Good evening/morning. I'm posting this first section about BOO (I hold) early, on Tuesday night, while it's fresh on my mind, and so I can get this out of the way and concentrate on small caps in the morning.

Timings - I've got to attend to a meeting from 12:30 for about an hour maybe. Then lunch, then I'll carry on here- so estimated finish time of 5pm. Today's report is now finished.

Agenda (Weds morning) -

Walker Greenbank (LON:WGB) - Interim results

System1 (LON:SYS1) - Trading update

Water Intelligence (LON:WATR) - Trading update Q3

Angling Direct (LON:ANG) - Interim results

Ramsdens Holdings (LON:RFX) - Trading update - sorry. I ran out of time to look at this one, and am not familiar with the company, so it would have taken too long to look at it from scratch. I really don't like pawnbrokers anyway. The share price is up 11% today, so the market clearly likes its update.

.

BBC Radio 4 - "All Sewn Up"

This was a BBC investigative programme, aired on Radio 4 at 8pm on 13 Oct. A reader kindly flagged this up to me, so I listened to it & took notes, which follow below. It mentioned Boohoo (LON:BOO) (I hold), hence my interest. If BOO doesn't interest you, then please move on to the next section. I'm not entering into any discussion about why I cover BOO. I cover it, and always will. End of!

NB. As I hold shares in Boohoo (LON:BOO) I'm not impartial. I've formed a view on the Leicester supply chain issue, and obviously as I've bought more shares in BOO, then my view is that the recent share price weakness is a buying opportunity, and the supply chain issues do not in any way impact the value of the shares long-term. The company has recently reported record trading, despite the best efforts of the media to tarnish the brand.

My view remains this: BOO has admitted there are failings in its Leicester supply chain, and has already announced extensive ways to rectify the situation.

This is roughly what the Radio 4 programme said (main points I jotted down whilst listening to it, together with my comments). Apologies for any errors or omissions;

Leicester supply chain - allegations

- Separate investigations by journalists Paul Kenyon & Ashley McCartney, who narrated the programme.

- Evidence of money laundering & VAT evasion (systemic fraud, endemic) in the Leicester garment factories, which supply some of the UK's fast fashion retailers. NB all factories are independent companies, not owned by retailers. No evidence that retailers are aware of illegal practices.

- Spinney Hills district of Leicester LE5 is powerhouse of fast fashion manufacturing - supposedly 1,500 hidden "dark" factories operating in secret, with VAT fraud key to the "impossibly low prices" they charge.

Case study - Mr Nagra, Rose Fashions

A civil action which blew the lid on dodgy practices in Leicester garment manufacturing industry

Select (High Street retailer with 170 shops) was the customer. They did not know a VAT scam was operating, and they paid full price, including VAT, unaware that Rose Fashions Ltd was generating fake invoices at inflated prices, through shell companies.

Shell companies were set up, typically had a lifespan of about 2 years. Never filed accounts, and were struck off by Companies House for failing to file accounts. Left behind large VAT liabilities, unpaid.

This was not explained at all well, but the VAT fraud seemed to involve fake invoicing, with surplus, never to be paid VAT. being withdrawn in cash, by the crooks, and then disappearing.

Double accounting, by manufacturers, one set of books for the taxman, and different, secretly coded cash books, to keep track of reality.

Mr Nagra ripped off another businessman, hence how this came to light in civil court case.

Judge said Nagra was a liar, and made him bankrupt.

NB No suggestion that Select knew anything about the VAT fraud. Select refused to comment.

Another example given of TNS Fashions, which folded in 2017, owing £1.7m in unpaid VAT. Sole Director banned for 7 years. Had supplied BooHoo. When queried, BOO said they had never dealt with the company. BBC then told BOO it was an unauthorised subcontractor of another company. BOO recognised name of other company, and severed all dealings with it. BOO appointed a supply chain auditor in 2019.

HKU Trading Ltd provided as another example of a shell company with 2 year life.

Shell companies used for VAT fraud look odd, because they immediately commence trading on a meaningful level, but don't have any staff or premises costs. So clearly bogus (but how is anyone meant to know that, since they haven't filed any accounts?)

