Good morning, it's Paul and Roland here today, welcome back Roland! Today's report is now finished.

Agenda -

Paul's Section:

Zoo Digital (LON:ZOO) (prepared last night) - a positive trading update. Good industry tailwinds in streaming TV, provide a boost, some one-offs though. Forward visibility is limited. I question the valuation, given a long, and weak track record of inability to generate profit.

Saga (LON:SAGA) (I hold) - Preliminary results for FY 1/2022 are as expected, a small underlying loss. Liquidity & going concern statements look strong, so no solvency or cashflow issues. Heavy losses from travel, due to covid, are covered by big profits from the insurance division - an excellent hybrid business model. Forward bookings on cruise are strong, less so in the tours business. I remain of the view that this share looks very cheap, for a strong recovery in the travel business.

James Cropper (LON:CRPR) - profit guidance is reduced by 29%, due to a huge increase in gas prices. The company is taking action (price rises, etc), so this could be a temporary problem, and it says customer demand remains strong. Shares look expensive though. A fairly muted market reaction today, shares only down about 10%.

Roland's Section:

Judges Scientific (LON:JDG): This scientific instrument group has delivered a record set of figures, ahead of expectations. But after a strong recovery from the pandemic, management sounds much more cautious about the year ahead. A flat outcome seems possible at this stage.

Dignity (LON:DTY): Listed funeral service provider has put out a downbeat set of numbers today. Management warns of the risk of falling profits and a potential covenant breach as the UK’s death rate returns to normal. There are also looming challenges from debt restructuring and new FCA rules relating to pre-paid funeral plans.

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps up to about £700m. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

Zoo Digital (LON:ZOO)

127.5p (up 5% at close) - market cap £112m

ZOO Digital Group plc (AIM: ZOO), the leading provider of end-to-end, cloud-based localisation and media services to the global entertainment industry, today is pleased to provide an update on trading and the outlook for the financial year ending 31 March 2022…

Full year revenue and profit to be materially ahead of expectations

This is a positive update, and the very strong organic revenue growth has certainly made me sit up and take notice.

My summary -

Raised guidance for FY 3/2022, revenues now >$65m (previous >$57m)

BUT, c.$10m are one-off contracts (that’s more than the upward revision of $8m)

Organic growth in revenues for FY 3/2022 is >65% - very impressive, even if some is one-offs

Adj EBITDA guidance raised to $6.5m, up >44% vs last year

BUT, at ZOO EBITDA doesn’t turn into profit - e.g. in H1, adj EBITDA was $2.4m, which produced only $373k in operating profit. However, a full year EBITDA of $6.5m could produce maybe $2m real profit, who knows? It’s still not very much for a £112m market cap company though.

Guidance - revenue growth is expected in FY 3/2023, but lower than FY 3/2022. That’s fine, I wouldn’t expect 65% organic growth to be repeated.

“Future visibility is limited” can only be seen as negative, and is another reason why this stock really shouldn’t be commanding a premium valuation in my opinion.

Next update in July 2022.

Good sector tailwinds, e.g. from streaming TV services expanding, and launching in new territories. So if ZOO can’t make money now, it probably never will (it hasn’t done in the last 20 years either).

Cash position isn’t mentioned, but checking the last accounts, it seems secure, thanks to a $10.3m placing in April 2021.

My opinion - this is a good update, and the expansion of streaming TV services is clearly a good sector tailwind for ZOO. It should break into a modest profit now, after a lamentable track record of over 20 years as a listed company. I wonder if there are any original investors left, or if each wave of optimists goes stale, and then sells up to the next generation of optimists?

I think the business model seems poor - there’s no pricing power offering these dubbing services, that’s why the company has never made any meaningful, or sustainable profits.

However, the strong industry tailwinds could mean ZOO’s time has finally come? If the market cap was say £20-30m, then I’d consider having a punt. But at £112m, risk:reward strikes me as poor.

