly anything about trading!

Photo-me International (LON:PHTM) - Trading update

.

Sdi (LON:SDI)

Share price: 100p (pre market open)

No. shares: 97.8m

Market cap: £97.8m

SDI Group plc, the AIM quoted Group focused on the design and manufacture of scientific and technology products for use in digital imaging and sensing and control applications, is pleased to announce another strong set of results and solid operational progress for the six months to end October 2020.

To recap, here are my notes from the trading update on 22 Oct 2020. Trading was said to be above current market expectations, albeit boosted by one-off covid-related contracts. Expectations for the following year were not raised. The share price has been very strong recently, rising from 68p to 100p since the last update. Is it fully valued now, I wonder?

Another acquisition, of Monmouth Scientific Ltd, was announced on 3 Dec 2020.

Key figures from today's interims -

- H1 revenue grew 23.4% to £14.13m (of which, 7.7% was organic growth)

- Adj PBT up 52% to £3.03m - impressive!

- Adj EPS up 45% to 2.47p

- Negligible net debt of £0.34m

The following suggests that covid seems to have been significant in the profit growth achieved - this needs to be quantified really, to give us the full picture, as it’s one-off business, as the company has mentioned before -

While maintaining safe working conditions, the Group has adapted to changing patterns of demand and has dramatically increased capacity and output in areas where its products could contribute to the global response to the COVID-19 pandemic…

during this pandemic, some of our companies have been awarded large one-off contracts to supply equipment to help test for, or treat, COVID-19. These contracts have ensured that the Group is trading broadly in line with forecasts set prior to the pandemic.

Outlook - it’s in line -

... the Board remains confident that SDI will deliver a full year financial performance in line with market expectations."

Broker forecasts have been noticeably raised. The most recent increases could be accounting for the acquisition of Monmouth -

.

Balance sheet - on a quick skim, I can’t see any funnies here, it looks OK.

NTAV is modest, at only £1.2m, or £3.2m if I deduct deferred tax, which I’m tending to do these days, because it usually relates to intangibles. Hence if we’re eliminating intangible assets (relating to acquisitions), then I think we should probably also eliminate deferred taxation relating to intangibles too. Do any accountants reading this agree with my approach or not? I’d like some feedback on this point if possible.

As with all acquisitive groups, it’s important to keep a grip on the balance sheet, so that it doesn’t become too top heavy with intangibles (goodwill) at the top, and too much debt nearer the bottom. I think SDI has got the balance right, with modest levels of debt, and NTAV that is still positive, so overall this looks OK.

A business like this, which is generating good profit margins, can carry a little debt without it causing problems, so I’m happy overall with the way this balance sheet is structured.

Cashflow statement - looks good, this is clearly a decently cash generative business. It’s benefited from favourable working capital movements. The tax creditor is small, and little changed, so it looks as if SDI has not stretched its payments to HMRC, which is good. Companies that are trading well should pay up on time, and not take advantage of late payment schemes - it’s important to do the right thing these days, not to act selfishly.

Capex is very modest in H1, at only £109k. I’m pleased to see that only £116k of development spend was capitalised in H1, indicating non-aggressive accounting.

SDI doesn’t pay divis, which is fine for an expanding group, but it has paid down debt by a striking amount in H1, £5.56m “repayment of borrowings” shown on the cashflow statement - I’m impressed.

My opinion - SDI looks good. Probably priced about right for now, on a PER of about 20, which I think is fair. I’m happy with the figures, in particular the balance sheet and cashflow statement look fine.

Acquisitive groups that generate plenty of cash can work very well - borrowing to make acquisitions, then paying it down quickly from cashflows. That has been the highly successful model at Judges Scientific (LON:JDG) - a major multibagger over the last 10 years. I wonder if SDI can pull off the same thing? It looks well on the way. The trick is to get rated as a growth stock (PER of 20 or more), then keep making cheap acquisitions (e.g. single digit PER) funded mainly by debt that can be repaid rapidly, hence little dilution of the equity. Rinse & repeat, and before long you have a self-fuelling virtuous circle, providing the acquisitions made are good ones.

The share price has done well recently, so possibly up with events now? So far though, management don’t seem to have put a foot wrong with the acquisitions, as far as I can tell. Could be an interesting one to tuck away for the long term possibly? It would be good to meet management - I wonder if they do results webinars? All companies should do these, as they’re incredibly helpful for investors, and make us more likely to buy the shares. After all, it’s private investors that set the share price & create most of the market liquidity, so it’s negligent for companies to fail to engage with this important element of the market. Results webinars are the best way of doing this. If the institutions are given results presentations, then so should other investors, to provide a level playing field for all investors, rather than big investors having privileged access.

