Welcome to Wednesday's report!

All done for now, see you tomorrow!

Companies Reporting

| Name (Mkt Cap) | RNS | Summary | Our view (Author) |

|---|---|---|---|

Ashtead (LON:AHT) (£22.8bn) | Rev +2%, adj PBT -4% to $552m. FY26 rev exps unch, free cash flow $2.2-2.5bn (prev. $2-2.3bn). | ||

M&G (LON:MNG) (£6.2bn) | Adj op profit ~flat at £378m, asset mgt net flows +£2.6bn. AUM +2.5% to £354.6bn vs Dec 24. Reuters: adj op profit below market consensus of £398m. | AMBER (Roland) According to the newswire, today’s operating profit is slightly below consensus expectations. Even so, results from this complex business look broadly as expected to me at a high level, and do not appear to flag up any serious concerns. I’m also encouraged by possible signs of a return to growth in PruFunds and overall net inflows. Although asset management growth is not yet sufficient to offset outflows from the group’s legacy Life products, progress seems positive. On balance, I feel M&G’s valuation is probably up with events after a c.25% rise this year. However, I remain confident in the 8% yield and would view M&G as worth considering for a high-yield income strategy. | |

Bakkavor (LON:BAKK) (£1.32bn) | Rev +0.9%, adj op profit +9.8% to £61.5m. FY25 adj op profit (cont) to be at upper end of range. | PINK (under offer) | |

| Cairn Homes (LON:CRN) (£1.16bn) | Half Year Results | Rev -22%, op profit -30% to €42.7m. FY25 op profit now exp c.€160-165m (prev. c.€160m) | AMBER/GREEN (Graham) Very healthy trading at Cairn: I'm impressed by management here, and I think the company is very well-positioned both economically and in the political context. However, balance sheet tangible equity is only €760m (£660m) and the shares are trading at a very rich premium to this level. That has to count for something: I usually wait for housebuilders to trade at a discount before getting too excited about them. On that basis I can’t be overly positive on this stock, no matter how well it’s trading right now. I leave my existing stance unchanged |

Watches of Switzerland (LON:WOSG) (£744m) | SP +7% H1 results to be in line with exps. Strong trading in US despite tariffs. UK stable w/ YoY growth. | AMBER/GREEN (Graham) A reassuring update and the market has reacted strongly to it. I'm upgrading my stance on this by one notch as I think the shares may offer some value here. The luxury watch market has apparently become very stable and predictable, creating nice conditions for WOSG. At a single-digit P/E multiple, I'm willing to stick my neck out and suggest that this may offer some value here - but based on my track record here, I'll probably change my mind again next time I look at this one! | |

Hilton Food (LON:HFG) (£739m) | SP -16% Rev +7.6%, volume +2.5%. PBT -4.7% to £24.3m. Cost inflation. FY25 to be within range of exps. Shore Capital updated forecasts: FY25E EPS: 60.4p (prev. 62.0p). FY26E EPS: 65.9p (prev. 67.2p) | AMBER (Roland) [no section below] This may not technically be a profit warning, but it looks like a slight downgrade to me for this meat/fish producer. Hilton is reporting difficult trading in its salmon business and broker Shore Capital has trimmed its FY25 earnings forecasts today. Hilton has attractive market share, but this is a very low margin business that’s also exposed to pressure on pricing (from supermarket buyers) and higher input costs. While returns on capital have been adequate in the past, debt levels have risen sharply over the last year. There are some attractive growth opportunities on the horizon – with Walmart in Canada, for example – but this isn’t a stock I’d want to buy on a high rating. After today’s indifferent update, I’m inclined to take a neutral view. | |

Naked Wines (LON:WINE) (£62m) | Trading in line with FY26 guidance. Adj EBITDA and cash generation ahead of FY25. | ||

Aoti (LON:AOTI) (£59m) | TWO2 is now active on NHS Supply Chain Framework, allowing AOTI to accelerate marketing. | ||

