Good morning!

Upcoming event: Ed, Megan and I will present a live webinar tonight at 5pm to discuss our current views on the markets. See you there!

12.30pm: This report is finished for today, thanks for dropping by!

Spreadsheet accompanying this report (updated to 3/1/2025).

Companies Reporting

| Name (Mkt Cap) | RNS | Summary | Our view (Author) |

|---|---|---|---|

Shell (LON:SHEL) (£159bn) | Q4 update | Gas production significantly lower than Q3 | AMBER/GREEN (Roland) |

| Flutter Entertainment (LON:FLTR) (£36bn) | Update on US sports market | Revenue warning: Too many ‘favourites’ winning sports events in Q3. | |

| Team Internet (LON:TIG) (£297m) | Possible Offer (published after mkt close yesterday). | Two possible buyers, both at 125p. The board is considering both of them. | PINK (Graham) |

Victoria (LON:VCP) (£128m) | Trading Statement | H2 trading stronger than H1. Full year earnings in line with expectations. | RED (Graham) |

Intercede (LON:IGP) (£107m) | Trading Statement | New orders added to existing pipeline for Q4. Full year performance ahead of consensus. | AMBER (Roland) |

Kistos Holdings (LON:KIST) (£95m) | Trading Statement | Production in line with guidance | |

Topps Tiles (LON:TPT) (£75m) | Q1 TU & CEO Succession | LfL sales +3.5% Q1 (to Dec), +12.5% last 5 weeks. CEO intends to retire after 18 years with TPT. | AMBER (Roland) |

Likewise (LON:LIKE) (£47m) | TU | On track to deliver profit exps for FY Dec 2024. Rev +7.5%. Buying logistics centre near Plymouth. | AMBER (Graham) |

Hornby (LON:HRN) (£43m) | TU | Q3 sales +7%. FY March 2025 forecast “remains on track for YoY growth”. No formal market exps. | |

PROCOOK (LON:PROC) (£42m) | Q3 TU | In line with exps. Q3 rev +11%, LfL rev +3.4% outperforming UK kitchenware market. | |

Ground Rents Income Fund (LON:GRIO) (£22m) | Possible Cash Offer | GRIO Board has not engaged with the potential buyer. Three bids, highest at 34p (48.5% premium). | PINK |

Summaries

Intercede (LON:IGP) - up 10% to 201p (£117m) - Contract orders and renewals - Roland - AMBER

This digital ID software firm has announced $5m of new contract wins, but the modest size of today’s earnings upgrade suggests to me that some of this may be business as usual. I admire Intercede’s high quality metrics, but visibility on earnings seems limited and I think the price is up with events, so I’m staying neutral.

Topps Tiles (LON:TPT) - up 6.7% to 40p (£78m) - Q1 Trading Update and CEO Succession - Roland - AMBER

The tile retailer is benefiting from trade growth, but higher-margin consumer demand appears to remain weak. I suspect margins remain under pressure, a trend that’s been present for several years. Although I can see some value potential here, earnings visibility seems poor at the moment. With a new CEO incoming, I’m happy to stay on the sidelines.

Likewise (LON:LIKE) - up 8% to 20.6p (£50m) - Trading Update - Graham - AMBER

It’s an “in line with expectations” update from this floor covering distributor, where the ex-Headlam CEO is very excited about growth prospects. Total revenue is up 7.5% and there are plans to increase capacity by 35%. They will also complete their geographic footprint with a Plymouth facility. This could be worth backing but at this stage of its development and at this expensive-looking valuation, I think you need a strong belief in management.

Victoria (LON:VCP) - down 10% to 101.65p (£117m) - Board Change & Q3 Update - Graham - RED

I’m downgrading this one from AMBER/RED to RED in the light of the interim results (published in November) and the subsequent lowering of the company’s credit rating by Fitch. In general I can be bullish on companies even if they have non-investment grade credit ratings, but VCP’s rating is deep in junk territory, its credit metrics have shot past comfortable levels, and it needs to plan for its August 2026 note refinancing. At least it has about 18 months left to do this. Victoria borrowed these funds at a rate of 3.625% and it’s unthinkable that similar rates will be offered to it again.

