Good morning everyone!

Wrapping this up just before 1pm. Thanks for all the comments!

Explanatory notes

A quick reminder that we don’t recommend any shares. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day. We usually avoid the smallest, and most speculative companies, although if something is newsworthy and interesting, we'll try to comment on it. Please bear in mind the "list of companies reporting" is precisely that - it's not a to do list. We have a particular emphasis on under/over expectations updates, and we follow the "most viewed" list of readers, so if you're collectively interested in a company, we'll try to cover it. Add your own comments if you see something interesting, and feel free to discuss anything shares-related in the comments.

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to, if they are using unthreaded viewing of comments.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced. And/or it's such deep value that we see a good chance of a turnaround, and think that the share price might have overshot on the downside.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

Others: PINK = takeover approach, BLACK = profit warning, GREY = possible de-listing. Links:

Daily Stock Market Report: records from 5/11/2024 (format: Google Sheet).

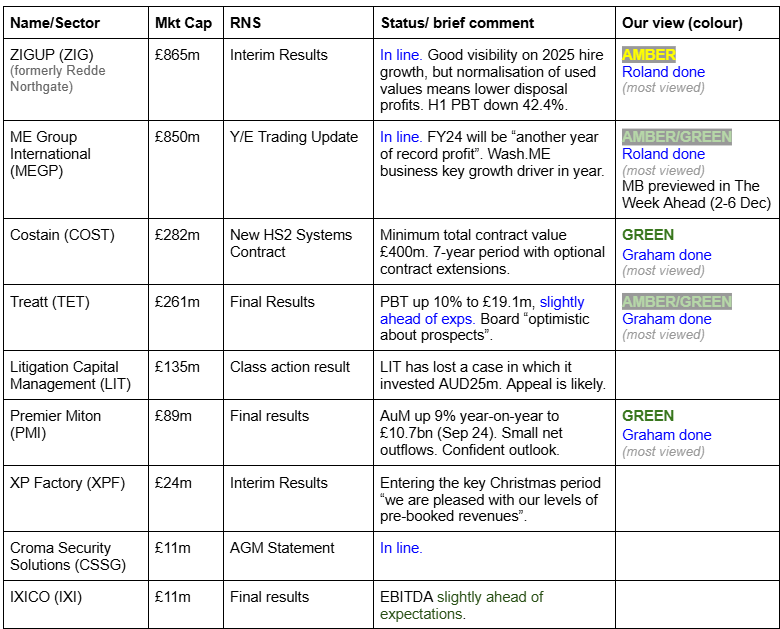

Companies Reporting

Summaries

Animalcare (LON:ANCR) - down 3% to 238p (£164m based on the new share count) - Conditional Acquisition - Graham - AMBER

Animalcare is buying an Australian equity business for £62m. The target produces medicines and supplements for horses internationally and the deal is both affordable (with the help of £20m of fresh equity) and strategically sound. Let’s hope it marks a fresh beginning for ANCR, which historically has not done well in M&A.

Treatt (LON:TET) - up 7% to 430p (£261m) - Full Year Results - Graham - AMBER/GREEN

A strong set of numbers from Treatt with record revenues, albeit growth only came in at 4% (not helped by currency headwinds). It’s a cleaner set of results than last year. Inventories are lower. At a PER of 16x, I would say that this old name in flavours and ingredients is probably worth looking into.

ZIGUP (LON:ZIG) - down 8% to 352p (£797m) - Interim Results - Roland - AMBER

A mixed set of results from the van hire and claims management business, with profits down sharply due to weaker used vehicle prices. The outlook for the van rental business is positive and the shares might offer value, but the dividend is not supported by free cash flow and I think leverage is creeping up.

ME International (LON:MEGP) - down 4% to 215p (£815m) - Year-end trading update - Roland - AMBER/GREEN

A solid year-end update, showing pre-tax profit up 10% for the y/e 31 October. Good growth in the laundry business is being supported by a continued stable performance from the cash-generative photobooth division. With no update on the outlook for FY25, I’ve moderated my view to reflect the higher valuation.

