Good morning, it's Paul & Jack here with Wednesday's SCVR.

I'm pleased to see that, so far, we haven't got the year wrong. It's remarkable that I manage to remember that it's 2022, pre-caffeine at 07:00 every day. Even Jerome Powell, Chair of the Federal Reserve, got the year wrong in his Q&A session with Congress yesterday.

Agenda -

Paul's Section:

Portmeirion (LON:PMP) - an impressive FY 12/2021 year end trading update. Sales are well ahead of expectations, which has allowed the company to absorb cost increases and still deliver profit 9% above market expectations. The turnaround, and digital-focused growth strategy seem to be paying off. Looks good value to me, as future profits should rise once shipping costs normalise.

Accrol Group (LON:ACRL) - profit warning - repeated waves of input cost increases are running ahead of customer price rises. So guidance revised down. Not a disaster, the company is still profitable, but not by much when you account for heavy depreciation & finance costs. So valuing it on (much higher) EBITDA is erroneous I think. Strategic review has been launched - good, because the current business model results in unstable profitability, and repeated profit warnings. In my view, ACRL needs to move to open book contracts with customers, if they will stomach that.

Frontier Developments (LON:FDEV) - another profit warning, down about 26%. The interim results are poor, and the outlook glosses over the financial hit from delays to future games releases. It's left to Liberum to deliver the bad news - a 38% reduction in forecast profits for FY 5/2023. This is not a proper way to report to the market, as not everyone can get hold of broker notes. Despite the lack of visibility, and 2 profit warnings, I'm tempted to have a little punt.

Jack's section:

Gateley Holdings (LON:GTLY) - mgmt is confident of meeting FY expectations, which suggests the valuation is fairly modest for what appears to be an established, well run, and growing enterprise with a long operating history. We can expect salary costs to rise in H2 but the group has a solid balance sheet that should allow it to execute on its acquisition strategy.

Mpac (LON:MPAC) - strong order book recovery bodes well for the upcoming financial year, and the diversification into clean energy could be an interesting development longer term. The shares have rerated strongly but the valuation is still not expensive on a forecast earnings basis. The large UK pension scheme is an issue, but one that would presumably benefit from rising rates.

Preamble from Paul

I listened in to Chairman Powell of the Fed, in his Q&A session with Congress yesterday, and was greatly reassured that all the talk of higher interest rates in the USA looks very modest. He talked of perhaps 3 interest rate rises in 2022, but they're only 0.25% rises, which would still leave interest rates at historically negligible levels.

The markets seem addicted to low interest rates now, and I can't see them returning to historic levels any time soon, or maybe ever. Base rates don't have to be linked to Govt bond yields any more, and in any case Govts have now discovered they can manipulate bond yields to any level they like, using QE. Where it ends, nobody knows.

Powell admitted that the Fed's response to the next proper recession (i.e. 2 quarters of economic contraction), as opposed to a major crisis (e.g. 2008 banking meltdown, or 2020/1 pandemic), would be more QE - money printing, and artificially low interest rates. So even if they rise a bit this year, they're likely to go back to zero when the economy turns down.

Remember also that in 2019 (I think?), the Fed (under Powell's leadership) tried to raise interest rates, then reversed course when financial markets went haywire. So Powell doesn't have a lot of credibility when it comes to raising interest rates, or being tough. Where the US goes, the UK is likely to follow suit, hence why this is relevant.

We need to draw a distinction between inflation (which is high, and could be persistent), and interest rates. In the old days, these were closely linked. They're not any more. Therefore, with real (after inflation) interest rates now heavily negative, the only sensible place to invest is equities and property. Cash and bonds look the worst places to be, for more than a few months anyway, because the yield is now lower than inflation, eroding value over time.

I've been looking closely at the US markets in recent days, and doing a bit of trading (which surprisingly, has gone quite well). One of my aims for 2022 is to be a bit more active, and trade some positions a bit more, as well as my existing buy & hold strategy, because markets are too volatile to just sit there and absorb large drawdowns when things turn bearish.

