Good morning, it's Paul here. I'm late with the placeholder, as my alarm didn't go off. Apologies for the inconvenience.

Superb reports from Jack on Mon & especially Tuesday, covering a lot of ground. The only additional share I want to flag from yesterday, is a trading update from upmarket wallpaper & furnishings group, Walker Greenbank.

Today's report is now finished.

.

Walker Greenbank (LON:WGB)

Share price: 45p

No. shares: 71.0m

Market cap: £32.0m

(I'm long)

Walker Greenbank PLC (AIM: WGB), the luxury interior furnishings group, announces its half year trading update for the six months ended 31 July 2020.

Note the unusual H1 period end, 31 July. The next year end is 31 Jan 2021.

- Covid - significant impact in H1 (as already reported, so no surprise there)

- Improving trend since April, gaining momentum

- H1 sales down 28% on LY (strikes me as not too bad, in the circumstances)

- Core licensing revenues down 10% (OK)

- Third party order book good, and demand growing

- "Robust" liquidity - £19.5m headroom, including bank facilities (that's good, but it is not disclosed how much creditors have been stretched (e.g. VAT, payroll taxes)

- Outlook for H2 uncertain

- H1 results to be published in Oct 2020

My opinion - I think that's satisfactory. We all know H1 will be a write-off, due to lockdown, for this and many other companies,. Therefore the focus should now be on how well companies are recovering. WGB sounds as if things are improving, but the company has withheld the figures (e.g. it could have told us the month on month trend of performance, but decided not to).

All in all then, this is a bit of a nothing update, as a reader commented yesterday. Nothing much of concern, but inadequate information to properly ascertain how the company is performing. I'm not very happy about that.

Overall, I don't think this update makes me want to buy more, or sell any. I'm happy to hold for hopefully further recovery. A few years back, this share settled around 200p, and seemed rock solid at that level. It's now under a quarter of that level, after a few mishaps. £32m mkt cap seems very low for a nice collection of brands, with great heritage, and licensing revenues from the historic back catalogue of e.g. William Morris famous designs. I wonder if it could be a bid target, at the currently bombed out valuation?

.

.

Boohoo (LON:BOO)

(I'm long)

Ethical funds

This has, so far, been one of this year's best trades. First there was a botched shorting attack from Shadowfall, which was largely nonsense, just regurgitating already-known points about family interests, etc.. Anyone paying attention would have already known that BOO is a family business with a listing, and yes there are some related party transactions, etc, all disclosed in the accounts. Attempts to sensationalise these issues haven't worked, as people already knew about them, and didn't care. What matters more to investors here, is that earnings have gone up about 10-fold in recent years.

More recently though, the share price halved on renewed allegations of malpractice in BOO's Leicester supply chain. Something similar was reported a couple of years ago, yet the first time it had hardly any impact on the share price. This time it halved the share price. How come?

The reason is possibly that fund managers are more focused on ethical investing, with ESG (Environmental, Social & corporate Governance) being the latest thing. Those are fine things, and I very much like the focus on urging companies to improve the way they behave.

I've read that BOO's share price plunge recently was down to ethical funds dumping the shares at any price, since they didn't want the scandal-hit company on their list of investments. But why were BOO shares in an ethical fund to begin with ? Even some very basic research would have revealed that the fast fashion sector is ethically questionable - because throwaway fashion hurts the environment in various ways (fabric is wasteful to produce, then landfill is brimming with discarded clothes). Plus the rag trade generally (from top brands all the way down to Primark) is regularly dogged with allegations of sweatshop conditions for workers. As I've mentioned before, it's almost impossible for retailers to police how their product is made, because the supply chains go all around the world, and sub-contracting out work to unknown factories is widespread.

The end result of this, is that these ethical funds which were dumping BOO shares as low as 200p shouldn't have been in the stock to begin with, and they handed a lucrative slice of their clients' funds to other investors, on a plate. I filled my boots, as reported here at the time, at 209p upwards, and it's now 312p at the time of writing, as the hoo-haa subsided.

If I were an investor in an ethical fund, I'd be asking the fund manager serious questions about this. Why did he invest in a sector with widely known issues? And why did he dump BOO shares at half price, handing Stockopedia blog readers a fabulously profitable trade? I'm very grateful for how things panned out, but wouldn't be very happy if I'd entrusted a fund manager with my money, and he'd handled it this badly.

This issue could resurface of course, because there's a full, independent investigation underway at BOO. Although I suspect it would just move production to even lower cost factories, abroad. BOO is also planning on opening its own, model factory in the UK, to showcase what standards it supposedly wants from its suppliers. This is a really clever solution, because cutting out the wholesaler's margin (usually about 20-30%) means that BOO would be able to pay its workers minimum wage without any impact on margins. There's never been any issue with people directly employed by BOO by the way.