Premier Miton (LON:PMI) - up 9% to 60p (£86m) - Full Year Results - Graham - GREEN

Profits have taken a hit in FY 2024 due to lower average AUM and a lower fee margin (attributed to a changing mix of AUM). But looking forward, AUM is on the rise and now stands at £10.9 billion. At this earlier stage of the financial year, FY 2025 is shaping up to be noticeably better. Investors get a remarkable £126 of AUM for every £1 invested in the stock at this market cap.

Short Sections

Costain (LON:COST)

Unchanged at 105p (£282m) - HS2 Systems Contract - Graham - GREEN

Today’s news of a £400m HS2 contract for Costain, to be delivered over 7 years, implies c. £60m of revenues annually, starting next year. Is that material?

The company will be “a sole supplier to deliver tunnel and lineside mechanical and electrical (M&E) systems for HS2”.

Costain generates revenues of £1.3 billion annually, so we are talking about c. 5% of revenues.

The announcement is considered to contain inside information, which implies that this news is material to the fortunes of the company. But the announcement itself contains no information on the margins and profits that might be associated with the contract, or how it might affect existing earnings expectations (if at all). Perhaps well-informed readers might be able to make an estimate? We know that the company has been targeting a 5% (pre-tax) operating margin.

I’ll leave the existing GREEN stance unchanged.

Graham's Section

Animalcare (LON:ANCR)

Down 3% to 238p (£164m based on the new share count) - Conditional Acquisition (and Fundraising) - Graham - AMBER

One of yesterday’s announcements was a £62m acquisition by Animalcare, expected to complete early next month.

The last time we mentioned Animalcare in this report was when it sold a “non-core asset” back in February. So it’s interesting to see that it is now acquiring rather than selling.

Back in February, it sold a pet micro-chipping business. The explanation for the sale was that the company wanted to focus on pharma:

As part of the Group's strategy to focus on pharmaceuticals and to drive growth through launching innovative products, Identicare was separated from the UK pharmaceuticals business within Animalcare Ltd in March 2021, with specialist leadership brought in.

Now it’s buying Randlab, “a leading equine veterinary business”. Randlab has an “extensive range of core equine generic pharmaceuticals and some over-the-counter products”. So the rationale adds up.

Randlab's website says “Australian Made - Australian Owned” - this may need to be updated!

Its revenues in FY24 equate to £12m, with EBITDA of £5.7m. It’s said to have “low capital intensity” so hopefully most of that EBITDA was converted to profits.

Free cash conversion is said to be 71%. Perhaps we could estimate real profitability at c. £4m? This would imply a moderate PER paid of about 15x.

The EBITDA multiple paid is 10.9x which also doesn’t strike me as particularly high or low.

Financing: the most recent interim results showed that ANCR had cash of £33m as of June 2024, with zero borrowings aside from a very small lease liability.

That sets them up well to fund this acquisition. They have also raised £20m in a placing at 232.5p (dilution for existing shareholders is 14%).

CEO comment on the acquisition:

This is a transformational deal that provides an excellent fit with our growth strategy and is complementary to our product portfolio. Over the last 20 years the Randlab team has built a sustainable, profitable and cash generative business with an impressive track record in a market that places great importance on knowledge and expertise of equine health and wellbeing. Not only will this acquisition significantly elevate the Group's offering in a growing equine market, it will also open wider opportunities in a commercially and regulatorily aligned business environment…

Trading update: Animalcare has confirmed that its outlook remains unchanged from the interim results. The latest estimates from Panmure I can find, published in October, are for 2024 revenues of £74m and adj. PBT of £9.1m.

Graham’s view

Animalcare is a company that has threatened to be great for investors for a long time. However, I totally lost interest in it after the strange acquisition of Belgian pharma business Ecuphar back in 2017, in a deal that created enormous dilution and seemed to generate very little value.

The shares have been range-bound over the long-term, since that deal:

I’m open to the possibility that they’ve cracked the code of how to do M&A successfully now. CEO Jennifer Winter has been in charge since 2018, and so in my mind she is not tainted by that Ecuphar deal.

