Good morning!

All done for today, thanks everyone.

Spreadsheet accompanying this report: link (last updated to: 5th September).

Companies Reporting

| Name (Mkt Cap) | RNS | Summary | Our view (Author) |

|---|---|---|---|

Entain (LON:ENT) (£5.37bn) | FY25 guidance reiterated: c. 7% online NGR growth (constant FX), EBITDA £1,100m to £1,150m. | ||

Rathbones (LON:RAT) (£2.08bn) | FUMA up 3.7% (to £113bn), net outflows £0.6bn. Operating income up 7.2% year-on-year to £236m. | ||

| CVS (LON:CVSG) (£1.0bn) | Response to CMA provisional decision announcement | Continues to expect to trade in line. Welcomes additional certainty, pleased to see CMA considered CVS’ and veterinary profession's feedback. | |

Jupiter Fund Management (LON:JUP) (£799m) | Q3 net inflows £0.3bn, AUM up 7% over the quarter to £50.4bn. Acquiring CCLA in Q1 2026. | GREEN (Graham) [no section below] It’s wonderful to see some inflows in this embattled sector, even if they are modest. Jupiter are quick to point out that it’s not a blip: with three quarters done, they are marginally positive year-to-date when it comes to flows. AUM grew by an impressive 7% in the quarter thanks to strong underlying market movements: with AUM now at £50.4bn, the shares currently offer £63 of AUM for every £1 invested. Much of the value has been squeezed out by the share price having more than doubled over the past six months: it took a long time, but my faith in this stock has been justified at last! Looking forward, the StockRank is now 98 (it’s a Super Stock) and investors can look forward to the CCLA acquisition booting AUM by c. £15 billion - funded from existing cash resources, with no dilution. Taking that account, value will rise to c. £82 of AUM for every £1 invested in the shares at the current level. To me, that’s still a very interesting valuation. It’s a little pro-cyclical of me, but I’m willing to stick my neck out by upgrading this by one notch to fully GREEN. Retail flows - not institutional - have driven the recent flow performance, which I think is a very positive sign of renewed sentiment and interest in the Jupiter fund range - long may it continue. | |

Pagegroup (LON:PAGE) (£768m) | 2025 operating profit to be broadly in line with current market consensus of £21.5m. Q3 gross profit down 6.7%. | ||

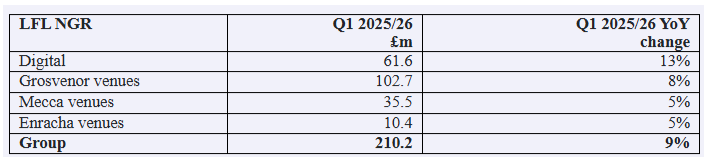

Rank (LON:RNK) (£607m) | Q1 like-for-like NGR up 9% to £210.2m. Confident of delivering like-for-like operating profit in line with expectations. | AMBER/GREEN (Graham) It's a nice update and I'm tempted to raise my stance on this back to fully GREEN. In StockRank terms, this is a Super Stock with improving Value as optimistic FY26/FY27 earnings forecasts come into view. However, the CEO notes the risk of increased taxes in the forthcoming UK budget. Having looked into the proposals (from 101 government backbenchers), I think I'd prefer to retain my moderately positive stance here, pending clarity. | |

Thor Explorations (LON:THX) (£491m) | Q3 gold poured 22,617 oz. Production guidance maintained at 85k-95k oz. AISC guidance maintained at $800- $1,000. | AMBER/GREEN (Mark) [no section below] | |

Brooks Macdonald (LON:BRK) (£276m) | FUMA up 3% in Q1 to £19.7 billion. Q1 net outflows £49m. | ||

Midwich (LON:MIDW) (£193m) | Group FD leaves to become CFO of RWS, is thanked. Will remain to ensure a smooth transition. Search process initiated. | ||