Short Sections

NVIDIA (NSQ:NVDA)

Down 6% yesterday (£2.8trn) - Keynote speech at the Consumer Electronics Show - Megan - GREEN

When NVIDIA (NSQ:NVDA) shares suffer a set back, it’s a pretty major amount of capital that has been moved. The company’s 6% decline yesterday wiped $221bn off its market capitalisation - that’s a bigger market cap than any company listed in London.

The fall can most likely be attributed to some profit taking after the company’s shares hit an intraday all-time high following the keynote speech made by chief executive Jensen Huang at the Consumer Electronics Show in Las Vegas on Monday.

Huang used his speech to hail the “ChatGPT moment for general robotics is just around the corner”, hinting that physical artificial intelligence might soon be available for public use, just like OpenAI’s large language model. I am not sure how I feel about the looming spectre of a humanoid robot assembling its arsenal in preparation for general use (if you’re not terrified at the prospect, you should watch Wallace & Gromit’s recent adventure in Vengeance Most Fowl). But regardless of where AI is heading, it’s clear Nvidia will remain at the heart of the industry for some time.

On Monday Huang also unveiled a variety of new partnerships which will see its hardware and software used in multiple markets. For example, the company has signed data storage group Micron as its memory partner for gaming semiconductors. And it will provide chips for Toyota’s driver assistance programs, Uber’s autonomous driving initiative and the technology behind Aurora’s self-driving trucks.

Regardless of your interest in the future of AI, it’s worth paying attention to Nvidia shares because of the impact they have on the market. If you were to buy an S&P 500 tracker today, 7% of your investment would be in Nvidia (the Magnificent 7 as a group account for 39% of the premier market in the US). Nvidia’s share price movement yesterday dragged the S&P 500 down as a whole and also sparked a sell off in other AI stocks, including Palantir and Tesla (down 8% and 6% respectively).

I like Nvidia and think the AI gravy train will continue to deliver for some time. But the company’s dominance in the US markets is a worry, because if something goes wrong at Nvidia, the whole market could begin to unravel.

Team Internet (LON:TIG)

Up 29% yesterday to 117.8p (£297m) - Possible Offer - Graham - PINK

Two private equity firms have spotted value at TIG: an American group and a European group, and they have both proposed a takeover at 125p. Both of them offered bids at lower levels that were rejected.

Current status:

The Board is currently considering both approaches with its advisers, including limited interaction with the Potential Offerors, and will make further announcements in due course as appropriate.

I was AMBER/RED on this in November (share price at the time: 99p) on the day of a major profit warning, after an advertising technology business acquired by TIG earlier in 2024 had seriously underperformed. Something that really bothered me was the discovery that the company had been buying back its own shares despite having about $100m of net debt. I was also put off by the complicated structure of the group and the lack of growth in its core assets.

However, two different sophisticated buyers both coming in at the same time, at the same price, is strong evidence that the valuation may have simply fallen too far: at one point it fell down as low as 77.5p, for a £200m market cap, vs. EPS estimates of 23p. So it was trading at only a little over 3x estimated earnings at the low.

The directors at TIG can now play the buyers against each other and wait for one of them to make a better offer. So I don’t think they need to rush into accepting either of the bids, which are only offering a PER of 5.4x anyway. If the buyers really believe in the underlying quality of the group, shouldn’t they be willing to pay substantially more than that?

Shell (LON:SHEL)

Down 1.6% to 2,574p (£156.6bn) - Q4 update - Roland - AMBER/GREEN

Today’s update from Shell warns of a fall in gas production during the fourth quarter of 2024 and “significantly lower” profits from its chemicals and products business. I don’t have access to broker notes for Shell, but press commentary suggests that several analysts have cut their Q4 earnings forecasts following today’s update. However, I suspect the impact on Shell’s full-year results will be modest. In itself, I don’t see today’s update as a serious concern.

In my view, Shell remains in good shape, with significantly improved profitability compared to the pre-pandemic period. CEO Wael Sawan appears to be pulling back from investments in electricity and renewables and I think it continues to make sense to view this business as a leveraged play on oil/gas prices and industrial activity.

At current levels, forecasts suggest the business could generate a return on equity of around 13% this year. With the shares trading just above book value, Shell’s valuation looks reasonable to me and I am confident the 4.4% dividend yield will remain safe.

However, the stock is also trading on 13 times 10-year average earnings (CAPE 10y), according to Stockopedia. My research suggests that’s at the upper end of its historic range. I would personally prefer to wait for the energy sector to suffer one of its periodic slumps before considering a purchase.

