Good morning, it's Jack here taking on SCVR duties today.

Paul has flagged up the Next (LON:NXT) trading update - the company is well-known for is thoughtful and considered commentary so it's worth moving out of small cap territory to take a quick look at what Wolfson et al are saying...

NEXT PLC

- Full price sales in the second quarter were down -28% against last year - 'much better than expected' and an improvement on the best-case scenario given in its April Trading Statement.

- Online warehouse picking and despatch capacity is now back at normal levels.

- Full year profit before tax, based on our new central sales scenario, is now estimated at £195m.

- New central scenario year end net debt is forecast to reduce by c.£460m.

- The group has modelled three new scenarios based on FY sales being down -18%, -26% and -33%,

I'm not going to spend too long on this statement, but the narrative is encouraging. Next is a famously high quality retail outfit though, so I can only hope there is positive readacross for the rest of the industry:

our experience over the last 13 weeks has given us much greater clarity on our Online capabilities during lockdown and the state of consumer demand, and we are now more optimistic about the outlook for the full year than we were at the height of the pandemic.

In summary, the Company is in a much better position than we anticipated three months ago: consumer demand has held up better than expected and our Online warehouses have achieved much higher capacities than we thought possible. Costs have been well controlled, and we have taken steps to ensure that our balance sheet is secure.

Whilst much of our time has been focussed on managing the business through the pandemic, we have not lost sight of the fact our sector was already experiencing far-reaching structural changes as consumers increase their expenditure Online. If anything, these changes are likely to accelerate as a result of the crisis. So, we have continued to move the business forward, actively investing in the systems, Online capacity and business ideas that we believe will be important in a post pandemic world.

The fact that online is booming suggests Next is being rewarded more for its own strategic initiatives and underlying operating strength than this being a wide-based retail recovery.

I'm sure there are some interesting propositions out there for risk tolerant contrarians in this part of the market - but if I was to own any retail stock and sleep at night currently, then that pick would be Next by a country mile.

Anyway, plenty of small cap news to catch up on.

Premier Foods (LON:PFD)

Share price: 86p (unchanged, at 08:09)

No. shares: 848m

Market cap: £729.46m

(I hold)

For a long time, Premier Foods (LON:PFD) has been on many an investor's bargepole list: a zombie company labouring under mountains of debt and a tempestuous pension fund. Structural change is on the way though and this food brand owner and manufacturer is meaningfully changing its capital profile after many years of hard work with little to show for it. Lockdown has added a further tailwind, with more consumers buying its products.

This means more revenue, more free cash flow, more investment in marketing, advertising, and innovation, and more debt reduction.

The StockRanks have been picking up on these improving prospects - I believe PFD plays a starring role in Ed's most recent SNAPS entry: SNAPS 2020 - the benefits of a good, long sleep.

Premier Food's trading figures continue to be strong - this is by far the most trading momentum I have seen at the companies in c5 years of following it. Can it last once lockdown ends? And how much is now priced in given the group's multibagging performance since March?

I would argue there is more room to grow but we can move onto that in a bit. For now the highlights:

- Q1 Group sales +22.5%, Q1 Branded sales +27.0%

- Q1 UK sales +23.0%, Q1 Branded UK sales +27.9%

- Online growth of +115%; gaining +2.7ppts share

- Strong household penetration growth, particularly for Grocery brands

- Advertising investment increasing from four to six major brands this year

Again, we see strong online growth. Online potential could be an important factor in the rate at which companies recover into the 'new normal' we find ourselves in... To this point, PFD says:

Another notable feature of the quarter was the extent of growth in the online channel. Over the last couple of years, the Group has been investing in its online proposition and capabilities, working closely with its retail partners.

You make your own luck... The Group saw elevated levels of demand for its Grocery portfolio throughout the quarter as households continued to experience few opportunities for eating occasions out of home.

PFD's brands are outperforming the market in every category and its recently upgraded expectations for the full year are unchanged. Initial Q2 volumes remain elevated, so the momentum continues. However, while sales grew in double digit percentage terms in each of the three months within the quarter, the sales growth rate at the end of Q1 was lower than observed at the beginning of the period.

So it's entirely possible that this one-off boost to sales will normalise by the end of the year. Previously, PFD had been grinding out between 2-3% revenue growth fairly consistently.