It amazed me that many speculative, wildly over-priced, trendy US shares (e.g. Peleton, Coinbase, Robinhood, Cazoo, Docusign, Gamestop, Beyond Meat, just to give a few examples) have absolutely crashed in price. Many are 50%+ down. So whilst I've been complaining about UK small caps suffering big falls, there's actually been a savage bear market in many speculative/tech shares across the pond. I think that's very healthy for markets - scrubbing off obvious over-valuations.

I've also been looking at US mega-tech (FAANGs, etc), and it dawned on me what amazing companies they are, and reasonably priced. So I've used the recent dip to load up with big positions in Facebook (now called Meta), Amazon, and Google (Alphabet), plus a few others. Looking at the StockReports for those companies, which dominate the internet, it does make me wonder why we bother with many low quality UK small caps? It makes much of the UK market look complete dross, when you look at American companies. I'm likely to focus my personal investing a lot more on US markets going forwards, as well as UK small caps, not instead of! As we still have the occasional nugget of gold over here too.

Overall then I'm feeling reasonably bullish about the markets. Especially for re-opening trades (retail, leisure, hospitality, travel, etc), as the outlook there looks better than it's been for a while. Maybe the public might refocus on leisure activities in 2022, and less on home improvements?

There were more interesting points in Jerome Powell's answers to questions from Congress, which I'll try to type up later today, or maybe on quiet Friday. I don't pretend to be an expert on macro stuff, but I find it very interesting to follow, and it often helps me put my individual company investing into context.

We're pretty good at spotting turning points in the market here at the SCVR - e.g. we warned about covid in Feb 2020, with Graham Neary and I discussing strategies to cope (well before the big market falls) - he decided to hold throughout (which worked), and I hedged with big shorts (which also worked). Plus we spotted the market low in March, a week early, and began buying heavily. And we started buying heavily on the vaccine news c.Oct 2020. All of those things were discussed here, it's not easy to find though as the index for old reports has gone. I've asked for that to be reinstated, as I'd like to re-read the old reports around the time covid started.

For balance, what I got wrong last year, was not believing the rally, after the initial big rebound in the spring, and I lost money over the summer, by persistently (and wrongly) shorting indices, expecting another leg down, which didn't happen. Also, we didn't see the big small caps sell-off this summer/autumn coming, although we did warn many things were over-priced in H1 of 2021.

So overall, I think we've got a pretty good track record here of commenting on general market themes, so we'll keep doing it. As always though, each investor has to make up their own minds, and we're all sometimes right, and sometimes wrong. The important bit is recognising when we're wrong, and taking remedial action - with individual shares, and general market view. Being adaptable, and willing to change your mind quickly, when the facts change, is a vital skill for investors.

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps up to about £700m. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

Paul’s Section

Portmeirion (LON:PMP)

£87m mkt cap pre market open

Portmeirion Group PLC, the designer, manufacturer and worldwide distributor of high quality homewares under the Portmeirion, Spode, Royal Worcester, Pimpernel, Wax Lyrical and Nambé brands, updates on full year trading for 2021.

Revenues - a strong performance here -

We are pleased to report an excellent Christmas seasonal trading period, with very high demand for our consumer homeware brands around the world and strong sell-through across our key channels.

We therefore now expect sales to be at least £104 million or 10% above current consensus market expectation forecasts for FY21. This is 18% above 2020 sales of £87.9 million and 12% ahead of pre-Covid sales of £92.8 million in 2019. This represents the highest ever level of sales for the Group driven by strong progress on our strategy in developing new sales channels, particularly online.

Profitability -

As a result we expect our profit before tax for FY21 will be at least £7.0 million, an increase of 9% over current consensus market expectations and a multiple increase compared to £1.4 million in 2020.

What a superb statement - crystal clear, giving precise numbers, and linking performance specifically to market expectations. This is the gold standard of announcements, I wish all companies would report like this, instead of all that silly coded messaging that has historically been done. PRs and brokers reading this, please take note, and follow this simple, clear format. Clarity is what investors want. Then we're more likely to buy the shares, if trading updates are honest, clear & unambiguous.

