Good morning, it's Paul & Graham here!

All done for today, see you tomorrow!

Update from Graham: Hi everyone, I have a brief interview tomorrow with the CFO of FTSE-250 hotel group PPHE Hotel (LON:PPH). If you have any questions you'd like me to submit to him, please let me know in the comments below. PPHE is a company I've been positive on, e.g. when it announced its most recent share buyback in July. So I'm looking forward to an interesting chat with the CFO, and some reader questions would be appreciated - cheers!

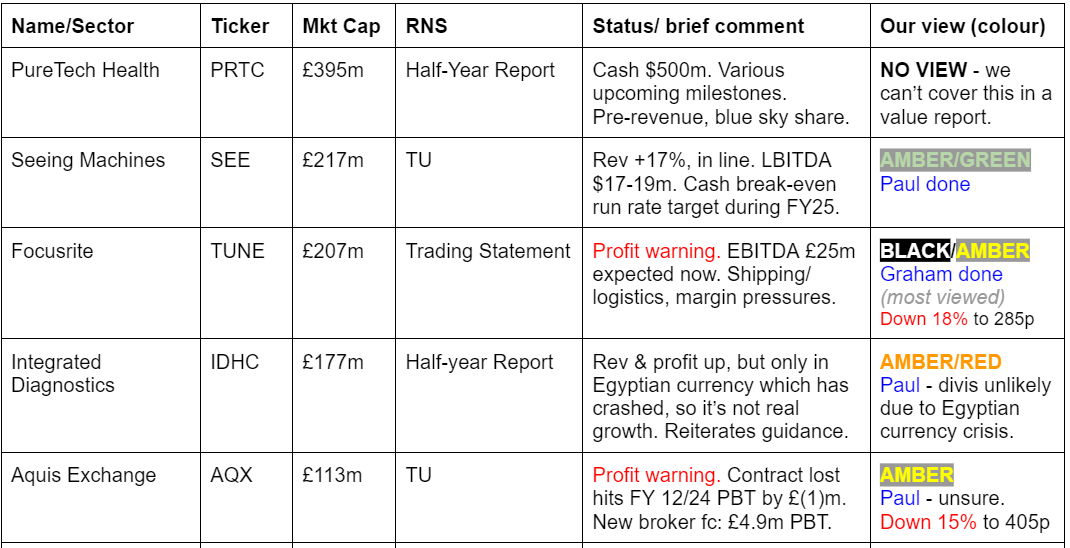

Explanatory notes -

A quick reminder that we don’t recommend any shares. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps (usually) between £10m and £1bn. We usually avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech, investment cos). Although if something is newsworthy and interesting, we'll try to comment on it. Please bear in mind the "list of companies reporting" is precisely that - it's not a to do list. We typically cover c.5 companies per day, with a particular emphasis on under/over expectations updates, and we follow the "most viewed" list of readers, so if you're collectively interested in a company, we'll try to cover it. Obviously with the resources available, we can't cover everything! Add you own comments if you see something interesting, and feel free to discuss anything shares-related in the comments.

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to, if they are using unthreaded viewing of comments.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced. And/or it's such deep value that we see a good chance of a turnaround, and think that the share price might have overshot on the downside.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

Others: PINK = takeover approach, BLACK = profit warning, GREY = possible de-listing.

Links:

Paul & Graham's 2024 share ideas - live price-tracking spreadsheet (2 separate tabs at bottom), Video update of results so far, June 2024.

** New SCVR summary spreadsheet for calendar 2024 ** This is the live one! (updated 26/8/2024)

Archive - SCVR summary spreadsheet for calendar 2023.

Paul's podcasts (weekly summary of SCVRs & macro views) - or search on any podcast provider for "Paul Scott small caps" - eg Apple, Spotify.

Phil Hanson's data analysis measuring performance of our colour-coding system in the SCVRs, from July 2023- Mar 2024 (with live prices). My video explaining/reviewing it.

My other video (June 2024) - How to screen for broker upgrades on Stockopedia.

