Good morning, it’s Paul here with the SCVR for Wednesday. It's a quiet news day (Edit: actually it's not, a load more came through after my initial trawl! End of edit) , so I've messaged Jack to say that I should be able to handle things solo today, and make some inroads into the backlog list.

.

Timing - Today's report is now finished.

Agenda -

Capita (LON:CPI) - Agreement to sell Education Software Solutions for up to £400m - helps very strained balance sheet

Driver (LON:DRV) - I review the results for FY 09/2020, published yesterday

Superdry (LON:SDRY) - Directorate changes, and waffle about the (not very convincing so far) "brand reset"

Concurrent Technologies (LON:CNC) - Trading update - ahead of expectations. Looks a nice little company.

Epwin (LON:EPWN) - Positive trading update

Frp Advisory (LON:FRP) - Half year results are in line, and the outlook sounds encouraging

.

Capita (LON:CPI)

43p - mkt cap £720m

This complex, low margin outsourcing group briefly dipped into small cap territory in October, but along with many other bombed out shares, bounced strongly in November on positive vaccine news, in what fund manager Keith Ashworth-Lord recently described as a “dash for trash”!

I want to follow up on it, because I covered Capita’s Q3 trading update here on 10 Nov 2020, and was quite shocked at how weak its balance sheet is - one of the worst I’ve seen, with NTAV negative at £(1.6)bn. Therefore a large equity fundraising will be needed at some point - hence shareholders are hostages to that being done on reasonable terms. If it’s bungled, and results in large dilution, then that could damage existing shareholders. Why take that risk?

There were going concern and bank covenant problems. So despite its size, I saw this share as very high risk.

A lot hinged on the pending disposal of its Education Software Solutions business. The good news (announced Mon 14 Dec 2020) is that an agreement has been signed with a credible buyer, Montagu Private Equity, to sell ESS for an enterprise value of up to £400m, with £298m payable on completion, expected in early 2021.

This certainly reduces risk at Capita, once it completes, which looks likely & imminent. However, Capita is far from out of the woods, because even with this cash injection, it will still have a painfully weak balance sheet. Also bear in mind that it’s selling off the family silver to raise cash. So whilst the balance sheet will improve from this disposal, the loss of the substantial profits made by the education division, £52.7m for FY 12/2019, means the remaining business is a lot less profitable & hence less valuable.

This deal reduces financial risk. Personally, I think this share looks awful, in a lousy sector, but good look to holders.

