Good morning from Paul & Graham!

Today's report is now finished.

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps up to about £1bn. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk.

Summaries of main sections below

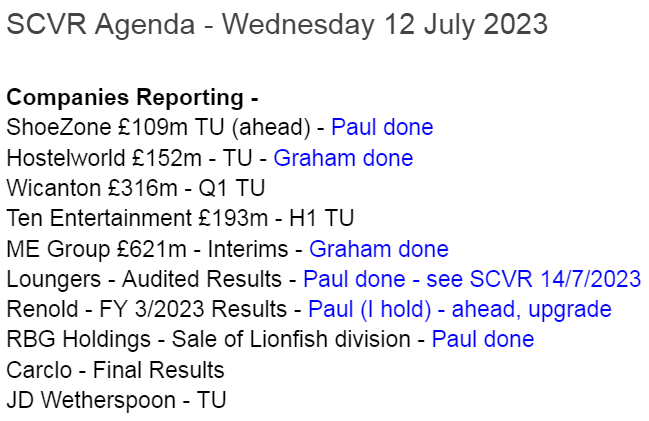

Hostelworld (LON:HSW) - up 3% to 125p (£154m) - Trading Update - Graham - AMBER

Hostelworld reiterates guidance on the back of a strong H1 with adjusted EBITDA making a €10m swing into profitability. The company may be close to generating financial results similar to the pre-Covid years, and the debt load is no longer of significant concern.

RBG Holdings (LON:RBGP) - up 16% to 31p (£30m) - Disposal of LionFish - Paul - AMBER/RED

Good news that the litigation financing problem division has been sold (for less than book value). That brings an end to a costly distraction & cash consuming activity. As mentioned earlier this week, the bombed out legal services sector could be an interesting area for value investors to rummage around in, after DWF received a bid approach. We don't have enough information on RBGP to judge its value at this stage, and high bank debt worries me, so AMBER/RED is to reflect the uncertainty & higher risk.

Shoe Zone (LON:SHOE) - up 10% to 257p (£109p) - Trading Update (ahead exps) - Paul - AMBER

A superb trading update, and big (29%) increase in broker forecast profits. Reasonable valuation still. However, I am worried about emerging Chinese direct competition from rapidly-growing, predatory website TEMU.

ME International (LON:MEGP) - up 2% to 168p (£636m) - Interim Results - Graham - GREEN

Expectations are unchanged as this photo booth /laundry /vending machine company issues interim results. However, it raised its outlook only last month. The company seems to enjoy excellent pricing power and high consumer demand. I will stay positive on it at this valuation.

Renold (LON:RNO) (Paul holds) - Down 4% to 29p (£65m) - FY 3/2023 Results - Paul - GREEN

Forecast-beating results, and upgraded broker estimates for FY 3/2024 have fallen completely flat in the stock market today. Bizarre markets right now! The valuation looks way too low to me, even allowing for the large cash outflows into the pension scheme. Too cheap I think, so I'm happy to continue holding.

Paul’s Section:

RBG Holdings (LON:RBGP)

27p (pre-market) £26m - Disposal of LionFish - Paul - AMBER

This legal services group might see a bounce today, as it confirms disposal of its problem division, LionFish (which does litigation finance, seemingly not very well).

The sale is for £1.07m immediately (to reduce an intercompany loan), with potentially up to another £2.0m in deferred payments, dependent on the outcome of legal cases being financed by LionFish.

This seems to be below the NAV of the cases (i.e. sunk costs) of c.£4m, so there’s a loss on disposal of about £1m.

Also, RBG seems to be keeping 4 out of 8 cases, which it says are fully funded (so presumably no further cash required to finish them).

RBG will no longer be on the hook for a further £2.6m of expected costs in relation to the 4 cases it is disposing of.

Paul’s opinion - there could be a bounce in this share, which seems to have been in a relentless downtrend this year. There was also the recent excitement around takeover talks, which caused a big rise in DWF (LON:DWF) (another legal services group). So as mentioned at the time, I think this sector could be an interesting area for bargain hunters to sniff around.

RBG’s foray into litigation finance didn’t work, so it’s good the division has been disposed of, as planned. That should mean after the disposal write-off, then losses and liabilities of that division should be gone, clearly a positive thing.

