Good morning. It’s Paul here, with the SCVR for Weds.

I had to chuckle at one reader's feedback on the small cap value report - "Waaay too much focus on small caps!" :-)

Estimated time of completion: 3:00pm (a bit later than usual, as a placing has just been announced by Sosandar (LON:SOS) so I want to comment on that, in addition to everything else).

EDIT at 13:31 - I'm tired out now, after a mammoth report, so today's report is now finished.

Sorry I didn't get round to looking at PLUS or RWS, but they're quite big, so you can find analysis of them elsewhere easily enough. My focus here is mainly on the smaller, overlooked stocks that have little to no coverage elsewhere.

GDP first quarterly estimate, UK Oct to Dec 2019

I’ve signed up for the Office for National Statistics (ONS) emails of important economic data, so I can comment here direct from the source material, rather than second-hand via newspaper articles.

It’s no great surprise that UK GDP (the main measure of economic performance) was flat in Q4 2019, given all the political uncertainty. The ONS says this is as expected.

The first estimate for the whole of 2019, is that UK GDP grew +1.4% - not too shabby in the circumstances [source: section 3]

Bear in mind that GDP statistics strip out inflation. The most recent inflation figure I have (CPIH) is +1.4% for the 12 months to Dec 2019, coincidentally the same figure as GDP growth. To put that into the same terms that companies report their revenue, we need to add the figures together. Therefore, just to be standing still, a UK business should be reporting organic revenue growth of 2.8% (i.e. GDP growth, plus inflation).

We should also bear in mind that initial estimates of GDP are often revised subsequently, sometimes quite a lot. Do you remember how, when coming out of the financial crisis after 2008, there was prolonged talk of a double-dip, or even triple-dip recession? It turned out that neither actually happened, as the initial GDP estimates were subsequently revised upwards, hence were initially too pessimistic.

Ed Balls and David Cameron both cover this issue in their respective memoirs – both of which are worth a read or a listen. I recently enjoyed both books, in audiobook format, as it’s less strain on the eyes after a day staring at computer screens. Also, with audiobooks you can drift off during the boring bits, and still feel virtuous for having completed the book. As with all political memoirs, both Balls and Cameron put their own spin on things. I found it interesting to compare them, and the sometimes remarkably different interpretations of the same events! Both Cameron & Balls are noteworthy for including important personal matters, often very poignant, in their memoirs.

Gordon Brown’s memoirs were probably the worst I’ve read recently. Edit: mayabe that's unfair? Good in places might be a better description. (end of edit) He completely re-writes (and conveniently omits parts of) economic history whilst he was Chancellor & PM, to suit his own narrative. This reminds me of Churchill's quip that history will be kind to him, because he intends to write it!

Incidentally, Alastair Darling’s account of the GFC in 2008 is a riveting read, highly recommended. It's truly shocking how close the UK banking system came (literally a couple of hours away) to collapse in 2008. On the positive side, at least next time there’s a massive financial crisis, everyone will know what to do – forcibly recapitalise the banks, Govt guarantee for systemically important banks' deposits, and create however much money is needed via QE, to keep the system running.

Moving on to a few stragglers from yesterday’s RNS…

Aa (LON:AA.)

Share price: 46p

No. shares: 616.7m

Market cap: £283.7m

AA plc today publishes its pre-close trading update for the year ended 31 January 2020 (FY20).

It sounds in line;

The Group looks forward to announcing growth in Trading EBITDA and strong free cash flow generation in line with market expectations*. The positive operational momentum in FY20 continues to gather pace and the Group remains on-track with its strategic plan.

(*) Based on latest published estimates from seven analysts.

The footnote falls a bit short of what we need. They should have provided the consensus estimate. Also I’m not keen on companies quoting EBITDA. That is not the same as profit! We really need some standardisation of trading updates. It’s a free-for-all at the moment, with companies cherry-picking whatever metrics they feel like reporting on.

The AA has two divisions, roadside breakdowns, and insurance.

