Good morning, it's Paul & Roland here with the SCVR for Weds. Many thanks to Roland for stepping in to help, so that Jack can have a few days off.

Timing - TBC. Very busy again for company reports, so we'll get through as many as we can by mid-afternoon.

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to cover trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty.

We stick to companies that have issued news on the day, with market caps up to about £700m. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research) - don't blame us if you buy something that doesn't work out. Reader comments are welcomed - please be civil, rational, and include the company name/ticker.

Agenda -

Paul's Section:

Virgin Wines Uk (LON:VINO) - trading update for FY 06/2021, with revenues & EBITDA "marginally higher" than previously expected, following a strong finish to the year. Demand is still good. I'm warming to this share, but still want to wait and see how demand and growth settle down post-pandemic.

Pci- Pal (LON:PCIP) (I hold) - another positive trading update, with guidance given in early June now exceeded, for FY 06/2021. Still loss-making, but very strong organic growth augurs well for the future. Plenty of cash following recent placing.

Creightons (LON:CRL) - Results for FY 03/2021 look very good - boosted somewhat by one-off sanitiser sales in lockdown 1, although there were also negative hits from covid. Weighing up those offsetting points is a key point for investors to consider. Very nice balance sheet. Looks a decent company, at a reasonable price, I like it!

Roland's Section:

Loungers (LON:LGRS) - full-year results for the year to 18 April. These numbers were always likely to be poor, but the company appears well positioned to move forwards from the pandemic.

Tristel (LON:TSTL) - a modest upgrade to profit guidance appears to have been overshadowed by disappointing news on US expansion hopes.

Virgin Wines Uk (LON:VINO)

205p (up 4% at yesterday’s close) - mkt cap £115m

This direct to consumer wine eCommerce business floated in March 2021. I’ve been keeping an eye on it, as it looks potentially interesting as an investment. As with most new floats, I tend to keep my distance at first, as mishaps often occur in the early days, since so many new issues are priced to perfection, and sometimes have some underlying problems that may be hidden from view. Or they’ve enjoyed a purple patch, facilitating a nice exit price that subsequently unravels. My suspicion is that, as with another recent float, Parsley Box (LON:MEAL) there’s likely to have been a big boost to trading from the pandemic lockdowns - which are certainly not over - plenty of people are still semi-isolating, which I’m doing at the moment actually, to avoid putting vulnerable loved ones at unnecessary risk whilst case numbers soar.

Trading update on 6 May 2021 - I reviewed it here, and it struck me as a little confusing in parts, although generally positive, and couldn’t make up my mind about the share, but leaning more towards positive, but still a bit sceptical.

Virgin Wines UK plc (AIM: VINO), one of the UK's largest direct-to-consumer online wine retailers, today provides an update on trading for the year ended 30 June 2021 ("FY21").

FY 06/2021 “finished positively”

Strong customer demand in May & June 2021

Revenue & EBITDA “marginally higher” than previous expectations

*The Board considers current market expectations for the year ended 30 June 2021 to be revenue of £73 million and EBITDA of £6.3 million.

New guidance -

Revenues £73.8m up 30% on last year, and +74% year before that

EBITDA £6.4m, +45% LY, and +183% year before that - I’m impressed.

Net cash - of £8.4m at 30 June 2021, and assessing opportunities to invest cash, including “organic investment initiatives” - a bit vague, they could have explained that better.

Diary date - FY 06/2021 results due out w/e 22 Oct 2021.

Current trading - “positive sales momentum” continued into July.

Also mentions: customer loyalty, subscription schemes robust, and new customers being acquired at competitive cost.

My opinion - I’m definitely warming to this share, and the recent c.20% fall in share price has gone some way to correct for my previous concern that the price was looking toppy back in May.

Overall pandemic conditions are still far from back to normal, so I think it’s too soon to be sure whether buoyant demand is likely to continue for the foreseeable future, or might still be receiving a boost from pandemic conditions?

The best way to assess any company, is to become a customer. I’ve had several orders from Virgin Wine, and the wine has generally been pretty good.

