Good morning from Paul & Graham.

Today's report is now finished.

My CEO interviews are resuming after a break. Today I'll be chatting to the CEO of Belvoir (LON:BLV) - that should be up on my website & podcast channels by about 14:30. EDIT: Belvoir interview is now live. Also on my podcast channel (Small Caps Podcast with Paul Scott)

Then tomorrow I'll be talking to the CEO of Portmeirion (LON:PMP) (I hold personally).

I'll put the links in here when the first one is live.

NB I only tend to interview companies that I think are good, and am considering buying some myself (or already hold). Other requirements are a sound balance sheet, decent recent trading update, and a reasonable or cheap valuation. I don't charge for these interviews, so you know I'm only selecting the things I think are best, from a value/GARP perspective. Never recommendations remember, and some will go wrong, that's inevitable.

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps up to about £700m. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

Main Sections -

(summaries here, main sections further down)

Mortgage Advice Bureau (Holdings) (LON:MAB1)

Finals - up 1% to 628.5p (market cap £360m) - Graham - GREEN

Adviser numbers are expected to stabilise in Q2, with the mortgage market relying heavily on refinancing deals for sustenance. I still rate this one highly but it’s less cheap now.

Team17 (LON:TM17)

Finals & CEO change - down 9% to 405p yday (market cap £590m) - Graham - AMBER

Organic growth of only 3% but excellent growth through acquisition. Bigger news is the long-standing CEO stepping down. A good company; valuation looks fair.

Michelmersh Brick Holdings (LON:MBH)

Preliminary Results FY 12/2022 - up 5% to 95p (at 08:25) - mkt cap £91m - Paul - GREEN

Smashing results for 2022, ahead of expectations. Low PER. Nice dividend yield (well covered too by earnings). Superb ungeared balance sheet, strong cash generation. 2023 energy costs hedged. Selling price raised, maintaining margins. Even the outlook comments sound quite good. This looks really good to me, so I'd be inclined to ignore macro guesswork, and just have this as a core long-term holding. Thumbs up from me.

S&U (LON:SUS)

Finals - down 2% to £23.50 yday (market cap £285m) - Graham - GREEN

Strong results; persistently high collections in motor finance and highest ever “normalised” profits. Some risk from increased gearing and rising rates. Valuation appears reasonable.

Strix (LON:KETL)

Results - up 6% to 93.8p (market cap £205m) - Graham - AMBER

Adjusted profits in line with guidance; company is seeing green shoots of recovery. I’m nervous about its debt load but management have promised to stop the M&A spree and to reduce capex.

Quick Comments -

Carr's (LON:CARR)

Trading in its shares is being restored this morning from suspension, caused by a technical problem with the audit.

Aeorema Communications (LON:AEO)

Interims -up 10% to 75p (£7m) - Paul - AMBER

- Record H1 revenue of £7.1m (up 45%)

- H1 PBT £326k.

- “Very confident” about FY 6/2023.

- Balance sheet - NTAV £2.0m. Cash pile of £3.7m, but partly offset by creditors.

My opinion - Impressive rev growth. Too small to be listed really. I recognise several shrewd PIs on the >3% shareholder list. Might be worth a closer look for nanocap investors, but beware wide spread & lack of liquidity for anything this size. Small, but interesting company.

UP Global Sourcing Holdings (LON:UPGS)

Interims (in line) - down 4% to 135p (£121m) - Paul - GREEN

- Good online growth. “Continued normalisation of global supply chains”. Revenue from retailers down 11%, as over-stocking unwinds.

- H1 adj PBT down 5% to £9.4m.

- H1 8.6p adj EPS.

- Historical seasonality is heavily weighted to H1.

- Outlook - trading in line with FY 7/2023 expectations.

- Valuation - modest fwd PER 9.2x, and lovely dividend yield of 5.5%.

- Net bank debt down 36% to £19.4m, more palatable than before. Overall balance sheet is adequate, but only c.£6m NTAV - probably OK as it has few fixed assets.

Overall, thumbs up from me. The slight dip in H1 profit isn’t a concern to me.

RM (LON:RM.)