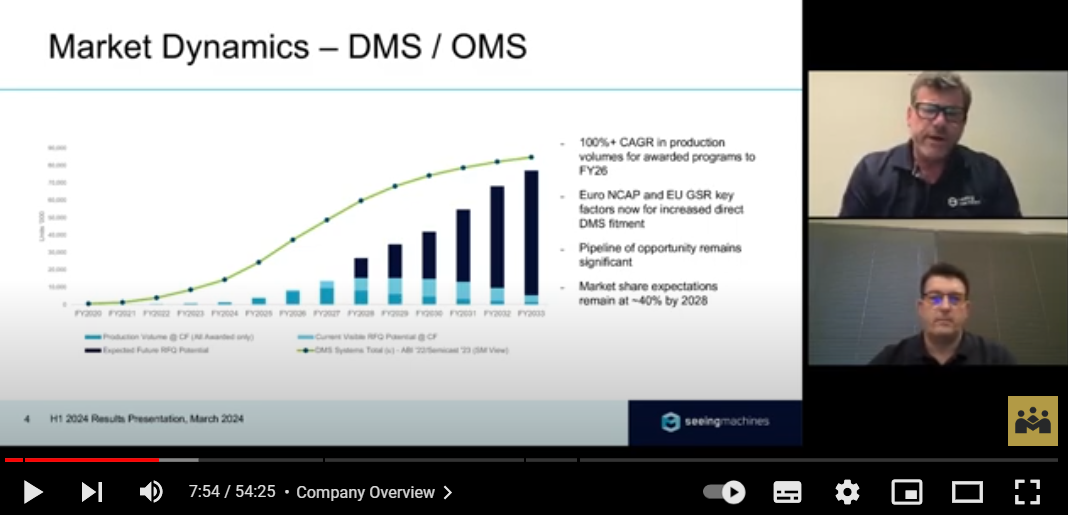

Companies Reporting

Summaries

Naked Wines (LON:WINE) - up 3% to 52p (£39m) - FY 3/2024 Results - New CFO - Paul - AMBER

Not as bad as you might think. For me the refinancing in July 2024 was key to reducing risk, and I'm happy to stick at AMBER today. It's a shrinking company, with way too high inventories, with soft current trading, so I think another profit warning looks quite likely. That said, the shares are very cheap now, so any glimpse of improving fundamentals could produce a strong bounce. Not a good business though, based on track record to date.

Focusrite (LON:TUNE) - down 15% to 296.5p (£176m) - Trading Statement - Graham - AMBER

A profit warning from TUNE as the planned H2 weighting does not materialise in full. Broker forecasts are closely guarded which is a shame, but the new full-year EBITDA estimate is £25m and we can expect a large gap between that figure and after-tax net profits. This one strikes me as fairly priced, so I’d be in little rush to buy in at current levels.

PCI- PAL (LON:PCIP) - down 2.5% to 56p (£41m) - Trading Update, New Partner and Notice of Results - Graham - AMBER/GREEN

This profit warning doesn’t concern me too much, as it’s simply revenue (not cash, which has already been received) slipping from one financial year into another. Instead, I’m more interested in the decent rate of revenue growth (20% this year, 24% forecast next year) as the company tries to cross the bridge into profitability. There is more to like than dislike here, from my perspective, and so I approve of the moderately positive stance we’ve taken.

Seeing Machines (LON:SEE) - down 1% to 5.1p (£213m) - FY 6/2024 Trading Update - Paul - AMBER/GREEN

Not the easiest thing to unpick, I don't think the communications has been good here. It's making progress, increasingly driven by legislation requiring automotive manufacturers to fit this technology to new cars. Cash looks OK for now, but continuing losses expected in FY 6/2025 mean it's a painfully slow journey to breakeven. Very difficult to value this share at this stage. But I still like the overall story, which is credible.

Paul's Section

Some stragglers from yesterday

Some interesting stories worth noting -

Ryanair Holdings (ISE:RYA) - rose 9% to 1305p - has completed a 700m Euro share buyback (launched on 21/5/2024).

O’Leary is quoted as saying fares price weakness has “levelled out” instead of fears they would fall further.

A follow-on buyback of up to 800m Euros is starting immediately, ending not later than 31 May 2025. Big numbers.

Press article quotes Michael O’Leary as saying that drunken/drugged customers are causing incidents (sometimes violent) on more flights. Worst culprits are from Northern English cities (eg Manchester, Liverpool), and by far the worst behaved flights are to Ibiza.

easyJet (LON:EZJ) rose 7%, and Jet2 (LON:JET2) up c.5%, so looks like a wider positive move for airlines as read-across from O’Leary’s comments on airfares having stopped falling maybe?

