Good morning! Let's see what's in store for us today.

We've run out of time now - thanks for dropping in.

Companies Reporting

| Name (Mkt Cap) | RNS | Summary | Our view |

|---|---|---|---|

AstraZeneca (LON:AZN) (£197bn) | Baxdrostat demonstrated a statistically significant and highly clinically meaningful reduction in 24-hour ambulatory systolic blood pressure compared with placebo. | ||

Shell (LON:SHEL) (£159bn) | Q2 adjusted earnings -$0.5 billion. Q3 outlook: -$0.5 billion to -$0.3 billion. | ||

Rio Tinto (LON:RIO) (£81bn) | Rio Tinto, Mitsui and Nippon Steel will invest $733 million (Rio Tinto’s share $389 million), extending mining activity for years to come. | ||

Imperial Brands (LON:IMB) (£24bn) | On track to deliver full year guidance, announces further £1.45bn share buyback.

“High-single-digit adjusted EPS growth” expected in line with forecasts (Stocko consensus 312p) | AMBER (Roland - I hold) [no section below] Today’s full-year update covers the year to 30 September and looks reassuring to me. Recently-departed CEO Stefan Bomhard appears to have followed the tobacco industry playbook successfully last year, with price rises “more than offsetting” the expected decline in volumes. In addition, Imperial says it gained market share in the US, Germany and Australia – three of its top five markets. The company continues to prioritise shareholder returns through dividends and buybacks, with an increased buyback of £1.45bn (FY25: £1.25bn) planned for the year ahead. I can’t fault the logic of this strategy in this context, but after a strong run, I don’t think the valuation is as compelling as it was even six months ago. Earnings forecasts have trended slightly lower over the last 18 months, too. While I currently hold Imperial Brands for income in SIF and my personal portfolio, I’m not inclined to buy more at current levels. I’m also a little wary about the recent change of CEO. I’m going to leave Megan’s previous neutral view unchanged today and await the full-year results to revisit the investment case here. | |

Londonmetric Property (LON:LMP) (£4.3bn) | Founder/investment director retires. £7.4bn portfolio has continued to perform strongly. Q1 dividend +7% to 3.05p. | ||

B&M European Value Retail SA (LON:BME) (£2.6bn) | H1 revenue +4%. B&M UK LfL sales +0.1%. Expects full-year adj. EBITDA of £510-560m (FY25: £620m). | BLACK (AMBER) (Roland) New CEO Tjeerd Jegen has completed his initial review of the business and makes some damning comments about operational failings, including prioritising “the look of a full shelf over actual stock availability”. However Jegen is an experienced retailer and I don’t see why these issues can’t be fixed. In the short term, the company must show it can return to positive LFL sales in the core UK business after a flat H1 LFL result. Today’s profit warning equates to c.12% cut to EBITDA guidance at the midpoint, with the actual outcome still highly dependent on H2 trading, especially the peak festive period. I am going to take a chance and maintain a neutral view today, as I estimate B&M now trades on c.8x earnings and could still enjoy many of the advantages that made it so successful (and cash generative) previously. While this situation isn’t without risk, I share the StockRanks view on this stock as a possible Contrarian opportunity. | |

| Greatland Resources (LON:GGP) (£2.5bn) | September 2025 Quarter Production Update | Quarterly production of 80,890 oz. AISC to be around the lower end of FY26 guidance. FY26 guidance remains 260,000 - 310,000 oz at AISC $2,400 - $2,800/oz. | |

Telecom Plus (LON:TEP) (£1.46bn) | Customer numbers up c. 19% in H1. “We remain confident in our previous guidance for both customer growth and adjusted pre-tax profits for the full year.” | GREEN (Roland) [no section below] I covered this utility reseller in more depth in June, when I reviewed the group’s FY25 results. The shares have drifted lower since then but today’s trading update seems fine to me and highlights continued strong customer growth. This business has consistently generated double-digit returns on equity and enjoys strong cash generation. I see it as an attractive alternative to traditional utility stocks and believe the shares look quite reasonably priced, on a forecast P/E of 14 with a well-supported 5.6% dividend yield. | |

