Good morning!

Before we get started today, I wanted to point out a fascinating article written by our colleague Alex Naamani - When Dividends Turn Dangerous. Something to read over your morning coffee.

I'd also like to point you towards our new spreadsheet with records of the stocks we've covered since 5/11/24. It's a work in progress and does need to be improved but for a quick snapshot of the companies we've covered and the stances we've taken, it should do the job.

Now let's see what the RNS has in store!

Wrapping this up just before 1pm. Special thanks to Keelan for his section on MTL. Have a good day!

Explanatory notes

A quick reminder that we don’t recommend any shares. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day. We usually avoid the smallest, and most speculative companies, although if something is newsworthy and interesting, we'll try to comment on it. Please bear in mind the "list of companies reporting" is precisely that - it's not a to do list. We have a particular emphasis on under/over expectations updates, and we follow the "most viewed" list of readers, so if you're collectively interested in a company, we'll try to cover it. Add your own comments if you see something interesting, and feel free to discuss anything shares-related in the comments.

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to, if they are using unthreaded viewing of comments.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced. And/or it's such deep value that we see a good chance of a turnaround, and think that the share price might have overshot on the downside.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

Others: PINK = takeover approach, BLACK = profit warning, GREY = possible de-listing. Links:

Paul & Graham's 2024 share ideas - live price-tracking spreadsheet (2 separate tabs at bottom), Video update of results so far, June 2024.

** New SCVR summary spreadsheet for calendar 2024 ** This is the live one! (updated 6/9/2024)

Archive - SCVR summary spreadsheet for calendar 2023

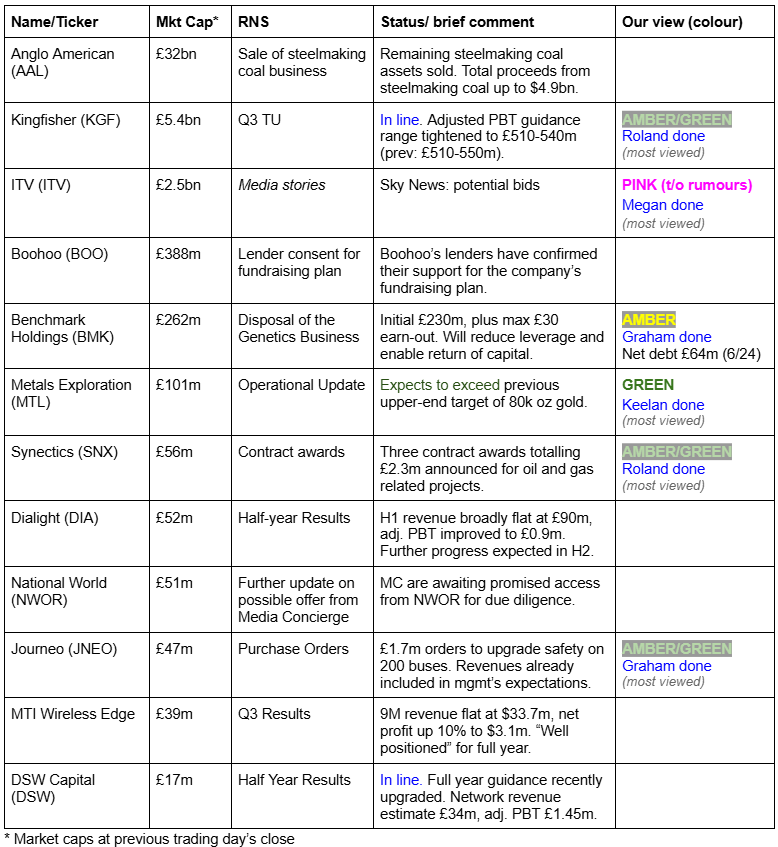

Companies Reporting

Summaries

Kingfisher (LON:KGF) - down 13% to 256p (£4.7bn) - Q3 Trading Update - Roland - AMBER/GREEN

The DIY retailer has trimmed the top end of profit guidance for 24/25 and warned of a potential £45m hit to profits next year due to tax rises in the UK and France. Cyclical headwinds remain a problem, but today’s guidance suggests a free cash flow yield of c.9%. This should provide ample support for the 4.7% dividend yield and suggests some value may be on offer.

