Good morning!

Spreadsheet accompanying DSMR: link (last updated 23rd June)

Agenda is complete.

14:25 - Report is complete!

FTSE9000

Having closed oh so close last night:

FTSE futures are pointing to a rise above 9000 today for the first time.

Despite difficult economic conditions, it perhaps shows the old adage is true - it's not about timing the market but time in the market:

Of course, the Uk indices have done nowhere near as well as the US recently (although they look better on a Total Return basis), but its nice to be making new highs over here too, and past a number that may be a psychological barrier for some investors.

Companies Reporting:

Name (Mkt Cap) | RNS | Summary | Our view (Author) |

Rio Tinto (LON:RIO) (£72bn) | Rio has appointed Simon Trott as group CEO. Trott is the current head of its iron ore division. | ||

Natwest (LON:NWG) (£44bn) | Full disposal of 11.7% holding in Permanent TSB through a placing at €1.98. Raised approx €127m. | ||

Experian (LON:EXPN) (£35bn) | Rev +12% (8% organic). N America +10% (67% of revenue). FY26 outlook unchanged. | ||

Barratt Redrow (LON:BTRW) (£6bn) | Comps -7.8% to 16.6k. Fwd sales +10.5% to £2.9bn. FY25 in line w/ exps for adj PBT of £582.6m. | AMBER (Roland) Today’s full-year trading update is in line with expectations in terms of profit. However, home completions missed previous guidance of between 16,800 and 17,200 due to slower London sales to PRS and international buyers. Today’s update also includes details of a whopping £229m of adjusting items that will be applied to profits this year. These relate to the Redrow acquisition and further legacy (fire safety and reinforced concrete remediation) costs of £98m. | |

B&M European Value Retail SA (LON:BME) (£2.6bn) | Rev +4.4% in March-June. B&M UK LFL +1.3%. FY profit guidance will be provided w/ H1 results. | ||

Ninety One (LON:N91) (£1.71bn) | AUM at £139.7m on 30 June 25, +6.8% versus 30 March 25. June AUM includes £1.9bn from Sanlam | ||

Genus (LON:GNS) (£1.5bn) | FY25 underlying trading in line with exps. Adj PBT to be “at least £72m”, with leverage <1.6x. | ||

Sequoia Economic Infrastructure Income Fund (LON:SEQI) (£1.3bn) | NAV+0.8% to 92.56p per share. Non-performing loans 0.9% of NAV. Pull to par 4.3p at 30 June. | ||

Dalata Hotel (LON:DAL) (£1.2bn) | Cash offer of €6.45 per share (€1.4bn), 35% premium to price before FSP. Trade buyers. | PINK | |

GlobalData (LON:DATA) (£1.2bn) | H1 rev +12% to c.£157m w/ FX tailwind. Renewals stable. £60m tender offer planned at £1.50. | ||

Integrafin Holdings (LON:IHP) (£1.1bn) |

Q3 net flows +84% to £1.2bn. 30 June 25 FUD £69.5bn, +11% YoY. Clients +5% YoY to 244.7k. Outlook: Launched group-wide cost review. FY25 cost growth guidance remains unchanged at 9%; cost growth expected to moderate from FY26. | AMBER/GREEN (Roland) [no section below] One possible concern is that margins remain under pressure, with a quarterly revenue margin of 22.4bps (FY24: 23.5bps). A group-wide cost review has been launched to address this at a structural level, with an update promised in December. I think IntegraFin remains potentially attractive as a long-term buy and am happy to leave my previous view unchanged. | |

Trustpilot (LON:TRST) (£1.0bn) | H1 rev +23% to $123m, bookings +23%. Upgrading FY EBITDA margin guidance to 14% (prev c.13%). | ||

Hilton Food (LON:HFG) (£760m) | Apax Global Alpha investing £22m for 26% of Foods Connected, HFG’s supplier mgt platform. | ||

Atalaya Mining Copper SA (LON:ATYM) (£669m) | Q2 copper prod 13,175t, -8% vs Q1. FY outlook unchanged for 48-52kt copper. Net cash €70m. | ||

Close Brothers (LON:CBG) (£599m) | Selling CBRL to MML Keystone for undisclosed amount. Modest gain and capital benefit on disposal. | ||

Partners Private Equity (LON:PEY) (£583m) | Selling PCI Pharma Services for c.€83m, in line with book value. Will reinvest €18m in PCI. | ||

ams-OSRAM AG (SWX:AMS) (£443m) | Strong momentum, exp H1 rev c.£110m w/ adj EBITDA £24-24.5m. FY in line with exps. | ||

Home Reit (LON:HOME) (£300m) (suspended) | Former investment advisers AITi RE and Alvarium Fund Managers have entered administration. | ||