Activeops (LON:AOM) (£121m) | SP +27% Double digit revenue growth, anticipates full year revenues will now be comfortably ahead of consensus expectations (exps: rev £40.3m, PBT £1.7m). Cash of £13.3 after £5m acquisition of Enlighten, a “workforce optimisation software and services provider with a strong footprint in North America and Asia Pacific“. | AMBER/GREEN (Graham) [no section below] I’m compelled to upgrade our stance on this by one notch after this exciting update. But when I check the new estimates at Canaccord Genuity (many thanks), I see that their revenue estimates are raised at a more modest pace (4%) than today’s share price reaction would have suggested. I also note that there is no change to EPS or adjusted PBT estimates, save for a slight decrease in this year’s EPS estimate. It might well be conservative, but I find it striking that an additional £2m added to the revenue forecast for each future financial year leads to no change in the profitability estimate. This year’s 34% organic revenue growth will be very much a one-shot success, to be followed by periods of much more modest growth, if these estimates turn out to be accurate. At least the company does already have a healthy cash position, and so it should not be reliant on cash profits to fund growth. In the SaaS sector, annual recurring revenue can easily be valued at a multiple of more than 3-4x, so I don’t think that today’s market cap of £150m is particularly expensive given ARR of £40.6m (with organic growth just seen of 27%). Therefore, while this will continue to look very expensive against EPS for the foreseeable future, the valuation does arguably make sense - and is even cheap - in a software context. | |

Audioboom (LON:BOOM) (£111m) | Q3 Revenue +9% to $20.4m, Adj. EBITDA +18% to $1.2m, cash $2.9m (30 Jun: $2.5m). $79m revenue booked for FY25. | ||

Oxford Metrics (LON:OMG) (£45m) | Group revenue broadly in line with market expectations. Headwinds around US academic funding. Adjusted EBIT in line with market expectations for the FY of £2.3m. Cash £37m (FY24: £50.7m) after £5.4m spent on acquisitions and £12.5m of dividends & buybacks. | AMBER (Mark - I hold) [No section below] | |

Getbusy (LON:GETB) (£42.3m) | SmartVault now integrated with Intuit ProConnect Tax, Intuit's flagship cloud-based tax preparation and advisory platform. | ||

PROCOOK (LON:PROC) (£37.6m) | Q2 revenue +25% to 21.3m (12% LFL), gross profit margin and costs in line with expectations. Net debt £4.1m (25H1: £4.2m). Confident in delivering full year performance in line with market expectations. | ||

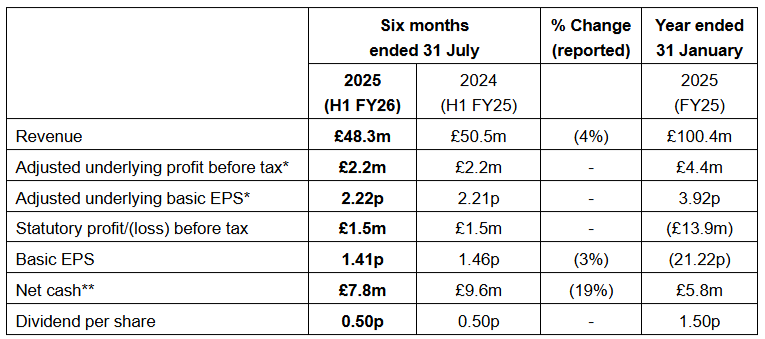

Sanderson Design (LON:SDG) (£34.3m) | H1 Revenue -4% to £48.3m, licensing +6% to £4.4m, Adj PBT flat at £2.3m Adj EPS flat at 2.22p, Net cash £7.8m (25H1: £9.6m, FY25: £5.8m), dividend held at 0.5p.Cost cutting complete. Brand sales +5% CCY so far in H2, confident of meeting FY expectations. | AMBER/GREEN (Mark - I hold) | |

Hercules (LON:HERC) (£27.3m) | Acquired a 70% shareholding in Warrington-based Lyons Power Services for £703k (£351k cash, £351k shares at 5-day VWAP). Lyons Power FY25 revenue £1.39m, PBT £0.29m. | AMBER/GREEN (Mark) [No section below] | |