Benchmark Holdings (LON:BMK) - up 11% to 39.4p (£291m) - Disposal of the Genetics Business - Graham - AMBER

It’s an enormous £260m disposal, although if you read the small print it will be c. £200m now plus the earnout of up to £30m. A debt-ridden, loss-making business is transformed into a cash-rich, probably loss-making business. I upgrade to AMBER as cash is now 45% of the market cap.

Synectics (LON:SNX) - up 0.6% to 315p (£56m) - Contract awards - Roland - AMBER/GREEN

Today’s contract awards show further progress at this business but appear to be included within existing earnings forecasts, which are unchanged today. I remain positive on this business but I think it’s worth considering the greater risk of disappointment, following significant recent share price gains.

Journeo (LON:JNEO) - up 3% to 290p (£48m) - Purchase Orders - Graham - AMBER/GREEN

Journeo announces some purchase orders that help to boost visibility, but their revenues were already included in management expectations so I don’t rate this news as material. I’m happy to leave our mildly positive stance unchanged due to a moderate valuation, healthy cash position and overall good performance.

Metals Exploration (LON:MTL) - up 1% to 5.8p (£101m) - Operational Update - Keelan - GREEN

Metals Exploration has seen its share price more than double in 2024, with the company's operations update this morning leading to further share price gains. Gold production is now expected to top previous guidance, reaching 82,500 ounces of gold, whilst the all-in sustaining cost per ounce has also beaten guidance. The stock trades at a P/E of 3.9x and a P/FCF of 2x.

Short Sections

ITV (LON:ITV) - up 7% to 69p (£2.5bn) - Media: Suitors screen potential bids - Megan - PINK (takeover rumours)

Last week’s market rumours that ITV (LON:ITV) might be being sized up for a potential takeover gained more weight over the weekend after a report from Sky News. Private equity group CVC Capital Partners (the group behind the current takeover of Hargreaves Lansdown) and a major European broadcaster (thought to be French media conglomerate Groupe TF1) are reported to be among the suitors for the UK broadcaster, whose share price has languished for the last few years.

ITV’s share price peaked around 270p back in 2015 before the onslaught of competition from international streaming giants. Under current chief executive Carolyn McCall (who has been the boss since 2018) the company has done a decent job at diversifying away from its reliance on broadcasting. Studios revenue, where the company makes money from creating and producing films and programmes for other broadcasters and media companies, now contributes about half of group revenues and is expected to generate annual revenue growth of 5% over the next 4 years. Operating margins for the division are expected to be between 13% and 15%.

The Studios business alone is reported to be worth more than the whole of ITV’s market capitalisation. That is believable given the calibre of productions coming out of the studio and the type of valuations being placed on original content producers elsewhere in the world. In 2019, Hasbro acquired the London-listed film producer Entertainment One for $3.8bn, equivalent to three times the revenue generated by the business (it wasn’t an especially successful acquisition for Hasbro, which recently sold eOne on again for just $500m after sales tanked). The Roald Dahl Story Company fared better when Netflix paid 14 times company revenue in 2021. And Disney is never one to shortchange the various creative businesses it has brought into its own fold over the years.

Companies including RedBird Capital-owned All3Media and Mediawan, which is backed by the private equity giant KKR, are reportedly weighing up acquisition offers for the Studios business. If the Studios division was put up for sale on its own, it wouldn’t be crazy to suggest it could fetch a value of over £2.5bn, which is a little less than 1.5 times the revenue the division is forecast to generate in 2024.

Megan’s view

There is a lot of value in content producers at the moment and with ITV Studios hidden under the cloak of the challenged broadcasting arm, shareholders are not currently enjoying its full value. Splitting the company into its two components makes sense.

