Good morning! Here we go - let's see what reporting season has in store for us today.

8.15: Agenda complete!

2.30pm: wrapping it up there, hopefully I'll see some of you at the Stocko webinar at 5pm!

Companies Reporting

| Name (Mkt Cap) | RNS | Summary | Our view (Author) |

|---|---|---|---|

3i (LON:III) (£37.7bn) | Both portfolios performing resiliently. Action LFL sales +6.5%, total sales +18% year-on-year. | ||

Halma (LON:HLMA) (£12.7bn) | Organic growth guidance raised from upper single to low double digits. Margin guidance unch. | ||

Babcock International (LON:BAB) (£6.18bn) | Full-year exps unchanged. Macro is “supportive”. Strong growth in Nuclear & Aviation. | ||

IG group (LON:IGG) (£3.69bn) | FY26 still expected in line (rev £1,110.7m, PBT £497.9m). Q1 net trading revenue -2%. | GREEN (Graham holds) Staying bullish on this stock which I view as a high-quality financial brand offering both quality and defensive characteristics. Recent trading (for Q1 FY26) is softer than Q1 and Q4 FY25 - the ups and downs of volatility and trading activity are part and parcel of the business. A protracted slump in activity can't be ruled out, but I still like this as a long-term investment. | |

Petershill Partners (LON:PHLL) (£2.5bn) | H1 distributable earnings $152m (+9%). Proposed return of capital of 415 cents (35% premium). | PINK | |

Vistry (LON:VTY) (£2.05bn) | Part of govt’s £2bn injection. Vestry’s total funding for affordable homes is now £252m. | ||

Mitchells & Butlers (LON:MAB) (£1.58bn) | FY25 outlook in line. Next year: cost inflation £130m. Confident to outperform the sector. | ||

Future (LON:FUTR) (£678m) | On track for market exps (revenue £743.2m, adj. op profit £205.6m). Revenue “broadly as expected”. | ||

Cohort (LON:CHRT) (£649m) | SP -5% FY26 growth exps unchanged. H1 revenue slightly behind last year. Optimistic about new orders. | AMBER (Graham) [no section below] Some slight disappointment is evident in the share price reaction to this AGM statement - this share has achieved an increasingly punchy rating over the past two years, bringing with it the weight of increased expectations. Today's statement also notes an H2 weighting "as in previous years" and a big swing in cash is forecast: from net debt of £30m at the end of H1 to net funds of up to £15m at year-end. The market is expecting FY2026 to be stronger than FY2025, and a weaker H1 year-on-year (in revenue terms at least) suggests to me that meeting full-year forecasts could be a challenge. As this is a "High Flyer" where the momentum rank has weakened, I'm inclined to pre-emptively switch to neutral here, while acknowledging that long-term holders might see no reason to head for the exits at this stage. | |

DFS Furniture (LON:DFS) (£351m) | FY25 LfL orders +10.2%. Adj. PBT £30.2m. FY26 to be in line: “comfortable with consensus”. Consensus profit before tax and brand amortisation is £39.4m. “The market demand drivers for the upholstery sector remain delicately balanced. Consumer confidence remains below the long term average and inflation remains elevated but housing transactions have been recovering, consumer savings levels are relatively high and interest rates look set to fall.” | AMBER/RED (Graham) [no section below] A nice reassuring update today - it’s a nice use of language when a company says it is “comfortable” with earnings forecasts. But we’ve been RED on this stock (see Mark in March) due to balance sheet concerns. Today’s report shows the company having bank leverage of 1.4x, a big improvement on last year’s 2.5x although still above the company’s target range 0.5-1.0x. The net debt figure is £107m (not including leases). They provide a measured take on the economy, offering both positive and negative drivers for their business. As leverage is no longer stressed, I’m happy to upgrade this to AMBER/RED. The profit figure is very clean. Do bear in mind that lease liabilities are enormous (their present value is £350m+) - that’s standard operating procedure for retailers but it’s one reason why I prefer when they have low net debt or ideally net cash. | |

Intuitive Investments (LON:IIG) (£230m) | Hui and leading baijiu brand to cooperate to introduce Sports Lottery Hongbao promotions. | ||