EDIT: Many thanks to SlickMongoose for pointing out that SDI has already provided online webinars, on the InvestorMeetCompany platform, recordings available here. I'm just taking a look at the webinar video from 23 Sept 2020, which is actually an online AGM - interesting, as I've not seen one of these before online.

Earlier than that, SDI did a full year results presentation, also on IMC platform, on 24 July 2020, so I'll have that running on my 2nd screen whilst writing the next company section.

Interim results presentation - See InvestorMeetCompany, 11 Dec (this Friday) at 16:30

End of edit.

Here’s the 3-year chart for SDI. I’d probably want to wait for a pullback before buying any shares myself.

.

.

Creightons (LON:CRL)

Share price: 63.5p (up c.7%, at 08:59)

No. shares: 64.7m

Market cap: £41.1m

My notes from the last full year results (FY 03/2020), which contain some important points, are worth re-reading, here.

Creightons makes hair & skincare products, under lots of brand names, here are some examples from its website -

.

Interim results today look excellent, key numbers;

- H1 revenues up 36% to £32.4m

- Gross margin down from 42.0% to 39.3%, but more than offset by revenue growth

- Profit before tax up 64% to £2.9m - excellent, and remember this is just for a half year

- PBT margin up from 7.4% to 8.9% - healthy, without being excessive (which could attract competition)

- Diluted EPS of 3.31p (up 61% - very strong) - be sure to use diluted EPS, because there is unusually high potential dilution at this company due to excessive share options, as noted in my last report

- Interim divi is tiny - what’s the point of paying out 0.15p?

Balance sheet is lovely, with freehold property, and NTAV of about £17.0m - very strong for the size of company. So shareholders can sleep well at night, not having to worry about any financial emergencies or discounted fundraisings in a crisis. We’ve seen in 2020 how the unexpected can plunge highly geared companies into serious problems. No such worries at CRL.

Cashflow statement - this is a bit of a concern. Adverse working capital movements (higher receivables and inventories) have soaked up all the cash generation. I suppose that’s understandable, given that revenues are up so much. After all, when a business expands rapidly, then two debits on the balance sheet go up (inventories and receivables) whilst only one credit entry goes up (trade payables). Result - cash is sucked into working capital, which is what’s happened here.

A bit more analysis of receivables;

H1 last year (LY): Receivables of £8.66m was 36.5% of £23,751k revenues

H1 this year (TY): Receivables of £13.09m is 40.4% of £32,375k revenues

If the proportion had been the same this year, at 36.5%, then receivables would have been £11.8m. It’s actually £13.09m, an excess of almost £1.3m in slower cash collections in H1 TY.

Therefore my conclusion is that receivables have slowed down somewhat, and the company could do with a focus on tightening up its cash collections from customers, to improve cashflow.

The commentary says working capital should reduce in H2 - something to confirm in due course when the figures are published.

Note that £1.0m of VAT has been deferred, which will have to be paid in H2, I imagine, flattering cash at the interim stage. I think this is a questionable decision, to stretch tax creditors, when trading well. The company should cough up, and not take this free loan from the taxpayer, in my opinion, given its strong profit growth.

Bad debt risk sounds well controlled;

We proactively managed the risks faced by our customers by working closely with them and by increasing debtor management and expanding our credit insurance. All customers' debtor limits, apart from the Department of Health and Social Care, are within insurance credit limits or they pay on a pro-forma basis.

Sales growth - I am concerned that the big growth in revenues could be one-off in nature, as it relates to covid sanitising products;

The main driver of this sales growth has been the increased sales of hygiene products, sanitising gels and hand washes, primarily through our reinvigorated 'Pure Touch' brand. The Pure Touch products were mainly sold to the Department of Health and Social Care (DHSC), as part of the NHS PPE procurement plan, and to major UK retailers. The increase in hygiene sales was partially offset by a reduction in sales to private label and contract manufacturing customers, whose sales were adversely impacted by Covid-19 related store closures.

If vaccines and testing lead to a gradual elimination of covid in 2021, then surely sales at Creightons would decline accordingly? Potentially reversing at least some of the strong sales growth in H1? Is that something which worries shareholders? Or not, maybe? If not, why not?

Other sales (non covid related) seem to have been solid though -

Revenues through our branded division, excluding the hygiene related revenues, continued to grow, with increased internet sales, a full period sales of Balance Active (acquired in June 2019) and increased sales from the launch of the Body Bliss brand. Sales through e-commerce increased by 180% in the period albeit from a low base.

Brexit - the group is prepared, with new subsidiary companies set up in Ireland and Germany. In summary it says;

Although there is still uncertainty surrounding the outcome of Brexit, we do not expect the direct consequences of Brexit to have a material impact on the Group.