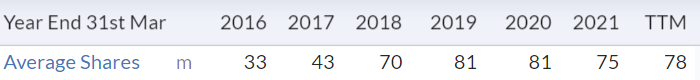

Look at how the share count has expanded, as it's needed to repeatedly raise funding, due to a lack of cashflow generation. The total is now up to 87.7m.

.

.

Saga (LON:SAGA) (I hold)

254p (y’day’s close) - market cap £356m

Saga plc (Saga or the Group), the UK's specialist in products and services for people over 50, announces its preliminary results for the year ended 31 January 2022.

No surprises in the figures today, as SAGA provided detailed guidance in a trading update which I reviewed here on 27 Jan 2022. So a small underlying loss was expected, and has come out at £(6.7)m. The statutory loss is £(23.5)m. Revenue was £377m, well below historic levels due to the restrictions on travel. This is forecast to bounce back to £636m revenues in FY 1/2023, and consensus EPS forecast of about 46p (PER of only 5.5).

The year was characterised by major disruption from covid, with the travel business largely mothballed in H1, although the 2 cruise ships were able to resume (limited) operations in H2.

It surprises me that the stock market doesn’t seem to value the excellent hybrid business model at SAGA, with a cash generative/profitable insurance division which has proven able to support the mothballed travel division during the pandemic. This seems obviously a far better business model than a pure travel business. SAGA only needed to tap shareholders for fresh equity once, and that was largely due to a weak starting point, with previous management having paid out excessive divis, and weakened the finances before covid struck. Since then, liquidity has improved further, with a fresh bond issue, providing solid long-term funding. So no solvency or liquidity issues here at all, as you can see -

The Group's performance was underpinned by our strong financial position following actions taken in 2021, with Available Cash at 31 January 2022 of £186.6m, and an undrawn revolving credit facility of £100.0m.

Cruise division

Only 1 out of 31 cruises was “meaningfully impacted” by a “limited outbreak” of covid. This is the one that we discussed here a few weeks ago, which sharp-eyed readers spotted on the internet, having turned the ship back to the UK, after being rejected from a Caribbean port. Therefore, as we already know, covid is not entirely behind us yet.

Summary of debt position

This neatly summarises it below. Bear in mind that the bulk of the debt is financing for the owned, nearly new, cruise ships (impairment review done, and no write-down required). So it’s mostly asset funding, that could potentially be eliminated with a sale & leaseback. That clearly needs to be viewed differently to the rest of the debt, which funds the business. The plan is to reduce debt over the next few years, from what should be strong cashflows. Then dividends will recommence when appropriate, so probably no divis for a couple of years, again this is as expected, nothing new.

In July 2021, we completed a series of financing transactions which provided us with greater flexibility through less-restrictive terms and ample liquidity to support the business through any ongoing period of uncertainty. These included the issue of a new five-year £250.0m bond and use of the proceeds to repay our £70.0m term loan and £100.0m of our existing bond, with the remainder held as Available Cash

At 31 January 2022, our net debt was £729.0m, £31.2m lower than at 31 January 2021, reflecting resilient cash generation within Retail Broking and the restart of the Cruise business which were only partially offset by support provided to Tour Operations and debt servicing costs.

Turnaround potential

This table clearly shows how the insurance division generates big profits (benefiting from reserve releases, indicating prudent policies, but may not repeat), which has mopped up the hefty losses from the covid-disrupted travel division.

If we strip out the travel losses, and replace the £(79.3) loss below with a future profit (say £50m+?) then you can see the group has the potential to be making a profit of £100m+ p.a. once travel has returned to normal. That’s the bull case in a nutshell.

.

Travel bookings

Cruise ship bookings are now well ahead of pre-covid, due to pent-up demand, which is encouraging. Also pricing power is good, with prices up strongly on pre-covid - necessary to absorb higher costs I imagine, including more expensive fuel.

Forward Travel sales

Cruise bookings for 2022/23 are higher than the same point two years ago by 46% and 9ppts for revenue and load factor respectively due to high levels of pent-up demand for cruises and completion of the cruise transformation programme, with per diems also 15% higher than at the same point two years ago.

