Good morning, it's Paul and Jack here, with the SCVR for Wednesday.

Timing - TBC

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to cover trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty.

We stick to companies that have issued news on the day, with market caps up to about £700m. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research) - don't blame us if you buy something that doesn't work out. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

Agenda -

Paul's Section:

Onthemarket (LON:OTMP) (I hold) from yesterday - my comments on the AGM trading update. Nothing earth-shattering, but this residential property portal seems to have carved out a niche, despite dominant competition from Rightmove and Zoopla.

Marston's (LON:MARS) - trading update, showing a recovery in trading as restrictions ease, but still down on pre-pandemic levels. I can't get excited about this.

Tracsis (LON:TRCS) - a big contract win, which feeds through into a significant increase in broker forecasts.

Jack's Section:

Staffline (LON:STAF) - significant recent dilution here limits the upside but goes some way to fixing the balance sheet. It's a favourable environment in which to execute a turnaround right now for recruiters so things look much more positive these days.

Aptitude Software (LON:APTD) - solid growth and scope for future margin expansion. Its addressable market is expanding. There are plenty of positives here and Aptitude looks like a quality SaaS company, but valuation is a concern.

Onthemarket (LON:OTMP)

(I hold)

95p (up 5% yesterday) - mkt cap £71m

Preamble - For background, there’s a useful recording of an InvestorMeetCompany results webinar here, published on 17 June 2021. The newish CEO looks very young, which I put down to clean living (probably) and favourable lighting/camera angles! Although being more serious, checking his LinkedIn, he’s got a lot of experience in the sector, and subjectively I think he comes across as eloquent and energetic. CEOs come in all shapes & sizes, so it's never certain how anyone will perform.

We’ve also got an extensive archive of SCVR commentary here, over quite a few years.

My last update was here on 8 June 2021, which highlighted a maiden profit, and a healthy cash position. As with other online businesses, the ability to flex overheads considerably in the pandemic (e.g. slashing marketing spend quickly when required) is a big advantage. We also saw this from Sosandar (LON:SOS) (I hold) for example.

OTMP seems to have carved out a niche, despite being in direct competition with near-monopoly price gouger Rightmove (LON:RMV) . OTMP’s market cap is only 1.2% of Rightmove’s market cap. That reflects RMV’s dominance, but also intrigues me, as even a little narrowing of that gap could see a multibagger from such a low base as OTMP’s £71m market cap. Speculative, but interesting.

AGM Statement (trading update)

OnTheMarket plc (AIM: OTMP), the majority agent-owned company which operates the OnTheMarket.com property portal…

- Chairman summarises previously published results for FY 01/2021 - maiden profit achieved, despite the pandemic

- Strong performance has continued in the current year FY 01/2022

- Trading in line with Board’s expectations

Strategy update - I won’t repeat all of the RNS, other than to say I’m not convinced OTMP yet has enough to differentiate it from much larger competitors such as Rightmove & Zoopla. The way I see it, OTMP seems to be sufficiently useful to estate agents, that they think it’s worthwhile paying a much lower monthly subscription, in addition to the major competition’s much higher charges.

Operational metrics are provided, but nothing jumps out at me as particularly significant.

Residential property market - continuing pent-up demand, and low mortgage rates, are keeping the market “very active”, despite tapering of the Stamp Duty holiday. Useful info for wider read across maybe?

Liquidity - cash of £9.7m at 30 June 2021. Sounds fine, although the new CEO has to balance spending the cash pile to accelerate growth, and the need to safeguard the business by conserving cash. In previous years, management squandered a lot of cash on advertising, so personally I’m hoping to see a more carefully planned approach in future. Digital marketing, done well, seems to be the key area.

Broker update - many thanks to Zeus for issuing updates on Research Tree, very helpful.

I’m looking through Zeus’s note from yesterday, which gives useful interpretation of the latest company update. It’s only 6 pages (excl disclaimers), so manageable. Longer notes just soak up too much time & energy, so tend to get printed out & never read, in my office!