Summarising the commentary, it says -

- 2021 sales were +12% above pre-pandemic highs - impressive.

- Profits of c.£7m are not yet at pre-pandemic highs (c.£9-10m PBT), so clearly the business has had to absorb additional costs (freight & energy, wages, I would imagine being the big ones)

- Covid still presenting “many challenges”

- Seasonal trading peak came later than usual, but “finished very strongly, particularly in the US market”

- Becoming an increasingly digital business - "opportunities for strong growth and improve margins in future".

- Key markets of UK, USA, and S.Korea all “grown well”. Remedial measures taken in S.Korea have worked.

Outlook - cautious, but sounds encouraging to me -

We are mindful of ongoing Covid risks and their potential impact on sales markets, global supply chains and the associated cost inflation, particularly in container shipping.

We expect further growth in 2022 and with the current uncertainty will wait to update the market with detail on the outlook for the current financial year at the time of the preliminary results in March.

Looking forward we continue to navigate these uncertainties and remain confident in our ability to improve margins over the longer term and grow the business strongly in the future."

Diary date - 17 March 2022 for FY 12/2021 results.

Valuation - I can’t see any broker updates yet, but working from the Stockopedia consensus figure of 37.3p, if we add 9% to that, it’s almost 41p EPS for FY 12/2021.

At 620p per share (pre market open) that’s a PER of 15.1

Given that 2021 is suffering from unusually high costs, then I think future earnings could rise well above this figure, once supply chains normalise. Combined with strong demand, maybe we could be looking at 50-60p EPS in future years? Put that on a PER of 15-20, and I have a target price of 750-1200p, thinking medium term (c.2 years). Fairly good upside from 620p now, if that bullish scenario plays out.

My opinion - this update is much better than I was expecting. I’m currently sitting this one out, as I was worried about the impact of freight costs (some product is made in the Far East), raw materials, and wage/energy inflation.

What’s good about today’s update, is that the strong demand has enabled profits to be protected, despite what must be considerable additional costs. I remember the company saying on a webinar that shipping was costing something like $20k per container, and each container had about $100k (or £100k, not sure?) of product in it. Pre-pandemic rates were about $1,500. So that’s a massive hike in cost, for product made in the Far East. Hence I was worried, and feared a profit warning - which was a logical stance at the time.

Today’s update is strong, and I’m inclined to buy back in (am not currently holding). The cost headwinds should at least partially subside, when supply chains normalise.

The turnaround strategy at PMP looks really good, especially the focus on digital.

Note there was dilution with an equity raise in the pandemic, so the share count has risen from 12m to 14m.

Overall then, a thumbs up from me, and I’ll add this to my list of things to buy on any dips in future. Although today, I would imagine a strong move up looks on the cards.

.

.

Accrol Group (LON:ACRL)

25.2p (down 18% at 09:14) - mkt cap £80m

Trading Update (profit warning)

Accrol (AIM: ACRL), the UK's leading independent tissue converter, today provides the following trading update for the current financial year ending 30 April 2022 ("FY22").

Inflation is hurting -

In the period since the Company's last trading update of 20 October 2021, the Group has experienced further inflationary pressure on input costs including pulp prices, supply chain costs and most significantly energy costs.

Action taken -

Further cost efficiencies (What? Why not done before?)

Another round of “substantial” price rises achieved with “all customers”

The company says it was on track to meet latest market expectations for FY 4/2022.

However, it’s now been hit with another wave of input cost increases, but supply chain sounds OK -

However, unavoidable surcharges to parent reel prices, relating to exceptional energy price increases, have very recently been levied on the Company, which will significantly impact margins. The management team has experience of successfully managing inflationary pressures and the Board is confident that this is a timing issue and that further cost increases, including these recent surcharges, will continue to be passed on successfully to Accrol's customers. The underlying business is in good shape and the Board remains confident in the medium-term prospects for the Group.

Despite continued supply chain disruption, particularly at ports, around the world and specifically in the UK, the business continues to manage customer supply well, having secured and maintained additional stocks in paper and finished goods.

