Good morning, it's Paul & Jack here with the SCVR for Weds. Today's report is now finished - quiet news day, and I'm off for an investor lunch.

Agenda -

Paul's Section:

John Menzies (LON:MNZS) - a cash bid approach, from a Kuwaiti infrastructure company at 510p (52% premium) looks very appealing. However, the Board rejects it, saying it's opportunistic & undervalues the company.

System1 (LON:SYS1) - Q3 trading update looks OK (in line with expectations), but a broker downgrade has taken the shine off things this morning. Difficult company to value, but there might be something interesting here, time will tell.

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps up to about £700m. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

Paul's Section:

John Menzies (LON:MNZS)

335p (pre market open) - mkt cap £294m

Rejection of Unsolicited Approach

Big news here for MNZS shareholders - the company has received a 510p cash takeover bid (up from previously, apparently undisclosed 460p cash bid) from a Kuwaiti infrastructure group called Agility. Agility’s shares are listed on the Kuwaiti & Dubai financial markets.

Having a quick look at the investor relations section of its website, Agility looks a credible bidder - and offering a full cash bid for MNZS, it’s not mucking about. 510p is a generous 52% premium - likely to be very tempting for MNZS shareholders.

I can’t see any previous announcements about a takeover approach, so it’s surprising that MNZS does not seem to have informed shareholders about the previous bid at 460p. This once again highlights how unsatisfactory the UK rules on takeover bids are - where shrouding bid approaches in secrecy seems to be the Takeover Panel’s main objective, with disclosure to shareholders only required if someone leaks it to the press. How ridiculous is that? Lord Lee recently tried to engage with the Takeover Panel on this matter, but they swatted away his valid concerns unfortunately.

Like many (probably most) investors, I think companies should be required to reveal to their shareholders, immediately, if they receive a credible bid approach. It should not be up to management to make a decision behind closed doors, whilst a false market in the shares exists (if the market has not been informed that a bid approach has been received).

The rest of today’s announcement from MNZS gives a spirited defence against the takeover approach, saying it’s opportunistic & undervalues the company - quite surprising, given that a 52% bid premium would normally look rather generous.

Here is what MNZS says, which does sound interesting. On the historic numbers I would say the bid premium looks very generous indeed - particularly when you take into account that MNZS has a very weak balance sheet, with NTAV negative at nearly £(200)m, with too much debt.. But if this turnaround information is correct, then maybe there could be better upside from MNZS remaining independent? Or maybe management just want to hang on their jobs & share options?!

My opinion - well done to MNZS shareholders. There’s obviously hidden value in the company, and ignoring the terrible, overly indebted balance sheet was risky, but has paid off in this case.

It’s likely to be a very lucrative day for shareholders! I imagine the share price is likely to rise vertically to close to the 510p bid price, as the bid looks credible. I imagine many shareholders would be happy to bank the profits at that level.

There's a lot of value in UK small caps right now, after some brutal price falls in the last 6 months or so, so I'm expecting plenty more takeover bids.

.

.

System1 (LON:SYS1)

375p (down 14% at 09:03) - mkt cap £48m

System1, the marketing decision-making platform, intends to issue quarterly updates for Q1 and Q3 of each year based on unaudited numbers. These updates are intended to keep investors informed of the Company's performance between the interim and final trading updates and results announcements. System1 today issues the following update on trading for the quarter ended December 2021 (Q3).

Bravo to that. Investors want to receive updates about how their companies are performing, so I like the concept of a regular, quarterly update.

It’s an in line trading update -

Profitability was in line with management's expectations and reflected an increase in expenditure on people and platform as highlighted in the interim results announcement.

Cash remains healthy -

Period-end cash, net of borrowings, was £8.1m

Broker update - readers were discussing this share below, in the comments, and wondering why it has fallen c.14% today? I think the answer seems to be an update note from Canaccord Genuity, which lowers revenue forecast (but profit unchanged) for FY 3/2022, and also lowers its recommendation to “hold” (broker code for: sell).

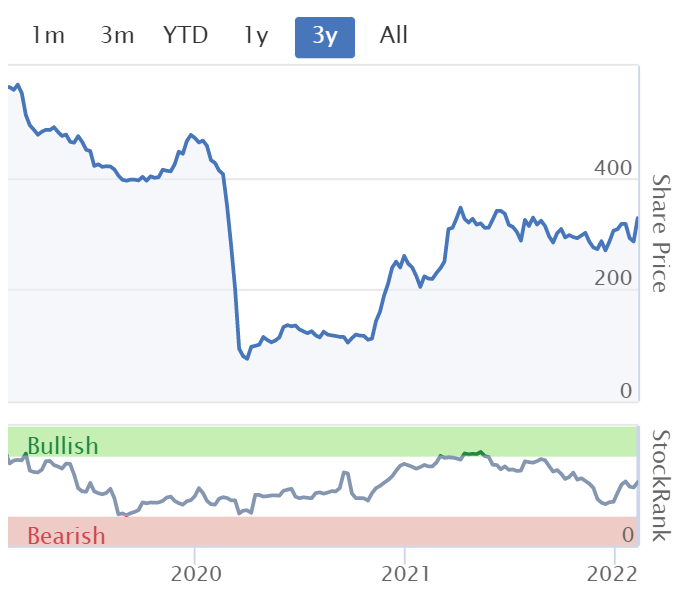

My opinion - both Jack and I are intrigued by this company, and think it might be interesting, if its data products take off. In the meantime though, it’s very difficult to value. Should we take a traditional PER approach? That’s not always relevant for growing companies, but in this case forecast EPS is 11.3p for FY 3/2022, and 13.2p for FY 3/2023.

At 375p per share, the PERs are therefore 33 and 28 - not a bargain then, on an earnings basis.

So holders must think the company’s likely to beat forecasts, and/or has a bright long-term future.

I don’t have any insights on what might happen in future, so take a neutral view - but it’s worth following this company, as a potential buy if revenues/profits really start to take off in future. The decent balance sheet, with plenty of cash, and management with lots of skin in the game, appeal to me too.

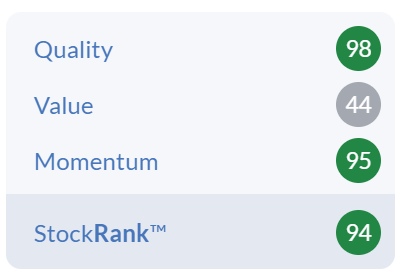

There's an unusually high StockRank too -

.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.