Good morning, it's Paul here with the SCVR for Weds.

Estimated timings - I'm now listening to the Creightons webinar (from noon), and cooking myself a cheese & mushroom omelette. So I'll get on to Arcontech (LON:ARC) after that. Should be finished by 2:30pm.

Today's report is now finished (14:24)

Today's agenda is;

Boohoo (LON:BOO) - my notes from chat with company last night

Cambria Automobiles (LON:CAMB) - Trading Update

Creightons (LON:CRL) - Preliminary Results

Arcontech (LON:ARC) - Final Results

As a reminder, I haven't got time to look at everything each day, so I tend to just select 4 or 5 of the more interesting companies, taking into account where possible reader requests. It's helpful when people post a comment explaining why a company is a good investment proposition, rather than just can you have a look at this, because I happen to own some shares in it!

.

Boohoo (LON:BOO)

I had an interesting chat with Boohoo (LON:BOO) last night. My thoughts here had come to their attention (yesterday's SCVR I assume), so we discussed the current situation. The key points were;

BOO adamant that it has done nothing wrong

Directors/family are exasperated & upset by their reputations being besmirched, and false allegations being thrown around (latest one is they've been falsely accused of people trafficking!) in newspapers & social media

Don't see it as their role to police the entire third party supply chain. Govts bring in minimum wage rules, so Govt's job to ensure compliance across all industries, including fashion sector. Suppliers are third parties, not owned or controlled by BOO. What about Jalal Kamani then? He left BOO some time ago, set up his own business, and is completely separate. Not a supplier. His company just re-packaged some BOO gear made in Morocco - see correction in The Times

If any suppliers are proven to be abusing rules, then they will be dropped

BOO has always been completely open about using UK suppliers. If they had anything to hide, then they wouldn't have told anyone!

Why do you use UK suppliers, when labour is so much cheaper abroad? Convenience, and it's fast. But UK production is relatively expensive, as labour cost so much higher

Competitors are buying garments made in Bangladesh where labour costs 50p per hour - where is the outrage against that?!

Speed to market - is an advantage of UK production. My article was right, in that production in Turkey or N.Africa only takes 5 days overland. However, another option is air freight from the Far East - this is only £1/kilo, so about 50p per garment. This works out cheaper, and almost as quick, as UK production. Hence if more overseas sourcing is done, gross margins will go up, not down! I was right about this, and lots of analysts/commentators got this completely wrong. This blows apart the bear case, in my view.

Is it a family firm still? Very much so. Family & staff who've been with them for the long term work 20 hours per day, flat out, it's that passion & love for the business that has made it so successful. "We've created the best fashion business on the planet", and growth continuing - got 9 brands now, that could be 18 in a few years. No limit to the number of brands that could be added, providing it can all be managed

There you have it, a robust defence from the company. I remain firmly of the view that this supply chain publicity has presented us with a lovely buying opportunity, for one of (maybe the) best growth companies on the UK market.

.

Cambria Automobiles (LON:CAMB)

Share price: 51p (up 2%, at 09:25)

No. shares: 100.0m

Market cap: £51.0m

This is a car dealership chain.

The Board of Cambria provides the following update on its trading for the eleven months to 31 July 2020...

Significant disruption from closure of all showrooms between 24 March - 31 May 2020. Reduced level of aftersales (repair/servicing) remained open throughout. Had a material impact on trading in Mar, Apr, May, despite mitigating actions taken.

Creditors - good to see CAMB is not stretching tax creditors. Companies that are doing this, could be building up problems for the future;

... maintained timely tax payments so that it does not build up a deferred payment liability.

Current trading - June & July trading was positive - "well ahead" of LY & mgt expectations, although has not fully recouped negative impact of lockdown.

Year-to-date 11 months sales -

- New vehicle sales down 27.6% on LY. Margins up - profit per vehicle up 4% vs LY.

- Used vehicle sales down 21.6% on LY. Margins up 4.3%

- Aftersales down 13.6%

- Govt support - drew £3.7m from furlough scheme, and £1.1m in business rates reduction

- Cost-cutting - in the process of "significant reduction" in staffing levels

- Focusing more on luxury cars

Outlook - June, July and August were good.