Prelims 11/2022 - up 8% to 70p at 10:05 (£59m) - Paul - AMBER

- Previously reported problems, led to divis being suspended.

- Bank facilities renewed to July 2025 sounds positive.

- Adj PBT down 65% to £5.3m. Statutory loss £(14.5)m.

- Outlook - vague, but says they will rebuild shareholder value, but tough macro conditions.

- Detailed going concern note is an important read - things sound tight, if trading were to deteriorate further, but otherwise OK. Disposals need to complete.

- Balance sheet looks precarious, with negative NTAV of £(15)m, and the pension surplus asset of c.£23m may not really be a surplus, so needs checking out.

My opinion - this is quite complicated, so best seen as a special situation. Difficult to value. Could be a nice turnaround if things go well, but be aware that it’s still quite risky.

Chapel Down (OFEX:CDGP)

Final Results FY 12/2022 - 37.4p (unch) (£66m) - Paul - AMBER

Good results flagged by grumpy5 in reader comments -

- PBT has risen from £1.1m in 2021, to £1.6m in 2022.

- Very good balance sheet, with £32m NTAV, and the company reckons open market value of its assets is higher.

- Not cash generative yet, due to increasing working capital and capex.

My opinion - could be interesting long-term. Valuation doesn’t stack up on conventional value metrics (other than maybe asset value). Could be an interesting punt if you like the wine & the shareholder discount. Personally I’m not keen on very slow, and capital intensive business model.

Surgical Innovations (LON:SUN)

Final Results FY 12/2022 - up 5% to 2.0p (£18m) - Paul - AMBER

Gosh, this company has been around for most of my investing career, it floated in 1998! Today it reports FY 12/2022 numbers -

- Good revenue growth up 24% to £11.3m.

- Only breakeven profits.

- Says the order book is strong.

- Balance sheet seems OK, so it may not need to raise any more equity (932m shares in issue is probably enough!).

My view - something good might eventually happen here, but as things currently stand, it’s difficult to see why anyone would want to buy or hold this share.

tinyBuild (LON:TBLD)

FY 12/2022 Prelims - up 14% to 52p (£106m) - Paul - AMBER

A reader request. Computer games company.

- Strikingly good headline figures - profit up 27% to $15.9m. Although of this, $11.1m appears to be “Other operating income”, which seems to be a one-off relating to eliminating a contingent consideration creditor - so caution needed.

- Outlook positive, says has good visibility due to portfolio approach to games (not a one-hit wonder), and at least in line with expectations for FY 12/2023.

- Interesting style & content of management commentary.

- Balance sheet is good, includes $26.5m cash and no interest-bearing debt, but down from $48.8m a year earlier, due to huge development spend of $35.8.

My opinion - looks potentially interesting. Note it’s owner managed, by what sounds a dominant CEO who owns 38%. Not a sector that I tend to invest in, as valuations get too stretched in bull markets, and earnings are often very difficult to predict. But this share has fallen a huge amount, and could be worth further investigation now.

To Do List

We'll cover the most interesting companies (eg. above/below expectations), and please remember there isn't usually time to cover everything -

Paul’s Section:

Michelmersh Brick Holdings (LON:MBH)

93.5p (up 3% at 08:47)

Market cap £90m

Michelmersh Brick Holdings Plc (AIM: MBH), the specialist brick manufacturer and brick-fabricator, reports its preliminary results for the year ended 31 December 2022.

Good numbers here, which the company says are ahead of expectations.

Crucially, it demonstrated pricing power, by raising prices thus mitigating cost increases - a key attribute that we’re all looking for right now.

Some numbers -

Revenue £68.4m (up 15%) - so quite a small business really. Larger listed competitors Forterra (LON:FORT) and Ibstock (LON:IBST) are multiples of its size. There’s also distributor Brickability (LON:BRCK) to consider in this sector.

Adj PBT is up a similar % to revenue, at +14.7% to £12.5m - note the strong profit margin here, at 18.3% of revenue - suggesting it has products with pricing power that are in demand.