Videndum (LON:VID) (£49m) | VID will focus on core professional markets. Proceeds undisclosed, will be used for debt repayment. | ||

Churchill China (LON:CHH) (£47m) | Rev -5%. Adj. PBT -35% (£3.1m). Net cash £5.6m. “Performing well within… a difficult trading environment.” | AMBER (Roland holds) These results appear to be in line with July’s reduced expectations. They show Churchill continuing to invest in areas such as automation in order to control its cost base and improve its competitive positioning. However, in a market where demand (and pricing power) are depressed, the company has not been able to fully compensate for higher labour and energy costs. Churchill remains a market leader and the combination of net cash and a share price below tangible net asset value suggest to me that the stock is probably attractively priced. However, there doesn’t seem to be any sign that external conditions are improving, so I feel there might be more compelling opportunities available today. For this reason, I’m staying neutral. | |

Ondo InsurTech (LON:ONDO) (£43m) | Two-year agreement with Admiral to continue offering Leakbot to home insurance customers. | ||

Gelion (LON:GELN) (£36m) | Major technical milestone in advancing Gelion’s next-gen battery technologies. | ||

Maintel Holdings (LON:MAI) (£26m) | Delays in pipeline closures and loss of a key deal. New revenue guidance £95m, adj. EBITDA £7m. | BLACK (StockReport: previous revenue expectation was £101m). | |

James Cropper (LON:CRPR) (£23m) | Confident in full year performance. Recent 18-week period is slightly ahead of exps in both divisions. | ||

Cirata (LON:CRTA) (£23m) | Outlook unchanged. H1 revenue $4.8m (+41%), adj. EBITDA loss $4m (H1 last year: loss $9.6m). |

Graham's Section

Watches of Switzerland (LON:WOSG)

Up 7% to 342p (£814m) - AGM Trading Update - Graham - AMBER/GREEN

We have an “in line” update from this watch retailer.

As a Burberry shareholder for many years (to my detriment, it could be argued!), I like to keep an eye on the luxury watch market, as it sits adjacent to luxury clothing..

WOSG reports stability in the UK, and consistently strong trading, particularly in the US.

We are delighted with the success of the flagship Rolex Boutique on Old Bond Street, London, which is exceeding our expectations. The response from clients has been excellent and traffic levels and conversion rates are very good. The Rolex Certified Pre-Owned salon on the lower ground floor is fast becoming the destination for Rolex aficionados.

Roberto Coin Inc, the acquired distributor of Roberto Coin products in the United States, is also “performing strongly”.

We plan to grow and develop the Roberto Coin brand and have launched an impactful advertising campaign featuring Dakota Johnson as global brand ambassador. Elevation and brand expansion within our own showrooms is proving very successful. We continue to develop and refine the offering and there are opportunities to extend this to our retail partners.

Showroom projects: detail provided on various refurbishments, openings and relocations in the UK and the US - there seems to be very active management of the store portfolio.

Outlook: performing is “encouraging and in line” with guidance given in July.

That guidance was for revenue growth of 6-10% (at constant currencies), and for flat to minus 100bps adjusted EBIT margin.

They are not expecting “any material impact” from US tariffs in H1 FY2026, which is the period from May to October 2025 (year-end is April 2026), which they say is due to increased inventories. So presumably the impact will be felt once these inventories have run out and need to be replenished?

Graham’s view

The luxury watch market appears to have fully stabilised, providing pleasant and predictable trading conditions for WOSG.

While other retailers have reported on a weak consumer - has the cost of living crisis really ended? - the luxury end of the market seems to be holding up well.

WOSG benefits from earning nearly half of its revenue in the US. US luxury consumer spending has been under some pressure in recent years, but it’s an enormous market in which to expand.