It’s subscription service is clever - I don’t actually recall signing up for it, but noticed £25 per month being deducted from my PayPal account. Then I got an email from Virgin Wines, saying you have £50 to spend on wine, and we’ll add £25 bonus to it, so that’s £75. Of course it worked a treat, and I ended up buying about 15 bottles for a couple of hundred quid. Twice. So clever marketing, and I think the Virgin name & branding definitely help too.

Management came across very well on a webinar a few weeks ago.

On balance therefore, I think this share looks quite interesting, but I’ll sit on the sidelines for the time being, to see if it continues to prosper once conditions become (hopefully) more normal, whenever that might be.

.

Pci- Pal (LON:PCIP)

(I hold)

86p (last night’s close) - mkt cap £56m

PCI-PAL PLC (AIM: PCIP), the global cloud provider of secure payment solutions for business communications, is pleased to announce a trading update for the year ended 30 June 2021.

The main attraction of this share is the very rapid organic growth, building sticky recurring revenues. The main downside is it’s still loss-making, and pushed back breakeven by deciding to accelerate international growth recently (which has up-front costs).

Growth is certainly impressive -

After a strong year of trading, PCI Pal expects to announce revenues of approximately £7.3 million1, a substantial increase of 66% on the prior year (2020: £4.4 million), and an adjusted pre tax loss marginally better than current expectations2.

1 The £7.3 million expected revenue is subject to audit confirmation.

2 Current market expectations for FY21 revenues is £7.0 million and an adjusted pre-tax loss of £3.6 million.

That’s a £0.3m revenue beat. Note that, as I reported here on 8 June, guidance had already been raised 3 weeks before the year end, so another increase today is a positive surprise.

An alternative KPI used by the company to demonstrate the run rate of future revenues is Total Annual Contract Revenue (TACV), running at £9.5m (up 41% in the year). This is a useful measure at rapid growth recurring revenue companies.

195 new customer contracts in FY 06/2021, almost double the prior year. It must be quite a job to handle all those implementations, but as pointed out, the software (which helps process secure payments) is cloud-based, and sold by resellers, hence the business looks nicely scaleable & can cope with rapid growth.

Customer retention - high, said to be over 100% - which muddles two factors in my view, it would be better to split out customer attrition, and customer upsells, not offset them. But nobody can quibble at a negative net attrition rate!

Net cash looks healthy at £7.5m, mainly sourced from a £5.5m placing in April 2021.

Visibility is high, since TACV of £9.5m covers most of the forecast £10.4m revenues for FY 06/2022. I think this is signalling that a beat against forecast is likely for the new financial year just started.

My opinion - I see the recent pullback as being healthy, as like many shares, the price probably got a bit ahead of itself.

Today’s update tells us that the very rapid growth is ongoing - this company clearly has a niche product that is in strong demand, with very large potential markets. It can do rapid roll-outs, to lots of clients, because it’s cloud-based & sold via resellers. Then a long stream of recurring revenues should roll in for many years. That’s such a good business model.

This latest update has renewed my enthusiasm for this share, it looks a clear long-term winner to me, for people prepared to tuck it away for a few years.

I’ve got mixed feelings on the strategy to continue incurring losses through increased overheads, to expand into new markets. Surely the main, USA market was big enough? I probably would have preferred a tighter geographic focus, and a swifter move into profitability.

That said, today’s news should mean there’s little downside risk from 86p, in my opinion (other than unpredictable short term volatility), given the very strong upward trajectory of recurring revenues.