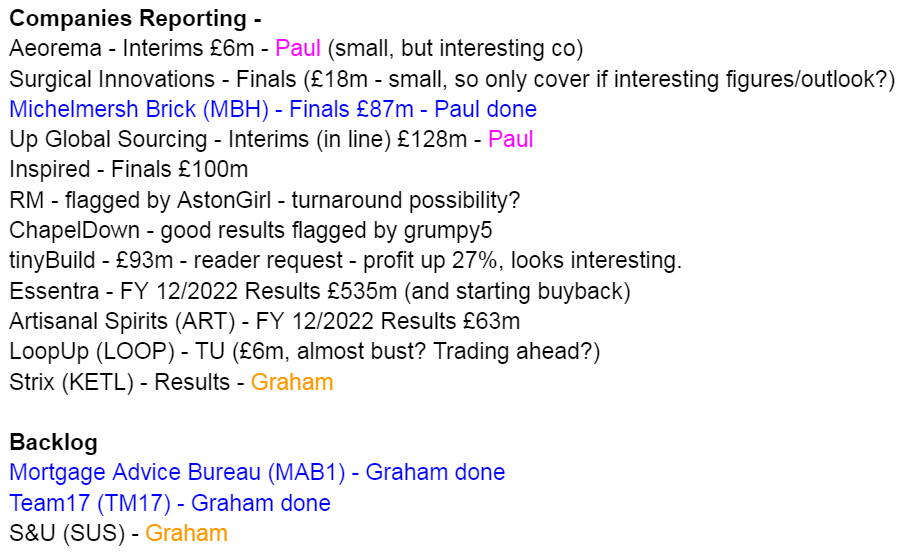

Adj EPS 10.61p (2021: 9.33p) - up 13.7% - this is a PER of only 8.8x

Adjustments - look fine to me, being the generally accepted practice of eliminating amortisation of goodwill.

Taxation - as we’re seeing with many companies reporting now, the tax charge has dropped a lot from an inflated 2021 charge (due to deferred tax adjs re the 19% to 25% rate change forthcoming). This is why the basic EPS figure rose a lot from 2021’s depressed EPS (caused by tax). It looks as if they've normalised the prior year tax charge in the adjusted numbers, to give a realistic underlying % increase in EPS, so that's all fine. The adjusted numbers are reliable in my view.

Dividend of 4.25p is up 16.4%, and more than twice covered by earnings. Yield of 4.7% is attractive. The interim/final divis split looks to be about 1:2 historically.

So that all looks pretty good. Can it be sustained though, given that we know the housebuilders are seeing reduced demand, and in some cases delaying construction projects? MBH looks more niche though, so might not be affected so much.

Outlook - key points are - lots in here, all interesting -

… we enter 2023 with a high-quality forward order book, deliberately covering a breadth of end market channels from RMI, housing to commercial, social and specification projects, now further expanded by FabSpeed

Despite the ongoing challenging market conditions, we remain well placed at the premium end of the brick market in the UK and Benelux markets. The long-term fundamentals of these markets are positive, with brick continuing to be the façade material of choice due to its longevity, sustainability and energy efficient qualities in use, low cost and broad aesthetic appeal, whilst equally, available brick stocks remain at historic lows.

Importantly, the strength of our balance sheet provides us with financial resilience and also flexibility to pursue further acquisition opportunities…

As we enter 2023, the ongoing higher inflation environment continues to provide an uncertain backdrop as we look to manage our supply chain and input costs. Given the high energy requirements for brick manufacturing, our energy price hedging policy remains incredibly important to ensure that we are well placed to manage the impact of utility price volatility over the medium term, with our requirements again materially hedged at over 90% for 2023 with further contracts into 2024 and 2025. We remain focused on mitigating these risks through maintaining appropriate portfolio pricing, and in collaboration with our customers we introduced our standard timetabled price increase at the start of January 2023…

With elevated inflation and higher interest rates potentially impacting demand for our products, we believe the quality fundamentals in our business will provide resilience and we are well placed to continue our strategic progress through 2023 and beyond.

What to make of that? It sounds pretty robust to me, but it’s probably safest to assume that demand and earnings in 2023 might dip somewhat from 2022, maybe?

