Good morning from Paul & Graham!

Today's report is now finished.

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps (usually) between £10m and £1bn. We usually avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced. OR it's such deep value that we see a good chance of a turnaround, and think that the share price might have overshot on the downside.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

Links:

Paul & Graham's 2024 share ideas - live price-tracking spreadsheet (2 separate tabs at bottom),

Frozen SCVR summary spreadsheet for calendar 2023.

New SCVR summary spreadsheet from July 2023 onwards.

Paul's podcasts (weekly summary of SCVRs & macro views) - or search on any podcast provider for "Paul Scott small caps" - eg Apple, Spotify.

Wednesday 17 April 2024 - SCVR

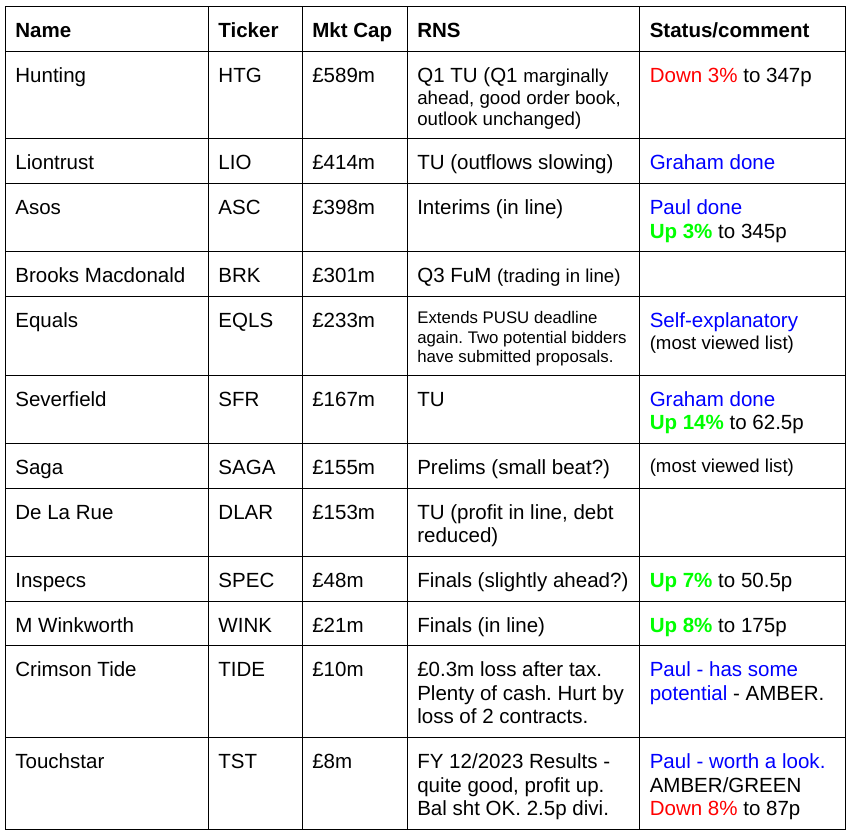

Companies Reporting -

Other mid-morning movers (with news) -

Surface Transforms (LON:SCE) - down 17% to 3.25p - Reduced sales forecast - Paul - RED

Only a few days after reiterating its revenue target, a new (lower) range of possibilities is announced. It says this is in response to shareholders requesting worst case scenarios. I think giving a range rather than a precise figure makes a lot of sense, given the very considerable problems SCE is encountering in its struggle to scale up production to meet strong demand.

I’ll remain RED until it’s concluded the next fundraise, which is looking increasing and highly likely, unless it can pull a rabbit out of the hat, eg with some up-front cash from customers.

…projected FY 2024 range of £17.5m to £22m sales.

With the majority of the year still to come, 2024 sales outlook is dependent on the amount of progress made on reducing scrap, building capacity and delivering to customers.

Sales were constrained in Q1 due primarily to scrap and constrained manufacturing capacity. Significant progress has been made on reducing scrap and this is expected to continue through 2024. Similarly progress on expanding our capacity during 2024 is advancing.