But for private equity suitors and retail investors alike, it’s the Studios business that holds the most appeal. Sure, there would be a cash boost to the business if its creative arm was sold off, but then all that would be left would be a broadcaster with an increasingly desperate reliance on aging shows like I’m a Celebrity and Love Island.

The good news for private investors is that there seem to be multiple potential acquirers and a bidding war would provide some welcome buoyancy to the share price. It has happened before. When 21st Century Fox first came calling for Sky, the offer was £10.75 per share. When Comcast finally won the bidding war, shareholders received £17.26.

Graham's Section

Benchmark Holdings (LON:BMK)

Up 11% to 39.4p (£291m) - Disposal of the Genetics Business - Graham - AMBER

Astonishing news here as a company with a c. £260m market cap (as of last Friday) announces a disposal with a headline price of £260m!

The valuation at Benchmark Holdings has been perplexing us for some time - see Paul’s most recent coverage in August when he noted that revenues were falling, losses were widening and net debt was at £64m.

Management have delivered for their shareholders today in the form of a £260m disposal to Novo Holdings A/S, the largest and controlling shareholder of Novo Nordisk (NOVO). NOVO was covered by Megan in this report earlier this month.

Here are Novo Holdings on the NOVO shareholder register, with a stake worth £22 billion (!):

There are a number of companies included in the sale to Novo Holdings but the primary one is Benchmark Genetics Limited, “a leader in aquaculture genetics, present in every major aquaculture market and for a wide range of species”.

Valuation: 17.9x adj. EBITDA - generally I’d want to be a seller at this valuation, not a buyer!

Price: £230m initially (to be adjusted for debt and working capital), plus up to £30m based on trading performance to Sep 2027.

Use of proceeds:

Net proceeds from the Disposal will be used to return capital to shareholders and to reduce the Company's leverage, by repaying the Group's unsecured floating rate listed green bond and drawn amounts under the Group's revolving credit facility provided by DNB Bank ASA in full…

Checking BMK’s balance sheet for March 2024, I see that the value of BMK’s outstanding green bond was 750m Norwegian krone, or £54m, and it was set to mature in September 2025. There is also £16m drawn from an RCF. So that’s about £70m of debt for BMK to repay.

One of BMK’s Genetics subsidiaries had some other debts, and these reduce the amount paid to BMK by Novo, unless there is cash to offset them. As of March 2024, I calculate £16m of other debts at the Genetics subsidiary.

The announcement tells us that initial gross proceeds are expected to be £200m, payable in cash and anticipated during the first quarter of 2025. So I’m guessing that the debt/working capital position at Genetics may have deteriorated further during 2024.

Shareholders need to approve the transaction at a general meeting, as it represents a fundamental change.

Strategic Review: BMK’s Strategic Review is now complete. BMK will now focus on its Advanced Nutrition and Health businesses.

Graham’s view

Looking forward, let’s calculate what BMK shareholders now own.

Cash/Debt: £200m minus £70m of Group debts to repay, leaving net cash of £130m.

The potential for another £30m payout based on performance of Genetics out to 2027.

Advanced Nutrition division: in H1, this division generated revenues of £40m (down 11% at constant FX) and adj. EBITDA of £9.9m (down 5% at constant FX).

Health: H1 saw £11.5m of revenues (down 37% at constant FX) and £2.2m of adj. EBITDA (down 65% at constant FX).

In aggregate, therefore, the two divisions saw £51.5m of revenues and £12.1m of adj. EBITDA.

At a group level, positive adj. EBITDA turned into negative operating profits and I can only assume that the same is true for these two divisions.

My conclusion is that BMK shareholders are going to have c. £130m of cash, the potential for another £30m, plus two divisions generating revenues over six months of c. £50m, that are probably unprofitable.

The genetics business is being sold for 4.5x sales, so if any multiple like that was possible for the other divisions, then BMK shares would currently be undervalued. Although maybe the other divisions would have already been sold, if that was possible?