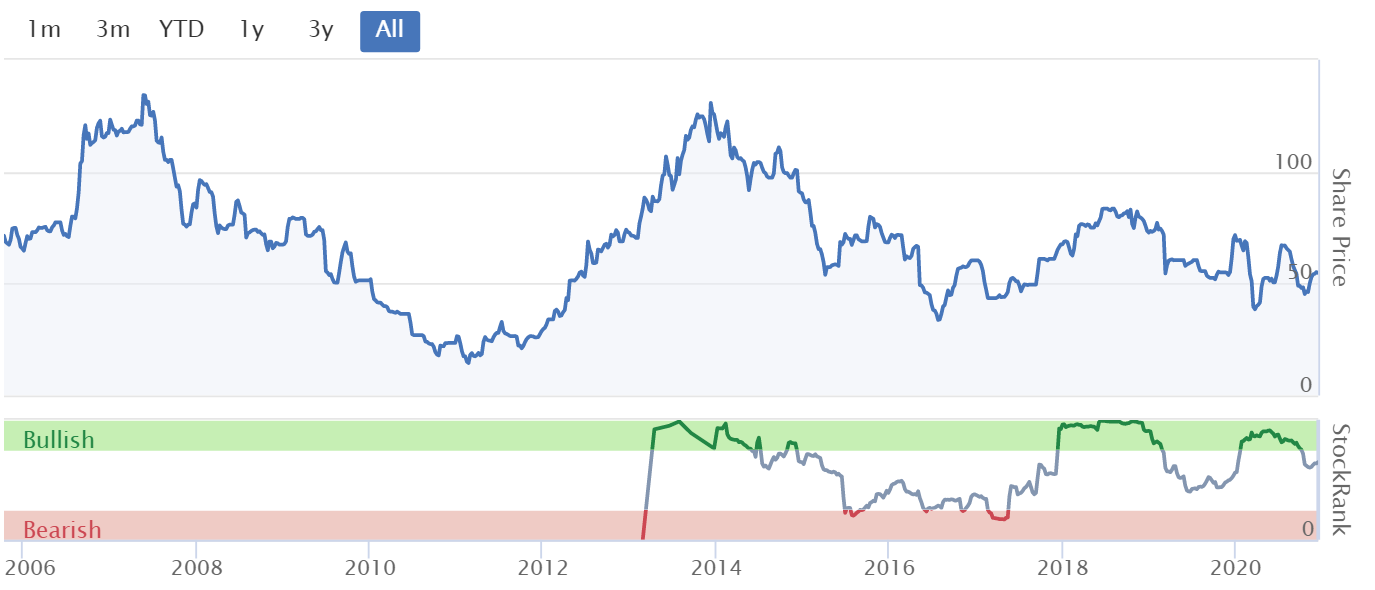

Note that the Stockopedia styles system doesn't look keen either -

.

.

Lowish StockRank too (see below), with the low forward PER triggering a high value score by the looks of it - but this doesn't of course take into account that the share count could rise considerably, when an equity fundraising is done. Hence why I personally wouldn't hang my hat on the low PER being sustained. Remember, if a PER is in low to mid single digits, it usually means there's something wrong! The forward PER is shown as 5.4 on the StockReport here. Does that take into account the disposal of the profitable education division? That's something to check. Therefore that high value score could be vulnerable to downward revision when fresh broker forecasts feed through to the data, maybe?

.

.

Driver (LON:DRV)

Share price: 53p

No. shares: 52.2m

Market cap: £27.7m

Driver Group PLC (AIM: DRV), the global professional services consultancy to construction and engineering industries, is pleased to announce the dividend for the full year and its results for the financial year ended 30 September 2020.

Here are my notes from the recent trading update, on 26 Oct 2020. I always re-read my previous notes to quickly get up to speed, before delving into the latest update. Driver guided us to expect FY 09/2020 to deliver underlying PBT c.£2.5m, net cash strong at £8.2m, and I last concluded that the share looked good value at 51p.

Actual results are in line with that guidance.

- Revenue £53.1m (down 9%) - seems reasonable in the circumstances of covid/lockdown

- Underlying PBT is indeed £2.5m as expected, which is down 17% - again not bad, considering

- Strategy is to focus on higher margin work, which sounds sensible

- One-off severance costs of £0.76m takes takes a big chunk out of the £2.5m underlying PBT, to make actual PBT £1.74m (down 46%)

- Basic EPS halved to 2.6p - a PER of 20.4, but that does include the one-off costs, so adjusted EPS would be about 3.7p by my calculations, or an adjusted PER of 14.3 - which looks about right. Ah, I’ve just found the company’s adjusted EPS, which they say is 4.0p (down 15%), for a PER of 13.3

- Dividend of 0.75p to be paid in March 2021 - useful, but not exciting. Good to see divis reinstated (the interim was passed, which made sense at the time)

Balance sheet - is capital light, which is good - very little in fixed assets, which means more cashflow available to pay divis, in theory. Receivables have come down 12% on prior year, but still look too high, at £17.8m - that’s 34% of the entire year’s revenues, or 4 months sales, which I’m not comfortable with. That’s about double what I would expect to see (2 months sales), so an amber flag here - requires further investigation. The risk with large receivables, is that there could be disputed amounts in there, requiring a future write-off.

Current ratio (working capital) is very good, at 2.15 (for this type of business, I regard anything over about 1.5 as being strong)

Overall - this is a strong balance sheet, providing receivables turn into cash in due course.