Argentex (LON:AGFX) - down 7% to 49.3p

The only news today is influential & widely followed Harwood Capital reducing its stake from 5.06% to 4.42%. This might be perceived as meaning there’s a potential selling overhang for the rest of the Harwood stake, and that a key investor seems to be losing interest in the upside case. See our archive for the various problems that have beset AGFX.

Just Eat Takeaway.com NV (LON:JET) - down 6% to 1,120p (£2.3bn) - Q1 Update - Paul - AMBER/RED

Update seems to be in line, and it reiterates guidance for 2024. So I’m not sure why the price is down 6%, clearly the market wanted something better -

We reiterate our guidance including adjusted EBITDA of approximately €450 million and positive free cash flow1 before changes in working capital in 2024

Substantial share buybacks have been done -

Under the share buyback programmes announced in April and October 2023, 8.9% of the issued shares were repurchased as per 12 April 2024.

Weird balance sheet with huge cash pile, offset by huge debt pile. Heavily negative NTAV.

Free cashflow was still negative in 2023, despite improving from 2022.

Paul’s view - looks a can of worms to me, I won’t be touching JET.

International Distributions Services (LON:IDS) - shot up c.25% at 11:00, but is drifting down now, up c.15% at 12:12.

I can’t find any news, other than on Sky, “Post Office boss exonerated” - not sure if this is related to IDS or not? Please post a comment if you find anything to explain this!

EDIT: thanks to clanger, who has updated us with a reader comment below, saying the FT has reported a Czech billionaire is apparently considering a takeover bid for Royal Mail.

Summaries of main sections

Auction Technology (LON:ATG) - down 16% to 526p y’day (£640m) - H1 Trading Update - Paul - AMBER

We've previously quite liked this share, but it now looks largely ex-growth, and I dislike the weak & heavily indebted balance sheet. So I'm now lukewarm.

Severfield (LON:SFR) - up 14% to 61.6p (£191m) - Trading Statement - Graham - GREEN

Changing my stance on SFR to “GREEN” today after it “slightly” beats expectations, with a positive outlook for the new year, and simultaneously announces a £10m share buyback. I said previously I’d turn positive on the stock if that happened, so that’s what I’m doing.

ASOS (LON:ASC) - up 9% to 363p (£434m) - H1 Results (to 2/2024) - Paul - AMBER/RED

I do a demolition job on these lousy H1 numbers, and demonstrate why the turnaround plan, even if it succeeds, will result in a business making zero real world cashflow. Poor, overly indebted balance sheet too. It's a mess. However, with Frasers (LON:FRAS) controlling 27%, there could be some strategic value or deals here possibly? That's the only reason I'm not fully red.

Liontrust Asset Management (LON:LIO) - up 5% to 671p (£436m) - Trading Statement - Graham - GREEN

Retaining my positive stance on this one as the company reports more net outflows in Q4, albeit at a slower pace than previous quarters. While it’s not my favourite share in the sector, it does offer a generous yield and a cheap valuation against both earnings and AuM.

Paul’s Section:

Auction Technology (LON:ATG)

Down 16% to 526p y’day (£640m) - H1 Trading Update - Paul - AMBER

London, United Kingdom, 16 April 2024 - Auction Technology Group plc ("ATG", "the Company", "the Group") (LON: ATG), operator of world-leading marketplaces for curated online auctions, provides an update on its trading for the first half of FY24 (six-month period ending 31 March 2024).

An interesting share, which dropped sharply yesterday. It floated in 2021 (yes, I know) and was initially well received, peaking at c.1,640p in Sept 2021, then sliding all the way down to c.450p by Jan 2024. A recent rally has been mostly snuffed out by yesterday’s fresh plunge. Is it a load of codswallop, or are we being offered a more attractive entry price?

Looking through our archive here, Roland saw it as amber on its 1/12/2023 profit warning, concluding that there might be some attractive qualities emerging after a drop to about 490p. Graham looked at it again on 31/1/2024, and boldly went green, after a 18% rise to 542p/share, after an encouraging trading update, although he concluded it was ”certainly not without risk”.