As I don’t know what the remaining divisions might fetch in a disposal, I feel obliged to take a neutral stance here. The group will now be swimming in cash (nearly half of the current market cap, until they return some of it to shareholders), and so continuing the mildly negative AMBER/RED stance would seem to be asking for trouble at this stage.

Journeo (LON:JNEO)

Up 3% to 290p (£48m) - Purchase Orders - Graham - AMBER/GREEN

I noticed this one on the “Most Viewed” list today, a sign of strong interest, even though the RNS didn’t seem terribly important to me:

Journeo plc (AIM: JNEO), a leading provider of information systems and technical services to transport operators and local authorities is pleased to announce that, further to its announcements on 11 March and 26 March it has received further purchase orders to supply and install the first tranche of safety systems on RATP buses within the Transport for London (TfL) fleet.

Key points:

£1.7m award to be paid in 9 tranches.

Installations on 200 buses, to be completed during Q1 2025.

External wing-mirrors will be replaced by the Journeo Camera Monitoring System, a digital wing mirror system for buses.

Key information is that “the revenues are included in management’s expectations of performance”, i.e. the orders do not change management’s revenue expectations.

CEO comment:

"I am delighted that RATP have selected our high-performance bus safety systems. This award is a further validation of Journeo's CMS which is increasingly being adopted by safety conscious public transport authorities and fleet operators throughout the UK where we have installed around 4,000 systems, including approximately 1,500 in London."

Estimates

I don’t see any fresh broker notes this morning, although I would not expect any change to forecasts even if there were. The most recent estimates I can find - published in September by Cavendish - suggested revenues this year of £50m, converting to adj. PBT of £4.8m, with modest growth anticipated in 2025.

Forecasts also suggest a healthy cash position with net cash of £13m by Dec 2024, more than a quarter of the current market cap.

Graham’s view

I’m happy to leave the AMBER/GREEN stance unchanged as the stock trades on a moderate earnings multiple and seems to be performing well. The share price has changed little since we covered it last, and I do not view today's update as material, even if it does help to boost visibility.

Given limited growth expectations and potentially lumpy revenues I don’t know if I’d pay a much higher multiple than the current level, but it could be worth a closer look:

Roland's Section

Kingfisher (LON:KGF)

Down 13% to 256p (£4.7bn) - Q3 Trading Update - Roland - AMBER/GREEN

Sales in line or ahead of the market across all our banners; full year profit guidance range tightened

The headline to today’s third-quarter update from DIY chain owner Kingfisher sounds confident, but unfortunately the numbers are less impressive.

Indeed, news that the owner of B&Q and Screwfix has trimmed the top end of its profit guidance for the current financial year appears to have triggered a nasty sell off:

Let’s take a look.

Q3 highlights: today’s update from Kingfisher covers the three months to 31 October 2024.

Revenue down 0.6% to £3.2bn (-1.1% like-for-like)

UK up 1.2% to £1.6bn

France -6.4% to £967m

Other regions up 4.7% to £637m

The majority (69%) of Kingfisher’s revenue is essentially made up of many smaller and relatively low priced items used for home repair, maintenance and improvement (RMI). Sales in this core business fell by 0.4% LFL in Q3.

However, the group’s exposure to consumer confidence and housing was highlighted by a 4% LFL fall in big ticket sales (e.g. kitchens and bathrooms). These account for 16% of sales.

The remainder of sales are classed as seasonal. This category fell by 0.9% LFL in Q3, which the company blames on mild, wet weather in October.

Outlook: Q4 trading to date is said to show an improved trend, with LFL sales -0.4% versus -1.1% in Q3.

The company believes trading is tracking in line with previous guidance for its largest markets:

Consistent with what we set out in September, we believe the UK & Ireland and Polish markets are currently tracking within the higher end of our scenarios. We believe the French market is continuing to track at the low end.

Cost cutting has continued to help support profits this year, with £120m of structural cost savings expected by the end of January 2025.