Rose Fashions supplies (ominous music starts) PrettyLittleThing, operated by, yes the same Kamani family which owns BOO. BOO then terminates relationship with Rose Fashions, when wrongdoing comes out.

Exploitation of employees in Leicester factories

NB, This is general to the Leicester factories, supplying fast fashion retailers.

Bulgarian woman interviewed via a translator. Says she & husband live in cramped living conditions. Is paid about £6 per hour, below minimum wage. Was paid £2.50/hr initially. Frightened to speak out. Came to UK for a better life.

HMRC

Supposed to be policing tax payments. Needs to ask tough questions. Under-resourced?

HMRC claims success, having done 25 VAT investigations in Leicester garment sector, recovering £2m. Suggestion this is only tip of iceberg?

Retailers

Auditing supply chains more. They say to suppliers, renegotiate if prices are too low, don't break the law.

My view

An interesting programme, but rather muddled, and poorly explained in parts.

No smoking gun re the retailers, in fact it seems they were paying in full, with full VAT, unaware that some suppliers may have then been using a web of shell companies to execute a VAT fraud.

Flaw in the logic of this programme, is that it claims retailers are getting artificially low supply prices of garments through suppliers almost being forced into committing VAT fraud. But then it later says that suppliers are spending their VAT fraud loot on £100k cars and lavish lifestyles for themselves.

What the programme failed to point out, is that retailers can get lower prices by sourcing from abroad, and air freighting into the UK. Because labour in places like Bangladesh is a fraction of Leicester, at only about 50p per hour. Leicester is used because it's convenient & quick, not because it's cheap.

VAT fraud occurs in many industries. It's a rubbish system, full of holes. You cannot blame the end customer, who has paid in full, if a supplier improperly accounts for their own VAT, unbeknown to the customer. Therefore the whole basis of this programme seems spurious to me.

I'm starting to wonder if deliberate, or maybe subconscious bias is starting to play a part in the hounding of the Kamanis at BooHoo. After all, they've built a fantastically successful business, becoming billionaires, being British-Asians, and flash with their cash, maybe there's a bit of jealousy creeping into some of the reporting?

We had a similar situation with Sir Philip Green. I went through 15 years of BHS filed accounts, and found no wrong-doing. But he's flashy, arrogant, so the press took great delight in presenting a largely false picture of his business dealings at BHS. For example, there was no pension deficit when he was legitimately paying out large divis from profits. The pension deficit arose due to UK Govt policy to slash interest rates in 2008-9, which made liabilities balloon. There were no divis after that, and he did everything possible to save the business, but BHS was overwhelmed by low cost retailers emerging, like Primark, and of course the internet.

Another example - look at the Telegraph article last weekend, hounding Mahmud Kamani, and contrasting his enjoying a birthday party in Istanbul, with low paid machinists in Leicester manufacturing items for BOO's websites. Why should't he enjoy a birthday party for goodness sake? You can almost hear the envy (or worse) dripping from the pen of the low paid journalist writing that piece - which again contained nothing new.

One of my readers here made a very good point in yesterday's SCVR comments - that re-hashing articles about BOO is a good way to get page impressions, hence ad revenues online. So perhaps this story will just run & run, as desperate journalists try to seek page views?

As for short sellers - remember that they are deliberately trying to provoke fear & panic selling, in order to trigger a short term spike down in share price, for their personal financial gain. I respect short sellers that expose frauds like Globo or Quindell, but I have little time for those who attack good companies, in order to trigger a brief spike down in price, for their own quick bucks.

.

Cloudcall (LON:CALL)

93.5p (up 3%) - mkt cap £36m

(I hold)

Trading on New York OTCQX Market

This is an interesting announcement. We've discussed here before that CALL has several disclosable shareholders based in the USA. A significant part of its operations & customers are also in the USA. Tech, growth companies are valued much more highly there, than in the UK, hence a potential opportunity for a re-rating, or takeover bid for this company? Although I noted that a recent RNS showed one of the US shareholders had reduced its stake.

In a webinar earlier this year, someone asked a question about whether CALL would move its listing to the US. The CEO said no plans to do so, but "never say never".