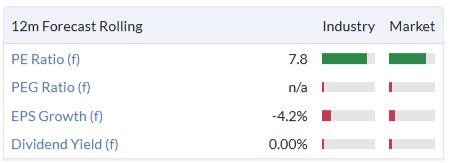

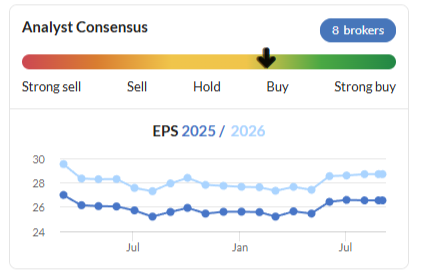

On valuation grounds, I think I’ll allow my stance on this to tick back up to AMBER/GREEN today. I’m hovering between AMBER and AMBER/GREEN, but the share price today is has dipped a little compared to when I reviewed it last. This earnings multiple is modest - this is based on last night’s close:

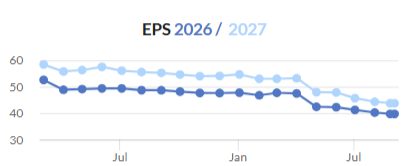

Bear in mind that EPS estimates have been under some pressure:

This is not a particularly high-quality company in terms of having clean accounts (it doesn’t), brand ownership or quality metrics. It’s a capital-intensive, economically exposed retailer of 3rd-party brands. But I’m willing to stick my neck out and say it may offer a little value here! Although given my track record, I’ll probably switch back to AMBER again next time!

Cairn Homes (LON:CRN)

Down 3% to 181p (£1.14bn) - Results for the Six Months Ended 30 June 2025 - Graham - AMBER/GREEN

Cairn Homes plc (“Cairn”, the “Company” or the “Group”) (Euronext Dublin: C5H / LSE: CRN) today announces its interim results for the six months ended 30 June 2025.

This Irish housebuilder is dual-listed on both Euronext and the LSE.

Its share price has increased only marginally since I last reviewed it in January, when I took a moderately positive stance.

The company is benefiting from a housing shortage in Ireland that is most acute when it comes to rentals, but is also very significant in the buying market. Cairn primarily caters to first-time buyers:

Our strategy of significant investment in construction activities and operational scaling is clearly delivering, with exceptionally strong sales in H1 2025, notably from First Time Buyers (FTBs), driving €625 million growth in our closed and forward order book to 4,092 new homes (€1.54 billion net sales value). This underpins our expected H2 delivery and another year of growth in revenue and profitability, supporting our upgraded FY25 guidance and new FY26 guidance provided today.

H1 revenues falls from €366m to €274m - this is pinned on “transaction timing and mix” compared to H1 last year, and there’s an H2 weighting.

With such a large revenue fall, it’s not surprising that measures of profitability are all down in H1 compared to H1 last year.

But what matters more is the full-year outlook, and that is upgraded as follows:

Revenue of c.€945 million (previously revenue growth in excess of 10%);

Operating profit of c.€160 – c.€165 million (previously c.€160 million); and

ROE of c.15.5%...

I note that the revenue outlook has in fact slightly deteriorated, as the new revenue guidance represents growth of 10%, not “in excess of 10%”.

But the operating profit figure looks set to exceed the previous target, and the forecast ROE is excellent.

Let’s turn to the new FY26 guidance:

Revenue of c.€1.02 – c.€1.05 billion;

Operating profit of c.€175 – c.€180 million; and

ROE of c.16.0%...

It’s still very early, but these will be great results if they are achieved.

CEO comment:

the business is performing strongly, our strategy is working, and we have doubled down on investment in our construction activities. As this unwinds, it will lead to a strong second half which is why we are raising our guidance today for 2025 and also introducing new guidance as a result of increased housing output for 2026.

In keeping build cost inflation under control, maintaining average sales price consistency, and placing a strong emphasis on energy efficiency, a well-designed Cairn home represents an attractive proposition for first time buyers. In parallel, the delivery of cost-effective new homes for our State partners, in mainly scaled apartment developments, plays a critical role in addressing the national housing challenge…

Net debt: €307m has almost doubled year-on-year. I note that inventories are up year-on-year by €170m, driven by higher construction work-in-progress. So hopefully this will unwind as H2 progresses and as work is completed and exchanged.

