Good morning, it's Paul here with the SCVR for Weds.

Estimated timings - I'll probably say 1pm, but will actually be finished by about 4pm. That's what usually happens.

Edit at 10:40 - there's already tons written, so my conscience is clear! I'll make a note here when I'm finished, not sure of timings.

Edit at 13:05 - today's report is finished. Broadly in line with the official finish time too!

Copying content onto advfn - please could subscribers refrain from copying content from here onto advfn (or other bulletin boards)? The SCVRs were free for about 6 years, but are now behind the paywall. It's not fair to other subscribers, who are paying to have access to these articles. Many thanks.

.

Quantitative Easing

I should emphasise that I'm not an expert in economics. I studied economics at O-Level, A-level, and as part of my Degree, so have a reasonable general understanding only.

The press have recently been publishing often alarmist articles about the explosion in UK Govt debt. This is unfortunate, because the large annual deficits incurred after the 2008-9 financial crisis had been gradually reduced, until almost eliminated. Then covid struck, and we're not just back to square one, we're now in a far worse position of over-spending than in the last crisis.

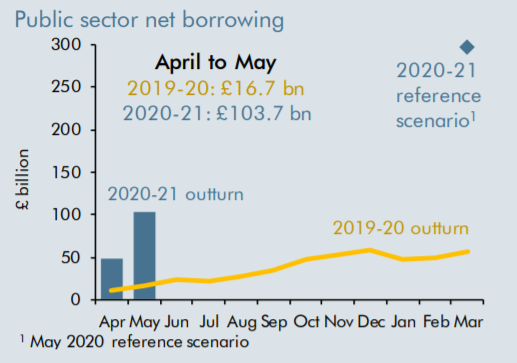

The unprecedented measures taken to keep the economy afloat during lockdown have been vastly costly - e.g. this article from the OBR (Office for Budget Responsibility) shows how Govt borrowing was £103.7bn in just two months. Tax revenues for April-May are down 43% vs LY, and central Govt spending is up 48%. Mind-boggling figures. Borrowing was only £16.7bn in the comparative 2 months LY (last year);

.

.

National debt has now risen to just over 100% of GDP, the first time it has got that high since the 1960s. Although that is based on a reduced GDP figure, adjusted to take into account the sharp economic slowdown due to lockdown. Hence the % should fall somewhat as the economy recovers.

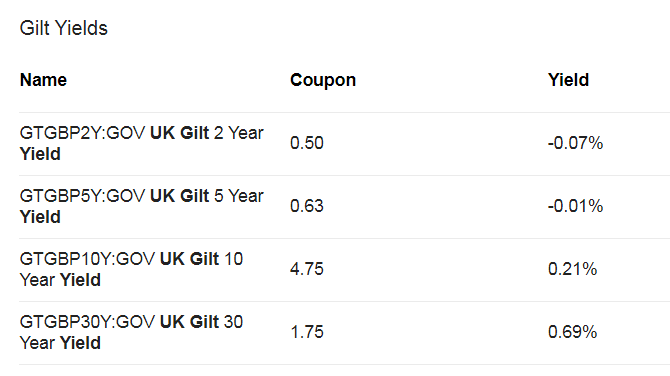

The Govt has to borrow from bond markets (by issuing Gilts) in order to finance this deficit. Conventional economics suggests that borrowing on this scale would trigger very high interest rates (a premium return required by investors, in order to take on the risk of lending money to a profligate Govt). However, as you can see, the yield on UK Govt debt is negligible - people are lending to the UK Govt for almost no return;

.

.

Why is this so? Partly because Gilts have now become an alternative to bank accounts, to park spare cash where it at least earns some return, however paltry - at least for 10 year+ gilts. Below that, and the yield is actually slightly negative.

The main reason however, is that the Govt is issuing new gilts to itself! Or rather, one arm of Govt is issuing debt to another arm of Govt (the Bank of England), via the market, in circular transactions. During this crisis so far, the BoE has bought ALL of the freshly issued debt. In fact it's bought up more than all the newly issued debt;

Between 1 April and 16 June, the DMO issued

£146 billion of gilts – 65 per cent of the £225

billion it plans to issue between April and July (net

of redemptions, gilt issuance totalled £125 billion).

In the period since 18 March, when the Bank of

England commenced purchases under the initial

£200 billion extension to quantitative easing, it has

purchased £174 billion of gilts from the market. So

in effect the Bank has purchased £28 billion more

gilts from the private and overseas sectors than the

DMO has issued so far in 2020-21 (and £49 billion

more than net DMO issuance). To date, the

Treasury has not made use of the ‘Ways & Means

Facility’ – its overdraft at the Bank.