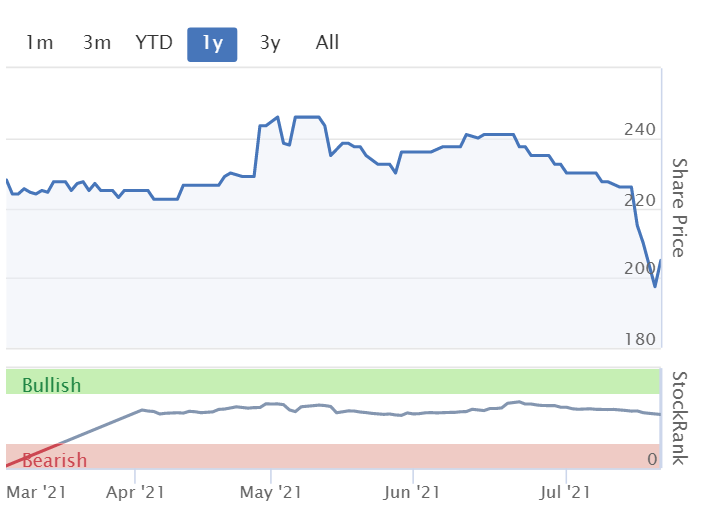

Stockopedia drenches me in cold water, with a dismal StockRank of 22 - it doesn’t like companies that make repeated losses, a very good sense check!

Note that PCIP qualifies for a shorting screen, based on its poor Z-score. However, this has been superseded by the recent placing, so is no longer relevant.

.

.

Creightons (LON:CRL)

79p (up 10%, at 10:10) - mkt cap £51m

Creightons Plc (the "Group" or "Creightons") is pleased to announce its preliminary results for the year ended 31 March 2021.

The company forgot to include a description of its business at the top of the results statement. Looking at Creightons website, it seems to produce & sell hair, skin, beauty & hygiene products, under lots of different brand names.

The 10% rise today needs to be seen in a context of recent days “flash crash” that we saw in many shares, not just small caps either, some mid caps too. It’s bounced back to where it was last week essentially.

So many share price charts look similar, don’t they? We could have bought practically anything in Oct 2020, and made a similar gain.

.

The highlights look really good -

.

Brexit - no significant impact, which is what practically all companies I cover are saying.

Covid impact - a mixed bag - the last point strikes me as a very heavy expense of £1.6m, given the relatively small size of the company, I’d be interested to know what is within that figure -

.

Cost increases are mentioned, similar to what many companies are saying - raw materials scarce & rising in price, freight from Far East expensive. Sales prices were raised accordingly, but not enough to fully offset cost increases.

Demand for hygiene products “reduced rapidly” when lockdown 1 ended, so this looks like a bit of a one-off boost.

Dividends are being paid, total only 0.65p for the year, a yield of only 0.8%

Balance sheet - is excellent. NAV of £20.1m, less £1.1m intangible assets, gives NTAV of £19.0m, which is really strong for the relatively small size of the business. Working capital looks particularly healthy. Hence no solvency, or dilution risk here, in my view. Also I think it has scope to make further acquisitions from existing resources.

Cashflow statement - it’s a genuinely cash generative business (£6.2m operating cashflow this year, £6.6m last year).

Capex was only £869k this year (£4.6m last year).

In both years, much of the cash generation fell through to increased cash balances, so it all looks pretty healthy to me, and the numbers look straightforward, no funnies in there that I can see.

Investor presentation - it’s great to see so many companies producing results webinars for the wider investing community, a spin-off benefit from the pandemic. Companies I talk to say that it’s so much easier to do back-to-back Zooms with investors, and a public one too, at results time, so I think this will persist beyond covid.

The Company will host an online presentation for analysts and investors at 2.30pm on 28 July. To register for the presentation please follow the link: https://bit.ly/CRL_FY21_results_webinar28721

My opinion - I can’t find any broker notes unfortunately. Since the company has a big private investor following, it would be helpful if they could make sure some broker research gets out there, either through a commissioned research company, or by switching to a house broker that publishes its research on Research Tree. To borrow a phrase from Jeremy Corbyn, broker research should be for the many, not the few!

Overall, these results are very good I think, and the company also gets ticks in the boxes of its shares still being reasonably valued, and having very sound finances, and producing a pretty solid operating profit margin.

I like this, it’s a decent company at a reasonable price.

The main issue to research, is to estimate how much future profits will be affected by the fall away in one-off sanitiser revenues, but offsetting that should be reduced costs, and improved trading in the areas where demand reduced. It might be safest to assume profits might slip back a bit from the level reported today?

.