Norcros (LON:NXR) (£247m) | Acquired supplier of wall panels for c.£45m (6.2x EBITDA). Will result in pro forma leverage of 1.6x | AMBER/GREEN (Mark) [no section below] Norcross continues to acquire businesses, which is a great strategy to scale up and lessen the impact of their pension deficit, something that they appear to have made good progress on in recent years. It is hard to say for certain without knowing forecast growth rates for the acquired business, but paying 6.2x EBITDA doesn’t look great value. However, it is in line with their own current rating on this metric (on an adjusted basis) and they say there are benefits of scale in the combined group. As this is debt-funded this is likely to be earnings enhancing by the time brokers get round to crunching the numbers. | |

Brickability (LON:BRCK) (£197m) | Rev +7.2% (LFL +0.7%), adj PBT +7.1% to £37.8m. Current trading is in line with exps. | AMBER/GREEN (Roland) A solid set of results from this construction materials group, marred only by what I view as too many profit adjustments. Underlying performance and cash generation seem fine to me though. Low profitability and cyclical exposure are risks, as is the fairly flat outlook. Until there’s an upturn in UK housing activity, I don’t see an obvious catalyst for a re-rating here. Even so, I remain broadly positive on Brickability and would argue that the valuation is probably reasonable at current levels. | |

Anglo Asian Mining (LON:AAZ) (£193m) | H1 production 16,378 GEOs (H1 24: 5,270 GEOs). Gold sales 9,781oz at $3,077. Net debt $13m. | ||

Mobico (LON:MCG) (£178m) | Net proceeds £273m, FY25 gearing to be 2.5x at year end. FY25 adj op profit exps unch at £180-195m. | ||

Gateley (Holdings) (LON:GTLY) (£178m) | Revenue +4% to £179.5m, u/l PBT+1% to £23.3m, u/l EPS -6% to 13.31p. Net debt £6.6m (FY24: Net cash £3.8m) | ||

Concurrent Technologies (LON:CNC) (£171m) | H1 revenue +27% to £21.3m. PBT +4% to £2.4m. Order intake £22.3m (FY24: £17.8m). Full year in line with current market expectations. | AMBER (Roland) [no section below] | |

Alumasc (LON:ALU) (£135m) | Revenue +12% (organic growth 7%), u/l PBT +9% to £14.2m , in line with market expectations. Net debt excl. Leases £6m. | AMBER/GREEN (Mark) This is a small revenue beat but an in-line update, meaning that H2 generated lower u/l PBT than H1 and was flat on H2 last year. This remains a Super Stock. However, it no longer looks cheap on forward EPS growth estimates, and with the Momentum Rank falling and lower PBT in H2 than H1, now looks to be the time to moderate our view on this one. | |

Robert Walters (LON:RWA) (£131m) | Q2 NFI -14%. Further cost savings made to reduce monthly operating cost base, more to come in H2. Period-end net cash of c.£30m (31 March 2025: c.£42m) following payment of 2024 final dividend during the quarter. “forward indicators in specialist recruitment slightly weaker as a result relative to the end of Q1” | AMBER/RED (Mark) This is a weak update, both in terms of Q2 NFI and the outlook. So far, the company has maintained their very generous dividend, choosing to pay this out of cash. However, with the company now loss-making and net cash declining precipitously, this looks ripe for a dividend cut. It would seem wise to wait for any cut to arrive and a more obvious improvement in trading conditions before investing for any recovery here. | |

ACG Metals (LON:ACG) (£127m) | FY2025 production guidance upgraded from 30-33koz to 36-38koz gold equivalent, driven by strong operational improvements, including higher gold and silver recoveries. Sponsor loans advanced to the Company prior to the Gediktepe acquisition have also been fully repaid ahead of the scheduled October 2025 maturity. Net debt as of July 13, 2025 was $66m. | ||

Afentra (LON:AET) (£116m) | H1 2025 Net Average Production: 6,348 bopd. Net Debt of $15.5 million (Net Cash $19.9 million post 1st July lifting). | ||

RM (LON:RM.) (£82m) | H1 Revenue -7.6% to £73.2m, Adj. Operating Profit £0.9m (£FY24: £0.6m loss), Adj Net Debt £59.6m (FY24: £52.7m). “...on course to meet full year management expectations for adjusted operating profit and adjusted EBITDA.” H2 weighting. | ||

Cake Box Holdings (LON:CBOX) (£79m) | Revenue +13% to £42.8m, u/l EBITDA +17% to £8.7m, u/l EPS +19% to 13.18p. Trading in the 2026 financial year has started positively and in line with market expectations. | ||

Anexo (LON:ANX) (£78m) | Extended to 22nd July | PINK | |

Ilika (LON:IKA) (£71m) | £1.25m grant funding from Advanced Propulsion Centre UK as part of a £3m collaboration. | ||