Today CALL says;

...announce that the Company's shares will cross-trade publicly on the OTCQX®Best Market ("OTCQX Market"), under the ticker "CLLLF", with trading commencing from today. CloudCall's ordinary shares of 20p each ("Ordinary Shares") will continue to trade on the London Stock Exchanges AIM market under the symbol "CALL".

I'm not familiar with US OTC markets, but the term "cross-trade publicly" sounds like a matched bargain type of arrangement, as opposed to a liquid market with market makers holding a float of shares to trade either way.

Commenting on this important step, Simon Cleaver, CloudCall CEO, said:

"I am delighted that CloudCall has now joined the OTCQX Market. We've been attracting the attention of U.S. investors and I hope to accelerate this trend by making it easier for them to find research and trade.

That sounds interesting.

One query though, maybe readers can help with this. I thought that AIM shares couldn't have a dual listing, or it impacted the tax benefits of AIM? I could be wrong there, but it's in the back of my mind, hence me querying it. Does anyone know the position on this? Does an OTC arrangement in the US count as a dual listing, or maybe not, I don't know?

EDIT - thanks to reader comments, confirming that it seems to be the case that an OTC listing in the USA might not qualify as a recognised exchange, hence that should not impact the AIM tax benefits. That sounds sensible to me. Hmmm, reading a couple of other reader comments, I'm not so sure now. Easiest thing is if I ask the company, I'll email them now & come back to you later.

Update at 13:51, I've spoken to the company, and they have helpfully clarified as follow;

This is not a dual listing. Whilst it’s an exchange and we have market makers etc, it’s a ‘cross listing’ or to be technically accurate it’s defined as a ‘Cross Trade’. As such, it should have no bearing on UK regulations or Tax. In short, it should not affect CALLs IHT status.

.

Walker Greenbank (LON:WGB)

Share price: 59p (down 6%, at 10:13)

