Good morning, it's Paul here with the SCVR for Wednesday.

Timing - I've got essential travel today, so will have to finish early - estimated at noon. Update at 11:26 - change of plan, I'm going to print off the results for DLAR, and review them on the train home to Bou'mth. Then I'll type up my notes once I'm home, so late afternoon.

Agenda - these announcements look interesting;

Gear4music Holdings (LON:G4M) - Director selling (Paul, done)

Scs (LON:SCS) - AGM Statement & Board changes (Paul, done)

D4t4 Solutions (LON:D4T4) - Half year results, six months to 30 Sept 2020 (Paul, done)

Fulham Shore (LON:FUL) - AGM statement & trading update (Paul, done)

De La Rue (LON:DLAR) - Half year results (Paul, to do later)

.

Gear4music Holdings (LON:G4M)

(I hold - Paul)

730p (unchanged) - mkt cap £157m

There were 2 announcements last night, detailing that 4 Directors of this online musical equipment retailer are selling some of their shares at 730p (market price). These have been placed with institutions?

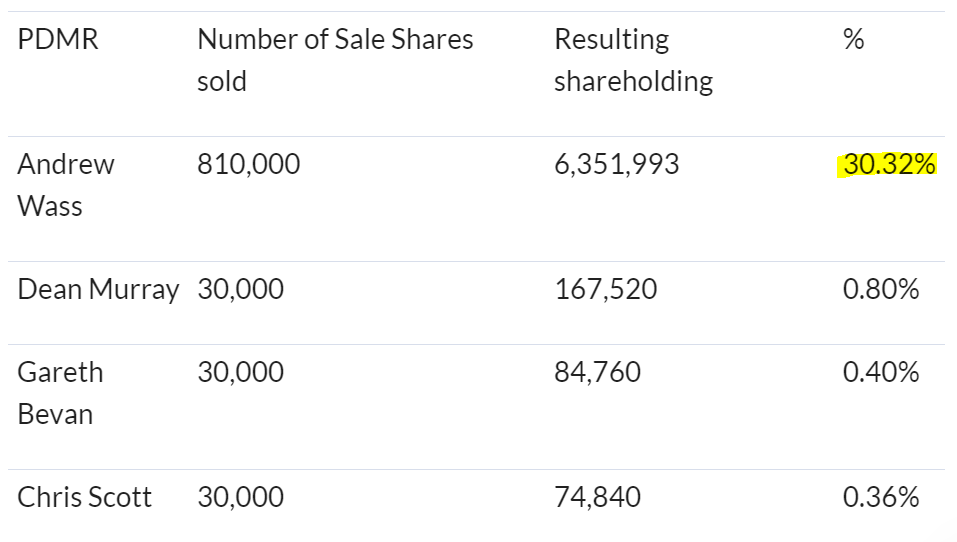

Should we be concerned about this? I don’t think so, because the Directors (mainly the founder CEO) still have tons of skin in the game;

Following the sale, these PDMRs would in aggregate hold approximately 6,679,113 ordinary shares, representing 31.88 per cent. of the Company's issued share capital (a decrease from 36.18 per cent.).

In my opinion, it is only to be expected that founders of successful businesses want to take some money off the table at some stage. People want to buy nice houses, help others, and enjoy themselves a bit, and why not? For me, it’s all about the scale of their remaining holding. If Directors with big shareholdings (i.e. £millions) sell more than half their holdings, then that rings an alarm bell for me, and I would probably follow them out of the door.

However, in this case, the founder CEO still holds a huge stake, so I don’t have any concern about this part disposal. The fact that institutions lapped up the sale shares quickly, and at no discount, shows encouraging stock market demand.

I recently bought back into G4M, as numbers published were impressive. The downside scenario is that very strong trading this year could be a one-off, due to lockdowns. That might be true in part, but I think the sector is clearly one where people seem to be shifting structurally to buying online. Hence my view is that growth may have accelerated in 2020 due to one-off factors, but is likely to continue long-term.