Cash generation - has improved vs last year, due to favourable working capital movements. Bear in mind that when revenues shrink, this throws off cash. As the business (hopefully) expands in future, it could suck cash back into working capital, but that’s fine because the cash pile is healthy enough. Hardly any capex, which I like. Nothing untoward I can see in the cashflow statement overall, it looks fine.

Outlook & current trading - sounds alright overall. Not exactly brimming with confidence, but who is at the moment?

In view of the continuing global uncertainty as a result of the ongoing pandemic we are not in a position to reinstate forward guidance at this point. We will review the position at the time of our half year results.… Driver is conditioned to operating with relatively low forward revenue visibility and that has been made even more difficult because the pandemic has resulted in so much global uncertainty.

However, activity levels in the early weeks of the new financial year are encouraging and with a strong net cash position and the availability of increased debt facilities, the Directors believe that the Group is well placed to trade through this current uncertain market environment, and to take advantage of the opportunities afforded as a consequence of the disruption of COVID-19 in the Group's target markets.

I’m not sure what those opportunities might be? Is it suggesting competitors might be retrenching or going bust, or acquisitions perhaps? A bit more clarity on that would be helpful.

My opinion - it looks soundly financed, and has traded well in very difficult circumstances. If earnings rise in future, then that would drop the PER into attractive territory. Personally, I can’t get excited about this share, and think there might be better growth opportunities elsewhere. As a value share, it looks OK though.