Tristel (LON:TSTL) (£174m) | New ultrasound probe decontamination product. First detergent of its kind with colour technology. | ||

Amicorp FS (UK) (LON:AMIF) (£149m) | Rev +7.8%. PBT $2.5m (H1 2024: $1.6m). Expecting steady growth in H2. “Well positioned.” | ||

Mercia Asset Management (LON:MERC) (£142m) | Positive start to current financial year. “Well-positioned.” Cash £35m. £3m buyback ongoing. | GREEN (Graham) [no section below] This regional investor has seen a modest (10%) share price increase since I reviewed it in April. Unlike mainstream fund managers, it has been able to raise funds and AUM , and the valuation is at a discount to NAV. Today's reassuring update doesn't give too much away, but I'm encouraged to see it buying back its shares at this level, even if the £3m programme will only reduce the share count by a few percentage points. I'm not put off the by high P/E multiple: the bull thesis here is as much to do with the balance sheet as it is to do with a new and growing fund management proposition. Third-party funds under management were last reported at £1.8 billion, up 10% organically in FY March 2025. | |

Seeing Machines (LON:SEE) (£120m) | Mandatory DMS in all new EU vehicles in nine months. Current trading in line with expectations. | ||

InvestAcc (LON:INAC) (£106m) | Organic rev growth 20.3% (to £6m). EBITDA +33% (£2.8m). Strategic priorities unchanged. | ||

Journeo (LON:JNEO) (£84.2m) | H1 Revenue -4% to £24.5m, Adj. PBT flat at £2.8m, EPS -15% to 13.0p, order intake +25% to £30m. Cash £18.0m (31 Dec: £14.3m), (£9.0m after acquisition post period end). Confident in meeting full year market expectations. | AMBER/GREEN (Mark) | |

Braemar (LON:BMS) (£78.8m) | H1 revenue expected to be -16% to £63.8m, with u/l profit -31% to c.£5.5m. Net debt £5.6m (31 Jan: £2.5m) after £2m buyback. Strong forward order book means expectations for the full year remain unchanged, with H2-weighting. | ||

Hansard Global (LON:HSD) (£68.9m) | New business sales +6% to £82.4m, AUA -2% to £1.13bn, u/l profit -40% to £5.1m, Final Dividend held at 2.65p. | ||

Marks Electrical (LON:MRK) (£65.1m) | Lower revenue trend of Q1 due to the pivot back to the premium segment continued into Q2. Cautious consumer impacting avg. order value, resulting in higher delivery costs. Other costs increasing due to employee costs and new ERP system. Material impact on full year profit guidance. Now expect adjusted EBITDA for FY26 to be approximately £1.7 million. Interim dividend cancelled. | BLACK (AMBER/RED) (Mark) [no section below] | |

Logistics Development (LON:LDG) (£60.4m) | 30 June unaudited estimated NAV per share was 26.7p, an increase of 8.67% compared 31 March. | ||

Centaur Media (LON:CAU) (£59.8m) | Marketing Week, Festival of Marketing and Creative Review, sold to Haymarket Media Group for an enterprise value of £3.9m. Proforma net cash £71m. | AMBER/GREEN (Mark) [no section below] | |

STV (LON:STVG) (£53.5m) | H1 Revenue flat at £90.0m, Adj. operating profit -37% to £6.7m, Adj EPS -54% to 7.1p. No change to full year 2025 outlook as guided in July. | ||

Petra Diamonds (LON:PDL) (£36.9m) | Extension of lock-up agreement to 29th Sep. | ||

Cobra Resources (LON:COBR) (£36m) | H1 LBT £0.45m (24H1:LBT £0.38m), Net cash £0.84m (24H1: £0.49m. | ||

Chariot (LON:CHAR) (£32m) | LBT $4.7m (24H1: $8.2m), Net Cash $5.6m (24H1: $3.6m), after June fundraise for $7.1m gross. | ||

Arecor Therapeutics (LON:AREC) (£27.4m) | H1 Revenue flat at £2.0m, LBT £2.5m (24H1: LBT £4.6m), Cash £1.9m (24H1: £2.5m). Post period-end, will receive a royalty monetisation £5.2m, extending the cash runway into 1H 2027. | ||