At the moment brokers are forecasting flat earnings in 2023, which might be a little ambitious maybe? (we obviously don’t know at this stage, it’s guesswork).

Balance sheet - is very strong. NAV is £89m, less intangibles and deferred tax, becomes NTAV of £80m. So what this means is that the £87m market cap is almost entirely supported by NTAV - that’s really pleasing to see.

Another way of looking at it, is that in a capital-intensive business, the £66m fixed assets are owned outright by the company, with no debt financing.

Working capital is also healthy, with a current ratio of 1.8

There’s a cash pile of £10.6m, with no interest-bearing debt.

Overall then, this is a cracking balance sheet, which gets an enthusiastic round of applause from me. Shareholders here don’t have to worry about solvency at all. Also it gives scope to make more acquisitions.

The commentary mentions potential sale of surplus land, which would be a nice bonus.

Cashflow statement - again, really strong. These are such nice, clean numbers, it’s a pleasure to review them. MBH generated £18m post-tax operating cashflow (2021: £13.6m), which comfortably funded £3.0m capex, a £6.0m acquisition, £1.5m share buyback, and £3.3m in dividends, with it still ending the year with a £2.4m increase in the cash pile. That’s very impressive I think.

You can see from those numbers that the dividend paying capacity is a lot larger than the 4.7% yield, which it can easily afford.

My opinion - as you’ve probably already guessed, I really like this share! It ticks all my boxes - a modest forward PER of only 9.2. A well-covered, easily afforded 4.7% dividend yield. A fabulous ungeared balance sheet. It’s demonstrated pricing power in a tough year for costs. And the outlook statement overall sounds quite positive. We don’t even have to worry about energy costs, with 2023 being hedged, and wholesale prices coming down so much that any future surprise might even be positive, who knows?

Downside risks are mainly macro - that demand could plunge if the housing sector really hits the buffers.

Overall, this gets an enthusiastic thumbs up from me. I think there’s a strong argument here to just ignore macro guesswork, and hold this high quality share for the long-term.

Stockopedia likes it too, with a 93 StockRank - I always like it when the unemotional algorithms confirm my analysis is on the right tracks!

The long-term chart does sound a warning though - it was absolutely crushed in the 2008 financial crisis -

Graham's Section:

Mortgage Advice Bureau (Holdings) (LON:MAB1)

Share price: 628.5p (+1%)

Market cap: £360m

After a turbulent year for the mortgage industry, let’s see how the mortgage advice bureau did:

Revenues +22% to £231m (organic growth 11%)

Adjusted PBT +13% to £27m

PBT down 25% to £17m

Current trading is in line with expectations.

Adviser numbers dropped due to the mortgage market shock, but “we expect adviser numbers will stabilise in Q2 2023 and then build gradually as business volumes improve”.

Mortgage transactions are down 35% year to date (vs. 2022), but MAB says it is outperforming the wider market and growing market share. And it is thought that refinancing transactions will grow in 2023 despite the collapse in new mortgages.

Rates have reduced from their peak but are obviously still higher than they were a year ago (impacting affordability/consumer confidence).

Faster advice - using technology, they are looking to reduce the time to take a mortgage from enquiry to completion, from ten hours all the way down to five hours.

My view

Please see my previous comments on this stock - I view it as a quality business, and I mentioned it as one of my top ten ideas for 2023. As trading is in line with expectations, there is little reason to change my fundamental view.

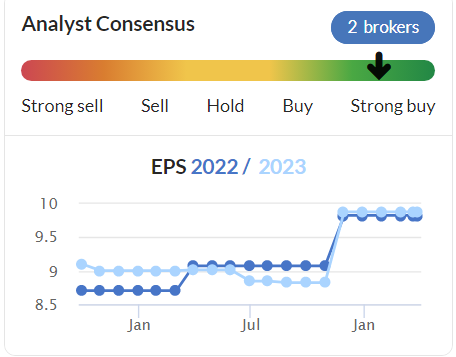

One thing that has changed is the valuation. MAB’s share price has made good progress since I first became interested in it, and it now has a below-average ValueRank:

So is it “cheap”? Not really. But I will continue to rate it positively - this is the analyst’s equivalent of “letting my winners run”!

