Good morning from Paul & Graham!

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps (usually) between £10m and £1bn. We usually avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

Summaries

Naked Wines (LON:WINE) - down 8% to 64p (£48m) - FY 3/2023 Results - Paul - RED

I reviewed this wine subscription service negatively earlier this year, and the FY 3/2023 results don't change anything for me. Its well-known problems include being massively over-stocked, resulting in most of the customers' cash deposits being sucked into inventories. Material uncertainty in going concern statement is a red flag. Current trading is weak, as it cuts back on marketing spend. Could be a turnaround, but too risky for me at this stage.

Big Technologies (LON:BIG) - down 6% to 216p (£628m) - Interim Results - Paul - AMBER

A Sept 2021 float, so beware of this vintage - many were over-priced and opportunistic, which has killed the IPO market for now. Useful tracking devices worn by eg the elderly, detecting if they've had a fall or gone AWOL. It's a nice, profitable, cash generative business, with recurring revenues. Owner/managed still. I find the valuation a bit toppy, and management greed over share options repels me. Lovely cash pile looks surplus to requirements, so could do deals with it.

accesso Technology (LON:ACSO) - down 11% to 658p (£277m) - Interim Results - Paul - AMBER/RED

H1 results reflect the usual seasonal split towards H2. Growth has slowed, and it's spent the cash pile on acquisitions, which I'm not keen on. Overall this share never quite convinces me that it's any good, and the story is feeling rather stale now.

Finsbury Food (LON:FIF) - up 22% to 109p - Recommended takeover at 110p - Paul - AMBER

Management has agreed with 10% shareholder DBAY for a cash takeover offer of 110p. It doesn't look generous enough to me, so we'll see what happens - maybe DBAY will have to increase the bid, or someone else might gatecrash the party?

Trustpilot (LON:TRST) - up 16% yesterday to 96.45p (£404m) - Interims (ahead) - Graham - GREEN

An excellent interim report from this review site. Putting adjusted EBITDA mischief to one side, the company is not far off breakeven and has generated a meaningful amount of cash in the last six months. I remain positive on it, as the bull thesis is currently playing out.

Judges Scientific (LON:JDG) - up 4% to £92.49 (£612m) - Interim Results (in line) - Graham - AMBER

A solid set of numbers with strong organic growth and a very strong top line, thanks to the large 2022 acquisition. I remain neutral for valuation reasons, as continued success is priced in. The company deserves its rating but I still wouldn’t rush to buy at this level.

Warpaint London (LON:W7L) - down 2% to 298p (£230m) - Interim Results [in line] - Paul - GREEN

Strong interim results as expected, and management confirm they are comfortable with (previously raised) FY 12/2023 forecasts. I think there's possible upside on forecasts, so see a profit beat as being more likely than a profit warnings. There seems loads of growth runway, with international markets only scratched the surface so far. Strong balance sheet, good & growing divis, hands-on owner-managers, could this be the perfect GARP share?! Thumbs up from me again, as usual.

Paul's Section:

Naked Wines (LON:WINE)

Down 8% to 64p (£48m) - FY 3/2023 Results - Paul - RED

Naked Wines is the well-known, innovative wine subscription service than was meant to be all about connecting wine enthusiasts with small growers. I don't think the business model has ever really worked, and I’ve always rejected the company’s attempt to split the figures to pretend that its core customers are hugely profitable, and that growth spending (massive marketing costs) was somehow separate. That was (and is) nonsense, because of customer attrition - it has to spend heavily on marketing, to keep refilling the hopper, because it loses customers otherwise. I feel vindicated in this view, because it has more recently been forced to cut marketing spending, and surprise surprise, sales are now falling heavily.

It’s also spent almost all the customers’s cash on buying wines, whereas competitor Virgin Wines UK (LON:VINO) keeps customer cash segregated, which I think is much more prudent, and ethical.

Could WINE customers end up as unsecured creditors and lose their cash, if it goes bust? That looks one potential outcome to me.

I viewed WINE negatively RED on both 27 April, and 4 July 2023, and haven’t seen anything in these delayed results to change my mind.

