Good morning from Paul & Graham!

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps (usually) between £10m and £1bn. We usually avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

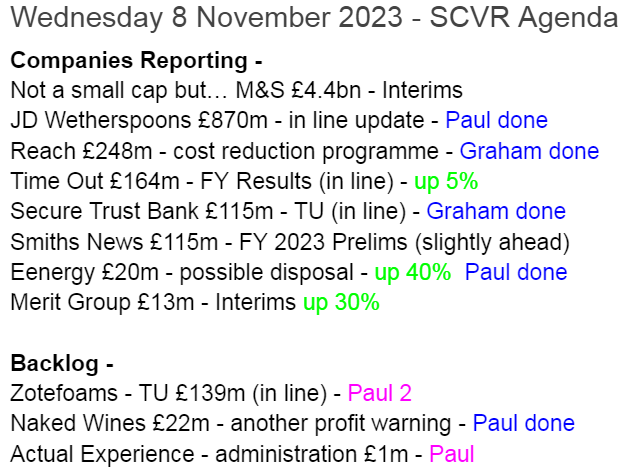

Agenda

Summaries

J D Wetherspoon (LON:JDW) - 676p (pre-market) £870m - Trading Update - Paul - AMBER

Reassures with a decent Q1 (Aug-Oct) update, LFL sales again exceeding industry average. Cost pressures abating, apart from energy, which is high still. Overall trading in line with expectations for FY 7/2024, which implies the PER coming down from high to middling. Looks priced about right to me, and I admire the company's long-term track record. Could hotels be a new growth area?

Reach (LON:RCH) - up 0.6% at 78.4p (£249m) - Cost reduction programme - Graham - GREEN

This large news publisher announces 450 job cuts as part of plans to reduce operating costs by another 5%-6%. It’s tough news for staff but I expect that it will help to maximise cash generation as the company continues on the road towards paying off its pension deficits.

Eenergy (LON:EAAS) - up 43% to 5.7p (£20m) - Luceco investment & potential disposal - Paul - AMBER/RED

Luceco makes an investment into EAAS, but seems to be doing it so that EAAS can pay invoices for goods supplied by EAAS. EAAS also tells us it has received indicative bids for its larger division at more than double last night's group market cap. That could transform the finances of this financially stretched group - I remind readers below of the nasty balance sheet.

Secure Trust Bank (LON:STB) - down 1% to 592p (£112m) - Q3 Trading Update - Graham - GREEN

This specialist lender publishes its Q3 trading update. There is nice growth year-on-year although new business lending has cooled down a little quarter-on-quarter. At a PER around 3x, and no sign of imminent collapse, I can’t avoid a positive stance on this stock.

Naked Wines (LON:WINE) - down 36% to 29p y’day (£21m) - Trading Update & Board Change (profit warning) - Paul - RED

Another quite bad profit warning. I've covered all the negatives here 3 times previously in 2023, being RED each time. Although with the market cap now only £20m, I'm wondering if this could be viewed as a special situation, a risky recovery trade, by people prepared to have a punt, knowing that it could end up at zero.

Paul’s Section:

J D Wetherspoon (LON:JDW)

676p (pre-market) £870m - Trading Update - Paul - AMBER

J D Wetherspoon plc (the "company") today publishes its scheduled trading update announcement for the 14 weeks to 5 November 2023, comprising quarter one (Q1) and a further week.

Summary - it’s trading in line for FY 7/2024, from 816 pubs -

"The company currently expects an outcome for the financial year in line with market expectations, and will provide further updates as the year progresses."

Anecdotally I’ve heard that trading has been tough for some bars, but serving the value for money end of the market, Wetherspoons looks resilient -

Like-for-like (LFL) sales in the first 14 weeks of the financial year were 9.5% higher than the same period last year.

It says this is higher than the industry average of +5.9%, a continuing trend of out-performance over the last 13 months.

Hotels - interestingly, it also mentions its hotels today, which I’ve never focused on before. Google says it has 57 hotels (which look like rooms over larger pubs, judging from the photos on Wetherspoons website booking area for hotels). They look quite nice, and cheap, although in locations that I generally wouldn’t particularly want to visit.