Next (LON:NXT) - down 1% yesterday. It lost an equal pay employment tribunal, to a group of 3,500 current & former women shop workers, who claimed they should have been paid more, in line with (mostly male) warehouse workers. Next said it just paid the going rate, irrespective of sex. The tribunal rejected that. I see this as a big worry for retailers (especially supermarkets) - the cost of compensating workers for Next is said to be £30m - well that might just be the tip of the iceberg, as it goes back 6 years, so the bill for say the supermarkets would likely be multiples of that. Similar cases against the supermarkets are in the pipeline apparently. I wonder if ambulance chasing type legal firms might latch onto this, will we start seeing TV adds from claims4u or whatever? Could get very expensive. This strikes me as a worrying case, as it overturns the concept of pay for different types of jobs being decided by free markets. So I’m likely to steer clear of any large retailers with lots of warehouse and retail staff until there’s more clarity.

Barratt Developments (LON:BDEV) - down 7% yesterday. No company-specific news, but commentators attribute this share price fall to another fire on a residential block with defective cladding, in Dagenham this time - BBC report here. Thankfully everyone was evacuated, with no fatalities this time. The BBC says of the 4.600 buildings with defective cladding, only half have been (or are being) repaired. The Deputy PM has said remediation is “far too slow”. Housebuilders have already had to make substantial provisions for the cost of cladding remediation, so I suppose the worry is that the new Govt might clobber them again for more costs & faster action? Personally I’m not touching housebuilders, as I think they’re sitting ducks for some kind of punitive taxation. Set against that is that the new Govt wants more houses built. So who knows how it will pan out?

Bunzl (LON:BNZL) Bunzl - a big riser yesterday, up c.7%. I intended to take a closer look at this larger cap, but it quickly became clear it wasn’t a quick job, so I abandoned it, sorry about that. Shares hit a new all-time high, and it has a wonderful long-term chart. Ahead of expectations trading update yesterday, raising the 2024 profit outlook from slightly above 2023, to a “strong increase”. Substantial share buyback also announced. Valuation metrics seem reasonable, this share could be worth a closer look, just not from me right now!

Applied Nutrition - a potential IPO, c.£500m mooted valuation, for a protein shake maker, with impressive growth and profits. It has some interesting Directors with good experience. I will take a look at this once it lists on the main market. Brokers trashed the IPO market in 2021, with numerous over-priced, and often junk floats. We need quality companies floating in London, not more of the speculative rubbish that clutters up AIM in particular. This one looks worth a look from the initial information. Great to see another sign of the UK market coming alive again.

Paul’s Section:

Naked Wines (LON:WINE)

Up 3% to 52p (£39m) - FY 3/2024 Results - New CFO - Paul - AMBER

New CFO is joining 11/11/2024 - Dominic Neary. He’s currently CFO at Mind Gym (LON:MIND) “where he has helped return the business to profitability, whilst building scalable global operations.”

Checking the figures, MIND made a profit in FY 3/2023, but then saw a poor FY 3/2024 with revenues down 18%, and a move back into losses. Although it trumpeted a profitable H2 within that year, due to deep cost cutting. MIND shares are around an all-time low today, down 88% from its all-time high in Jan 2020. Market cap is currently £24m, so hardly a success story, although the FD can’t be blamed for that. He’s previously had other finance roles in larger companies too. So I can completely understand why Mr Neary (not our one!) wants a new gig. Is he jumping from the frying pan into the fire (one troubled small cap to another), I wonder? I suspect a new CFO at WINE could well “do a Rachel Reeves” (my new name for kitchen-sinking) - tell everyone that they’ve discovered a black hole, and do a massive provision against the wine lake of unsold inventories at WINE. That’s just my hunch though, time will tell.

Full year results for the 52 weeks ended 1 April 2024 (which I will call FY 3/2024)

“Naked Wines is not just an online wine retailer; we're trailblazers on a mission to enable enthusiastic wine drinkers to enjoy great wine without the guesswork.