Here’s the chart since ATG listed on the LSE main market -

Zooming in, this is the last 12-months -

Latest news - this is an annoying update which gives piecemeal bits of information, but fails to pull it all together to tell us how the company is performing versus expectations. Who writes these things? The outlook below might help analysts, who can plug the numbers into their spreadsheet models, but to everyone else this is close to useless -

FY24 Outlook

We expect our full year Group revenue to be in the range of $175m-$180m implying a mid-point growth rate of 7%, including organic revenue growth of 2% - 5% and a strong contribution from ESN. Revenue growth in the second half of FY24 will be driven by the continued growth in value-added services, less challenging comparatives for the upcoming period, and encouraging trends seen from the roll out of cross-listing and ATG white label across the Group. The Group now expects its FY24 adjusted EBITDA margin to be 46% due to the mix of revenue with a higher contribution of lower margin value-added services relative to higher margin I&C commission revenue.

Broker update - good old Cavendish come to our rescue. It issues reduced forecasts, but they’re only trimmed really - FY 9/2024 adj diluted EPS is lowered 6.5% from 40.1 US cents, to 37.5c - hardly a disaster. Divide that by 1.25, and it’s 30 pence per share. So a PER of 17.5x - doesn’t sound expensive for a niche software company.

ATG did 32.6p adj EPS in 2023, and 29.5p in 2022, so this is looking ex-growth. Hence it possibly should be on a low PER?

Balance sheet - nothing said in this update, but looking back to 9/2023, I’m afraid it’s very poor. NAV of £530m includes intangible assets of £695m, so NTAV is heavily negative at £(165)m. Even if I eliminate the £41m deferred tax creditor, I still only get to £(124)m NTAV.

There was net debt of £116m at Sept 2023. I think that’s too high. Finance costs swallowed up most of the operating profit in H1 results.

Paul’s opinion - just on a quick review, I’m not enamoured with these figures. Growth seems to be stalling, and I’m worried that its big acquisitions spree might have resulted in it taking on too much debt. Maybe it overpaid for acquisitions, I don’t know?

So I can’t back up Graham’s previously bullish view, hence I’m shifting it down a gear to a neutral view of AMBER. We can always go back up a gear if the figures & outlook improve as time goes on.

Mind you, software companies often tend to attract big premiums from takeover approaches, and are more highly valued by private buyers than the UK stock market, so there could be upside here maybe?

EDIT: many thanks to one of our regulars here, grumpy5, who has left a comment below, saying that a competitor is gaining ground by undercutting ATG on price. Many thanks for this interesting industry info.

Also thanks to JamesKerr1 who below posts experiences of using ATG software, and the competitive landscape, which sounds challenging. More excellent insights, great stuff!

ASOS (LON:ASC)

Up 9% to 363p (£434m) - H1 Results (to 2/2024) - Paul - AMBER/RED

Interim results for the 26 weeks to 3 March 2024

The market cap of this eCommerce fashion giant rises by £36m this morning.

The numbers look pretty awful to me, eg -

H1 revenue down 18% to £1,498m

Adj (?) gross margin is also down, and very low at only 40.3%

EBITDA is a nonsense number, due to omitting large capitalised IT spend, hefty finance charges, and depreciation on its expensive warehouses.

Adj loss before tax is £(120)m vs LY H1 comparative of £(87)m.

Statutory loss before tax is even worse at £(270)m.

Note that this period includes the busiest season, autumn & Christmas, so it should be profitable, but is nowhere near profitable.

Its commentary follows the usual pattern of glossing over dismal results with talking up positives & turnaround potential.

Outlook -

AEBITDA for FY25 expected to be significantly higher than FY23 and FY24 driven by:

(1) materially higher gross margin following removal of old stock and higher full-price sales mix of flexible stock models; and

(2) ongoing transformation of the business following cost action already taken in FY23 and H1 FY24…

Our guidance for FY24 and FY25 remain unchanged and we are committed to accelerating towards an 8% EBITDA margin in the mid-term, enabling ASOS to be sustainably cash generative on an ongoing basis.

That sounds impressive, an aspiration to get EBITDA up to 8%. However, I’ve run a simple calculation to see what that 8% margin would turn into, in cash terms (assuming no working capital movements). I’ve replaced depreciation with actual H1 capex (most of which is internal capitalised IT development costs), and actual H1 finance charges. It looks like this -

I’ve not fiddled the figures, the 8% EBITDA aspiration results in a big fat zero in cash profit the way I’ve defined it here (reflecting reality).