Cautious outlook comments, mentioning worries about;

- Order book for Sept "building at a slower rate than the previous year"

- Concerned about economy & consumer confidence in Q4

- Furlough scheme ends in October, with expected rise in unemployment & reduced household incomes

- Brexit uncertainty & lack of clarity - a 10% tariff (under WTO rules) would have "a significant impact on sales volumes"

- Emissions regulations mentioned, but not clear how this could impact CAMB?

- No guidance given, due to uncertainty

... potentially challenging economic conditions from Q4 2020 onwards

My opinion - there's almost too much detail in this announcement, but no profit guidance. Therefore I don't know how to value this share, until we have sight of the preliminary results, due out on 25 Nov 2020.

I'm reluctant to rely on broker consensus figures, which look about flat against last year, at c.10p EPS. I've just had a look at flash notes from N+1 Singer and Zeus, which don't have forecasts. Although Zeus estimates that FY 08/2020 profit could come in about 20% below last year (since H1 was ahead, and H2 impacted by covid). That implies about 8p EPS this year. That's a PER of 6.4 times, which looks cheap considering what an unusually bad year this has been.

Maybe there's scope for this share to continue recovering? It's not yet clear where demand for cars is likely to settle, once the pent-up demand has worked through the system? Like others in the sector, CAMB is blessed with lots of freehold property on the balance sheet, hence why this sector is quite interesting - these companies are really hybrid shares - part car retail/servicing, and part property companies.

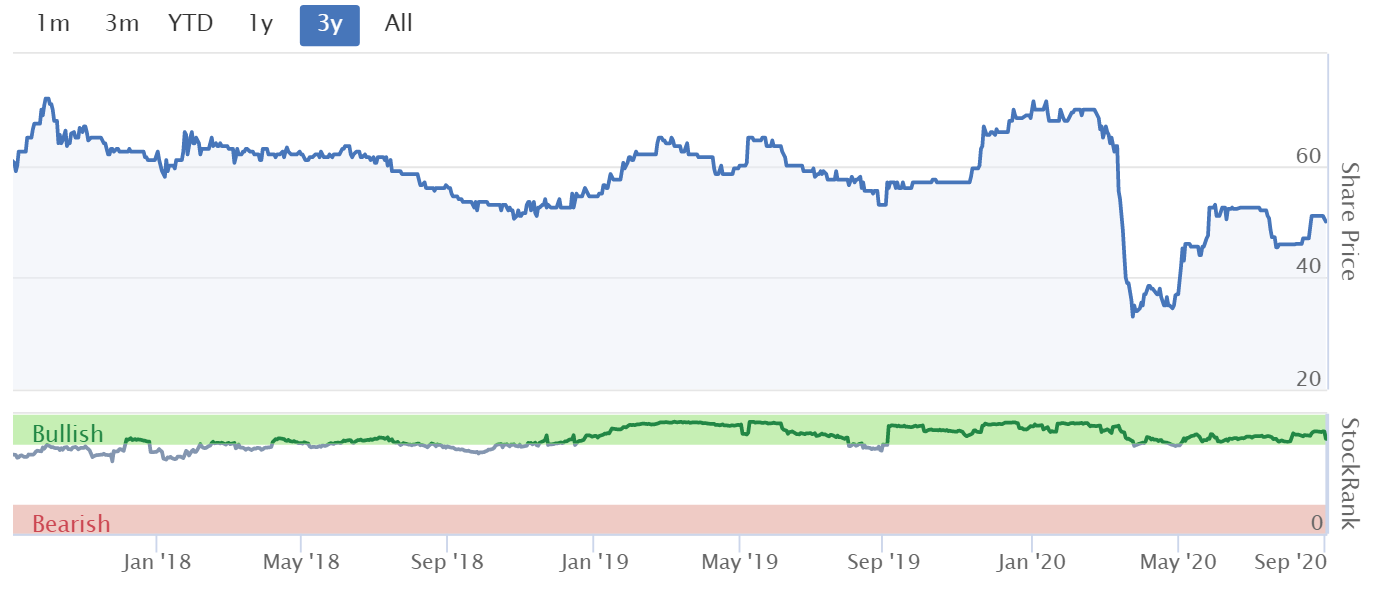

Overall, this looks quite good - asset-backed, and cheap on earnings multiple. One way or another, the issues mentioned as being of concern are likely to be sorted out longer term. Stockopedia likes it too, with a consistently high StockRank over the last 3 years, see below;

.