As CliffW helpfully pointed out in the comments to yesterday’s SCVR, OTMP could possibly be re-rated substantially upwards (Zeus suggests c.3x future revenues is possible), if investors begin to view it as a subscription revenues business.

Projected revenue this year FY 01/2022 is forecast to rise quite usefully Y-on-Y, from £23.0m to £29.2m. There are some convincing drivers for that growth too, e.g. the two biggest items being estate agents converting from free trials to paying contracts (+£1.9m revenues), and pandemic support measures last year (discounts) of £2.6m no longer being required again (we hope).

Hence I’m saying the forecasts look credible, and are not pie-in-the-sky hockey stick optimism that we sometimes see from small cap forecasts. Overall, I generally find Zeus research notes are really good, and well worth reading, because they're credible, and a lot of work has clearly gone into them.

With its highly variable, discretionary overheads spending, OTMP can dial up or down whatever profit it wants, within a range. That’s often the case with online businesses - it’s a policy decision by management whether to run for cashflow at low growth, or whether to open up the throttle of growth spending, with bigger marketing spend, but then short term losses. Or anything in between. To me, the main thing is that I need to see effectiveness from bigger marketing spend. The worst situation is often when they raise a lot of cash, and squander it, before they’ve really worked out what works best.

Tax losses - Zeus helpfully points out that OTMP has £32.4m of tax losses, which I'd forgotten. So it won’t be paying any corporation tax for a while probably - that's helpful, and should add a bit to our valuation calculations.

My opinion - this is not a value share, so may not appeal to SCVR readers. However, I remain of the view that there’s something interesting going on here. OTMP has got itself into a much more favourable financial position, with fairly secure-looking recurring revenues, and healthy net cash. The estate agents part-own the business remember, so if the share price really takes off, then that could create some excitement, and greater commitment from them to push this portal to the end users.

I have no idea how this will pan out, only time will tell. However, if you take a fresh look at the numbers, things are looking quite promising.

How to value it? No idea at this stage, but obviously I believe there’s more upside than downside, or I wouldn’t hold it personally.

Position size is everything, and for me this is currently a small-medium sized position, that I’ll monitor, and keep a flexible view on it, depending on how the newsflow & finances develop over time.

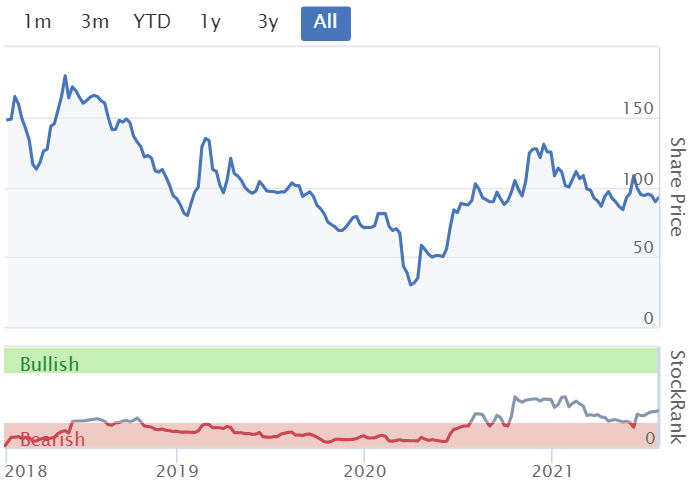

Even the Stockopedia computers seem to acknowledge that it's not a complete basket case any more, with the resolutely red StockRank breaking out tentatively into lower-middle ground (see below, graph within a graph) -

.

Marston's (LON:MARS)

86p (up c.3% at 08:09) - mkt cap £546m

NOTES TO EDITORS

· Marston's is a leading pub operator with a 40% holding in Carlsberg Marston's Brewing Company

· It operates an estate of c1,500 pubs situated nationally, comprising managed, franchised and leased pubs

Marston's PLC issues the following trading update for the 42 weeks to 24 July 2021.