Great Portland Estates (LON:GPE) (£1.33bn) | Whistleblower review finds no unlawful conduct & Q2 business update | “We reiterate our rental growth guidance… with portfolio-wide growth of 4.0% to 7.0%.”NEDs investigated whistleblower allegations; concluded historical bonuses were correctly calculated. | |

CVS (LON:CVSG) (£897m) | Continuing PBT -7.4% to £32.6m on an increase in finance expense and depreciation. New financial year off to a strong start. | ||

Oxford BioMedica (LON:OXB) (£766m) | Pays $4.5m for FDA-approved, commercial-scale viral vector manufacturing facility. Supports existing financial guidance. | ||

Cohort (LON:CHRT) (£643m) | 4yr contract for airborne countermeasures and related services for UK prime contractor & international end customer. | AMBER (Graham) [no section below] I’ve been neutral on this defence stock - e.g. see here - with a large anticipated H2 weighting creating a risk of a profit warning, in my view, which could be dangerous as the stock is quite highly rated. Today’s announcement only covers about 2% of annual revenues and I don’t think it makes any difference to forecasts, but as the CEO says it does help to “enhance the visibility” of revenues. I maintain my previous concerns and neutral stance. | |

PRS Reit (LON:PRSR) (£615m) | Rev +14%, adj EPRA EPS +19% to 4.4p, in line. NAVps +7% to 143p. Portfolio completed at 5,478 homes. | PINK (under offer) | |

Funding Circle Holdings (LON:FCH) (£373m) | Defaulted loans previously sold to Azzurro Associates have been settled by guarantors. | ||

Victorian Plumbing (LON:VIC) (£256m) | Rev +5%, in line with exps, adj PBT -5.6% to c.£21.8m, at top end of exps. Market share gains. | ||

Liontrust Asset Management (LON:LIO) (£209m) | Q3 net outflows of £1.2bn, AuMA £22.0bn at 30/9. Seeing signs of increased demand, but progress “slower than we had hoped”. | AMBER/GREEN (Graham) Everything has its price and I think Liontrust shares are cheap enough. The bear arguments are easy to make, but at a P/E of 7x and with over £100 of AUM for every £1 invested in the shares at this level, I think the bear arguments are priced in. | |

M&C Saatchi (LON:SAA) (£172m) | WSG is a specialist advisory and media rights consultancy. Deal funded with cash, no value provided. | ||

Gooch & Housego (LON:GHH) (£164m) | FY25 results to be broadly in line with exps. Y/E order book £142.3m (FY24: £104.5m). | ||

Orosur Mining (LON:OMI) (£77m) | Results from recent holes “consistent with expectations”. Targeting MRE by end of year. | ||

Angling Direct (LON:ANG) (£39m) | Rev +17% w/ UK LFL +14.2%. Adj PBT +34.7% to £3.0m. FY26 to be ahead of exps: revenue >£102m and adj EBITDA >£4.35m. (prev. £3.8m) | AMBER/GREEN (Roland) Today’s results show decent levels of growth and improving profitability. While this remains a low-margin retailer that needs to carry a lot of stock, the numbers seem to be moving in the right direction and today’s c.16% upgrade to FY26 EBITDA guidance is a respectable result. The share price looks up with events to me on a near-term view, especially given management’s cautious view of the outlook for FY27. But I think this business has the potential to become larger over time, especially if its European operations can scale up profitably. I’ve left our moderately positive view unchanged today. | |

Inspiration Healthcare (LON:IHC) (£20m) | Rev +41%, adj EBITDA £1.3m (H1 25: £3.2m loss). Strong order backlog. Confident of meeting FY26 expectations. | ||

Tan Delta Systems (LON:TAND) (£15m) | Order for oil analysis sensors to be used on commercial shipping. Small order but will be valuable as a user reference to aid sales. | ||

Cordel (LON:CRDL) (£14m) | Extended this Australian contract to 31 Aug 26. Includes LiDAR, Video and Clearance Assessments. |

Graham's Section

Liontrust Asset Management (LON:LIO)

Down 2% to 320.16p (£204m) - Trading statement - Graham - AMBER/GREEN

Liontrust Asset Management Plc, the specialist independent fund management group, today issues its trading update for the three months ended 30 September 2025.