Team17 (LON:TM17)

Share price: 405p (-9%)

Market cap: £590m

It was a double RNS from Team17 yesterday, with both results and a statement on the CEO position:

…Debbie Bestwick MBE has indicated her intention to step down from her position as Chief Executive Officer of the Company once a suitable successor can be found.

The company is planning to do things the right way, with an orderly handover, and with Bestwick helping to choose her successor. To me, that seems appropriate as she has been so crucial to the long-term evolution of Team17.

The company offers reassurances that the business can survive without Bestwick as CEO:

Debbie will remain equally focussed on maintaining a "business-as-normal" mentality across the Group, with the senior team committed to delivering the Group's strategic ambitions.

Over the last eighteen months, a highly experienced and effective divisional senior leadership team has been established, that work closely together with the Executive team and are closely aligned to the Group's core values. This team now runs the day-to-day divisions within the Group and boasts extensive and unequalled gaming industry knowledge and operational experience.

My view - it is definitely a negative news story for the stock, but the reassurances around the search for a successor and the handover plans do take some of the sting out of it. With the right successor, I would say that the business can continue to thrive.

Now let’s take a quick look at the full-year results for 2022:

Revenue +52% to £137m (organic growth 3%)

Adjusted PBT +35% to £47m

PBT down 1% to £29m

Cash £51m

Adjustments - the £18m of adjustments include £9m of amortisation and £9m of “acquisition related adjustments and fees”.

In other highlights, Team17’s own IP was responsible for an impressive 41% of total revenues (up from 22% in 2021).

Headcount rose strongly from 265 to 392, including 53 who joined from acquisitions.

Outlook - lots of detail provided on new titles, and a reminder that acquisition opportunities continue to be studied.

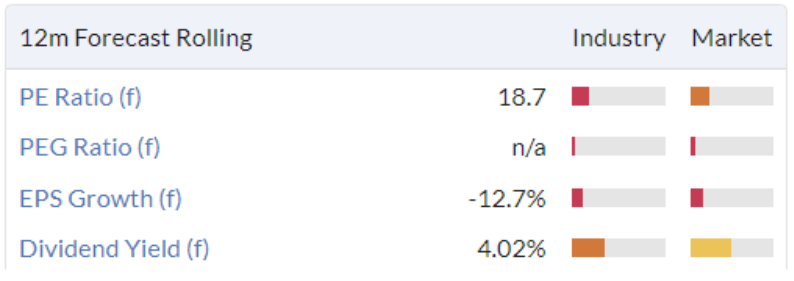

My view - there’s no change to my view on this one. Last time (January), I was neutral, saying that I liked the company but that it was fairly valued.

The market cap now is around the same level, and it is going through a CEO change. So I probably like it a little less than I did in January. That said, if you are willing to allow those £18m of adjustments to the profit figures, then the shares do not look so expensive.

The StockReport does not take a strong view on it, either:

S&U (LON:SUS)

Share price: £23.50 (-2%)

Market cap: £285m

We covered the full-year trading statement from this lender last month. Yesterday saw the release of its full-year results.

Financial highlights for FY January 2023:

Revenue +17% to £103m

PBT down 12% to £41.4m

Net receivables +30% to £421m

Net borrowings £192m (last year: £114m).

These numbers alone tell you that a lot is happening at S&U: huge growth in the loan book, a significant increase in borrowings to help fund this, but profits reversing year-on-year.

The company explains that the prior year’s profits were abnormally high, and that it considers these latest results to represent the highest “normalised” profits in S&U’s history:

The profit for [FY January 2022] was enhanced by a lower than normal loan loss provision charge which reflected the lower use of impairment provisions made in the previous Covid-affected financial year. The average annual profit before tax in the two pandemic years to 31 January 2022 was £32.6m.

The property bridging division saw a small increase in PBT, with only one tiny impairment suffered despite receivables almost doubling to £114m.

The motor finance division saw a decrease in PBT (from £44m to £37m).

Within this division, the impairment charge ticked up to £13m. Arguably, that’s still an excellent result given a year-end receivables book of over £300m. Indeed, collections remain strong at 93.6%, marginally higher than they were a year ago.