The year end is FY 09/2021.

I like the summary at the top of this announcement -

Significantly improved trading since 17 May, and better than our expectations

- Reminds us that H1 was “significantly disrupted” by the pandemic/lockdowns.

- Restrictions gradually removed in stages - 12 April (outdoor trading began), 17 May (indoor trading allowed, with restrictions), 19 July (most restrictions lifted)

- All sites trading since 17 May

- 90% of sites have outside areas, some enhanced with “Inside Out” programme.

- LFL sales (compared with 2019 pre-pandemic comps) were -23% (12 April - 16 May 2021), improving to -8% (17 May - 24 July 2021) - I can’t get madly excited about that, as trading is still down on pre-pandemic levels, and no doubt costs will be significantly higher.

Current trading -

In the first week of trading since restrictions were lifted on 19 July, we have seen a modest uplift in sales. Whilst this is clearly encouraging, it is too early to extrapolate any meaningful trends at this stage.

Profits/Cashflow -

We have previously reported that we achieved break even from a cash flow and earnings perspective in April, and as a consequence of the easing of restrictions we generated positive earnings and cash flow in both May and June despite operating at around 70% capacity for those months.

Directorspeak - suggests reform of business rates, and a permanent reduction in VAT for hospitality. Good luck with that.

Diary dates - 13 Oct 2021 for year end FY 09/2021 trading update. 30 Nov 2021 for preliminary results.

My opinion - despite the upbeat tone, this all sounds a bit flacid to me. There’s been some interesting commentary lately, suggesting that people are stratifying, using our own risk assessments. I think that’s absolutely right. Some people are partying & almost back to normal (especially younger people), but many are still being cautious, if they feel vulnerable or want to play it safe due to a vulnerable loved one. Maybe that might still be holding back a full recovery for general community pubs like Marstons?

Overall, I don’t know enough about Marstons to form an opinion on the shares, so will just say I’m neutral. There’s nothing in today’s update to excite me.

.

.

Tracsis (LON:TRCS)

982p (up c.4%, at 09:34) - mkt cap £287m

Large RailHub Enterprise Software Contract Win / Updated Forecast

Tracsis, a leading provider of software, hardware, data analytics/GIS and services for the rail, traffic data and wider transport industries, is pleased to announce it has been awarded a new multi-year significant contract in the UK for its RailHub software product suite. This is one of the large rail opportunities that we highlighted in our Interim Results announcement that was in the final stages of contract award.

Trading update -

As a result of this large enterprise licence win, ongoing growth in Rail Technology & Services and Data Analytics/GIS and a post Covid recovery in business activity levels in our Traffic Data and Events business units, we are now expecting full year EBITDA for the Group to exceed market expectations.

It would have been better if this update had provided some numerical guidance.

Finncap to the rescue! An update note this morning indicates +£1m in revenues this year, at high margins, for the licence element of the contract, then support revenues in subsequent years.

That drops through mostly to profit, and adj EPS forecast for FY 07/2021 is raised +16% to 29.9p - giving a PER of almost 33 times - not cheap, but the group is performing well, so it’s probably justified.

My opinion - Tracsis is looking good!

.

.

Jack’s section

Staffline (LON:STAF)

Share price: 63.27p (+8.71%)

Shares in issue: 165,767,728

Market cap: £104.9m

It’s been a rough ride at Staffline. It recently launched its second refinancing in 12 months, diluting shareholders further, but providing a more solid foundation for a recovery. The necessary placings have completely transformed what had been a good track record of keeping a lid on shares in issue.

Back in 2011 there were 26.4m shares and by 2018 that had risen to 34.4m. But just a few years later the number has ballooned by nearly 5x to 165.8m. A lot of this happened after a collapse in share price.