Tour Operations bookings for 2022/23 are below the same point two years ago by 30% and 35% for revenue and passengers respectively. This is due to continued customer caution in relation to overseas travel.

Outlook - the main guidance seems to be within the going concern section - this is quite useful -

In the latest round of long-term financial forecasting, the Group updated its modelling assumptions to reflect:

· In the base case, which represents the Group's central plan and best estimate outlook, Cruise continues to see some impact of COVID-19 in the first half of 2022/23, with reduced load factors and higher return to service costs, but then largely returns to normal operation thereafter. The Tour Operations business is targeting to break even in 2022/23 and then return to pre-pandemic contribution levels from 2023/24, with a lower overhead cost base following completion of the recently announced restructuring plans. Insurance plans include an estimate of the impact of the FCA market study on customer pricing, which is expected to have an adverse impact on profit before tax for 2022/23 and 2023/24.

· In the RWC, which represents the Group's severe, but plausible, downside scenario, Cruise assumes a layup of both ships for a further two-month period during 2022/23 due to further potential travel restrictions, and with suppressed load factors for the remainder of 2022/23 and 2023/24, capped at 75% and 80% for each year respectively. Tour Operations also sees a much slower recovery from 2023/24 onwards than in the base case. Insurance is assumed to be impacted by a number of downside risks, including a more conservative outlook for the impact of the FCA market study compared with base case assumptions.

The Group has made an initial assessment of the potential impact that the Russia-Ukraine conflict could have on its outlook, and potential downsides are considered to be limited to short-term reductions to Travel bookings and inflationary pressures that are sufficiently covered by the assumptions within the base case and RWC.

Going concern - this is fine, with plenty of liquidity in both the base case, and the severe but plausible case (which includes a further 2 month covid restriction, and slower recovery of travel) -

In both the scenarios modelled, the Group expects to be able to operate within its debt covenants and to maintain ample Available Cash reserves until at least September 2023, being 18 months from the date of signing the financial statements, which more than accommodates the minimum 12-month assessment period for going concern. The Directors therefore have a reasonable expectation that the Group will continue to trade through the continued COVID-19 disruption and will have sufficient liquidity for at least the next 12 months, and accordingly have prepared the financial statements on a going concern basis.

Balance sheet - it’s a large, and complicated balance sheet.

NAV is £652.9m, from which I deduct intangible assets (goodwill £718.6m + other intangibles of £47.1m), giving NTAV of £(112.8)m. I’m not keen on negative balance sheets, so am pleased the group’s strategy is to strengthen its balance sheet before recommencing divis. That’s the right thing to do.

Investor presentation -

A separate live presentation for retail investors will be held via the Investor Meet Company platform on 25 March 2022 at 10.30am. The presentation is open to all existing and potential investors.

My opinion - the figures are in line with expectations, and I don’t see anything worrying in the numbers. Liquidity is ample, due to secure bond funding, confirmed in a positive going concern statement, so there are no issues re solvency or liquidity. That message still doesn’t seem to have got through to investors, with the market still treating & valuing SAGA as if it’s a distressed business, when it clearly is not. Strange, but there we go. Sometimes it takes a long time for investor perceptions to reflect reality, but re-ratings can also be rapid (up or down).

It seems to me that everything is now set up for a return to profit this year, with travel partially recovering, and then a full return to normal in calendar 2023 - which is similar to what Carnival (LON:CCL) said this week for its cruise ship business.

That should leave SAGA as a highly profitable & cash generative business (again, as it used to be) from 2023 onwards. Debt reduction should then be possible, from cashflows, with all the upside flowing to equity, as debt reduces.

With a 2-year view, this share looks well set up to deliver strong returns, in my opinion, as the travel business recovers from covid restrictions.

SAGA’s customer base of affluent over-50s are probably the demographic least likely to be impacted by cost of living concerns. Hence this should be a resilient business in current higher inflationary conditions, where disposable incomes are being squeezed.