Budget hotels are a lucrative area at the moment - I recall being amazed at the tremendous profitability of Premier Inn, within Whitbread (LON:WTB) - and it pointing out that the UK only has a few budget hotel brands, whilst lots of independents have left the market.

Could this be a longer-term opportunity for Wetherspoons to further expand into larger sites, with a hotel above, or even standalone hotels? Maybe a different brand name for the hotels might be a good idea? Wetherspoons has both good, and bad brand aspects in my view. I’d need reassurance that its hotels use industry-leading sound deadening in the building, before wanting to book a room!

Inflation - pressures are easing, except for energy which “remain at far higher levels than pre-pandemic…”.

Capex is being increased to £70m this year (LY: £47m), to improve existing pubs - a good indication of a company that’s now on the front foot, after all the pandemic disruption. That sounds a lot, but it’s only £86k per site.

Financing - it looks as if some new interest rate fixes were agreed in Aug & Sept.

This is the key area to research, as finance costs consumed 64% of its (much improved) operating profit in FY 7/2023.

Note that free cashflow was hugely boosted in FY 7/2023 from a highly lucrative deal to close out interest rate swaps (set up very cannily in the zero interest rate era), which was a one-off. So free cashflow is much less than it seems, if normalised.

Paul’s opinion - it’s difficult not to admire the achievements of management here, with an excellent long-term track record. The main differentiating factor being low prices, which has obvious appeal to customers, especially when disposable incomes are under pressure.

Are the shares good value though? On the historic numbers, no not really. It did 26.4p adj EPS in FY 7/2023, so at 676p we’re being asked to pay 25.6x earnings. That implies the market thinks earnings should improve further in the future.

The StockReport is showing big forecast increases in earnings to 40.4p FY 7/2024, and 50.4p FY 7/2025. If those numbers are achieved, then the PER drops to a much more palatable 16.7x and 13.4x respectively. So you need to be comfortable that forecasts are achievable, to hold this share. Note that broker forecasts have been steadily increasing this year, which is usually a good sign -

Assuming it achieves forecast, and we’re told Q1 is in line, then the share price looks about right to me.

JDW has said in the past that there’s upside in the valuations of its freehold properties.

Lots of competitors continue to go under, so JDW could end up with greater market share in the long-run.

Taking everything into account, this share looks priced about right to me, so I’ll stick with AMBER.

JDW once again reiterates its defence document against a strikingly large number of inaccurate, misleading press articles, and politicians’ inaccurate comments, where JDW has obtained retractions/apologies. There does very much seem to be an anti-Wetherspoons agenda - I wonder if that’s because Tim Martin was such a vocal supporter of Brexit, and is generally outspoken? The press seem to be out to get him, a bit like their determination to destroy Boohoo (LON:BOO) whilst ignoring far worse abuses by the Chinese operators that are now dominating the fast fashion sector. The internet may be full of nonsense, but half the time so is the conventional media! That’s why I never believe anything I read in the media, and instead always check source documents myself, where possible, and listen to the opposing point of view too.

Stockopedia likes JDW, ranking it as a "Super Stock", and with a high 82 StockRank.

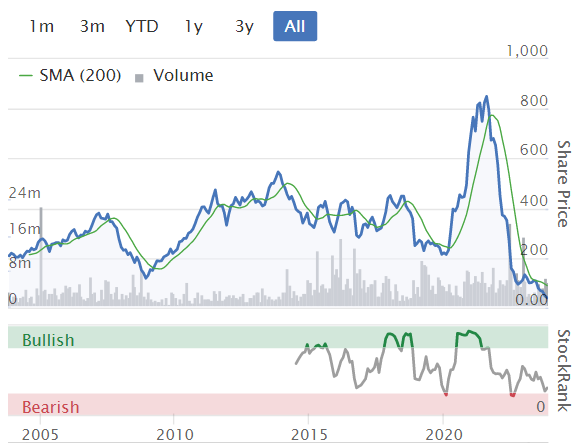

See from the long-term chart below, the share price is still a long way below pre-pandemic levels. Although note that there were c.106m shares in issue pre-pandemic, which has since risen to c.129m. So the equivalent peak market cap would be a share price about 18% lower now.

