Good morning from Paul & Graham!

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps up to about £1bn. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk.

Summaries of main sections

Cohort (LON:CHRT) (Paul holds) - 484p (pre market) £200m - Contract Win - Paul - GREEN

A contract win announcement doesn't move forecasts, but does provide an opportunity for me to review the numbers below, reiterating my positive view (that's why I bought some recently). High quality scores, a low valuation (fwd PER 13x), large order book giving high visibility, reasonable & well-covered divis, a strong balance sheet, and experienced management - what more could I ask for?!

Tracsis (LON:TRCS) - down 1.5% to 778p (£229m) - Trading Update (in line) - Graham - AMBER

This diversified group serving the rail and wider transport industries reports that FY July 2023 has finished in line with expectations. Growth in cash was held back by acquisition payments but those are now in the rear-view mirror. Seems to be fairly valued.

Anexo (LON:ANX) - Up 12%y’day to 67p (£79m) - Interim Results - Paul - RED

These numbers look uncannily similar to the disastrous Accident Exchange and Quindell - big profits, but little to no cash generation, due to gigantic receivables swallowing up arguably fictitious profits that don't turn into cash. Although to be fair, H1 2023 cashflow was better than in 2022. I'm very wary of this business model, explaining why in detail below, having seen it all before. Although it could be a trading punt for the brave!

Costain (LON:COST) - up 5% to 51p (£141m) - Results for six months to June 2023 (in line) - Graham - GREEN

I am obliged to go Green on this stock despite my distaste for low-margin contractor stocks. The company raised £100m in 2020 and currently has around £130m of net cash. It’s an accident-prone, risky business but at a PER of 4x I believe that it’s in value territory.

Angling Direct (LON:ANG) - up 3% to 39.5p (£31m) - H1 Trading Update (in line) - Paul - AMBER

An in line update, for negligible £0.9m aPBT expected for the full year. The £17m cash pile is the main attraction here. I think management needs to do something good with it - eg buy another complementary business, and scale things up. The current business model seems rather pointless, unless they can meaningfully improve profitability from a whisker above breakeven at present.

It's another quiet day for news, so hopefully we might cover one or two backlog items in addition to those below -

Paul’s Section:

Cohort (LON:CHRT) (Paul holds)

484p (pre market) £200m - Contract Win - Paul - GREEN

Cohort, the AIM-listed independent technology group, announces that its subsidiary Systems Engineering & Assessment Limited ("SEA") has been awarded a 32-month contract to the value of £17.5 million with a UK customer to provide an External Communications System (ECS) for a major defence programme. The ECS will provide enhanced real-time data exchange, critical information dissemination, and seamless co-ordination, significantly enhancing overall mission effectiveness.

Is it additional to forecasts? I’d guess probably not, judging from this bit -

"This contract is another significant win for SEA and will deliver essential communications capability to our customer's programme. It builds upon SEA's long-standing reputation and record of successful performance in this technology area. Together with other recent wins across the Group, this contract further underpins our order book and enhances the visibility of future revenues."

Paul’s opinion - I recently bought some Cohort shares after being impressed with its FY 4/2023 results (reviewed here on 19 July), and I interviewed its CEO here on 28 July, which I thought went very well, and gave me a better understanding of this collection of 6 defence-related businesses.

What I particularly like is - high quality measures, low PER (fwd: 13.3x), well covered divis yielding 3.1% (capable of paying more), sound balance sheet, and a large & growing order book giving great visibility. That’s pretty much exactly what I look for in any share! Add in experienced management with a long track record of sensible acquisitive growth.

Today’s contract win doesn’t sound as if it’s moved the forecasts, so must have been expected. This is now the 7th big contract win this year, the previous 6 are listed in a note available from Equity Development.

CHRT shares have dipped in the recent market sell-off, for no company-specific reason, so it’s now about 10% cheaper than the price I happily paid, so any further falls might induce me to top-up my position. We like bargains here! I think the risk of a profit warning should be quite low, since it has such good visibility from a large order book.

As you can see below, the track record is good, and this share is usually valued on a much higher PER than 13x currently. So I see this one as an opportunity. Today’s contract win was a good chance to review my position, and I’m happy to stay GREEN on it.

Anexo (LON:ANX)

Up 12%y’day to 67p (£79m) - Interim Results - Paul - RED

Anexo Group plc (AIM: ANX), the specialist integrated credit hire and legal services provider, is pleased to report its Interim Results for the six months ended 30 June 2023 ('H1 2023' or the 'period').

I normally avoid this share, as I’m not a fan of the ambulance-chasing legal services sector. There’s too much regulatory risk, spivvy operators, and often cripplingly large receivables books, which can hide a multitude of sins, as we saw with Quindell and Accident Exchange - both still marked on my memory. There have been other smaller operators in this sector that have also crashed and burned.