All in all then, I think if people are going to set up ethical funds, they should take a lot more care in checking out the sectors & companies they invest other peoples' money in, to avoid squandering client funds, as in this case. I do hope that readers took full advantage of this wonderful opportunity to be given some free money! One reader I'm corresponding with, put about 50% of his portfolio into BOO near the lows. So he's a lot happier with his YTD performance now. Let's hope he top slices, to reduce portfolio risk.

.

.

EDIT: I enjoyed the reader comments below about this. In particular, Pangit's daughter's short-lived boycott of BooHoo! Hilarious!

Hostelworld (LON:HSW)

Share price: 62p (down 1% today, at 09:45)

No. shares: 114.7m

Market cap: £71.1m

Hostelworld, a leading global OTA focused on the hostel market, is pleased to announce its interim results for the period ended 30 June 2020 [Paul: 6 months, H1]

They've given it one of those summary headers, which says;

H1 2020 in line with expectations; modest increase in bookings in recent weeks in line with the easing of travel restrictions. Accelerated delivery of Roadmap for Growth initiatives

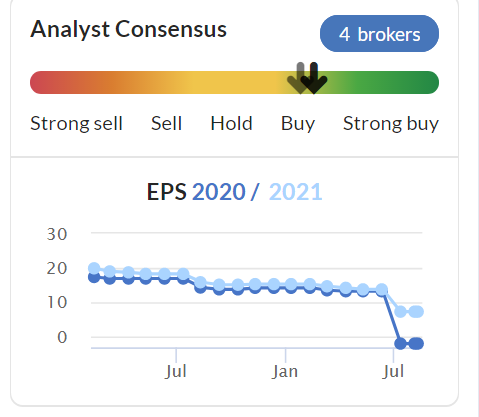

In line with expectations doesn't mean much, since expectations were slashed (darker line is the current year), now forecasting a loss of c.2p EPS this year;

Given what's happened with lockdown, it's probably not worth me poring through the detail of these interim results. All that matters are: strength of balance sheet, and outlook/current trading comments, so I'm generally focusing on that at the moment. Figures are massively distorted by covid, income from furlough, etc..

Refreshing my memory, I last looked at HSW here on 27 Mar 2020, concluding that its flexible cost business model meant that it should survive the covid crisis intact. In particular, large marketing spending can be easily reduced or switched off altogether, to conserve cash.

- H1 revenues down 69% to E12.0m

- Marketing costs slashed to E7.5m, down 54% on H1 LY - see what I mean about flexible costs? This is a huge advantage over travel agents with physical stores, which have limited scope to downsize costs in a crisis

- Hefty loss at EBITDA level of E8.3m (vs a profit of E8.9m H1 LY), but it says this is in line with guidance

Balance sheet - raised E15.2m (gross) in a June 2020 placing

Cash position looks very strong;

Closing cash position €32.9m (H1 2019 €25.4m) includes cash on hand of €29.4m and a €3.5m short-term financing facility

Although the balance sheet overall isn't as strong as I expected. I've reviewed the balance sheet & cashflow, and note that trade and other payables have risen to E18.0m (up from E11.1m 6 months earlier), which looks like it has perhaps stretched creditors? That's only a short-term benefit, and is likely to reverse in 2021, which together with ongoing cash burn, could mean the underlying cash position is not as strong as it looks.

Going concern note - worth reading. It concludes that the group has sufficient cash headroom for the foreseeable future.

Dividends - no cash divi, but a scrip (bonus issue of shares) divi is being paid. Why? I cannot see the point in this, as everyone's % shareholding remains the same. Maybe it wants to stay on the dividend list for some technical reason, who knows?

Current trading -

In recent weeks we have seen an increase in demand as travel restrictions have eased, and we are tracking slightly ahead of our Base Case scenario. This recovery started with very modest growth in domestic bookings in June, and more recently has progressed to very modest growth in domestic and short-haul bookings into Europe. Overall, we expect the pace of recovery to mirror changes in travel guidance in individual markets over the coming months, both positive and negative. Elsewhere, source markets in the Americas, Asia and Oceania continue to remain very depressed.

The obvious point is that fresh outbreaks of covid are happening all over the place, so nobody really knows when the travel sector will get back to normal. Also, are customers likely to want to stay in hostels, where social distancing is surely more difficult than in hotels? (e.g. multiple occupancy rooms, etc). Or are younger people more prepared to take the (minimal, to them) risk?

Overall, we are encouraged that our travellers are continuing to book Dorms in the majority of cases - with only a slight shift to date in accommodation mix towards Private rooms versus Dorm accommodation across markets.

H2 outlook - not good, for reasons outside their control;

Overall while bookings continue to trend well below normalised patterns, and assuming a gradual improvement in the macro travel environment, we expect the recovery to improve further in Q3 and Q4 2020, albeit net bookings will remain at significantly reduced levels when compared to 2019. Whilst this recovery is likely to take some time and the consumer environment will continue to be uncertain and challenging, the Board remains confident in the resilience and flexibility of our business model...

No full year guidance is given.

