Good morning and welcome to Tuesday's report - we'll have the Agenda posted for you ASAP - done!

All done for today's report, thanks everyone!

Companies Reporting

| Name (Mkt Cap) | RNS | Summary | Our view (Author) |

|---|---|---|---|

Rio Tinto (LON:RIO) (£83bn) | On track to meet 2025 production guidance. Copper in line, bauxite upgraded, iron ore at lower end of guidance. | ||

BP (LON:BP.) (£66bn) | Upstream production to be higher in Q3 vs Q2, gas marketing & trading result to be average. Net debt to be broadly flat at c.$26bn. | ||

GSK (LON:GSK) (£66bn) | Approved for all over-18s at additional risk due to immunodeficiency or immunosuppression. | ||

Bellway (LON:BWY) (£2.9bn) | Completions +14% to 8,749 homes. PBT +21% to £222m. Net cash £41.8m. Dividend +30% to 70pps. | AMBER/GREEN (Roland) [no section below] Today’s full-year earnings of 176.7p per share are slightly ahead of the consensus figure of 168p shown on Stockopedia. This result was aided by a modest improvement in margins and volumes last year, but profitability remained relatively low with an underlying pre-tax return on equity of 8.2%. My sums suggest a post-tax figure (most relevant for equity investors) of 4.4%. That is pretty dismal, but I think there’s scope for improvement here. Management guidance is for an 5% increase in completions this year, with a marginal improvement in average selling price and stable margins. Forecasts suggest c.10% earnings growth this year. When paired with a £150m share buyback below book value, I think it’s fair to expect an improvement in return on equity over the coming year. Needless to say, if housebuilders do achieve their goal of persuading the government to provide some kind of housing stimulus, performance could improve more rapidly. At current levels I think Bellway is fairly valued. But the stock remains >10% below book value and management have an explicit focus on improving returns on equity and capital employed. I see this as a well-run business, where the risk/reward balance is probably favourable on a medium-term timeframe. I’m leaving my AMBER/GREEN view unchanged today. | |

MITIE (LON:MTO) (£1.87bn) | SP +11% Rev growth c.10%, contract wins c.£3.0bn. Outlook: op profit guidance upgraded to >£260m. | ||

Ashmore (LON:ASHM) (£1.28bn) | AUM +2% to $48.7bn in Q3, net flows continued to improve, with EM delivering strong returns. CEO comment: "Given the positive emerging markets backdrop, evident risks to investors' overweight positions in the US, and Ashmore's continued investment outperformance, the Group is well-positioned to capture additional flows as investors increasingly look to shift allocations away from the US including into emerging markets." | GREEN (Graham) [no section below] This emerging markets asset manager reports net outflows of $0.3 billion for its Q1 period (to September). But in the context of total AUM of nearly $49 billion, it’s not significant, and indeed AUM has risen by 2% despite these outflows. Only one category saw net outflows - “external debt”, which is debt owed by emerging countries in foreign currencies, typically USD. That is a large and important category for Ashmore, but I do take some encouragement that all other categories were flat or saw inflows. I’m always rather positive on this stock but I like the fact that the CEO owns such a large stake (29%), and the balance sheet is a fortress (shareholders’ equity over £500m). It has paid a stable dividend for a decade, with a yield of 9%+. For income investors in particular, I think this continues to be worth a look. | |

Integrafin Holdings (LON:IHP) (£1.21bn) | Q4 platform net inflows of £1.0bn, record FUD of £74.2bn (+16% YoY). FY25 rev +8% to £156.8m, margin guidance unchanged. | ||

Bytes Technology (LON:BYIT) (£985m) | Rev +2.5%, op profit -7% to £33.1m. Outlook: confident of FY outcome within the range of market expectations. | AMBER/RED (Roland) Today’s results are in line with July’s guidance for H1, but the company is facing various headwinds and an increased cost base. The outlook for H2 seems cautious and I think there’s still a chance the full-year result could drop below expectations. I don’t think there’s anything fundamental wrong with Bytes, but it’s not my top pick in this sector and its UK dependence means growth could remain under pressure for a while yet. I don’t think the shares are cheap enough yet for me to upgrade my view, so I’m remaining cautious today. | |