We should be hearing from all the fund managers soon, with their quarterly updates.

Here’s the latest news from Liontrust.

Key points:

Net outflows £1.2 billion (previous quarter outflow was £1.1 billion, and the outflow in the corresponding quarter last year was also £1.1 billion)

Assets under management down 2.7% over the quarter to £22 billion

CEO comment:

"Over the past few quarters, we have written about our belief that the market environment going forward will be more favourable for active managers. We are now seeing clients seeking to diversify away from the US and towards active management, and this is shown in an acceleration of interest in Liontrust strategies.

It scarcely needs to be said, but the acceleration of interest is not yet translating to an acceleration of net flows.

He continues with an explanation:

We are having success among institutional investors and wealth managers, notably internationally. This includes new mandates as yet unfunded and being added to clients' buy lists. This progress has been slower than as we had hoped, however, leading to £1.2 billion of net outflows in the last quarter, which were spread across wealth manager, adviser and retail clients in the UK.

Unfunded mandates are a concrete achievement which should lead to imminent inflows, but being added to buy lists is a less tangible achievement - Liontrust funds will be just one set of options among many alternatives.

This comment from the CEO on active management is relevant for everyone, so I’ll quote it in full - I think fund management companies are very useful for macro comments like this:

The Magnificent 7 are still heavily influencing market performance; their earnings and valuations dominate the S&P, exposing the market to volatility. But, at the same time, we have seen increased dispersion among these mega cap stocks and currency movements have been a positive tailwind this year for investors in non-US markets such as the DAX, Nikkei and FTSE 100.

Geographical diversification, therefore, is becoming more important, as is stock selection outside the very biggest companies in the world. We expect to see greater dispersion of returns generally going forward highlighting the value that active management brings to client portfolios.

In other words: buying the Mega-caps/Mag 7 is no longer proving to be guaranteed easy money for investors.

He says Liontrust are “confident about the outlook” for their business - impressive, given that it has been years since the company reported net inflows!

Fund performance: looking through their table, I count that 39 funds are in the 3rd or 4th quartile over 1 year, while only 14 funds are in the 1st or 2nd quartile.

Granted that 1 year should not be a very significant timeframe for investors, but I think in practice that retail investors (who account for the overwhelming majority of Liontrust’s AUM) do care about 1-year performance, and it’s uninspiring to see so many funds in the bottom half of performers.

Graham’s view

The very latest AUM figure is £22.2 billion. At a £204m market cap, that’s £109 of AUM for every £1 invested in Liontrust shares, up from £92 in July. I was AMBER/GREEN in July.

At this even cheaper valuation, I’m inclined to leave AMBER/GREEN unchanged, once again on the basis of sheer cheapness against AUM.

The bear argument is easy to make: net outflows are continuing uninterrupted, despite management’s confidence, and the addition to “buy lists” may or may not make a meaningful difference to this trend. Fund performance, meanwhile, remains uninspiring - and that’s compared to other funds, not even the more difficult benchmark which is given by stock market indexes!

I’ve also been a little critical of management’s M&A strategy here - remember the GAM fiasco?

But everything has its price and I do like the risk:reward here.

Stockopedia considers this a Contrarian stock - accurate.