Roadside sounds like it’s stabilised, and insurance is said to be generating “strong rates of growth”.

Balance sheet – this is the elephant in the room. Probably the two worst balance sheets I’ve ever seen, are the AA’s, and Thomas Cook. Both had been wrecked by financial engineers, loading them up with crushing levels of debt.

The AA has £2.7bn of net debt. Yes, you read that right. £2.7 billion. That was as at the last interim accounts at 31 July 2019. This is a net debt: EBITDA level of 7.8x. Normally banks are comfortable to lend up to about 2x, maybe a bit more, so this is off the scale. The AA’s debt is class A and class B2 notes. I see there has been some juggling around with its bonds, which looks complicated & outside my remit here. All I care about is that this company is burdened with debt levels that cannot be repaid. Indeed, I read somewhere that that was in the intention – to have debt which is never repaid, just permanently rolled over. What could possibly go wrong?! How come it’s even legal to structure a balance sheet like this?

At 31 July 2019, the balance sheet showed NAV negative, at -£1,696m. Deduct intangible assets of £1,345m, and NTAV is negative on a scarcely believable scale, at -£3,041m.

Since debt ranks ahead of equity, this situation means that the equity is really almost like an option. Equity could easily get wiped out completely if business turned down, and/or if debt could not be rolled over at low interest rates – potentially debt becoming too expensive to service, and covenants breached.

There was a warning buried in the last interim results;

We are due to refinance £1.5bn of debt by July 2022 of which £200m relates to the refinancing of the Class A3 note in July 2020 and can be fully funded by a committed forward starting senior facility with a maturity date of July 2023. The current bond market suggests that debt would need to be refinanced at a much higher interest rate than the current debt and this is considered an emerging risk. Consistent with our approach to proactive debt management, we continue to regularly assess a range of strategic options and are monitoring market conditions closely.

Modelling indicates that even at higher interest rates, the business remains cash generative and able to meet its financing commitments at the same time as being able to pay down debt.

Debt interest already consumed 65% of operating profit, in the last interim results, and it sounds like that could go higher when bonds are refinanced on expiry.

Is AA equity worth anything? I’m thinking it’s probably only worth a few pence. Since dividends have already been slashed by more than three quarters, and it’s only paying out 2.0p, then you could argue that the only value in the equity is likely to be maybe a couple of years’ more divis, then nothing, possibly. That would value this share at maybe 4-6p. That’s all I would be willing to pay for it.

At some point I think the only solution here would be to persuade debt holders to convert into equity, at least partially. Situations like that usually all but wipe out existing equity holders.

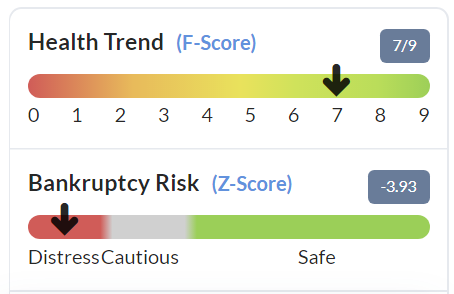

Note that the Altman Z-Score (a proven system of assessing financial risk) is flagging that the AA is financially distressed.

I don’t use the F-Score, but that is showing a surprisingly high reading. Looking at the 9 factors that make up the F-Score, the flaw seems to be that it doesn’t take into account the actual level of debt, which in this case is extraordinarily & very dangerously high. So I wouldn’t rely on the F-Score in this situation. Manual work shows that the good F-Score looks a bit of a red herring in this case. Personally, I place a lot more reliance on the Altman Z-Score, than the F-Score.

Overall, we must be careful not to be tricked by the low PER, and high value scores here. It’s not good value at all, it’s submerged in excessive debt, such that the equity could easily turn out to be worth nothing.

The upside case, is that if debt can be refinanced cheaply, and if the business trades well, then equity could see leveraged upside.