Revised guidance - well done to the company and advisers for providing us with clear, specific profit guidance (although we prefer profit before tax & EPS, not EBITDA, here at the SCVR) -

In FY22, revenue is now expected to grow by 17% to c.£160m (FY21: £136.6m), generating adjusted EBITDA1 of c.£9.0m (FY21: £15.6m) with margin recovery anticipated in FY23.

Bear in mind this is quite capital-intensive business, so EBITDA is fairly meaningless. For example, the depreciation charge was £4.8m last year, and net finance costs were £2.0m, which if repeated this year would take EBITDA of £9.0m down to PBT of only £2.2m. The market cap is still £80m, so it doesn’t look cheap, even after the share price tanking in the last year.

Liquidity - it worries me when companies mention bank covenants, even if they say they’re in compliance, as it could be a flag that debt might become a problem in future, if trading continues to deteriorate. To be fair though, they’re damned if they do mention covenants, and damned if they don’t -

The Group continues to operate well within its existing banking covenants and has more than sufficient liquidity to meet its existing and future needs.

Strategic review - again, this makes me a little queasy -

In light of the above and the short-term but inherent volatility of earnings experienced in the current year, the Board has concluded that it is now appropriate for Accrol to conduct a full strategic review of its business. Such review will be designed to capitalise on the evident strength of the business' market position, its balance sheet, and its solvency, underpinned by significant banking support, to ensure that the shareholder value is optimised.

That’s too vague to draw any conclusions. Are they saying a placing could be on the way to reduce reliance on the bank? Or that they’re happy with significant bank debt?? I’m not sure. So I’ve checked the last full year accounts, and net bank debt was only £14.6m at 30 April 2021, which looks OK. So panic over I think. The much larger "borrowings" figures shown on the balance sheet contain lease liabilities. The company needs to split those out on the face of the balance sheet, it's a mistake to lump them together, as it scares off investors, making the company looking a lot more indebted than it actually is.

Diary date - 18 Jan 2022, for H1 results to 10/2021.

My opinion - as mentioned before, I don’t think ACRL’s business model is currently much good, because -

- Low gross margin - so there must be lots of competitors - hardly surprising when the main product is toilet rolls, a basic product where outside the main brands, competition is going to be on value (price:quality)

- Volatile input prices

- Capital-intensive - plant & machinery fixed assets were £40m book value at 4/2021 (excluding lease right of use assets) - which has to be updated/repaired/replaced over time

- Ruthless, cost-minimising customers (e.g. supermarkets)

- Mismatch between input costs & selling prices - causing wild swings in profitability

- Poor investor perception - due to opportunistic float, when unsustainable profits were being made, forecasts repeatedly missed, and big restructuring/refinancing needed soon after floating on AIM

It seems obvious to me that ACRL needs to change its customer contracts to an open book basis - i.e. a cost-plus arrangement, where selling prices mirror input costs, plus an agreed margin (and whatever cost savings can be hidden from the customer!). That would stabilise profits, and lead to the shares becoming investable.

The trouble is, why would supermarkets agree to that, if they can shop around to get the best deal, from competitors desperate to win orders and keep their factories running efficiently at full capacity?

I don’t see any attraction to this share, as things currently stand. That could change though, if the strategic review & implementation of changes, are able to give better visibility over future profits. If it got down to say 10p/share, then I might be tempted to have a dabble, but not at the current level.

.

.

Frontier Developments (LON:FDEV)

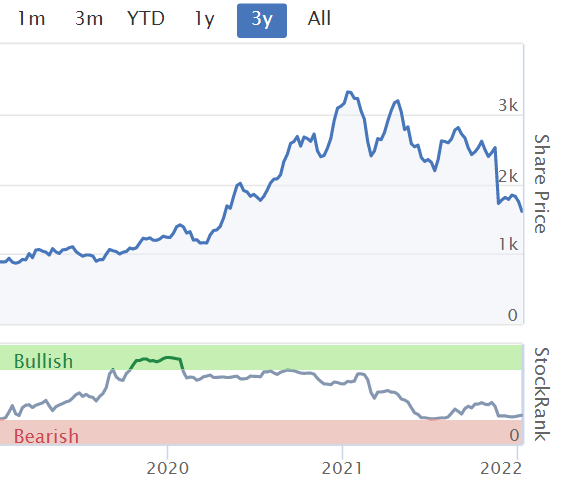

1337p (down 25%, at 11:06) - mkt cap £527m

I’ve only looked at this computer games developer once, here on 22 Nov 2021, when it warned on profits. Looking back at my notes, sales of 2 games were disappointing, and the outlook for peak trading over Xmas being uncertain.

