Good morning! Mark Simpson is joining us today to help out with the report.

Wrapping it up there for today (1pm). Huge thanks to Mark for his first contribution to the daily report!

Explanatory notes

A quick reminder that we don’t recommend any shares. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day. We usually avoid the smallest, and most speculative companies, although if something is newsworthy and interesting, we'll try to comment on it. Please bear in mind the "list of companies reporting" is precisely that - it's not a to do list. We have a particular emphasis on under/over expectations updates, and we follow the "most viewed" list of readers, so if you're collectively interested in a company, we'll try to cover it. Add your own comments if you see something interesting, and feel free to discuss anything shares-related in the comments.

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to, if they are using unthreaded viewing of comments.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced. And/or it's such deep value that we see a good chance of a turnaround, and think that the share price might have overshot on the downside.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

Others: PINK = takeover approach, BLACK = profit warning, GREY = possible de-listing.Links:

Paul & Graham's 2024 share ideas - live price-tracking spreadsheet (2 separate tabs at bottom), Video update of results so far, June 2024.

** New SCVR summary spreadsheet for calendar 2024 ** This is the live one! (updated 6/9/2024)

Archive - SCVR summary spreadsheet for calendar 2023.

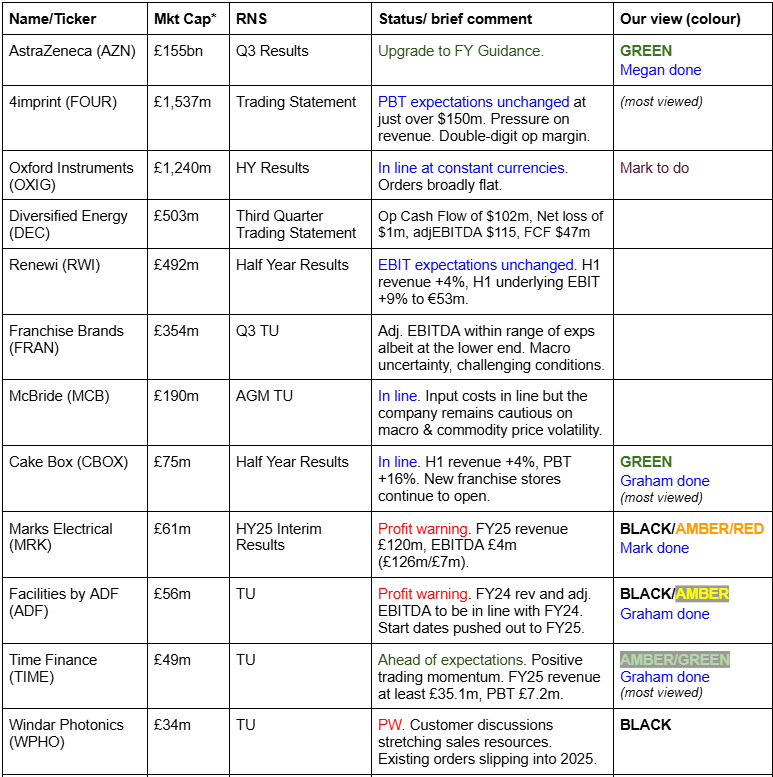

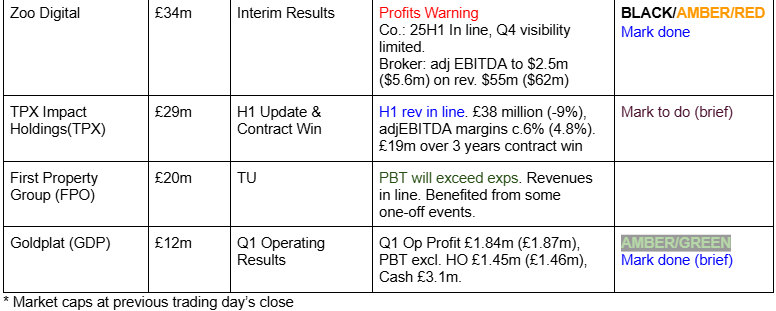

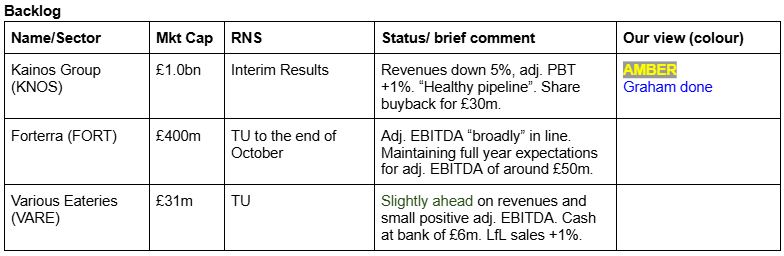

Companies Reporting

Summaries

Kainos (LON:KNOS) - up 6% to 844p (£1.06bn) - Interim Results - Graham - AMBER

After a recent profit warning, this Belfast-based provider of software services and consultancy published its full interim results yesterday. While the outlook is uninspiring, and the company is hugely dependent on factors beyond its control (public sector spending and demand for Workday products), its financial performance is objectively quite good and it is cash-rich. So I’m happy with a neutral stance here.

Facilities by ADF (LON:ADF) - down 36% to 33.5p (£36m) - Trading Update - Graham - AMBER

Investors must wait another year for recovery as the anticipated H2 revenues have not come through and the risk of a further profit warning has materialised in full. 2024 is now expected around breakeven and 2025 forecasts also get cut (new adj. profit after tax forecast £6.8m, previously £11m).

Cake Box Holdings (LON:CBOX) - up 1% to 189.5p (£74m) - Half Year Results - Graham - GREEN

A pleasant update from this franchisor of fresh cream cake shops. Like-for-like growth is not running too hot (4% in October) but the company continues to expand with 7 new franchise stores opened in H1. It’s difficult for me to not be positive on a successful franchisor, and the valuation here seems reasonable.

Marks Electrical (LON:MRK) - Down 15% to 50p - FY25 Interim Results - Mark - BLACK