First Tin (LON:1SN) (£27.1m) | Participating in an EU-funded XTRACT consortium project to demonstrate that indium can be extracted directly from the ore body using bioleaching. | ||

Poolbeg Pharma (LON:POLB) (£25.4m) | Signed an agreement with a specialist blood cancer trials organisation, Accelerating Clinical Trials Limited, to conduct the upcoming POLB 001 Phase 2a trial. Secured the supply of an approved bispecific antibody drug for the trial at no cost. | ||

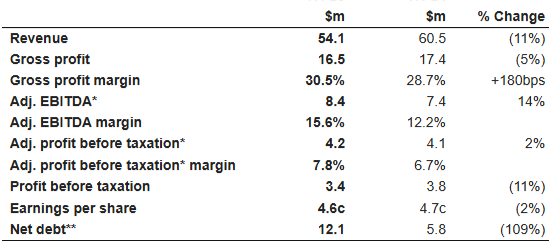

CT Automotive (LON:CTA) (£24.7m) | H1 Revenue -11% to $54.1m, Adj EBITDA +14% to $8.4m, Adj. PBT +2% to $4.2m. Net debt $12.1m (24H1: $5.8m). Outlook: FY25 Revenues expected to be slightly softer due to timing. Strong margin growth in H1 means on track for FY25 profit expectations. | AMBER/GREEN (Mark - I hold) | |

Blencowe Resources (LON:BRES) (£21.9m) | Higher-grade tonnes added to Camp Lode resource. High grades continue in infill zones at Northern Syncline. | ||

Portmeirion (LON:PMP) (£18.9m) | H1 Revenue +1% to £37.1m, h/l LBT £2.9m (24H1: LBT £2.6m), h/l LPS 21.0p (24H1: LPS 19.2p), Net debt £14.8m (24H1: £13.4m). Challenges ahead due to uncertain economic environment and with a significant Q4 weighting. | AMBER/RED (Mark) [no section below] | |

ARC Minerals (LON:ARCM) (£16.7m) | H1 LBT continuing operations £2.3m (24H1: LBT £0.5m), Net cash £0.7m (24H1: £1.6m). | ||

Mothercare (LON:MTC) (£16.1m) | Franchise sales -18% to £230.6m, Adj. EBITDA -49% to £3.5m, Adj. LAT £2.5m (FY24: PAT £3.5m), Net borrowings £3.7m (FY24: £14.7m). Outlook: 1st 23wks franchised sales -25% to £80.7m. Will result in materially reduced profitability. | ||

Genincode (LON:GENI) (£12.3m) | Collaboration with a London NHS Foundation Trust, becoming the first hospital trust in the UK to provide the Risk of Ovarian Cancer Algorithm (ROCA) surveillance test service as part of its Familial Cancer Clinic. | ||

Zoo Digital (LON:ZOO) (£11.6m) | Expects 26H1 revenue $22, in line with 25H2. 26H1 EBITDA is in line with management expectations. Looking to normalise working capital after active management of creditors in FY25 | AMBER/RED (Mark) [no section below] |

Graham's Section

IG group (LON:IGG)

Down 1% to £10.50 (£3.65bn) - First Quarter Trading Update - Graham - GREEN

(At the time of publication, Graham has a long position in IGG.)

The main headline here is that we have an in line outlook statement for FY26.

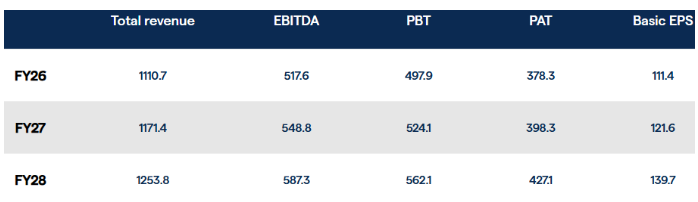

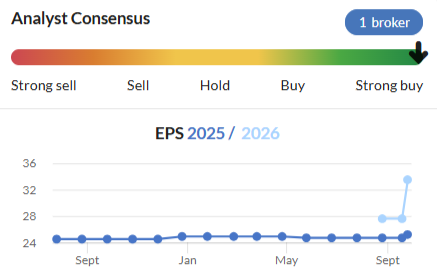

IG’s investor website lays out the consensus estimates for the next three years:

At £10.50, the shares are therefore trading on a current-year P/E multiple of 9.4x.