Graham's Section

Likewise (LON:LIKE)

Up 8% to 20.6p (£50m) - Trading Update - Graham - AMBER

This update is in line with expectations (or to quote them precisely, “on track to deliver” expectations).

Likewise Group plc (AIM:LIKE), the fast growing UK floor coverings distributor, is very pleased to announce that Total Group Revenue for the year ended 31 December 2024 ("FY24") was £150.8 million. It is particularly encouraging that this important milestone has been reached.

Key bullet points:

Total group revenue +7.5%

Sales in Likewise Floors +15.5%, while the acquired carpets wholesale “Valley” saw a decline of 3%.

Based on the strong Q4 trend, annualised sales would approach £175m, but this does not allow for seasonality.

Plans from the company are ambitious, with another 35% increase in capacity planned for 2025 across facilities in Glasgow, Derby and Newport. Additionally they are going to complete their UK network with the addition of a logistics centre near Plymouth. Operational cash flow will be used to fund all of this.

Buyback programme: Likewise announces a very small buyback programme for only £200k. I see that this follows a £250k buyback in July. All told, that's less than 1% of the current market cap. I wonder what the point is - are they trying to signal that they think their shares are cheap? If so, the value isn’t jumping out at me:

And they aren’t exactly drowning in cash: the cash balance was £3.2m as of June 2024, plus they had various bank loans adding up to c. £10m. So it makes sense to me that they should keep the buybacks at token amounts for now (actually it would make more sense to me if they didn't bother with them at this stage).

CEO comment:

"Following four years of developing the Group's Sales and Operational infrastructure we have stepped up to a new level of performance in H2 2024.

With significant new product launches in Q4 and more planned for Q1 and 2 this year, the Group is well placed to continue the exponential sales increase into 2025.

We have excellent Teams of people throughout our businesses, in Product, Sales and Marketing, Warehouse and Transport, to capitalise on the significant opportunities before us.

We are absolutely on the correct course to build a really meaningful flooring distribution business in the UK."

Estimates: Zeus have left forecasts unchanged for the next two years, including revenue of £160m (2025) and then £172m (2026), with adj. PBT doubling to £4m (2025) and then growing further to £5.2m (2026).

Graham’s view

The ex-CEO of Headlam (HEAD) seems very excited about his new project at LIKE and a comparison of the two shares reveals some stark differences. Sales at HEAD have fallen from a high of over £700m to c. £600m, while LIKE (boosted by M&A) is rushing towards higher sales from a very low base.

Measured by their price to sales ratios, LIKE (at 0.33x) is nearly twice as expensive as HEAD (0.18x). HEAD is not only cheaper in terms of price to sales, but it also has a stronger balance sheet backed up by a freehold property portfolio. The catch is that HEAD is loss-making and in retreat.

The question is when (or whether) higher sales will translate to meaningful profits at LIKE. Today’s update says that H2 saw “evidence of operational gearing and improving profitability as the Group aspires towards a more acceptable return on sales”. The lack of meaningful profits to date is the main reason why the notion of the company buying back shares seems premature to me. But if you believe in the forecasts, profits should see a bounce in 2025.

Perhaps it could be worth backing a management team who are ambitious and excited to steal market share from their former workplace?

Personally, I find this to be a very troublesome and unattractive sector in which to invest, and I would want to see very clear value on offer before taking a positive stance. So I still can’t get this any higher than AMBER.

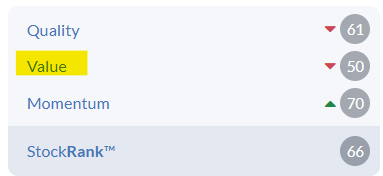

This is consistent with what the StockRanks are saying:

Victoria (LON:VCP)

Down 10% to 101.65p (£117m) - Board Change & Q3 Update - Graham - RED

I’ve been moderately negative on this one (e.g. in October). The balance sheet is in sharp focus with net debt at £658m (Sep 2024 balance sheet), including a large Euro-denominated note that matures in 2026. The Sep 2024 leverage multiple was 6.2x, which is far higher than I (and most lenders) would be comfortable with. The leverage multiple (net debt/EBITDA) typically needs to stay below 3x for most companies.

The simple fact that net debt is nearly six times the market cap is a big warning, and has resulted in some amazing share price volatility - the share price has recently doubled from its low.