Alkemy Capital Investments (LON:ALK) (£24.9m) | H1 LBT £1.13m (24H1: £0.68m), Net debt £0.48m (24H1: £0.4m) after raising £0.71m during the period. Focused on advancing TVL through the FEED study to FID. | ||

Tap Global (LON:TAP) (£13.9m) | Launch of corporate customer programme with 25 business customers, worth £75k. | ||

Light Science Technologies Holdings (LON:LST) (£13.2m) | AgTech division extended its distribution framework agreement to distribute products developed by Gavita for a further 12 months. £24m sales pipeline. | ||

IXICO (LON:IXI) (£11.1m) | New 3-yr contract to assist in the validation of a diagnostic blood test and contract extension on an existing Alzheimer's Disease clinical trial worth £1.2 million combined. |

Graham's Section

Rank (LON:RNK)

Down 1% to 128.24p (£601m) - Trading Statement - Graham - AMBER/GREEN

Pleasant news from this casino/bingo group: all businesses growing in line with expectations.

I’ve been GREEN and AMBER/GREEN on this, most recently taking the slightly more cautious stance in August on publication of its full-year results for last year.

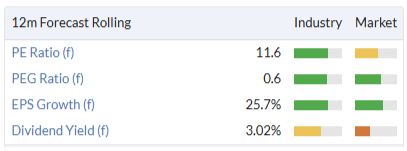

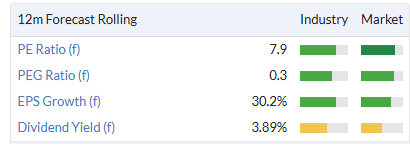

However, as the positive estimates for FY26 and FY27 start to come into view, perhaps there is still good value to be had here?

Even with a 60% share price gain over the last six months, the forward P/E is not prohibitive:

Let’s dig into today’s Q1 update a little:

Digital - Rank is keen to highlight its online presence, and it has been a nice source of growth. Grosvenor Casinos are the main driver here, with their digital UK revenues up 31% year-on-year.

Grosvenor - a nice spread of increased visits (5%) and higher spend per visit (3%). New regulations on land-based casinos have enabled the installation of hundreds of new gaming machines. In total 850 new machines will be added.

Mecca (bingo) - steady revenue growth but visitor numbers slightly down.

Enracha (Spanish casinos) - steady revenue growth.

CEO comment:

We have started the year strongly and are confident of delivering Group like-for-like operating profit in line with expectations, notwithstanding the significant cost increases we have incurred in employer national insurance contributions, the national living wage and the new statutory levy.

There’s also a comment on tax:

Speculation regarding tax changes in the upcoming Budget is, inevitably, hanging over the business. We are engaged with the Treasury on the implications of tax changes on the viability of our venues, employment levels, future investment and the customer. Last year the Group generated £44.6m in profit after tax, having paid HMRC and local authorities £188.0m in taxes. The Rank Group, with its strong UK focus, is certainly paying its fair share.

I note that over 100 Labour backbenchers have called for an increase in Remote Gaming Duty, amplifying calls from the Institute for Public Policy Research to increase it from 21% to 50% of the operator’s “gross gambling yield”.

Graham’s view

I was tempted to raise my view on this back to GREEN, as I do greatly admire the company (and its venues!). However, as there is a real and imminent threat of tax increases, I’ll hold my existing stance.

One thing that Rank followers know well is that the company’s profits can easily evaporate due to its heavy fixed costs - and the emphasis on Digital was presumably supposed to offset this. But if rising fixed costs aren’t offset by higher revenues in a timely manner, or if revenues take an unexpected hit, then the income statement gets ugly - this happened during Covid of course, but also in the inflationary period that followed. Perhaps tax rises on Digital could be the third time in less than a decade that the company’s profits are hobbled? I hope not, and I’ll keep my moderately positive stance, but it’s something to keep an eye out for. This year’s budget is on November 26th.