Close Brothers (LON:CBG) (£673m) | Further provision of £135m, in addition to original £165m provision. "Taking into account the estimated CET1 benefit from the sale of Winterflood of c.55 basis points alongside the impact of the estimated provision, the pro-forma CET1 capital ratio would be c.13.0%, significantly above the group's regulatory requirement of 9.7%." | GREEN (Graham) [no section below] Close Brothers' market cap has held up well in recent months, e.g. it was £600m in August when the Court of Appeal ruled on the motor finance issue. Last week, the company said that the FCA's proposed compensation should would be "likely to result in a material increased" to the existing £165m provision. Today the company says that while uncertainty remains, it now believes that the appropriate total provision is £300m. As with Lloyds Banking Group, CBG intends to argue its case with the FCA when it comes to making a fair calculation of the redress that is owed to customers. Tangible net asset value per share at the most recent full year results (to July 2025) was £9.10, and even if 90p falls off due to the increased provision (£135m additional provision divided by 150 million shares), that still leaves the shares trading at a big discount to tangible NAV. This might be a little generous, but I'm happy to upgrade Close Brothers all the way to GREEN at this stage. | |

Morgan Advanced Materials (LON:MGAM) (£608m) | SP -7% Underlying sales -3.6% in Q3, demand in semiconductors remains weak. Outlook: now expect FY sales -4% w/ op margin c.10% (vs 11% in H1) | RED (Graham) [No section below] We already had a profit warning from MGAM in August so it's a worry that they continue to slide against expectations. Weak demand is the ongoing theme and I'm dismayed to find that the company doesn't provide a range or an estimate of the final outcome. Revenue was £1.1 billion last year which suggests that organically sales are headed for c. £1.06bn this year, with adj. operating profits in the region of £106m (at a 10% margin). The adj. operating margin was 11.7% last year, and 11% in H1, so that too continues to deteriorate. Net debt excluding leases was £250m at the interims. I don't expect that it will experience any financial distress, as it is still profitable, but I'm going to automatially downgrade our stance on this to fully RED until it's clear that estimates have stabilised. | |

Discoverie (LON:DSCV) (£566m) | Sales +0.5% organic, +2.5% acquisitions. H1 results in line with FY adjusted EPS expectations. | ||

THG (LON:THG) (£541m) | Q3 rev +6.3%, driven by Nutrition (+10%). FY expectations are unchanged and in line with consensus. | ||

Anglo-Eastern Plantations (LON:AEP) (£537m) | Acquisition of an Indonesian plantation company for Rp150 billion ($9 million) funded from existing cash resources. | ||

Tatton Asset Management (LON:TAM) (£439m) | H1 results in line with exps, with continued growth in both revenue and profits driven by strong net inflows (£1.7bn). | ||

| Hollywood Bowl (LON:BOWL) (£438m) | Trading Statement | Rev +8.9% (UK +6.4%, Canada +32.8%). LfL +0.6%. EBITDA in line. Confident outlook for FY26 and beyond. Net cash £15.2m. | AMBER/GREEN (Graham) |

YouGov (LON:YOU) (£338m) | Rev +1%. Adj. op profit +26% (£60.7m). Net debt £144m. Trading for FY26 has begun in line with exps. | ||

Tharisa (LON:THS) (£299m) | PGM production for the year at 138.3 koz (FY2024: 145.1 koz). Q4 production up 19.7% to 41.3 koz (Q3 FY2025: 34.5 koz). Net cash $68.6m. | ||

Petrotal (LON:PTAL) (£298m) | Production +21% over Q3 2024. Unrestricted cash $108.8m. “Company continues to deliver steady YoY production growth, even though the Bretana field has been producing below capacity…” | ||