Short-sellers had a lot of fun with this one but there are no longer any notifiable positions on the short side: the big money has already been made on that trade.

Today’s update is in line with expectations: demand remains subdued but H2 is expected to benefit from various management actions as the company attempts a turnaround. They are targeting £32m of fixed cost savings this year, through various business reorganisations and integrations. This is part of a total package of £80m of cost savings to be achieved by the end of FY March 2027 - a remarkable number in the context of a £120m market cap!

They reassure on improved performance and “a sharp increase in earnings” over the next two years. This is based on demand normalising, operational leverage, their “self-help” initiatives, etc.

Board change: a US institution with an 11% shareholding gets a new NED on the Board, as the previous one resigned.

Debt situation: I remain deeply concerned about the risk levels attached to this one.

It’s fair to say that it’s in “high risk, high reward” territory as the recent doubling of the share price demonstrates. However at a leverage multiple in excess of 6x this can only be described as extremely high risk: the only reason I have not been RED already is the absence of financial maintenance covenants attached to VCP’s notes. If the notes had financial covenants then they would most likely be broken already, given the current state of trading, and VCP would be in technical default.

However, in the absence of covenants, VCP still has the time to come up with a solution, i.e. a refinancing, and this will be made easier if financial performance recovers over the next year.

Victoria’s August 2026 Note has seen an improvement in price to 92 cents, vs. 87.5 cents in October. It should gradually approach 100 cents as August 2026 approaches, if lenders are confident of a refinancing. But bear in mind that if it’s an equity refinancing, that could spell huge dilution for shareholders:

Credit rating agency Fitch downgraded Victoria from BB- to B+ in May 2024.

Worryingly, Fitch downgraded it again in December (external link) from B+ to only B, and the outlook remains negative.

According to Fitch:

'B' ratings indicate that material default risk is present, but a limited margin of safety remains. Financial commitments are currently being met; however, capacity for continued payment is vulnerable to deterioration in the business and economic environment.

Explaining their decision to downgrade Victoria further and their negative outlook even at this lower rating, Fitch said:

The Negative Outlook reflects our expectation of negative free cash flow (FCF) for FY25-FY28, which coupled with high leverage and low interest coverage, is likely to increase refinancing risk in FY26.

Graham’s view

I’m going to downgrade my stance on this from AMBER/RED to RED. It’s not fashionable to have much trust in credit ratings agencies these days but I do find that the debt perspective is often more rational than the equity perspective, and if Fitch are worried about the refinancing risk next year then I think that needs to be taken seriously. The leverage multiple alone (>6x) is a major red flag. So this one is getting a downgrade from me

Roland's Section

Intercede (LON:IGP)

Up 10% to 201p (£117m) - Contract orders and renewals - Roland - AMBER

We don’t always cover contract awards in these reports. They are often already priced into current market forecasts and are effectively business as usual.

Today’s update from digital identity security specialist Intercede appears to be an exception to this.

The company signed over $5m (c.£4m) of new contracts in December, which has prompted management to upgrade its 2025 guidance.

These orders, combined with expected additional conversion of the existing pipeline in Q4 FY25, means that the Company now expects financial performance to be ahead of market expectations for FY25* and further underpins confidence looking forward towards FY26 and FY27.

The new contract awards are with a varied mix of new and existing customers and include both licences and service agreements. Customers listed include an Asian government, a Middle Eastern airline and US federal agencies.

Updated forecasts: Intercede helpfully specifies existing market expectations as being for FY25 revenue of £16.1m and adjusted EBITDA of £3.3m.

The company hasn’t provided new guidance today but Research Tree subscribers do have access to updated forecasts, with thanks to broker Cavendish.

FY25e: adj EPS +3% to 4.9p (previously 4.8p)

FY26e: adj EPS +3% to 4.4p (previously 4.3p)

The modest size of these upgrades suggests to me that some of the contract awards announced today might be seen as business as usual, after all. Note that FY26 earnings forecasts remain c.10% lower than FY25, suggesting limited visibility on the new business pipeline.

Roland’s view

As I commented yesterday when I looked at Corero Network Security, Intercede boasts the kind of high margins and strong quality metrics I look for in a software business:

Today’s contracts suggest Intercede is successfully expanding its reach into new geographic markets, reducing its historic dependence on the US public sector. I see this diversification as a positive, assuming margins are maintained.

