Good morning and welcome to today's report!

The agenda is now complete.

Today's report is now complete.

Spreadsheet accompanying this report: link (last updated to: 5th September).

Companies Reporting

| Name (Mkt Cap) | RNS | Summary | Our view |

|---|---|---|---|

Lloyds Banking (LON:LLOY) (£49bn) | Notes recent FCA announcement on industry-wide redress scheme and is assessing its impact on current provision for this issue. | ||

Anglo American (LON:AAL) (£33bn) | Supportive of Teck’s revised approach to QB. Says outcome of Teck’s review is “broadly consistent” with own due diligence. | ||

Bunzl (LON:BNZL) (£8.0bn) | Bolt-on acquisitions in Ireland and Spain in September. Holding webinar today on acquisition strategy. | ||

Unite (LON:UTG) (£3.5bn) | 95.2% beds sold for 25/26 (24/25: 97.5%). 4% rental growth YTD. FY25 EPS exps unch: 47.5 - 48.25p | ||

Greencore (LON:GNC) (£1.0bn) | FY25 rev +8%, food to go esp. strong. Now exp FY25 adj op profit c.£125m, ahead of exps (prev. £118-121m). | PINK (AMBER/GREEN) (Roland) | |

Serica Energy (LON:SQZ) (£832m) | SP -10% Production suspended from 30/9 due to flare problems. Expected to restart shortly at “severely limited” rates until the root cause of the problem has been identified and resolved. FY production to be below previous exps of 29,000 - 32,000 boepd. Auctus Advisors has cut its FY25 production forecast to 27.5k boepd (prev. 30.8k). | AMBER (Roland) [no section below] I’m starting to lose count of the number of times I’ve seen this RNS title from Serica. While the company’s recent acquisition looks attractive, as Mark discussed here, today’s news is a reminder that nearly half the group’s (pre-acquisition) production depends on flaky, ageing infrastructure that’s controlled by someone else. Serica has cut production guidance again today but isn’t in a position to provide definitive new guidance until some clarity emerges on the timeline for repairs. CEO Chris Cox describes the news as “incredibly frustrating” and I imagine shareholders will agree. But it’s not clear to me that he has much power to influence the situation. I’m going to maintain our neutral view today on the grounds that the recent acquisition should help to dilute the impact of Triton production, while Serica’s overall valuation continues to look reasonable to me. However, my view remains that these North Sea consolidators probably deserve to be cheap, given the limited lifespan of many assets and the potential decommissioning costs they will face in the future. | |

Foresight group (LON:FSG) (£542m) | H1 EBITDA is in line with current FY26 consensus. AUM +3% to £13.6bn, FUM +1% to £9.6bn. | ||

IP (LON:IPO) (£472m) | IP has 12.3% holding in Monolith, an AI software company. No financial terms disclosed. | ||

Pantheon Resources (LON:PANR) (£332m) | 25 frac stages completed in 8 days. Operations underway for clean-up and production testing. | ||

Kenmare Resources (LON:KMR) (£273m) | Commissioning started on 2 Oct. Expected to take 3-4 weeks. On track for 2025 production guidance. | ||

Impax Asset Management (LON:IPX) (£250m) | Q4 AUM flat at £26.1bn with positive market performance offsetting £1.4bn of net outflows. "Material inflows" from EU/NAm clients. | AMBER/GREEN (Graham holds) [no section below] I’ve been AMBER/GREEN on the fund management sector in general, to reflect their cheapness but also that current trends are against them. As with Liontrust yesterday, Impax continues to report net outflows, and these have ticked up to £1.4bn (previous quarter: £1.3bn net outflows). As with Liontrust, Impax argues that things are actually looking up, despite higher net outflows: “there is solid evidence that flows are stabilising, including in our wholesale channel”. Unfortunately, that solid evidence is not visible yet when it comes to actual flows, but as with Liontrust I do think that pessimism is sufficiently priced in here. This stock qualifies for the “Ben Graham Deep Value Checklist” and the “Ben Graham Defensive Investor Screen”, and I’m happy with my currently small (and underwater) position in it - with no intention to add to it unless there are tangible signs of improvement. | |

Marston's (LON:MARS) (£246m) | Underlying PBT to be ahead of expectations. LfL sales +1.6%. Year-end net debt (pre-IFRS 16) to EBITDA now below 5x. | AMBER (Roland) Today’s upgrade is positive and my number crunching suggests management commentary could imply a c.6% increase to underlying PBT guidance for FY25 (y/e 27 Sept 25). However, debt services costs and capex remain high, while a sluggish economy appears to be limiting sales growth. Despite the tempting discount to book value, I would prefer to wait for the full-year results to learn whether Marston’s debt repayment capacity has improved and to be able to review updated guidance for the current year. For these reasons, I’ve left our neutral view unchanged today. | |

Riverstone Energy (LON:RSE) (£223m) | Managed wind-down: compulsory redemption of 70% of shares at £11.01. | PINK (managed wind-down). | |

Netcall (LON:NET) (£202m) | Rev +23%, adj. PBT +8% (£8.3m). Enters the new financial year with strong momentum and a record pipeline. | ||