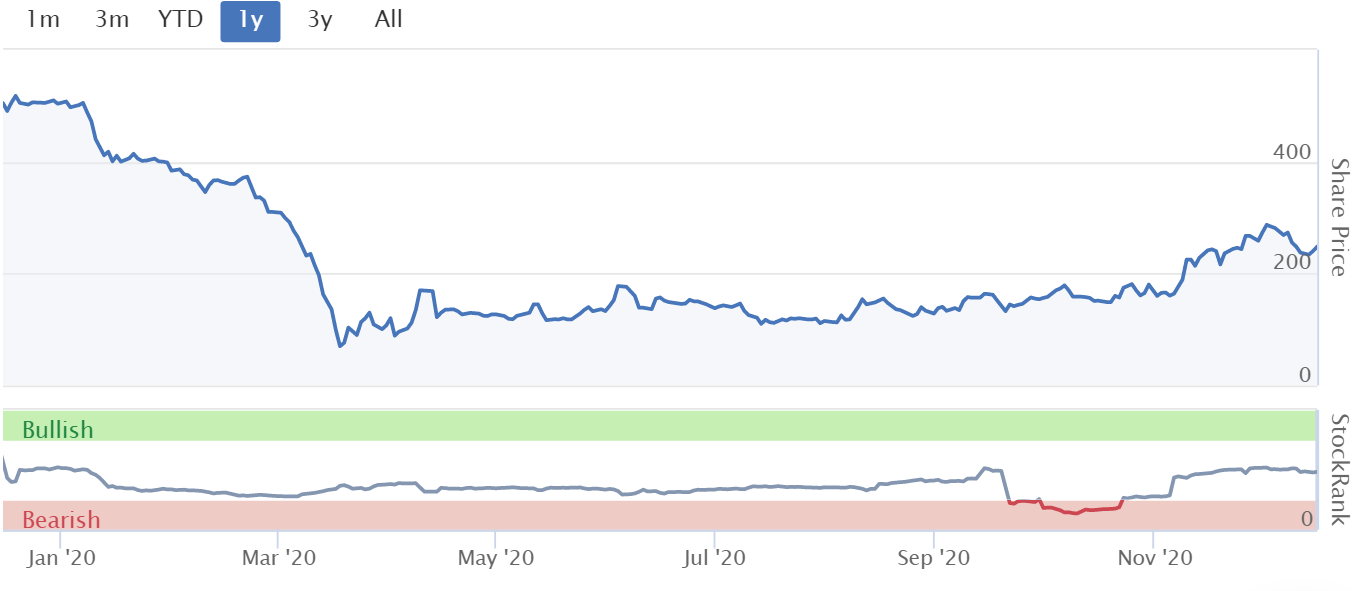

The trouble is, there's an opportunity cost to holding a share that goes sideways for years. 2011-2014 would have been a lovely trade, but it's very difficult to predict that kind of move. Imagine the profits that could have been made by holding say one of the big US tech stocks over the period below - contrary to the popular saying, elephants can gallop, very fast, some of them! Which does make me question what the point is, in buying unremarkable small caps?

.

.

Superdry (LON:SDRY)

Share price: 250p (up 4%, at 08:47)

No. shares: 82.0m

Market cap: £205m

- Founder & 20.3% shareholder, Julian Dunkerton, has been appointed CEO on a permanent basis - replacing his interim contract (to April 2021).

- Silvana Bonello (18 years at NIKE) is appointed Chief Operating Officer, effective March 2021.

- The Chairman, Peter Williams, is stepping down in 2021, when a successor is found. Dunkerton is in charge, I’ve heard secondhand from an insider that he’s very dominant internally - not necessarily a bad thing - I like founder-managed businesses. So Chairman is likely to be a fairly toothless role, in my opinion!

- CFO - they’re searching for a new one.

There’s additional commentary, which is mainly waffle about “resetting the Superdry brand”. Reading between the lines, it sounds like there’s no tangible evidence of progress yet - if there had been, then we’d have been given some hard numbers by now, e.g. this doesn't exactly fill me with confidence -

...There remains much to do - particularly against this current backdrop...

My opinion - this is a really tough turnaround, in my view. Much like Ted Baker (LON:TED) there is all the baggage of expensive, city centre shop leases, which are a millstone. Negotiations with landlords can only go so far, and in my view a CVA should be done, to clear the decks of loss-making stores & onerous leases, once and for all. I'd be much more interested in getting involved then.

I don’t think the broker forecasts are anywhere near realistic (i.e. too optimistic), and we have to remember that business rates relief, and furlough funding, have softened the blow this year. Once those schemes end, then retailers are likely to be facing really serious headwinds in future, requiring large sales increases to get anywhere near profitability again. How likely is that?

Remember that SDRY wasn’t making any money before covid struck. Therefore turning it around is a herculean, multi-year task. I just can’t see why people are so keen to gamble on that, when the odds look stacked against it.

If SDRY can really crack online sales, and shrink the store estate down to just a few prominent showrooms, then it could work. Joules (LON:JOUL) is a good example of a company apparently succeeding at that, and of course Next (LON:NXT) is the best in class for that winning strategy.

I’ll monitor SDRY closely, but for the moment, I think the stock market could be over-estimating the likelihood of a successful turnaround. If the turnaround gains traction, and looks like it's going to work, then of course I would turn bullish. But it needs to be based on realistic facts & figures, not wishful thinking.

My notes here from reviewing the interim results on 5 Nov 2020 give a lot more detail. A fundraising in late 2021 looks highly likely, in my view. In the meantime it has enough headroom, so no immediate cash crunch.

The chart looks good for now, but almost everything has rebounded lately. Will these increases stick? Some will, some won't, we just don't know which ones yet!

.

.

Concurrent Technologies (LON:CNC)

Share price: 108.5p (up 12%, at 10:11)

No. shares: 73.4m

Market cap: £79.6m

Concurrent Technologies Plc (AIM: CNC), a world leading specialist in the design and manufacture of high-end embedded computer products for critical applications in the defence, aerospace, telecommunications, transportation, scientific and industrial markets, announces a trading update for the year ending 31 December 2020.

Short & sweet, here is today’s update in full -

Based on its unaudited management accounts for 2020, the Company confirms that it expects to report revenues and profitability ahead of market expectations with cash generation remaining strong.

The Company also expects to continue the practice of paying a further interim dividend to shareholders and to pay this on or before 6th April 2021.