Another major profit warning here with Canaccord cutting 2025 EPS from 3.5p to 1.5p and 2026 from 3.8p to 1.9p (now down 75% in the last year.) The blame is put on restrained deliveries during a new ERP implementation plus a move away from premium products in the search for volume. This is now viewed as a mistake but leaves them stuck between a rock and a hard place. Revenue growth was about the only thing going for a company on a forward P/E of 26. Growth now looks unlikely in the medium term, leaving them on an aggressive rating despite the share price almost halving this year.

Zoo Digital (LON:ZOO) - Up 4% to 36p - Interim Results - Mark - AMBER/RED

The company reports that these results are in line but raise some doubt as to whether their Q4 bookings will deliver. Progressive Research are less circumspect and reduce adjusted EBITDA to $2.5m from $5.6m on revenue reduced to $55.0m from $61.8m, implying that revenue in H2 will be slightly down, and Adjusted EBITDA in H2 will be just $0.9m versus $1.6m in H1. The company seems confident that their cash and debt facilities will see them through to cash flow break even. On current forecasts that looks to be the case, but it doesn’t leave a lot of wiggle room for any further slips. With so much of the value based on an expected recovery in trading far in the future, and much of that already being priced in, it is hard to feel positive about taking a position now in the hope that an even better future arrives.

Short Sections

Goldplat (LON:GDP)

Down 5% to 6.75p (£12m) - Q1 Operating Results - Mark (I hold) - GREEN/AMBER

Steady as she goes from this company that recovers gold from mine waste in South Africa and Ghana:

The two recovery operations achieved a combined operating profit for the quarter of £1,838,000 (excluding listing and head office costs, finance cost and foreign exchange losses) (FY Q1 2024 - £1,865,000). The finance cost and foreign exchange losses incurred in Q1 mainly related to trading activities and resulted in a combined profit before tax excluding listing and head office costs for Q1 of £1,451,000 (FY Q1 2024 - £1,455,000).

Head office and listing costs typically run at about £200k per quarter, so a PBT of around £1.2m for the quarter compares favourably with the £12m market cap. In addition, the company holds net cash on the balance sheet:

Our cash balances in the group remained strong at £3,100,000 at the end of Q1. The cash balances will mainly be used to manage working capital requirements in Ghana and repayment of intercompany loan balances and other capital requirements.

The Value Rank here is 97, with a lot of green on the StockReport:

However, shareholders have yet to see any return from that as the dividend payout has been zero over the last few years, and only a very minor share buyback has been conducted. Instead, changes in business strategy are requiring greater short-term working capital. Ghanaian authorities want gold producers in the country to produce doré bars instead of concentrate, and this requires additional equipment to be installed and a greater pipeline of material on-site in Ghana. In the medium term, this should give a working capital benefit, as bars can be sold quickly. However, the share price reaction today tells observers everything they need to know - shareholders are fed up with waiting.