So the idea that Asos is going to become (or is) highly cash generative is complete hogwash!

Balance sheet - is weak. It has NAV of £620m, but that includes probably worthless intangible assets of £692m. So NTAV is negative £(72)m.

See note 15 for details on debt. It has large gross borrowings (excl leases) -

Given that Asos is not generating any sustainable cashflow (it relied on a one-off £176m reduction in inventories to report positive cashflow in H1, which obviously won’t repeat to that extent), then how is this debt above going to be repaid when it matures?

To be fair, there is £332m in cash, so almost half the debt, although year end snapshots usually present the most favourable view possible.

Paul’s opinion - on fundamentals, Asos looks in real trouble, and I could see it going bust in the medium term.

However, it also has turnaround potential, since the low 40% gross margin has lots of scope for improvement, and on £3bn revenues, that could be transformative. I think it would need new management first though, this has been a very badly run business for many years. This is possibly what Mike Ashley sees in Asos, and why he’s accumulated a 27.1% position (20% shares + 7% derivative). His approach (learned from Philip Green) seems to be buying struggling businesses (often out of administration), then applying brutal tactics to strip out cost, often involving hammering suppliers & landlords for discounts. But that didn’t work at Matches, and this approach can sow the seeds for future business failure, as relationships with important suppliers, brands, and key staff are trashed (eg. BHS, TopShop).

I wouldn’t touch Asos shares as a standalone business, because the numbers (and outlook) are so poor. However, there might be a trade in here for some kind of takeover deal perhaps?

We haven’t even touched on the Chinese (Shein, Temu, etc) battering this sector by deeply undercutting on price. Sure Asos sells third party brands, but that’s low margin business, and with handling costs, returns, etc, leaves no scope to make any profit.

On balance I’ll stick with my previous 2 reviews with AMBER/RED - lousy business, but might have strategic value to an acquirer.

Dave Murray is appointed new CFO. He’s got his work cut out, that’s for sure.

Almost a round-trip now! So I'm not feeling quite so bad about selling my 0.5m Asos shares at 9p many years ago, because they looked over-valued (I'd bought them at 5p) -

Graham’s Section:

Severfield (LON:SFR)

Up 14% to 61.6p (£191m) - Trading Statement - Graham - GREEN

This is a good news update:

Severfield plc, the market leading structural steel group, today issues the following trading update for the year ended 30 March 2024…

The FY 2024 result is “slightly” ahead of previous expectations.

Net debt, excluding leases, finished the year at £10m, also ahead of expectations.

Checking the recently published note from Progressive, their net debt estimate for FY 2024 was nearly £29m. So the company has beaten that by a very wide margin.

Reasons for the excellent net debt result include “an improvement in underlying working capital and an increase in advance payments” - I would cautiously assume that these factors could reverse, i.e. that the net debt improvement isn’t likely to be permanent. Working capital ebbs and flows!

Operational update

Some key bullet points:

Good growth in UK order book in H2 (to £511m), of which nearly £400m is due for delivery in the next 12 months. (GN note: this gives visibility over most of SFR’s forecast revenues for FY March 2025; £561m according to Progressive.)

Indian JV: order book has reduced but company still very positive on outlook and pipeline of opportunities. Profitability expected to improve.

Share buyback

Severfield already pays a decent yield (and the dividend is forecast to continue to grow).

But it can afford to do even more for shareholders, as it announces a £10m buyback.

At the current market cap, that would give a meaningful reduction in the share count of c. 5% of total shares.

The company is keen to emphasise that its growth strategy is unchanged and that the buyback is possible thanks to “the highly cash generative nature of the business”.

Outlook

The Group is performing well, the outlook is positive and our businesses are well-positioned in markets with excellent long-term growth opportunities. Whilst there remains some uncertainty in the wider economy, we are seeing an improvement in market conditions which, together with our high-quality order books, diversified activities and operational delivery capabilities, provides us with confidence for the year ahead.