Today’s update demonstrates the simple truth that the trading platforms cannot maintain their performance, when their clients are choosing to trade less:

Net trading revenue of £231.9 million declined 4% on the prior year and 8% on the prior quarter, as strong OTC customer income retention was offset by lower trading activity in less supportive market conditions.

Just after I left for my recent holiday, we published a more in-depth look at IG, where I highlighted two primary risks for IG. One of these - which I described as inevitable - was lower volatility leading to lower trading activity (the other was regulation).

Q1 FY26 is the period from June to August 2025, i.e. after the Trump tariff situation calmed down. So I don’t think it should come as a huge shock to find that quarter-on-quarter trading revenue is down 7%. Within OTC derivatives (which includes spread betting), quarter-on-quarter revenue is down 11%.

Tastytrade, the US options trading platform for retail investors, has seen very good 16% revenue growth year-on-year (5% quarter-on-quarter) to $54.7m. That’s about a fifth of IG’s total revenue for the quarter.

Freetrade: IG’s official customer base, and its assets under administration, have both exploded thanks to the recent acquisition of Freetrade. But Freetrade’s customers are very much low-value compared to the existing base - they trade rarely, generating very little commission when they do. IG's task now is to activate a meaningful proportion of these customers. Thanks to the acquisition, their customer base has grown from 545,900 (Q1 FY25) to 1.315 million (Q1 FY26).

They say that performance at Freetrade has been “excellent” in Q1, and that is borne out by a 32% increase in net trading revenue at the division to £6.5m (comparing recent revenue to revenue last year, prior to the acquisition). But it’s still just a tiny percentage of IG’s total revenue - about 2%.

As covered by Roland recently, IG has also made a small (£87m) acquisition to accelerate its crypto offering in the Asia Pacific region. Freetrade cost £160m.

Buyback: £16.8m has been spent out of a planned buyback of £125m. Looks like they’ve spent an average of £11.20 per share - higher than the current share price. I don’t have any major objection to a buyback at the current level.

Graham’s view

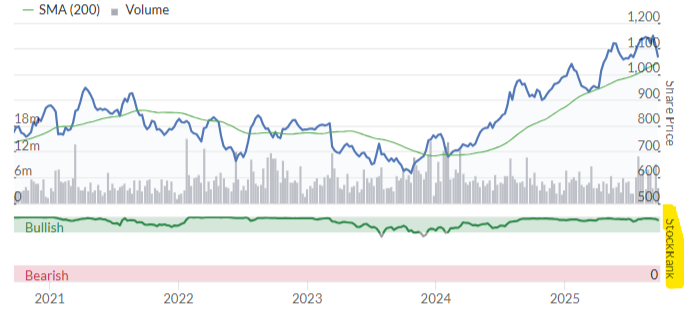

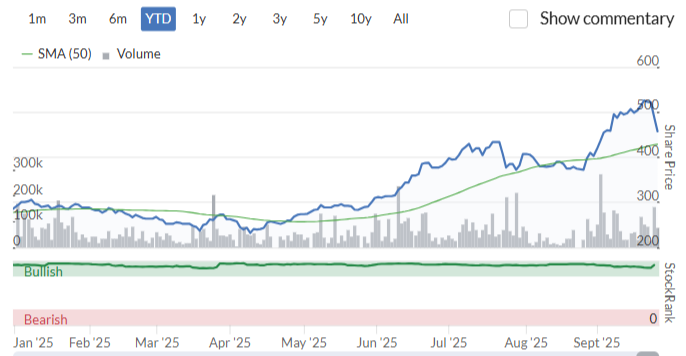

I risk becoming a broken record on this one, but I’m in good company as the StockRank is also consistently high here:

The current StockRank is 94, making it a "Super Stock" (albeit one with declining momentum):

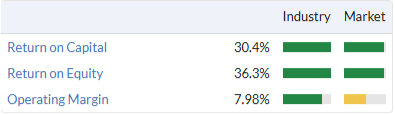

Note that in addition to posting very high quality metrics, it also has value/defensive characteristics:

That’s on top of the fundamentally defensive nature of a business where activity tends to pick up when investors are panicking.

