Good morning from Paul & Graham!

Today's report is now finished.

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps up to about £1bn. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk.

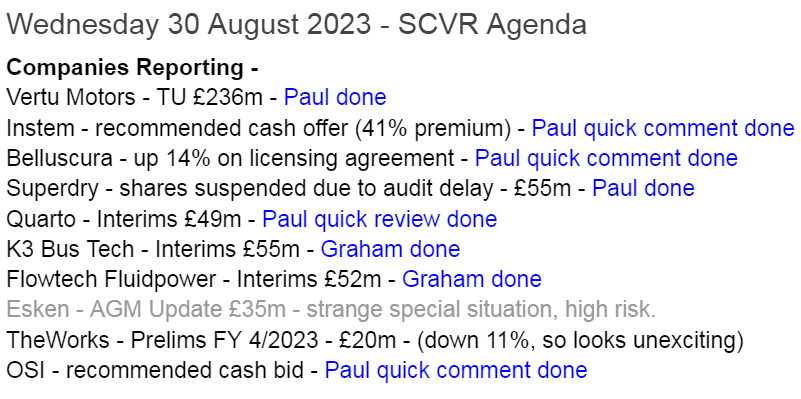

Summaries

Vertu Motors (LON:VTU) - down 1% to 68.6p (£234m) - H1 Trading Update - Paul - GREEN

H1 trading is in line with expectations, and it confirms FY expectations too. Surprisingly upbeat I think, considering tough macro. PER is only about 7x. Still lots to like here I think, so I remain positive.

K3 Business Technology (LON:KBT) - 116p (unch.) (£55m) - Interim Results (current trading in line) - Graham - AMBER

We haven’t covered KBT since 2021 and today’s interim results remind me why that might be. This provider of software products to the fashion industry reports an H1 loss; an H2 weighting should produce an “ok” full-year result, but there seems little to get excited about.

Flowtech Fluidpower (LON:FLO) - up 2% at 85.7p (£53m) - Half-Year Report (in line) - Graham - AMBER

This share remains materially lower than it was at the time of the profit warning it published in July. Revenues from high-margin distribution are lower due to the combination of a disrupted customer experience and external headwinds. Perhaps fairly valued now.

Superdry (LON:SDRY) - shares suspended at 56p (£55m) - Paul - RED

Shares are suspended today, due to late audited accounts not being ready for publication yet. It’s a full listing, so the deadline is 4 months after FY 4/2023, which is about now. It’s 6 months for AIM listed companies. It says this will only be a couple of days delay -

The Company is currently working with its auditor, RSM UK Audit LLP, to complete the final technical points of the audit of its FY23 results and expects to announce later this week. The Board confirms that the delay is a result of normal procedures taking longer than anticipated during the first year that RSM are auditing the Company.

The Company expects to request a restoration of the listing of Ordinary Shares on publication of its FY23 results before the end of this week.

Paul’s opinion - audit delays used to be extremely rare, and very much frowned upon. Since covid though, it’s a lot more common. With SDRY this has to be taken in the context of very poor financial controls, flagged up repeatedly in the audit reports in previous annual reports.

I think SDRY is having serious problems overall, evidenced by now having 2 expensive borrowing facilities, and the long silence over the supposed $50m IP sale.

After underestimating the warning signs at Joules, I’m not going to make the same mistake here, so I think it’s just safest to keep away from this one. RED. On the upside, if owner/manager Julian Dunkerton is able to deliver a turnaround (as opposed to just talking about it) then shares could do well.

Osirium Technologies (LON:OSI) - Up 79% to 2.15p (£3m) - Recommended takeover bid - Paul

Another one! This is an interesting nanocap which we’ve looked at here before, mainly in the reader comments I think. The problem was its precarious financing, and in the current environment, nobody much is interested in refinancing nanocaps. A US bidder, SailPoint Technologies, has stepped in with a rescue bid at 2.35p cash, a nice premium to yesterday’s close, but a diabolical result considering the previous highs of 150-200p in 2016-2019. With some big shareholders having agreed it, and convertible loan notes of £2.9m also having a big say in the matter, I think we’ll be waving a tearful goodbye to this share shortly. Pity, as OSI did look quite promising, if it had been properly capitalised.