Mark’s opinion - it is hard to ignore the valuation metrics here which make it one of the cheapest shares on the UK market (hence I hold). However, significant risks are present too - the geographic locations the company operates in are not straightforward. While the company has operated for many years without major problems, the reality is that the challenges present themselves in other ways, namely delays. The patient shareholder will probably do well…eventually!

Time Finance (LON:TIME)

Up 10% to 57.8p (£53m) - Trading Update - Graham - AMBER/GREEN

It’s the briefest of updates from this SME lender; let’s quote it almost in its entirety:

Time Finance plc, the AIM listed independent specialist finance provider, announces that it has continued to enjoy positive trading momentum throughout the first five months of the 2024/25 financial year…

This positive momentum year-to-date includes record revenues, a lending book hitting new heights, and arrears remaining well under control. As a result, the Board now has increased confidence that Group performance for FY25 will be ahead of current market expectations. Revenue and Profit Before Tax for FY25 are now expected to not be less than £35.1m and £7.2m respectively.

Prior expectations were for revenue of £34.5m and PBT of £6.9m.

Graham’s view

Roland covered TIME’s full-year results in excellent detail here, in September, and was AMBER/GREEN on the stock (share price at the time: 57.8p).

After a positive trading update today, further boosting the investment case, I’m inclined to leave the existing positive stance unchanged.

The company’s tangible net assets as of May 2024 (the year-end date) were £39m, so TIME is trading at a substantial (c. 35%) premium to this.

Looking ahead, broker Cavendish argues that the stock is trading at only 1.1x FY 2026 tangible net assets, i.e. at a 10% premium. But it seems generous to value the company on its 2026 numbers.

Well done to those who’ve held this during its tremendous bull run. I’ll leave our mildly positive stance alone for the time being, as the business goes from strength to strength.

Perhaps if it declares a dividend, attracting even more investors to the story, that will be a good moment to switch to neutral? Based on the premium to TNAV, I do think a switch to neutral could be justified before too long.

AstraZeneca (LON:AZN)

Up 1% to 10,040p (£155bn) - Third quarter results - Megan - GREEN

When AstraZeneca’s management team rebuffed Pfizer’s £69bn takeover in 2014 they said that the offer materially undervalued the company. The British company is now worth more than twice what Pfizer offered and, with a market capitalisation of £155bn it is now bigger than Pfizer itself (£149bn).

Astra offers a lesson in the importance of innovation in the pharmaceutical industry. Revenue in the first nine months of 2024 has risen 19% to £39.2bn, driven by continued strength in oncology. When Pfizer came calling, cancer treatments weren’t worth splitting out as their own operating division, now they’re equivalent to 43% of product sales.

Importantly the investment in innovation continues at pace. In 2024, the company has invested 23% of its revenue into research and development. It’s also had some significant read-outs from clinical trials. Tagrisso and Imfinzi (both chemotherapies) have been approved for the treatment of more cancers in the US and EU. Meanwhile Lynparza, the targeted cancer therapy which is significantly less invasive than chemotherapy, has been approved for endometrial cancer in the EU. Ongoing label expansions to these cancer medicines should help keep revenue ticking up and protect sales from falling off a cliff when patents expire.

Beyond oncology, Astra has today reported positive clinical results from its neurofibromatosis trial - a rare disease that causes tumours to grow along the nerves, for which there is currently no approved treatment. Rare disease is the third largest revenue-generating division of the company, but growth here has lagged other parts of the business in 2024.

Megan’s view: Astra lost its crown as the largest company in the UK last week after a new report fueled fears of an escalating insurance fraud investigation in China. On Tuesday the share price fell 8.4% or £15bn, equivalent to roughly three years worth of the group’s total sales in China.

The report suggested that the financial implications of these allegations could be significant, a statement that has spooked the markets. But for me, this seems like something of an over-reaction. China is not a meaningful part of the investment case; it’s a market that is hard for foreign pharma companies to operate in and it’s not growing as quickly as Astra’s other markets.