Vertu Motors (LON:VTU) (£191m) | JLR cyber-attack: one-off impact on FY26 adj. profit before tax of up to £5.5m. Excluding this impact, underlying PBT expected in line. | ||

Seeing Machines (LON:SEE) (£153m) | Additional Purchase Order valued at c. $1.8m to “a world-leading North American self-driving car company.” | ||

Ramsdens Holdings (LON:RFX) (£125m) | SP -5% Updated forecasts from Panmure Liberum: | AMBER/GREEN (Roland) [no section below] With gold topping $4,000/oz for the first time yesterday, I’m surprised to see Ramsdens’ share price fall following today’s ahead-of-expectations trading update. The company’s commentary highlights a strong full-year performance across the business, in particular from gold purchasing. However, I think there are a couple of other factors worth considering. Firstly, this business is unusually exposed to the price of gold. Gross profit from precious metals totalled nearly 30% of the group total in H1, slightly ahead of pawnbroking gross profit. This weighting is likely to have increased in H2 – today’s note from Panmure Liberum suggests precious metal GP will be the largest contributor to group profits in FY25. CEO Peter admits that “we have benefited from the sustained high gold price”. He believes the group’s diversified income stream provides some protection, but I suspect that in a gold downturn there might also be knock-on effects on jewellery sales and pawnbroking – the overall impact on Ramsdens’ profits could be significant. Of course, there’s no guarantee the gold price will fall. It could stay high or rise further, in which case Ramsdens could continue to outperform over the coming year. We are generally positive on Ramsdens and I believe there’s plenty to like about this business. But I think the rising valuation and growing level of commodity price exposure means that to some extent, the near-term outlook for profit is more speculative and less under the company’s control. To reflect this risk, I’ve moved our view down by one notch today. | |

Fiinu (LON:BANK) (£42m) | Has now fully drawn down £2m convertible loan facility. New joint broker. | ||

Aptamer (LON:APTA) (£26m) | New £360,000 contract. Visibility of £1.03 million in value for current period, with nine months remaining. Company not providing formal guidance at this time | ||

Fusion Antibodies (LON:FAB) (£17m) | Work is expected to be completed within the current financial year and generate revenues of not less than £175,000. | ||

Velocity Composites (LON:VEL) (£12m) | 10-year contract extension. Expected to generate approximately $2.5 million in revenue in FY26. | ||

Oxford Biodynamics (LON:OBD) (£10m) | Development of a new highly accurate blood test to diagnose Chronic Fatigue Syndrome (CFS), also known as Myalgic Encephalomyelitis (ME). |

Roland's Section

Greencore (LON:GNC)

Up 0.5% at 233p (£1.03bn) - Trading Update - Roland - PINK (AMBER/GREEN)

Convenience food producer Greencore has upgraded its full-year guidance for the year ended 30 September 2025 today, extending a run of upgrades over the last 18 months:

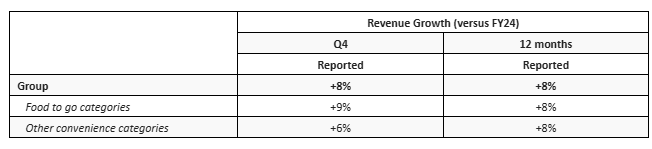

Today’s commentary sounds positive. Q4 revenue rose by 8%, consistent with growth over the last 12 months. Food to Go has been particularly strong recently, which management says has been driven by categories such as sandwiches and sushi.

Cash conversion has remained good, supporting a further reduction in net debt to £70m from £136m at the end of March 2025. Leverage is said to be “well below” the target range of 1.0x-1.5x, presumably leaving plenty of capacity for the cash outflows required when its acquisition of Bakkavor completes later this year.

Outlook

FY25 adjusted operating profit is now expected to be “approximately £125m”.

Previous guidance in July was for £118-£121m, which itself was an upgrade from £114-117m. So we can see that management has been inching up guidance as trading has evolved over the year.

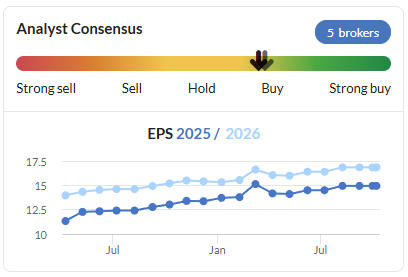

I estimate that today’s upgrade could drop out to give an adjusted EPS figure of around 15.5p for FY25, leaving the stock on a P/E of around 15x.

Roland’s view

Greencore’s share price is now back at pre-pandemic levels and no longer obviously cheap, in my view, for what remains a low-margin and somewhat cyclical business:

From here, I’d argue outlook is increasingly dependent on the success of the Bakkavor acquisition/merger. This cash/shares deal is expected to complete later this year and will see Bakkavor shareholders own 44% of the expanded company.

Combining two £1bn+ companies is not without risk and complexity. Greencore will be paying out c.£500m on the cash element of this deal, so any subsequent setbacks or cash flow problems could leave the group with an uncomfortable level of leverage.