Instem (LON:INS) - up 40% to 825p (£189m) - Recommended Cash Offer - Paul - GREEN

Well done to shareholders in this software company focused on the life sciences sector. A French private equity group has agreed with management to buy it for 833p cash, a healthy 41% premium to last night’s closing price.

I think the price looks fair, being about 10% below the all-time highs in a much happier market of 2021.

We only looked at Instem once this year, here on 1 Feb 2023, at 630p concluding that the share looked good, and worth a closer look.

Yet more evidence, growing by the day, that UK public markets are significantly under-valuing many companies, compared with private markets. I see that as a bullish sign for a market recovery in due course.

Belluscura (LON:BELL) - up 15% to 47p (£64m) - Exclusive Licence Agreement - Paul - AMBER

Not a company I’m familiar with, but it has cropped up as a top riser today, so I’ve had a quick look. Historic numbers are no good, with negligible revenues, and heavy losses, and prodigious cash burn to build inventories. So the valuation all rests on newsflow for promising-sounding deals, and hopes of future commercial success.

Today it says that a licensing deal has been done with a Chinese company, who will manufacture its portable oxygen concentrator. It’s a 10-year agreement, with minimum royalties of between $27.5m to $55m, depending on whether the deal remains exclusive for 5 or 10 years. Quite a hefty amount of money, if it turns into reality. It doesn’t sound like pure profit though, as BELL has to contribute towards sales & marketing.

It will be interesting to see how this pans out, but for the moment it’s too jam tomorrow for me to able to meaningfully comment here.

I see the Chairman is prolific company promoter, Adam Reynolds. Nigel Wray holds 10%. It has cropped up before as an investee company of Tekcapital, which still holds 11%.

Quarto (LON:QRT) - down 24% to 117.5p (£49m) - Interims - Paul - AMBER/GREEN

Thanks to Rusty2 for flagging interim results from this illustrated book publisher (main market is USA). I’ve had a very quick look, as almost out of time.

H1 numbers look poor, with adj PBT roughly halved to $3.1m. However, it has a heavy weighting to H2, so management don’t sound too concerned, even saying that H1 results are in line with their expectations. They don’t seem to have told the market that profits were expected to halve, as the share price is down 24% on the news.

Balance sheet - is pretty good. In particular, a sharp reduction in receivables has allowed Quarto to repay all its medium & long term bank debt, resulting in a net cash position of $9.1m. That’s very good, providing it can be maintained, and isn’t just a favourable timing difference at the year end.

Outlook - expecting challenging market conditions to continue in H2. Freight cost & delays have improved. I can’t find any broker research - an omission that the company needs to rectify.

Paul’s opinion - on the quickest of reviews, I think this share is worth you taking a closer look at, and properly researching. We used to follow it quite closely, but gave up right at the low point, and then it multibagged! (I think the vernacular is “Sod’s Law”). Looking at Quarto fresh today, after quite a long gap, I’m pleasantly surprised at the balance sheet strength. Disappointing results in H1, the quiet half, could be presenting a buying opportunity possibly, if you think it can bounce back in H2. Market cap of £49m doesn’t seem much to me, for what looks a well-financed business that has delivered a strong turnaround in recent years.

Paul’s Section:

Vertu Motors (LON:VTU)

Down 1% to 68.6p (£234m) - H1 Trading Update - Paul - GREEN

Ahead of the announcement of its results for the six-month period ended 31 August 2023, Vertu Motors, a leading UK automotive retailer with a network of 189 sales and aftersales outlets is pleased to provide an update on current trading...