You would really need to be an expert on junk bond financing, to properly assess this situation. I’m just flagging that the equity is very high risk. Just look at the shareholder value destruction here, from an obviously inappropriate financial structure that was deliberately created;

China New Energy (LON:CNEL)

I’m flagging this one purely for its RNS comments yesterday about China/coronavirus.

The Board of CNE (AIM: CNEL), the AIM quoted engineering and technology solutions provider to the bioenergy sector, provides a trading update for the year ended 31 December 2019 and outlines its response to the novel coronavirus (2019-nCoV) ("Coronavirus").

As widely reported in the press, business activities in China are being disrupted by the Coronavirus outbreak and, whilst the Company does not currently believe this will cause a significant financial impact in 2020, the Board of CNE would like to provide shareholders with further information to understand the situation as it relates to CNE.

Firstly, during the Chinese New Year holiday also known as the Spring Festival, the Company usually closes its office and factory for a period of two weeks which this year ran from 23 January 2020 to 6 February 2020. In order to contain the Coronavirus, the authorities have requested that companies in our region should remain closed until 15 February 2020 and the Company will comply with this directive.

During this extended holiday period, the Company's Chinese employees are working from home and the Company expects minimal interruption to its office-related business activities and, specifically, minimal impact to its ongoing audit and resubmission application to the HKEx. The closure of the factory for an additional five working days is expected to cause only minor manufacturing delays which, with overtime, the Company expects to correct quickly during production in Q1 2020….

… The Company will only provide further updates on the Coronavirus outbreak if it is expected to materially affect the performance of its business.

My view – this is the most upbeat assessment I’ve read so far, from any company operating in China.

Intu Properties (LON:INTU)

Plunged another 30% yesterday to 12.18p.

The immediate catalyst for this was the withdrawal of Link Real Estate (a Hong Kong investor) from the refinancing talks.

There’s an interesting article in the FT here.

It looks as if existing equity in INTU could turn out to be worth little to nothing. Hence it’s far too risky to even consider catching this falling knife.

Today's updates;

China/Coronavirus updates

Cathay International Holdings (LON:CTI) - a micro cap listed in the UK, which operates hotels & makes healthcare products in China.

What it says today is interesting;

The majority of the Group's operations are based in China and a number of restrictions have been imposed by provincial and national government to limit travel within China and to extend the Chinese New Year holiday period, in an attempt to control the spread of the novel coronavirus.

At present production at all of our plants is either on hold or preparing to gradually resume production within the next 7-10 days, subject to the further development of the epidemic and government advice or restrictions. Accordingly, there is a risk that these restrictions, if prolonged, may limit production and sales of our products which may have an adverse impact on our results for 2020. At this stage it is too early to gauge whether there will be an impact of any significance on the Group's operations for the year 2020.

Our hotel business in Shenzhen is showing a marked reduction in occupancy and bookings in the short term, as a result of the extended Chinese New Year break and restrictions or travel warning on travel within and to China. In the short term this will have a material impact on the hotel's financial performance, but it is not yet possible to say whether this will translate into a material impact on the results for the Group for 2020 as a whole.

We are monitoring the situation closely and will provide further updates as appropriate.

I read somewhere that hotel occupancy is down to only 25% in China, but that was about a week ago, so I don't know if that has changed or not.

Given the track record of small Chinese companies listing in the UK, then obviously I wouldn't touch this share, or anything like it. But it's still interesting to hear what it says about the situation on the ground in China.

.

Heineken Holding NV - in its 2019 results today, this large cap says;

As a result, HEINEKEN currently expects operating profit (beia) to grow by mid-single digit on an organic basis, barring major negative macro economic or political developments. In particular it is at this stage not possible to assess the extent and duration of the impact of Coronavirus on the economy and on HEINEKEN's business.

No other mention is made of this issue in its results statement.

.

Scapa (LON:SCPA)

Share price: 175p (down 36%, at 08:26, price volatile)

No. shares: 155.2m

Market cap: £271.6m

Trading update (profit warning)

Scapa makes adhesive-based products, for healthcare & industrial markets.