Clearly it’s a positive update, but doesn’t give any actual numbers. It would have been better to say: profit is expected to be in the range £x-y, subject to audit adjustments.

I suppose in this case, the code is generally that “ahead of market expectations” probably means something like 2-10% ahead of expectations (I’ve made that up), on the basis that you wouldn’t report if it was less than 2% ahead, and you would probably say materially ahead if more than 10%.

Isn’t it daft the way these things are done! Numbers are always better than coded wording.

Also, we're not given a footnote telling us what market expectations are, so I give this update a score of D - could try harder.

Thankfully, good old Cenkos come to our rescue, with an update note available on Research Tree, many thanks to them for this, it’s incredibly helpful.

Updated forecast for FY 12/2020 -

- Revenue raised to £20.2m (second upgrade in recent months) - note that about half revenues come from N.America

- Statutory PBT raised 19% to £2.5m

- Adj EPS raised from 5.7p to 6.1p (up 7%) - which at 108.5p share price, is a PER of 17.8 - which seems reasonable for a decently profitable company that is trading resiliently in a tough year

- Dividends - there’s a good track record of rising divis, and 2.55p is expected this year - yielding 2.4% - not bad in a low interest rate environment, and it’s well covered, and looks dependable

- Note that last year’s profit was boosted by a £1m keyman insurance payout, hence is not directly comparable to this year

Fabulous balance sheet (I’ve checked the last interims), with plenty of net cash. This suggests to me it’s a tight ship, with conservative management, which is very much what I look for, and what we need more of, in an uncertain world.

My opinion - this looks good to me. A decently profitable small cap, with a bulletproof balance sheet, and clearly operating in a niche with good margins, and seemingly dependable revenues.

My main reservation is that growth in profits has been pedestrian in recent years. So where’s the upside going to come from?

What I can say is that the financials get a thumbs up from me, so this would be a good share for readers to research further, to see if there might be anything exciting in the pipeline, from new products, etc. That’s outside my scope, so over to you.

.

Epwin (LON:EPWN)

Share price: 93p (up 5%, at 12:35)

No. shares: 143.0m

Market cap: £133.0m

Epwin Group Plc (AIM: EPWN) ("Epwin" or the "Group"), the leading manufacturer of low maintenance building products, supplying the Repair, Maintenance and Improvement ("RMI"), new build and social housing sectors, announces a trading update in respect of the year ended 31 December 2020 ("FY 2020") and notice of its full year results.

This sounds rather good -

Trading ahead of expectations for FY 2020

The Group has experienced better than expected trading conditions since reporting its half year results to the end of June 2020 on 10 September 2020. Demand from the RMI market, which represents around 70% of Group revenues, has been particularly strong during the fourth quarter of the year, while demand from the new build and social housing sectors has also been increasing.

This is more evidence, which we’re seeing across multiple sectors (apart from the obvious problem ones of travel, leisure, hospitality & retail), that the economy is recovering. I’m seeing this every day, from numerous companies. Hence why I’m bullish about the stock market - earnings are clearly now recovering, and massive Govt support measures are working, in preventing a prolonged or deeper recession.

LFL revenues were up 2% in July, and 3% in August (previously reported)

This improved to 5% ahead for July-November, implying (my workings below) assuming no seasonality, that Sept-Nov inclusive was up c.6.7% vs LY.

My workings below - as you can see, I just put in the numbers we're given, then the 320 figure is the balancing figure.

.

.

Year to date for FY 12/2020, revenues have improved from -33.4% in H1, to -15% for the 11 months to 30 Nov 2020 (versus last year). Clear progress in getting the business back to normal there.

Overall -

As a result, the Group's revenues and adjusted profit before tax for the year ended 31 December 2020 are anticipated to be ahead of current market expectations. Net debt at 31 December 2020 is also expected to be lower than current market expectations.