While the balance sheet here has been reduced, if we zoom in to a one-year view, it shows that shares have already rerated significantly so it’s not immediately clear that an opportunity remains.

While the shares have slightly more than doubled over a year, the market cap is actually close to 5x higher year-on-year due to shares in issue. Still, the market cap was north of £300m at its height a couple of years back compared to today’s c£100m, so there could still be a case to be made here if the group can fully recover.

Trading has continued to be strong across the first six months of the year to 30 June 2021 and is ahead of expectations with all three of Staffline's core divisions delivering a solid performance in the first half.

Highlights:

- Revenue +4.7% to £450.7m,

- Gross profit +14% to £39m,

- Gross margin up by 0.8% to 8.7%,

- Net cash up by £57.1m to £20.9m.

Strong trading, cost reduction measures, and new higher margin business have allowed for underlying operating profit growth.

The swing to net cash results from £44.4m of net proceeds from the June 2021 equity raise, VAT payment relief of £40.7m (still to be repaid), around £15m of timing benefits (expected to unwind), and improvements in trading cash flow and cash collection efficiency, which have generated an additional c.£10m.

Recruitment GB performed well throughout the first half across food, logistics and e-commerce, with additional margin gains arising from new business wins in online food distribution and after exiting legacy lower margin contracts.

Staffline experienced challenges in its specialist driving division due to the widely reported acute labour shortages.

Recruitment Ireland has seen good trading in its core Northern Ireland business alongside tight cost control and continued growth in the Republic of Ireland.

PeoplePlus also reported an excellent performance from its core 'employability' division, and generated an underlying operating profit compared to a loss in the prior first half.

Conclusion

Based on what other recruiters have recently said, this appears to be a supportive environment in which Staffline can execute its turnaround, with some promising post-lockdown tailwinds.

But these kinds of situations often feel very different depending on the perspective: existing, diluted shareholder or patient observer looking to invest capital in a turnaround.

If you are the latter, it pays to be mindful of the history and the scale of the collapse in value here. Also the fact that placings and the rest, while often necessary, can come at a time of depressed prices, and maximum equity and upside dilution.

And even after the placings, there is still more than £40m of VAT to be repaid. We haven’t seen the ‘fixed’ balance sheet yet but we should get that in the interims, to be released on the 14th of September.

These points do somewhat temper my enthusiasm but the fact remains that if Staffline can stage a full recovery then there is good potential upside even after the dilution. Conditions are currently favourable and the group is trading ahead, so there’s every chance of making it through. Early signs of margin expansion are a positive.

But those margins remain fairly low. Given the events of the past couple of years, I’m waiting for more detail in future updates, signs of further strategic execution, and confirmation of a more entrenched recovery in recruitment - even if that does mean missing out on shorter term share price gains.

Aptitude Software (LON:APTD)

Share price: 602.68p (+5%)

Shares in issue: 56,611,258

Market cap: £341.2m

Aptitude’s software addresses the growing trend for finance automation. Clients include some of the world's largest companies, typically organisations with complex financial data and technology landscapes.

Development, together with a growing number of other services, continues to be performed at the Aptitude Innovation Centre in Poland with sales, support and implementation services provided from Aptitude Software's offices in London, North America and Singapore.

Products include:

- Aptitude Accounting Hub (AAH) - centralises and automates finance, accounting and reporting processes. Its view of financial data enhances business insights to enable decision making,

- Aptitude Revenue Management (ARM) - enables finance teams to further automate their revenue management functions to address the demands of the subscription economy, with the market opportunity now growing into adjacent verticals including high-tech advanced industries and medical devices. The applications simplify the whole revenue lifecycle, from contract order to revenue recognition, and reporting and forecasting,

- Aptitude Insurance Calculation Engine (AICE) - enables data insights and decision support delivering long-term business benefits.

Services include implementation services and solution management services. The latter is growing. These products and services Aptitude Software's target the CFO within large international businesses.