Key points from my skimming of the results statement -

53 weeks to 3 April 2023 but for convenience I’ll refer to that as FY 3/2023.

Large adjustments to achieve a profit, it’s loss-making on a statutory basis £(15)m statutory PBT loss is the more accurate number for me, not the £17.4m adj EBIT.

The most concerning adjustment is an inventories write-down, either £10.3m, or £14.0m (two different numbers are mentioned) - ie being forced to reduce the carrying value of some wines to below cost. This could be the thin end of the wedge, and indicates to me the risk of a much bigger problem. It’s still massively overstocked. And of course even after inventories are written down, they’ll still only probably be sold at a negligible profit margin, so there’s a double hit to profits. I don’t like the way the company tries to gloss over this as “right-sizing”. It’s not, it’s bad buying of poor product, in my book.

Net cash crashed from £39.8m to £10.3m in the year. It should have £71m in customers cash ring-fenced, but it isn’t ring-fenced, a lot of it has already gone.

Current trading is poor - “slower than expected” revenues in Q1, down 18%.

Detailed guidance is provided, which I like, saying forecast EBIT of £8-12m for FY 3/2024. IF that is achieved, it sounds like the company might have bought some time to turn bloated inventories into cash - that’s the number one problem.

Inventories still forecast to be huge at £145-155m at 3/2024 year-end. There’s clearly been excessive, and bad buying here, that’s what worries me the most, and I think the bad news might be being drip-fed out, but only time will tell on that front.

£18.2m charge for other asset impairments.

Going concern statement is a red flag - “material uncertainty” - so this has to be treated as very high risk.

Balance sheet net tangible asset value of £84m sounds healthy, but how much of that is real, if it turns out that the £166m inventories is full of poor wines that can’t be sold?

Paul’s opinion - I’m pointing out fairly obvious negatives about this share that we’ve been aware of for a while now, so there’s nothing new in the figures.

The market cap is only £48m now, so I’m wondering if there’s a chance a turnaround here might create a multibagger? It strikes me that the former founder, who returned to try to save the company, is doing sensible things to turn it around, and there’s a chance he might succeed. So I wouldn’t completely write this off. My hunch is that more inventory write-offs could be needed, and the clock is probably ticking on the necessity to turn their wine lake into cash, and prevent any more ruinous buying commitments (note the comments that it needs co-operation from major suppliers).

The additional problem is that I don’t think there was ever any evidence of this being a good business in the first place. It’s never really made any money from the Naked Wines business (the original, disposed business was cash & carry Majestic Wines, which was sold off).

I’m happy to keep an open mind, and look out for early signs of a turnaround, but I don’t see anything credible on that front yet.

Good luck to them though - it’s easy for us to criticise, and sit in judgement, but much harder to deal with battling to sort out a problem business. I just don’t want to risk my own money on the outcome here.

Big Technologies (LON:BIG)

Down 6% to 216p (£628m) - Interim Results - Paul - AMBER

This is a new share for us here at the SCVR. It floated in Sept 2021, selling remote monitoring software/hardware, specialising in healthcare and criminal justice. “Buddi” seems to be its main brand. It was founded in 2005 by Sara Murray, CEO and largest shareholder at 25% today. Uses include monitoring where elderly people are, if they’ve had a fall, etc. My immediate thought with that, is whether it’s old technology now that could be replaced with smartphone apps perhaps?

EDIT: There's a more useful description of the business in the reader comments here, from FeatheredCapital, who says that BIG's business is now almost entirely focused on tagging for criminals, and it's winning business internationally too. Thanks for taking the trouble to post this, very useful.

Interim numbers look quite good - this is a highly profitable, and cash generative business.

Key figures -

H1 adj EPS 4.3p, expecting an even split for FY 12/2023, so c.8.6p? That would put it on a punchy PER of 25x.

Outlook - good H2 visibility from recurring revenue streams. “Lower end” of market forecasts doesn’t sound good enough to me, to justify the valuation -

Assuming no further strengthening in sterling over the second half of the year and no new contract wins, the Board expects the Group to deliver full-year revenue of approximately £54m with an adjusted EBITDA margin of around 60%, which is at the lower end of current market expectations(1).