Eenergy (LON:EAAS)

Up 43% to 5.7p (£20m) - Luceco investment & potential disposal - Paul - AMBER/RED

Many thanks to one of our regulars, eParo, who flagged in the comments below interesting developments at eEnergy. There are 2 elements to this announcement -

Luceco (LON:LUCE) is subscribing for 35.078m new shares in eEnergy, at 5p per share = £1.75m.

What makes me sceptical about the reasons for doing this, is that Luceco is a supplier to eEnergy, and is owed money! We’re not told how much is owed by eEnergy to Luceco (Luceco supplied electrical parts to eEnergy).

As I mentioned here on 29 Sept, it’s clear from the 30 June accounts that EAAS is having financial trouble. The receivables book was far too large at £22.9m (compared with £33.2m annual revenues!), net bank debt of c.£6.5m, and negative NTAV of £(4.75)m. It also has debt maturities of Feb & May 2024 which need refinancing, although the company said in its last going concern statement that it expects to be able to refinance, including more equity “if required”, which sounds a pretty loose set of assumptions to me! Accordingly, I previously marked it RED, due to the need to refinance, which is currently unclear.

Possible disposal - this bit is much more important, and is the reason buyers have moved in today, taking shares up 40% in early trades -

Board considering unlocking value via a disposal of the Energy Management division

EAAS says it received

“a number of unsolicited approaches expressing interest in acquiring the Energy Management division”,

and received,

“a number of indicative cash offers which valued the Division in excess of £30 million. The Board has now entered into a period of exclusivity with one of the interested parties”.

Discussions are at an advanced stage, but there’s no guarantee the deal will complete, or as to its terms. Also, we’ve only got the word of EAAS on all of this, I can’t see any supporting third-party announcements, or named suitors.

Looking back at its 12 month results to June 2023, there is a divisional split, showing that the Energy Management division looks decently profitable at £4.0m. However note the very large central costs of £3.8m, which seems very high considering there are only 2 divisions. Although central costs are actually £2.0m, with the £1.8m above that being depreciation/amortisation and finance charges.

Paul’s opinion - this is clearly a financially stressed group, and it has been clear for some time that it needs to refinance. If a disposal goes through, and raises >£30m, then I’d be more than happy to take a more positive view of EAAS shares. Although that would depend on how viable the remaining, smaller division is? Is it trying to sell the family silver, to get out of a hole?

However, that’s not something I would want to gamble on, because this deal may not happen. In which case all the question marks over balance sheet, cashflow, and refinancing, would take centre stage again.

The deal with Luceco doesn’t particularly impress me either, as it looks a roundabout way for Luceco to get paid from a customer that’s in financial trouble.

As planetx points out in the comments below, how is the Luceco subscription not insider dealing, given that the market had not been informed that a possible disposal is at an advanced stage for (at last night’s value) double the group market cap?

Overall, the news about a possible disposal does sound very significant (if it completes). However, I still have considerable concerns about EAAS if this deal were to fall through. Therefore I’ve got to continue reflecting the negative financial position as things stand currently, but also the upside from a potential deal, so have decided to improve from RED to AMBER/RED.

EAAS seems to have been formed in a reverse takeover, on 9 Jan 2020, of Alexander Mining. Failed junior resource stocks don't die, they just morph into something new! The Doctor Whos of the shares world! The first day of dealings announcement on 9/1/2020 says EAAS had 130.9m issued shares on admission, at 7.5p. Note that EAAS has been a prolific issuer of new shares in the last 4 years, with the total having since risen to 352.1m shares.

I've set a custom date range below, from 9/1/2020 to today, so we can see the performance of EAAS as a standalone entity post. As you can see, a lot of excitement in 2021 has fizzled out, and it's now back below the original listing price, despite today's 40% surge -

Naked Wines (LON:WINE)

Down 36% to 29p y’day (£21m) - Trading Update & Board Change (profit warning) - Paul - RED

This is the well-known wine subscription service that's trying to expand in the USA as well as its home market of the UK.

Checking our previous notes here, I was unconvinced by the turnaround strategy in Dec 2022, so amber. But we then went RED on 27 April, 4 July, and 20 Sept 2023, because there was no evidence of the turnaround plan working. Problems we reported on included late FY 3/2023 accounts, material uncertainty in going concern, weak current trading, and massively overstocked on its balance sheet with its own wine lake - where I suspect more write-offs might be necessary. The founder returned as Chairman, and has today taken over as acting CEO.