Mark's Section

Sanderson Design (LON:SDG)

Up 6% at 50p - Half Year Results - Mark (I hold) - AMBER/GREEN

On the surface, this is a relatively uninspiring half for the company, with revenue down slightly and most other figures flat on the previous year:

Cost savings:

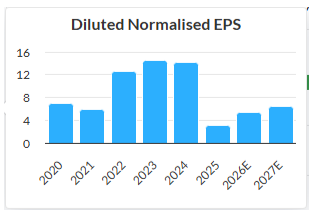

The narrative is one of cost savings to protect margins and they have now delivered cumulative annualised cost reductions of £4.8m over three years and £2.5m in the latest programme. I have a theory that they were caught out by the severity of the downturn in revenue in their key markets and were slow to cut costs. This is why the medium-term EPS trend looks like this:

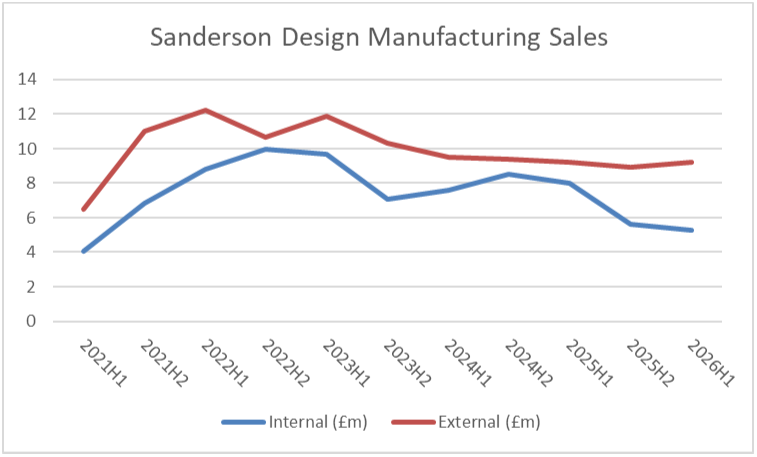

My other theory is that the strength of the licensing revenue meant that they were initially reluctant to cut costs. However, the nettle has been grasped, especially in manufacturing:

The factory restructuring completed in the first half of this year has reduced costs, increased efficiency and delivered a much more flexible workforce able to respond to market demand and to the requirements of digital printing. There is positive momentum in our current manufacturing order books, with a better mix of new collections and repeat orders compared with the same time last year. We continue to expect the manufacturing segment to achieve break-even, or slightly better, for the current financial year.

There are some other low-hanging fruit that appear to have been picked, too:

Our approach to issuing these pattern books has changed compared with the prior year. Under the old "book scheme" members paid a monthly fee to receive a pattern book for all new collections. Under the new loyalty scheme, members pay for each pattern book on an individual basis. This change has seen a reduction in both Other operating income and Distribution and selling expenses, and a net saving to the Group of £0.7m compared with H1 FY25.

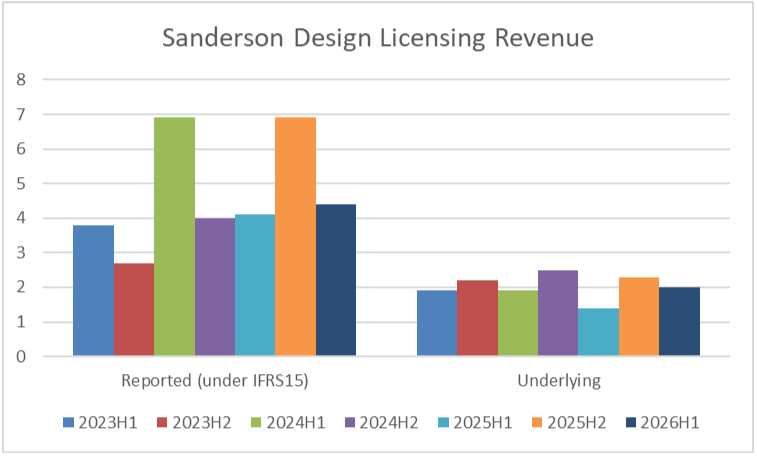

Licensing:

In terms of licensing revenue, this is another bright spot, with the company saying:

Licensing revenue, an important strategic focus for the Group and a key profit driver, continued to perform well in the first half with revenue up 6% at £4.4m. Importantly, there was strong growth of 22% in licensing's underlying performance (licensing revenue excluding accelerated income under IFRS15) reflecting both new agreements from last year which have moved to product launch and increased on-going sales from existing licensees.

However, this increase comes off a recent low for underlying licensing revenue, and is perhaps less impressive with a historical context:

Over time, I would expect underlying licensing to track closer to the reported licensing, but it shows there is still some way to go before this is a significant contributor to cash flow.

Brand sales:

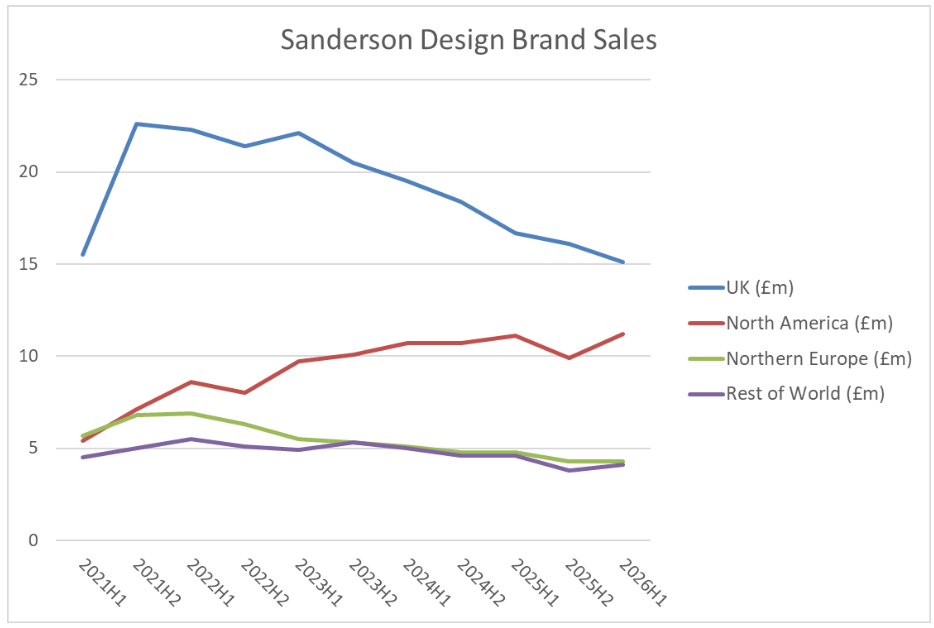

In terms of brand sales, Europe and the ROW seem to have bottomed out, but the UK sales continue their downward trajectory:

North America continues its medium-term growth trajectory, but there are some risks here:

From 29 August 2025, the US government removed the $800 de minimis threshold for commercial shipments into the USA. The majority of our US shipments fell below this threshold and so recently we have begun to incur tariffs and administrative charges. We have moved swiftly to recover the additional costs from customers via a surcharge on invoices whilst the tariff situation, which continues to evolve, becomes clearer.

Unlike Colefax, who sell through distributors, it seems the vast majority of Sanderson’s NA sales are made direct to interior designers or similar and shipped from the UK. This means that they haven’t benefited from the big push to source product into stock before tariffs came into force. Presumably, they will face less of a reduction in demand post-tariffs, although the impact of the associated price rises is yet to really hit.