I’m tempted to upgrade this one to AMBER/GREEN but I have a very strong association in my mind between ANCR and seeing unclean financial results with very little real profitability.

The Randlab acquisition will hopefully be a success but if they have paid fair value for it at 11x EBITDA, does it really change much?

I hope this leopard has changed its spots but I don’t believe it yet.

Treatt (LON:TET)

Up 7% to 430p (£261m) - Full Year Results - Graham - AMBER/GREEN

Treatt, the manufacturer and supplier of a diverse and sustainable portfolio of natural extracts and ingredients for the beverage, flavour and fragrance industries, announces today its audited results for the financial year ended 30 September 2024.

This is a very old company (founded 1886!) and a successful long-term investment for its shareholders, but it hasn’t been a great place to be invested over the past 5 years:

Profitability has been up and down:

But today’s full-year results show some progress:

Revenue +4% to £153m, marginally lower than anticipated (extreme weather delayed a shipment into 2025).

Adj. PBT +10% to £19m, slightly ahead of Board expectations.

PBT +36% to £18.5m.

I’m pleased to see that the adjustments (“exceptional items”) are minimal this year at only £0.6m (last year: £3.8m). This explains why actual PBT grew by 36%, while adjusted PBT only grew by 10%.

Net debt is immaterial at less than £1m. The balance sheet has net assets of £142m with the biggest entries being PPE (£70m) and inventories (£52m). There has been a helpful £10m+ decrease in the latter: the company explains this reduction but also defends the principle of having a large inventory pile:

This decrease was driven by a reduction in inventory volume, as supply chains normalised, partially offset with higher raw material costs. One factor in the success of the business is our management of risks, such as geographic, political and climatic, to ensure continuity of supply for our customers. Consequently, the overall level of inventory held by the Group is highly significant in cash terms.

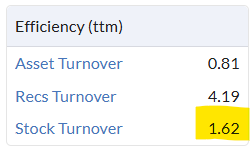

Let’s calculate a new inventory turnover ratio to put a metric on TET’s inventory levels.

COGS (cost of goods sold): £109m

Average inventory: £57.1m

2024 inventory turnover = COGS / average inventory = 1.9x.

So they turned over their inventory less than 2x during the year.

From this we can calculate the average time to sell inventory. Intuition says that it should be a little over six months.

Inventory days = 365 / inventory turnover = 191 days.

Objectively I think we can say that this is a very long time to sell inventory (even allowing for the fact that unfinished work in progress is included within this figure). But if management insist that it’s needed to ensure continuity of supply, I’m happy to take their word for it.

Note that the same calculation for 2023 gives inventory days of 233, so at least there has been a downward movement in this metric.

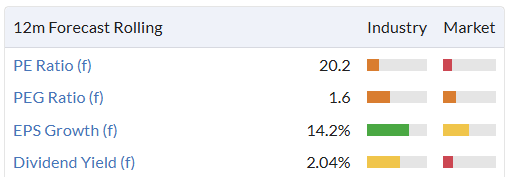

You can find trailing Stock Turnover (same thing as Inventory Turnover) on the StockReport, within the Efficiency section:

Dividend: the full-year dividend increases to 8.4p, for a 2% yield.

Management: a new CEO joined in June from Croda International (LON:CRDA). His first CEO review is in the form of an interview-style “Q&A”. The main takeaway is that he wants to expand beyond US/Western Europe, moving into new geographies in Asia and LatAm. He sees Treatt in the future as “a truly global solutions provider of sustainably led flavour technologies”.

Outlook: no specific info given.

Graham’s view

I’m happy to maintain a mildly positive stance on this one.

I appreciate the company’s emphasis on ROCE: they calculate an adjusted ROCE of 13.6% in 2024, improved from 12.2%, and their target for this metric remains 15-20%. Getting there will mean being generally disciplined on pricing, costs, working capital and capex.

Unadjusted ROCE is a bit lower than the company’s own calculation, as you’d expect:

Even so, overall Quality is very high:

I could consider upgrading this to GREEN but I can hold off on doing this until organic revenue growth picks up to something much better than 4%. The stock is priced at a PER of about 16x which in today’s market is not that cheap. For now I think AMBER/GREEN makes a lot of sense.