Reach (LON:RCH) (£205m) | Q3 revenue down 2.5%. Digital revenue +2.1%. Outlook: confident in delivering exps (adjusted operating profit £99.1m). | AMBER/GREEN (Graham ) I'm very optimistic about this one but I acknowledge that it's complicated, and that share price momentum is currently against it. Today's trading update doesn't change very much although it does highlight that digital revenues - the only possible source of growth - aren't really growing this year, due to reliance on Google that isn't currently providing the expected traffic. The adjusted P/E is only about 3x, although the adjustments will be material. Personally, I'm inclined to think the continuing business should still be meaningfully profitable in a few years, after the pension liabiltiies have been paid off, and that restructuring activities should eventually lead to some sort of stability. | |

Serabi Gold (LON:SRB) (£195m) | On track to achieve 2025 consolidated production guidance of 44,000 – 47,000 ounces gold. Net cash $33m. | ||

Robert Walters (LON:RWA) (£85m) | Q3 net fee income down 12%. “...overall conditions globally remain fragile… our planning assumption continues to be that recovery in hiring markets will develop very gradually.” | AMBER/RED (Roland) [no section below] On Friday I commented that the main highlight from recruiter Hays’ update was evidence of some normal seasonality and the lack of another profit warning. Today’s in-line update from Robert Walters feels similar. While net fee income fell in all the group’s operating regions, the rate of decline in Asia Pacific and the UK eased during the quarter, to just -2% and -4% respectively. As with Hays, headcount reductions have taken place and fee earner productivity has improved, with net fee income per consultant up by 7% YoY. Even so, net cash fell by nearly £4m during the quarter to £26.6m (30 June: £30.1m). While this is still a material amount relative to the £93m market cap, cash is still falling. The dividend also remains suspended, with an update on returns due with the full-year results in March. Forecasts suggest cost savings will help to reduce the scale of the H2 loss vs H1, before a return to profitability in FY26. However, with fee income still falling steadily and a MomentumRank of just 19, I would like greater confidence in a return to profit in FY26 before turning neutral. For now, I am leaving Mark’s previous AMBER/RED view unchanged. | |

Roadside Real Estate (LON:ROAD) (£81m) | Put option on Cambridge Sleep Sciences to produce profit of £7m across three years. Strong acquisition pipeline. | ||

DP Poland (LON:DPP) (£73m) | Group EBITDA (pre-IFRS 16) for 2025 to be broadly in line with market expectations. | ||

Gear4music (HOLDINGS) (LON:G4M) (£59m) |

SP +10% | AMBER/GREEN (Roland) [no section below] A brief but positive update from this musical equipment retailer, with G4M’s third upgrade to guidance since June. Sales rose by 31% in H1, an outcome the company puts down to its “enhanced marketing capabilities and improved inventory availability” but also “a more favourable competitive environment”. Profits are now expected to be significantly ahead of expectations; we have a hefty 50% upgrade to EPS forecasts today from Progressive. I am pleased to see that I was AMBER/GREEN on this stock in September. Arguably I should have maintained Graham’s GREEN view from June. However, I can’t help wondering if some of this year’s improved profit performance might reflect one-off gains from the sale of inventory purchased from administrators at a discount to book value earlier this year (e.g. here). Today’s slightly unusual decision by paid research provider Progressive to temporarily withdraw its FY27 forecast also highlights the lack of forward visibility. With the peak Christmas season ahead, it’s possible I’m being too cautious. But while I respect the recent momentum here, this remains a low margin retailer with a mixed track record. I’m going to leave my AMBER/GREEN view unchanged today, to reflect the mix of opportunity and risk – as I see it – and the stock’s forward P/E of 17. I look forward to reviewing the situation when H1 results are published in November. | |

Aptamer (LON:APTA) (£27m) | Rev +40% (£1.2m), adj. EBITDA loss £2.2m. “Enters 2026 positioned to deliver sustained growth.” | ||

Sosandar (LON:SOS) (£13m) | Trading in line. Expectations: revenue £43.6m, PBT £0.4m. | ||

Fadel Partners (LON:FADL) (£13m) | On track to achieve guidance (includes an adj. EBITDA loss). Strategic review conclusion: focus on organic growth. |

Graham's Section

Hollywood Bowl (LON:BOWL)

Up 6% to 277.5p (£463m) - Trading Statement - Graham - AMBER/GREEN

Hollywood Bowl, the UK and Canada's largest ten-pin bowling operator, announces a trading update for the financial year ended 30 September 2025 (FY2025).