Eagle Eye Solutions (LON:EYE) (£62m) | Flat Revenue, Adj. EBITDA +9% to £12.2m, Net cash £12.3m (FY24: £10.4m). “Cost reduction initiatives…provide the Board with confidence in maintaining a double-digit adjusted EBITDA margin for FY26, with an improving adjusted EBITDA progression by the end of FY26.” | ||

Arrow Exploration (LON:AXL) (£51m) | Current production 4,600-4,800 boe/d net, with production flattening out and shallower declines, as expected. Net Cash $13.5m. | ||

Cirata (LON:CRTA) (£37.2m) | Q2 bookings $0.8m down 53%. Q2 cash burn $2.2m. Sells BlueOptima for up to $3.5m gross consideration. Seeking further cost base reductions to $12-13m run-rate from $16-17m. Cash $6.1m. | RED (Mark) [no section below] $0.8m of quarterly bookings versus a £37m market cap just looks daft. They sell “BlueOptima” presumably to keep the show on the road, but I note the $3.5m figure here is “up to” and “gross” so they may be getting much less in cash. Despite further cost savings planned, cash is already looking tight, although strangely there is no shortage of mugs willing to put fresh equity into this perennial dog. | |

Carclo (LON:CAR) (£33.8m) | “The Company has secured a significant contract renewal with one of its major customers, extending an existing business relationship that forms a significant portion of Carclo's revenue base.” | AMBER/RED (Mark) [no section below] No figures are given so you have to wonder if this should have been an RNS Reach, but they do say this customer represents a significant proportion of their revenue. The 2024 AR says that “One CTP customer accounted for 41.1% (2023: 28.4%) of Group revenues from continuing operations and similar proportions of trade receivables.” Therefore, this looks like a huge risk that has been mitigated rather than a gain and hence doesn’t change our view. However, the absence of very bad news is good news. Although they don’t say anything about pricing, which with increasing reliance on this one customer could be under pressure. | |

Novacyt SA (LON:NCYT) (£29.1m) | Launch of LightBench® Discover, a high-precision 3-in-1 instrument for genomic research labs conducting long-read sequencing. | ||

Sosandar (LON:SOS) (£20m) | FY25 Revenue -20% to £37.1m, Adj. PBT £0.2m (FY24: £0.3m loss). Net cash £7.3m (FY24: £8.3m). Statutory loss increased to £0.5m vs £0.1m guided in April due to stock writedown & warehouse move. Q1: Net Rev +15% to £9.5m, 65% GM. Net cash £8.0m. FY26 Profits Warning: PBT now £0.4m vs £1.5m previous forecast. | BLACK/AMBER/RED (Mark) Another profits warning here, not helped by the auditor forcing them to take stock write-downs. This time they guide FY26 numbers lower as well, adding to the misery. With Sosandar’s business model in a state of flux, the one thing that remains constant is their ability to snatch defeat from the jaws of victory. Despite some decent sales growth figures so far this year, considerable doubt remains as to whether they have a long-term sustainable business. | |

Challenger Energy (LON:CEG) (£18m) | AREA OFF-1: 3D seismic to commence on Q4 AREA OFF-3: commence farmout in September. | ||

Altitude (LON:ALT) (£17m) | CEO leaves with immediate effect to pursue other opportunities. She is thanked. Group continues to trade in line with market expectations for FY26 with positive performance across all three divisions. | ||

Zinc Media (LON:ZIN) (£17m) | FY25 Revenue £35m with possible extra £5m in advanced discussions. Net Cash £0.7m (FY24: £0.6m) | ||

Probiotix Health (OFEX:PBX) (£16m) | 25H1 Revenue +33% to £1.34m, EBITDA Loss £110k (FY24: £268k loss. Cash £1.3m) Current order book at record levels. | ||

Northern Bear (LON:NTBR) (£12.7m) | Revenue +14% to £78.1m, Adj. EBITDA +32% to £5.4m, Adj.EPS +88% to 20.1p. Net cash £2.5m (FY24:£2.2m net debt). Q1 trading positive and in line with management expectations. | AMBER/GREEN (Mark)

Mean reversion in weather conditions and the usual contract risks remain considerations here. However, the forward P/E of 5 looks too cheap, despite a recent rise in share price as investors anticipated the positive trading. |

* Market caps at previous trading day’s close

Roland’s Section:

B&M European Value Retail SA (LON:BME)

Down 7% to 240p (£2.4m) - Positive Quarterly LFL Trading Performance - Roland - AMBER/RED

When I looked at discount retailer B&M’s annual results in June I moved our view up by one notch to neutral (AMBER), concluding that the unloved value retailer could be “worth considering as a contrarian play”.

However, the market response to today’s Q1 update – the first from new CEO Tjeerd Jegen – has been poor. Did I upgrade B&M too soon? Let’s take a closer look at what might have upset shareholders.

FY26 guidance withheld!

Markets hate uncertainty and I think Jegen’s decision to withhold full-year profit guidance today is probably the main reason for the share price drop.