In fact, further down we have the Outlook statement:

Q2 sales have started strongly, however the Group anticipates this trend to normalise through the quarter as consumers gradually return to eating out of home. Looking to the full year, the Group expects to make further progress as it continues to employ its successful branded growth model strategy, which has been instrumental in delivering twelve successive quarters of UK revenue growth. Recently upgraded expectations for FY20/21 are unchanged, which includes anticipated further Net debt reduction this year.

My view

Even if trade normalises rapidly, this has been a game-changing period for PFD. The group is on the way to downsizing and overfunding its pensions and net debt is tumbling thanks to the increased trade. You can read more on that here.

This is important because there are some clear share price drivers at PFD. The size of the group's equity continues to be small for an established branded consumer goods operator. This is because of its debt and pension funds, which comprise a large part of the overall entity's enterprise value. They also suck up PFD's free cash flow generation like vampires (no offence to any PFD bondholders and pensioners out there) in the form of interest payments and pension contributions.

This obscures the true value of the underlying entity to shareholders if you assume PFD can rightsize its capital profile. If you pay down debt and resolve these pension issues, a larger proportion of trading profit flows down to the shareholders.

In the group’s full year reports it gives something like the following reconciliation of trading profit to free cash flow:

FY20 (£m) | % of trading profit | |

Trading profit | 132.6 | |

Depreciation | 19.9 | |

Other non-cash items | 1.7 | |

Taxation | 0 | |

Interest | -35.6 | -26.85% |

Pension contributions | -44.7 | -33.71% |

Capex | -18 | |

Working capital & other | 14.6 | |

Restructuring costs | -6.6 | -4.98% |

Misc | 1.1 | |

Free cash flow | 65 |

Interest costs, pension contributions and restructuring costs are highlighted to show just how much of a drag they are. That’s 66% of trading profit spent on those three items. In fact, over the past five years, more than 71% of trading profit has been spent in this way.

What Premier Foods is trying to do, in offloading and shoring up pension funds and paying down debt, is to close that gap between £132.6m of trading profit and £65m of free cash flow (as defined by the company). As you reduce that gap, you increase cash generation which can be profitably reinvested, which could lead to meaningful revenue growth and even margin expansion.

It has been a slow journey so far though, and the share price has just moved more in a couple of months than in probably the last half a decade combined so a pause for breath wouldn't be surprising. That said, with all the positive news flow and multiple potential drivers of share price growth, things are looking brighter for PFD than they have done in a many years.

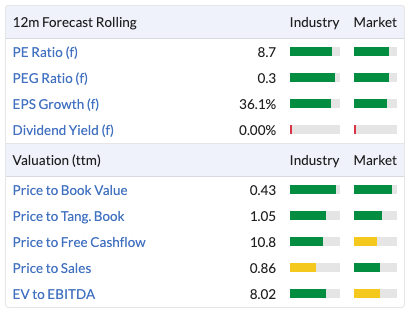

Even after more or less quadrupling since March, the shares still aren't expensive so I'm happy to continue holding:

Yellow Cake (LON:YCA)

Share price: 227.5p (-1.09%)

No. shares: 87m

Market cap: £199.80m

Thanks to the community for flagging up this interesting little company in the past.

Yellow Cake (LON:YCA) is a specialist company operating in the uranium sector with a view to holding physical uranium for the long term - almost like a uranium ETF. It has a longstanding agreement with the world’s largest uranium producer to buy the commodity at spot as it sees fit (up to a certain annual limit).

YCA management has been buying back shares with a vengeance. They seem like a financially astute bunch led by an experienced team of investment bankers over at Bacchus Capital.

Some highlights from the update:

- Value of U3O8 held increased over the quarter from US$263.5m to US$303.7m. Total increase in value of U3O8 held by Yellow Cake at quarter end of 50%

- Estimated net asset value at 30 June 2020 was £2.92 per share, although this fell to £2.77 as of 28 July - meaning today’s share price of 227.5p is an 18% discount to last reported NAV.

- On 30 June 2020, the Company announced its intention to conduct an enlarged share buyback programme commencing on 8 July 2020, to purchase up to US$10 million of the Company's shares. The buyback programme is being largely financed by the disposal of 300,000 lbs of U3O8, which completed on 30 June 2020, at a price of US$33.20/ lb, realising a gain of US$3.7 million and raising net proceeds of US$9.9 million which were received on 7 July 2020.