.

Creightons (LON:CRL)

Share price: 55.5p (up 2%, at 11:18)

No. shares: 64.75m

Market cap: £35.9m

Online presentation - at noon today, so I've just signed up for that. Hopefully there should be a recording afterwards for people who are reading this later today.

Preliminary Results - for the year ended 31 Mar 2020. Note that this will have pre-dated the worst impact of covid, which is likely to fall into FT 03/2021.

Revenues up 9% to £47.8m

Operating profit is highlighted, but I prefer to measure Profit before tax, because that includes the increased finance charges which are sometimes associated with property leases. PBT is up 24% to £3.55m, a good result, and a reasonably good profit margin of 7.4%

EPS - there's a large difference between basic EPS of 4.99p, and Diluted EPS of 4.34p. Note 5 gives the detail on this, and the total share options of 9.5m seems excessive, at 15% enlargement of the existing share capital. That would need looking into.

If we use diluted EPS of 4.34p to take into account potential dilution, then the PER is 12.8 - which seems a reasonable valuation.

Acquired Peterborough freehold site for £4m. Good, I like freehold properties on balance sheets. £3.0m long term loan funded this.

Balance sheet - fixed assets have gone up £3.6m to £5.96m, which I assume is related to the freehold acquired?

Working capital looks healthy, with a current ratio of 2.49 - very good indeed, and includes £2.96m of net cash. I'm happy to ignore the £2.8m long term debt, because this is related to the freehold purchase (it was nil last year).

Overall this is a very clean, and decently strong balance sheet. I don't see any insolvency risk here at all.

Favourable (low) tax rate - note that this boosts EPS somewhat.

Final dividend of 0.5p (up 25% vs LY) - yield quite low though, and note that divis only started again after a long absence in 2017. With the 0.15p interim divi, that's 0.65p for the full year (the narrative in the RNS today says 0.55p, but I think that might be a typo?), a yield of only 1.2%.

To put that in perspective, the quoted market bid/offer spread is 3.0p, so you would need to hold for at least 4 years probably, to recoup the spread through the divis! In practice, you could probably buy inside the spread, but I'm just pointing out that the divis are not a material factor in buying this share, more just nice to have.

Covid - £400k delayed sales for FY 03/2020, and small increased costs.

Post year-end: covid boosted sales from shift to supplying hygiene products, and higher costs to create safe working environment, and;

Trading to the 31 July 2020 is ahead of last year, which has enabled the Group to absorb the increased costs and risks associated with the pandemic.

My opinion - this looks a really nice share. Reasonably priced, with a decent balance sheet, and a good track record. So it gets a thumbs up from me.

Long term holders have done amazingly well - it was only 2p back in 2013;

.

.

Post Script - the Creightons results webinar organised by our friends at PIWorld was really good. Tamzin hosts these things so well. I found it very informative indeed, and the 3 Directors (Chairman, CFO, Marketing) came across as open, and knowledgeable. Questions were excellent, and answered honestly, it seemed to me. So I feel these are people I could trust, and would be happy to invest in.

I also like the longer term aspirations for the business, to arrive at £100m revenues (doubling from now), and raising the margin from 7% to 10%. That looks do-able, from a mixture of acquisitions, and creating new products internally.

Creightons shares probably won't shoot the lights out, but as a tuck away & forget thing with a 5-year view, I could see investors doing quite well, if management continue to execute well.

Results webinars are absolutely brilliant, I am finding them so useful, and such an efficient use of time. Let's hope all companies engage with investors in this way.

.

Arcontech (LON:ARC)

Share price: 180p (down 7%, at 12:09)

No. shares: 13.2m

Market cap: £23.8m

Arcontech (AIM: ARC), the provider of products and services for real-time financial market data processing and trading, is pleased to announce its final audited results for the year ended 30 June 2020.