Roland's Section

B&M European Value Retail SA (LON:BME)

Down 8% at 236p (£2.4bn) - FY26 H1 Trading and Operational Update - Roland - BLACK (AMBER)

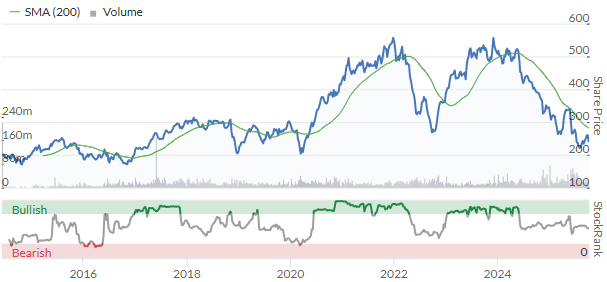

Unfortunately today’s update from value retailer B&M is a(nother) profit warning. This business was a FTSE 100 member not so long ago, but its share price chart now suggests it has now become either a contrarian bargain or a structurally-challenged business:

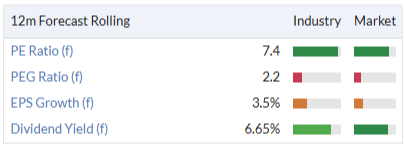

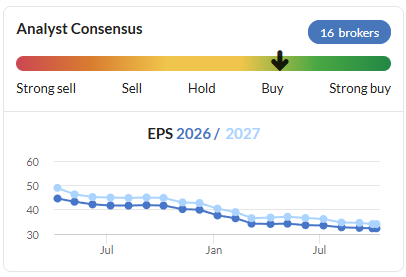

Earnings expectations have also collapsed, falling by more than a quarter over the last year, prior to today’s downgrade:

Clearly we need to be a little wary here – and it’s possible I haven’t been cautious enough. In my last review of B&M in June I concluded the FY26 outlook was probably in line and upgraded my view to AMBER.

With hindsight, I should probably have waited until new CEO Tjeerd Jegen – who only started work in June – had had more time to review the situation.

Let’s take a look at the main points from today’s update.

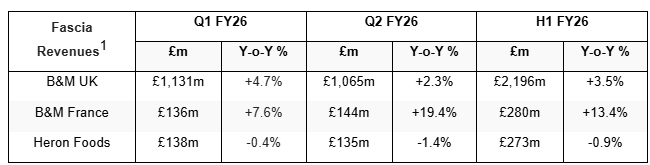

H1 trading: headline revenue figures for H1 show revenue up 4% to £2,749m, with growth in the core UK business and faster-growing French unit:

However, this growth was almost entirely driven by new store openings, which totalled 15 net new stores across the group (+9 UK, +5 France and +1 Heron).

Like-for-like sales in the core B&M UK business rose by just 0.1% in H1, as weaker FMCG sales offset growth in General Merchandise. This appears to reflect poor operational execution as much as weaker demand, according to Mr Jegen’s comments today.

Back to basics: Jegen is a highly-experienced retail exec and today’s update suggests to me that he is pinning the blame for B&M’s problems on a decline in operational execution in recent years. My reading of this is that the problems may have begun to emerge following the retirement of longtime CEO and co-owner Simon Arora in 2022.

In today’s update Jegen highlights four key actions being taken to improve the performance of B&M UK following his initial review:

Cutting prices on key FMCG items: while B&M pricing is said to have remained competitive at a basket level, some individual lines had become less competitive. Prices have been cut on 35% of “key value items”, lowering the average KVI price by 1.8%. Price rises elsewhere are expected to limit the impact on overall margins.

Rebooting ‘Managers Specials’ promotions: these are said to have become “static and duplicative”. To bring “excitement and great value back to our front-of-store bays”, store managers will be allowed significantly more discretion to choose the best lines to offer to meet local demand.

Refocusing our ranges: a material increase in SKUs (product lines) in recent years has “introduced complexity for our customers and our operations”. Plans are underway to reduce line count and accelerate the clearance of discontinued ranges.

Restorying product on-shelf availability: this made me sit up - “we found that our emphasis on store presentation prioritised the look of a full shelf over actual stock availability of products customers want”. As a result, availability of best-selling FMCG items fell to 86%, well below best practice standards of 98%. B&M is now planning to improve replenishment processes and simplify its ranges to ensure “our most popular products are always available”.

Retail is detail, as the saying goes, and the list above suggests to me that operational management has weakened since Simon Arora stepped down.