It all sounds pretty solid, with shares trading at an attractive discount to net asset value and potential for uranium prices to increase further in future.

This point is odd though - perhaps it is common practice in this area but I’ve never encountered it before:

On 24 July 2020, Yellow Cake concluded a location swap agreement in terms of which it will exchange a volume of U3O8 located at Cameco's storage facility in Canada for an equal volume of U3O8 located at Orano's storage facility in France for a period of six months. The location swap will be reversed in January 2021 when Yellow Cake will again receive the same volume of uranium in Canada in exchange for uranium held in France. In consideration, Yellow Cake will receive proceeds of US$1.0 million, net of costs and commissions.

There must be some value provided to Cameco here that I am missing, otherwise it is just free money...

Uranium market update

The group gives a useful update on the state of the market here. Per YCA’s CEO:

Continued supply curtailments combined with the additional impact of Covid-related production cutbacks have resulted in the uranium price rising 30% in the year to date.

Uranium spot prices continued to improve in Q2 2020, driven by record-level transactional volume as intermediaries/traders, uranium producers and utilities all purchased.

Although this has since tailed off, supply continues to be constrained. The world's largest uranium producer, Kazatomprom, instituted an initial three month cut-back in operations in early April and increased this by one month on 6 July. This won’t last forever though. At some point, Kazatomprom will become fully operational and what might that do to the uranium market?

I have no idea how concentrated the supply base is here, but I suspect Kazatomprom and Cameco might be key players. Cameco has also reduced supply. YCA says the net effect of all the cut-backs is a c15% reduction in 2020 uranium production to 121 million lbs.

Another key talking point here is the delayed release of the Nuclear Fuel Working Group’s report: "Restoring America's Competitive Nuclear Energy Advantage - A strategy to assure U.S. national security,"

The report calls for the establishment of a national uranium reserve created through the direct purchase of $150m of uranium. These proposals appear to be taking a long time to work through the US political system though so this is not yet being felt in the market. A potential driver of demand in future.

My view

This is worth a closer look at some point. Shares trade at a discount to net asset value and management is quite rightly taking advantage of this valuation disconnect by buying back shares, which enables the group to gain additional exposure to uranium below the spot price.

Market prospects look reasonable, particularly with the short-term supply constraints introduced in lockdown. I do wonder what happens to the spot price once supply normalises, though. More research is needed on this point.

The group’s location swap agreement shows scope for further value creation, although I’m unsure what the benefit to Cameco is here, and am therefore unsure how material this kind of agreement might be to YCA moving forward.

Ultimately it's the buybacks at YCA I keep returning to... I don't know much about uranium but so far YCA has acquired 1,386,806 shares for a total consideration of £3m at a volume weighted average price of £2.13 per share. So management, at least, must think the shares are undervalued and that a rerating is on the cards somewhere down the line.

Shearwater Group (LON:SWG)

Share price: 201.6p (+2.34%)

No. shares: 23.6m

Market cap: £46.63m

I haven’t encountered this small cap cybersecurity firm - ‘cybersecurity’ is quite a vague term encompassing a lot of different services and business models.

According to Shearwater (LON:SWG) , its capabilities include identity and access management and data security, cybersecurity solutions, and security governance, risk and compliance.

Perhaps SWG has a winning combination but a quick look at the Financial Summary shows that it is early days.

The company is loss making and soaking up cash:

So we can see SWG is funding rapid top-line growth with net losses and cash burn.

We can also see these losses are being funded by equity raises - a risky position for shareholders to be in:

Flicking over to the cash flow statement, we can confirm that SWG has raised just under £35m from shareholders in the past three years. Another c£4m has been raised post this update. I learned my lesson here a while ago and typically try to identify healthily cash generative companies.

That said, loss-making growth companies can be very profitable investments if you call them right.

Let’s take a look at the update.

Highlights

- Revenue up 41% to £33.0m (2019: £23.5m)

- £5.5m from the software division, up 41% (2019: 3.9m)

- £27.5m from the services division, up 41% year-on-year (2019: 19.6m)

- Underlying EBITDA of £3.4m, an increase of £4.8m (2019: loss £1.4m)

- Underlying EBITDA margin of 10% (2019: -6%)

- Adjusted earnings per share of 8p (2019: loss of 10p)

- Multiple new contracts with existing and new clients secured

It looks like strong top line growth and underlying trading momentum.