Buybacks: the company has completed a €45m share buyback programme. I’m not convinced that Cairn shares are obviously cheap right now, so I’d be nervous if the company were to launch another large buyback.

Graham’s view

Not enough companies use ROE as a key metric for management for their investors. Cairn uses it prominently and is showing a knack for delivering it.

More broadly, Cairn continues to look very well-positioned to me. It devotes a large section in today’s report to “supportive policy developments”, outlining various beneficial government policies.

There is heavy government involvement in the Irish housing market, which can be a double-edged sword for a housebuilder, but as things stand the policies are working for Cairn. Cairn provides social and affordable housing for government agencies, and of course it is also reliant on the planning system. On both fronts, it’s a beneficiary of current government priorities.

Its forward order book has ballooned from 2,361 new homes (end of Dec 2024) with a value of €910m to a current level of 4,092 homes (Sep 2025) with a value of €1.54 billion.

For me, this puts to bed any immediate concerns about the debt load and the inventory position.

However, I think I’ll keep my existing AMBER/GREEN stance, rather than giving it an upgrade today.

Balance sheet tangible equity is €760m (£660m) and the shares are trading at a very rich premium to this level.

That has to count for something: I usually wait for housebuilders to trade at a discount before getting too excited about them.

On that basis I can’t be overly positive on this stock, no matter how well it’s trading right now. Experience says that the really juicy opportunities in housebuilders are when they trade much cheaper than this!

Roland's Section

Churchill China (LON:CHH)

Up 0.5% to 432p (£48m) - Roland - Interim Results - AMBER

(At the time of publication, Roland has a long position in CHH.)

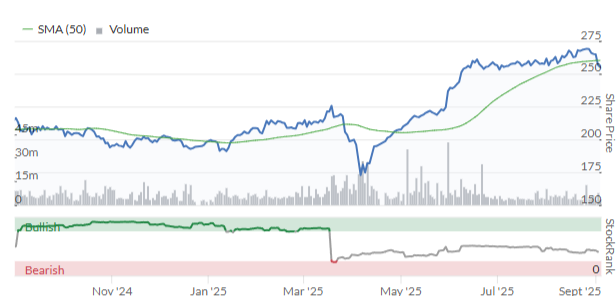

Shareholders in this leading manufacturer of tableware for the hospitality trade have had a torrid time over the last year:

A dramatic slowdown in the hospitality sector has hit sales and profits, culminating in a big profit warning in July (which Mark covered here):

Today’s results give us a fresh opportunity to appraise progress and review Churchill’s accounts, which have historically been strong and conservative. The immediate good news is that there doesn’t seem to be any further change to guidance today – as far as I can see, these results are in line with July’s downgraded expectations.

Whilst the performance in the period has been below that initially expected, as highlighted in our July trading update, the Board believes that the Company is performing well within what is currently a difficult trading environment.

H1 results summary: turning to the accounts, the general theme is that Churchill is maintaining its market share in a contracting market where cost inflation is also an issue.

The financial headlines highlight a nasty dose of reverse operating leverage, with profits falling much faster than sales as lower volumes are spread across a relatively high fixed cost base:

Revenue -5.2% to £38.5m

Pre-tax profit down 35.4% to £3.1m

Adj EPS -35.9% to 21.0p

Interim dividend -39.1% to 7.0p per share

Net cash -28% to £5.6m

The dividend cut had already been flagged up by broker forecasts on Stockopedia, but it’s still a blow for income-seeking shareholders like myself. It’s a prudent decision though – it makes no sense for the company to run down its cash reserves paying an uncovered dividend.

Today’s management commentary confirms that the company was not able to increase prices sufficiently to offset lower volumes and higher employment costs, which equate to £1.5m on an annualised basis.

However, the company is continue to invest in automation and modernisation in an effort to reduce its production costs and maintain competitive positioning:

Our focus internally is on reducing our cost base without damaging core skills and on employing capital spend to bring down cost of production and enable new product launches at competitive price points.