Founded in 2008, on the pillars of quality, choice and fair pricing, we set out to create the most inclusive wine club in the world - dedicated to transforming the wine-buying experience and empowering people to make their own wine choices, and championing world-class independent winemakers. We've proudly been delivering outstanding wines to our customers (who we call Angels) for over 15 years.

Our business model is simple yet innovative: Naked Wines funds the production costs for winemakers upfront, allowing them to focus on creating exceptional wines without the financial burdens of traditional wine production, while passing the resulting savings back to our customers.”

Its gushing style of prose does sometimes make me wonder if the people who write its RNSs are keen on sampling the products?

Sounds a terrible, cash absorbing business model to me. I think it’s fair to say that this business model has been tested to destruction, and it doesn’t work - as in it doesn’t make any consistent profits, apart from a blip during the pandemic when it was more difficult for customers to get to the shops, and we were all twiddling our thumbs thinking up ways to blow our furlough money online. Wine was a good option at the time!

Some numbers for FY 3/2024 -

Revenues fell 13% vs LY to £290m (on a properly comparable basis of 52wks vs 52wks. Actual was -18% as it’s 52wks vs 53wks)

The adjusted numbers & various KPIs are all rather confusing, so in situations like that, I tend to go to the statutory results, then work out if I can tolerate any adjustments to these numbers -

From this I can glean -

It’s a shrinking business, with revenue & profit both well down.

US inventory provision is a cost in both years, what else lurks below the surface I wonder?

Deep cuts to general & admin costs, but advertising costs actually rose (so clearly not very effective spending at winning new business).

Impairment of non-current assets is nearly all goodwill write-offs, so I’m happy to ignore this cost of past mistakes, because it has no cash cost now.

Note that finance income (interest on customers’ cash) is lower than (rising) finance costs.

Why is it paying corporation tax when loss-making? Some seems to be overseas tax.

Loss on redemption - £12m was due to be paid to WINE by Majestic Wines in Dec 2024, but as WINE is desperate for cash, they agreed to early settlement in return for a £3.0m discount. This is a one-off, so can be adjusted out.

My version of adj PBT is therefore: £(16.3)m statutory loss before tax above. Add back: £9.9m goodwill impairment, and £2.6m one-off re vendor loan = £(3.8)m adj PBT - so a modest loss, not a disaster, but obviously not good either. Using a similar basis, I make the LY comparative a £(0.9)m loss, but that includes a larger hit from inventory writedowns. Overall then, I think performance has worsened in FY 3/2024 vs LY.

Guidance for FY 3/2025 - is admirably detailed, and I like them giving us a range, this is the best way to provide guidance, all companies should do this, rather than trying to be exact when there are so many things that could change.

I’ve highlighted the only numbers that matter to me, and they need to be added together of course to arrive at adj PBT range, which is from £(4)m loss to £4.5m profit. Not very exciting, if this is presumably management’s optimistic view of what might happen. Bulls have to hope they’re being cautious and hope to beat this guidance. Although history shows that’s not a likely outcome with this company.

Current trading - doesn’t inspire confidence, as this means they’re slightly under-performing already in the new year (Apr-Jun 2024) - what about July & August? -

“Q1 trading broadly in line with expectations”

Balance sheet - big problems here previously, mainly excessive inventories. This is as a result of its (I think) deeply flawed business model of funding production of wine up-front - the opposite of what I look for in any business. I want someone else taking the risk & financing production. Although to be fair, WINE gets the cash up-front from its customers, so it’s their money really, with WINE as a middleman.

As it’s my biggest concern (by far) about WINE, I’ll repeat in full what they say about it today - I think this has scope to produce more bad news in future, so I am very wary about this problem -

“The inventory issue we faced requires some context. At the height of COVID, the team in place at the time entered into a number of contracts assuming that COVID levels of demand would persist for an extended period. This proved to be an incorrect assumption, which took an unhelpfully long time for the team to recognise and remedy.

This has been compounded by a US bulk market that has the highest oversupply ever recorded. There are several reasons behind this, the main one being that the US has had three harvests in a row without the usual natural disasters of floods, drought, fire and frost. This has meant that Naked's ability to sell off surplus inventory in the bulk market has been severely hampered.

What we have done about it

1. We have stopped the problem getting worse - we have negotiated with our suppliers to reduce or cancel shipments to stop new wine coming in. We have done this intelligently to ensure that we can maintain a competitive range and support our strategic suppliers.