So does this sell-off provide an opportunity for those looking to benefit from share price weakness? Quite possibly. The company has increased its earnings estimates for the full year in these numbers and shares are now trading on a PEG ratio of less than 1. Worth a closer look in my opinion. GREEN

Graham's Section

Kainos (LON:KNOS)

Up 6% to 844p (£1.06bn) - Interim Results - Graham - AMBER

Kainos Group plc (KNOS), a UK-headquartered IT provider with expertise across three divisions - Digital Services, Workday Services and Workday Products - is pleased to announce its results for the six months ended 30 September 2024.

We had a profit warning from Kainos on 31st October (covered here) and so it would have been surprising if there was any bad news left to be revealed in yesterday’s interim results.

The main reasons for the October profit warning, as summarised in a helpful broker note from Canaccord, were: a) a pre-Budget slowdown in public sector spending; b) smaller contracts relating to Workday.

Yesterday's H1 results showed a modest decline in revenues (down 5% to £183m), with a 1% increase in adj. PBT to £38.2m.

Bookings were down 11%.

The company proudly stated that “our disciplined execution and strong growth in higher-margin products have supported profitability”.

They finished the period with cash of £152m of cash and have earmarked £30m of this for a share buyback programme. It’s nice to have the flexibility to do that but bear in mind that this will only reduce the share count by c. 3% at the current market cap, so it’s not going to be a meaningful driver of EPS.

Current trading/outlook

First a reminder of what happened:

On 31 October, we moderately reduced revenue expectations for the full year reflecting the poor macro-economic conditions and delayed UK Government decision-making. We expect the majority of the revenue reduction (along with the impact of the additional investment to support our products partnership with Workday) to flow through to lower adjusted profit before tax.

Looking ahead, the watchword is “flat” for the time being.

We continue to have a healthy pipeline, ongoing cost discipline, a strong balance sheet and a significant contracted backlog…

In Digital Services, we expect a slight revenue decrease in the remainder of the year and a flat outlook into FY26, as slow UK Government decision making persists, before the new Government determines and executes its investment priorities in both central Government and the NHS.

We expect flat Workday Services revenue in the second half and into FY26 in a soft market…

Graham’s view

My biases say that this is an IT consultancy with limited intellectual property of its own, probably labour-intensive, and reliant on the fortunes of a particular software company (Workday).

But if I put those biases to one side, I have to admit that the financial statements themselves are appealing from an investment point of view.

The income statement published yesterday (for the six months to Sep 2024) has an operating margin of 17% - nothing wrong with that at all.

Stockopedia finds impressive ROCE/ROE in addition to an attractive operating margin:

On the balance sheet, there is positive tangible equity (£118m) and a large cash pile (£137m), with zero borrowings. I note a very large (£41m) basket of deferred income, which is a good thing - customers paying upfront for services they will receive later, or over a period of time.

The cash flow statement is attractive too, at least over this brief 6-month window, with hardly any capex to detract from nearly £37m of operating cash flow (before movements in working capital). Capex over the entire year to March 2024 was less than £6m.

I’m therefore leaning towards the view that this stock might be worth a second look. But bear in mind that with a “flat” outlook, we aren't expecting much growth for the foreseeable future.

And the stock isn’t all that cheap on traditional metrics. Back-of-the-envelope calculations suggest that at the latest share price (844p) it’s trading at a PER of about 20x. Adjust for the cash balance and you can maybe get this down to 17x.

Personally, I wouldn’t want to pay so much for a company in this sector. However, given the objectively strong financial performance, I shouldn’t let my biases force me to take a negative view on the stock. Let’s go AMBER.

Facilities by ADF (LON:ADF)

Down 36% to 33.5p (£36m) - Trading Update - Graham - AMBER

Facilities by ADF, the leading provider of premium serviced production facilities to the UK film and high-end television industry ("HETV"), today provides an update on trading in respect of the full year ended 31 December 2024...

I’m afraid this is one that I got wrong, as I was AMBER/GREEN on it after studying the interim results in September.

Today we get a profit warning that results in massive cuts to profit forecasts for the current year.

At the time of the interim results, there was hope that film and TV production was normalising and that ADF was about to return to very high levels of activity.

Unfortunately, it hasn’t panned out:

…following the conclusion of macro-economic events on both sides of the Atlantic, it is now clear that a significant number of the productions that ADF had in its sales pipeline for H2-FY24 will have start dates pushed out into FY25, and some will not proceed at all.

Compounding the misery, ADF’s decision to focus on “shorter duration” productions during the Hollywood Strikes means that its follow-on revenue (“add-ons”) is lower than usual.

