A framework to define your stock market strategy

Choosing a portfolio of stocks can seem like a daunting task, especially if you're new to the process. So many thousands of listed companies, so little time. Maybe you’ve years of experience but have struggled to bring consistency to your results. In either case, the key is understanding what pays off in the stock market, selecting a strategy that works for you, and having the discipline to stick to it.

Richard Rumelt, author of the excellent “Good Strategy, Bad Strategy”, once said “a strategy is a set of coherent actions designed to meet a challenge.” The challenge for most investors is developing a plan that not only meets their goals but also aligns with their routines, psychological traits, and tolerance for risk.

In this eight article series, we introduce you to a range of proven stock market strategies curated from the classic literature of the genre. We assess what it takes to implement each style and help you self-assess whether they might fit you.

This introductory article lays out a master framework to make sense of seemingly conflicting strategies. Consider it a “Strategy Map” to help you navigate the terrain.

Can you really beat the market?

It’s true that active, institutional fund managers often have a difficult time beating the market. Fund managers, on average, underperform by the aggregate level of their fees each year and because cash balances they hold act as a drag on performance. It would be impossible for the arithmetic to settle any other way.

But that doesn’t stop them trying. Many active managers do beat the market in a typical year, but in their effort to join the winning group, they chop and change their holdings. All this portfolio turnover generates price volatility in the market, providing great opportunities for smaller, more nimble, investors.

Institutional investors have become too large. Most funds run hundreds of millions, or billions of dollars in investment funds. When they buy and sell shares, they do so in size. Their movements are like whales moving through the market sea. As a small investor, you can take advantage of the pricing inefficiencies they leave in their wake. And what’s more, you can capitalise on the significant opportunities they leave in smaller companies that are too illiquid for them to efficiently price.

What pays off in the stock market?

Many investors in stocks think that share prices are driven by news flow, that some announcement will happen in upcoming months that will propel share prices higher. It could be drilling or mining results, or a regulatory approval for a biotech stock, or taking a punt that company results will be better than forecast.