It’s lurched down again today, so it must be another profit warning. Bad luck to holders here.

Frontier Developments plc (AIM: FDEV, "Frontier", the "Company"), a leading developer and publisher of video games based in Cambridge, UK has published its unaudited interim results for the 6 months to 30 November 2021 ('H1 FY22') and provides a trading update following the important Holiday season.

As you can see, the H1 results look poor compared with H1 LY, but I don’t know what investor expectations were for H1. The full year comparative for last year suggests a strong H2 bias to profits.

.

H1 revenue is up 33%, but profits have vanished. Looking at the detailed P&L, this is due to large increases in costs, some of which might be timing issues, reading the commentary -

.

.

Balance sheet - looks strong to me.

Writing off all intangibles (which actually do have some value in this sector), NTAV is £39.8m

Liquidity & working capital look very good, with a current ratio of 2.79

There’s plenty of cash £33.6m, and no interest-bearing debt (just lease liabilities, which are quite high at £21.4m, but only £1.4m is a current liability, suggesting it has long lease(s) that are not actually very much in annual rent (as only £1.4m in current liabilities for leases).

So a clean bill of health for the balance sheet, nothing to worry about here.

Cashflow statement - the big item is obviously capitalised development spending on new games, which is running at about £32m p.a..

For this reason, EBITDA is totally meaningless.

It burned cash in H1, despite receiving a £4.0m tax receipt, because development spending in H1 exceeded operating cashflow. The commentary says cashflow improved in early H2 as customers paid up.

Other items on the cashflow are small.

Headcount - a stand-out item, with >250 new joiners, taking headcount to 745.

That’s a lot of extra cost. Let’s hope they produce a good economic return in due course.

Outlook - provides details about the pipeline of new games, sounding positive.

But, FY 5/2022 revenue guidance is nudged down from £100-130m last time, to £100-120m now. That seems a wide range, considering peak Xmas trading has already happened.

Guidance for next year, FY 5/2023 is also reduced, due to a key game being delayed -

As a result of this scheduling adjustment, the Board have revised the revenue guidance range for FY23 to £130 million to £160 million, implying 18% to 45% annual growth from the mid-point of FY22 guidance.

Revised broker forecasts - the update from FDEV is of limited use, as it only talks about revenues. Profits matter more, but are ignored in the company’s outlook comments, which strikes me as ridiculous.

Many thanks to Liberum, for providing an update note on Research Tree.

Forecasts come down a lot -

FY 5/2022 is reduced by 19% to 28.1p EPS.

FY 5/2023 comes down 37% to 55.1p (a PER of 24 times)

The question is, should we be valuing the company’s cashflows to perpetuity just on short term earnings? That’s the big question for all share ownership.

I’m struck from the broker note how dependent FDEV is on one game - the Jurassic Park game being almost 43% of this year’s revenues, and a similar £ amount (but lower percentage) next year.

The F1 management game in the pipeline (sounds a bit like a football manager strategy game, but with Formula 1 cars/drivers) is forecast to be a hit in FY 5/2023, and would then be an annual franchise with new releases.

My opinion - I don’t know how to value this share. Earnings seem lumpy & unpredictable.

You could value FDEV on some notional value on each game franchise, so a sum-of-the-parts valuation perhaps?

Overall, this is way outside my area of expertise, but I do find falling knives difficult to resist, and am tempted to have a little punt here. Even though I don’t like the business model. Somebody give me a slap!

.

.