The share price had been recovering from a previous profit warning, but is back to square one after another one today.

Scapa Group plc (AIM: SCPA) provides an update on current trading ahead of its financial year-end on 31 March 2020.

.

.

Profit warnings are a nuisance, because the share price often moves so quickly, that by the time I've typed the above header, it has to be recalculated because the price has dropped. I started at 190p, and in a few minutes it had dropped further to 175p.

The Group expects FY20 revenue to be approximately £306 million, broadly in line with market expectations. However, trading profit is now expected to be approximately £28 million, significantly below consensus.

Whilst it's good that revised profit guidance is given, unfortunately there is no footnote to explain what consensus expectations are. That wastes time for everyone reading the RNS, as we now have to look it up, and that info may not be available to everyone.

A hat tip to Arden, which has helpfully issued an update note today. This quantifies the revised profit guidance of £28m as being a shortfall of 11% vs previous consensus. You could argue that a 36% negative share price reaction seems a bit harsh, but I suppose to miss the full year forecast by 11% less than 2 months before year end, suggests a sharp recent reduction in trading.

Reasons given for the profit shortfall;

Healthcare trading profit is expected to be lower than consensus, reflecting slower progress in reducing costs than expected at the time of the interim results.

Industrial revenue is expected to be approximately £168 million, which is slightly below market expectations but has a material impact on Group trading profit. This is primarily the result of adverse macroeconomic conditions, particularly in the automotive and specialty products markets.

If industrial revenues is only slightly down, but profit materially down, then to me that suggests it's having to discount prices to achieve sales. What other reason could there be, apart from increased costs?

Outlook - not great;

The Group expects the macro environment to remain challenging in some of the industrial markets in which it operates.... we will focus on cost reductions to drive the margin in Industrial to historical levels.

Automotive is a sector with well-known problems, so that must be tough for Scapa, although I don't know what proportion of sales/profits it represents.

Legal action - Scapa lost a lucrative contract with ConvaTec. Its interim results say that Scapa has filed an $83m+ claim against ConvaTec in Connecticut. Given the materiality of this legal claim, there really should have been an update in today's statement. However, nothing is mentioned. That's a glaring omission.

My opinion - this seems a fundamentally good business, and it remains highly profitable, even after today's update.

I imagine forecasts for FY 03/2021 are likely to be reduced too, but don't yet see any updated numbers.

A lot hinges on how the ConvaTec legal action pans out. Scapa's claim at around £64m, is almost a quarter of its market cap. We need more information about this case, and the likelihood of success or failure. Without that, I'm struggling to form a view on this share, hence have to say I'm neutral.

Ted Baker (LON:TED)

Toscafund - an activist investor, is now up to 15.5%, with continued buying.

As mentioned here previously, Tosca (15.5%) and the founder Ray Kelvin (34.9%) combined, are now in the driving seat, with a controlling 50.4% stake potentially, if they decide to work together. I've not seen any evidence of that yet, and they would have to declare a concert party.

The big risk for outside shareholders is if they decide to launch a low-priced takeover bid.

The other big risk is that the company continues its meltdown, as it has serious problems with excessive inventories, and declining sales/profits, and debt, as previously covered here - where Graham, Ben, and I have written loads of stuff about TED, it's a really interesting situation.

To my mind, it's too risky to either be long, or short, as it could go either way.

United Carpets (LON:UCG)

Too small for a full section, only c.£4m market cap

United Carpets Group plc (AIM: UCG) the third largest chain of specialist retail carpet and floor covering stores in the UK, announces the following trading update for the year ending 31 March 2020.

Profit warning -

- No uplift in trading after Election result in Dec 2019

- Still challenging environment

- LFL sales down -5.7%

- Startup & servicing costs of new instalment scheme higher than expected, won't contribute to profits this year

- "Very competitive" market conditions, including aggressive discounting

Overall - top marks to the company and its advisers (Cantors, and Novella Comms) for the simplicity & clarity of this announcement, when it gives us precisely the information we need, which so many other companies (aided & abetted by their PRs) try to obscure! Trying to pull the wool over our eyes is not helpful, it's actually counter-productive, undermining trust.