(1) Latest company compiled view of market expectations show adjusted EBITDA of £32.7m to £34.7m (stated before share-based payments).

Litigation claim is mentioned, re 2018 acquisition.

Share options charge is an outrageous £5.5m in H1 alone! Maybe if management could keep their hands out of the till, the valuation might look a bit more attractive?

Statutory PBT of £9.0m in H1.

Very strong balance sheet - c.£100m NTAV, including a growing £76m cash pile, with minimal liabilities. So it clearly has plenty of options for acquisitions, etc.

Good cash generation.

Paul’s view - just an initial quick look, and I like the figures - this is a decently profitable, high margin business, with pots of surplus cash. Is it worth £628m though? Probably not, is my initial reaction, but that’s just based on a desktop review of the figures, not any deep dive into the products, competition, etc.

Zeus reckons there’s scope to beat its forecasts with new contract wins, which would bring down the PER from a rather-too-high 25x to something more reasonable perhaps.

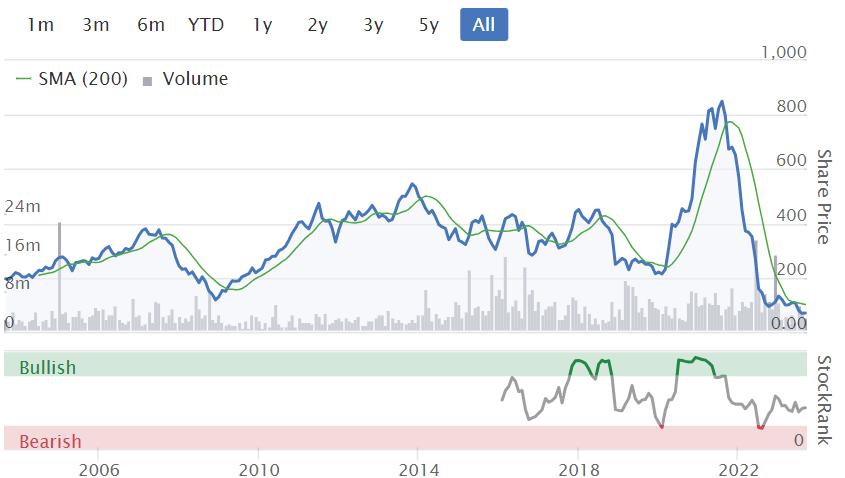

Downward trend since listing in Sept 2021 - and still not cheap -

accesso Technology (LON:ACSO)

Down 11% to 658p (£277m) - Interim Results - Paul - AMBER/RED

A quick review of these interims leaves me underwhelmed. Growth has slowed, and overheads have increased (which it annoyingly tries to present as somehow positive!). Outlook comments say it’s trading in line with FY 12/2023 expectations, and remember that there’s been an H2 seasonal weighting in the past, so the small H1 statutory loss doesn’t alarm me. Figures have always been difficult to interpret, too many adjustments and little sign of genuine profits historically I think.

The worst thing is that the previously super balance sheet has been damaged badly through 3 acquisitions, taking net cash down from $65m to only $9m. Fine if they’ve spent wisely, but only time will tell, and doing more acquisitions does make me worry that there may not be much faith in the core business perhaps? NTAV is now down to only c.$20m.

Paul’s opinion - I can’t see anything much of interest here, and the story is now very stale I think. So I’ll shift down a gear from AMBER, to AMBER/RED, to reflect the weakened balance sheet from yet more acquisitions.

Massive multibagger originally, but a lot of it turned out to be hot air -

Finsbury Food (LON:FIF)

Up 22% to 109p - Recommended takeover at 110p - Paul - AMBER

We quite like FIF here at the SCVR, usually being mildly positive about it, but it’s a boring share that never seems to go anywhere. Not a bad business though, making cakes for supermarkets and cafes, but lowish margin. It seems well managed.

Management has reached agreement with existing 10% shareholder DBAY Advisers for it to take over the whole company at 110p cash. Not a blowout offer, the norm is for 30%+, this is only about a 24% premium on last night’s closing price.

Although the announcement does point out that it’s a 55% premium to the last date before DBAY’s interest was announced, on 2 Sept 2022.