No. shares: 71.0m

Market cap: £41.9m

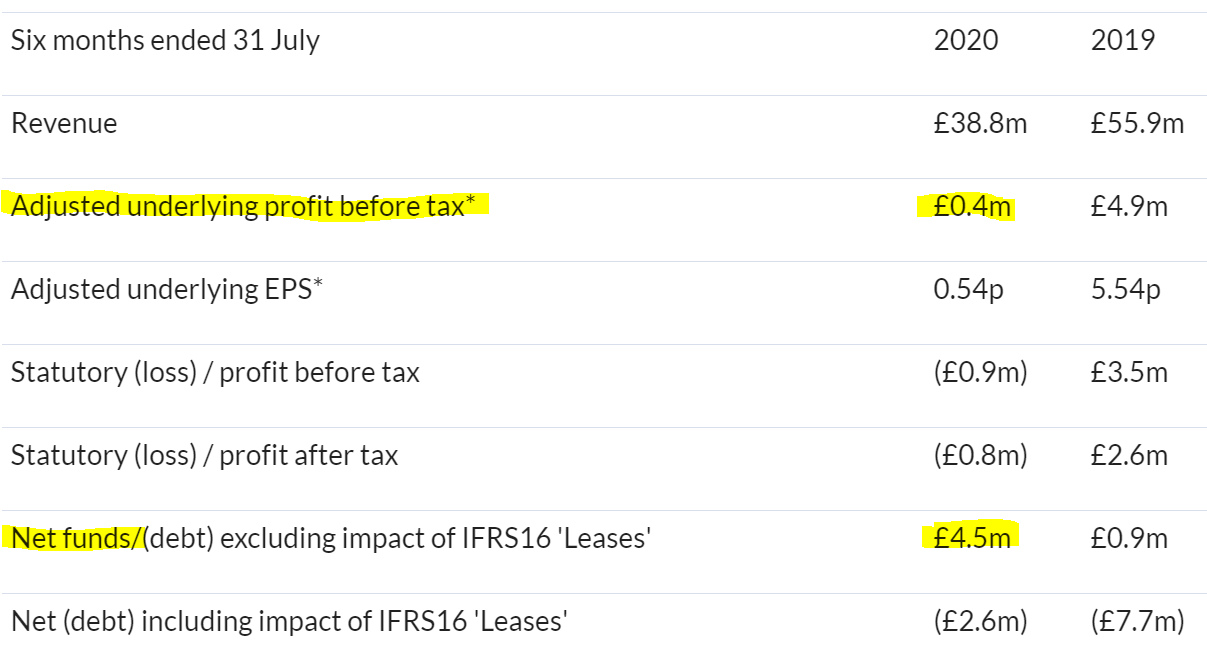

Walker Greenbank PLC (AIM: WGB), the luxury interior design and furnishings group, announces its interim results for the six-month period ended 31 July 2020.

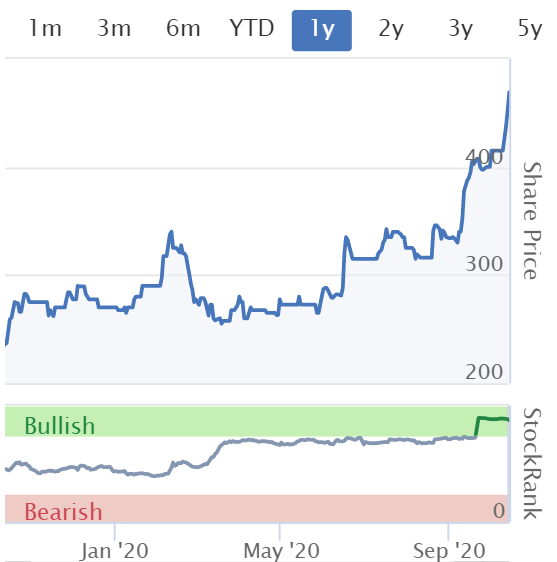

The share price is down 6% this morning, but as you can see from the 1 year chart below, it's still in a healthy up-trend since the March lows;

.

.

It looks as if a realistic broker forecast didn't come through until July 2020. Its caused a huge headache this year, given that companies and brokers withdrew forecasts & guidance for so long. This seems very bad to me. Just because things are uncertain, doesn't mean investors should be left in the dark. The missed opportunity for companies/brokers is that they should have given a range of forecasts: base case, then a downside, and an upside alternative. This approach is often taken when companies are seeking funding, and for going concern purposes. So why couldn't such estimates have been more widely published? It's not good enough, and I think the city has badly let investors down throughout this crisis, with poor, or non-existent information. In difficult times, guidance to investors is more important than ever, so shutting it down is the opposite of what's needed.

Anyway, given the extent of the forecast fall, it looks to me as if we can rely on these estimates as being realistic;

.

In terms of valuation then, I'm ignoring this year FY 01/2021 as an aberration, and would base my valuation on a multiple of earnings somewhere between 6-10p. On the basis that FY 01/2022 will probably be a partial recovery year, then hopefully the company might subsequently recover further back to levels anticipated pre-covid. I'm also making a general assumption that a severe or prolonged recession globally seems unlikely, given the vast amount of stimulus being injected by Govts. Why would then suddenly withdraw support, and allow the economy to slump, given that they've propped it up this far, and can continue to borrow for free (and print the money via QE)?

On that basis, WGB is probably still quite cheap. 12 times earnings, based on my 6-10p range of future earnings potential, gives a share price range of 72-120p, usefully above the current price of 59p.

Interim results - this looks much better than I was expecting. A small profit, in a chaotic covid/lockdown period, strikes me as commendable. Also, it has net cash;

.

Although note that furlough grants of £3.2m helped considerably - which is what they were designed to do.

Liquidity looks ample;

Measures taken to improve liquidity resulted in cash headroom against available banking facilities of £19.5 million at 31 July 2020 compared with £13.8 million at 31 January 2020

Dividends - no interim divi, but committed to restoring divis when conditions allow. That's fine. I think companies which have benefited from taxpayer support, are honour bound not to pay divis for the time being.