Outlook comments - maybe I’ve missed it, but checking the RNS twice, I cannot find anything said about expectations for H2 & therefore the FY. That’s very unusual, not to give an outlook statement at all.

My opinion - very impressive results. I think it would have been helpful if the company had quantified how much of a financial boost it has had from covid-related sales, which do sound significant.

I very much like the strong balance sheet. My comments above on receivables & inventories were just me kicking the tyres, but overall I’m satisfied that the big increase in revenue will have caused working capital to rise. This should settle down or reverse in H2, something to check.

Unfortunately, I cannot find any broker forecasts. Allowing for the fact that H1 might have seen a one-off boost from covid products, which could slow in H2 perhaps, then at a guess we might be able to use 6.0p as a FY earnings forecast. That puts the PER at about 10.6 - still good value, providing that can be maintained or grown in future years.

Overall - despite the rise in share price, Creightons still looks attractively valued. It has an excellent track record long-term. As before, it gets another thumbs up from me!

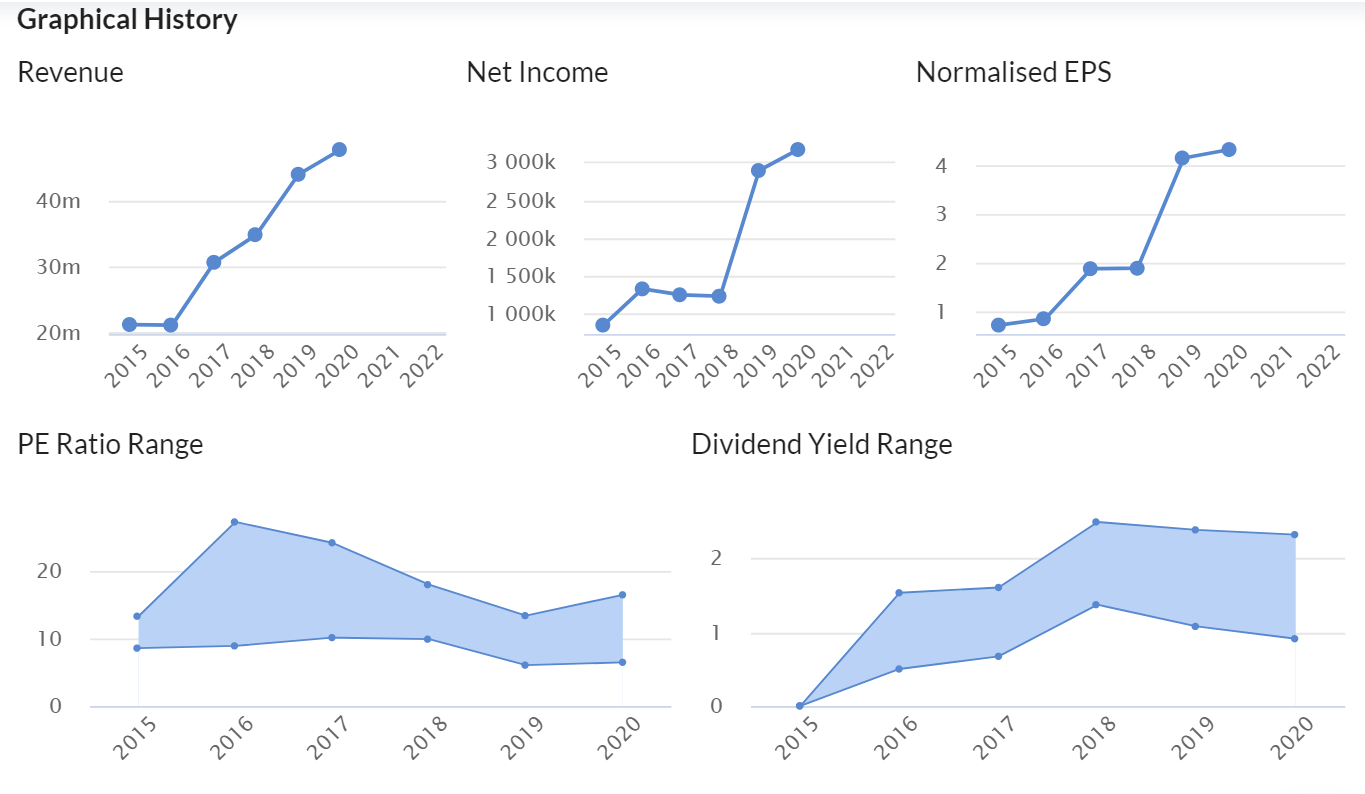

Superb progression in EPS as you can see below. If I'm right that it's heading for c.6p this year, then this graph would look even better in future.

.

.

That’s the main in-depth sections done. Now I’ll move on to other announcements which look less interesting, hence shorter sections.