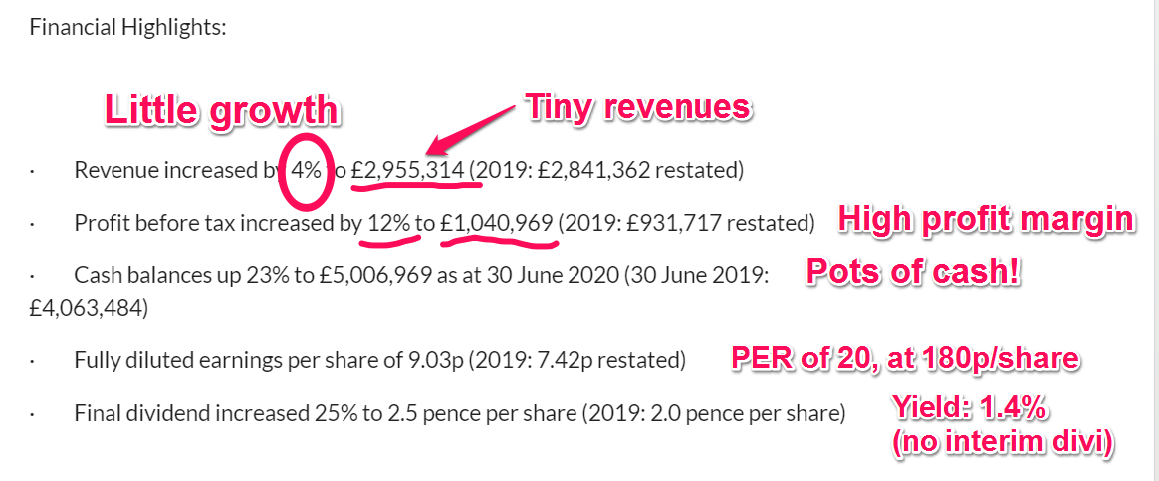

I've never really looked at this company properly, but checking the archive I had a quick look here on 15 July 2020, on the prompting of a subscriber here. At the time I thought it looked potentially interesting, with an unusually high profit margin on tiny revenues, and announcing in line with expectations trading, along with £5.0m cash pile, and the intention of pay a dividend.

Today we have;

Arcontech (AIM: ARC), the provider of products and services for real-time financial market data processing and trading, is pleased to announce its final audited results for the year ended 30 June 2020.

I've done one of these;

.

Revenue is highly concentrated, with the 4 largest customers being 63% of total revenues. Therefore profits could be clobbered if client(s) were lost.

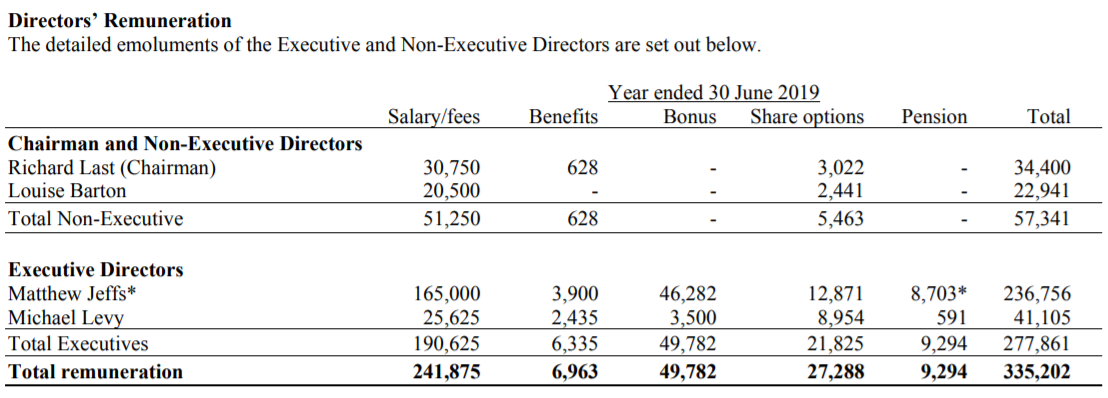

Directors remuneration is basically just the CEO, with scraps for everyone else, including the CFO Michael Levy who must be part-time, I imagine.

.

ARC only has 16 staff in total, including Directors.

It's not at all clear to me why this is a listed company?

Outlook comments - recurring revenues provide stability. Mentions negative macro factors. Long & complex sales cycles. So doesn't sound like there's much prospect of a step change upwards in sales & profits.

My opinion - too small to be listed. Probably over-valued at the moment, given that it's a tiny company relying on 4 main clients.

Mind you, it's decently profitable, and could shoot up if they were to land some big clients in future, who knows.

Overall, it's not for me.

I'll call it a day there, see you again in the morning!

Best wishes, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.