In June’s results, the company issued a carefully-worded outlook statement warning that FY26 would bring “sector-wide challenges” from higher employment costs. However, at the time, the company said that the impact of these higher costs was “reflected in the current range” of consensus forecasts for FY26.

Mr Jegen took charge on 16 June, after these results were published. He appears to have decided to withdraw this previous guidance. Instead, he’s waiting until after the summer trading season before issuing profit guidance for the current year:

Half year financial results for the 26 weeks to 27 September 2025 will be published on 13 November 2025 when we will provide full year profit guidance - following completion of our Spring/Summer trading season

I think this is an understandable decision, but it’s obviously also a little ominous. In my view, it’s reasonable to infer from this change of guidance that the new CEO may not be confident that the outlook for the current year is within the range of previous consensus forecasts.

With that said, let’s take a look at today’s trading details.

Q1 Trading: positive LFL

Last year’s results were marred by negative like-for-like sales in the group’s core B&M UK business. Against an inflationary backdrop this implied a likely sharp fall in volumes.

Today’s trading update covers the 13 weeks to 28 June 2025 and offers some (limited) signs of hope that trading in the core UK business may be turning a corner. Revenue growth was positive in two of the group’s three main units:

At constant currencies, Q1 revenue growth was 4.5%. This is an improvement on last year’s Q1 figure of 2.4%.

Perhaps more importantly, the core B&M UK business reported positive like-for-like sales growth of 1.3% during the quarter.

B&M France also remained in positive territory with like-for-like sales growth of 1.1%, albeit this is below the FY25 full-year figure of +2.6% LFL.

Today’s update suggests the improvement in B&M UK’s performance was driven by warmer weather and the timing of Easter, which collectively boosted general merchandise sales (Toys, Garden and DIY). However, the company says these categories saw deflation in average selling prices, resulting in a fall in gross margins in some categories.

Falling gross margins are not good news against a backdrop of rising overheads – I would think it’s almost inevitable that this will drop through to lower operating margins (and profits) in H1.

New ranges are being brought in which have a higher gross margin, but until we see the impact of this over a longer period I would be wary of relying too heavily on any existing consensus forecasts.

Another area of weakness highlighted in today’s results is Fast-Moving Consumer Goods (FMCG). LFL sales were negative last year and remained this way in Q1, although Health & Beauty sales are said to be improving following improvements in operational execution.

Roland’s view

CEO Tjeerd Jegen only started work on 16 June and can be forgiven for wanting more time to review the situation before committing to firm guidance. He appears to be highly experienced in supermarkets and discount retail and has already accumulated a useful shareholding, spending £524k on shares at c.260p in the days before he started the role.

However, today’s update suggests to me that a cut to existing profit forecasts is almost inevitable for the current year due to the likelihood of lower profit margins, even if sales continue to rise.

Assuming this is correct, then my previous concerns about B&M’s debt levels and store opening plans (a further net 10 stores opened in Q1) remain relevant.

While I continue to think that B&M’s problems should be fixable by the new CEO, I think today’s comments highlight the risk that a dividend cut may be needed as part of a broader financial reset to stabilise the business.

I remain interested in B&M as a potential turnaround. But with hindsight I should have remained more cautious until the new CEO had a chance to update the markets.

Today’s trading update and the apparent withdrawal of profit guidance leaves me with no choice but to downgrade our view to reflect the extra risk and uncertainty this has created. AMBER/RED.

Brickability (LON:BRCK)

Up 4.9% to 64p (£203m) - Final results - Roland - AMBER/GREEN

Brickability Group PLC (AIM: BRCK), a leading distributor and provider of specialist products and services to the UK construction industry, is pleased to announce its audited results for the twelve-month period ended 31 March 2025 (the "Period").

Today’s results from this construction materials group have left markets unruffled. While this business is unavoidably cyclical, Brickability appears to have delivered as expected last year and has also left expectations for the current year largely unchanged.

FY25 results summary

Today’s numbers show respectable revenue growth and a useful increase in gross margins. The company says this improvement in gross margin was driven by the contribution of two acquisitions made in the preceding year – Topek and TSL are both higher margin businesses than the group’s core divisions.

Here’s a summary of the main figures from today’s results:

Revenue up 7.2% to £637.1m

Gross profit up 15% to £121.7m

Gross margin: 19.1% (FY24: 17.8%)

Adjusted pre-tax profit up 7.1% to £11.7m

Reported pre-tax profit down 45.3% to £11.7m

Adj EPS down 0.8% to 8.6p

Net debt unchanged at £56.6m

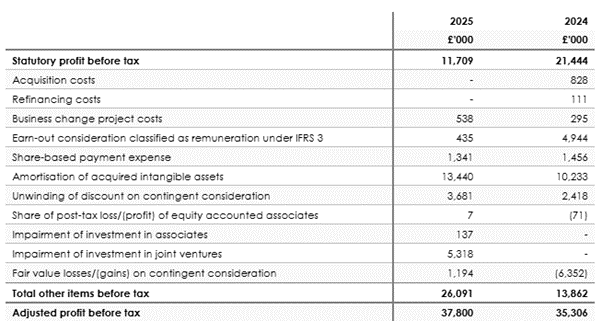

Adjusted items totalled £26.1m, more than double Brickability’s statutory pre-tax profit last year.