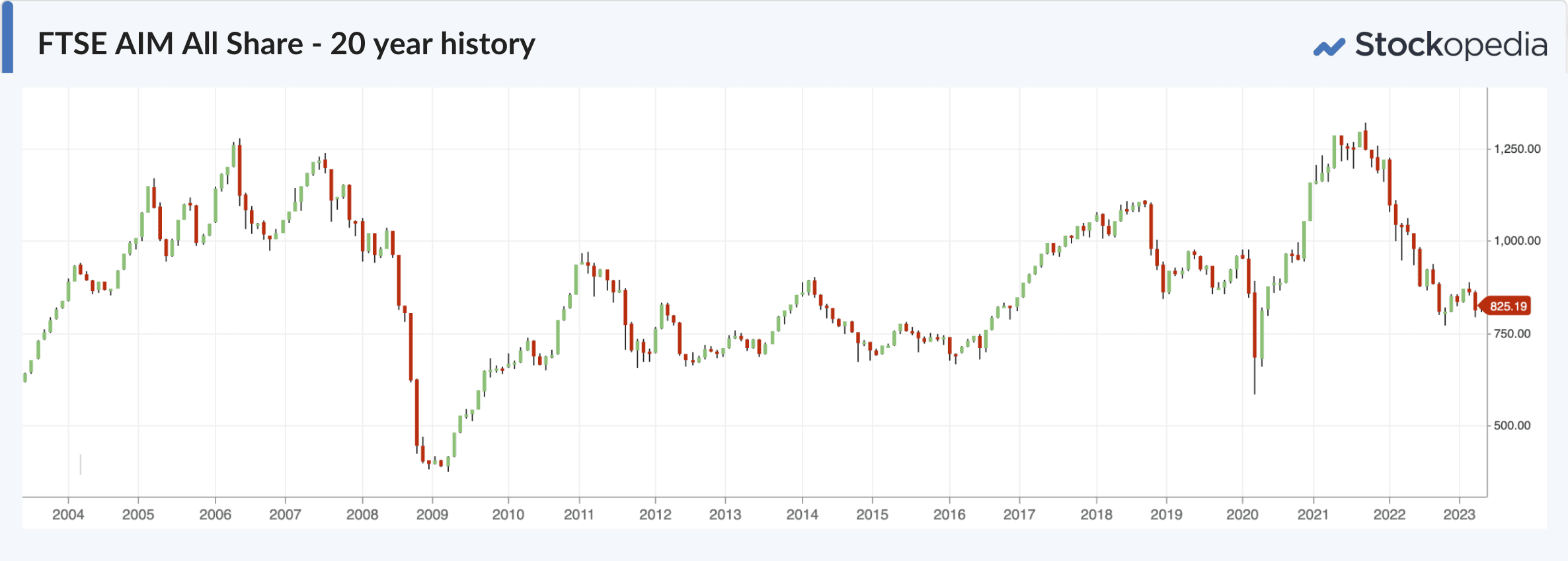

These expectations are driven by narratives, so it’s little surprise that as private investors, we tend to load our portfolios with “story stocks” - companies listed based on future expectations alone. While news events do impact individual shares, on average, story stocks often disappoint. The FTSE AIM All Share, the junior market in the UK, tells a 20 year story of “story stock” pain.

Here’s what Ben Graham, the pioneer of Value Investing, had to say on the matter:

"In the short run, the market is a voting machine, but in the long run, it is a weighing machine.” Ben Graham.

What he meant is that what really drives stock returns is the statistics behind the stocks, not the stories associated with them. Over time, the weighing machine does its work, and that’s what drives share prices. To develop an effective stock market strategy, we have to select shares that the weighing machine rewards, and ignore those that it doesn’t.

So what should we weigh? Well, many overcomplicate this, and stock markets are full of jargon designed to confuse, but it’s easier than it seems.

One hundred years of stock market evidence shows that the weighing machine rewards a limited set of characteristics. I repeat myself on this point regularly, but three of the most powerful and well rewarded characteristics are the Quality, Value and Momentum of each stock.

If you build a portfolio of shares that share these measurable traits, and manage it sensibly through time, you can beat the market. Simplicity and consistency are key. While the art of stock picking gets all the press, it’s more often the combined traits of the group of shares you own that drive the returns. As the great Ben Graham wrote late in his life:

As we circle around the Strategy Map we will dig into the kinds of financial ratios and metrics with which you can objectively measure the Quality, Value and Momentum of each stock. As you will likely already know, we have designed Stockopedia’s StockRanks as simple to use combined measures of these core return drivers.