I’ve had a look at the FY 12/2022 group accounts, and £3.8m losses from LionFish are separated out as discontinued operations. I’m not sure the £10.9m adj PBT is valid, because it includes a £3.8m gain on litigation assets at the top, under revenue.

Stockopedia is showing the forward PER as just 3.4, but the lack of trading updates means that I don’t know how the company is performing versus forecasts. Hence at this stage, it’s impossible to accurately value RBGP shares, it’s a leap into the unknown really.

Also, its balance sheet is weak, dependent on £22m of loans at Dec 2022, partly offset by £3m cash. It has a lot tied up in receivables, as is often the case for lawyers, which can often contain things that need to be written off.

Overall then, for traders & gamblers, this could be an interesting punt, for a rebound. But it’s not possible to judge whether it will make a good investment or not.

Hence I’ll stick at AMBER/RED, as I need more information. The risk of a profit warning seems high, but has the share price already baked that in maybe?

Oversold, or in serious trouble? We don't know at this stage -

Shoe Zone (LON:SHOE)

Up 10% to 257p (£109m) - Trading Update - Paul - AMBER

This value shoe retailer has issued one of the most upbeat-sounding trading updates I’ve heard for a while -

Shoe Zone is pleased to announce that since its last Trading Update on 9 June 2023, the Company has achieved an exceptional month of sales. Trading has significantly exceeded management expectations due to continued strong demand with volumes up double digit on last year, despite no price increases on our core ranges.

Alongside exceptional trading, the Company has also experienced margin improvements due to the lower container rates and favourable foreign exchange rates with management expecting these improved margins to continue for the rest of the financial year.

As a result, the Company now expects adjusted1 profit before tax for the financial year ending 2 October 2023 to be not less than £13.5m.

1 Adjusted to exclude the profit on the sale of freehold property and foreign exchange revaluations.

Broker update - many thanks to Zeus, who crunch the numbers for us. It’s another (big) upgrade to forecasts - EPS for FY 9/2023 goes up from 16.9p to 21.8p, which gives us a PER of 11.8x - hardly demanding for a company performing so well.

Divis forecast at 9.0p gives a growing yield of 3.5%, with a good history of paying special divis on top.

Paul’s opinion - SHOE was one of my favourite shares for 2023, being on my runners up list here in January. Although the previously forecast drop in earnings did seem strange. So it’s good to see forecasts significantly raised again. A reminder that broker forecasts are definitely not gospel, and can often be considerably above or below reality, due to the sensitivity of profit to trading conditions. Predicting this is difficult, but there are sometimes clues. Bulls on SHOE (eg. CockneyRebel) have been saying for a while that the forecasts were too low, and he's been proven correct - good work!

SHOE’s customers are clearly appreciating the selling prices that have not been raised, delivering increased sales volume, and with good gross margins (helped by cheaper freight, and the strong pound, now approaching $1.30 today).

One word of caution though. The Chinese are coming. I reviewed website TEMU in a recent podcast, and the extraordinarily cheap products they are now air-freighting direct to customers in the UK (the Lenovo earphones are a stunning bargain at £8). I’ve just checked, and TEMU is selling shoes, including childrens, at low prices. SHOE makes high gross margins on Chinese-made shoes, but TEMU now means customers can buy direct from China, at lower prices. I reckon that could potentially damage SHOE (and other retailers that buy product from China, and mark it up a lot).

So for that reason, I’m a bit wary about SHOE, facing what could be its most serious emerging competitor. Hence even though the figures are terrific, I’m shifting from GREEN to AMBER over this new, very aggressive Chinese competitor. Look at what SHEIN did to the likes of Boohoo (LON:BOO) and ASOS (LON:ASC) - it wiped out their profits completely. There’s a risk the same thing could happen to SHOE, so I think bulls need to seriously consider this emerging risk.

Renold (LON:RNO) (Paul holds)

Down 4% to 29p (£65m) - FY 3/2023 Results - Paul - GREEN

Renold (AIM: RNO), a leading international supplier of industrial chains and related power transmission products, is pleased to announce its audited results for the year ended 31 March 2023.

Record trading performance and order book….Significant revenue and earnings growth….Successful integration of significant strategic acquisition

Some excellent figures in the financial highlights -

Note the boost from favourable currency.