I’ve said pretty much everything I want to say about IG - please see my recent article for more background. It’s currently my third largest holding, representing 12% of my portfolio. Of course nobody can rule out a protracted slump in trading activity levels, but that cycle is part and parcel of this type of business. At the current valuation, I still like the risk/reward on offer here.

Mark's Section

Journeo (LON:JNEO)

Down 7% at 456p - Half-year Report - Mark - AMBER/GREEN

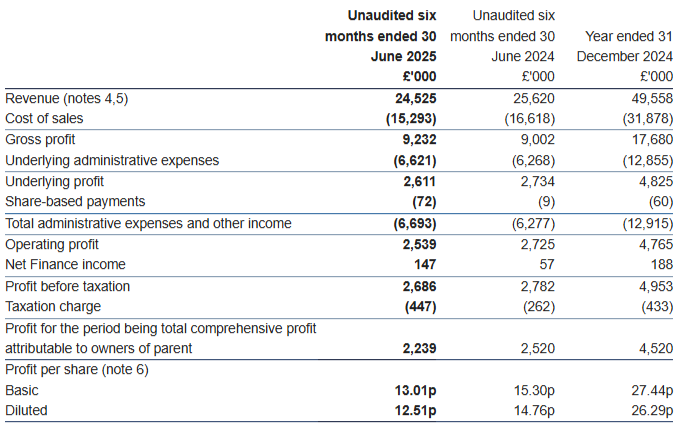

I’ve got to say I’m a little underwhelmed by these results. Revenue is down 4%, adjusted PBT flat and EPS drops by 15% to 13.0p. Partly, this is to do with my expectations. When the 6-month chart shows the share price almost doubling:

…and when the forward P/E is 19, I really would be expecting results to show increasing EPS. However, this decline was partly due to timing effects. They say:

H1 2024 included £3.4m of revenue from the first phase of the New York City contract, which successfully completed during 2024. H1 2025 included no revenue from this contract.