Trading remains positive - in line with expectations for the full year

The Group has delivered a trading profit above prior year levels, aided by the Helston acquisition which was completed in December 2022. The Board anticipates that full year results for FY24 will be in line with current market expectations.

Helston was quite a big acquisition, so will have provided a material boost to the results.

That sounds OK. Here’s my summary of the other points in today’s trading update -

New car sales (incl. Motability) - volumes are up as supply constraints ease.

EVs (electric vehicles) - weak demand from consumers, so manufacturers are offering discounts. Fleet sector demand for EVs is “robust”.

Fleet & commercial vehicles - strong demand, improved supply, and gross margins “remain strong”.

Used vehicle sales - down 6.3% (to end July) - blames higher interest rates, and lack of supply. Prices are stable, apart from EVs (falling in price). Gross margins remain high.

Servicing - “strong demand” for this high margin activity. Shortage of technicians, so has raised pay again, to attract & retain - impact on profit margin %, but as expected.

Cost inflation - sounds under good control -

Group operating expenses as a percentage of revenues are slightly lower than last year despite higher energy costs, inflation, pay actions and investment in the Group's Information Technology platforms. A strong focus on driving efficiency and productivity is in place, with growing use of technological solutions to deliver efficiency and therefore cost reductions. The Group continues with its energy purchase strategy with 26 sites now having solar panels installed. 12% of the Group's July electricity requirement was self-generated, with installations at 14 further sites currently ongoing.

Interest costs - this is the main reason I’ve cooled on the sector a little - funding inventories with stocking loans is much more expensive now - I wonder is this a typo below “changes” looks it should be “charges” maybe? -

Interest expenses are higher than anticipated in the period due to increased manufacturer stocking changes as new car pipeline stock increased and interest rates rose.

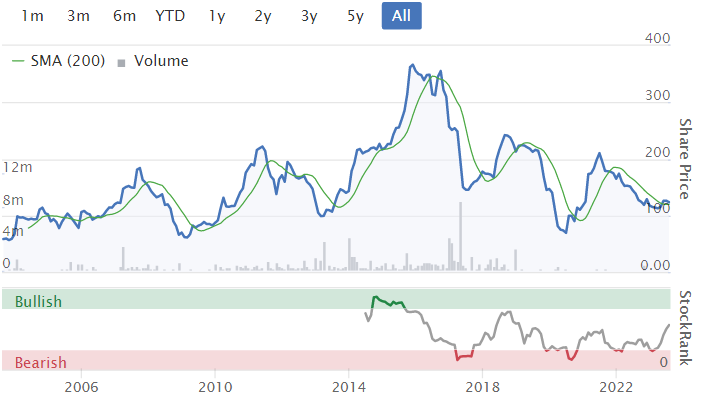

Share buybacks - are a notable feature of this share, note the StockReport shows a steadily declining share count, from 397m in 2018, to 342m currently (see further down the StockReport for the bang up-to-date figure).

This year so far, £4.8m has been spent on buybacks, reducing the share count by 7.4m shares, or 2% of the total. I like this strategy, of paying both divis and doing buybacks - makes sense when the valuation on the company is low.

Average annual shares in issue - coming down consistently, which is the opposite of what most companies do! -

Current shares in issue -

Outlook - sounds fine to me, no reason to panic, despite weak macro conditions I’d say -

The Board remains optimistic for the future. New vehicle supply is increasing whilst constraints in used vehicle supply in the UK persist, particularly in the sub-5-year-old parc, helping to underpin used vehicle values.

The roll out of agency distribution models is at an early stage and the Group will continue to monitor the impact on the business and financial returns. Whilst used vehicle purchases remain essential for many, the market outlook remains unclear due to the impact of inflationary pressures and higher interest rates for consumers.

Aftersales demand remains strong with actions taken to increase available resource.

The Helston acquisition made in FY23 continues to perform in line with expectations and remains on target to deliver on the planned improvements.