Other points -

- Pressure on supply chain, due to strong demand for extruded products

- This has impacted delivery times (hence some deferral of sales likely)

- Efficiency also impacted

- New warehouse in Telford should sort problems out in H2 of next year

- Dividends - will reinstate final divi (no amount given)

Outlook -

We look forward to a more positive 2021, with the medium and long-term drivers of our markets remaining strong."

My opinion - it sounds as if things are gradually getting back to normal, with another c.6 months needed to get there.

I think it makes sense to value the business on say 10p EPS future earnings. That would put it on a PER of about 9 - which seems good value.

Worth a closer look, I’d say, as a value/recovery idea, with a decent dividend yield likely in future.

.

Frp Advisory (LON:FRP)

Share price: 106.5p (up c.1.5% at 16:28)

No. shares: 239.6m

Market cap: £255.2m

FRP Advisory Group plc, a leading UK professional services firm specialising in restructuring advisory, is pleased to announce its unaudited interim results for the six-month period ended 31 October 2020 ('H1 2021' or 'first half').

Increasing size and profitability despite a subdued market

Highlights - to save me re-typing it all, I've copied the bullet points below, and added my own comments in square brackets -

Revenue increased 14% in the first half to £35.9m, 9% on an organic basis [Paul: in line with the H1 trading update previously]

· Adjusted underlying EBITDA up 7% to £9.7m [Paul: also in line with previous guidance]

· Adjusted PBT of £8.8m in line with Board expectations

· Strong balance sheet with cash at 31 October 2020 of £15.4m and an undrawn committed revolving credit facility (RCF) of £5m

· For the first half basic and diluted EPS is 2.48p. Adjusted EPS is 2.96p

· The Board declares an interim dividend for the first half of 1.6p per eligible3 share. This dividend will be based on shareholders per record date of 19 February 2021 and will be paid on Thursday 18 March 2021.The board intends to adopt a quarterly dividend payment schedule commencing in 2021

· The Board believes current trading is on track to comfortably achieve full year expectations

That all sounds quite good.

The half year trading update was published on 13 Nov 2020, I covered it here. FRP has an unusual structure, in that 25% of profits are paid out in additional remuneration to the partners. So it’s really a hybrid structure of a conventional partnership and a listed company.

I wasn’t sure whether the Cenkos forecasts included the 25% partners profit share or not, so I raised a query with the analyst, James, who kindly confirmed that his forecasts do indeed include this cost. So we don’t need to make any adjustments to forecast EPS.

Valuation - the latest Cenkos note out today (thanks again for that!) suggests:

5.8p adj EPS this year FY04/2021, a PER of 18.4, and

6.7p next year, a PER of 15.9

There’s likely to be upside on those forecasts, given that it’s already done 3.0p in H1, and the outlook says “on track to comfortably achieve” FY 04/2021 forecast.

Govt support schemes are keeping lots of zombie companies afloat, but clear signs are already appearing of struggling retailing/hospitality companies reaching the end of the line - e.g. Arcadia, Debenhams, and many smaller ones too. Also note that there are tons of CVAs being done in those sectors, to reset rents to affordable levels, which is lucrative work - I seem to recall that the relatively small & simple CVA done by Revolution Bars (LON:RBG) (I hold) cost about £1m. Both those sectors in their entirety need to reset rents lower, so CVA work could be a goldmine in the next few years for insolvency firms.

For that reason, I think even if Govt support schemes are extended again, as seems likely, it won’t be enough to save the many companies that are teetering on the edge already, and a few more months' lockdowns of some kind seeming likely.

Hence, sad though it is for the victims, FRP is likely to have plenty of work in the coming year or more.

Balance sheet - looks fine. As is usual for an insolvency practitioner, the receivables book is large - because these jobs are often paid after months, or even years’ work has been done.

My opinion - I think FRP looks good, and seems priced sensibly. If you’re bearish about the economy, then it’s a nice counter-cyclical thing to hold, and pays good divis too.