Still, a forward PER of only 8.3x last night, was hardly including much of a bid premium in the valuation, but FIF has always been cheap.

DBAY says it wants to accelerate growth through acquisitions, as a private company.

The deal only has lukewarm 14.3% support so far.

Paul’s view - I think DBAY has pitched this too low, and might need to sweeten the deal to 120p+ to get it voted through, but time will tell. You have to remember that institutions often like a takeover, as it’s a liquidity event that enables them to sell, whereas in an illiquid share they might otherwise be stuck with it, unable to sell. Whereas we private investors can enter & exit much more readily, a key advantage we have over fund managers.

There’s the possibility of a higher competing offer, now FIF is in play. Or if you want to play it safe, there’s the option of selling some in the market now for 109p. Your money, your choice, as we always say!

Warpaint London (LON:W7L)

Down 2% to 298p (£230m) - Interim Results - Paul - GREEN

This owner-managed makeup company is one of my favourite GARP shares, which we’ve been raving about here for a while now. There have been several big upgrades to forecasts this year, and I think it looks set to possibly beat even these increased FY 12/2023 forecasts, as it comes into the seasonally busy autumn/winter season.

Thank you to management for squeezing me into their morning Teams/Zooms, which gave me a chance to ask a few questions, which I’ve included in my notes below.

H1 revenues £36.7m (up 46%) - seasonally slower half

International is now 64% of total revenues, and growing faster at +58%

Expecting H2 weighting as usual - which I reckon could mean the 14.4p EPS forecast from Shore could be beaten (as 6.5p already achieved in H1). A profit beat seems more likely than a profit warning, is my view of these numbers.

Gross margin of 39% is nothing special, but I asked management about this, who replied that they spend very little on marketing compared with other brands with higher margins, so it balances out fine. It's value for money product, not fancy high end stuff that needs big marketing budgets.

Net cash of £7.1m, and a lovely strong balance sheet as always - as we typically see at owner-managed businesses, who don’t tend to take the risks that hired hands often do with empire-building sprees fuelled by debt.

Current sales growth is similar to H1, with the 8 months sales up 45%

Supply chain and inflation - all sounds under control, some additional costs coming through, but they’ve put through selling price rises I think.

Strategy is to keep targeting big retailers. Trials with Superdrug and Boots in the UK mentioned as having good growth potential. All started with the Tesco deal initially 50 stores, which grew to 1,400.

Previously seen as discount products, W7L and Technic have now become brands in their own right, and are sought out by customers, so can be more picky about which retailers they’re sold in.

Affordable brand, so appeals in a cost of living squeeze.

I commented that despite the impressive growth, the numbers are still quite small, considering growth is now international. Surely there’s a massive potential runway for growth? Yes, management agrees, huge growth upside long-term.

What could go wrong? Unexpected events happen, as we’ve seen with covid, Ukraine war, supply chain disruption, etc. Business model has proven very resilient - in particular conservative balance sheet means going concern is never a problem, even if sales go to zero for a while. Also they keep plenty in stock, so can deliver for months, even if shipping disrupted.

Online - good growth but quite small. Could grow faster, but margins are better through retailers I think was the gist of what they were saying.

China - started selling direct online there, and starting to gain traction, quite unusual for a UK brand.

Paul’s opinion - the share price looks up with events at 300p, but I reckon we could see another beat against forecast later in 2023, and the long-term investment case here is so strong, I think the price is fully justified.

Hence I’m going to stick with GREEN.

Why on earth didn’t I buy any myself, as it’s been one of my favourite GARP shares for a long time now, and the results & forecasts keep getting better and better!? Oh well, never mind. I’ll pick up some shares at some point, for sure.

Management always really impress me, as what I specifically look for - hands-on, down to earth owner-managers. No fancy talk, just delivering on their strategy. Look at how little the share options are too - this puts many other companies to shame. And they pay generous divis too, so the growth is all self-funded, whilst spewing out nice divis along the way. I genuinely can’t see any problems with this, W7L seems an almost perfect GARP share.

I suspect that with patience, this share could be moving to new all-time highs in future.