The combination of these factors means that the Board now expects profit before tax for the full year to be below current market expectations of £0.5m and in the range of £0.15m to £0.20m (before non-cash costs associated with IFRS16).

The share price is only down 14% today, probably (at least in part) because the company has just told it like it is, and given us the numbers. Everyone can now crunch the numbers, form an accurate view, and move on. This is how all profit warnings should be presented. What a pity that very few are served up in this clear, common sense way.

Outlook - these are fair comments;

Importantly, United Carpets remains a well-positioned business with a strong brand and well established, predominantly franchised, store network. The Company has significant cash balances and virtually no debt, creating a platform that together with its experienced management team means it is well placed to benefit from any upturn in market conditions.

My opinion - It's not a bad little company, just too small to be listed. I don't see how all the costs & hassle of a listing make any sense at this level.

That's the small caps done for today. On to some other interesting announcements.

Dunelm (LON:DNLM)

Share price: 1326p (up 10.3%, at 10:20)

No. shares: 202.2m

Market cap: £2,681.2m

Dunelm Group plc ("Dunelm"), the UK's leading homewares retailer, today announces its interim results for the 26 weeks to 28 December 2019.

I'm not going through all the detail, this is just a quick heads up to flag smashing results. It just goes to show, that not all retailers are struggling, if they provide what people want, at a sensible price.

Stand out points include;

- LFL revenues up +5.6% - that's outstanding, in a market where most retailers complained how tough it was! Also talks about positive footfall, unlike others. Its sites are in retail parks, so must be destination stores

- Gross margin up 120 bips

- Profit before tax in H1 up 21.3% to £83.6m in H1 (which includes Xmas, so is the seasonally more profitable half)

- New digital platform launched - more sales growth?

Outlook & current trading -

The third quarter has started well, with a successful Winter Sale across the total retail system. As a result, we expect full year FY20 profit before tax to be slightly ahead of the top of the latest range of analyst expectations9.

9 Management understand that updated FY20 PBT analyst estimates are in the range of £135.0m to £137.3m (adjusted for IFRS 16 where appropriate)

We are monitoring the Coronavirus outbreak carefully. To date we have not assumed any material disruption to our supply chain or any financial impact in the year.

Fantastic that a footnote was included, to tell us what the analyst forecasts are. Thank you to the company, and its advisers, MHP Comms, who are noteworthy for being investor friendly.

Whether a slight beat justifies a 10% rise in share price today, is a question.

Balance sheet - looks fine to me. Lease liabilities don't matter, because it's so profitable. Also, the rent as a percentage of revenues seems amazingly low. Selling stuff that people want, at good margins, from cheap sheds, is clearly a great business. Not rocket science, retailing, is it really?! Although Dunelm has not had to deal with legacy issues like older retailers.

Valuation - it looks as if EPS might be around 55p this year, rising to maybe 60p+ next year (I've added a bit on to existing forecasts there). So PERs of 24 and 22 times. That's toppy for this sector, even allowing for what a cracking business Dunelm is.

My opinion - I put this in the same category as Greggs (LON:GRG) - lovely business, but shares have gone up too much, and now look over-priced.

I'd buy both on a big pullback though, as they're clear winners in a very difficult sector.

It makes so much more sense to buy the best, and pay up for the privilege, rather than buying cheap retailers in the hope of a turnaround. Even if we overpay, timing a purchase badly, we'll still probably make a decent profit by tucking away shares like this for several years.

Overall then, I love the company (by which I mean its financials, nothing to do with emotions), not too keen on the valuation right now. A lot of its product must come from China, so this share would be very vulnerable to an escalation of coronavirus. Hence I'm inclined to play it safe, and sit on the sidelines for now.

This would have made such a good buy in 2018!

.