We have an in line full-year update from Hollywood Bowl.

Let’s cover off some of the key points.

Revenues +8.9% (UK +6.4%, Canada +32.8%)

LfL revenues +1.1% in UK, +3.2% in Canada

Net cash £15.2m

EBITDA is set to be in line with expectations, with the range of these expectations being £66.9 - 70.8m (average £68m).

And I note that full-year revenues of £250.8m are above the range of analyst expectations (£246 - 250.6m, with an average of £248m).

Strategic progress: 5 UK locations, 2 Canada openings, and various refurbishments. There was £37m of capex which will be split across growth and maintenance spending.

Checking the interim results, I see they had 90 centres across the UK and Canada at that time. The target is 130 centres by 2035 which does not sound overly ambitious to me: 40% growth over 10 years.

CEO comment:

"We are very pleased with our full-year performance, both financially and operationally. We have again demonstrated the success of our proven, customer-led strategy and differentiated business model by delivering record revenues and further profitable growth. Our motivated and engaged teams consistently delivered high quality customer experiences which resulted in increased dwell time and record levels of positive customer feedback.

Graham’s view

We covered the interim results in May and they provided plenty of useful detail, e.g. £20m capex spend, of which the majority (£14m) was expansionary. I’ll be keeping an eye out for the same detail when it comes to full-year capex, which was £37m.

I downgraded our stance in May to AMBER as I thought there was heightened risk of a profit warning later in the year - the company warned that dry weather had impacted short-term trading.

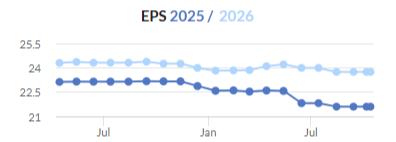

Fortunately, no major profit warning has materialised, although I should note that PBT forecasts were trimmed after the May update:

With FY September 2025 now in the bag and seemingly a successful year, I think it’s right that I upgrade our stance on this back to AMBER/GREEN.

Yes, it’s a capital-intensive leisure business - but it does generate real profits even while it expands.

Many such businesses - think of growing restaurant chains for example - produce an endless string of losses, chalking them up as the cost of growth.

Hollywood Bowl, in contrast, is growing at a relaxed pace while also producing real profits for shareholders. No mean feat.

It completed a £10m buyback in H1, and then started a £5m buyback in H2, while also paying a meaningful dividend (yield is c. 5%). And this is all quite affordable, as the company has maintained a decent net cash position, before lease liabilities.

Leases were recorded as having a value of £220m at the interims: when a company is highly leveraged in terms of leases, I like to see that it's not piling on more risk with financial debt: BOWL doesn’t do this.

With so many positive features, I’m even tempted to go all the way to GREEN today, but that might be a little adventurous. A one-notch positive movement is enough!

Reach (LON:RCH)

Down 3% to 62.3p (£198m) - Trading Update - Graham - AMBER/GREEN

Reach’s share price has been rather weak in recent months, suggesting that the caution of my co-writers has been well-founded.

Six-month chart:

I’ve tended to think that the bad news (and the pension deficit) is priced in, but I do acknowledge that this is a “cigar butt” stock - where the question is how many puffs are left.