[Source: OBR report on Govt finances]

Why hasn't sterling collapsed then? Because other Governments are taking similar action. So what would sterling devalue against?

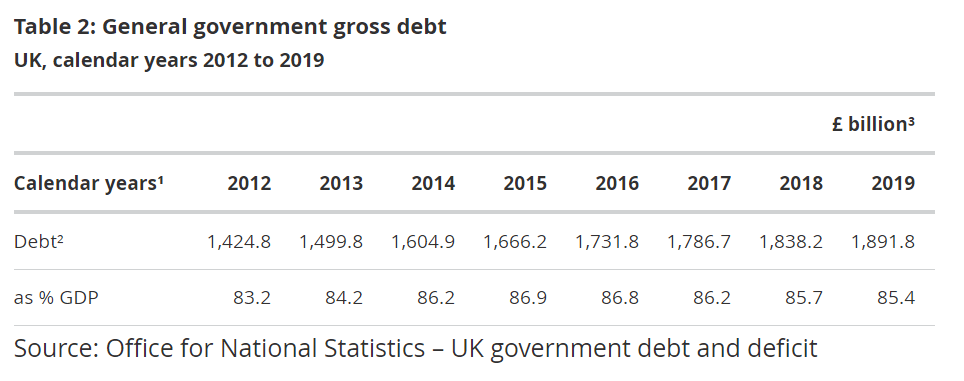

Figures for the National Debt are below. As you can see, it rose considerably during a time of supposed "austerity". The latest figures have topped £2 trillion, and is likely to reach about £2.2trn+ this year, with a projected budget deficit of over £300bn this year (about 15% of GDP, compared with a peak of c.10% of GDP in the 2008-9 financial crisis, and a similar figure in the 1990 recession). Remember that the deficit is an annual shortfall, which then adds to the national debt. Every time I hear idiot politicians use debt & deficit incorrectly or interchangeably, then I shout at the television, and mark them down as totally clueless.

.

.

So far, so bad. This situation looks grim, doesn't it? Well actually, no it doesn't, and this is why;

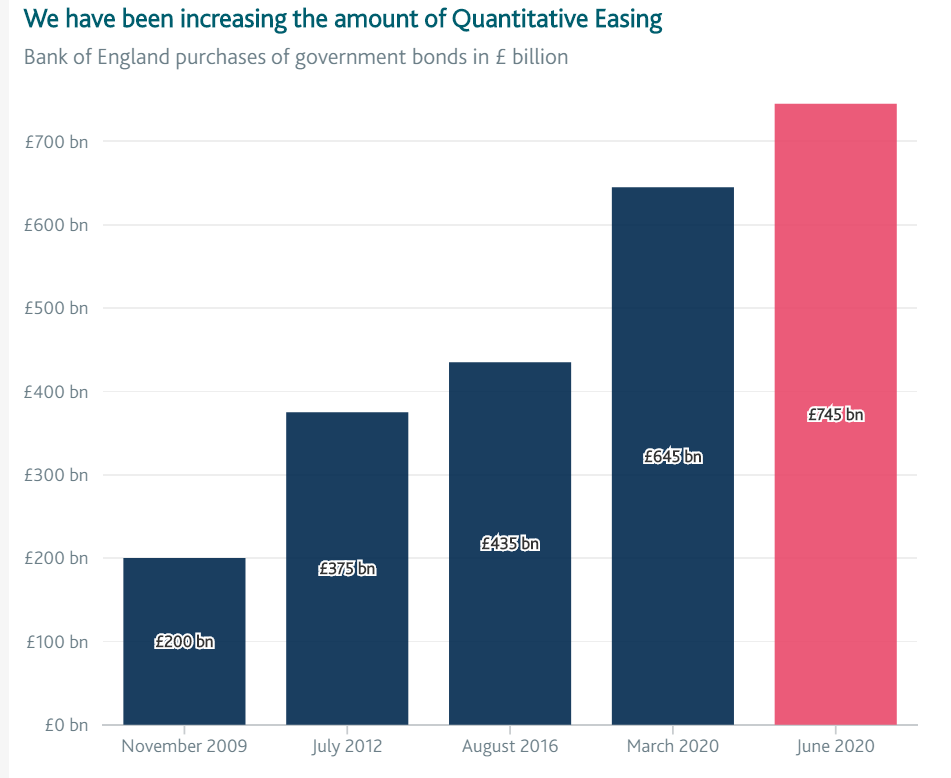

Quantitative Easing - this blue link takes you to an excellent, very clear explanation from the Bank of England, explaining QE very well. This is my synopsis: the Bank of England creates new money electronically, which it then uses to buy UK Gilts (government bonds).