But SWG also lists two other points: a ‘successful business reorganisation’ and the acquisition and integration of Pentest in April 2019. This suggests it has not all been plain sailing at SWG and the company is having to pivot in order to create a sustainable and profitable future for itself.

Businesses pivot all the time. The ability to adapt and evolve is essential - but, coming to this company for the first time, it is also a warning sign. Perhaps SWG is setting itself up for a promising future but in the past at least, it sounds like it has been a tough ride.

That said, the current momentum does sound positive.

Post-period highlights and outlook:

- Current trading has seen positive continued momentum in line with management expectations

- Successful equity placing to raise £3.75m (gross) in April 2020 to provide funds for further acquisitions as part of the Group's ongoing strategy

- Finalised new £4 million, 3-year committed RCF with Barclays Bank plc to provide financial flexibility

- COVID-19:

- Staff adjusted rapidly to working remotely and continue to effectively service clients

- Impact on clients varies by industry

- Adjusted to the new economic climate with carefully managed costs

- No requirement to utilise government support schemes

- In the long term should accelerate market demand for the Group's offering

Phil Higgins, CEO of Shearwater Group, commented:

We have signed a number of significant contract wins, with our ability to grow organically through the cross-selling of services and solutions clearly coming to fruition… We believe that our buy, focus, grow strategy is the right one and we fully intend to welcome more quality businesses to the Group as we continue to consolidate our highly fragmented market through targeted acquisition.

My view

Higgins is just finishing his first year as CEO. New management with a clearly defined growth strategy can be a powerful catalyst, but this kind of acquisition-led strategy tends to divide opinion.

Sometimes it works with incredible results. Possibly more often, something goes wrong and management fails to realise the promised synergies and shareholder value.

Perhaps, ultimately, it comes down to your faith in the management team’s ability to execute and integrate. Given the constantly evolving tech and cybersecurity landscape, I would want a high degree of confidence in this team as obsolescence must be a risk.

SWG says it can realise ‘substantial’ cross-selling opportunities within the group going forward. It has reached underlying profitability, lockdown-related work-from-home trends could provide a nice boost to business, and it says it is well placed to execute a ‘targeted acquisition program’.

Net losses have fallen substantially, from -£5.9m to -£1.5m and operating cash flows have swung from -£3.5m to £5.2m ‘owing to significantly improved year on year trading performance’ and reorganisation-related cost savings.

It’s a mixed bag, with some green shoots to consider, but I would want more proof of management execution, sustained profits and cash generation, and a stronger balance sheet before I considered this one.

Of SWG’s £70m of total assets, c£50m is intangibles. This can be hard to avoid in the software space, but often other companies tend to be supported by strong recurring cash flows and an organic net cash position on the balance sheet.

Too early for me given SWG's frequent stock issues and lack of historic cash generation, but perhaps over the coming year or two it can prove its new strategy, enhance cash flows, and strengthen its balance sheet. I can certainly see the beginnings of the bull case for shareholders here and wish them luck. Hopefully management can execute.

Walker Greenbank (LON:WGB)

Share price: 48p (+3.23%)

No. shares: 71m

Market cap: £33.01m

The valuation metrics at Walker Greenbank (LON:WGB) are attractive but I’ve never dug into the actual turnaround story here:

Stockopedia rates it as a ‘Contrarian’ stock, which seems appropriate. A look at the three-year chart shows that things have gone quite badly wrong over the past couple of years for this international luxury interior furnishing company.

Through it all though, the group has remained a profitable, cash generative dividend payer. Compare this cash flow section to Shearwater’s above, and I am more intrigued by WGB’s turnaround potential given its apparently resilient cash generation.

Free cash flow can be lumpy, but even if you take the five-year average of 5.4p per share that would value WGB at 5.9x FCF.

The key takeaway here is that product sales in the first half of the current financial year were impacted by Covid-19 but that sales have been on an improving trend since the start of April 2020 as lockdown measures have progressively eased.

Brand product sales in the first 25 weeks of the current financial year were down 32% and in the four weeks to 24 July 2020 were down 15% on the prior year. Core licensing income was more resilient, down approximately 10% compared with last year over the first 25 weeks.

WGB seems safe unless conditions deteriorate once more, with cash headroom actually increasing by £1.8m between 26 June and 27 July:

The Company's focus on liquidity continues and on 27 July 2020 the Company had cash headroom of £17.8 million against its banking facilities, compared with headroom of £16.0 million on 26 June 2020 as reported in our accounts for the year ended 31 January 2020.