Historically, B&M’s core customer proposition was built around keen pricing, good availability of well-chosen ranges and fresh offers. The business seems to have been underperforming in all of these areas. I think it’s remarkable for a major retailer to admit that it has been pretending to have full shelves while disregarding actual stock availability.

I don’t mean to reflect unkindly on Jegen’s predecessor as CEO, Alex Russo, who took over from Simon Arora. But Mr Russo was promoted from CFO and perhaps didn’t have the operational experience needed for this role.

Outlook & revised FY26 profit guidance: we already know that gross margins were impacted at the start of the year by price deflation on some products. These changes are now starting to annualise, but some one-off cost headwinds remain:

Annual Extended Producer Responsibility tax costs of £14m

Higher wage costs of £30m in H1, before mitigation

H1 adjusted EBITDA is expected to be £198m, 27% below the £274m reported for the same period last year.

Leverage is expected to be above the group’s target range of 1.0x-1.5x at the half-year mark.

FY26 adjusted EBITDA is now expected to be £510m to £560m, versus a previously-reported consensus range of £569m to £646m. Taking the midpoint of each range, this represents a cut of c.12%.

The eventual outcome is expected to be highly dependent on B&M UK sales trends:

Given the visibility available on operating costs and trading margins, we expect B&M UK's LFL sales will be the principal driver of the outcome within this range, for which we assume a second-half UK LFL percentage growth rate of between low-single-digit negative and low-single-digit positive levels.

I don’t have access to updated EPS forecasts today, but I would guesstimate that B&M is probably now trading on a FY26E P/E of about eight after today’s share price fall.

There’s no mention of the dividend in today’s update, but my guess is that a more conservative payout may be likely, until leverage comes under control and LFL sales return to growth.

Roland’s view

After falling by nearly 20% at the open, B&M’s share price has recovered somewhat and is currently down by around 8% on last night’s close.

I can see why investors may be choosing to buy into this morning’s weakness. While I think today’s update gives a fairly damning view on the group’s operational management in recent years, my previous view that these issues are all fixable is unchanged.

Based on his comments so far, I am inclined to think Jegen could be a good fit for this role and has a decent chance of delivering a recovery.

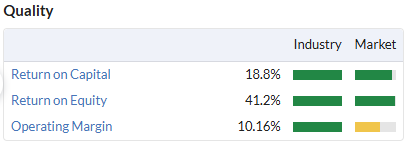

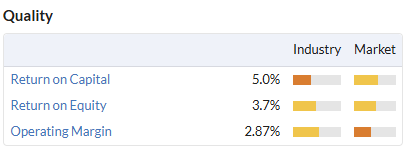

The business doesn’t look too expensive to me, either. While profitability will clearly be lower this year, historically B&M’s quality metrics have been much stronger than those of the big supermarket groups:

If these advantages can be restored in the future, I think profits could recover strongly over time.

I can’t take a positive view on a company that has just issued a profit warning. But I am going to take a risk today and maintain my AMBER view on B&M. Stockopedia’s algorithms rated this as a Contrarian stock prior to today. I believe that remains a fair view of the situation.

Angling Direct (LON:ANG)

Up 5% at 56p (£41m) - Half Year Results - Roland - AMBER/GREEN

I’m happy to see that I upgraded our view on this fishing equipment retailer to AMBER/GREEN following its H1 trading update in August, noting “the potential for an upgrade if H2 trading is strong”.

The shares have continued to rise since then, extending a strong trajectory over the last year:

Today we have the actual results for H1 FY26 – and an upgrade to full-year FY26 guidance.

Sales growth has been consistently strong at this business, but (real) profitability has been very poor in the post-pandemic period, so I’m interested to see if this is improving.

H1 results summary

Here are the main headline figures from today’s results:

Revenue up 17% to £53.6m

Gross profit up 21.3% to £20.4m

Gross margin: 38.0% (H1 25: 36.7%)

Adjusted pre-tax profit up 34.7% to £3.0m

Reported EPS up 29.9% to 2.91p

Net cash down 26.5% to £12.5m

The company says retail sales in its UK business rose by 15.4% to £30.5m in H1, with like-for-like store sales up by a creditable 9.8%. Two new stores have been opened so far this year, taking the total to 55 UK stores.