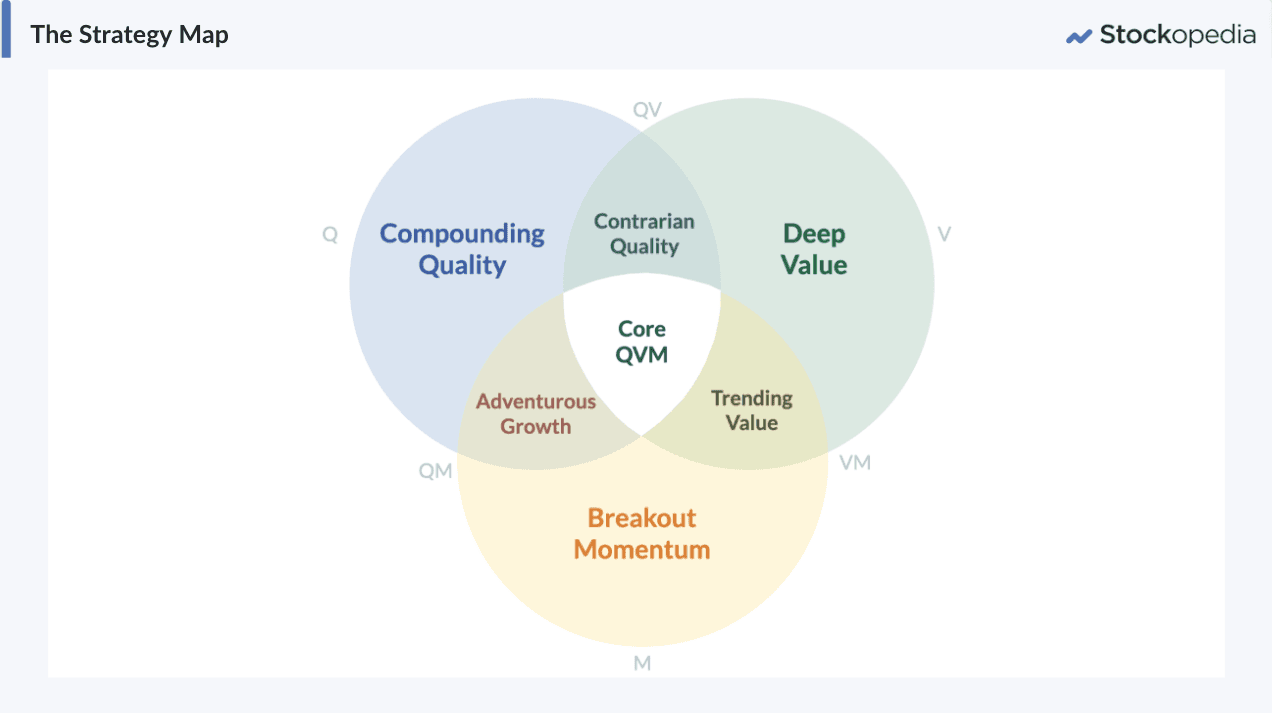

Three begets Seven

Many great investors have developed their investment strategy around just one of these core “QVM” return drivers, often ignoring the elements that make up the others. We categorise the core approaches as follows:

“Compounding Quality” - investors like Terry Smith and Warren Buffett have sought to invest in the greatest businesses of all time. These companies reinvest their profits at high rates of return “compounding” their growth. It takes diligence to find lasting quality, patience to reap the rewards and may require purchasing stocks at higher valuations than preferred.

“Deep Value” - investors like Walter Schloss, Ben Graham and more modern incarnations like Carl Icahn, have been able to profit in bargain shares in most market environments. Deep Value stocks are those that are priced significantly cheaper than their true, intrinsic value. It takes bravery to invest in deep value stocks as you have to go against the grain.

“Breakout Momentum” - traders and investors like Mark Minervini and Richard Driehaus dominate bull markets, but stand aside when prices turn. They benefit from share price momentum on the upside. It takes an active, watchful mindset to deal in breakout momentum, and a ruthlessness to cut losses when trends reverse.

At the intersection of these three basic strategies there is further adventure. With apologies for sounding biblical, but “Three begets Seven”. If we draw Quality, Value and Momentum as circles on a Venn Diagram, we can see the intersections clearly, and map them to some more classic styles.

“Contrarian Quality” (QV) - this is the approach to buying “quality merchandise when it’s been marked down”. This is the preferred hunting ground of famous investors like Joel Greenblatt while Quality Income investors often seek profitable stocks with high dividend yields (a value factor). You have to be an obstinate individual, believing your assessment of company quality is correct, when the market valuation is against you.

“Adventurous Growth” (QM) - not without risk, and often dominated by younger, more dynamic businesses, growth investing seeks to find high-quality, higher earnings momentum businesses that can benefit from the double boost of earnings growth and P/E multiple growth. This is the land of the “multi-bagger”. Some famous investors are willing to “pay up for growth” more than others. Jim Slater would keep a “Growth at a reasonable price” bias while others like Bill Miller would be willing to pay high P/E multiples to find the exceptional winners. You have to be an open-minded individual to invest in big themes and growth stocks, and must have a willingness to take a few knocks.

“Trending Value” (VM) - a phrase coined by James O’Shaughnessy who proved that Trending Value was “the best performing strategy of all time”. Cheap stocks tend to become fairly valued over time, while strong stocks tend to trend - combining both provides a double boost to profit potential. Buying trending value stocks can need a more opportunistic mindset and often is attractive to geeks. There is “Value and Momentum Everywhere” as the quants have said.