I’m going to maintain our AMBER/GREEN view today out of respect for the company’s seemingly strong momentum and repeated upgrades. But at current levels, I would personally be inclined to wait for the merger to complete before considering an investment. The lack of any share price reaction to today’s news suggests to me that the market may share this view.

Marston's (LON:MARS)

Up 6.7% at 41.4p (£261m) - Trading Update for 52 weeks to 27 Sept 25 - Roland - AMBER

Checking back in the archives, we last covered this heavily indebted pub chain in October 2024 and then in December 2024, when Graham reviewed last year’s results.

The share price has hardly changed since then, but trading (and profitability) seem to have improved – at least that seems to be the implication of today’s upgrade to FY25 profit guidance.

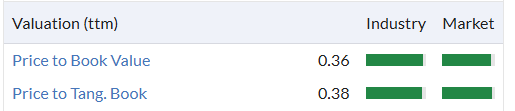

I’m interested to see if an opportunity might be emerging. After all, these shares currently trade at a c.60% discount to book value, according to Stockopedia – although we should remember that this is potentially a fair reflection of high indebtedness and low returns on assets.

FY25 trading summary

This update is fairly light on detail, in my view.

We aren’t given a full-year revenue figure, but are told that like-for-like sales rose by 1.6% during the year to 27 September. This result is said to have outpaced the market.

However, as some of you have suggested below in the comments, this low level of LFL growth may well imply a reduction in volumes, when inflation is taken into account.

One interesting point is that recently refurbished pubs are said to be performing much better, with “average initial revenue uplifts” of 23%. Leaving aside the heavy lifting done by the word “initial” here, I think this just highlights the capital-intensive nature of this business. Pubs need regular refurbishment – Marston’s capex is currently running at 7%-8% of revenue and is expected to have been c.£60m in FY25. If profitability isn’t sufficient, what can happen is that businesses of this kind end up running to stand still.

Fortunately, profitability does seem to have taken a further step forward over the last year, thanks to a variety of efficiency-type measures:

Step-change in profitability underpinned by sustained margin expansion through our market-leading pub operating model, including revenue management, labour efficiency and procurement initiatives

We aren’t told anything about operating margins, but Marstons says that underlying EBITDA margins have improved by more than 1% over the year. This margin was 21.4% last year, so it seems reasonable to assume a figure of c.22.5% this year.

This seems cautiously encouraging to me, given the impact of higher employment costs since April.

Applying this margin estimate to Stockopedia’s consensus revenue forecast of £917m suggests a FY25 EBITDA figure of £206m. That would imply a slightly lower H2 weighting than in 2024, so perhaps it’s slightly low (or perhaps market conditions were weaker this summer than in 2024).

The other key point is that the company confirms year-end net debt/EBITDA leverage is expected to remain below 5.0x, as was reported at the half-year mark (4.9x). Unfortunately there is no detail provided on net debt, so we don’t know if this reduction is due to debt repayment or simply the deleveraging effect of rising profits.

Outlook & Upgraded Guidance

Unfortunately we are left guessing about the exact scope of the improvement to FY25 expectations today. Marston’s management are not as forthcoming as that of Greencore (see above) and have not provided explicit new profit guidance.

This is what we get instead:

“Underlying profit before tax expected to be ahead of market expectations”

Previous market forecasts were for underlying PBT of £67.2m, with a range of £64.6m to £69.2m, according to company-compiled figures

I don’t have access to any updated broker forecasts today, so I’ve used my EBITDA guesstimate above as the starting point for a new estimate of underlying PBT:

Underlying EBITDA: £206m

Depreciation and amortisation: -£45m (in line with FY24 and FY23)

Finance charges: -£90m (annualised from H1)

Underlying PBT: £71m

This estimate suggests a c.6% increase in underlying PBT versus previous expectations, which is consistent with the share price movement this morning. So I’m happy to use this as a working assumption (although of course I could be wrong).

Applying a similar increase to forecast EPS suggests a figure of 8.25p, leaving the stock on a FY25E P/E of 5.

There’s no update on FY26 guidance today, except to note that an accelerated capex plan is in place for pub refurbishments next year.

Roland’s view

Marston’s underlying pre-tax profit in FY24 was £42.1m, so the FY25 results look likely to show growth of 60%+.

This sounds impressive, but I think it’s worth remembering that this business is still primarily being run to service its debt burden – H1 reported net debt was £1,252m, including lease liabilities, dwarfing the £261m market cap. Interest payments are likely to be c.2x reported net profit and there is no dividend currently.

Today’s update seems broadly positive to me, but it leaves several questions unanswered, notably whether Marston’s has been able to make any meaningful debt repayments this year. Remember that last year’s big reduction was funded with the proceeds of the sale of the company’s brewing business.

A bullish view here would be that if Marston’s can maintain higher levels of profitability, it should be able to repay debt and reduce the discount to book value, potentially supporting a share price re-rating.

However, the business is currently faced with a sluggish UK economy, persistent inflation and demanding levels of capex and debt service.

Graham upgraded to neutral after reviewing last year’s results and I am happy to maintain that view today, reflecting the StockRanks. However, I would prefer to wait for the full-year accounts and updated FY26 guidance before considering whether to turn positive.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.