Reflecting these various factors, the company has tightened its full-year profit guidance by lowering the top end of expectations:

Adjusted pre-tax profit of c.£510m to £540m (previously £510m to £550m)

Free cash flow expectations unchanged at £410m to £460m

Consensus forecasts on Stockopedia ahead of today’s update suggest adjusted earnings of 20.9p per share for the year ending 31st Jan 25. That would put Kingfisher on a P/E of around 12 after today’s drop, but I suspect we’ll see some modest downgrades to analyst estimates, so this multiple may increase somewhat.

Forecasts for 25/26 may also come under pressure after today’s update. Kingfisher says that tax increases in the UK and France are likely to have a £45m impact on profit next year. Some, but not all, of this is expected to be offset by further cost savings.

I don’t have access to any updated broker notes for Kingfisher, so we’ll have to wait to see what changes filter through to Stockopedia’s consensus estimates over the coming days.

Roland’s view

Kingfisher shareholders have seen a nice recovery over the last year, but much of this has now unwound.

However, while the macro environment is clearly quite weak, I do not think there’s any cause for serious concern. Kingfisher’s cash generation appears to remain strong and today’s guidance suggests the stock could be trading with a free cash flow yield of more than 9%.

On this basis, this year’s forecast dividend of 12.4p per share should be covered c. two times by surplus cash, so I don’t see any obvious reason to expect a dividend cut at this time. With the dividend yield now up to 4.7%, this could be of interest from an income perspective.

On a related note, it’s worth noting that while the StockReport shows Kingfisher’s net debt at c. £2bn, this is all lease debt (e.g. stores). The interim accounts showed a net cash position excluding leases, something that has been typical for this business in recent years.

On balance, I think CEO Thierry Garnier is doing the right things to strengthen the business while awaiting an improvement in external conditions.

The question is how long Kingfisher may have to wait. This issue is made more complicated by the group’s exposure to multiple markets.

Historically, the group’s growth has often been restricted by the tendency for strong performance in the UK to be offset by weaker performance in France, or vice versa. This seems to remain a problem.

A 10-year snapshot of operating profits suggests this business may be better suited to cyclical trading than long-term holding:

I can’t ignore the risk of further downgrades. But on balance, I think some caution is already reflected in the stock’s reduced valuation. I can see some value here, so I’m comfortable taking a view of AMBER/GREEN.

Synectics (LON:SNX)

Up 0.6% to 315p (£56m) - Contract awards - Roland - AMBER/GREEN

This small-cap surveillance technology specialist has issued another contract award RNS today, disclosing details of two new business wins for the company totalling £2.3m in value. Both are in the offshore energy sector, highlighting the company’s strong credentials in this market.

Qatar: a £1.8m contract with North Oil Company (NOC) to provide Synectic’s security camera station technology as part of the Ruya Project to expand the Al-Shaheen field, Qatar’s largest oil field. Delivery in two phases, expected in 2025 and 2026. This is a repeat customer for Synectics.

Brazil: a £0.5m contract to provide “specialist security and surveillance solutions” for a floating production, storage and offloading vessel. The solution provided by Synectics will help to ensure “compliance with rigorous offshore safety and performance requirements”.

These wins continue a strong recent run for the firm:

4 November 2024: a £2.2m contract with National Grid, following on from previous contracts awarded under the same framework agreement.

9 September 2024: $3.2m contract award at a gaming resort in Asia (casinos are another key market for Synectics products). This extended a $10m contract announced in June 2024.

Outlook: for a company with annual revenue of c.£55m, contract wins of this size are clearly material. However, today’s wins appear to be within existing broker forecasts for the firm.

With thanks to Synectics’ house broker Shore Capital, I can see that earnings forecasts for FY24, FY25 and FY26 have remained unchanged after today’s news.

Shore’s estimates match those shown in the StockReport for 2024 and 2025:

Roland’s view

If the strong profit growth seen over the last couple of years can be maintained, then I think the stock’s forward P/E of 17 could still reflect attractive value.