G4M’s strategy of focusing more on margin than revenue growth (it’s actually achieved both this year) is the right way to go, and is working very well, with a series of upgrades throughout this year. I think the current forecasts still look too low. By my calculations, I reckon a share price of c.1000p looks more rational that the current price of 730p. Mind you, shareholders need to be braced for possibly poor results vs strong lockdown comparatives from 2020, in H1 of FY 3/2022.

.

.

EDIT: An additional point that irks me, and many other investors, namely this claptrap in the RNS;

The PDMRs have advised the Company that their sales of ordinary shares in the Company are to satisfy existing market demand.

This is nonsense, that we often hear when Director sales happen at many companies. It's simply not true! They are selling because they want to turn some of their shareholding into cash, and find the market price acceptable. The fact that there is market demand is helpful, but it's clearly never the main reason for selling.

End of edit.

Scs (LON:SCS)

Share price: 194p (down 2%, at 08:46)

No. shares: 38.0m

Market cap: £73.7m

(I hold - Paul)

ScS, one of the UK's largest retailers of upholstered furniture and floorings, provides the following update ahead of the Company's Annual General Meeting ("AGM")

The summary says;

Trading in line with the Board's expectations; new CEO appointed

Strong order intake this financial year 07/2021 - note the pent-up demand in Aug, Sept, Oct. Then a drastic fall more recently, to be expected due to the second lockdown, forcing most of its shops to close. This is not a concern to me, because ScS has already demonstrated that it recoups lost sales in lockdowns, when demand returns afterwards. Plus, it benefits from people wanting to spruce up their homes.

.

Lockdown 2 should be less disruptive than the first, because it’s shorter, and less severe;

Unlike the first national lockdown, and in line with government guidelines, our regional distribution centres have remained operational and continue to deliver goods to our customers.

Liquidity - ScS is swimming in almost embarrassingly large amounts of cash - substantially more than its market cap! (although a lot of the cash is up-front deposits paid by customers);

At 21 November 2020, the Group's cash balance totalled £113m and had no debt.

Further liquidity is available through the £20.0m CLBILS revolving credit facility (RCF) granted on 25 August 2020.

Note that larger competitor Dfs Furniture (LON:DFS) was forced to raise fresh equity earlier this year, due to its desperately weak balance sheet, with large negative NTAV. Whereas ScS has actually reduced its share count in the last 5 years, due to a share buyback. ScS is a superior & safer investment, in my view, due to its low PER and bulletproof balance sheet. Whereas DFS looks precariously financed, so only of interest to investors who don’t look at balance sheets!

My opinion - I reckon the broker forecasts at ScS seem too cautious still, so am hoping for a good boost when we see the next interim results in spring 2021. I’m also more optimistic about the resumption of dividends, than the cautious broker forecasts. My personal price target on ScS is c.300p, so good upside from the current level of c.200p. It's safe as houses too, with that balance sheet strength.

Note that IFRS16 has mucked up the debt & enterprise value figures on the StockReport, so that has to be manually removed.

Note that the StockRank is consistently in the green, over the last 2 years;

.

.

D4t4 Solutions (LON:D4T4)

Share price: 209p (down 3%, at 09:48)

No. shares: 40.2m

Market cap: £84.0m

(I hold - Paul)

D4t4 Solutions Plc (AIM: D4t4, "the Group", "D4t4"), the AIM-listed data solutions provider, announces its half year results for the six months to 30 September 2020 (H1 2021).

Preamble - This share has been on my watchlist for a long time. I recently had some spare cash, so decided to dip my toe in here with a starter sized position (c. 1% of my portfolio). Is there any point in opening such a small position? I find it tends to get me more interested, and pay closer attention to something, research & think about it a bit more. Then I either chuck it out, if it does nothing in the next year or so, or buy more to make it a proper position.

Interim results today are in line with expectations.

The company issued a half year trading update, which I reported on here in Oct 2020. I was a bit sceptical about the assurances given that H2 would be strong enough to recoup the H1 shortfall. However, the company then backed up its confidence with contract wins, which I covered here on 5 Nov 2020. Once I’d slept on it, this gave me the confidence to dip my toe in with a small purchase.