Another cost headwind is energy. Churchill has switched much of its energy usage from gas to electricity to reduce its carbon footprint but is not seeing any reduction in costs due to the high cost of UK electricity, relative to gas.

The company would like to add more solar generation to its sites but says that grid bottlenecks mean that no new solar will be able to be added to the grid until 2032, “hampering our transition to a lower carbon environment”.

Management are engaging with the UK government and other relevant organisations to press for change on these issues – as I imagine many other UK industrial firms are doing. But there’s no doubt the twin issues of grid connection delays and high electricity prices are a competitive headwind for UK businesses at the moment.

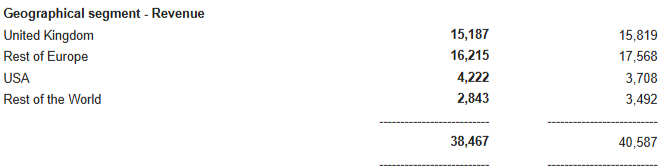

Geographic results: UK investors tend to associate Churchill with the UK market – and the company is a major supplier to this sector, including large chains such as Wetherspoon. However, European exports are equally important:

Management say trading in Germany was particularly weak in H1, as the company is more heavily exposed to independent operators in this market than in the UK. Similar dynamics applied in the Rest of the World markets, where new restaurant openings were down and transaction values reduced.

However, sales in the US actually rose by 1.6% despite some turbulence caused by tariffs. Churchill has increased its stockholding in the US to improve its service proposition, noting that it has been “taking advantage of service problems” suffered by competitors. Perhaps this could be a medium-term growth opportunity.

Balance sheet: the balance sheet remains relatively strong in my view, with net cash of £5.6m and scope for further cash generation from planned inventory reductions in H2.

My sums suggest a net tangible asset value of just under £52m or 470p per share, excluding the pension surplus.

The shares are currently trading around 10% below this level, suggesting Churchill could be an attractive value opportunity for investors willing to bet on a medium-term recovery.

Outlook

Management believes Churchill is “maintaining share in key territories” and is outperforming the market in the UK and USA.

The company can’t control external conditions, but is using Churchill’s strong cash position to invest capital in automation and other improvements that should help to reduce ongoing operating costs. This could support an attractive recovery in profits when (if?) volumes do start to recover.

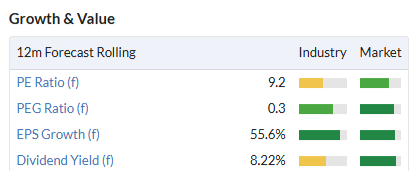

I don’t have access to any broker notes today, but my feeling from these results is that full year expectations are likely to remain unchanged. Stockopedia’s consensus figures show earnings of 40.9p per share in both 2025 and 2026, putting Churchill on a P/E of around 10. The reduced dividend is expected to provide a 4.9% yield.

This valuation looks pretty undemanding to me, if we assume this year will be a low point for earnings:

Roland’s view

When labour costs are low, companies tend to invest less in automation. When labour costs rise, investing in automation makes more sense. In my view, Churchill is doing all the right things. The business is able to make these decisions because it’s historically maintained a debt free balance sheet with significant net cash.

The cash pile is now somewhat reduced, but remains c.10% of the group’s market cap.

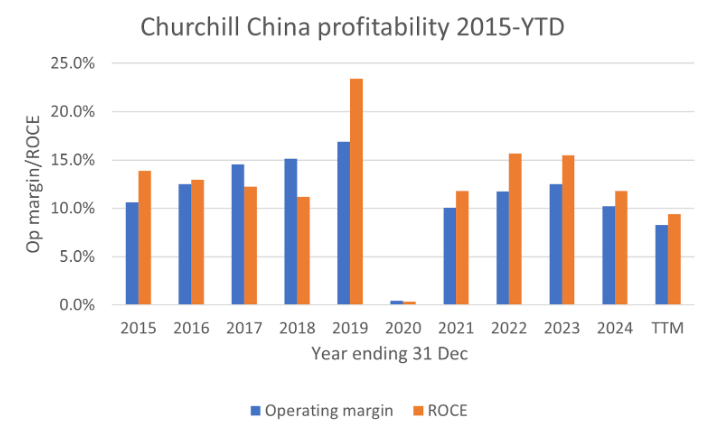

My main concern is that profitability will continue to erode due to difficult market conditions and persistent cost pressures in the UK. However, I don’t think we’re there yet. Today’s interims show profitability at the bottom end of the group’s historic range, but I don’t think the numbers are too alarming yet:

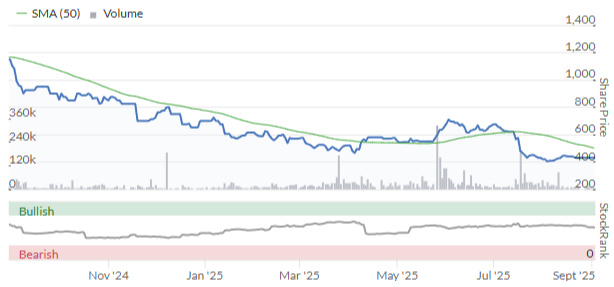

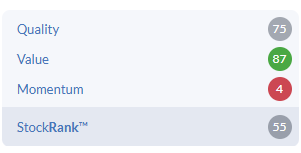

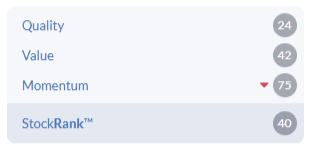

I think Churchill shares look reasonably priced at current levels and could offer significant value in the event that market conditions improve. However the stock’s low MomentumRank is perhaps a warning that the current situation could persist for some time yet:

I’m going to maintain our neutral view today. AMBER

M&G (LON:MNG)

Down 1% to 254p (£6.13bn) - Roland - Interim Results - AMBER

While a private investor might reasonably claim to understand the fine detail of Churchill China’s accounts and business model (see above), very few are likely to be able to make this claim about life insurer and asset manager M&G.

This doesn’t necessarily make this FTSE 100 financial a bad investment, but it is something I always keep in mind when reviewing (and investing in) such stocks. I don’t own M&G shares, but this is a company I’ve followed with interest in recent years, due to its extremely high dividend yield and seeming ability to maintain this payout.

Shareholders who bought M&G at the start of this year, when the dividend yield hit 10%, have subsequently enjoyed a c.25% share price gain that’s reduced the yield to around 8%:

Interestingly, Stockopedia’s algorithms are now flagging the stock as a Momentum Trap:

In my experience, this is a relatively unusual styling for a large, mature financial stock. But it seems that it could be apt today, as the Reuters newswire is reporting that M&G’s half-year profits have come in slightly below consensus expectations today.

Let’s take a look.

Half-year results summary: the main headline numbers reported by the company today present a mixed view of performance, relative to the same period last year:

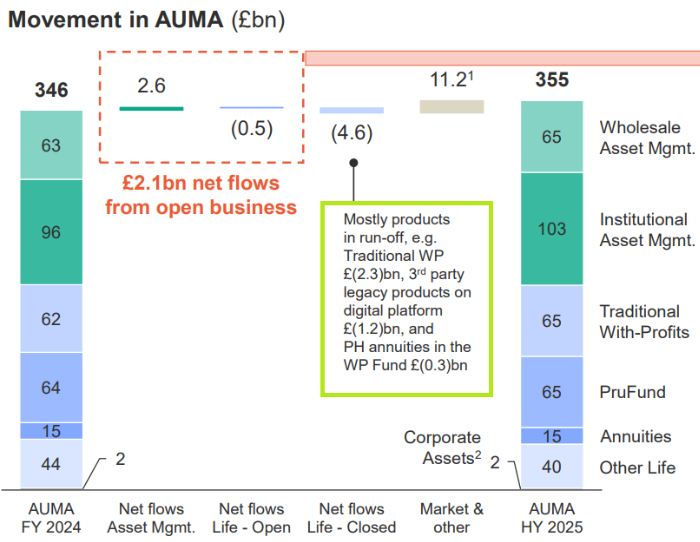

Net flows from open business of £2.1bn (H1 24: £1.1bn outflow)