My opinion - this is the type of share that has been really whacked by covid, and buying/holding this share is really taking a view that covid will be defeated, and the travel sector returns to normal. that's obviously going to happen at some point, but the timing is uncertain. Meanwhile travel companies burn through cash. I prefer the online model here, to a physical travel agent.

HSW was a decently profitable business pre-covid, but was facing stiff competition. Therefore my worry is that it might be an also-ran in a sector dominated by e.g. Booking.com

It might be worth spending some time looking at HSW's growth plans, as there could be good value here, if it is able to become a growth stock again. Overall, I'm not convinced, so cannot see any reason to rush out and buy this share at the moment.

.

Appreciate (LON:APP)

Share price: 35p (down 13% today, at 11:51)

No. shares: 186.3m

Market cap: £65.2m

Appreciate Group (the 'Group'), the UK's leading multi-retailer redemption product provider to corporate and consumer markets, today announces its final results for the financial year ended 31 March 2020, and provides an update on current trading for the new financial year to date.

Subscriber markmac has asked me to look at this, and it appeared on my radar recently when Lord Lee wanted to chat to me about a share he likes, Air Partner (LON:AIR) , and he also mentioned Appreciate, my notes from our conversation are (this was in early July);

- Used to be called Park Group

- Hopeless acquisitions

- New CEO, with impressive strategy to focus on digitalising for smartphones

- Company seemed confident about the future, pre-covid

- Passed divi

- Encouraging trading update (in July)

Results for FY 03/2020 - impacted by covid in the final month, but in line with expectations in previous 11 months.

Profit before tax & exceptionals of £11.4m (down 9% on LY)

No divis, but will resume when prudent

Current trading/outlook -

Total billings* have progressively recovered as lockdown eases; 48 per cent down as at the end of Q1 in the new financial year compared to Q1 in the prior year.... Our continued investment in transformation, with changes to logistics and operations completed, is already showing significant benefits. Whilst our performance has been interrupted by the lockdown, we have seen trading start to recover and expect the resumption of growth founded on the more robust and scalable business model. "We are confident that delivery of the strategic business plan will be the bedrock of strong and sustained future growth."

Pension schemes - look fine;

No further contributions to either scheme are currently required. The next triannual valuation will be undertaken as at 31 March 2022 when the positions will be reassessed.

Pension deficits are getting worse in some cases, because of the move to near-zero interest rates. Offsetting that could be rise in asset values. But if the schemes are currently fully funded, then I imagine any possibly future funding requirement would be likely to be small, if at all. Although it's always worth checking the last Annual Report before buying any share with a pension scheme.

Forecasting/stress testing - there's useful information provided about this in the going concern section. In particular;

The actual results for quarter one are slightly ahead of the base case, with overall corporate and HSV billings decreasing by 48 per cent compared to the 60 per cent assumed. In addition, July trading is ahead of forecast. This gives the Group confidence that the base case scenario is currently the best estimate and minimises the likelihood of any downside risks modelled within the other scenarios.

From a going concern perspective, the monthly forecasting of the Group's free cash balance in this scenario is the key area for consideration, as liquidity is the principal going concern risk. The base case, before usage of the RCF, shows a negative free cash balance in July 2021, recovering by September 2021.

A further downside scenario results in negative free cash balance a month earlier, in June 2021. If cost savings were implemented, then the cash balance turns negative in Aug 2021.

Bank facilities are in place to handle these scenarios, so it doesn't sound a problem -

New financing

The Group has access to a recently agreed committed RCF of £15m, with an additional uncommitted accordion of £10m.

With the RCF in place, and having cancelled the final dividend payment, the directors consider that sufficient headroom exists to cover any negative sensitivities of COVID-19 in both the base case and downside scenario.

The bank covenants are then explained, good transparency there.

This is the most important bit, and sounds OK;

With the RCF in place, in line with the base case forecast, it is not envisaged that the Group will draw down on the facility until July 2021. The Group is forecast to be in full compliance with the three covenants throughout the twelve month period from the signing of the annual report and accounts, with sufficient headroom in place in both the base case and downside scenarios.

That all sounds OK to me.

Balance sheet - the most striking number is £102.7m cash, "Monies held in trust" - customer prepayments presumably. There are large creditors, presumably relating to the other side of the double entry of this customer cash.

It's not a brilliant balance sheet. The current ratio is only 1.05 for example.

NAV is £18.3m, but by the time we take off £5.6m intangible assets, and the £4.2m pension asset, then NTAV is quite modest, at £8.5m.

I would have preferred to see more asset backing here.

My opinion - I don't know enough about this business to form a view overall.

I'd prefer the balance sheet to be stronger - i.e. it might be better to keep divis low for a couple of years, to allow the balance sheet strength to build from retained profits.

I'll do some more research on the products & strategy, and we can look at it again when the next trading update comes out.

Here is the results video presentation, courtesy of our friends at PIWorld.

.

I'll leave it there for today, as the other things reporting today are very small, and don't interest me.

Best wishes, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.