Sosandar (LON:SOS)

Share price: 17.5p (down c.3% today, at 12:50)

No. shares: 162.9m existing + at least 29.4m new shares = 192.3m

Market cap: £33.7m after new placing shares issued

£5m institutional placing at 17p

This is an 18% increase in the share count, at a modest 5.6% discount, so I don't see either of these points as being a cause for concern. Institutions are happy to put more money in, to accelerate growth.

In the meantime, I've already spoken to management, and my main question is probably what you're all thinking too - why have they done another placing, so soon after the last one (raising £7m in July 2019)? Three main reasons;

Inventories - the original business plan assumed that factories would, once established, be prepared to supply on credit terms. However, in the last 3-4 years there have been so many bad debts from UK retailers, that suppliers are not prepared to offer credit terms. Therefore Sosandar needs cash up-front to buy inventories.

This is an increasing hit to cashflow, as the business is expanding so fast. New products such as denim are now being bought in much larger quantities, because sales were lost last year from running out too quickly & not being able to re-order fast enough. This was reflected in much higher inventories (at cost) reported recently (£3.5m at 31 Dec 2019) - a lot of that apparently is the spring/summer denim which landed just before Xmas. This needs funding.

Marketing spend - the increased marketing spend which started after the last fundraising, has been highly successful. TV in particular, has been very successful. They want to spend more on all marketing channels, which are delivering strong results. The payback period on marketing spend is 12 months. Therefore the more they do, the heavier the short term losses, but the greater the long-term benefit.

Growing faster - this really puts together the above 2 points. Management want to scale up the business as fast as possible, which because the customer repeat spending is so strong, and getting better as they expand the ranges. Shareholders are supportive of this faster growth strategy, hence the opportunity to raise more money, and get on with it.

The alternative would have been having to cut back on other marketing channels, in order to fund more TV ads, and larger inventories. Management felt that was not in the best long-term interests of the business, so they've swallowed the dilution, and pushed ahead with this latest funding round.

My view - I was a bit surprised that they've decided to raise again, but the reasons make sense. As I've mentioned before, it's taking a lot more money than originally planned, to achieve scale. But the good thing is, they've achieved stunning growth so far (ahead of the original plan), but it's costing more than originally expected.

Sales are being made at high gross margins (50%+), the overheads are largely fixed, so it's now just all about scaling up sales to about double the current level. Then it moves into profit.

I expect there will be some critics of this strategy, but they don't really matter as they're never going to buy any shares in this anyway. The people who matter, are the people who are backing the placing! That 's providing the funds to accelerate growth, and reach breakeven (or close to it) in about a year.

The next couple of trading updates in early April, and early July, should look stunningly good, because the comps are very soft, as the company wasn't spending much on marketing last year. Plus, the next 6 months will benefit from the long tail of new customers recruited last autumn, who are already repeat-ordering strongly apparently.

As I said to SOS management in a recent call, you're going to get some flak for this in the short term, but the early April & July trading updates should silence your critics (as they're up against soft comps where marketing spend was low).

Here's a reminder of the significant escalation in sales growth once TV ads were trialled in Sept, then continued because they were doing so well;

- October revenues up 108%

- November up 138%

- December up 153% year on year. This momentum has continued post-period, with

- January tracking up over 160%, and pleasingly repeat order performance is exceeding that in the highly successful Autumn/Winter period.

To properly understand this share, the key concept to grasp is that marketing spend has a payback period of 12 months, and builds an ever larger group of repeat customers. Established customers (i.e. stripping out new customers from the figures) are ordering 4 times per year. This makes the marketing spending an absolute no-brainer. That comes at an up-front cost, but once acquired, results in long-term profitable customers.

Once scale is reached, then we should be looking at operationally geared profits kicking in from 2021.

Edit: A key question I always now ask management, is what their exposure is to China supply chain. Sosandar has minimal exposure to China, under 5% of supplies, and it can easily switch elsewhere if needed. End of edit.

That's me done for today. Thanks for your comments, and thumbs ups, both are great!

Best wishes, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.