2. We have set up a separate team with the sole focus of clearing the surplus through third-party sales.

3. Where we can do so, we are taking the opportunity to increase volumes through our own channels, at lower margins, without cannibalising our core proposition.

The good news in all of this is that the inventory is high quality and almost all from the winemakers we expect to keep working with for the long term. Where we have not seen a path to selling inventory before it is likely to deteriorate, we have bitten the bullet and cleared or written off that inventory.

I would like to thank our winemakers for their continued support through this process. While the results of a lot of our work remain to be seen, gross inventory (i.e. before any provisioning) has dropped 10% during FY24 and we expect it to continue to fall significantly during FY25.”

Inventories overall are still very large at £131.6m, although some progress has been made, that’s down c.10% on LY. However, revenue was down 13%, so I would expect inventories to mirror that, so it’s not a decrease relative to sales.

It separately discloses “Inventory staged payments to winemakers”, which has fallen nicely from £20.2m to £13.3m in the year.

There’s a really simple way of looking at WINE’s balance sheet actually which has just occurred to me. Since fixed assets are small, and non-current liabilities are also small this year (due to debt moving up from non-current to current), then we can just ignore them completely. That leaves the working capital section of the balance sheet as the only bit that matters, which is this -

Net cash is only £19.6m, but it’s had £68.3m in cash up-front from the Angels (customers). That’s because WINE has spent the customer cash on buying wine. That’s fine as long as customers remain customers, but as we know there is attrition, and as customers disappear, the working capital position deteriorates.

Overall, the need to slash inventories is more clear than ever - that is absolutely key here, and not enough progress has yet been made.

Refinancing - seems a very positive development, previously announced on 9/7/2024, which is why I upped my view from RED (on both 18/3/2024 and 20/3/2024 - when WINE looked in serious trouble), to AMBER on 9/7/2024, to reflect a major change in that a new & improved credit facility had been agreed with PNC Bank, secured on the inventories. It’s a 5-year facility from July 2024, for a maximum of $60m, secured on group assets, primarily inventories. Cost looks reasonable, at 2.75-3.25% margin over SOFR (US based, currently 5.3%). There’s only one covenant, and only tested in certain circumstances.

This facility is mainly to provide liquidity if there’s a run on customers wanting to withdraw their cash.

Current net cash has fallen since the year end - which is a concern -

“At the unaudited management reporting period end closest to the completion date of the facility on 8 July 2024, the Group held net cash excluding lease liabilities of £15.3m. On completion, the facility had available liquidity of $48.1m.”

This net cash figure is down c.£5m from the year end number, which suggests WINE is continuing to make losses, and probably hasn’t made any meaningful reduction in inventories recently. It’s not clear to me why they can’t (or don’t want to) give a bang up-to-date cash position, not one from c.7 weeks ago?

Cashflow statement - is a huge improvement on last year, when inventories really exploded upwards. This year it got inventories down a bit, plus had the one-off £9m benefit of receiving the Majestic loan note early. Excluding one-offs, it operated around cashflow breakeven - not a disaster.

Paul’s opinion - I remain of the view that WINE just isn’t a very good business. It’s been badly run in the past, hopefully now improving, but this has the look of a business struggling to manage decline, rather than being on the front foot, let alone generating “profitable growth” (the ridiculous phrase, which is used 8 times in today’s announcement!) Dear oh dear. Maybe we could get AI to measure how share prices perform, and if there’s any link between performance and the number of times this woolly phrase is used by companies?! At the moment WINE isn’t either profitable, nor producing growth.

Bull points -

- Management has stabilised things.

- Refinancing gives a secure cash/liquidity position, so risk of a 100% loss looks remote, and there would probably be plenty of time to exit beforehand if things do deteriorate.

- Shares are so cheap, that any meaningful improvement in performance could give you a speculative multibagger.

- Could be value in the brand name to an acquirer maybe?

Bear points -

- Just not a very good business model or sector, with lots of competition, and no reliable/repeatable profits ever made by WINE.

- Inventories still way too big, with more write-offs being highly likely in my opinion, especially with a new CFO coming in.

- High risk of more profit warnings, given soft Q1 trading, and history of over-optimism.