Even in a recovery, lots of companies are likely to need some form of restructuring. So either way, I reckon FRP should have maybe several years of work ahead.

It’s a respected firm, with a good name, and seems to be winning some high profile larger, complex jobs. Therefore it’s not really a direct competitor with Begbies, which seems to get the crumbs from the giants table! FRP is somewhere in the middle it seems. There could be upside from it moving up the value chain, which seems to be happening.

The problem is possibly stock market sentiment. With a vaccine now at the start of a rollout, we can see how the market is only really interested in cyclical recovery, and growth companies now. So will insolvency practitioner shares attract any buying interest? I’ve no idea, but it’s an important question. After all, for shares to go up, there have to be more buyers than sellers.

Fundamentals are good - FRP looks a decent company, and reasonably-priced. It could be a nice one for value/income investors to tuck away. I'm more interested in cyclical recovery/growth stocks at the moment, with probably larger & quicker upside potential, so it's not for me at this particular time, but i wouldn't rule out adding it to my portfolio if it languishes.

Having had more time to think about it, I'm more comfortable with the structure of shareholdings, partner profit share, etc.

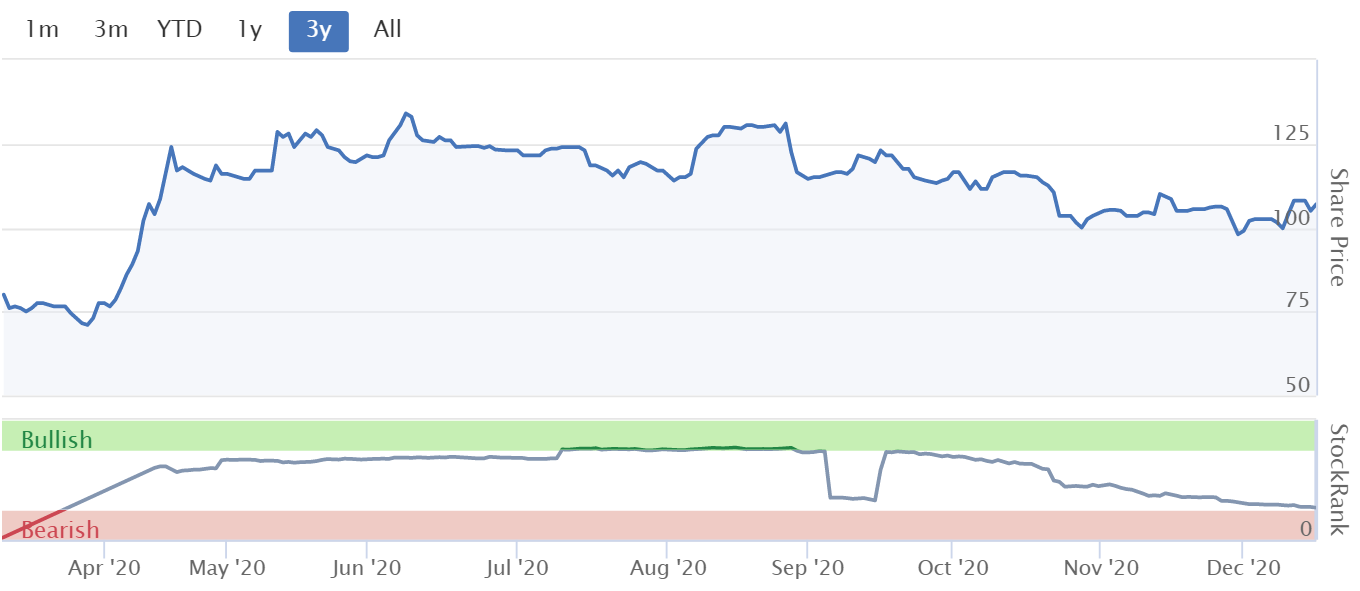

I'm not sure why the StockRank has declined so much recently, when the company is actually trading quite well?

.

.

That's me all done for the day! See you in the morning.

Regards, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.