Current trading - sounds OK;

Better than expected trading performance in July, August and September 2020; given the ongoing impact of Covid-19, the outlook remains cautious at the start of the autumn selling period

Name change - Dec 2020, Walker Greenbank plc will change to Sanderson Design Group plc - I quite like this idea, as Sanderson is probably its best known brand. I'm glad they're using a recognisable brand name, and not some silly invented word that means nothing to anyone (as name changes often are), or just using initials. A reminder from its website that WGB has a stable of lovely brands, and attractive products, some of which attract licensing revenues (valuable intangible assets).

Cost-savings - a useful benefit for future years. It's interesting how lots of companies are now saying that covid/lockdown has forced them to re-assess everything they do, bringing long-term benefits;

Year-to-date efficiency and cost-savings expected to deliver a saving of £1.2 million in the current financial year with annualised savings of £3.0 million

Outlook - sounds pretty decent to me, in the circumstances. Companies have to flag uncertainty, because things are particularly uncertain at the moment, due to covid Brexit, US politics, etc. So I don't see anything company-specific to worry about in this uncertain outlook;

Whilst our results for the six months ended 31 July 2020 have been impacted by Covid-19, we have come through the first wave of the coronavirus with a better performance than anticipated in our scenario planning, carried out at the onset of the pandemic.

Trading has been ahead of our expectations in July, August and September 2020, with the business both fulfilling delayed orders and demand returning more strongly than expected.

We are now at the start of our key autumn selling period and, owing to Covid-19, we remain cautious in our outlook for the remainder of the year. We have a clear strategy and, with the decisive action taken to improve liquidity and reduce costs, we are confident of emerging as a leaner and more agile business when the pandemic recedes.

That sounds good to me. I have no idea why the share price has fallen today.

Pension deficit - has gone up. We're getting mixed messages from different companies on this issue. Some are reporting pension deficits down, due to buoyant equity markets, others are saying deficits increased due to low bond yields;

The retirement obligation has increased from £5.7 million at the end of January 2020 to £9.2 million, reflecting the effects of reduced asset values and increasing liabilities due to lower bond yields.

I am worried that the Bank of England appears to be moving towards possible negative interest rates, which I assume would make pension deficits worse again?

Balance sheet - tremendously good. There is no insolvency risk here at all, in my view.

NAV: £61.2m, deduct £29.1m intangibles (even though WGB has considerable value in its designs & brands, so this is being super-conservative), giving NTAV: £ 32.1m. That's really strong, considering the market cap is only £41.9m

Note that working capital has shrunk somewhat, reflecting reduced activity levels in H1, so expect the hopefully improved future activity levels to suck in some of the excess liquidity. With net current assets of a whopping £26.1m, this business is in a very comfortable financial position. Shareholders should sleep soundly at night. I think management was overly cautious in its cash preservation measures, but that's with hindsight.

My opinion - I think the share price should have gone up today, not down.

As a shareholder myself, I'm pleased with these interim figures. The group has sailed through covid/lockdown, and remains in rude health. Current trading is good. Uncertain outlook is to be expected.

Overall, as with everything, I've no idea what the short term share price will do, but I reckon this is a nice share for the long term. I find today's numbers & commentary very reassuring, and better than I expected.

.

System1 (LON:SYS1)

Share price: 109.5p (down 5%, at 14:11)

No. shares: 12.7m

Market cap: £13.9m

System1, the marketing services group, issues the following update on trading for the six months to end-September 2020.

The Company will announce its interim results on 17 November 2020.

Given the sector it operates in, I would expect H1 to be bad, but in the circumstances this reads quite well;

H1 sales down 25%, due to covid

Costs 22% lower, thus largely protecting the bottom line - impressive that costs are so flexible (mainly people though, so not clear whether this is redundancies, or furloughed staff)

Reviewing leasehold property for impairment. Says this would be a non-cash charge, my view is yes and no. If locked into still paying rents, then it's future cash outflows for empty/under-utilised office space. We're starting to see the impact of work from home - I imagine this is likely to become a recurring investment theme

Profit before tax (before lease impairments) of £0.6m - still positive, seems to me a good outcome, down from £1.4m in H1 LY.

Net cash of £5.1m is up including a £0.5m R&D tax credit.

Guidance suspended & no divis.