Although Redde Northgate (LON:REDD) is an exception, which broke the mould by working cooperatively with insurance companies, and has been a reliable, generous dividend payer since. Redde then lowered its sector risk by merging with van hire business Northgate. Actually, reviewing REDD’s StockReport, it looks cracking value currently on a forward PER of only 6.4x, and a lovely divi yield of 7.3%. That seems to me as if it might be coming into buying range again (lots of us did well on it here from buying the pandemic lows).

However, if the sector leader only commands a PER of 6.4x, then why go further down the food chain with Anexo?

Anyway, the 12% rise in Anexo shares yesterday compels me to take a fresh look.

Directorate change - a long-serving former CFO Mark Bringloe (cue: predictable jokes about his surname, and the share price), is returning as interim CFO.

Anexo Group plc (AIM: ANX), the specialist integrated credit hire and legal services provider, is pleased to report its Interim Results for the six months ended 30 June 2023 ('H1 2023' or the 'period').

"Significant revenue and profit growth with unchanged outlook for the year"

H1 revenue up 13% to £77.8m

H1 PBT up 12% to £15.2m

This is probably the worst sector imaginable for profit figures, which are sometimes meaningless. It’s cash collection & receivables that give us the true picture.

Outlook - in line -

The focus in the first half of 2023 has been firmly on the conversion of profits to operating cash flows. The Group has shown robust growth during the period and plans to continue to optimise cash generation in the second half, whilst increasing activity levels within the Credit Hire division to levels previously seen in the first half of 2022.

Growth in cash collections allows the Group to increase activity, including continued investment in HDR [Paul: housing disrepair] and additional emissions claims, without the need for increases in net debt. The focus for the second half is to ensure this investment is self-funded. Management has confidence in meeting market expectations for the year.

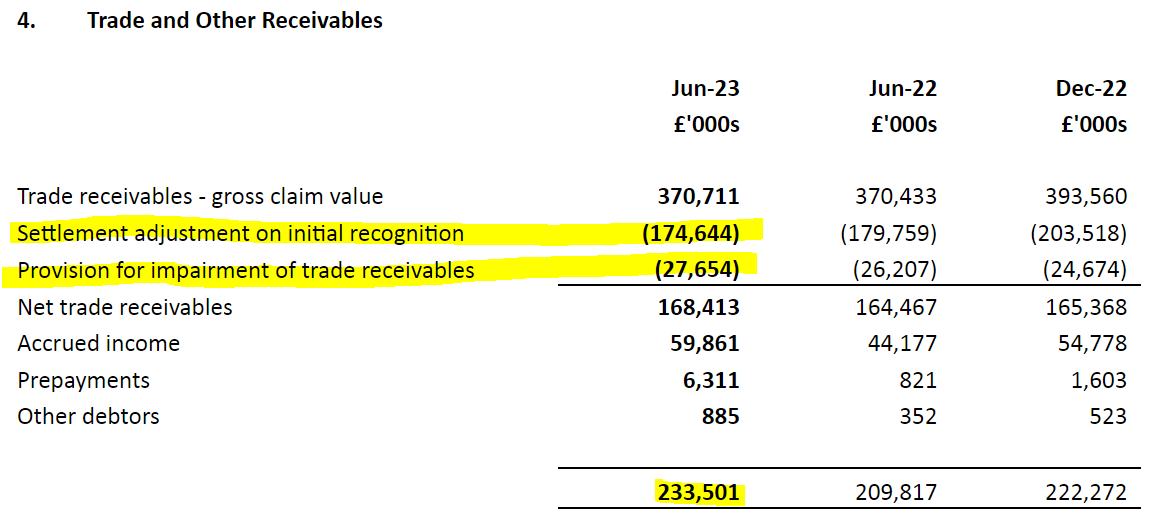

Balance sheet - the most important bit for me.

Oh my giddy aunt! It has receivables of £233.5m! That’s equivalent to 18-months revenues that haven’t turned into cash.

This is mainly funded by equity, with NTAV of £155m. Clearly the market doesn’t have confidence in these figures, with a market cap of only £79m, and nor do I.

Look at the huge impairments already booked against receivables. How do we know if these are adequate? Some of these claims could be worthless.

There’s £7.4m in cash, and £58m in interest-bearing debt (excl. lease liabilities). See note 5 for details on the various loan facilities (RCF £10m, invoice discounting £25m, and others, some of which are expensive). I can see why they want to generate cash to pay down debt, as it looks a little stretched.

Cashflow statement - the numbers at the top for cash generation look large (£23.9m in H1 this year, and £40.8m for FY 12/2022), but follow the figures down, and it almost all disappears - e.g. £34.1m consumed in 2022 by increased receivables. That’s a classic warning sign in this sector, and these numbers remind me very much of Accident Exchange, which was a disaster for shareholders. It kept reporting big profits, none of which turned into cash, and in the end it ran out of money & got taken out for peanuts by a big US financial firm. It looked dirt cheap all the way down to close to zero, as problem companies often do.