Today’s update continues the trend of lower overall revenues, while digital revenues still provide a little growth:

Revenues down 2.5% in Q3 (down 3.1% year-to-date)

Print revenues down 3.9% (down 4.5% year-to-date)

Digital revenues up 2.1% (up 1.9% year-to-date)

I don’t blame Reach for how it presents its results, but it’s good to always be aware of the small choices made in presentation - for example, putting digital revenues above print revenues in the summary box. And leading the commentary with “Digital revenues grew 2.1%...”. Companies always put their best foot forwards!

Reliance on the tech mega-caps, particularly Google, has been an issue:

Throughout the quarter we saw lower digital referral volumes, particularly from Google. As a result, page views, a measure of on-platform audience volumes, fell 1% over the nine-month period.

Could this be due to more changes in Google’s algorithm? Or (perhaps less likely) increased usage of ChatGPT?

Either way, it’s rather unappetising to find that digital page views are lower - digital is the only possible source of growth here, after all.

That said, the company still benefits from its significant Print revenues:

“...circulation revenues remain a reliable and predictable revenue stream, with our publications offering stand-out market deals to our readers. Print advertising revenue continues to perform above circulation volume declines.”

In other words: print advertising revenue is not falling quite as quickly as volumes are falling (but print advertising revenue is still down 13% year-on-year).

Circulation revenue, i.e. revenue from the sale price of printed publications, remains steady due to price rises offsetting volume.

Outlook:

We remain confident about our future, with three clear priorities and are encouraged by our progress against these. Profit expectations are well underpinned by the resilient print performance and disciplined cost management, and we are on track to deliver our 4-5% cost saving target. We anticipate full year digital revenues to be broadly flat on the prior year, reflecting the ongoing volatility in referral volumes and weak macroeconomic backdrop. We remain confident in delivering market expectations for the year.

Again, this isn’t very appetising: digital revenues are the only possible growth engine, and they aren’t moving.

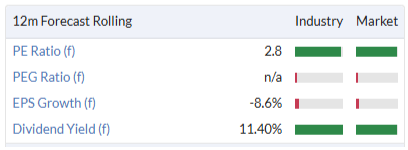

Estimate: the adjusted operating profit forecast is £99.1m. Pretty good for a market cap of £198m!

Graham’s view

Personally, I’m GREEN on this, but I acknowledge that my co-writers have been more cautious. Also, I have to respect that share price momentum is currently against my view - but I’ll be watching for this to change!

There is little further detail in today’s update. I do note that there will be a full-year restructuring charge of £20m, which will be adjusted out of the AOP figure. And bears might reasonably speculate that restructuring charges could be an ongoing feature of the business as it continues to decline.

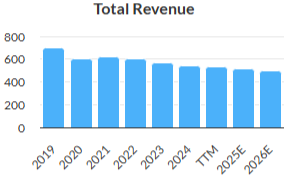

Pension contributions are scheduled to end soon (2028) and I do think that this will remain a viable business for many years after that, but of course it might be significantly smaller than it is now. Revenues have been in an inexorable decline:

But at a current forward P/E ratio of 3x (with adjustements), I still think it’s worthy of research. Even if underlying profits halved, it would still be viewed a value share, assuming that the pension contributions are made as planned and that liability goes away.

I suppose the counter-argument is that investors who buy today will have to wait three years until that occurs. So I’m not pretending that this is an easy or straightforward value share: it’s certainly complicated. But I do think it could have a few more satisfying puffs left in it

Roland's Section

Bytes Technology (LON:BYIT)

Down 11% at 367p (£880m) - Interim Results - Roland - AMBER/RED

I went AMBER/RED on value-added IT reseller Bytes Technology following the company’s profit warning in July. My concern was that further downgrades and share price de-rating might follow the firm’s initial cut to guidance.

September’s half-year update left H1 expectations unchanged from July but warned of “tough comparatives” for the second half of the year and did not provide any update on full-year guidance.