.Jack’s section

Gateley Holdings (LON:GTLY)

Share price: 223.5p (+2.76%)

Shares in issue: 119,153,923

Market cap: £266.3m

Following on from Knights Group (LON:KGH) yesterday, we have the Gateley Holdings (LON:GTLY) half year results this morning. Compared to Knights, Gateley has a much better track record so far of maintaining operating margins and generating strong returns on capital, with steadily increasing profitability.

Recent updates have also been encouraging, and Gateley has Knights beaten on every Rank.

Without knowing the two companies closely, that strikes me as a much more attractive selection of metrics and news flow from which to justify further research.

The group operates a ‘platform’ strategy, adding businesses to four areas:

- Corporate - corporate, financial services, and restructuring.

- Business Services - commercial agreements, managing risks, resolving disputes, protecting assets.

- People - dealing with and developing human capital, personal affairs.

- Property - focused on client activities in real estate development and investment.

This legal and professional services group was founded in Birmingham in 1808, so it presumably knows its sector very well.

Highlights:

- Revenue +23.5% to £62.3m (‘predominately organic’),

- Underlying adjusted profit before tax +14.1% to £8.5m,

- Profit before tax +19.5% to £7.3m,

- Underlying diluted EPS +16.6% to 5.76p,

- Net cash down from £9.3m to £8.8m (due to reinstatement of bonuses and dividends),

- Interim dividend up 20% to 3p.

Revenue from consultancy work has increased by 33.9% to £8.3m. Two acquisitions reported in the period: Tozer Gallagher (quantity surveyors, Property) and Adamson Jones (patent and trade mark attorneys, Business Services).

Average fee earner headcount is up from 785 to 794, with 75 new roles mandated for H2. Personnel costs were 64.1% of revenue in the period, up from 60.9%, and are expected to return to historic levels in H2.

Expected wage inflation:

In April 2020 the Group cut pay by up to 20% and froze all existing salaries until activity levels returned in the second half of FY21. However, in H2 21 all previously deducted pay was returned to staff and in H1 22 a comprehensive review of salary rates was implemented to address wider market trends in, what has now become a challenging recruitment market.

Something to think about for all of these professional services companies, which tend to have high salary costs.

Trading margins are ahead of pre-pandemic levels and operating costs remain lower, with adjusted underlying profit margin of 13.7% (H1 20: 13.3%, H1 19: 13.2%).

It is now evident that there is a permanent change to our traditional ways of working.

Momentum is expected to continue into H2 and Gateley says it is on track to meet expectations, with a healthy acquisition pipeline going forwards.

Property - H1 like-for-like revenue growth of 24.3% to £27m (43.3% of total revenue). Transactional activity has been strong and the core markets of house building, warehousing, and distribution and supported living remain strong.

People - H1 LfL revenue growth of 21.5% to £9.4m (15.1% of total).

Corporate - H1 LfL revenue growth of 47.4% to £15.2m (24.3% of total), with the legal services team in corporate, banking and tax ‘extremely busy’.

Business Services - H1 LfL revenue growth of 20.2% to £9.7m (15.5% of total). Litigation teams remain busy on long-term mandates for both UK and overseas clients.

On whether or not these Legal Services businesses should be listed companies or remain partnerships, it’s good to see the following:

Since our Admission to AIM, the Group has established a number of share-based schemes that variously offer all staff the ability to participate in early ownership of Gateley and share in the rewards of that ownership as they contribute to the success of the Group. I am delighted that 72% of current staff are now existing share or option holders in the Group. Our ability to incentivise people through plc share ownership provides an attractive alternative to traditional professional services ownership models.

COO to step down as planned, to be replaced by Head of HR Victoria Garrad.

Diary dates - Gateley is preparing a new accounting system set to go live in June. As a result of the anticipated disruption it has agreed with auditors to delay financial results until September 2022, with a full year trading update scheduled for May.

Poor cash conversion in the period - cash generated from operations was just 40% of net income (£2.4m) compared to 271.1% last year. Free cash flow fell from £10.6m to -£1.9m. The difference comes from paying bonuses after a period of reduced pay and dividends. Cash flow from operations before changes in working capital was a much better £11.4m.

The group says it has returned to its usual cash generation profile and remains debt free.