I don’t want to sound like a stuck record on the subject of adjusted versus reported profits. But this seems absurd to me. As far as I can see, the company is simply attempting to redefine the accounting measure of profits by excluding many items that accounting standards say should be included in profit. Here’s the full list – note how many items appear in both FY24 and FY25:

In my view, most or perhaps all of these items are likely to be routine and recurring for an acquisitive business of this type.

We might adjust out one or two of these (e.g. fair value movements) to provide a smoother view of underlying trading performance. But that’s all I’d want to do, personally.

To get a more objective view on trading performance I like to check free cash flow.

In this case, my sums suggest Brickability generated free cash flow of £20m before deferred consideration payments for past acquisitions. Including these payouts, free cash flow was £10.6m.

For all practical purposes, I’d view this last figure as the real profit generated by Brickability last year. Based on today’s £196m market cap, this gives the stock a trailing free cash flow yield of around 5.5%. That looks about right to me, given the fairly flat outlook.

Trading performance: diversification pays off

I don’t want to sound too negative here. I think Brickability is one of the better IPOs of recent years (it floated in 2019) and is probably quite well run. CEO Frank Hanna was previously in charge at Michelmersh Brick Holdings, another AIM business I rate quite highly.

Hanna only took charge in April 2024 and hasn’t yet overseen any acquisitions. But he seems to be committed to maintaining a strategy that’s used M&A to help diversify the business since IPO to reduce its dependency on brick sales – with some success:

The divisional reporting in today’s results highlights the benefits of this strategy of diversifying by product and end user:

Bricks and Building Materials (66% of revenue): external revenue was down 0.5% at £419m, with adjusted EBITDA down 14% to £21.7m (note the very low margins!).

While UK brick market volumes rose by 8.3% last year, Brickability’s volumes rose by 5.2%, driven by 15% growth in sales at its Taylor Maxwell subsidiary. This business supplies timber, bricks and cladding and benefited from exposure to social housing, where new starts were stronger than in private housing.

Timber revenue was also up 5.6%, driven by higher volumes despite some price weakness, as also reported recently by AIM veteran James Latham.

Importing Division (8% of revenue): external revenue fell 2.5% to £51.6m, with adjusted EBITDA down 20% to £5.7m.

Trading conditions were described as challenging, but the second half saw brick volume growth of 16.3%, outperforming the wider imported brick market growth of 12.3%.

Management expects performance to improve in FY26 as demand for imported bricks increases, reflecting manufacturing capacity constraints in the UK.

Distribution Division (11% of revenue): external revenue rose by 10% to £67.8m, with adjusted EBITDA up 5% to £8m.

This growth was driven by “a near doubling of revenue” from solar business Upowa, which supplies solar panels and other energy efficient products such as electric radiators and underfloor heating.

Upowa’s strength helped to offset the broader impact on sales at this division’s other businesses, which were exposed to weaker activity in the housing market.

Contracting Division (15% of revenue): external revenue rose by 69% to £98.6m thanks to the first full-year contribution from the Topek and TSL acquisitions. Revenue rose by 2% on a like-for-like basis. Adjusted EBITDA was £21,7m, compared to £10.1m in FY24.

Cladding and fire remediation are relatively busy areas of the market at the moment, for reasons well documented elsewhere. However, management says that margins in the supply and fit section of the division were held back last year by more unfavourable conditions for housebuilders that put pressure on pricing.

Continental JV loss: as previously reported in September 2024, Brickability decided not to provide a further loan to its German tile manufacturing joint venture last year. This business subsequently went into administration. While some recovery may eventually be possible, the company has written off the full £5.3m value of its loans to the JV.

Outlook & Estimates

CEO Frank Hanna sounds fairly confident about the outlook for this year (my emphasis):

The new financial year has started well, with the Group delivering year-on-year organic growth, and trading in line with management expectations.

However, Hanna notes that further interest rate cuts have not yet materialised and that housing starts and RMI work remains relatively subdued.

Some Fire Remediation projects are also being held back by approval delays stemming from the Building Safety Regulator.

Estimates: house broker Cavendish has left its FY26 and FY27 estimates almost unchanged today:

(FY25 actual adj EPS: 8.6p)

FY26E EPS: 8.8p (prev. 8.9p)

FY27E EPS: 9.8p (prev. 9.9p)

Paired with today’s flattish share price, this means the valuation outlook is almost unchanged:

Roland’s view

Brickability’s move into higher margin, value-added markets looks like a sensible medium-term strategy to me, assuming the company can avoid any bad acquisitions.