Estimates: Cavendish have slashed their revenue forecast for the current year by 28%, to bring it down to ADF’s guidance of £35m.

As for profits, the less said the better! The adj. profit after tax forecast falls from £5.2m to breakeven, and I assume that the unadjusted result will be in the red.

Looking ahead to 2025, that year doesn’t escape cuts either. Cavendish are rebasing forecasts due to the risk that a return to pre-Strikes levels of activity might continue to take longer than anticipated. This mere possibility results in the adj. profit after tax forecast for 2025 reducing from £11m to £6.8m.

Outlook: let’s hear the company’s own views on 2025.

The sales pipeline for FY25 has been steadily building across the Summer and supports what many in the industry believe will be a full return to previous activity levels of film & HETV production. Adding the deferred work from the back end of FY24, for which the Group has the fleet capacity to deliver alongside the pre-existing FY25 pipeline, will ensure ADF begins FY25 with a significant pipeline. ADF is in discussion with several new customers for large, multi-series productions with Netflix, Apple and Marvel.

Graham’s view

I don’t think I can argue that the market is overreacting today. The percentage share price fall (36%) is similar to the percentage reduction in the profit forecast for 2025 (38%).

This creates an opportunity for investors who are willing to bet on recovery by 2026. At a market cap of £36m, the stock is now trading at a low single-digit multiple (only c. 3.3x) of the after-tax earnings it was previously forecast to earn in 2025. Is there any chance it could achieve this on a one-year delay?

However, the timing of the recent £21m acquisition (discussed here) now looks unfortunate in the short-term, as it was accompanied by both share dilution and higher net debt, with debt now forecast to end 2024 at £14.5m.

If the company hadn’t taken on that acquisition and if it had a net cash position, maybe I could stick my neck out and stay AMBER/GREEN despite today’s profit warning.

However, I need to be mindful of the risk:reward when there is a substantial acquisition in the works and net debt accompanying a profit warning. I very much expect that ADF will be profitable again soon but for now I must take a neutral stance on the stock.

Cake Box Holdings (LON:CBOX)

Up 1% to 189.5p (£74m) - Half Year Results - Graham - GREEN

This is “the UK’s largest retailer of fresh cream celebration cakes”, i.e. vegetarian cakes. The store count is now at 232, as of the end of H1 (September 2024) and is growing at a rate of about 10% p.a.

CBOX operates a successful franchise model, meaning high returns for shareholders:

Today’s trading update from the company is a pleasant read: they are on track to deliver full year results in line with expectations, and all metrics seem to be going in the right direction.

Key bullet points for H1:

Like-for-like sales growth of 2% is “against strong comparatives” in the prior year.

Total revenue up 4.3% to £18.7m, driven by freshly opened stores and higher sales volumes at stores that opened in the previous year.

Pre-tax profit up 16% to £2.8m

Net cash hasn’t changed much at £5.6m.

Interim dividend gets a boost to 3.4p.

Current trading/outlook: like-for-like sales were +4% in October. Nice growth in online sales of 23%.

CEO comment:

"During the first half of the year, we delivered strong growth across key financial metrics and expanded our customer base, resulting in double digit increases in profits and dividends. We have seen continued growth in online sales as well as brand awareness. Importantly, we increased our customer database by 40% and launched our customer loyalty programme in the period.

Graham’s view

This company had some accounting drama in 2022, and the share price has still not recovered:

When I see a damaged chart like this, the contrarian in me wants to be GREEN. But fundamentally, the point of this stock is the franchising model, which is a dream when it works - and it seems to be working at CBOX.

The main danger for investors is probably related to those accounting problems - can we trust CBOX now, or could it be another CAKE (Patisserie Valerie)?

As with CAKE, CBOX investors can take comfort from the fact that their Chairman has a significant exposure to any potential problems (or more optimistically, he is aligned with his fellow investors). Co-founder Sukh Chamdal maintains a 25% stake in the company. With a new CFO since last year, and another few years of trading and expansion under their belt, maybe it’s plain sailing for the company from here on out?

It warrants further investigation but my overall impressions are positive and it doesn’t seem excessively priced:

Marks Electrical (LON:MRK)

Down 15% to 50p - FY25 Interim Results - BLACK

This distributor of consumer goods is continues to grow revenue:

· Robust first half trading period with revenue growth of 9.3% to £58.8m (H1-24: £53.9m).