Pulling it together, I think this is a pretty rubbish business, but at £39m market cap, there could be a speculative potential trade here, for people who are prepared to take a bit of risk. Hence I think AMBER is a fair overall assessment - it could go either way. I think management have actually done quite well to put it on a more secure footing so far, but none of us have any idea what the future holds.

The 5-year chart below shows an epic pandemic boom in sentiment, stoked by crazy Americans hyping it up (I remember it being pumped on CNBC as this miraculous new "platform" or possibly even "ecosystem", I can't recall precisely which) -

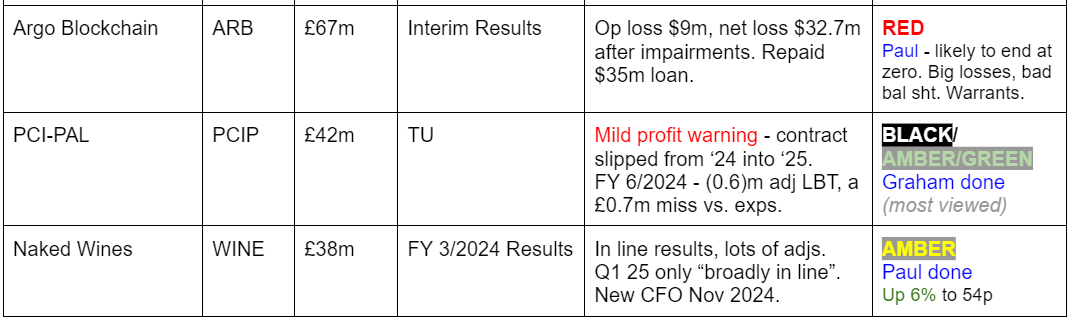

Seeing Machines (LON:SEE)

Down 1% to 5.1p (£213m) - FY 6/2024 Trading Update - Paul - AMBER/GREEN

Seeing Machines Limited (AIM: SEE), the advanced computer vision technology company that designs AI-powered operator monitoring systems to improve transport safety, provides a trading update for the year ended 30 June 2024 ("FY2024"), based on unaudited numbers.

I like the story here, having been AMBER/GREEN previously this year, after the business model & prospects were explained to me properly on a call with management in early 2024. The quick version is that it’s an established leader in eyeball tracking software which improves driver safety. This technology is now becoming mandatory on new cars in the EU, and possibly other countries. SEE has good and growing visibility on vehicle manufacturer contracts, so it can predict strongly growing revenue growth. Revenues are a fairly small one-off licence fee (SEE doesn’t manufacture anything), but for millions of vehicles, which should drive strong growth in revenues and move it into profit. SEE reckons it can do that before it runs out of cash.

My only quibble was the change in wording of the last 2 updates. Its Q3 KPIs update (7/5/2024) confirmed in line with market expectations. Q4 KPIs update on 9/8/2024 dropped that wording, so declined to say if trading was in line with expectations or not - understandably raising a question mark. Despite that I’ve stuck at AMBER/GREEN the last 3 times we’ve looked at it this year, reversing a RED on 9/2/2024 when I was worried it needed another placing and might miss forecasts. Both those worries now seem OK. Although SEE has no track record of profitability, so it can only be valued on guesses about its future profits, which is a tricky business, especially at £213m market cap - a lot for something that is still jam tomorrow and cash-burning.

“Revenue and cash for 12 months ended 30 June 2024 in line with expectations”

There’s something important missing from the sentence above - profits! So by omission, it sounds like they’re telling us it has missed profit forecast (as I suspected from the Q4 KPIs update a couple of weeks ago).

Further down it mentions EBITDA -

“Further to announcement on 26 June 2024, EBITDA loss expected to be in the range of US$17-19m”

That 26/6/2024 announcement related to receipt of a $16.5m one-off, up-front 5-year licence fee from Caterpillar - usefully bolstering the cash position. I remember that RNS, but didn’t spot that it also contained a trading update, which said -

“Subject to final revenue recognition associated with the Revised Agreement with Caterpillar and the final outcome on Automotive royalties for Q4 2024 it is expected that Cash EBITDA will be lower than market expectations. This has been largely driven by Aftermarket margin mix due to the slower than expected transition from Guardian Generation 2 to Generation 3 and the previously reported adverse Automotive royalty volumes and mix during the year. Automotive royalty volumes have improved during Q3 2024, delivering 74% growth in unit volume for the year to date.