I don’t believe WINE has ever really demonstrated it has a viable business model. With the market cap now only £21m though, is there a chance it might survive and prosper?

Astonishingly, WINE shares peaked at almost 900p at the market peak in summer 2021. I remember happening to be watching CNBC at the time, when some crazy Yank was ramping WINE shares, saying it was an expanding “platform”, or maybe even “eco-system”, I can’t remember the specifics, but do remember he was talking total nonsense!

The share count hasn’t been diluted (yet), and remains around 74m shares in issue.

This is the latest detail from yesterday’s profit warning -

That’s clearly a large reduction in adj EBIT (operating profit), now only expected to be £2-6m (previous forecast £8-12m, and LY actual was £17.4m).

There were very large adjustments of £31.6m last year, so it was a statutory loss of £(15.0)m. £14.0m adjustments LY was stock impairment, which to my mind is not justified to be adjusted out. It’s a bona fide cost of business - from bad buying decisions. I suspect it might be the tip of the iceberg of unsold inventories, time will tell.

NTAV was £83m at 3 April 2023, 4-times the market cap. So the share price is implying what I also think - that inventories of £166m could contain a lot of problem products that need writing off.

Liquidity - this actually sounds OK -

The Group ended H1 with £3m net cash and £45m of additional liquidity available through its credit facility. The Group is currently at its lowest point of forecast liquidity and continues to anticipate converting excess inventory to cash over the next 12-18 months given its materially reduced inventory commitments. As a result of the reduced revenue expectations in the US, the previous destocking timeline has extended slightly.

The Group has met all borrowing covenants to date and is projected to continue to meet all covenants under the revised guidance set out above.

Paul’s opinion - the CEO has left, being replaced in the interim by the founder, who says this rather scathing comment -

My view is that this [US trading] shortfall is largely to do with execution, which in turn is largely due to Nick Devlin splitting his time across both the role of CEO and US President.

Overall, I’ve got to maintain my RED opinion here, as there’s still no sign of a turnaround, and with another profit warning under its belt, the question remains whether they have a viable business here or not?

On the upside, liquidity and covenants sound OK. Although I’ve just re-read the extensive going concern statement published on 19 Sept 2023, and it still contains a “material uncertainty” warning.

I don’t know what will happen in the future, but I think it looks like a coin flip now as to whether the founder can improve performance enough, and turn inventories into cash, to ensure survival.

With the market cap now down to only £20m, it’s almost being priced to go bust.

Could it be worth a punt, as a trade for a rebound? Maybe, for risk-takers who are happy to accept the risk of either massive dilution from an equity raise, or even losing all your money in an insolvency.

Someone might come along and bid for it, you never know - there must be some value in the brand, and the customer lists.

So definitely not for widows and orphans, as a regular investment, it’s a definite avoid for me though, with my sensible hat on.

The more excitable part of me is starting to get interested though, purely as a small, speculative, risky trade, that may or may not work - the valuation of £20m leaves plenty of room for recovery, if the founder does manage to turn it around. What's the time difference between here and the US? Is it worth a phone call to CNBC I wonder?!

Naked Wines was meant to be the saviour of the old Majestic Wines, so that hasn't really worked. Although to be fair, shareholders did have a lovely selling opportunity in 2021 to cash out at a premium.

Graham’s Section:

Reach (LON:RCH)

Share price: 78.4p (+0.6%)

Market cap: £249m

A brief announcement from Reach plc this morning, with bad news for the workforce.

First, the company reiterates that it will deliver the 5-6% reduction in operating costs that was planned for 2023.

Then:

Furthermore, Reach will deliver a 5-6% in-year reduction in the operating costs for 2024 as part of its ongoing planning process. This cost reduction programme is part of the Company's drive to strengthen its position as a leading digital publisher, and mitigate against the backdrop of continuing inflationary pressures that we expect to impact 2024.

As part of this programme Reach proposes to reduce its total workforce by an estimated 450 full time roles. The savings will allow the business to deliver on its long term plans, while continuing to invest to drive better customer value, develop online products and grow new audiences.

Checking the 2022 annual report, I find the following description of average staff numbers:

So 450 full-time roles should be somewhere in the region of 10% of the total.