Industry comments - there are mixed trends in the car market, although they mostly sound positive for S&U:

Overall used cars sales have not yet recovered to pre-Covid levels

Inflation has cooled as supply has increased; used car prices now only up by c. 3% year-on-year

Long-term trend is for used car prices to increase and for more people to finance their used car purchase

“Near prime customers are being rationed and restricted” by the mainstream - this gives S&U its opportunity.

Interest rates/gearing

S&U is now more leveraged than usual, but they say they are ready for higher rates:

A rapidly increased Bank Rate has been budgeted for, not only in our usual budgets but in our longer-term projections. Current signs hint that such a view might happily prove conservative.

Gearing is now 85.5% (calculated as net borrowings over equity). This is up from 54.9%.

Checking the balance sheet myself, I see that almost half of the company’s assets are now financed by liabilities. This is up from 37% a year ago.

It’s a more aggressive stance than usual, but I would argue that it’s a safer model than what we usually see in this industry.

Trading update/outlook: “Current trading is good”.

My view

The valuation has ticked higher since last time we looked at this. However, based on the latest figures, the price to book value is still only c. 1.3x. I continue to view this as an attractive valuation for a lender that’s as good as this one is.

Strix (LON:KETL)

Share price: 93.8p (+6%)

Market cap: £205m

The market likes these results, although the headline numbers are poor as expected:

Revenues down 10% to £107m

Operating profit down 23% to £26m

PBT down 31% to £22m

The fall in revenue was “driven predominantly by a reduction in Kettle Controls due to market environment”. Global market share for kettle controls is maintained at 56% if you exclude Russia and nearby territories (if you include Russia, the company has seen a reduction in global market share).

Overall strategic highlights sound positive - the company appears to be happy with the integration and opportunities provided by Billi.

CEO comment:

"Following a period of uncertainty across a number of Strix's key export markets in Q4, recent sales data in 2023 indicates some green shoots are appearing and the path to a return of growth is opening across all segments.

The successful integration of Billi will propel Strix into a new growth phase, further diversifying away from the core Kettle Controls business with strong potential for greater top line growth and improved margins going forward.”

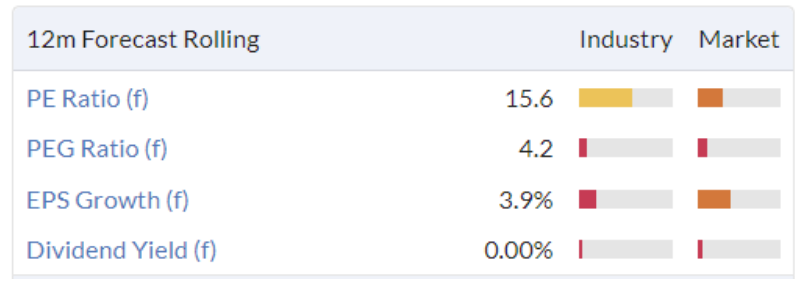

Net debt (excluding leases) rises from £51m to £87m. The company reduces its dividend in order to prioritise debt reduction instead.

Net debt/EBITDA is 2.2x based on the company’s calculation of trailing EBITDA. The plan is to get net debt/EBITDA below 2.0x during 2023 and below 1.5x during 2024.

I’m relieved to read an unusual promise from management, suggesting they are serious about paying down this debt: “there will be no further M&A activity or investment into new factory builds, with significantly reduced capex and working capital over the medium term”.

Outlook - kettle sales through an online retailer (Amazon?) grew 17% in January vs. the same period last year. There are “signs of a pipeline refill”.

Cash flow statement is skewed by the Billi acquisition (£38m cost). The company also capitalises a few million pounds of development costs each year. At least the capex bill declined:

My view

I’m tempted to give this one a red mark, but I’ll stay neutral on the basis that management have promised to get cash flow under control with some clear promises: no more M&A, and no more new factory builds.

If they do that, then the promising cash flow from operations (c. £23m this year) can potentially start to take a bite out of the debt pile.

Remember that this company is registered in the Isle of Man, so it is not the typical domestic stock.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.