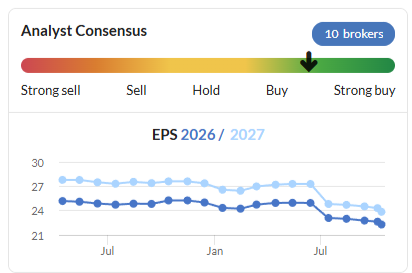

Some broker analysts appear to have used this as a cue to further trim their forecasts, ahead of today’s results:

Bytes shares have opened lower this morning, so it looks like today’s results have not entirely reassured investors. Let’s take a look.

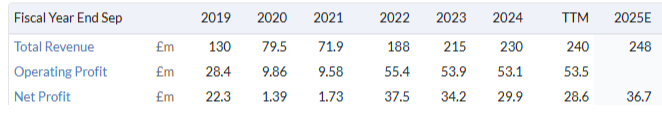

H1 results summary

The overriding impression I get from these results is that Bytes’ growth more or less came to a halt during the six months to 31 August, to the extent that the company was not able to offset increases to its cost base since last year.

Some of the external headwinds mentioned aren’t surprising. The company generates c.95% of revenue in the UK, so is heavily exposed to sluggish spending in both the public and private sectors.

There were also a couple of one-off changes that may have impacted sales in H1 – the group’s corporate sales teams were restructured earlier this year. Bytes is also having to navigate a change in Microsoft’s incentive scheme for its partners that appears to be aimed at persuading resellers to move their customers onto higher-margin cloud services.

I’ve highlighted what I see as the key numbers below:

Gross Invoiced Income (GII) up 9.1% to £1,342m

Revenue up 2.5% to £108.1m

Gross profit up 0.4% to £82.4m

Operating profit down 7% to £33.1m

Adjusted earnings down 5.1% to 12.03p per share

Interim dividend up 3.2% to 3.2p per share

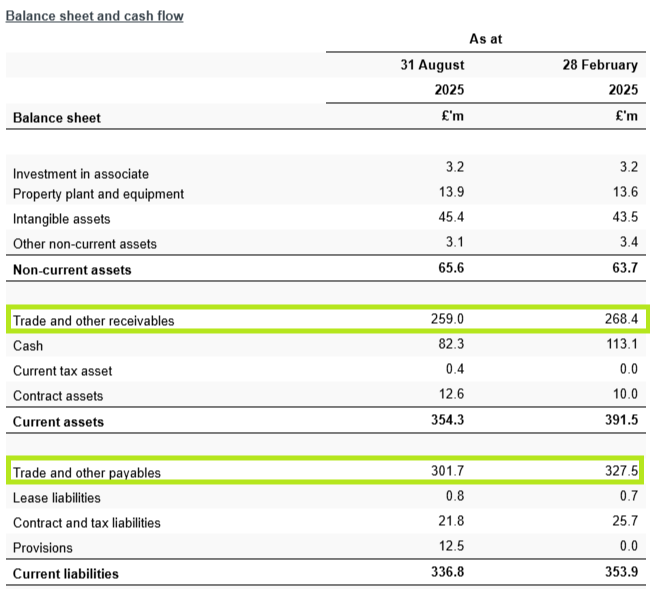

Net cash up 15.1% to £82.3m

I think it’s useful to understand the way revenue and profit is generated by this business.

Gross Invoiced Income (GII): this represents income billed to customers, much of which is simply passed through to [software] vendors. In this case, the company says GII is being boosted somewhat by a change to Microsoft’s reseller arrangements this year.

In short, Bytes is now billing corporate customers and passing money to Microsoft in situations where Microsoft previously invoiced the customer and paid Bytes a rebate.

While GII isn’t a standard accounting measure, I think it is still a useful measure to consider, in part because it affects working capital movements (and thus cash generation).

Checking the balance sheet, we can see that Bytes’ receivables and payables are both significantly greater than annual revenue:

Careful management of these large balances is one of the reasons why Bytes and its peers are able to generate such strong free cash flow - the company generated £64m of free cash flow from £55m of net profit last year.

Cash flow is typically weighted to H2 due to various timing factors, but I expect another good result this year.