Given that 72% of staff (as of the end of 2022) were in production and editorial, it’s inevitable that the cuts will hit this group. I’d be curious to know where Reach thinks the greatest efficiencies might be achieved - in production/editorial, in sales or even in admin?

CEO comment is unapologetic:

Our industry has a history of change and the future will undoubtedly involve yet more. That's why it's essential we set ourselves up to win, by making our operations suited to an increasingly fast-paced, competitive and customer-focused digital world."

Graham’s view

I remain very interested to see how this share will pan out. Much depends on how the pension funds are resolved - see my comments in October trying to guess at future contributions.

Sadly, I doubt that very many at all of the staff losing their jobs in 2024 will enjoy anything like the pension benefits of the previous generation.

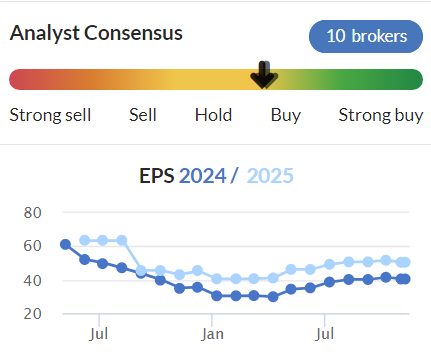

From an investor point of view, I think these jobs cuts are a good sign that the company is being run for cash flow and for profit: let me remind you that there are some very nice profit forecasts for the next two years, even after downgrades:

As the enormous contributions into the old pension schemes get paid (probably around £60m p.a. until 2028), I think this stock could gradually see its earnings multiple recover towards something normal.

The other possibility is that the pension contributions sink the company. But the nicer outcome looks more likely to me at the present time, so I’m keeping my positive outlook on Reach. Today’s announcement underlines management’s ruthlessness in ensuring that the company continues to generate as much cash as possible.

Secure Trust Bank (LON:STB)

Share price: 592p (-1%)

Market cap: £112m

It seems topical to look at banks, given their very “cheap” valuations. STB has a ValueRank of 98! Price to book is only 0.35x, according to Stocko, and how about this for a P/E ratio?

Let’s check out the company’s Q3 trading update to see if there are any signs that investor concerns are justified.

Highlights table:

Net lending: steady growth of 1.7% quarter-on-quarter in the loan book, helped by 16% growth in commercial finance. STB is a specialist in asset-based lending: invoice finance, stock/inventory finance, etc.

New business lending: this falls 7.3% in the quarter but is up 15.3% year-on-year.

I think the new business figures are clouded by the fact that Q3 2022 was a time of particularly high uncertainty - there was the mini-budget in September, along with rising interest rates and inflation. So I’m not sure I would read too much into the growth figures in Q3 2023 vs. Q3 2022. The company was very cautious in Q3 2022, for good reasons.

Deposits: growth here is commensurate with the growth of loans. The company offers a range of savings accounts, fixed rate bonds and fixed rate ISAs, and the rates offered look competitive to me (e.g. 5.5% on a 1 year cash ISA).

CEO comment:

The Group has continued to grow in the third quarter and demonstrated the diversity of its business model with Business Finance contributing its highest quarterly new business volumes in over a year…

The continuing fall in inflation is welcome. We may have seen the high point of interest rates as a result, although the current rate environment has resulted in demand softening more recently. The impacts of the recent high inflationary environment may not have materialised fully yet and so we continue to monitor our markets and customer portfolios closely.

Graham’s view

STB is not acting as if the sky is about to fall, and I don’t see any sign of economic calamity striking it just yet.

Interim results to June showed a pre-tax profit of £16.5m which included the cost of a big impairment in commercial finance. The company guided for a “significant improvement in profitability during the second half of the year through loan book growth and cost leverage”.

Shore Capital are forecasting adjusted PBT of £45.6m for the current year.

Balance sheet equity was last seen at £314m, supporting £3.1 billion of total assets.

This is another high-risk, high-reward situation but again I have to point out that investors don’t get offered valuations like this every day.

Sentiment is on the floor and the chart looks terrible but I don’t see how I can avoid taking a positive stance on the stock at this valuation. I was neutral at 735p earlier this year, when uncertainty seemed higher. But below 600p today, I can’t deny that this looks like a bargain.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.