Profitability is always going to be constrained in a business of this kind, but my sums suggest an operating margin of 3.3% and return on capital employed of 6.9% for FY25, on a statutory basis, broadly in line with last year:

I would guess this is not really high enough to cover Brickability’s true cost of capital. But the opportunity here is to benefit from the eventual uplift in profits that’s likely when housing market conditions improve. Judging from past performance in this sector, I’d expect a broader upturn to drive improved margins and substantial operating leverage, due to stronger volumes and pricing power.

The risk is that we don’t know when this might happen. Broker forecasts have been cut over the last year and have remained flat today:

There’s an opportunity cost to waiting – Brickability’s share price has stagnated over the last year, underperforming the broader UK SmallCap market:

However, investors at current levels should continue to benefit from a c.6% dividend yield that is just about covered by cash, and looks relatively safe to me.

On balance, cyclical risks and low profitability mean I’m not inclined to go fully positive here. But I am very comfortable maintaining our previous AMBER/GREEN view after today’s results.

Mark’s Section:

Alumasc (LON:ALU)

Down 4% to 355p - Full Year Trading Update - Mark - AMBER/GREEN

Alumasc has been outperforming general construction and RMI markets recently, and today’s update shows that FY25, which ended on 30th June, is no different. They report revenue growth of 12%, of which 7% is is organic. The rest comes from their acquisition of ARP during the year.

o Revenue growth of c.12% to approximately £113m (FY24: £101m), underpinned by organic growth significantly ahead of UK construction markets

o Underlying profit before tax ('UPBT')1 expected to be c.£14.2m, approximately 9% above the prior year, in line with market expectations

Looking at the previous Cavendish note, they had revenue estimates of £110.5m so this is a small beat. However, u/l PBT is exactly in line with what Cavendish had pencilled in. This suggests that they may have seen a lower margin mix than forecast.

There are a couple of things to be concerned about with this. The first is that, when I run the maths on all these figures, I find that H2 revenue and u/l PBT are down in H2 on H1:

This looks better on the revenue side once I adjust for the ARP acquisition. This doesn’t appear to be due to seasonality as revenue and u/l PBT grew strongly from H1 to H2 in FY24. Something is a little strange with how much they claim ARP added to revenue in H1, and the organic growth rates giving higher H2 revenue Ex-ARP!. However, there is no confusing the reality that H2 u/l PBT is down 11% on H1 and flat on H2 the year before.

The second issue is that exceptional costs here have been large and recurring. I looked at this issue when I wrote a Stock Pitch on the company in early 2024. Here is the updated chart of these costs:

Most notable is that restructuring costs are regularly classified as exceptional and were unusually large in 25H1. This will be a key focus for me when we get the Final Results on 2 September.

Net debt is up slightly compared to the year end:

Year end net bank debt (pre-IFRS 16) is expected to be approximately £6m, representing a leverage ratio of c.0.3x. This includes an increased level of trade receivables at 30 June 2025, due to the timing of shipments into the Chek Lap Kok airport project, which is expected to normalise over the first quarter of FY26.

The Group has continued to invest in its organic growth opportunities, and with its strong operating cash generation, and significant headroom against its committed banking facilities, retains substantial capacity to fund its strategic and operational plans.

However, they explain this as working capital movements, and will include a dividend payment made in April. The overall leverage is low which should afford them the ability to make bolt-on acquisitions if the opportunities present themselves.

Mark’s view:

This has been a strong performer over the last year. However, it is no longer particularly cheap, with a forward P/E of around 12 versus a forecast EPS growth of 7%. It looks more expensive if investors take a more conservative view of exceptional costs that appear less exceptional than the company would have us believe.

Despite being in line with expectations, a H2 PBT that was flat on the previous year and down 13% on H1, gives me pause for thought. This remains a superstock:

However, the declining Momentum Rank and weaker H2 makes me think that this may be the time to downgrade the view to AMBER/GREEN.

There is certainly the scope for the company to do better in better economic conditions, but the same could be said of the whole sector, and unless this starts to beat expectations again or finds a great value acquisition, it no longer stands out.

Northern Bear (LON:NTBR)

Up 2% to 94p - Preliminary Results - Mark - AMBER/GREEN

This is a strong set of results with Revenue up 14% to £78.1m, Adj. EBITDA up 32% to £5.4m, and Adjusted EPS up a whopping 88% to 20.1p. Before we get too excited, it is worth reminding ourselves that this is largely a Northern roofing contractor where gross margins are still relatively low:

Gross profit of £19.2m (2024: £15.9m), with a gross margin of 24.6% (2024: 23.1%)

Normally this sort of company wouldn’t have great operational gearing, but as the net margin is relatively small the improvement in gross margin is having a big impact, despite admin costs having risen faster than revenue at 18%. It is also a company that has warned in the past due to periods of prolonged wet weather, so are a big beneficiary of good weather, which they are upfront about:

All of the Group's subsidiaries have benefited from the very dry winter period and also our strategy of maintaining a balanced mix of private and public sector clients.