However, I think it’s probably worth remembering that FY24 (y/e March) was a bumper year for Intercede, with revenue of £20m and net profit of £6m. FY25 and FY26 earnings are expected to be >50% lower than in FY24. This might also help explain management’s enthusiasm for announcing new contracts ahead of the year end of 31 March.

Forecasts have been upgraded more materially on two occasions over the last year, but today’s more modest upgrade does not suggest to me any substantial change in the company’s near-term outlook.

Indeed, I can’t help feeling that today’s good news is already firmly priced into the shares, which trade on a forward P/E of over 40:

Personally, I’m a little surprised today’s share price rise has exceeded the increase in earnings forecasts. This means Intercede shares are actually more expensive now than they were yesterday.

While I can see some things to like in this business, the shares are too expensive for me at current levels. I’m going to maintain Graham’s recent AMBER view on this small cap.

Topps Tiles (LON:TPT)

Up 6.7% to 40p (£78m) - Q1 Trading Update and CEO Succession - Roland - AMBER

Retailer Topps Tiles is up today, after announcing a 4.6% rise in sales for the 13 weeks to 28 December and the amicable departure of its CEO.

Sales growth is said to have accelerated during the most recent five-week period, with sales up 12.9% versus the prior year and like-for-like sales up by 12.5%.

Trading update: Like B&Q’s owner Kingfisher (which also owns Screwfix), Topps Tiles appears to be benefiting from trade demand offsetting weaker consumer spending.

In Topps Tiles, the total number of active registered traders at the end of the period was up 7% year on year to 141,000, with the number of new traders registering in the quarter more than doubling year-on-year, both in store and online.

To illustrate the point, trade sales during the quarter to 28 December rose by 13.5%, compared to overall sales growth of 4.6%.

We don’t have a revenue split today, but trade sales in Topps Tiles accounted for 62.8% of sales in 2024. This suggests to me that there was a significant fall in consumer sales over the last quarter.

In Topps’ FY24 results, the company noted that trade customers bring “repeat purchases and high degrees of loyalty”, but receive “advantaged pricing” resulting in lower gross margins (than consumers). There’s no comment on gross margin in today’s quarterly update.

Elsewhere, the company says its other main business, Pro Tiler Tools, is continuing to perform well, with sales up 20% year-on-year over the quarter.

CEO Departure: CEO Rob Parker has decided to leave the business after “an extended period of consideration”. He’s been CEO since 2019 and was CEO for 12 years prior to that.

This departure seems amicable and he will remain in place until a successor is appointed.

CMA review: Topps Tiles acquired retailer CTD Tiles (30 stores) out of administration for £9m in August 2024. This deal is currently being reviewed by the CMA, so any contribution being made was excluded from today’s update

A decision on CMA’s Phase 1 review is expected on 17 February 2025.

Topps has 300 stores, so the CTD estate would represent a 10% addition and might provide a useful boost to sales.

Outlook: today’s update does not mention performance against expectations, but broker Zeus appears to have left its FY25 forecasts unchanged today. I’m assuming this means today’s update is in line.

Consensus forecasts on Stockopedia suggest Topps adjusted earnings will rise by 58% to 3.8p per share in FY25, although this needs to be seen in the context of last year’s 48% earnings slump.

FY25 forecasts remain lower than FY23 adjusted earnings of 4.5p per share.

Roland’s view

Topps Tiles is a market leader in its niche, but trading conditions appear to remain difficult – or at least, mixed. While trade demand is good, higher-margin consumer business is weaker. I wonder if the profitability of the company’s large store estate could be under pressure at present.

Certainly, we can see that while revenue has trended steadily higher in recent years, aided by acquisitions and trade growth, profits have fallen as margins have collapsed:

The StockReport shows net debt of £77m, but checking the balance sheet shows that this is made up of lease liabilities, with the group maintaining a modest net cash position excluding these obligations.

I don’t have a problem with big lease liabilities when they relate to profitable stores, but Topps Tiles’ underperforming consumer business makes me wonder if some of these stores may be borderline in terms of profitability.

Topps Tiles continue to look cheap on valuation metrics, suggesting a possible opportunity if profits do recover:

While there may be an opportunity here, I can also see some risks. Personally, there are other retailers I’d rather own.

I’ll be interested to see the company’s half-year results and to hear from the new CEO, when appointed. For now, I’m going to remain neutral.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.