There’s a lot of pent-up demand too, from a customer base with plenty of savings, as the cruise bookings demonstrate, being well ahead of pre-covid.

Hence I think this looks a compelling share to own over the next couple of years. The share price is unusually volatile, I don't know why.

The fundamentals are clearly improving, so the falling share price doesn't make sense to me, hence I see it as a buying opportunity.

EDIT: Thanks to rmillaree who flagged up this (well buried!) outlook comment, which I missed on my first read of the results statement. Apologies for this omission -

" Given the continued uncertainty arising from COVID-19, the Group is not providing any earnings guidance for the 2022/23 financial year but would expect a return to profit in both the base case and RWC scenarios. "

.

.

James Cropper (LON:CRPR)

1125p (down 8% at 08:06) - market cap £108m

James Cropper plc ('CRPR' or the 'Group'), the leading advanced materials and paper products group, today issues an update on trading and the impact of worldwide wholesale gas price rises.

Top marks for clarity here - gas prices having a big impact on profitability -

As previously announced, the Group has experienced strong demand throughout the year and across all divisions, with over 30% sales growth in the current year to 26th March 2022, which is ahead of previous market expectations.

However, as a direct result of the wholesale gas price increases impacting Q4 and subsequently, the profitability of the Paper division, our expectations for the full year will be for adjusted* PBT for the Group of £3.5M (FY2021: £1.1M) against previous market expectations of adjusted* PBT of £4.9M.

That’s a 29% decrease in profit guidance for FY 3/2022, despite strong demand.

This is a reminder that a big increase in costs can cause a leveraged impact on profits.

It sounds obvious, but all energy-intensive businesses must be vulnerable to this issue, depending on what extent they’ve hedged or fixed the prices of energy in advance.

It’s tricky for investors, because information on hedging of energy prices is something I’ve rarely seen disclosed in results or trading statements, although some companies have started mentioning it more recently.

Pricing power - this suggest the company is passing on higher costs, although clearly not fast enough to avoid a profit warning -

While the situation in Ukraine has resulted in uncertainty concerning the Paper division's input costs in the short term, the long term opportunity for the Group remains positive, and we are encouraged by our ability to flex pricing to respond to rising input costs. Building on a strong track record of growth, the year is expected to deliver a new sales high across the Group. We continue to maintain a strong financial position, with transformation programmes well in advance to transition away from natural gas across all Group divisions.

Liquidity - sounds OK -

The Group has recently secured new credit facilities to support investments and other growth programmes. The £4m Government provided COVID related loan facility, CLBIL, has been repaid in full and undrawn facilities stand comfortably at £20m.

My opinion - there’s additional detail in the announcement, which is interesting, but I won’t repeat it here.

The cost of energy is a really tricky issue for many companies large and small at the moment.

If a business is a heavy energy user, then maybe it’s best to sell the shares, to be on the safe side? We can always buy them back at a later date.

Or, another option is to accept the risk of short term profit warnings, and look through the current crisis, in the hope that Ukraine gets resolved somehow, and energy prices come back down again. Who knows what might happen? It depends on your investing timescales.

It sounds as if CRPR is on top of the situation, and taking action (e.g. energy price surcharges, and moving away from natural gas), so the long-term performance of the business might be OK.

I don’t understand the valuation of CRPR shares - they seem very expensive on a PER basis.

.

Roland’s section

Judges Scientific (LON:JDG)

Share price: 7,500p (+7% at 08.12)

Shares in issue: 6.3m

Market cap: £486m

“Post-Covid recovery enables record performance”

Judges Scientific, a group focused on acquiring and developing companies in the scientific instrument sector, announces its final results for the year ended 31 December 2021.

It’s no surprise to see another excellent set of results from Judges Scientific this morning. This AIM-listed company is a deeply impressive buy-and-build operation that’s delivered quality growth for many years. Its operations are unlikely to be heavily affected by energy prices or the conflict in Ukraine, although supply chain challenges are a possible risk.