My thinking now is that data seems an area that everyone tells us is incredibly important, and as D4T4 is winning contracts with big organisations, it must provide good software & services. Quite simplistic really, the way I’m looking at this. The reason to hold this share, is not so much about valuation (which looks expensive), but the opportunity if it can scale up.

Recent broker notes indicated that a lot of the required H2 sales are already in the bag, so it’s not such a stretch to imagine full year forecasts can be met, despite the weak H1. These notes are available on Research Tree.

To save me re-typing it all, here is slide 7 from the presentation pack for today’s interims;

.

The above is all self-explanatory. I’ve reviewed the accounts, and it all looks fine.

Balance sheet - very strong, with plenty of cash.

Note that it hardly capitalises any development spend, which I like - conservative accounting.

Online capital markets day, Oct 2020, is available to watch on a recording here. You need to just put in your details, then it goes straight through to the video. It’s over an hour long, so I’ll park that to one side and watch it later.

Outlook - an excellent pipeline with a healthy increase in new opportunities. ….

Although a number of contracts slipped past the half year end by a few weeks they have since closed and we now have exceptional revenue visibility for this financial year.

We continue to invest in our international markets, product innovation and strengthening our partner relationships in line with the substantial market opportunity that is presented to us.

Overall, we are in a good position. The strength of the Group's balance sheet and excellent short, mid and long-term prospects provides the Board with significant comfort and a high level of confidence in prospects for the current financial year and beyond.

My opinion - D4T4 looks quite interesting, but is difficult to value at this stage. Previous results have been lumpy, shareholders just have to accept that’s the nature of the business.

.

.

Fulham Shore (LON:FUL)

Share price: 9.125p (up 6%, at 10:54)

No. shares: 609.6m

Market cap: £55.6m

AGM Statement & Trading Update

This update is for FY 03/2021 to date. The group operates mainly Franco Manca pizza/pasta restaurants, and the smaller chain of The Real Greek casual dining restaurants. Both are good, popular, and well differentiated formats in my opinion.

Here’s my summary of today’s update;

- Q1 - loss-making due to lockdown 1

- Q2 - reopened, should recoup most of Q1’s losses, but at the headline EBITDA level (i.e. approximates to cashflow)

- Q3 & Q4 - not possible to predict, as performance depends on Govt restrictions

- Most branches are currently open, but just for delivery & takeitaway

- Lower rents being offered for new sites

- A few new sites opened

My opinion - the opportunity here is to look past covid, and imagine that trading is likely to be buoyant after Easter 2021, when I imagine restrictions are likely to be permanently removed, due to widespread vaccinations of the vulnerable. Let’s hope so anyway, but that’s looking a reasonable viewpoint, and was recently confirmed by the Health Secretary as being likely. This gives a lot of potential upside for retailers, hospitality/leisure, travel, and other sectors which have been under so much pressure due to covid/lockdowns.

For this reason, I’m looking at what companies are likely to be worth, once they can trade normally again. The market seems to be doing the same thing in the last few weeks, substantially re-rating a lot of cyclical shares. I think the big recovery in many cyclical stocks is justified (in most cases), but maybe some have run up too much, too fast? Profit taking seems to be happening now.

The problem I have with FUL, is that the valuation now seems to have already baked in most of the upside. Therefore, on a valuation basis, I don’t see enough upside to get me interested. Whereas some other shares, e.g. Saga (LON:SAGA) (my 2nd largest position) I see a possible multi-bagger with a 2-year view. So why would I want to put money into FUL, where I see little upside on a rational valuation basis? It just doesn’t appeal to me, due to the high valuation. Although it’s possible that investors may chase the share price higher, because they like the format of the restaurants. It’s been over-valued in the past, and the 5-year share price history is quite poor, because it started off far too expensive.

I’m also concerned that competitors doing CVAs, which large numbers are currently doing, could leave FUL with an over-rented estate, facing stiff competition on lower rents. Business rates are likely to kick in again in 2021/22 too, maybe phased in, at a reduced level to begin with, but the Govt needs the tax revenue longer term (unless you buy into Modern Monetary Theory, where they can just print the money instead!).

.

.

I have to leave it there for now, but should be able to finish off the section on DLAR late afternoon (or worst case, tomorrow).

Regards, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.