Here are the figures of how much QE has been done, since this wheeze was invented in c.2009;

.

.

Therefore, of the c.£2trn in Govt debt (gilts in existence), over a third (c.37%) are actually owned by the Bank of England! Hence the reality is that UK National Debt is not £2trn, it's more like £1.3trn, or about 65% of GDP (which also happens to be c.£2trn coincidentally). 65% is generally considered a reasonable, sustainable level, especially when servicing costs are so cheap - as old gilts expire, they're replaced by new ones issued at negligible interest rates. So funding the national debt, is actually getting cheaper over time.

It all sounds crazy, but that's the reality. As things stand now, soaring Govt debt really isn't a problem at all. There's a guaranteed buyer - the Bank of England, which theoretically could keep buying gilts ad infinitum with newly created money.

How does all this end? Nobody knows.

Andrew Bailey's comments - the latest Bank of England Governor, Andrew Bailey, has made some incredibly stupid public comments this week, e.g.;

Andrew Bailey told Sky News that the government would have struggled to fund itself had the Bank not intervened during the market “meltdown”. “We basically had a pretty near meltdown of some of the core financial markets,” Mr Bailey said.

Asked what would have happened if the Bank had not intervened, he replied: “I think the prospects would have been very bad. It would have been very serious.“I think we would have a situation where in the worst element, the government would have struggled to fund itself in the short run.”

That's the sort of stuff that goes into memoirs, 5-10 years later (e.g. see Alastair Darling's excellent memoirs). When a financial system is built on confidence, you don't tell the world that it almost collapsed a few weeks ago! What a plonker.

Conclusion - of all the things that investors should be worrying about, soaring national debt really isn't one of them, at the moment anyway. Because it isn't actually soaring at all, when you adjust for QE. Although Andrew Bailey talks about reversing QE at some point, I can't see that happening, ever. Why would the Govt want to destroy money, by selling the Bank of England's holding of gilts back into the market, and then electronically writing off the cash received, and push up interest rates? That would be utter madness, and likely to push the economy into recession. It's not likely to ever happen, in my view. Long-term, I reckon the Treasury and Bank of England could just do a contra entry in their books, and bingo, a third of the national debt vanishes! Surely that must be the unspoken plan, as nothing else makes sense.

For now anyway, the UK Govt can borrow at negligible cost, and has a ready buyer (itself, basically!) for any amount of debt it wants to issue. Therefore, surely this is a perfect time to be borrowing huge amounts to fund major infrastructure projects? I would like to see the housing problem finally addressed. Private rents are far too high, and we need a massive programme of new council housing, which could then be let to young people at cheap rents, to incentivise them to work hard, and avoid gangs/crime. Plus it would inject huge new spending power into the economy (via increased disposable income), instead of lining the pockets of private landlords.

.

Robinhood client suicide

Robinhood is a commission-free stock broker in the USA, which has become extraordinarily popular recently. Apparently it has signed up something like 11-14 million clients, that are apparently punters, or beginners, interested mainly in trading. The professionals at CNBC scoff at them, e.g. for buying shares in bankrupt companies like Hertz (why on earth are its shares still allowed to trade, if it’s bankrupt?). However, apparently Robinhood punters have done very well in recent months, buying momentum stocks. Anecdotally, reports are that some Americans have put their Govt stimulus cheques into Robinhood accounts, and are playing the market successfully (for now). I hear that social media stars are appearing, who talk about their day-trading, and have large numbers of followers.

Clearly this all sounds like top of the bull market kind of stuff. What is so perplexing, is that other euphoric bull market highs like this have happened when the economy was at least ticking along OK. I can’t remember any time in my lifetime, when the economy was collapsing, yet shares are in a manic bull phase at the same time.

Things are different this time though. This is the first time ever (or at least in living memory) that we’ve had a deliberately engineered economic shutdown, due to a highly contagious disease. The level of stimulus from Govts now is also off the scale compared with other recessions, even 2008-9. So economies are definitely going to recover, but we just don’t know when. Interest rates have never been this low, for so long before - thus driving money into risk assets.