Management remains focused on operational excellence around cost, conversion and customer experience and the delivery of the Group's strategic objectives through enhanced performance coming from scale and technology.

The Board anticipates that full year results for FY24 will be in line with current market expectations.

Have market expectations been managed down? Actually no, they’ve increased (driven mainly by the Helston acquisition I think) -

With a share price just under 70p, and c.10p EPS expected this year FY 2/2024, and next year, then the PER is about 7x - still looking good value, despite the share price having been unusually robust this calendar year to date.

In valuation terms, VTU is unusual in the sector for having a share price that is only slightly above NTAV (most of which is freehold property, with working capital tending to net off).

Paul’s opinion - I was half-expecting a softening of trading, and a more cautious outlook, given current wobbly macro conditions. Hence I see today’s update as reassuring, and positive, despite being in line with expectations (which have increased, not reduced). Although at some point, used car margins seem likely to reduce, which could be why the stock market is only attributing a low PER to the sector?

The whole sector is in play re takeover bids, eg a protracted bid situation ongoing at Lookers (LON:LOOK) which is also trading well - I reviewed Lookers interim results last week here. So perhaps VTU could also attract a bidder? I’ve been saying that for a long time now, but nobody has come forward as yet.

Vertu continues to fire on all cylinders, so I remain positive on this share’s fundamentals (I’m not currently holding, due to needing the money to buy other things). Hence am happy to remain at GREEN. Stockopedia is also green, with a very high StockRank -

Graham’s Section:

K3 Business Technology (LON:KBT)

Share price: 116p (unchanged)

Market cap: £55m

This is a “provider of business-critical software solutions focused on fashion and apparel brands”.

H1 performance is said to be ahead of management expectations, although they also say that current trading is “in line”.

There are losses in H1 on both an adjusted and reported basis.

Depending on which metric you use, the losses in H1 this year seem a bit larger than last year’s. Management expectations must have been quite undemanding!

However, a change of accounting policy means that revenues of c. £1.1m were not recognised in H1, which otherwise would have been. So underlying performance is perhaps better than the table above would suggest.

The company says that there is a significant H2 weighting. However, the historical performance isn’t getting me too excited about what H2 might have in store:

Broker finnCap forecasts a small adjusted PBT in the current year of £0.6m. I presume that this will translate into an unadjusted loss (after amortisation of intangibles and share-based payment expenses).

Operationally, the company provides a wide range of products and services:

K3’s Products division consists of K3 Fashion, K3 Pebblestone, K3 Imagine, K3 ViJi and various legacy products, which seem to be in run-off.

If you scroll down to the footnotes, you find that this division is currently loss-making. The company suggests that the legacy products are the issue.

The other division, “Third-Party Solutions”, is profitable. This division consists of a reseller of ERP software and a service provider to the Inter IKEA Group.

Outlook

Current trading and free cash flow; both in line with management expectations. Encouraging new business pipeline for H2.

Strategic fashion products - targeting growth of 30% p.a. in recurring revenue in FY23 and beyond

Board is focused on further simplifying operations, reducing central cost, adjusted net cash generation and continued transition to higher margin growth activities

CEO comment concludes:

Our healthy balance sheet underpins the improvements that we are making to the business. We remain focused on our high-margin growth opportunities, cost discipline and adjusted net cash as we continue to move to higher quality earnings.

Net cash as shown in the table earlier is £2.9m, with the option to draw down a little more from Barclays. This isn’t very reassuring but the company says its cash flow is weighted to H2, and renewals will be coming in.

Graham’s view

Unfortunately, I’m finding almost nothing to get excited about here. The company talks a good game about growth and recurring revenue, but the numbers are unconvincing to me. Even the broker estimates are uninspiring.

It’s a bit of a mystery to me as to how a mature software business - this has been around for decades - can produce so little profit. The company did simplify its operations a few years ago: did it sell some of its better parts?