Platform strategy - the group’s four Platforms are now ‘the established growth vectors’ of the business and financial reporting is now aligned with these. Work continues to further integrate each platform in order to realise operational advantages.

Balance sheet - Net cash ex-leases of £8.8m. Intangibles and goodwill are a modest percentage of total assets (14.6%). Current ratio of 2.9x is good. Trade receivables has increased from £33.1m to £41.4m, presumably due to the active conditions. Net tangible assets are £42.3m.

All in all, a solid balance sheet that leaves the group well placed to further invest in its Platform strategy.

Conclusion

From this quick look through the half year statement, all seems well at Gateley.

The three negatives that stand out are the delayed full year results, which are well flagged (but investors have an instinctive wariness of such developments), the reduced cash conversion, which should normalise in H2, and likely wage inflation.

The group is growing with a clear strategy, and conditions are strengthening, but the shares trade on around 14.5x forecast rolling earnings with a 4.17% dividend yield.

It strikes me as decent value, particularly when set against the long trading history of the group and its habit of (so far) steadily increasing profits and dividends to shareholders, barring a bit of turbulence over lockdown-affected periods.

There’s a clear H2 weighting here, so there should be more to come in the next six months.

Management only says it is confident in meeting full year expectations today, so I’m not expecting fireworks from the share price. But potentially a decent small cap to look into in more detail.

Mpac (LON:MPAC)

Share price: 515p (0.19%)

Shares in issue: 19,894,138

Market cap: £102.5m

MPAC has an impressive 5Y share price chart, with the stock rising from 72p to today’s 514p, so no surprise to see a period of consolidation at the moment.

The Covid rebound is particularly notable.

It looks like the group’s ‘One Mpac’ strategy is bearing fruit post-Mollins disposal, with an increasingly integrated and joined up enterprise focused on organic growth in resilient markets, and complementary acquisitions.

The Board is pleased to announce that the Group has had a strong FY21 and expects to report revenue, underlying profit before tax, and closing cash in line with market expectations.

Order intake, revenue, and underlying profit before tax have all increased despite global supply chain challenges and Covid-related labour availability issues.

The strong order intake continued in H2, delivering full year growth and a closing order book of c£77.0m (December 2020: £55.5m). This, along with a healthy prospect pipeline, gives MPAC confidence on the outlook for FY22.

Contract with FREYR Battery - announced in July 2021, MPAC is developing and building a clean energy casting and unit cell assembly line. This is on track to be completed in Q3 2022.

The Group remains focused on executing its long-term strategy of developing Original Equipment order intake growth and improved margins through our Digital Services customer offering, together with increased operational efficiencies. This has led to an improved financial performance and cash generation by operating as a single entity business model.

Full year results are scheduled to be announced in the week commencing 14 March 2022.

The group has a pension scheme, which must be accounted for. At the half year stage, MPAC reported £1.6m of deficit recovery payments despite the UK scheme being in surplus to the tune of £26.8m. It’s a very large scheme for the size of the operating business - £429.4m of assets and £402.6m of defined benefit obligations.

The US pension scheme is much smaller, with total assets of £10m and a deficit of £2.3m.

Conclusion

The earnings multiple has risen slightly from what it was a couple of years ago. Back in late 2020, I recall you could buy the shares on c11x forecast earnings following its acquisition of Switchback, compared to today’s 14.5x. Meanwhile, Mpac retains that worryingly large pension scheme.

The flipside of this is that rising interest rates would be beneficial and pension contributions could decrease should the UK scheme remain in surplus. The scheme could even be offloaded at some point if the surplus is secure. Either could be a catalyst, but the sheer size of the scheme remains a financial risk.

That aside, the group has struck upon a successful strategy (‘One Mpac’) and has fairly resilient business lines. More acquisitions can be expected and the order book is up strongly, so the outlook is encouraging.

Mpac itself has had a phenomenal share price recovery and it looks like its renewed strategy is working well, while the diversification into clean energy with the FREYR battery contract win is an additional point of interest. There’s an Equity Development note out on the company this morning, which has a fair value target of 660p.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.