Graham highlighted a potential opportunity here back in February, suggesting further upside was possible. The shares have since doubled, providing a nice return for investors who did their research and decided to buy in:

While the value may not be as obvious as it was at the start of this year, I’m encouraged by the operating leverage on display as Synectics continues to scale.

The company’s operating margin has improved steadily with sales growth, suggesting it’s been able to deliver higher sales without a corresponding increase in costs. In situations like this, profits can grow significantly faster than sales, potentially supporting a much higher share price rating.

However, while progress so far is encouraging, I think it’s worth remembering the downside risk here too.

The 7% operating margin achieved by Synectics over the last 12 months is unspectacular, in my view.

Meanwhile, unchanged forecasts after today’s news are a reminder that a fairly strong rate of growth is already baked into the share price. This is also reflected in Stockopedia’s High Flyer style rating, providing a useful reminder of the potential for a share price slump if Synectics’ results should disappoint the market:

Checking back in the archives, we last viewed Synectics as GREEN in September, when the shares were at 225p and the company upgraded its guidance for the current year.

Given the 40% share price increase since then and the lack of any further upgrades to guidance, I’m going to step back a notch to AMBER/GREEN following today’s update.

Keelan's Section

Metals Exploration (LON:MTL)

Up 1% to 5.8p (£101m) - Operational Update - Keelan - GREEN

Philippines-based gold producer, Metals Exploration, has been one of the standout performers in this year’s NAPS portfolio. The share price has more than doubled year-to-date and shows no signs of slowing down after this morning’s operations update.

The company has announced that it now expects to exceed its previous upper-end target of 80,000 ounces of gold for the year. The total figure is now forecast to come in at around 82,500 ounces. The additional cherry on top is that the AISC, or All-In Sustaining Cost per ounce, is expected to fall to $1,125 per ounce, nicely below the lower guidance target of $1,175. At the current gold price of $2,670 per ounce, the company is making a profit of $1,545 per ounce…

This level of profitability is what led me to cover Metals Exploration in a recent article, which also explores what gold and silver miners may have in store for 2025. What strikes me most about Metals Exploration is its incredibly low valuation, despite its share price strength over the past year.

The company trades on a forward price-to-earnings ratio of 3.9 and, more impressively, a price-to-free cash flow ratio of just 2. This means that the company’s current free cash flow generation could pay back the equivalent of its market capitalisation within just 2 years. If you look at the most recent quarterly cash flow figures and extrapolate these it gets even better. Metals Exploration is well on track to generate around $100 million in free cash flows this year. An impressive feat for a company currently worth $126 million.

Now, when companies trade at these valuations, there’s likely to be a catch. Of course, miners will typically receive lower valuation multiples due to their cyclical nature. However, in this case, the market’s hesitation stems from concerns about Metals Exploration’s reliance on its single-producing asset, the Runruno mine. Current estimates are that only a few years of production remain, and the mine’s limited life significantly impacts long-term earnings visibility.

Therefore, the management team has actively been looking at ways to extend the mine life, whilst also securing other assets nearby. The acquisition of Yamang Mineral Corporation (YMC) this year will allow it to apply its technical expertise and hopefully secure the company’s future growth prospects in the Philippines. I’ve provided more details of these activities in my recent article.

Keelan’s view

Even with limited mine life left, the current gold price environment has transformed Metals Exploration into a cash cow and one of the cheapest companies listed on the London markets. Moving into a net cash position with substantial free cash flow generation gives the company much greater flexibility. It can now invest money into its new Abra tenements from the YMC acquisition, acquire further complementary assets, commence dividend payments or buy back shares, all of which could justify a higher valuation in the future.

After the full-year results are published, brokers will likely start revising their projections as well. A forecasted net profit of $33.8 million for FY2025 is currently too conservative, given the company’s production rates and the current gold price.

As long as the gold price doesn’t fall off a cliff in 2025, and there aren’t any operational issues (the Philippines is unfortunately very natural disaster-prone), the company is well positioned for a strong 2025.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.