Note also that in H1 2023 the trade payables increased by £7.1m, helping cash generation, and to be fair, the increase in receivables in H1 2023 was less than in 2022, at £11.2m.

So we get to £19.8m cash generated from operations in H1 2023.

After that, there’s a hefty £4.1m in interest paid, £5.3m in lease payments, £1.8m in divis paid, negligible capex, and a net £10m of loans repaid.

Simplifying it then, it generated cash of about £10m in H1 after finance/lease costs, which was used to reduce borrowings. Not too bad I’d say, but the real test will come in future, whether the horrendously high receivables can turn into cash, or whether in reality the figures would have to be massively discounted to persuade insurers to pay up.

This is reminding me so much of Accident Exchange and Quindell, it’s uncanny.

Paul’s opinion - I’ve seen enough to know that this is a bargepole job for me. Credit hire only works well if it’s done the way Redde does it, with modest receivables, by agreeing reasonable terms with insurers that they’re happy to pay.

Anexo seems to be jumping on other compensation bandwagons, like the emissions compensation, and now defective housing.

The fundamental (and big) problem with this business model, is that it’s incurring costs up-front, and over an extended period whilst cases are developed, then eventually (18 months later it seems) insurers might pay up, which often requires a negotiation and discount offered by the claims company to settle. Insurers have deeper pockets than the claims company, and they can (and have) driven some out of business by doing nothing, and waiting for the claims company to run out of cash.

The figures are very much deja vue for me, re Accident Exchange and Quindell, both of which ended really badly. Although Quindell managed to stuff some gullible Australian legal firm (Slater & Gordon) into a wildly overpriced takeover bid, which later destroyed almost all of S+G’s shareholder value, with it eventually delisting from the Australian market.

Who knows what is going to happen with Anexo’s share price?

The chart below is looking tempting as a trading punt, for a rebound. But the fundamentals of the business look terrible to me, and I’d be pretty confident that the end game for Anexo is not likely to be positive, mainly because the profits aren’t real, if they don’t turn into cash.

The shareholding structure is highly concentrated, with 3 big holders.

For me, this is a definite avoid, so it’s RED. But good luck to any traders who have a punt on it, the share prices of these things can go all over the place, and many investors don’t even look at the balance sheet, just relying on (artificial) profit numbers. That can work well for a while. I remember Quindell became almost a personality cult of the CEO Rob Terry. I could see it for what it was, and wrote dozens of negative pieces about it here, pointing out all the holes in the accounts, and got a lot of abuse over it, but I was proven correct in the end. Accident Exchange I’m afraid was a less happy tale, where I bought into the CEO’s bullishness, even visiting its HQ - never again! That was an expensive lesson, but it’s seared on my memory, which is a good thing, as I’ll never go near any similar business again. Anexo looks very similar.

Here's the chart since it listed. It seems to have only paid 6p in total divis since listing - that's because it doesn't generate any cash!

Angling Direct (LON:ANG)

Up 3% to 39.5p (£31m) - H1 Trading Update (in line) - Paul - AMBER

Angling Direct plc (AIM: ANG), the leading omni-channel specialist fishing tackle and equipment retailer, provides an update on trading for the six months ended 31 July 2023 ('H1 24').

H1 revenues up 11%

LFL (like-for-like) store sales up 4.9% - not bad, but that’s below both inflation and likely pay rises for staff, I imagine.

2 new stores, now operating 47 in the UK.

European online sales still very small, but growing well, especially in Germany.

Net cash of £17.6m, up slightly, which is equivalent to 57% of the market cap - the main reason to own this share, I suggest!

Outlook/guidance -

Overall the Board is confident that a combination of continuing UK sales momentum with balancing European growth and profitability means that the Group is well placed to deliver revenue and Pre IFRS 16 EBITDA in line with full year market expectations."*

*Angling Direct believes that market expectations for the year ending 31 January 2024 prior to this announcement were revenue of £83.0 million and pre-IFRS 16 EBITDA of £2.7 million.

Paul’s opinion - as I’ve pointed out before, the EBITDA figures are not a good measure.

Many thanks to Singers, whose update note today shows £2.7m EBITDA turns into £0.9m adj PBT - just above breakeven really, on revenues of £83m. So not a very good business model really. Why keep opening more stores, when they don’t generate any meaningful profit?

I imagine maybe half that modest profit might come from interest receivable on the cash pile?

The main attraction of this share is the net cash pile. What mgt eventually do with it, is key to whether there’s going to be any shareholder value created here.