Premier Miton (LON:PMI)

Up 9% to 60p (£86m) - Full Year Results - Graham - GREEN

Premier Miton Group plc ('Premier Miton', 'Company' or 'Group'), the AIM quoted fund management group, today announces its final results for the year ended 30 September 2024.

It’s nice to see AUM up by 9% year-on-year at this fund manager, to £10.7 billion.

However, even though year-end AUM was up, average AUM throughout the year was down by 5%.

And it’s average AUM that primarily determines revenues. So PMI’s revenues and gross profits fell:

I note that there was also some fee erosion with a decline in the net fee margin of 5% to 59 basis points.

Those are the main factors behind falling profits at PMI in FY Sep 2024 and they don't concern me greatly. I accept that it will have been difficult to maintain average AUM throughout the financial year.

Adj. PBT fell from £15.7m to £12.2m.

Flows

PMI says there were net outflows of only £300m but to arrive at this number they include the positive effect of acquisitions. I don’t think this is right - net outflows should be before the effect of acquisitions and disposals.

The Q4 AuM update showed that net outflows for the year were £760m, with the main withdrawals being from the biggest categories, Equity and Multi-Asset:

CEO comment is positive on the prospects for Fixed Income and US/global equities. The UK equity market has “remained very much out of favour”.

Looking forward, we see investor demand improving and being focussed on Fixed Income, US & Global equities and Absolute Return strategies post the UK budget and the US election. We also expect demand to remain strong for MPS solutions and low cost, high performance multi-asset strategies where changes to the UK CGT regime will support ongoing interest from advisers.

Cash is worth mentioning as it’s a large chunk of the £86m market cap. The company has tangible balance sheet equity of £30m and this includes a cash balance of £35m. So if you start to do enterprise value calculations, this can look very cheap.

The full-year dividend is unchanged at 60p, for a yield of 10%.

Adjustments

I should spend a moment on these as the company has applied very large adjustments to its earnings.

If the company wants to adjust out amortisation I can see the logic behind that, but I do not accept that share-based payments should be adjusted out.

The “non-recurring items” also do not strike me as non-recurring, as they occurred in both 2023 and 2024!

Therefore the way I see it, the real PBT number is £7.1m, allowing only amortisation to be adjusted out. We could apply tax to that for adjusted net income of £5.3m.

Graham’s view

I’m GREEN on most fund managers and PMI is not an exception.

The enterprise value is only about £50m and for that you get a company that has achieved (by my calculations) adj. net income of £5.3m in a very tough year.

AUM has improved to £10.9 billion as of November 2024, and the newly-acquired Tellworth funds are achieving net flows. It seems to me that the current direction of AUM is positive so that FY 2025 should see higher average AUM and the benefits of operational leverage should be seen on next year’s income statement.

In the long-term, familiar themes are at play here: can active UK equity fund managers recover from their current unpopularity? While I don’t expect a return to the easy and high fee generation that was seen before, I do think that active UK equity managers will have a role to play when there is inevitably some weakness in the Magnificent 7 and the global ETFs that robotically follow them. Active investing has to be done by someone and PMI strikes me as capable of offering some interesting and decent-value funds

Roland's Section

ZIGUP (LON:ZIG)

Down 8% to 352p (£797m) - Interim Results - Roland - AMBER

Van hire and claims management group Zigup (formerly Redde Northgate) has issued its half-year results today, revealing a mixed picture of trading over the six months to 31 October 2024.

Our strategy continues to deliver, and we are well placed with our broadening position in the essential market for mobility services. We are pleased to report underlying growth in revenues, and the delivery of PBT in line with expectations, while reflecting normalising disposal profits as previously stated.

Zigup shares have looked decent value for a while, and score highly with the StockRanks.

However, the stock has opened lower this morning, which I think may be a reasonable reaction to today’s numbers. Let’s take a look.