Assets under Management or Administration (AUMA) up 3% to £354.6bn

Adjusted operating profit +1% to £378m (vs market consensus of £398m)

Operating capital generation -16% to £408m

Solvency II Coverage Ratio 230% (Dec. 24 223%)

Interim dividend +1.5% to 6.7p per share

Operating capital generation can broadly be seen as equivalent to surplus cash generation. The H1 result equates to just under 17p per share, providing comfortable support for the interim dividend.

The increase in Solvency II coverage (a regulatory measure) reflects the net increase in surplus capital during the half year, despite the payment of last year’s final dividend during the period. I don’t see any concerns here, as this result is well above regulatory requirements.

Segmental results: it’s easier to understand M&G if we divide the business into its two parts, Life and Asset Management. While asset management is a key focus for growth, the Life business remains the main source of profits and surplus cash for dividends:

Asset Mgt op profit: £129m (H1 24: £128m)

Life op profit: £340m (H1 24: £344m)

Central costs: £94m (H1 24: £94m)

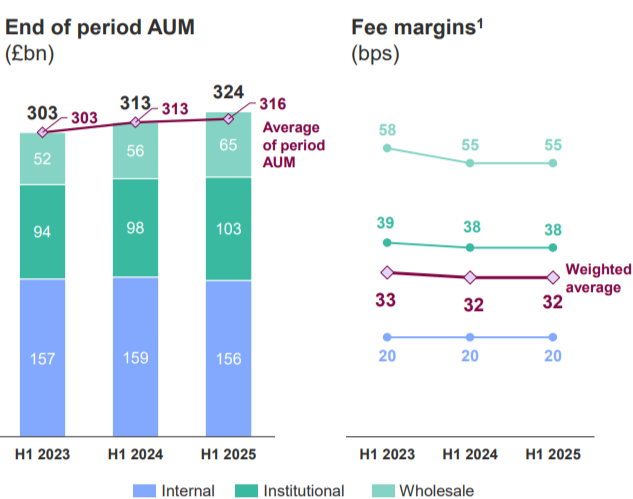

Asset Management: performance was positive during the period, with net inflows of £2.6bn from external clients. This helped to support a 2% year-on-year reduction in the cost:income ratio to 75% and continued the company’s expansion of its external asset management business, reducing dependence on internal assets managed for the slower-growing Life businesses.

M&G also announced a partnership with Japanese life insurer Dai-ichi in May that’s expected to generate at least $6bn of net new flows over the next five years.

Like its UK-listed peers Schroders and Legal & General (I hold), M&G is keen to expand its presence in private markets. It’s not hard to see why – fee margins are roughly double those achieved on public market assets:

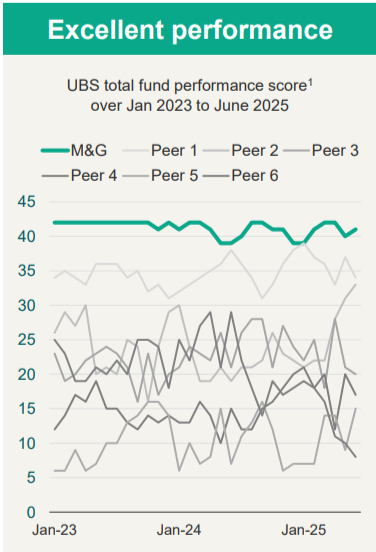

Whether this superior profitability will be sustainable and justified by investment performance as more capital crowds into private markets remains to be seen. In fairness, though, industry metrics published by M&G seem to suggest that its overall fund performance is better than that of many (unnamed) peers:

Life: this business has two parts, the PruFunds business (multi-asset funds for retirement solutions) and the Traditional With-Profits business, which is largely in run off.