Revenue: broadly speaking, this includes the full value of hardware and internal services sales, plus gross profit on software and external services such as training.

Revenue is a statutory accounting measure, but it can be affected by changes in sales mix and is not necessarily representative of underlying business growth.

Gross Profit (GP): Bytes says this is its primary measure of sales performance. It effectively includes all gross profit from hardware, software and services, while excluding any revenue that is passed through.

Given this, I think it’s useful to look at the split of gross profit across segments:

Software down 3.5% to £72.1m

Internal Services up 46.3% to £6.0m

Hardware +25% to £2.0m

External Services +41.2% to £2.4m

Bytes is mainly a software reseller – effectively the digital equivalent of a distributor, I think. However, management is trying to move up the value chain by increasing sales of services. These are, by nature, higher margin than any kind of hardware or software resale.

Operating profit: I can’t be certain, but my impression is that a large part of Bytes’ workforce may still be front-line sales agents on relatively low salaries. In today’s results, Bytes flags up the impact of higher headcount, salary and national insurance costs – comments we typically see from companies where the workforce is dominated by lower-paid staff.

This has put pressure on the company’s operating margin, which fell to 30.6% (HY25: 33.8%).

Perhaps reflecting this, my sums suggest that revenue per employee is much lower at Bytes than its two main UK-listed peers:

Bytes: £170k/employee

Computacenter (disc: I hold): c.£345k/employee

Softcat: c.£415k/employee

One other reason for the fall in operating profit may also be that growth has not yet improved to justify last year’s 18% increase in headcount. At the time, the company said this was needed to:

… focus on bolstering sales and service delivery teams while ensuring support areas also grow to support the expanding business

However, slower growth this year (and rising employment costs) means that these extra employees have eaten into profits this year. In fairness, it’s probably too soon to be sure if this new headcount will pay off, but it’s possibly something to watch.

Outlook

CEO Sam Mudd has left guidance unchanged today, just about:

We remain confident of delivering a full year outcome within the range of market expectations.

I don’t know what the range of market expectations is, as Bytes hasn’t included them in the RNS and I don’t have access to any broker notes.

However, the share price reaction today suggests to me that at least some of the 10 brokers who cover Bytes may have trimmed their full-year outlook.

I’ll keep an eye on the consensus trend chart on the StockReport in coming days to see if the graph edges lower. As is often the case, private investors are being kept in the dark while institutions will have been able to access updated forecasts before markets opened this morning.

Roland’s view

Bytes doesn’t disclose what percentage of its revenue or profits come from Microsoft, but my impression is that it’s quite material – I’m pretty certain it’s (by far) the company’s largest vendor partner.

This is making it a little difficult to untangle the impact of depressed public/private spending in the UK from changes to Microsoft’s incentive schemes. It is also a reminder that at its heart, this is a sales organisation operating on commission, so changes to incentive schemes can have a sizeable impact.

Despite these concerns, I don’t see any specific problems here. Bytes’ balance sheet looks fine to me with a decent net cash balance (which I’d consider essential given the level of working capital movements) and reasonable profitability.

However, there’s no escaping the company’s broad exposure to factors beyond its control. I wonder, too, if Bytes’ headcount has risen a little too fast.

Looking ahead, I think there’s still a risk of a further profit warning later this year, or perhaps a downgrade to FY27 forecasts. Our research tells us that a more prolonged period of underperformance often follows an initial profit warning.

Today’s results don’t give me that much confidence in a more positive outcome, while this morning’s share price drop suggests to me that market forecasts may have been cut.

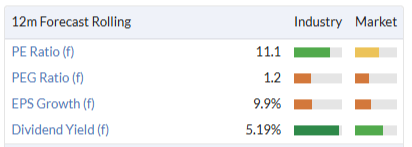

With the stock still trading on a forward P/E of c.17, I am not sure the risks are yet fully reflected in the valuation.

I’m going to leave my previous AMBER/RED view unchanged until greater clarity emerges on H2 performance and the outlook for FY27.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.