Half-year results summary: the first decision investors need to make when reviewing the numbers is whether to use the company’s reported or underlying figures. As we can see in the table I’ve copied in below, there are very substantial differences between the two:

Whichever numbers you prefer, it’s clear that Zigup’s profits fell sharply in H1 when compared to the same period last year.

This business has three main profit centres, and if we split out the results into these segments we can get a better feel for the company’s trading over the last six months. Again, I’ve copied the table below from today’s results to avoid retyping:

Revenue: vehicle hire and claims services both saw single-digit revenue growth. The company prefers to use an underlying revenue measure that only includes these two business units.

This approach strips out the volatility of revenue from used vehicle sales, which fell by 27.5% to £128.7m during the period. This slump was due to a smaller number of older vehicles being sold, compared to the prior period.

I’m not convinced by the logic of stripping out revenue from used vehicle sales – it’s a core part of the business model, as we can see when we consider the profit breakdown.

Rental Profit: profits were broadly flat at £59.1m. While the Spanish business saw a 7.6% increase in the number of vehicles on hire, this number fell by 4.6% in the UK.

This reflects changes made to the fleet in the latter part of last year, when Zigup defleeted some older vehicles as visibility improved on new vehicle supply.

The outlook for rentals seems reasonably positive. Zigup’s group fleet had risen by 4,300 to 132,500 by the end of the half year, and the company reports “strong demand” including large fleet orders from major customers.

Claims and services profit fell by 31.6% to £17.4m. Profits last year benefited from extended replacement vehicle hire periods caused by supply chain issues (e.g. long delays for replacement car parts).

This situation has now normalised, meaning shorter repair times. In turn, this means demand for replacement vehicles on credit hire has been lower. The company believes hire demand should now be stable through the (busier) winter period.

The claims business was also hit by a cyber attack during the half year, which Zigup estimates had a £4.2m impact on EBIT. This incident also resulted in £2.8m of exceptional costs. It’s probably fair to say these costs were a one-off.

Disposal profits fell by 25.5% as the company sold fewer, older vehicles into a weaker market. We commented on this risk when we looked at Zigup in July.

Used van prices have fallen and the average profit per unit (PPU) fell by 54% to £1,600 (H1 24: £3,500).

Improved new van supply in the UK and Spain has reduced the demand for older vans. The balance will stabilise at some point, but my feeling from today’s commentary is that this process may still be ongoing.

Cash flow & balance sheet: Zigup relies on debt and lease obligations to fund its sizeable fleet. Leverage has crept up a bit in recent years, relative to assets.

Net debt of £782.5m represented 75% of net assets of £1,040.7m at the end of October, up from an equivalent figure of 58% at the end of April 2021.

The company prefers to use an EBITDA-based measure of leverage and says leverage was 1.6x at the end of October, with the target range of 1.0x - 2.0x. For contrast, this ratio was 1.5x at the end of April 2021, so it has remained fairly stable.

Relying on net debt/EBITDA rather than net debt/net assets is arguably more appropriate for a business with a service element to its profits.

However, the vast majority of Zigup’s profit still comes from rentals, if we include the credit hire element of the claims management business and disposal profits. I would probably prefer to monitor debt relative to net assets, so I’m a little wary of the rising leverage here.

On a related note, cash generation remained weak with a free cash outflow of £20.5m, reflecting capex on fleet growth

Net capital expenditure increased by £127.6m to £232.4m (H1 2024: £104.8m) due to a £75.4m increase in net replacement capex and a £52.2m increase in growth capex.

In FY23, company-calculated free cash flow was £30m, compared to reported net profit of £125m.

If fleet size flattens out in the future (or shrinks), cash generation may improve. But at present, I don’t think this business is generating all that much surplus cash, relative to profits.

Dividend: the interim payout has been increased by 6% to 8.8p per share. However, consensus forecasts suggest the full-year payout could be flat at 25.8p per share. That gives a 7.1% yield after this morning’s fall – high, even for this business.

However, this payout would cost around £58m, so seems unlikely to be covered by free cash flow this year. Arguably, the payout is starting to look stretched against a backdrop of rising debt and falling earnings.