In the meantime, stimulus money could be at least partly finding its way into the stock market? Another credible theory is that with casinos being shut, and no sports to bet on, then maybe gambling money has also found its way into the stock market? I’m sure that is true, the only question is whether it’s enough money to move the dial much, given the vast existing flows of money in US stocks.

Back to Robinhood. One of its clients, just 20 years old, apparently racked up heavy losses recently, trading options, and committed suicide. I feel desperately sad about this. I wish I could have spoken to him, and explained my situation in 2008, and how you can & do recover, and life goes on. What’s the worse that could happen? Bankruptcy, and a fresh start. I chose not to go down that route, preferring a solvent solution, and negotiated payment plans (Spreadex and IG were very helpful - they don’t want to ruin anyone’s life, and will negotiate to find a solution, if people get into a mess, but co-operate with them).

I’m told that there have been occasional suicides in the UK over market losses too, particularly spread betting, over the years. Googling it reveals that about 500 people p.a. may commit suicide over all forms of gambling debts in the UK. You can't stop people gambling, if they want to. But surely more could be done to prevent that tragic death toll?

Can I make a plea to all readers here? If you get into trouble, or someone you know is struggling with awful market losses, then please ask for help - ideally from trained counsellors. Although whilst not trained, I do have experience of this personally. So I will happily give my time to anyone who’s got into a mess, and talk you through how you might resolve it.

.

Online results presentations

One positive spin-off from covid, is that many more companies are doing online results presentations, often interactive with Q&A, and a recording being available afterwards.

I haven't had time to look at the presentation yesterday from Volex (LON:VLX) because I prioritise my time to concentrate on looking at things which I am seriously considering buying, or already hold. Whilst Volex looks a really good turnaround, it has not moved from my personal watch list onto my buy list yet. Feedback from a couple of subscribers here, in yesterday's reader comments, was positive, so thanks for that. Although do bear in mind that feedback from all presentations should be positive, as companies are putting the bull case to us! If you come away from a presentation feeling negative, then the company needs to find a new CEO. that's why it's usually best to sleep on it, after a meeting, rather than rushing to buy immediately. But it depends, sometimes a prompt buy of something really exceptional can be lucrative.

Last night at bath-time, I took the risky decision to balance my laptop and a glass of wine, on one of those trays that you loosely put astride the bath, to watch a BRR Media produced results presentation which is here , from De La Rue (LON:DLAR) (I'm currently long), Thankfully my laptop didn't plunge to a watery grave (unlike an iPad mini that did last year). It's only a chromebook anyway, so cheap enough to replace.

It seemed to me, from the tone & confidence of DLAR management, that the turnaround there might be more impressive than I had hitherto realised. A large fundraising is underway at 110p, so I'm reluctant to pay much more than that in the open market. Hence am hoping the share price might slide somewhat lower than its current 151p in order that I may increase my position size from small to medium.

Anyway, thank you to all the companies that are starting to publish online results presentations/webinars. These are incredibly useful for investors, so please keep doing them, and hopefully make them standard procedure for all companies in future.

Memo to company advisers (many of whom read my reports here): please do everything you can to persuade/bully companies into doing the right thing, and communicating with all their shareholders, not just giving privileged access & information to the elite institutional shareholders (which is actually contrary to company law, by the way).

.

Loopup (LON:LOOP)

Share price: 140p (up 10% today, at 09:04)

No. shares: 55.4m

Market cap: £77.6m

LoopUp Group plc (AIM: LOOP), the premium remote meetings company, is pleased to provide the following statement ahead of its Annual General Meeting (AGM) at 10am today, 24 June 2020.

This is self-explanatory;

In our trading update on 6 May 2020, we noted a material increase in business volumes, driven by the large-scale migration towards working from home associated with the Covid-19 outbreak, and expressed our confidence in exceeding prevailing market expectations in terms of revenue, EBITDA and cash generation for the current financial year to 31 December 2020.

Since that update, the Group has continued to trade materially above pre Covid-19 levels. Whilst it remains difficult to predict near term developments in working practices and business climate, we do now nevertheless expect to exceed revised market expectations in terms of revenue, EBITDA and cash generation for the current financial year.

I want to know what profits are going to be like, not EBITDA.

Still, a second upgrade this year is clearly good news.

My opinion - market conditions this year couldn't have been more perfect for LoopUp - business should be booming, given that physical meetings have all but ceased, due to covid. Therefore, whilst today's update is clearly positive, is it positive enough? From what I'm hearing, meetings are moving onto Zoom, and Microsoft Teams, not onto LoopUp. Although occasionally I do hear "welcome to LoopUp" when joining a conference call, and of course it's tiny in comparison with those behemoths.