Taking a look back in the archives, I last covered Judges at the time of its half-year results on 24 September 2021. Although I was impressed with the results, I noted that the shares looked significantly more expensive than in previous years, and questioned whether this was justified.

Looking at the chart today, there’s been some significant price action since September. Ahead of the market open today, the shares are now nearly 10% lower than they were when the half-year results came out (update at 08.12: Judges’ share price has risen by 7% to 7,500p):

Financial highlights

Today’s results show a very strong recovery from the pandemic slowdown seen in 2020. Chairman Alex Hambro says the company has delivered “record revenue, profits, cash generation and dividends”.

- Revenue: £91.3m (+14%)

- Adjusted operating profit: £18.8m (+31%)

- Adjusted earnings per share: 238.1p (+34%)

- Cash generation from operations: £19.6m (+34%)

- Total dividend: 66p (+20%)

- Net cash: £1.4m (FY20 -£5.7m)

These figures appear to be ahead of consensus forecasts shown in Stockopedia this morning:

Strong organic growth

Companies with buy-and-build models sometimes report headline growth (from acquisitions) without disclosing whether their existing businesses are continuing to expand. Fortunately, that’s not the case here.

Judge’s organic growth performance looks very satisfactory to me:

- Organic revenue +10% vs 2020

- Organic order intake +25% vs 2020 and +8.5% vs 2019

- Organic order book at 22.6 weeks (2020: 14.7 weeks)

Fundamental performance

Judges has a strong track record of profitability and cash generation. Let’s take a look at how last year’s figures compare with historic numbers.

2021 performance: my sums show continued strong performance across these metrics in 2021.

- Operating margin: 17.1% (statutory)

- ROCE: 25.5%

- Free cash flow/share: 195p

- Free cash flow conversion from reported earnings: 96%

The balance sheet also remains strong, with a modest net cash position and low levels of gross debt.

I have no concerns about Judges’ fundamental quality, which is also reflected in the high quality score awarded by the StockRanks.

Outlook

The company is seeing a return to “a more normalised trading environment”, but warns that the war in Ukraine has exacerbated existing supply chain issues. However, management suggest that the record order book is a strong indicator of further recovery.

My view

I’m not in any doubt about Judges quality as a business, past and present. Looking ahead, I don’t see any obvious reason why the company’s model can’t continue to deliver strong results.

However, I’d note that CEO and 11% shareholder David Cicurel is now 71, so succession planning might become an issue at some point.

House broker Shore Capital has put out an updated note this morning, but left its FY22 forecasts unchanged due to geopolitical risks. Given last year’s outperformance, this suggests very modest growth is expected this year, with the possibility of flat earnings.

Apparently, only 0.4% of group revenue has come from Russia and Ukraine in the last three years.

However, the company admits that the war is exacerbating supply chain issues “and may in future create competing claims for public funds across the world”. This is a useful reminder that many of the company’s clients are in the public sector.

At current levels, Judges shares are trading on around 30 times forecast earnings, with a yield of under 1%.

Given all of these concerns, my view is that the share price is probably up with events at current levels. However, as a long-term compounder, I think the stock is probably likely to continue delivering.

Dignity (LON:DTY)

Share price: 447p (-16% at 08.28)

Shares in issue: 50.0m

Market cap: £224m

Revised strategy is “likely to lead to lower profits in the short-term”

Dignity is the UK’s only listed funeral service provider, operating a network of funeral homes and crematoria across the UK. The company estimates that it’s involved in 20% of UK funerals.

Today’s results have been given a poor reception by the market, with the stock down more than 15% in early trading. Concerns seem to focus on an uncertain outlook and continued debt risks.

I’m interested to take a broader look at this turnaround situation, which has attracted a number of high-profile turnaround investors, including top shareholder Phoenix Asset Management.

Business model: Dignity operates 800 funeral homes and 46 crematoria around the UK. For years, this buy-and-build business appeared to be a reliable performer. But the illusion was shattered in 2018 when it became painfully apparent that Dignity’s profits relied on acquisitions and uncompetitive pricing to offset shrinking market share.