Outlook: the outlook for the year ahead sounds positive, with new contracts underpinning demand and increases in UK infrastructure spending also expected to drive future growth.

In Spain, the van hire business continues to enjoy “record demand”.

However, the normalisation in used vehicle residual values is expected to see disposal profits moderate “as expected”.

Overall results are expected to be in line with market expectation. Stockopedia shows earnings forecasts of 53.2p per share for the year ending April 2025, with a sharp fall expected in FY26.

That prices Zigup on a FY25e P/E of less than seven after today’s drop, rising to a P/E of eight in FY26.

Roland’s view

I was never quite convinced by the reasoning behind the merger of claims management group Redde and Northgate van hire. While Northgate is a genuine market leader in its core markets, I don’t see Redde in this way. I’d prefer to invest in Northgate alone, personally.

Today’s results don’t seem too bad to me. But we’re now starting to see the flipside of the bumper profits enjoyed over the last couple of years, when Zigup’s scale and access to vehicles gave it pricing power and boosted disposal profits.

Against this backdrop, I think Zigup’s balance sheet looks slightly less robust than it did. I would also argue that the dividend is starting to look less affordable.

Today’s slump has left the shares trading in line with the tangible net asset value of 364p per share. For a heavily-leveraged business that has generated a five-year average return on capital employed of 8%, I think that could be slightly cheap, but not significantly so.

On balance, I think it makes sense to take a neutral view, so I’m going AMBER.

ME International (LON:MEGP)

Down 4% to 215p (£815m) - Year-end trading update - Roland - AMBER/GREEN

This instant-service equipment specialist has been a multi-bagger over the last three years. The shares are up by more than 70% so far this year:

ME Group has now earned Stockopedia’s High Flyer styling, reflecting its strong momentum and more demanding valuation.

Today’s update covers the year to 31 October 2024 and sounds positive to me. But it’s an “in line” statement and the company has not provided any new guidance for FY25. These factors may explain this morning’s mild share price drop:

Building on the positive trading momentum throughout H1 2024, the Group is pleased to report continued growth in H2 2024. As a result, the Board expects to report that FY 2024 will be another year of record profit and financial performance in line with the Board's expectations.

ME Group helpfully provides plenty of detail in today’s update, so we can get an idea of financial performance for the year just ended.

Revenue up 3% to £308m, after £10m of negative currency impact

Adjusted EBITDA up 5% to £112m

Profit before tax up 10% to £73m

Year-end net cash was £38.2m (FY23: £33.9m)

I don’t see too much to worry about here.

The business has achieved an improved pre-tax margin of 23.7% (FY23: 22.5%) and maintained good cash generation – net cash has risen, despite c.£30mm of dividend payments over the last year.

Operationally, ME says that growth was mainly driven by the self-service laundry business, Wash.ME Revolutions.

Net revenue from this division rose by 19% and the company is now operating 1,111 machines in the UK and France. New machines are being installed at a rate of 80-90 per month.

Today’s update doesn’t include the details, but checking back to last year’s final results suggests to me that FY24 revenue from laundry operations may have been c.£97m (FY23: £81.6m). So Wash.ME may now account for around one third of the group, in terms of revenue.

Revenue in the core photobooth operations only rose by 0.4%, but this business generated 58% of revenue last year and is described as “highly cash-generative” today. It remains very important.

The only slight negative in today’s update was that the rollout of new next-generation photobooth machines in France has been “slightly slower than expected” due to some technical issues.

Roland’s view

No new outlook statement was provided in today’s update. However, I don’t see anything to suggest any major changes to current forecasts, which suggest earnings could rise by 8% to 15.4p per share in FY25.

ME Group shares don’t look as cheap as they did…

… but I think the valuation is potentially still quite reasonable for a company with a strong balance sheet and excellent quality metrics:

However, ME Group shares have risen by over 20% since we last covered the stock in July, without any corresponding increase in expectations.

I think it makes sense to moderate our view from GREEN to AMBER/GREEN until the company provides some updated guidance on expectations for the coming year.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.