LoopUp does have some good product features, and is simple to use. But so is Zoom. To my mind, LoopUp looks a bit of an also ran. It's got a massive market opportunity right now, so let's see what the figures look like next time. It's used by firms of accountants & lawyers, and has an impressive client list. So there could be a decent niche for LOOP.

The balance sheet is weak. Last reported NTAV was negative, at about £(12m). Therefore, I think it might come under pressure to do an equity fundraising to eliminate unwelcome bank debt. That should be possible in the current environment, especially as LoopUp's product is so relevant to current circumstances. I urge management to bite the bullet, and raise c.£15m in fresh equity, which would only dilute existing holders by about 20% - well worth it, to eradicate insolvency risk. My invoice is in the post! ;-)

.

.

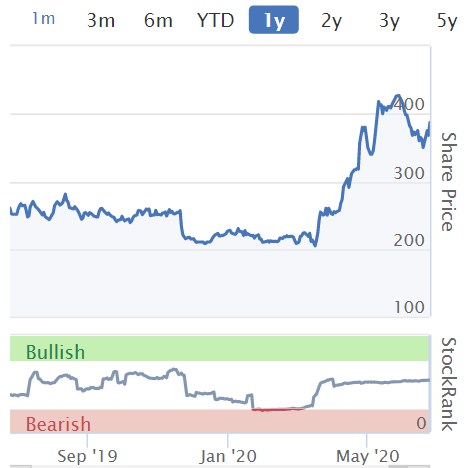

Naked Wines (LON:WINE)

Share price: 386p (up 4.6% today, at 09:08)

No. shares: 72.9m

Market cap: £281.4m

Appointment of joint broker - sometimes a precursor to a placing. [Edit, but not in this case, as it has tons of cash]

Full Year Results for the 52 weeks ending 30 March 2020

There's no explanation given of what the company does, which is not a good start to a results statement. Further down it explains;

Naked Wines connects everyday wine drinkers with the world's best independent winemakers. Why? Because we think it's a better deal for everyone. Talented winemakers get the support, funding and freedom they need to make the best wine they've ever made. The wine drinkers who support them get much better wine at much better prices than traditional retail.

It reversed into Majestic Wines listing, and then sold off that business (the profitable bit).

The company says these are strong results. But it's not making any profit or free cashflow! How is that strong? It's a growth company, but revenue growth was only 14%, to £203m. Adjusted EBIT is a £(1.4m) loss. Why on earth is this valued at £281m, given such poor numbers?

It looks like a situation where cashflows are being recycled into marketing spend to drive growth;

Investment in new customers(6) of £22.9m (+20%)

That's fine, but revenue growth of only 14% seems a poor return for that level of "investment" (i.e. expenditure).

Its claimed 20 year payback of 4.9x cost of acquisition, for new customers, strikes me as questionable. Will customers really stick around for 20 years? I've not seen such an aggressive assumption used by other companies when calculating LTV/CAC. The workings are shown further down in the commentary.

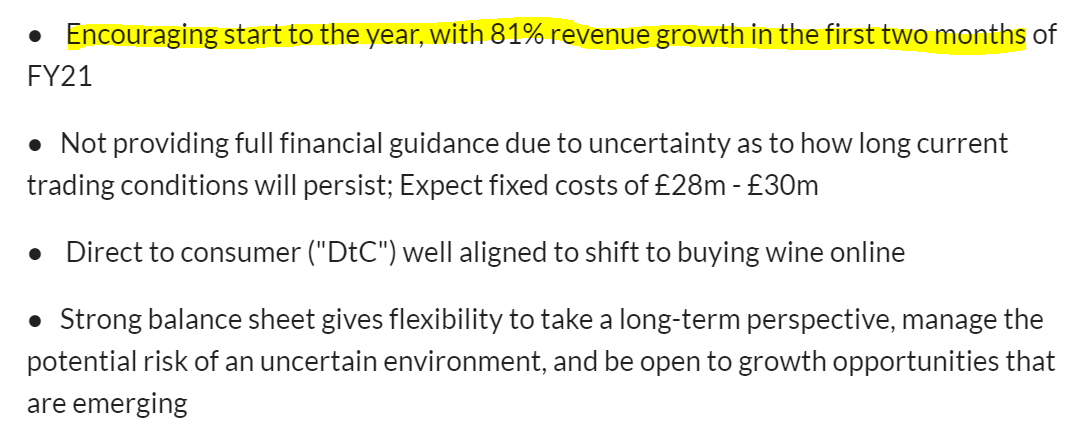

Current trading - this is a bit more like it!