Despite Cash EBITDA being lower in FY2024, the Board confirms that the business is funded to deliver on the Seeing Machines business plan and reiterates its expectation to achieve a cash flow break-even run rate in FY2025.”

[from RNS 26/6/2024]

So there seems to have been a bit of confusion on what the FY 6/2024 profit (or rather loss) would look like, as also seen in the broker consensus figures (we don’t have access to the full broker notes, a glaring omission that SEE needs to sort, given that this share is likely to attract a lot of PIs. The Stifel note mentioned on SEE’s website cannot be opened by us, it’s reserved for institutional accounts at Research Tree) -

Revenue growth of 17% to $67.6m ($5m from Caterpillar licence fee) isn’t madly exciting for FY 6/2024, especially as it leaves SEE still substantially loss-making at EBITDA loss of $(17) - $(19)m.

Most revenues are not recurring, with ARR only up 11% to $15.1m.

Cash looks OK at $23.5m, after receipt of the $16.5m Caterpillar fee.

Lifetime value of $392m for contracts won to date is impressive, and “majority” of this is expected over the next 4 years to FY 6/2028.

Outlook - note the words “run rate”, indicating that FY 6/2025 as a whole is likely to be another loss, with FY 6/2026 being the first likely year of profit -

“...we are well placed going into the new financial year and reiterate our expectation to achieve a cash flow break-even run rate in FY2025."

Seeing Machines is well positioned across all key transport sectors as growth momentum continued to accelerate in FY2024.”

It has growth potential in other sectors apart from cars, such as buses, aviation - more info in today’s RNS.

Paul’s opinion - it’s going in the right direction, but maybe not as quickly as I would want for a £213m market cap.

Another loss is likely for FY 6/2025, before finally achieving profit in FY 6/2026. So this share does require continuing patience.

Rather than having to make a leap of faith, I think the company needs to better inform private investors on the contracted forward revenue streams. It’s all very well giving the multiyear total, but I think it needs to be split out in a table on an annual basis. I seem to recall seeing a slide giving this information, but it might have been in an institutional presentation a while back?

I’ll have a watch of old videos on IMC and Proactive to see if I can find more clues.

EDIT: I've found the slide in the recording of SEE's H1 2024 results webinar on IMC, this is the slide (sorry for low resolution, as it's a screenshot). The green line is expected volume in royalties, or unit volumes, I'm not exactly clear. The darker blue bars are the existing orders. The lighter blue & black are various categories of pipeline expected. Watch the video yourself for more clarity.

Overall I’m not quite as keen as I was, but there is a good and credible story here, which seems to be playing out, driven by EU regulations.

It’s tricky to value though, as the entire market cap rests on what profits (if any) it might make in future, and that’s not at all clear at present.

I’ll just about stick with AMBER/GREEN for now, but don’t feel any compulsion to buy at the current price with considerable uncertainty over valuation. Although with very high gross margin royalties rising in future years, the operational gearing here on profits could be remarkable. That's why I'm staying positive.

This share is good reminder of just how slow blue sky projects are to turn into reality. It's been listed c.19 years, with the same product & story all that time. It's only now that the story finally seems to be approaching commercial viability - with the share count up to 4.16bn shares! Hence a good reason to avoid early stage blue sky things, which nearly always fail, and instead look at shares like SEE which are the rare ones which have got to the commercialisation in scale stage.

Graham’s Section:

Focusrite (LON:TUNE)

Down 15% to 296.5p (£176m) - Trading Statement - Graham - AMBER

Focusrite plc (AIM: TUNE), the global music and audio products group supplying hardware and software used by professional and amateur musicians and the entertainment industry, provides the following update on trading for the year ending 31 August 2024 ("FY24").

This is a bad news update, I’m afraid. Kudos to Paul who highlighted the expected H2 weighting back when H1 results were released, and flagged the risk that H2 weightings can sometimes be “deferred profit warnings” (April).

Here’s a brief overview of what we’ve got today:

FY August 2024 revenues £157m, in line.

Audio reproduction division: in line.