· Particularly strong volume growth with Major Domestic appliances achieving 13% volume growth during the Period and Consumer Electronics over 90% volume growth against H1-24.

However, like many companies at the moment, increasing costs means this is not reaching the bottom line:

· Adjusted EBITDA(1) of £2.0m (H1-24: £2.3m) at 3.4% margin (H1-24: 4.3%)...

· Adjusted EPS of 0.72p (H1-24: 1.11p)(2), Statutory EPS of (0.79)p (H1-24: 0.83p).

I note that there is a large gap between the adjusted and statutory figures, which they explain as:

This decrease is primarily driven by exceptional costs incurred in relation to our ERP implementation project of £1.9m incurred in the Period.

These may be one-off, but they are not small and an ERP system is part of the core of what the company does - distributing consumer goods. Not only are there considerable exceptional costs, but the outlook reveals that this is a major profits warning:

As a result, we now expect to achieve revenue in FY25 of circa £120.0m with EBITDA in excess of £4.0m.

Previous forecasts were £126m revenue and £7m EBITDA so this is a big reduction. The broker, Canaccord, cuts 2025 EPS from 3.5p to 1.5p and 2026 from 3.8p to 1.9p, suggesting that there are no easy fixes to the company's current woes. Indeed, the broker trend here is not exactly encouraging, with the 2026 forecast dropping 75% in the last year:

The reasons they give for today's multi-year profits warning are:

· Outbound deliveries in September and to a lesser extent, October were reduced to enable the successful implementation and switchover to our new ERP system. Whilst this held back H2-25 growth, we still anticipate a recovery in revenue growth in the second half.

· During the Period we saw a significant reduction in average order values (-9%) as demonstrated by our volume growth outstripping the pace of our revenue growth. Whilst this is positive from a customer acquisition and market share perspective, it means that distribution costs represent a higher proportion of revenue, which ultimately has a detrimental impact on profit margin and unit economics, given the relatively fixed cost of delivery.

It seems the three scariest letters for shareholders to hear are E, R, and P. The implementation of a new ERP system often costs far more than planned and causes significant business disruption. While things have gone relatively smoothly here, it has still meant they had to reduce deliveries, which has led to significant (statutory) losses.

The reduction in average order values is more worrying. Historically, Marks has been a supplier of premium-branded goods, doing its own nationwide logistics, all from its warehouse in Leicester. While margins are very similar, premium products mean that the value of the goods on a van is higher, the gross profit per van is higher, and logistics costs are a lower proportion of gross profit. Recently, they appear to have been going for volume growth by selling lower-value products, which has negated their previous advantage. Their solution now is:

As the consumer has continued to trade-down, we have evolved our business to meet those needs, perhaps leaning too much into non-premium products, which has led to erosion in our premium average order value. The knock-on implications of this on our distribution costs are something that we need to actively address moving forward by pivoting back to our historically premium focussed operating model.

This leaves them between a rock and a hard place. While the problems caused by changing their ERP system and leaving the Euronics buying group may be behind them, in order to try to recover profitability, they are going to have to forgo sales growth. It seems there is a limit to the number of premium brand customers, at least in the current market. And high sales growth is one of the only reasons to own a stock with historical valuation metrics like this:

The good news is that they have time to turn things around. We are often sceptical about companies that describe their balance sheet as “strong” or “robust”:

Robust, debt-free balance sheet with closing net cash position of £6.7m(3) (H1-24: £10.9m)

However, here, the current ratio is reasonable at 1.36, suggesting no immediate worries:

This is down from 1.59 last year, though, and there is no asset support to protect the downside. So, this is something investors may want to pay a closer eye on in the future.

Mark’s View

When Paul reviewed this at the start of the year, in response to the profits warning at that time, he rated it AMBER/RED. The shares have almost halved since then. Even so, they appear to be significantly overvalued on medium-term earnings forecasts. At 50p the company is still trading on 26x 2026E EPS, and the current 15% move down in response to this further warning looks too light. With no easy fix for the core issue of demand for premium products to make the distribution costs low, that AMBER/RED stance has to remain.

Zoo Digital (LON:ZOO)

Up 4% to 36p - Interim Results - Mark - AMBER/RED

Zoo Digital has been a highly volatile stock in the last year:

Historically, this supplier of local services to the TV and Film industry has been an investor favourite. Rapid revenue growth from 2020-2023 meant that this became highly rated.