.

.

That's the sort of boost I would expect an online business to be reporting due to lockdown conditions. These conditions are a one-off (we hope!), but should provide a nice springboard for online businesses to grow faster.

Balance sheet - is excellent. This includes £55m of net cash. NAV is £113.6m, less £36m of intangibles, gives a very healthy NTAV of £77.6m. I'm very happy with this balance sheet, and would say there is no insolvency risk. The commentary even mentions the possibility of returning surplus cash to shareholders.

Cashflow statement - is dominated by the disposal of the Majestic Wine stores business, so is not of much use in considering the continuing business.

My opinion - it's an interesting niche business. I like the very strong balance sheet, since this means there shouldn't be any dilution to worry about. If the business model really takes off, then existing shareholders should see nice upside.

As I see things, it's a bit in limbo at the moment. The concept is proven, but the growth is lacklustre. Also it needs to spend up-front, to recruit new customers, and the payback stretches over years. And that's assuming customer churn remains low. The risk with this type of business is that marketing could get more & more costly, then newly recruited customers might not stick around long enough to make it worthwhile for the company. Existing stats on this are not set in stone - they can change over time, as more effective forms of marketing become more expensive, or start to deliver diminishing marginal returns. I'm not saying that will happen, it's just a risk to think about.

How big is the overall market? The company says it's huge. But surely most people are perfectly happy with the vast selection of wines available immediately online or in stores? It sounds very niche to me, wanting to connect with the growers, and sponsor their production. Why bother, when you can get perfectly good wine from supermarkets from £10 per bottle?

Overall then, I think the valuation prices-in too much future progress, and the growth rate is too slow to make me want to pay up with a growth company rating. It's probably a bit too niche for my liking too, in terms of overall market size for this particular concept. I could be wrong there, as it has reported 20% growth in the USA, and there are probably plenty of wealthy wine buffs over there.

I tried out the Naked Wines platform a few years ago, and hope it has improved since then, as my experience was very poor. It struck me as very time-intensive, to research the various vineyards. When I found some I liked the sound of, they were sold out. Overall then, a disappointing experience. Maybe I should try it out again, as that was at least 4 years ago!

The other concern is that the covid premium currently in the price could scrub off, once treatments & possible vaccines enable life to return to normal.

I'm happy to hear from readers who are more positive on this, and why. People often become very certain about the upside potential when they've spent a lot of time researching companies.

.

.

Quick comments now, because my eyes are getting tired.

Wynnstay (LON:WYN)

Up 10.5% to 273p today (at 11:47) - Interim results for 6m to 30 April 2020 - looks positive, with a resilient performance (profit up). Balance sheet is surprisingly strong, given the market cap, so I like that. Maintaining the divi, which sends a strong signal of confidence. Expects trading backdrop to "remain difficult", but that hasn't stopped it trading well in H1.

Overall, I think this looks quite good - worth a closer look.

.

Tribal (LON:TRB)

Trading update - in line with expectations (remember that type of update?!).

The commentary sounds encouraging - the company & its customers adapting to working remotely. Minimal interruption to project implementation. No noticeable attrition to annual contract renewals. Sales pipeline good, but delays occurring due to uncertainty over higher education student numbers (that's got to be a big risk right now, due to covid, and students deferring for a year - why pay £9k fees, to get a few tutorials online?)

Overall, it looks a reassuring update for existing holders. I can't see any particular reason to want to buy, at the current price, which looks about right (PER of 14). Its track record is lacklustre, with the shares being lower now than 5 years ago, hence I find it difficult to conjure up much enthusiasm for this share.

.

Stuff that didn't make it into today's report;

Futura Medical (LON:FUM) and Open Orphan (LON:ORPH) - both of these are pharmas, which is a sector I don't cover, because it needs specialist sector knowledge to add any value, which I don't have. Please note that for the same reason, I don't cover any natural resources stocks. I have to draw the line somewhere, because there's only one of me, and a couple of thousand listed companies!

Pebble (LON:PEBB) also reported today. It floated in Dec 2019, so I've not looked at it before, and don't fancy spending a couple of hours looking at something new.

Therefore, I'll sign off for the day! As usual, thanks for your contributions in the comments (well, most of them anyway).

Best wishes, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.