I was bullish on this share, when it was 25p, as the cash pile supported pretty much the entire market cap. Now it’s risen a fair bit, I don’t see it as such good value, so it’s quite tempting to bank the profits. Upside would need to come from a meaningful improvement in profitability I think.

Checking out the major shareholders, I imagine the big holders might be pushing for something to be done - a sale, or merger of some kind maybe, to crystallise shareholder value? So something could happen here, in terms of corporate actions. Hopefully not a de-listing though - it seems pointless being listed when this small, and with such a small free float. So maybe an opportunity, or a risk here?

Graham’s Section:

Tracsis (LON:TRCS)

Share price: 778p (-1.5%)

Market cap: £229m

This is an “in line with expectations” trading update for FY July 2023.

Description: Tracsis is “a leading provider of software, hardware, data analytics/GIS (geographic information systems) and services for the rail, traffic data and wider transport industries”.

Highlights:

Revenue +19% to £81.5m

Adjusted EBITDA c. £16m (last year: £14.2m)

Cash c. £15.3m (last year: £17.2m) after paying £9.5m of contingent/deferred acquisition payments during the year. “All material earn-outs have now been paid.”

The company signals an intention to get back on the acquisition trail, now that the payments for historic acquisitions are largely complete.

Rail Technology and Services Division: strong UK growth with large multi-year SaaS contracts for train operators and Network Rail, and strong North American growth “driven by the US Government’s infrastructure spending bill”.

Data, Analytics, Consultancy and Events Division: revenue growth ahead of expectations. There has been a “very strong post Covid lockdown recovery in the Events and Traffic Data businesses”.

Outlook - there is no specific “outlook” section, but the final paragraph says the following:

In order to continue providing a solid platform for ongoing scalable growth, the Group has continued to integrate its activities, technologies and operating model. Alongside this, technology investment has increased to accelerate future growth which will continue through the forthcoming financial year. As a Group we expect the weighting of growth to be in the second half of the next financial year as we continue to grow our pipeline and deliver a large orderbook of work.

Graham’s view

When Roland covered this one in detail in April, it was trading at 24x earnings.

Similarly, when Paul looked at it in February, it was trading at 25.5x.

With the marching of time, we can now use the (higher) FY 2024 earnings forecast as the basis for this multiple.

Also, the share price has drifted lower, like so many other stocks in our universe.

So it’s now back at a cooler valuation:

Profit growth has been uneven but the overall record here is decent and I think I can see why investors might want to give it a punchy rating. The company’s acquisition process seems to be working well. At this valuation I’m neutral.

Costain (LON:COST)

Share price: 49.86p (+4%)

Market cap: £138m

This contractor publishes H1 results:

Revenues down slightly to £664m

Adjusted operating profit £15m (last year: £14m)

Reported operating profit £7.6m (last year: £11.9m), “reflecting costs of repositioning digital services towards growth and our Transformation programme”.

The “Transformation programme” is both credited with increasing the company’s adjusted profits and blamed for reducing its actual profits!

Note the extremely low margins (c. 1% operating margin for Costain this year) - this is why I avoid this sector.

However, Costain is special because of its balance sheet: it has net cash of £132m.

Almost any business can be a value investment if it can be bought at a discount to net cash, and that is almost the case here.

The company raised £100m in early 2020, after suffering problems with a range of contracts.

Let’s scroll straight down to Costain’s balance sheet and see how it’s holding up currently.

Total equity: £210m

Tangible equity: £163m

Working capital: £72m

There is a pension scheme to be aware of - and there was good news about reduced deficit recovery payments last month, discussed by Paul here.

And the wealth isn’t locked up inside the company: Costain has a history of making dividend payments, and is planning to pay them again soon.

The risk, of course, is that the company gets into serious contract difficulties again.

The order book currently stands at £2.5 billion, down from £2.7 billion year-on-year. The company expects awards to be made later this year on “the very high level of bids undertaken in H1 2022”.

Outlook: trading is in line, with a strong pipeline.

We remain mindful of the macro-economic and geopolitical backdrop, recognising the challenges it has created for inflation and energy costs, and its impact on the rephasing and rescoping of some major contracts, in particular in Transportation…

…we remain on track to deliver an adjusted operating margin run-rate of 3.5% during the course of FY 24 and 4.5% during the course of FY 25; in line with our ambition to deliver margins in excess of 5%.

Graham’s view

It’s not a sector that I like to go fishing in but I can see the argument that this one is simply too cheap at this level. We have a very cheap earnings multiple and a rich balance sheet. It’s not often that you get both.

I think I’ll have to go Green on this for the simple reason that a market cap any lower than this would strike me as just plain unreasonable. It’s already trading at 4x earnings (and the “target P/E” on forward earnings, according to the broker, is only 2.3x!). It’s already trading around the value of its net cash balance. It’s almost certainly a poor-quality and risky enterprise but those features seem to be priced in at these levels.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.