My opinion - not too shabby at all, I'd say, given the terrible circumstances. Unfortunately there's not enough information for me to form an overall view. The danger is that H1 could include work that was contracted prior to covid, but may not now recur? With no forward guidance, I can't take this any further.

The market cap looks very low now, at some point the market might start to price in a recovery in marketing, perhaps? The cash position looks fine. Note that, in extremis, SYS1 could slash spending on its heavily loss-making startup subsidiary, so management does have more levers to pull if necessary.

Looks temptingly cheap, but at this stage, not knowing what the outlook is, then it's nothing more than a punt. Management has previously said that visibility is limited, even in the good times.

.

Water Intelligence (LON:WATR)

Share price: 465p (up 3%, at 16:13)

No. shares: 16.89m

Market cap: £78.5m

Water Intelligence plc (AIM: WATR.L) ("Water Intelligence" or "Company"), a leading multinational provider of precision, minimally-invasive leak detection and remediation solutions for both potable and non-potable water, is pleased to provide a trading update for year-to-date through the end of the third quarter.

[YTD is Jan-Sept 2020, Q3 being July-Sept 2020]

This sounds excellent;

The Company had a very strong third quarter building on its already strong 1H results.

Revenue accelerated and profit before taxes (statutory and adjusted) are on track to exceed expectations for full year 2020.

The Company also has a strong corporate development pipeline for 4Q and 2021.

Revenues by division are given, and are up 13% to $27.8m for the 9 months YTD. That's decent, but not spectacular growth. If we assume 13% growth in Q4 also, then FY 12/2020 revenues would be $36.6m, usefully above the $34.0m broker consensus shown on the StockReport.

There's plenty more detail in the trading update, see the RNS, the tone is very positive, it does look like a business on a roll.

WH Ireland has today upped its forecasts, but looks to be cautious, so I think we can probably work on the basis that EPS of US 20c is more likely than WHI's 18.4c. Convert my guess of 20c into sterling, and that's 15.4p - giving a valuation of a PER of just over 30.

My opinion - the valuation is too rich for me now, but it looks a decent, but small, growth company, with good earnings momentum. It looks set to more than double EPS over 2 years, which is very impressive, so maybe the high rating is justified? That's for you to decide. Things are clearly going well, but well enough to justify the large price increase shown below?

.

.

Angling Direct (LON:ANG)

63.7p (down 7%) - market cap £49m

I'm out of time now, but will make a quick comment on interim results 6m to 31 July 2020, from this fishing equipment business, stores and online.

Considering that its stores were closed for a good part of H1, then these numbers look OK. It seems that a combination of pent-up demand after lockdown, and healthy online sales during lockdown, plus the £1.5m benefit from the furlough scheme, have offset the difficulties of covid.

- Revenues up 21% to £32.4m

- Profit before tax of £1.4m (up 250%)

- Net cash of £21.0m - seems very high, so why did they do a £5.5m fundraising?

- Balance sheet looks superb, with about £26m NTAV

The Board is now of the view that there is sufficient visibility to reinstate guidance for the current year outturn and confirms that the Group is trading in line with market expectations for the year ending 31 January 2021 ('FY21').

They forgot to include a footnote stating what market expectations are, which would have been useful.

Stockopedia figures show a small loss for the year, so this is nothing to get excited about.

My opinion - I've not got time to dig any deeper, but I'd say the H1 numbers look OK in the circumstances.

I like the very strong balance sheet. Also I like the growth of international websites - currently only small, but could provide good future growth maybe?

I'm not convinced that ANG's hybrid model of online, and physical stores, is a good idea or not. Time will tell, but at the moment it seems to tie up an awful lot of capital, and not generating a return from it.

Mind you, we saw with Gear4music Holdings (LON:G4M) (I don't currently hold) that a focus on improving margins, and large online sales, can suddenly become quite lucrative. I don't see ANG being anywhere close to that, so for me it's a no. Although I'll continue to monitor it, and if signs emerge of more profit potential, then I'll be happy to revise my view. Almost £50m market cap, for a business that hasn't really proven up its business model yet, seems dubious.

.

I have to leave it there for today, as time has run out.

See you tomorrow.

Regards, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.