Only a small difference between adjusted and statutory profit.

Super-low PER of only 4.5x (partly explained because of cash-hungry pension deficit).

Alternatively, a more cautious valuation would be based on the 5.6p EPS at constant currency, giving a PER of 5.2x

Net debt (above excludes leases) is up due to an acquisition.

Healthy order book -

Closing order book £99.5m, up 18.3% against 31 March 2022 |

Acquisition of YUK is performing ahead of expectations, which gives me increased confidence in the acquisition strategy - buying complementary businesses in a sector RNO management knows well - hence unlikely to make mistakes. The acquisition strategy also dilutes the pension deficit into a larger group.

Outlook comments sound confident -

… we have entered the new financial year with good momentum and confidence in the excellent fundamentals of the Renold business, although macroeconomic trends add a note of caution.

Throughout the reported period the business performance has been on an improving trend and finished particularly strongly as supply chains eased in the last quarter.

We expect the current financial year to be no less challenging, but we remain vigilant in the environment within which we operate; however, we started the new financial year from a positive position with good momentum and confidence in the capabilities and fundamentals of the Renold business and the markets we serve.

Given that Renold has demonstrated great resilience throughout covid, and the energy/inflation problems more recently, I’m not worried about the macro comment above. It’s a fairly standard thing that most companies are saying (sensibly) at the moment.

Dividend policy - Directors reckon they can generate better returns from internal investment, and acquisitions, rather than paying divis. The pension scheme sucked out £5.8m this year, and £4.8m LY, so that’s a considerable drain on cashflow, which would otherwise be available for divis.

The pension payments are rising by £1m pa, so this remains a big issue, which should be factored into valuing the shares on a much lower PER than would be the case for an equivalent company that doesn’t have a pension deficit problem.

Bank debt - looks fine to me now. In the past it has been over-geared, but that is no longer an issue in my view, eg -

The Group has operated well within agreed covenant levels throughout the year ended 31 March 2023 and expects to continue to operate comfortably within covenant limits going forward.

The net debt/adjusted EBITDA ratio as at 31 March 2023 was 0.9x (31 March 2022: 0.6x), calculated in accordance with the old banking agreement. The adjusted EBITDA/interest cover as at 31 March 2023 was 13.7x (2022: 19.6x), again calculated in accordance with the banking agreement.

Going concern statement looks fine, and has some useful extra information, but nothing that worries me at all.

Balance sheet - NTAV is around nil, once intangible assets are written off.

The pension deficit stands out, at £62m, but down by over a quarter on LY, on an accounting basis.

In other respects, I’m satisfied that the balance sheet looks OK.

Broker forecast - looks undemanding, at 5.2p adj EPS FY 3/2024, so I would hope to see ahead of expectations trading updates as the new financial year progresses.

Paul’s opinion - I’m very happy to continue holding for the foreseeable future.

Renold shares look significantly under-priced to me, I would say 50p+ would be a far more realistic valuation than the current 29p. So it’s great value, with a positive outlook too.

It sailed through covid and more recent macro problems, displaying strong pricing power, and repeating revenues (as a lot of chains are replaced on essential maintenance schedules, rather than being discretionary spend).

I’m half-expecting a takeover bid for RNO too, which would be a nice development, if a suitable premium were to be offered.

So far, the stock market really hasn’t given RNO any credit for an excellent turnaround, and the upside from its bolt on acquisitions strategy. A re-rating upward looks only a matter of time.

A lacklustre long-term chart, but Renold is a greatly improved business now, so a re-rating is long overdue I think.

Graham’s Section:

Hostelworld (LON:HSW)

Share price: 125p (+3%)

Market cap: £154m

This online travel agent gives a quick update on trading for H1.

H1 revenues are €51.5m (up 57% on last year). We already knew from the statement in May that revenues were running at a record level in the first quarter.

The number of bookings made on the platform is up 64% but the net average booking value is slightly down to €15.15, which the company says is due to a higher proportion of them being in Asia.

Direct marketing spend as a percentage of revenue falls from 60% to 51%.