Of course, weather effects have a tendency to mean-revert, and the impact of nice weather appears to have been anticipated by investors recently:

Which may be why the market has only reacted mildly positively to what looks like a huge beat on the Stockopedia EPS consensus:

There has been a widening gap between adjusted and statutory figures with these results, so that requires some closer attention. Here is what they are adjusting out:

They announced the closure of H Peel in a recent trading update:

We have made the decision to close our fit-out operation at H Peel & Sons ("H Peel") in Dewsbury. H Peel has been particularly impacted as its primary markets - Leisure and Hospitality - have struggled to recover from the COVID pandemic. As a result, we will integrate its business and ongoing contracts into Arcas, our specialist building solutions business in the North East of England. We have fully accounted for trading losses and expected closure costs in the EBIT expectation for the year to 31 March 2025 stated above.

While this specific case is clearly one-off, it is the nature of the contracting business to have loss-making contracts and operations from time-to-time.

Balance sheet:

They get an A+ for reporting here:

Our net bank cash position at 31 March 2025 was £2.5m (31 March 2024: £2.2m net debt). The net cash position consisted of £4.0m cash and cash equivalents (2024: £1.0m) and £1.5m bank debt (2024: £3.2m). As we have emphasised in previous years' results, our net cash (or net bank debt) position represents a snapshot at a particular point in time and can move by up to £1.5m in a matter of days, given the nature, size and variety of contracts that we work on and the resulting working capital balances.

The lowest cash position during FY25 was £2.1m net bank debt, the highest was £2.5m net cash, and the average was £0.4m net bank debt.

I wish accounting standards required all companies to report highest, lowest and average net debt during the trading period, as it would be quite enlightening and allow investors to make better investment decisions. Overall, the balance sheet isn’t that strong, with a current ratio only just above one:

However, this is stronger than this has been in the past and it hasn’t stopped them making generous shareholder returns, so it suggests that they are comfortable with this. It does add to the risk, though.

Outlook:

Given continued nice weather, it should be no surprise that FY26 has started well:

Trading in the first quarter of the current financial year ("FY 26") has started positively and results are in line with management expectations for Q1 FY 26.

As always, the timing of Group turnover and profitability is difficult to predict, despite the continued strong forward order book, and our results are subject to monthly variability.

The latest expectations for FY26 are for operating profits to remain consistent with the excellent results in FY25 notwithstanding significant investments in both personnel and premises to generate further growth.

Perhaps most importantly FY26 in line with FY25, which, with no major exceptionals, would see them beat current consensus and put them on a clean forward P/E of 5, despite investing in growing the business in future years.

Mark’s view:

When I looked at this briefly following the trading update, I said it looked cheap. Today’s results confirm that, and put it on a low P/E even if we take the unadjusted figures. The risks are that they are highly dependent on the weather and if rainy conditions return so will a gloomy outlook. Plus the usual risk with contractor businesses of onerous contracts eating years worth of profitable but low-margin business. This should never be too highly rated for those reasons. However, they still look too cheap despite a recent rise and I’m happy to keep my AMBER/GREEN rating.

Sosandar (LON:SOS)

Down 22% to 6.25p - Full Year Results & Trading Update - Mark - BLACK/AMBER/RED

When we last covered this on the DSMR, Roland noted that an updated note from broker Singer had a PBT number significantly below its previous forecast of £1.0m. So this was a profits warning. Today we get a further warning:

The Group is reporting an audited £0.1m loss before tax for FY25. This differs from the £0.5m profit before tax that the Group anticipated reporting for FY25 in the trading update released on 16 April 2025, the difference being due to adjustments arising from the audit including £0.4m associated with a stock write down and £0.1m of additional one-off costs associated with the move of warehouse.

Revenue is in-line with previous updates but significantly down overall:

Revenue of £37.1m (FY24: £46.3m) reflecting a deliberate transition away from price promotional activity in order to improve gross margin

Improved gross margin of 62.1%, up from 57.6% in the prior year

While it makes sense to pursue this strategy if the gross profit is higher, in this case this works out to be £23.0m gross profit, versus £26.7m the previous year. No doubt the refusal to engage in price promotional activity in a weak consumer market also contributed to the £0.4m of stock write-downs that their auditor has forced upon them, casting further doubt on this strategic direction.

Unlike many fashion retailers that have been aggressively pursuing online growth, Sosander has been moving in the other direction:

The opening of our first stores was a milestone for Sosandar, and we are pleased with how we have brought our brand to life in the physical retail environment. We have taken clear learnings from the trajectory of our stores in market towns versus shopping centres and are focused on getting our existing portfolio to profitability before opening any further stores.