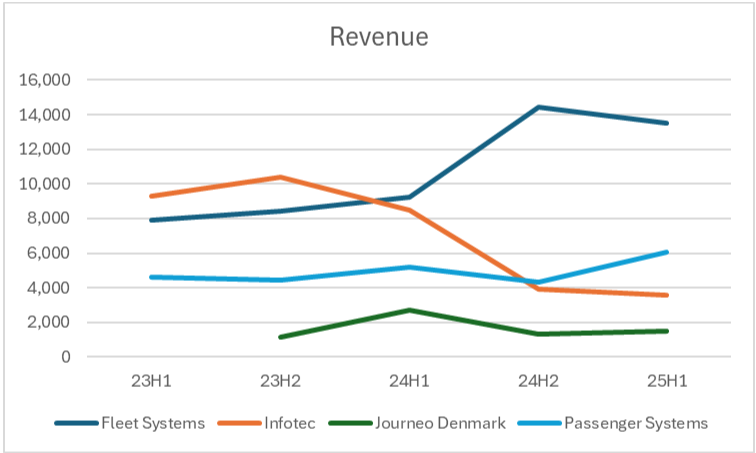

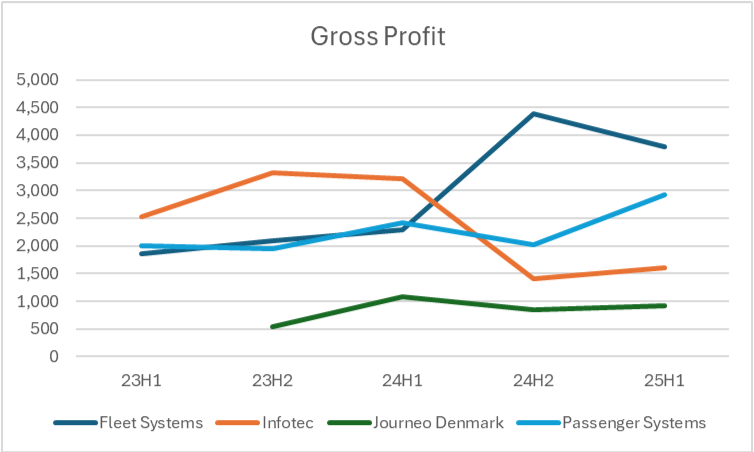

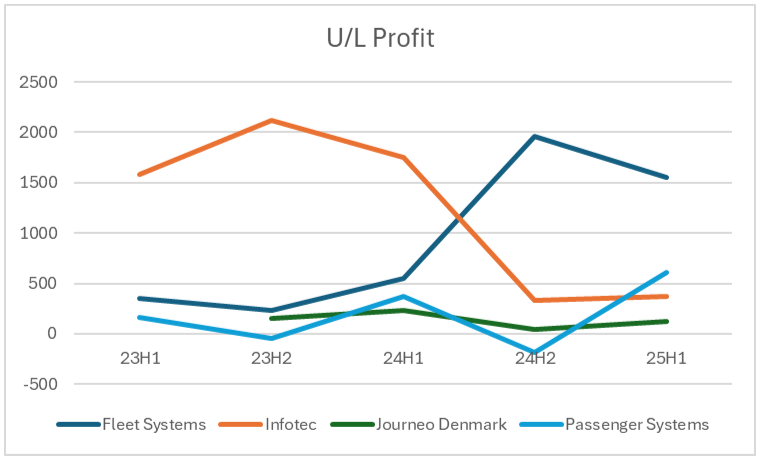

Journeo provide good segmental reporting and the impact of this can be seen in the trends for Infotec:

The decline in infotech revenues has been particularly offset by revenue growth in Fleet Systems (although this is down slightly on H2 last year) and Passenger Systems which is starting to make a meaningful contribution.

US orders have started to come in for Infotec, where they say:

The relationship with Outfront Media Group ("OFM") and the New York City Metropolitan Transportation Authority ("MTA") continues to grow in strength, with two significant orders placed in H1 2025, totalling $5.2m, that will serve North America's largest transportation network.

However, even if they delivered all of that in H2, it won’t bring Infotec revenue back to the levels of when they were delivering the initial New York City subway contract.

Part of the reason that I had been expecting better results is that there have been a string of contract announcements over the past six months. Of course, it is unreasonable to expect the company to recognise revenue on these immediately. Today they guide in line for the full year, which their broker Cavendish have as £56m revenue and 26.5p EPS. This leaves £31.5m revenue to deliver in H2 and 13.5p EPS. This is aided by an expected £4m from their recent acquisition of Crime and Fire Defence Systems.

This growth is supported by positive trends in orders:

· Sales order intake increased by 25% to £30m (H1 2024: £24m) providing increased visibility into H2 2025 and beyond

· Sales opportunity pipeline increased to £80 million (H1 2024: £60m)

But it is worth noting that they don’t give an overall orderbook. I do wonder if investors have reacted to the recent announced orders expecting the company to beat expectations. Whereas the reality is that they will need to keep delivering similar orders in order to to hit expectations. While I don’t think there is a risk of a miss, contract announcements seem a regular occurrence here, I think the idea that contract announcements will lead to upgrades may be false in this case.

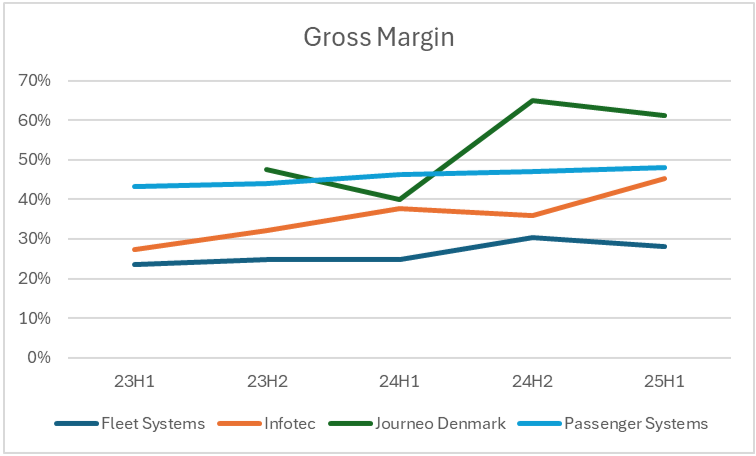

It would be nice to also have some breakdown of order metrics by BU, as the gross margins across the business vary significantly For example, an additional order at Journeo Denmark would likely have at least double the impact on profits with its 60%+ gross margin, compared to one in Fleet Systems at sub-30%:

Looking at the detailed income statement, it is a pleasant surprise to see a company that makes very few adjustments:

A SBP charge has increased, and I think that investors should at least account for that by using the diluted EPS. The drop in EPS is due to an increased tax charge. I can’t see any discussion around this in these results. Since tax rates are still well below UK corporation tax rates at 16.6% for 25H1 versus 9.4% in 24H1, I am assuming this is due to lower R&D tax credits or use of historical tax losses. Cavendish are assuming 17.9% tax rate for FY25 and 194% in FY26, meaning this will remain a small drag on EPS growth rates

Looking further ahead, Cavendish had 6% organic revenue growth and 11% organic EPS growth for FY26, they increased this by 31% at the revenue level and 20% at the EPS level due to the recent acquisition. This makes the forward P/E still look reasonable, especially if we adjust for the remaining £9m of cash. However, in my opinion, investors should only pay up for organic growth, and here a 14x P/E compared to an 11% growth rate.

Mark’s view

Overall, this leaves the short-term finely balanced. On one hand, the weak H1 results are largely due to timing issues and I don’t see why they won’t achieve FY forecasts. This means that the shares look reasonably priced on around 14x forward earnings, especially when you consider that there are few adjustments and there is still around £9m of net cash. Cash continues to build, although partly because they choose to retain capital, rather than pay a dividend.

On the other hand the shares have risen strongly and have almost doubled in the last six months on an EPS trend that has been entirely flat until they announced a recent acquisition:

It seems that many investors expected that the stream of recent contract wins means that the management are being conservative in their forecasts and that they will beat expectations. Today’s results, with declining H1 EPS, means that possibility looks more remote. I do think that this is the type of business that needs to generate continuous order wins and without a detailed breakdown of the order book, it is hard to judge if these announcements will be leading to incremental revenue.

These recent share price trends have propelled this to High Flyer status:

The Momentum Rank has risen even this month, so isn’t an obvious sell signal. However, looking to the future, this is likely to fall as these results and today’s share price fall are assimilated into the ranks. Our research into High Flyers suggests that it is often better to have a hair trigger when it comes to a declining Momentum Rank, and sell at the first sign of trouble. Once short-term price momentum starts to turn down in a stock with high recent gains, it can be a long way down before value characteristics start to provide support. Today’s chart suggests that point may well be today:

In reality, it probably depends on investors' timeframes. Those who bought this as cheap quality stock and then rode the momentum up to the current share price level will view today as an opportune moment to take significant profits and move on to better short-term opportunities. Those who bought for the possibility of a multi-year growth in orders and believe in the company’s strategy to reach £100m revenue and double-digit operating profit in the medium term, will be happy to hold through any short term volatility. I tend to use the latter for forming my view, hence, I am happy to keep this as AMBER/GREEN on long-term fundamentals.

CT Automotive (LON:CTA)

Up 4% at 35p - Half-year Report - Mark (I hold) - AMBER/GREEN

This is another company where revenue is suffering from global macro headwinds:

However, improved margins see it manage to increase profitability, at least on an adjusted basis. These are those adjustments:

During the period, the Group incurred non-recurring expenses totalling approximately $0.9m, comprising:

· $0.3m (H1 24: $0.3m) relating to hyperinflation adjustments in Türkiye,

· $0.2m associated with a one-off tooling amortization,

· $0.4m of severance costs in Türkiye following union pay increases agreed upon earlier in H1 25.

While severance costs are likely to be one off, I’m less convinced by the hyperinflation adjustment. Surely the bad point of hyperinflation is that it is sticky and once embedded in an economy is recurring? Indeed, it appears to have occurred in 24H1 as well, although it is reversed for the full year! The key point here is it is non-cash, as it gets added back in in the cash flow statement, which makes its exclusion perhaps more reasonable.