And at the heart of the Venn diagram:

“Core QVM” - this is where good, cheap and strong stocks lie. The legendary Professor Robert Haugen, who proved the market could be beaten with these shares, once called these kinds of stocks “Super Stocks”. As Haugen described “This is a dream profile”. Of course, finding dream profile stocks is almost impossible to screen directly for as everyone is looking for them. So you often need to sacrifice certain traits in individual shares to create a portfolio that meets the overall criteria.

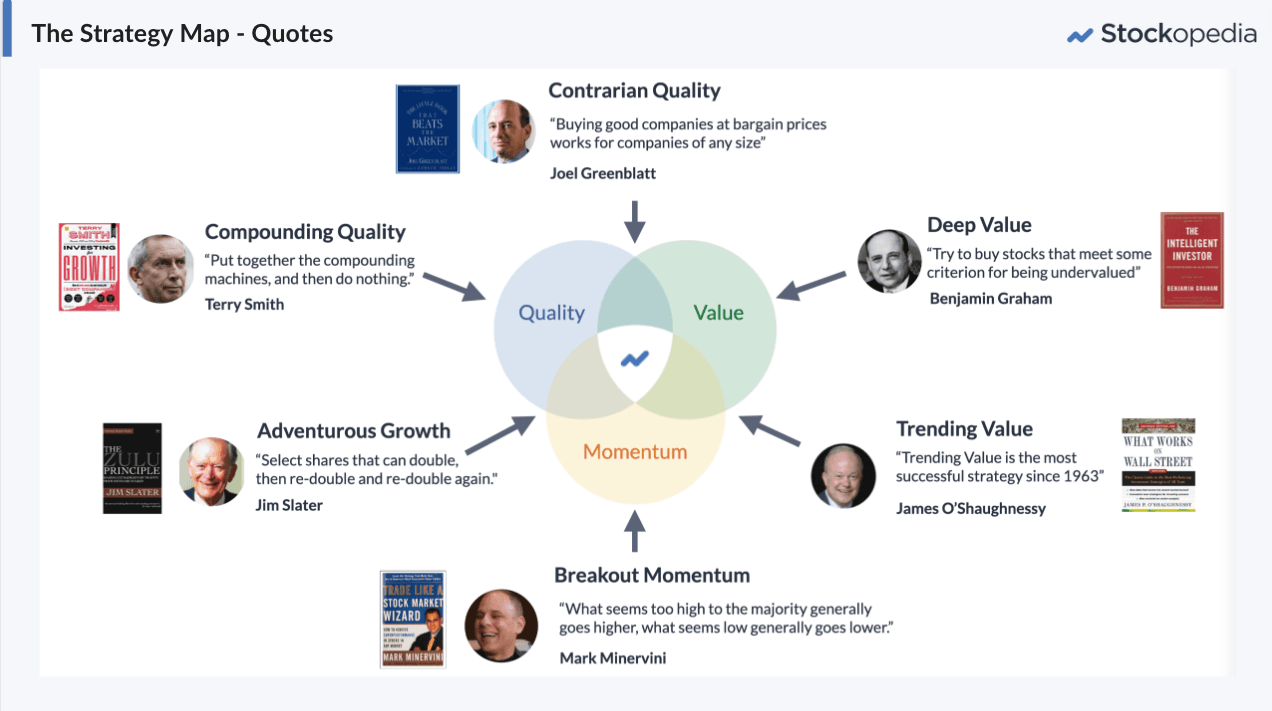

The following graphic illustrates most of these approaches with some quotes from luminaries of each genre.

Simple rules beat human judgement

In this article series, we’ll be going deep into each of these key investment styles. While the nuances of each approach can get into the weeds, it’s important to state up front that simple rules often beat human judgement. We humans can find it incredibly hard to stick to simple rules, even when proven to work. We tend to over-ride them as we get emotional or believe our expertise can add value. It’s the same for all of us.

Let me give you an example.