Graham’s Section:

Trustpilot (LON:TRST)

Share price: 96.45p (+16% yesterday)

Market cap: £404m ($499m)

This well-known review site has been catching my attention recently - see our review of the H1 trading update in July.

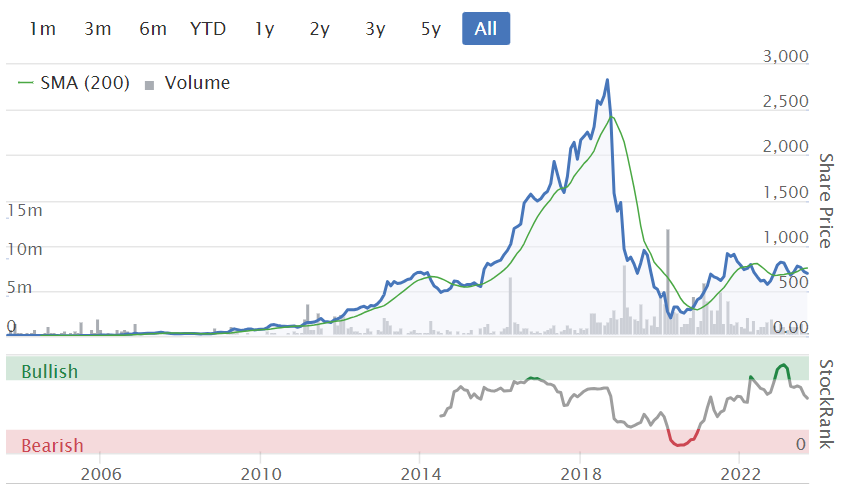

The share price is up 50% from its low in July, but it remains far below the valuation at which it floated in 2021:

Yesterday we had H1 results for June, with raised expectations for the full year. The headline numbers were already known:

Revenue +18% at constant currency to $85m

Annual recurring revenue +21% to $180m

Adjusted EBITDA comes in at $5.7m, vs. $3m expected.

However, the company also provides an adjustment to its adjusted EBITDA!

They say that due to improved profitability, accounting rules now allow them to capitalise the sales commissions paid to their employees, and they have done this in H1 2023.

They say that if you don’t exclude these commissions, then EBITDA was really only $3.4m.

So on an apples for apples comparison, I don’t think they have beat the expected EBITDA number by all that much.

The cash flow/profit numbers are simpler to understand and do impress me:

Free cash inflow of $6m (vs. $13m outflow in H1 last year)

The statutory net loss reduces to just $2.5m (vs. $9m in H1 last year)

The company’s net cash has increased from $73.5m to $82.7m over six months.

Business highlights - there are now 106,000 active domains (up 13%) and the number of monthly users rose to 52 million (H1 last year: 42 million).

The company’s new CEO has just finished his first week in charge, as the Founder wished to take a backseat and become a NED (the Founder is however currently missing from Trustpilot’s Board of Directors page).

Outlook: Trustpilot gave a revenue warning at the start of this year, but they have been very pleasantly surprised by progress since then, especially in Q2. “This positive trend has continued into Q3”:

Consequently, we maintain our outlook for mid-teens constant currency revenue growth for the full year but, with further operating leverage in H2, we anticipate that adjusted EBITDA (before the impact of capitalising sales commissions) will exceed the current range of market expectations.

I have found one analyst note published yesterday morning, and it suggests adj. EBITDA of $6.2m in the current financial year (back in July, the expected range was $2.4m - $4m).

Plans for future dividends and buybacks?

The company doesn’t specifically mention dividends or buybacks. However, now that it is profitable, and given that it has a very healthy cash balance, it is able to start thinking about what it might do with excess capital:

Trustpilot has a strong balance sheet and the business is now cash flow positive. As we consider our capital allocation policy, our priorities include continuing to invest in people, innovation and go-to-market to drive organic top-line growth and retention. We also aim to maintain the flexibility to engage in targeted M&A, assessed against rigorous returns criteria, to accelerate our product strategy or to strengthen our presence in specific regions. We are committed to returning excess capital, not required for other priorities, to shareholders.

Graham’s view

I did believe that Trustpilot was undervalued, but at the same time I’m surprised that the market saw fit to increase the share price by 16% yesterday. The adjusted EBITDA beat does not seem very impressive to me, considering the change in accounting treatment.