CEO Andrea Rossi has been focused on expanding Asset Management to help offset an expected long-term decline in profits from Life, as the With-Profits funds run off.

For some context, Life was responsible for £5.1bn of outflows during H1, including £4.6bn of outflows from legacy products in run off. Seen in this light, the £2.6bn net inflow from asset management looks less impressive – it was only a strong market performance that allowed the company to report an increase in overall AUMA:

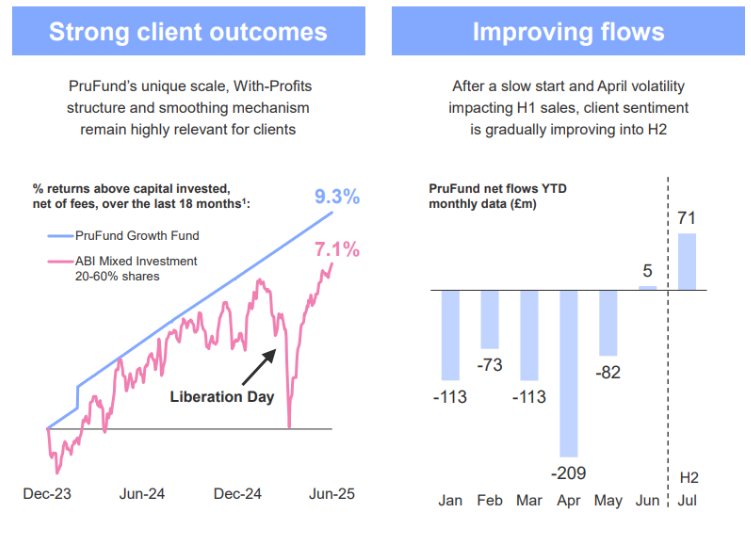

However, there may be some signs that the PruFunds business is returning to growth, after a period of sustained outflows. The company says these products provided attractive, smooth returns in H1, demonstrating their value to clients during a volatile period.

While flows were negative for H1 as a whole, they did turn positive in June:

Outlook: there’s no explicit financial guidance today, but the tone of the commentary suggests to me that full year expectations are largely unchanged:

The progress achieved in the first six months of the year underpins our continued confidence in the delivery of our strategic priorities and financial targets, as we remain focused on delivering great customer, client and shareholder outcomes.

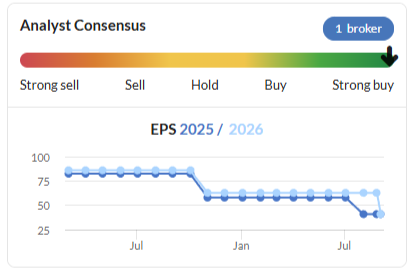

Stockopedia consensus forecasts have been fairly stable over the last 18 months and suggest further progress in 2026:

These estimates put the stock on a rolling forward P/E of 9, with an 8.2% yield:

Roland’s view

I see M&G primarily as an income investment. This means that the key questions for me are whether the dividend is sustainable, and whether the current yield is attractive.

As far as I understand them, today’s results look fine and do not flag up any underlying problems in the business.

The company has committed to a progressive dividend payout and seems likely to target growth of c.2% per year. I reckon this should remain affordable thanks to the strong cash flows from the Life business, at least in the medium term.

On a longer view, there’s potentially a risk that growth in Asset Management and PruFunds will not be sufficient to replace declining cash generation from legacy With-Profits funds. That’s something I’d watch.

In terms of valuation, an 8% dividend yield plus 2% dividend growth implies an expected return of c.10% per year. That seems about right to me, especially given that we can get a supposedly risk-free 5%+ from long-dated UK government bonds at the moment.

I’m tempted to maintain Graham’s AMBER/GREEN view from March, but I’m aware that the shares have risen sharply since then and that the StockRank has fallen.

I also have to consider the complexity and inherent black-box tendencies of this business.

On balance, I think M&G’s valuation is nearing fair value for the time being, so I’m going to move our view down by one notch to AMBER.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.