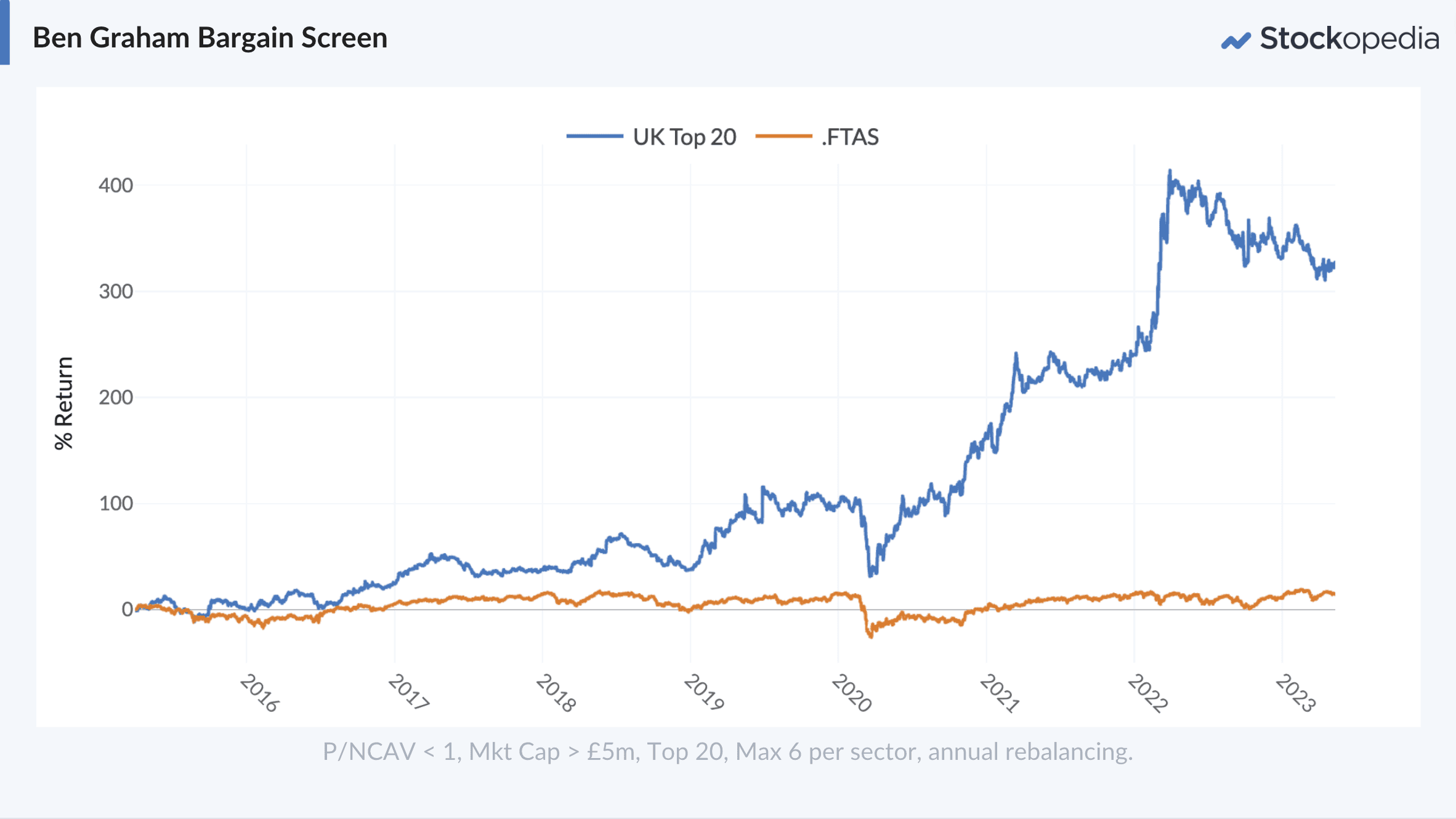

Imagine you are taken with the idea of the “Deep Value” approach to the stock market - of buying a dollar for 50 cents. You learn that Benjamin Graham searched for companies whose share prices were so cheap they were priced below the value of their “net current assets” - which essentially means they are valued so cheaply that you are buying all their property, plant and equipment (and more) for free.