In our most recent coverage we noted that ‘with some share price momentum and potential earnings upgrades, it has all the makings of another High Flyer tech stock.’

That looks to be the case in light of today’s update, but some heat has come out of the share price recently. That’s probably because of the premium relative valuation that has been attached to it by the market.

The group is notably cheaper on a price to free cash flow basis though.

Highlights:

- Annual recurring revenue +11% to £32.2m; total revenue -5% to £27.6m,

- Software and subscription revenue +14% to £16.7m,

- Implementation and solution management services revenue -24% to £10.9m,

- Cash +51% to £46.8m,

- Adjusted operating margin +1% to 18.5%,

- Adjusted operating profit level at £5.1m; statutory operating profit +4% to £4.7m,

- Interim ordinary dividend per share level at 1.8p per share.

Continued new business success across key regions and strategic products driving 11% year-on-year revenue growth on a constant currency basis.

Software and subscription revenue (the strategic focus of the group) now represents 61% of total revenue (H1 2020: 51%), with a number of multi-year subscriptions signed with insurers. Aptitude Revenue Management has attracted a growing number of clients in new industry verticals, ‘increasing the size of Aptitude Software's addressable market’. Clients continue to be upsold.

This growing proportion of revenues should in time lead to an increase in operating margins greater future revenue visibility.

Adjusted Operating Profit of £5.1m is ahead of the board's own forecasts as a result of better than expected implementation services revenue, leading to an increase in profit expectations for the full year of approximately 10%.

The group has net funds of £45.4m (H1 2020: £29.2 million) and no bank loans, freeing it up for acquisition opportunities. It has increased its acquisition activity with a pipeline of actively monitored opportunities.

Conclusion

The shares are expensive but then again recurring revenue is increasing which should increase margins, it looks like there’s good demand for the products, and Aptitude is on the hunt for acquisitions with a net cash balance. Aptitude’s markets are expanding and there’s an increasing demand for smart compliance, finance automation, and finance transformation in the cloud.

So perhaps concerns over relative valuation multiples are a red herring.

The revenue management products in particular are well positioned to address the fast growing subscription economy. The addressable market in North America also continues to grow. This is where the move to finance automation is expanding the fastest.

Given these dynamics, North America will increasingly be a focus for future Go-to-Market investment in the group.

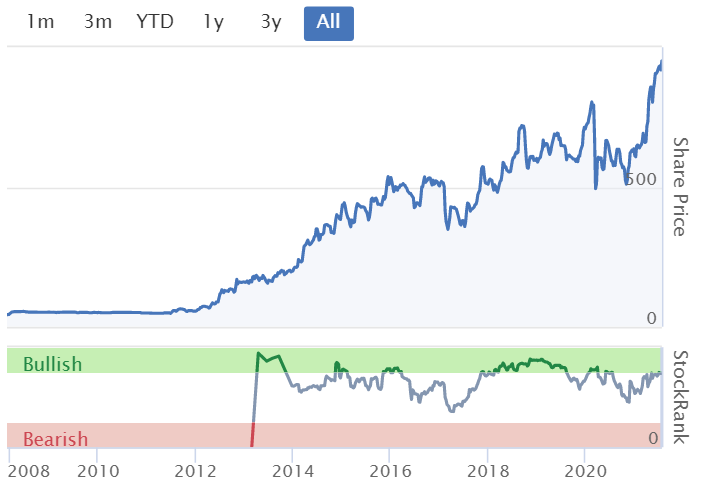

Aptitude is clearly a quality operator - the Quality Rank is 95.

Free cash flow growth has notably outstripped earnings growth (25.7% 5Y compound annual growth rate compared to 6.13% for normalised EPS). Margins are set to expand as subscription becomes a bigger proportion of revenue, and it does seem as though the company can continue to grow steadily via organic demand, with the potential for acquisitions to boot.

But relative to the rest of the market, the shares do look pricey on a forecast PE ratio of 40.6x and a forecast PEG of 5.4x.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.