I can only conclude that it’s a lower-quality business than its description would suggest. Remember that its profitable operating segment is the one which consists of a reseller and a services provider.

The unprofitable operating segment is the one which contains a wide range of software products. Why is it that legacy products are blamed for poor performance - shouldn’t they be the most profitable, since they don’t require any ongoing investment?

The balance sheet is thin with equity of over £30m that includes over £27m of goodwill, so there is almost nothing tangible that might support the valuation. And the rather small cash balance would concern me.

I’m tempted to give this one the thumbs down but I try to reserve that for extreme situations where the valuation makes no sense, where solvency is in doubt in the short-term, or where management is crooked.

I don’t think KBT deserves to go into that basket. The price to sales multiple is only around 1x, i.e. not high at all. It’s possible that they might get to breakeven or a small level of profitability over the next year or two. Maybe a takeover or more disposals could be engineered. So I’ll take a neutral stance.

Flowtech Fluidpower (LON:FLO)

Share price: 85.7p (+2%)

Market cap: £53m

Despite a small bounce this morning, these shares are lower than when we last looked at them in July.

That July trading update was a profit warning which put a big dent in the share price:

We now have the interim results which are in line with the new expectations after the profit warning:

And the new CEO Mike England offers the following comments:

"Despite increasingly challenging economic conditions, overall Group revenue increased by 2.8% in the period with a more positive performance in our solutions and services segments and a weaker performance in the product distribution segment, as previously reported. We have continued to make positive progress on working capital management, continuing to improve our debt position whilst maintaining tight cost controls.”

“We expect these market headwinds to continue through H2 23 and into 2024 but I am pleased to report good progress is being made in deploying an immediate performance improvement plan and the refreshed strategy, strengthening the leadership team and simplifying the operating model building the capabilities to deliver mid-term scalable growth in a highly fragmented market."

H1 gross margin is 35.5% (H1 last year: 36.3%), because the higher-margin “Product Distribution” segment has seen a reduction in sales.

This means that the group as a whole has produced below-inflation revenue growth and reduced profitability on those sales.

H1 PBT halves to £1.6m (H1 last year: £3.1m).

At least the net debt position, as previously reported, is stable/reducing, now at £15.4m.

Production Distribution: this segment is responsible for 45% of revenues. Here is the explanation for its underperformance:

“…in part due to the more volatile economic and industrial landscape but also due to internal challenges resulting from the consolidation of five businesses into one during 2021/2022 including the closure of the Leicester Distribution Centre, consolidating inventory into the main Skelmersdale Distribution Centre. Whilst this consolidation has enabled improved scale and efficiency, aspects of this integration have impacted some parts of the customer experience. Interventions are in flight to address this to ensure we have quickly returned to the levels of high service expected by our customers including further improvements to our website, catalogue, commercial discipline and our service.”

This is unfortunate; the customer has been impacted. Hopefully the new CEO (appointed in April) has a grip on this situation. The company has a “Performance Improvement Plan” for the near-term, and a “Refreshed Strategy” for more long-term goals. Included within this strategy is the target of a “mid-teens” underlying operating margin.

For context, it looks like the underlying operating margin in H1 was c. 6%.

Operating margin is often (not always) a very good metric for companies to focus on, so I can get on board with a strategy aiming to nearly treble this metric from its current level!

Outlook - expecting continued economic headwinds and a challenging H2, but optimistic about the company’s refreshed strategy.

Graham’s view - I don’t see any reason to change my view expressed at the time of the July profit warning. This company did perform reasonably well pre-Covid and may offer some recovery prospects. The new strategy, if it works to reboot margins, would almost certainly lead to a good result for shareholders. On the other hand, I still don’t think that there is much intellectual property here and I’m unimpressed by historic quality metrics. So at the end of the day, I’m far more excited about other opportunities in these cheap markets.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.