Graham’s view

Paul and I both expressed our views on this one in November. We each thought that the shares were cheap for good reasons, i.e. that a low-margin, highly cyclical structural steel group should trade at a cheap earnings multiple.

Quoting myself is usually a bad idea, but this is what I said at the time:

I think I would have to accept that this share was offering deep value if:

PER was 5x or less, or:

Dividend yield was higher than the PER (ideally >10%) and was covered by earnings, or:

The company was materially reducing its share count with a buyback.

Have any of these conditions been met?

PER: based on the latest Progressive forecast for FY March 2025 adj. EPS (9.3p), the adjusted PE Ratio is 6.6x.

The forecast dividend yield is currently about 6%, which is not higher than the PER. But it’s close, if you’re willing to use the adjusted PER of 6.6x!

Buybacks: Yes, the company is materially reducing its share count. A c. 5% reduction in the share count isn’t huge but it is meaningful and material in my book. And who knows, perhaps it can pave the way for further buybacks in due course?

Therefore, I’m going to stick to what I said previously and turn positive on this share now. It’s unlikely to ever be a high-quality compounder (the long-term share price chart backs me up on this), but it might simply be too cheap at this level, especially since the number of shares is about to start reducing.

Liontrust Asset Management (LON:LIO)

Up 5% to 671p (£436m) - Trading Statement - Graham - GREEN

Liontrust Asset Management Plc… the specialist independent fund management group, today issues its trading update for both the financial year ended 31 March 2024… and the three months ended 31 March 2024.

LIO’s share price has fallen and recovered since we covered last in August:

Today’s trading statement confirms that, unfortunately, the company has seen a decline in AuM (or what the company calls “assets under management and advice”) by 11.5% during the financial year to March 2024.

AuM finished the financial year at £27.8 billion.

Net outflows have been enormous, and far too big for investment returns to offset:

In my experience, it’s highly unusual to see c. 20% of starting AuM get withdrawn in a single year.

The main category of funds, “UK Retail Funds and MPS” performed less badly than the group as a whole, with about 15.5% of starting AuM withdrawn.

With £27.6 billion of AuM (or to be more precise, “AuMA”) as of mid-April, investors get £63 of AuM for every £1 invested in LIO stock at the current share price.

CEO comment

"We start the new financial year with confidence to drive the business forward after the challenges of the last 18 months.

Liontrust has improving investment performance in the short term as well as excellent performance over the long term and it appears the UK and other developed economies have reached peak interest rates. This follows a period in which many of our core investment strategies, notably quality growth, small/mid-caps and UK equities, have been out of favour, impacting both performance and flows. This led to outflows of £1.2 billion over the three months to 31 March 2024.

We have made continued progress against our strategic objectives, enabling us to seek to generate growth through an expanding product range, distribution and client base.

The outlook statement doesn’t give too much away; it reiterates that Liontrust wants to build its reputation abroad and broaden its investment capabilities.

Personnel changes: there are some NED changes on the Board. The executive team also sees new appointments including Chief Strategy Officer and COO.

Graham’s view

It has been a while since I updated my view on this one. While I agree with the CEO re: the outlook for interest rates, net flows continue to concern me.

The profile of outflows in FY 2024 was as follows:

H1: outflows of £3.2 billion

Q3: outflows of £1.7 billion

Q4: outflows of £1.2 billion

It can be argued that this is an improving trend, but it’s still deeply in the red and therefore it’s too early, in my view, to argue that the company has turned a corner. Others may be more optimistic, but I’d wait until flows were much closer to breakeven before getting out the champagne.

That said, I’m inclined to keep my positive stance on these shares as we have the classic “dividend yield higher than PE Ratio” situation:

The dividend is barely covered by earnings and therefore should be considered vulnerable, but the cheapness is still readily apparent.

As before, I should reiterate that this is not my top pick in the fund management sector. Liontrust tried and failed to take over rival fund manager GAM, while other acquisitions it did get through have subsequently been impaired. I also believe that Liontrust is less differentiated than its peers when it comes to its investment specialisms.

This is arguably reflected in a cheap valuation and I do think that LIO shares are underpriced, but personally I’d invest in other fund management companies before investing in this one.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.