Perhaps we shouldn't be surprised that their retail stores aren’t yet profitable early in their life, yet Sosander management appear to be! All of this makes it sound like the company has created a strategy around just doing something, anything differently to what they were doing before because that was failing, and are now finding that isn’t the secret to success. However, there are signs that things may be about to turn a corner, led by their own online retail site:

Return to revenue growth with net revenue of £9.5m, a 15% increase versus the prior year (Q1 FY25: £8.2m). This is despite no sales through Marks & Spencer, our second biggest third-party partner, since mid-April due to their cyber incident.

Importantly, own website also returned to revenue growth with a 15% increase versus the prior year, driven by an increase in traffic, conversion and number of orders from both new and existing customers

Continued improvement in gross margin to 65.0%

However, yet again, Sosander manages to snatch defeat from the jaws of victory:

Following the cyber-incident, the Company is cautiously anticipating lower revenue through Marks & Spencer for the rest of FY26. This, alongside the decision to focus on the existing store portfolio, means that the Company is taking a prudent view and is therefore modifying FY26 guidance. The Company now expects FY26 revenue to be up 18% to £43.6m, with an expected profit before tax of £0.4m*.

This doesn’t appear to be wholly their fault. However this is a huge downgrade versus previous market expectations for sales of £46.2 million and adjusted PBT of £1.5 million. Doing some quick maths, 65% GM on £43.6m of sales is £28.3m gross profit, which starts to validate their pullback from promotional activities. However, it also means that admin costs will have gone up from £23.1m to £27.9m some 21% higher to generate these sales. Until they can show that they can grow sales, while maintaining high gross margins and keep admin cost under control it seems hard to conclude that they have a sustainable business. The good news is that their net cash gives them a runway to attempt to prove me wrong. However, I note that a big cash balance didn’t help other struggling omnichannel fashion retailers such as Quiz, in the end.

Mark’s view:

With Sosandar’s business model in a state of flux, the one thing that remains constant is their ability to snatch defeat from the jaws of victory. Despite some decent sales growth figures so far this year, considerable doubt remains as to whether they have a long-term sustainable business. My previous AMBER/RED view looks well-deserved today.

Robert Walters (LON:RWA)

Down 5% to 172p - Q2 Trading Update - Mark - AMBER/RED

I looked at this company recently while reviewing some recruiters that were hitting 52-week lows. However, I concluded that share price weakness here was warranted. Today’s Q2 trading update underlines this:

These may be a very slight improvement on the trends in Q1, but they are still poor overall and in line with a sector that is largely struggling. Part of their problem is a focus on permanent hiring, which is 66% of NFI, and tends to respond negatively to weak market conditions - who wants to move jobs and give up employment protections if there’s a chance of being let go in the near term?

As if to highlight the predicament they and permanent hires face, Robert Walters answer is cost-cutting, i.e job losses:

The Group exited the first half with a monthly operating cost base of £24.5m, down from c.£25m at the end of 2024 and with further cost reduction planned for the second half.

Period-end total headcount of 3,125 down 2% quarter-on-quarter (31 March 2025: 3,202) and down 14% year-on-year (30 June 2024: 3,625). Fee earner headcount of 1,815 down by 4% quarter-on-quarter (down 17% year-on-year), whilst non-fee earner headcount of 1,310 was flat quarter-on-quarter (down 10% year-on-year). The Group continues to be highly selective in replacing fee earner natural attrition and is allocating resource in the front office to areas with the most compelling returns.

In my 52-week lows article I said “With a 13% yield, this stock may appeal to income investors. Although this is uncovered, and while the company may be able to pay this out of their generous cash balance, they will likely need to see a strong recovery in FY27 to be able to maintain this.” And today two things highlight these concerns. The first is that net cash continues to decline precipitously.[Note that the figure they quote here excludes lease liabilities.]:

Period-end net cash of c.£30m as at 30 June 2025 (31 March 2025: c.£42m) following payment of 2024 final dividend during the quarter.

In 2024, their 13p/share dividend cost them £15.5m, and this looks unlikely to be able to be maintained and also fund the working capital draws that any recovery in trading will require. Equally worrying is that things look to be getting worse before they get better:

Whilst net fees were higher than in the first quarter, macroeconomic uncertainty was more pronounced in Q2, with forward indicators in specialist recruitment slightly weaker as a result relative to the end of Q1.

Mark’s view

This is a weak update, both in terms of Q2 NFI and the outlook. So far, the company has maintained their very generous dividend, choosing to pay this out of cash. However, with the company now loss-making and net cash declining precipitously, this looks ripe for a dividend cut. It would seem wise to wait for any cut to arrive and a more obvious improvement in trading conditions before investing for any recovery here. Given the cash balance reduction I am reducing my view to AMBER/RED.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.