On the other hand there is no doubt that the company is experiencing nice momentum in earnings estimates. And its cash flow and profit metrics are much improved on last year.

Here is the very helpful earnings estimate chart from the StockReport:

When it comes to valuation, enterprise value is now around $420m, give or take. With $180m of ARR, that’s an EV/ARR multiple of only 2.3x.

A quick search suggests that US software companies are currently trading at an average EV/ARR multiple of around 6x-7x.

I view Trustpilot as being of higher quality than the average software company, due to its brand name recognition and the lack of meaningful competition it faces. So for me, it doesn’t make sense that it should trade at a cheap ARR multiple.

The fact that it’s now cash-rich and approaching breakeven reduces the risk. In summary, the bull thesis is playing out and I remain positive on Trustpilot!

Judges Scientific (LON:JDG)

Share price: £92.49 (+4%)

Market cap: £612m

Judges Scientific, the group focused on acquiring and developing companies in the scientific instrument sector, announces its unaudited interim results for the six months ended 30 June 2023.

We reviewed the corresponding H1 trading update from Judges in July.

Key points:

Organic revenue up 16.5%

Revenue up 32% to £61.3m

Adjusted PBT +33% to £12.8m

Cash generated from operations +40% to £11.5m

Statutory PBT £0.8m (H1 last year: £3.9m)

The reopening of China after lockdown policies ended appear to have played a big role in the positive result.

M&A: after the £80m acquisition of Geotek last year, its largest ever, Judges chose to take things easy on the acquisition front. It spent less than £4m on acquisitions in H1 2023. I do like to see companies spend a little time digesting large acquisitions, before they move on to new ones!

Outlook summary:

Business environment still in recovery mode.

Strong second half anticipated for the Group due to the timing of the next Geotek coring expedition.

Strong H1 Organic order intake and solid Organic order book (21.4 weeks at the end of August) augur positively for H2.

The Board expects that the Group will meet market expectations for the full year.

The Chairman also write a longer outlook statement later in the report, highlighting the need to “sharpen our acquisition discipline” in the face of higher interest rates and higher inflation.

Estimates: Multiple brokers are now covering this stock: Shore Capital, WH Ireland and Liberum. I’ve chosen Shore Capital at random and can confirm that their adjusted PBT estimate for the current year is £31.6m, with adjusted EPS of 368.1p.

Note that this implies nearly £19m of adjusted PBT in H2, much higher than the result in H1 (£12.8m). This goes back to the lumpiness of Geotek’s business, which had been flagged in advance of the acquisition.

Excerpt from the Chairman’s comment:

"During the period all the measures of Organic performance were again beaten, with results bolstered by the contribution from Geotek. While we have not yet returned to a pre-pandemic trading environment and we continue to operate in a challenging world, we have seen improving prospects across our markets.

Graham’s view

I have taken a neutral stance on this one for valuation reasons:

While I remain a long-term fan of Judges, it would be remiss of me not to mention that the company has posted a statutory loss in H1, if you don’t allow for the various adjustments it has made to its numbers.

Adjusting items in H1 2023 add up to £12.4m, up from £5.2m in H1 2022 and higher than the entire adjusting items for all of 2022.

They include:

£6.1m of amortisation.

£5.5m relating to the issue of shares for the purchase of Geotek (the Judges share price rose after the deal was agreed; therefore the value of the shares being issued rose, and this must be reflected somewhere in the accounts).

I can happily treat the second item as being exceptional in nature, but the first item is more debatable.

For what it’s worth, the cash flow statement shows after-tax cash generation of about £7m (there are many ways to do this, but I use operating cash flow minus investing cash flow minus lease payments, ignoring cash spent on acquisitions).

That £7m figure is not far from what you would get if you took the adjusted PBT figure (£12.8m) and added back in the cost of amortisation (£6.1m).

So for me, the “real” earnings in H1 was about £7m.

H2 should hopefully be much stronger again, but I feel I’m left with little choice but to maintain my neutral stance on this one for the time being. At a market cap of over £600m, its wonderful track record and acquisition process seem priced in.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.