Since then, Dignity’s hefty £500m debt burden has come to the fore. Although Covid-19 has led to an elevated death rate, the company’s new focus on competitive pricing and service has impeded a recovery in profits.

Let’s start with a look at Dignity’s 2021 financial results.

Financial highlights

The numbers show that although the UK saw an elevated death rate again last year due to the pandemic, Dignity’s underlying performance declined.

- Underlying revenue: -1% to £312m

- Underlying pre-tax profit: -12% to £26.8m

- Underlying earnings: -8% to 42.8p per share

- Net debt: £471.2m (2020: £480.6m)

- Number of deaths: 664,000 (2020: 663,000, 2019: 584,000)

The company uses underlying revenue to adjust for the impact of pre-paid funeral plans. Revenue relating to these appears to be held by a trust and then released to the company when the service is provided. This is a very material line of business for Dignity; the balance sheet shows more than £1bn in assets held by these trusts.

The adoption of a new, more competitive pricing strategy means that Dignity’s profits haven’t benefited from an increase in the number of deaths. The company says that it expects to gain market share as a result of fairer pricing.

However, this is unlikely to be a quick process and management appear to be (rightly) concerned about what might happen to the group’s financial performance if the UK death rate returns to more normal levels this year. As a preparatory measure, Dignity recently secured a covenant waiver from its lenders.

Strategy update

Departing chief executive Gary Channon is given credit by the chairman for restructuring and refocusing the group’s operations. Changes have been made to the group’s regional organisation and investment is underway in staff and assets.

The group is now focused on achieving economies of scale, better service provision and pricing and growing its volumes as a share of the market. Channon says these elements have been neglected over the years, at some cost to the group (and its customers, I’d argue). He appears to expect a difficult road ahead:

“We have a stream to cross at the bottom of the valley before we start our climb to higher ground”

FCA rule changes

The FCA is introducing new rules relating to the sale of pre-paid funeral plans in July 2022. I’d need to do more research on this to understand the full implications, but my feeling is that Dignity expects some adverse impact from these new rules.

Regulatory risk is certainly one of my concerns with this business.

Debt restructuring

Dignity has secured debts with a total repayment liability of £757.4m at the end of 2021.

Net debt is given as £471.2m, reduced from £480.6m at the end of 2020.

The main covenant on this debt requires EBITDA to total debt service costs to be greater than 1.5x. This figure was 2.13 times at the end of 2021, but the company has secured a waiver for the year ahead as part of its preparation for a reduction in the death rate.

For reference, net finance costs were £23.7m last year, so they accounted for around half the group’s underlying operating profit. This does not seem ideal to me.

Dignity says that it's aiming to reduce debt levels through an update to its capital structure. This is said to be “most likely by use of the crematoria portfolio”. I’d guess that some kind of sale and leaseback might be an option, but details are sparse so far.

This level of indebtedness should be a big concern for equity investors, in my view. I’d argue that dilution remains a risk, although this can probably be avoided.

Outlook

Departing Mr Channon hasn’t minced his words in today’s update. In what’s likely to be his final outlook statement, he warns that “the strategy [ … ] is likely to lead to lower profits in the short-term as we see a full year effect of the lower prices we have been using since September.”

Over time, lower costs are expected to deliver some offsetting benefits, but “the biggest factor affecting us is likely to be the death rate”. Dignity expects the excess death effect of the pandemic to reverse at some point, creating uncertainty about the outlook for profits.

My view

Dignity’s turnaround has now been ongoing for several years. I had thought that I might see some improvement in the 2021 figures. Having looked through them, I’m not convinced.

For me, this business is uninvestable at the moment due to its high debt levels and uncertain profitability. I’d guess that Dignity can be turned around in due course, but without much more research, I’m not sure how long it will take or at what price the stock might offer value.

Stockopedia forecasts show the stock trading on around 14 times 2022 forecast earnings after today’s drop. I’m not convinced the balance of risk and reward is attractive at this level. However, further research may be worthwhile for investors who are interested in this situation.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.