Online sales rose by 21.2% to £20.6m, with customer numbers up by 17.9%.

Online growth is said to have been helped by the company’s loyalty scheme, MyAD – which now has almost half a million members – and by social media activity, with AD’s YouTube channel attracting 3.9m viewers during the half year.

In the nascent European business, trading improved but operations remained loss-making, with an adjusted EBITDA loss of £0.2m.

Profitability: operating costs rose by 20% during the period as cost and wage inflation added pressure to margins.

Even so, the increase in sales appears to have provided some operating leverage benefit, with an increase in operating margin to 6.1% (H1 25: 5.8%).

I estimate this translates into a return on capital employed of 5.9%, on a trailing 12-month basis.

These figures are an improvement on last year’s result, but ROCE is still likely to be below the group’s cost of capital:

Looking at the accounts, my feeling is that the main reason for the low returns is the level of stock Angling Direct carries and the slow stock turnover it achieves.

Today’s report shows £26.2m of inventory at the end of July. That’s 20% above the levels reported at both H1 25 and FY25 – which seems to rule out seasonal shifts. Inventory seems to have risen faster than sales over the last year, which doesn’t seem ideal.

In addition, stock seems to move quite slowly. I estimate it’s taken around 140 days to turnover stock over the last 12 months. That’s consistent with the stock turnover ratio of 2.7x shown on the stock report, which implies a figure of 135 days.

If the business needs to hold stock for c.3.5 months and then only achieves a mid-single-digit margin, overall returns are likely to be constrained.

Fortunately, the negative working capital model of the business – where customers pay up front and Angling Direct benefits from supplier credit – does help to offset this somewhat, improving cash generation.

While net cash reduced during the period, the £12.5m net cash position still represents over 30% of the market cap, a margin of safety and some optionality on future plans.

Outlook & revised profit guidance

As a result of the strong trading over the first half and now that we have traded the final two months of the key trading season, the Board believes the Company will exceed current market expectations

Helpfully, the company provides specific guidance on this today for the FY26 year that ends in January:

Revenue: “not less than £102.0m” (prev. £97.7m)

Adjusted EBITDA: “not less than £4.35m” (prev. £3.75m)

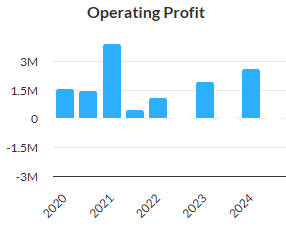

This is a 16% increase on previous consensus EBITDA expectations, but it still translates to a somewhat sad EBITDA margin of 4.3%, below the H1 operating (EBIT) margin of 6.1%. This is a useful reminder that profits are heavily weighted to the first half of the year in this business. H2 has been loss-making or breakeven in recent years:

Perhaps a greater concern is the lack of guidance for the following year, with the company citing headwinds relating to “inflation pressures and consumer spending capacity”:

This ongoing wider uncertainty means that the Board will continue to adopt a prudent approach to planning for the next financial year.

Roland’s view

Angling Direct’s share price has only moved by around 5% today, despite the 16% increase to FY26 EBITDA guidance. I can see a couple of potential reasons for this.

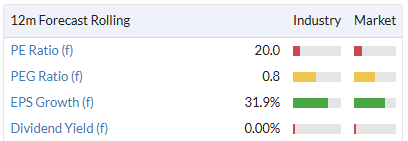

First of all, the shares were already trading on a rolling P/E of 20 ahead of today. Not cheap, for a low-margin retailer:

Secondly, the cautious tone on guidance for FY27 doesn’t necessarily suggest to me that the pace of growth and improvements in profitability seen this year will be maintained.

On the other hand, the company does seem to be trading well, gaining share and improving its financial performance. If the company can make its European operations work profitably, there could be scope for considerable further growth in years to come.

While I can see some risks, this is the second upgrade in six months. I think it's appropriate to maintain my AMBER/GREEN view on Angling Direct today.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.