Roland’s section

Loungers (LON:LGRS)

274p (pre-open)

Market cap £282m

“Material market out-performance post re-opening”

Loungers runs two branded chains of cafe/bar/restaurants across England and Wales -- Lounge and Cosy Club. The group has 175 outlets in total and now intends to resume opening sites at its pre-Covid rate of 25 sites per year. Seven new branches have already opened since May.

The focus of both brands is very much on all-day opening, casual dining, etc. There aren’t any outlets in my area, but I have heard good things about them from friends and family.

Loungers’ financial year ended on 18 April, so this included numerous periods of closure and restrictions. Against this backdrop, I don’t think today’s full-year numbers look too bad. I’ll start with a look at these and then move on to look at the company’s trading since reopening in May.

Financial highlights

Last year’s performance was obviously affected by periods of closure.But furlough, business rates relief and some rent waivers meant that Loungers’ costs were contained during lockdown.

I’m encouraged by the results that the company did achieve during the periods it was open.

- % of weeks able to trade: 34%

- Revenue: -52.9% to £78.4m (FY20: £166m)

- Gross profit margin: 41.8% (FY20: 40.8%)

- Adjusted EBITDA: £13.9m (FY20: £28.8m)

- Adjusted EBITDA margin: 17.8% (FY20: 17.3%)

I’m impressed to see that revenue only fell by 53%, even though the company’s sites were closed for 66% of the year. Similarly, both gross margin and adjusted EBITDA profit margins were stable when compared to the previous year.

My reading of these numbers is that when Loungers’ locations were open, they were operating profitably and with strong capacity utilisation. Given the year we’ve just had, I think that’s the best that can be expected from an operator in this sector.

Exceptional costs: Loungers’ accounts for the past two years show plenty of moving parts and exceptional costs. In FY20, the company reported £15.3m, mainly relating to its IPO and to impairment charges (presumably triggered by the first lockdown).

Exceptionals fell to £1.3m last year, relating to Covid costs.

Although I’m not generally a fan of heavily-adjusted profits, I think these costs all look reasonable and are likely to be genuine one-off costs. So I’m not too concerned.

Balance sheet: More importantly, Loungers seems to be emerging from a difficult year with an undamaged balance sheet.

The group’s net debt is broadly unchanged at £144m (IFRS 16 - including lease liabilities) or £34.3m (IAS 17 - excluding lease liabilities).

That seems like a positive result to me. In both cases, I believe the group’s leverage looks manageable. I’m not concerned about the balance sheet, which was reinforced with an £8m placing last April.

Trading since reopening

Management are very bullish in today’s results on trading since reopening, claiming “significant” outperformance versus the wider sector. The numbers certainly seem encouraging:

- Underlying like-for-like sales +11.6% for 17 May - 18 July versus the same period in 2019. This excludes the impact of the reduction in VAT.

- Non-property net debt has fallen from £34.2m in April to £18.2m on 11 July, thanks to negative working capital. What this means, I think, is that the company saw a cash outflow when it initially restocked its outlets, but is now benefiting from customers paying for their food and drink before Loungers needs to pay its suppliers. This is how supermarkets work, too.

The company says that it’s invested heavily in slimming down its menus, reconfiguring its sites and improving outdoor space. Many of these changes are expected to deliver lasting benefits going forward.

Loungers’ locations are also thought to have helped - the company is mostly small towns and suburbs, not travel/tourism/office hubs.

My view

Today’s results and commentary confirm my view that Loungers is well run and financially sound. I don’t see any reason why this business can’t return to profitable growth from this year onwards.

Plans to open 25 new sites per year seem ambitious to me, but progress so far does seem encouraging. Management appears to have a sound strategy and good operational execution. I’d guess that property market conditions are favourable for new tenants, too. Securing new units at reduced rents could provide a tailwind to profitability over the next few years.

Are Loungers’ shares worth buying? The stock has recovered strongly and is now trading above pre-Covid levels, despite (modest) dilution from last year’s £8.3m placing:

Consensus forecasts for the current year put Loungers on 28 times forecast earnings. That seems a full price to me, given that this sector is competitive and relatively low margin.