However, a strike by actors and writers in 2023, highlighted the level of customer concentration here. When that customer cut orders, revenue more than halved. However, Zoo was slow to cut its costs in response, and significant losses ensued:

The company was only saved from insolvency because it had raised £10m from shareholders at 160p for an acquisition that didn’t complete. Today’s results reflect the ending of the strike and new orders being received from their major customer:

· Revenues increased by 29% to $27.6 million (H1 FY24: $21.4 million) as content output continues to recover following the Hollywood writers' and actors' strikes of 2023

· Gross profit increased by 386% to $10.1 million (H1 FY24: $2.1 million)

However, this isn’t enough to bring them into profitability:

· Operating loss of $2.5 million (H1 FY24: loss of $10.9 million)

So there are only two major things to consider in the short term - can they grow revenue fast enough to break even? And do they have enough cash to get there?

This is what they say about revenue:

· Entertainment industry recovery expected to continue steadily in H2 FY25, gradually improving through calendar 2025

· While H1 FY25 trading was in line with full year expectations, visibility of Q4 orders remains limited

That seems to be quite a caveated statement and raises doubt as to whether forecasts will be achieved. In their updated note, paid-for broker, Progressive, seem to think so too, saying:

Forecast revisions due to limited visibility. The pace of recovery remains key, and we understand that it is taking time for ordering patterns to resume as the major players grapple with revised business models. While order flow is improving, visibility remains limited and we have revised our FY25E estimates, with adjusted EBITDA moving to $2.5m ($5.6m) on revenue of $55.0m ($61.8m). Net cash is expected to be $2.6m.

The implication of this is that revenue in H2 will be slightly down, and Adjusted EBITDA in H2 will be just $0.9m versus $1.6m in H1. So this is a profits warning, even though the company don’t explicitly say this. It seems Paul was prescient when he reviewed Zoo in August and said: "It wouldn’t surprise me if ZOO warns again on profit in Q3 or Q4. Cash could get tight by then if a more convincing recovery hasn’t started."

Progressive also introduces a 2026 forecast with $60m revenue and $7m EBITDA and 1c EPS. This shows how sensitive the business is to changes in revenue but must also include assumptions over cost-cutting. Here they have made progress:

o Salary costs reduced by $4.5 million to $13.5 million (H1 FY24 $18.0 million)

However, things still appear to be quite tight on the cash front. They say:

· Cash balance of $4.3 million at period end (H1 FY24: $16.8 million)

However, this is gross cash, not net. A look at the balance sheet shows $5.6m of debt. The bulk of this will be lease liabilities, but unfortunately, they don’t break it out during the half-year. The annual report has $5.5m of lease liabilities out of $5.7m gross debt. They made $750k of lease capital repayments during the period, suggesting there may be up to $1m of bank debt. Progressive is forecasting $2.6m net cash at year-end, plus they have:

Secured additional debt facility of £2 million giving $5.6 million funding in total…

Board believes its cash and debt facilities provide the Company with sufficient working capital to meet its operating requirements for the foreseeable future

So it seems the company are correct about this on current forecasts, but perhaps it doesn’t leave much headroom if there is any further delay in revenue. Working capital is quite finely balanced, with a current ratio of less than 1, excluding the lease liabilities. Operating cash flow has been positive over the last six months, which helps the case here:

Capex and capitalised development are understandably being constrained and much lower than depreciation and amortisation, which helps with free cash flow but doesn’t get them into positive territory.

The bull case is that they have managed to grow revenue rapidly in the past, and if they can do so again, the rating will come down quickly from the current 59x P/E multiple that Progressive have for FY26. The problem is that this is outside the forecast window. The shares are actually up today, but this may well have more to do with the big fall in share price yesterday. I’m not sure we can conclude that there was foul play at work in the fall. The reality is that this hasn’t been a stock to hold into results for quite some time now.

Mark’s View

I have held Zoo in the past as a recovery stock. Unfortunately, that recovery took far longer than I expected, and I bailed when I realised they were not cutting costs anywhere near fast enough to reflect their current financial situation. With today’s update, the recovery takes a further step back. Although they may have finally grasped the nettle on costs, you have to hope it isn’t too late. Paul rated this as AMBER, but with a further warning and Progressive forecasting more cash outflows in H2, I think this has to go to AMBER/RED.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.