Dialight (LON:DIA)

255p (down 1.5%) - mkt cap £83m

This company makes LED industrial lighting, e.g. for roadworks being done at night. Its track record has been very erratic over the years, so it doesn’t really interest me, but let’s have a look anyway.

Today’s trading update is for FY 12/2020 to date.

- Continued problems with suppliers & transport, causing production delays & increased costs, and “disrupted” revenues

- Mexico factory 20% reduced staff, due to covid restrictions

- Net debt 30 Nov is £14.9m (£3.1m improvement from half year position) - driven by inventory reductions. Expecting similar debt level at year end

Outlook -

In the longer-term, the growth drivers of LED lighting and sustainability are as strong as ever. The COVID-19 crisis is also expected to accelerate the structural drivers for LED lighting and our scale and innovation-led customer offering positions us well and gives us confidence for the future.

The closest we get to anything meaningful re trading, is this;

Lighting MRO orders have steadily improved since April, as expected, and in recent months there has been a modest recovery in project work, despite challenging market conditions.

Signals & Components continued to perform well.

My opinion - who writes these things? There’s not actually anything specific, in terms of facts or figures given. So a trading update that gives us little idea how trading is going, is not very useful.

How are they trading versus market expectations? Where’s the guidance for the full year, which only has 22 days left to run, so surely the company could have given us more than this?

H1 numbers to 30 June 2020 were poor - loss-making, due to the covid impact in Q2. It doesn’t sound as if things have improved much in H2. I see a new CFO has just been appointed, so maybe they don’t know what their figures are yet?

The last reported balance sheet isn’t too bad, so I imagine the business should survive.

Given the lack of information, I’m not able to assess this share. It would just be a leap of faith buying now, hoping that the business can recover from covid in due course, and return to profitability.

.

Photo-me International (LON:PHTM)

57.3p (down c.3%) - mkt cap £216m

This operator of photo booths & other self-service equipment, used to have a 30 April year end - it looks like this was changed to 31 Oct 2021, so an 18-month reporting period is referred to.

As announced in March 2020, the Board extended the Group's financial year end by six months to 31 October 2020. The Group will publish its results for the 18 months ended 31 October 2020 in February 2021.

I see that its results for FY 04/2020 showed underlying profit down 35%. The prodigious cashflows have made this share look interesting in the past. Although is it in structural decline long-term now? Photo booths have been around for longer than I expected, but will we still need them in say 10-20 years’ time? What about its other operations, e.g. washing machines in car parks. I don’t think PHTM splits out profits, by type of machine, so we can’t assess whether growth areas might replace declining photo booths revenues or profits.

Today it says -

- All markets & business areas “severely impacted” by covid

- Photobooths down 26% (revenues presumably) in H1

- Slight recovery in the summer, but renewed lockdowns have reversed this

- Laundry machines resilient, revenue down only 2% (but I’ve never seen any numbers reported on how much profit this division makes)

- Total revenue in H1 26% lower than last year H1

Profit guidance -

Profit before tax for FY20 (18 months to 31 October 2020), excluding IFRS16 impact, is expected to be approximately £0.5 million, taking account of the previously announced £23.7 million impact from exceptional items, provisions and impairment in the 12 months ended 30 April 2020, and a second impact of approximately £7 million in the six months ended 31 October 2020 . The Group was cash flow positive in the period.

- Diversifying product - more laundry machines, and fresh juice machines being rolled out

- Thousands of photo booths are being removed, c.17% of the total - that should improve profitability, as obviously they would only be likely to remove loss-making machines.

- Net cash of £22m at end Oct 2020

- Covenant breach occurred but BNP Paribas being helpful, so not expected to re-occur

- Scenario planning indicates sufficient liquidity

- Cutting costs, and conserving cash. Might need to do more restructuring, closely reviewing

Guidance -

the Board estimates and has budgeted for revenue of £175 million in FY21 (12 months to 31 October 2021), and estimates profit before tax will be £9 million before any exceptional items, and also estimates that the Group will be cash flow positive.

Even in a downside scenario, the Board believes that the Group's existing financial resources will be sufficient for the Group to withstand the uncertain economic conditions which are currently expected in 2021.

My opinion - I’ve no idea how to value this, sorry.

It seems clear that the business is likely to survive, until things return to normal. Then revenues should recover somewhat (maybe not back to previous levels, who knows?), and profits should improve from the current run rate, especially since the estate has been rationalised.

Long-term though, I can’t see why photo booths would be needed at all in the future. It just feels like a structurally declining business. Hence it doesn’t interest me, unless the valuation got down to a ridiculously low level.

That's it for today. Please see tomorrow's report for a couple of catch up items, namely Simplybiz (LON:SBIZ) and Marshall Motor Holdings (LON:MMH)

Regards, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.