Net debt increased, but this appears to be wholly due to one customer:

Trade receivables increased by $9.6m to $35.3m, primarily due to a delayed payment from one customer, which was received in July and an increase in tooling prepayments for future programs, which corresponds to an increase in deferred revenue.

Net debt increased from $6.2m at year end to $12.1m. The key contributor was a delay in payment from a key customer which had a net impact of approximately $4m. Net debt normalised in July 2025 at $7.4m following receipt of the one-off delayed payment.

This seems reasonable, and their customers will be large global Auto OEMs or Tier 1s who should be a good credit risk. However, I will certainly be asking about credit insurance in their results presentation on Monday, as delays of this kind, or at worst, non-payment, can stretch the finances of smaller suppliers. Net debt will increase slightly in the short-term to $9-10m at year end, but declining significantly in FY26. Even at peak net debt will be around 0.5xEBITDA so this seems perfectly reasonable.

Outlook:

This is pretty much the same as the HY results, the impact of weak revenue being made up by stronger margins:

· Solid H1 25 performance with strong margin growth despite industry-wide tariff-related volatility, placing the Company on track to hit FY 25 market expectations for profitability.

· Revenues for FY 25 are now expected to be slightly softer reflecting timing adjustments only-no change to long-term production volumes, with demand ramping up in Q1 26.

I can’t see any updated broker coverage, so my assumption is that the current 12.8c EPS remains valid. This means that there is a fair bit to do in H2 to hit this figure, although there was a H2 weighting in FY25. Longer-term they seem to be in a good place with increased quoting activity:

Revenues for FY 25 are now expected to be slightly softer reflecting timing adjustments only-no change to long-term production volumes, with demand ramping up in Q1 26.

Significant expansion of the global sales team, now covering every major automotive region, driving RFQ book to all-time highs.

Overall, the Group's margin progression and a record RFQ pipeline provide a solid platform for a stronger second half with the contractual pipeline giving the Board confidence over current FY 26 market expectations and beyond.

Very few companies are expressing confidence in FY26 at this point, which underlines that this is a business with good revenue visibility, barring some questions over exact timings.

Valuation:

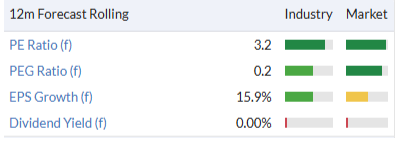

All of this puts them on a very low forward P/E for a company forecast to grow EPS by 16%:

Perhaps more importantly given their industry, they are growing with some really strong returns on capital:

The automotive industry is cheaply-rated, and single digit P/E’s are not out of place for major players. However, these ratings are usually accompanied by large amounts of debt, lacklustre growth and single-digit returns on capital. CT has modest debt, is winning business that should lead to strong revenue growth going forward and good returns on capital. Being a smaller player in a highly competitive industry is not without risk, but has the advantage of having the runway that bigger companies will miss.

Mark’s view

Having worked in the Automotive industry in the past, with some interiors experience, I am naturally averse to investing in it. It tends to be low-margin, cyclical and facing structural headwinds, plus a volume game. However, CT appear to have done very well as a smaller niche player using technical innovation to drive increased business. They are effectively a tier 2 business but one of the signs of their success is that they often get directed by the OEMs, who recognise their capabilities.

The long-term chart shows an optimistic float price, but by April this year the shares had lost over 80% of their value, largely on the assumption that tariffs were going to seriously impact their business:

Instead of tariffs damaging the business it turns out that customers were moving business to them as their Mexico facility actually faced lower tariffs than elsewhere. Despite generally weak automotive markets and my aversion to the sector, I held my nose and bought in because the valuation just seemed to mismatch the company’s profitability and ability to grow. The shares recovered somewhat but have sold off more recently as global economic concerns have again come to the fore.

At the end of the day, if the company can continue to win business, grow sales and EPS, with a ROCE well above their cost of capital, significant shareholder value will be created. While the market will never give an automotive supplier a high rating, a consistent mid single-digit P/E rating on EPS growing double digits will still generate very nice returns from here. I am happy to keep our previous broadly positive view of AMBER/GREEN, and hang on for what could be quite the ride.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.