H1 EBITDA is €5m, versus an EBITDA loss of €5m in H1 last year. The company leaves the full-year forecast unchanged for full-year EBITDA of €16.5 - 17.m, “absent any deterioration in the macro-economic environment, the reintroduction of Covid restrictions or air travel disruptions”. The company included a similar disclaimer in their May statement.

Debt: as I discussed in May, Hostelworld has taken great steps towards solving its debt issue, replacing a large and very expensive facility with smaller and cheaper facilities (coming in the form of a term loan, an RCF and an overdraft).

The company announces today that the interest rate charged on its RCF has fallen further, thanks to an agreement with the bank that sees the rate fall if the company deleverages. Hostelworld is now paying a margin of 3.25% over EURIBOR (previously 3.75%).

Net debt now stands at €16m.

CEO Comment:

…I am delighted that we have delivered record generated revenues and improving EBITDA margins driven by our differentiated Social growth strategy and a continuing focus on operational excellence and cost discipline.

Looking further ahead, I remain very confident that our innovative, asset-light business model is well-positioned, well-financed and firmly on track to deliver against our long-term growth goals

Graham’s view

I remain interested in Hostelworld. Prior to Covid and what that did to the travel sector, it did generate material profits for shareholders. It even paid dividends from 2016 to 2019!

Recent trading updates suggest to me that it is on track to return to its former glory. The revenue and booking numbers certainly attest to that. All the indications are that this will be a record revenue year; perhaps it won’t be in real, inflation-adjusted terms, but it should be in nominal terms.

I’m close to turning green on this one, but I’ll hold out and wait for proof of convincing profitability down at the bottom of the income statement. Adjusted EBITDA is likely to be excellent; if the company converts this to real profits then there’s a strong chance I’ll turn positive on the stock.

ME International (LON:MEGP)

Share price: 168p (+2%)

Market cap: £636m

ME Group International plc (LSE: MEGP), the instant-service equipment group, announces its results for the six months ended 30 April 2023 (the "Period").

It’s difficult not to be impressed by the table that opens these results:

The company notes that pandemic restrictions eased in Asia compared to the prior year, and this did help to boost results.

The net cash balance has fallen but an amazing £43.5m has been returned to shareholders over the past 12 months - the company had more cash than it needed.

Performance at each major division:

Photo revenue +25% to £84m (the number of units fell slightly, so the revenue growth is entirely reflective of higher activity and higher prices).

Laundry revenue +37% to £38m (the number of laundry units continues to grow at a rapid pace)

Printing revenue +11.5% to £6m (these machines have been removed from the UK and Ireland after a trial; they are “far more profitable” in France.

Food vending +106.5% to £6m

Outlook

Key elements of the outlook include the M&A strategy (see Paul’s recent coverage of a small acquisition in Japan), the installation of 10,000 next-generation photobooths, continued expansion of the laundry estate, and development of food vending operations.

They are now back in the FTSE-250 index, a highly attractive place to be.

Forecasts are unchanged for today, but they were upgraded as recently as 1st June. These expectations are for revenues of £300-320m, EBITDA of £100-110m, and PBT of £64-67m.

Chairman comment

Sir John Lewis states that the company has a “resilient business model where we benefit from a dominant market position, with limited or no competition, in many of the countries in which we operate”. I suppose he is right - there can’t be many other companies operating these machines on anything like the scale that MEGP does.

CEO comment outlines performance by geographic segment, with 23.5% revenue growth in the key segment of Continental Europe.

On a personal note, I thought my eyes were deceiving me when I saw Revolution laundry machines on a trip to Portugal last month - they are everywhere now!

Graham’s view

Last November, I included MEGP on a list of “four contrarian stocks to buy for a rebound” (the others being TTR, IGR and JUP). MEGP has performed the best out of that selection, up over 60%, and although I don’t own these shares personally, I’m inclined to “let my winner run” and maintain my positive view on them.

They are not nearly as cheap as they were then, obviously, but earnings upgrades have kept a lid on the earnings multiple (c. 12x according to Stockopedia).

Now a member of the respectable FTSE-250 index, it will be even easier for stock market investors, domestic or international, private or institutional, to justify owning them.

Everything I liked about this company last year remains true today, except they now have significant momentum in both the share price (MomentumRank 90) and in their financial results. The valuation isn’t setting off any alarm bells for me at this point so I’m staying GREEN.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.