So, with no immediate liquidity risk, WGB looks well positioned to continue with its recovery.

I don’t know anything about the actual quality of WGB furniture. You can see its brands here but the names don’t mean anything to me. Assuming its products are actually good, then this looks like a potentially promising high QV contrarian opportunity.

The company remains cash generative and directors have been buying shares recently:

WGB’s operating margin has more than halved over the past five or six years. If management can reverse this decline, then that could be a material opportunity for investors.

If you take the 2015 net profit margin (c6.1%) and apply that to forecast 2021 revenue of £104m, it gives a figure of £6.34m.

If you then apply a multiple of 10x that would imply a target market cap of £63.4m against today’s market cap of £33m. So that’s 100% upside if management could pull that off.

The devil’s in the detail of course. I don’t know how WGB came unstuck or quite what it’s recovery prospects look like. Assuming the upside is anything like the above then this one is worth more investigation given its track record of cash generation and dividend payments, and its reasonably strong balance sheet.

The next step here is to go back through the management commentary over the past five years or so to understand just why WGB has fallen so low, and what exactly management is doing to return it to former levels of profitability.

Edit: There is a small pension deficit on the balance sheet. In FY20 WGB recorded a £464,000 charge to its income statement for the defined contribution scheme and around £2,184,000 in contributions to its defined benefits schemes. You can see more in note 23 to the 2020 Annual Report. Something to be mindful of, particularly given the scale of contributions, as the Funded Status can be very sensitive to inputs like discount rates and the rest.

Aptitude Software (LON:APTD)

Share price: 407p (-0.49%)

No. shares: 56m

Market cap: £230.6m

Shares are basically unchanged on Aptitude Software (LON:APTD) ‘ s interim results today. This is a ‘specialist provider of powerful financial management software to large global businesses’.

On the face of it, there are some good points to this software company. It is reliably cash generative with solid liquidity metrics and strong financial health measures. The group has built up a c£30m net cash position and shares in issue have been stable over the past five years.

As with so many software and IT companies though, valuation is the thing. APTD trades on 33.2x forecast earnings and 15.2x TTM free cash flow.

Compare that to unspectacular (though admittedly solid) earnings per share growth of c10% per year over the past five years, and I wonder if a little too much growth is priced in at 407p.

Brokers were recently expecting a jump up in EPS to 22.4p though:

If this is one of those instances where full year forecasts have just been pushed out to the right by a year or two, then APTD would be trading on a ‘normalised’ forecast PE of just 18.2x, which would be a much different picture.

As it stands though, it appears that brokers are also reducing FY21 earnings forecasts and the company itself notes the ongoing extended sales cycle in the insurance sector.

My view

For the six months to 30 June, annual recurring revenue rose by 11% to £30.9m, cash increased 31% to £30.9m, and adjusted basic earnings per share grew by 12% to 6.7p. The interim dividend has been maintained at 1.8p. That’s good but not stellar.

The group’s sales cycle has been hit by COVID, which probably explains the drop in forecast earnings. If this has been overstated and APTD can bounce back to the levels of profit previously forecast by brokers then there could be an opportunity.

It looks like a cash generative software company with a strong balance sheet and recurring revenue. It is winning new customers but I’d just like to see more growth for a forecast earnings multiple of above 30x.

It’s not doing much wrong - in fact from the financial metrics alone, it looks like a good business - I just wonder if there are better opportunities out there on organic growth and relative valuation grounds.

I see from the most recent Annual Report that the company has recently demerged with Microgen for c£51m. That’s an interesting company-specific event and a possible catalyst for the share price if it frees management up, but I haven’t had time to get up to speed with this situation.

So perhaps there is strong growth potential once the trading environment normalises. APTD does say it’s on the hunt for acquisitions as well:

Whilst our focus is currently the organic growth of software and subscription revenues, the Group's robust financial position provides the Board with confidence to continue to progress with the analysis of potential acquisitions. Any acquisition will need to meet our strict criteria of comprising complementary technologies focused on Aptitude Software's product suite.

It seems high quality but expensive, with lukewarm momentum for now - I’d like to see either higher growth rates or a lower valuation, but I also acknowledge the group does generate decent returns on capital, which partially explains the valuation multiple.

.jpg&w=384&q=75)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.