Well, some simple rules for this kind of strategy could be to screen for shares with a “Price to Net Current Asset Value” (P/NCAV) of less than one, buy the cheapest 20 stocks with no more than 6 in a single sector, with a minimum market capitalisation of £5m. Each year do the same thing again. If you took this approach, you could have more than quadrupled your money over 8 years at a 19% compounded rate (spreads and yields included).

While it looks attractive in hindsight, the realities of living this method are much more gruelling. Could you stomach the kinds of horrible looking shares that this strategy invests in? The down-and-out stocks, beaten up relics, basket cases and stocks that literally nobody else wants to look at? Could you pick your moments to deal carefully in illiquid shares that averaged a more than 5% bid-ask spread? Could you stomach the volatility of the ride, and the steep drawdowns, especially when some of the individual names may go bust? Could you watch in regret as your friends have all the fun in popular market names? As we’ll see in our Deep Value investing articles, it takes courage and contrarianism to put this kind of style to work, but more than this, it takes a commitment to simplicity and simple rules that most investors can’t stomach. (To be clear - buying Graham bargain stocks is not something I recommend for novices!)

Matching your psychology to strategy selection

It’s vital to understand yourself, your willingness to invest in certain kinds of shares, your time availability, your financial goals, and your risk tolerance before rushing to implement a stock market strategy. Many investors get so excited at the prospect of discovering a strategy that “works” that they throw their money at it, without realising that it takes time for return drivers to work. The interludes can be galling.

As we saw above, it’s perfectly reasonable to build a strategy around just one return driver (like Deep Value), but the truth is that what drives the market changes in different eras. Momentum stocks dominated during big bull runs (think 1990s or 2010s) while Value stocks have dominated more counter-cyclically (e.g. 2000s). Quality may be a universal, but often gets significantly over-valued when investors “flee for safety” leading to weak returns thereafter. Investors that focus on a single style can sometimes find themselves at the wrong end of history, underperforming for a period of time. But as with anything in life, the more you commit to a chosen path, the more likely you can attain mastery even in tough markets.

I fear not the man who has practiced 10,000 kicks once, but I fear the man who has practiced one kick 10,000 times. Bruce Lee

Can you psychologically stick to a strategy in its bad times? If not, then taking a more blended approach can make sense. It can help you maintain more emotional control. Given value and momentum often zig when the other zags, a “half-and-half” approach to your portfolio can reduce the periods of significant under-performance.

Alternatively, if you are an attentive investor, and willing to monitor market trends, you can switch between strategies when the market cycle changes. At the extremes of bear markets, bargain stocks are bountiful, but in trending bull markets they disappear. Switching from value to momentum and back again can pay dividends.

What you’ll get in this series of articles

While this piece is just an overview, we hope you’ll gain insights as we circle around “The Strategy Map” in coming weeks. Each week we’ll introduce a new style with an overview that includes the following:

An overview and background to the Style

The character traits it takes to succeed with the Style

Key financial ratios to use for screening (plus links to example screens)

Guides to implementing the style - from active approaches, to more passive approaches

Risks, limitations and market cycles of each Style

Reviews of famous literature

We’ll also be following up each overview article with a focused piece about stocks of interest that qualify for various rulesets. We’ll also be illustrating ways to use the Stockopedia service to explore these stocks further.

We know that most investors are bottom-up stock pickers, but taking a more top-down, holistic approach to stock market strategy is a fresh lens. We hope you enjoy this series and that it brings you some enlightenment, aha moments, and encourages you to build up your library of stock market classics.

Recommended Reading

We’ll be recommending scores of books in this article series. Some of the books referenced in this article are recommended as a starting point for any serious investors library:

Compounding Quality - Investing for Growth - Terry Smith

Contrarian Quality - The Little Book that Beats the Market - Joel Greenblatt

Deep Value - The Intelligent Investor - Benjamin Graham

Trending Value - What Works on Wall Street - James O’Shaughnessy

Breakout Momentum - Trade like a Stock Market Wizard - Mark Minervini

Adventurous Growth - The Zulu Principle - Jim Slater

Core QVM - The Inefficient Stock Market - Robert Haugen