However, Loungers does seem to have the potential to become a best-in-sector operator. Such businesses can sometimes continue expanding for a surprisingly long time. Wetherspoons is one such (past) example, in my view.

I’m not sure if I have the conviction to buy, but if I held Loungers’ stock today, I’d certainly be inclined to keep on holding.

.

Tristel (LON:TSTL)

594p (-10% at 08:50)

Market cap £283m

Infection control firm Tristel makes disinfectant wipes and foams that are used to clean medical devices after examinations. These are typically routine procedures such as endoscopies and ultrasounds.

The company also has a smaller but growing operation producing surface disinfectant wipes.

Both product ranges are built around the company’s proprietary cleaning chemicals. These appear to have some moat-like characteristics, including patent protection and regulatory barriers.

This highly-rated growth stock has been a 10-bagger since 2014:

However, Tristel’s share price is down by 10% as I write, following today’s full-year trading update. Something seems to have upset the market. What’s happened?

“Positive signs of recovery”

Despite today’s share price drop, today’s update actually appears to be a modest upgrade to previous guidance.

Updated guidance: For the year to 30 June 2021, Tristel now expects to report revenue of £31m, with adjusted pre-tax profit of £5.5m.

Previous guidance in April was for £31m/>£5m.

Last year’s results (2019/20) were £31.7m/£7.1m.

The background to this is that sales of medical device cleaning products have suffered over the last year due to the widespread cancellation of routine outpatient activities.

The company says that its seen demand for these products improve since April as outpatient departments have gradually returned to normal activities.

Although sales of surface disinfectant wipes have grown strongly over the last year, it’s important to remember that these are still a small proportion of total sales. Tristel’s half-year accounts show that although sales of surface wipes rose by 80%, they still only accounted for 12% of total revenue.

Investment update/US progress: Today’s modest upgrade to profit guidance doesn’t seem to explain the share price slump, unless the market was expecting a more substantial upgrade.

I’m not sure, but I wonder if today’s sell-off is linked to the second piece of news in today’s update, which relates to Tristel’s US expansion hopes.

Back in 2017, Tristel invested in “a medical device company focussed upon women’s health”. The investment is said to have led to a close collaboration that’s yielding some “exciting” product development initiatives.

Like Tristel, this unnamed company’s shareholders wanted to break into the US market. Their strategy was to try and sell the business to a larger medical device company which would have the resources needed to succeed in the US.

We learn today that - so far - this strategy has failed. No buyer has been found. This investment was previously valued at £0.8m on Tristel’s balance sheet, but will now be fully impaired - i.e. written off. Although the investee company is said to be trading as a going concern, it sounds to me like there’s a risk it could fail.

This isn’t a disaster for Tristel, which had net cash of £8m at the end of June and can afford small speculative investments. But it’s disappointing and suggests that hopes of an indirect entrance to the US market have been stymied.

My view

Tristel’s largest client is the NHS, but the group generates more than half its revenue abroad. However, the company has been trying for years to gain approval to sell its products in the US - by far the world’s largest healthcare market.

So far, progress has been slow. The company has promised an update on current US FDA submissions in October, so we may learn more then.

In today’s update, CEO Paul Swinney reflects on a difficult year for the company, commenting that this “ordinarily stable and predictable business has been disrupted by both Brexit and the pandemic”.

However, Mr Sweeney does say that the company is now seeing signs of a return to normal.

I don’t have too many concerns about Tristel’s financial performance. The company has a track record of consistent growth and strong profitability:

What concerns me is the company’s share price. Even after today’s fall, I estimate that Tristel shares are trading on 65 times FY22 forecast earnings. The dividend yield is less than 1%.

Although I expect Tristel to continue generating incremental growth in its main UK and EU markets, I don’t think the outlook justifies this valuation.

In my view, the stock’s high rating is only likely to be justified by a successful entry to the US market. As things stand, I don’t know how likely this is or how soon it might happen.

As a result, Tristel is too expensive for me to consider. However, I do think this is a good quality business that’s likely to continue performing well after the pandemic.

.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.