Content creation division: as before, this remains challenged. Focusrite says that this division is outperforming the broader market, but that broader market includes “macro-economic weakness, channel consolidation and an oversupply in the channel”.

FY24 EBITDA: c. £25m new estimate, “due to the impact of shipping and logistics challenges as well as various pressures on product margins”. Shipping and freight costs have risen and this trend is expected to continue.

Adj. EBITDA was £12.1m in H1, so the expected c. £13m in H2 means that the expected H2 weighting has not fully materialised.

Net debt: £15m, down from £27m six months previously. Helped by promotional activity to boost sales/reduce inventories (but at lower margins).

Graham’s view: Paul was AMBER on this and I’m inclined to leave that stance alone, as the weaker share price now implies much lower expectations than before:

I’d invite you to check out Focusrite’s brand portfolio - if you have music production experience, you might be familiar with them. My synopsis is that it’s an impressive-looking list of brands; unfortunately I can’t tell if they have much in the way of pricing power/competitive advantages. The focusrite brand is well-liked on Trustpilot.

TUNE’s gross margin has been under pressure but it was last seen at a still respectable 46%.

This is one of those companies that leads with an impressive-looking adj. EBITDA number, leaving you to look up the (much lower) after-tax net income figure.

Overall, this strikes me as an average-quality company from an investment perspective. If investors wanted to price in a recovery to previously higher levels of profitability, I could understand that. But I’m more comfortable with a market cap around the current level: if Covid-era revenues and margins were to somehow materialise again (unlikely), then investors should enjoy terrific upside. But if things stay the way they are for the next few years, then perhaps the current valuation is about right.

Stockopedia’s calculations think it’s higher-quality than I do, but they agree with me that this is a very average investment opportunity:

PCI- PAL (LON:PCIP)

Down 2.5% to 56p (£41m) - Trading Update, New Partner and Notice of Results - Graham - AMBER/GREEN

PCI-PAL plc (AIM: PCIP), the global cloud provider of secure payment solutions for business communications, announces a trading update for the financial year ending 30 June 2024.

This update is later than usual, “due to the Company’s audit process taking longer than expected this year”.

Key points:

Full-year revenue +20% to £18m, missing Board expectations by £0.7m.

It’s a classic case of revenue recognition, a subject I’ve taught to many private investors. In this case, PCIP had received the relevant cash (£0.7m) from the customer and believed that it had delivered the service to that customer. However, the auditors have a different interpretation of the delivery of the service, and therefore the income statement will not include this revenue in FY 2024.

Instead, the revenue for this contract will slip onto the FY 2025 income statement, even though no cash will be received for the contract in that year.

In summary: I don’t think this matters at all to the value of the business, except in the sense that management should try to be more conservative in their assumptions around revenue recognition.

Continuing:

PCIP now expects an adj. pre-tax loss of £0.6m for FY 2024.

Year end net cash £4.3m.

Partner update: Zoom was already signed as a reseller for PCIP, and today we get more good news. A major new reseller contract has been signed with “a US headquartered business communications vendor”.

CEO comment:

"I am very pleased with the progress the business has made in FY24 with ARR continuing to grow at market leading rates, the launch of new product features and enhancements, and the addition of exciting new enterprise partners to our partner eco-system. This progress has been achieved despite the distraction of the unfounded patent litigation that we were forced to deal with and successfully resolved as announced on 27 June 2024.

Graham’s view

Historically, the income statement here has been a sea of red:

However, note the rising top line, with losses becoming a much smaller percentage of sales over time.

And impressively, the share count has seen only moderate dilution, much lower than I would have assumed:

Today’s update doesn’t concern me too much as far as the revenue recognition goes - it is just an accounting problem (although management shouldn’t make assumptions that are more aggressive than the auditors will allow).

Overall, I’m inclined to maintain Paul’s AMBER/GREEN on this one. For small and unprofitable companies, I do want to see rapid revenue growth as a core reason to get me interested, and PCIP is just about offering this, with revenue growth of 20%. After today’s news, the latest broker forecasts suggest revenue growth of 24% for FY 2025.

The company also has a modest net cash position and it’s not far from break even.

Price to sales is about 2x which is on the cheap end of the spectrum if this company grows as it hopes to.

It’s a mixed bag, mostly positive, so I like the moderately positive stance we’re taking on this.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.