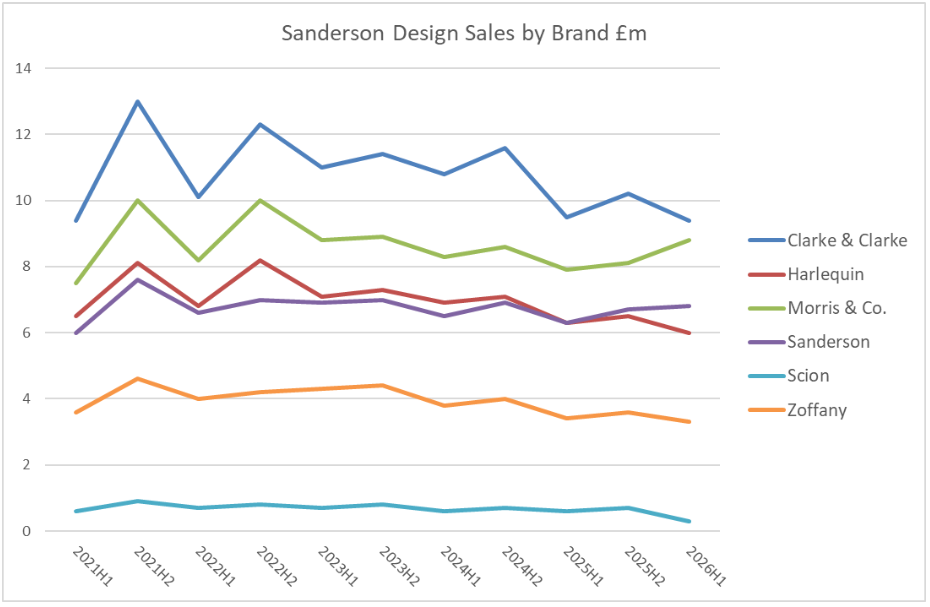

In terms of brands themselves, most follow similar trends, although there is a notable uptick in sales for Morris & Co. in H1:

Scion is struggling. Although this brand is far more important in terms of licensing deals than direct sales.

The trends for brand sales are encouraging with a 5% rise in CCY sales in H2 so far:

As noted in the Half Year Trading Update issued on 7 August 2025, brand sales in the nine-week period of June and July 2025, although slightly below the same time period last year, were on an improving trend compared with the full six months ended 31 July 2025. This momentum has continued into the current half year, and brand sales in the first 9 weeks of the second half are up 5% at constant exchange rates compared with the same time last year.

It would be nice to have got some regional breakdown, though.

Manufacturing:

External manufacturing sales appear to have bottomed and look to be starting a modest recovery:

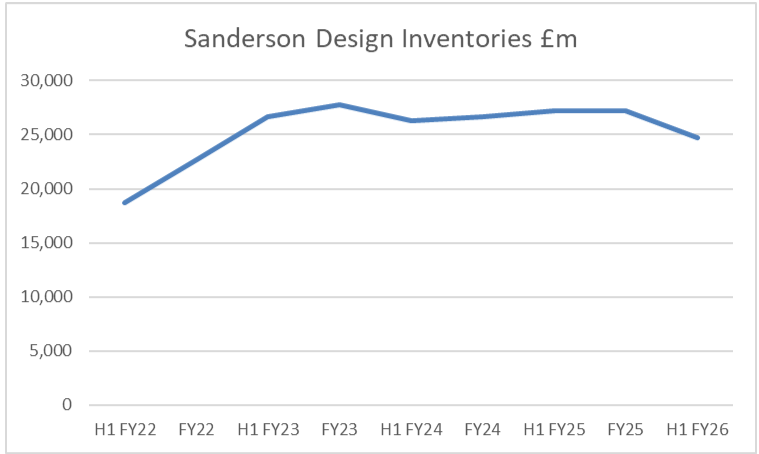

Internal sales are lower, presumably as the company chose to sell from inventory. This has led to inventories declining to £24.7m from £27.2m the year before and the flag scope for further reductions in the future.

Cashflow & Balance sheet:

As well as the decline in inventories, the company has spent very little capex during the period. Payables have remained static, but receivables increased by around £1m. This meant that cash increased by around £2m. The current ratio is over 3, meaning that the balance sheet is very strong.

Total equity increased slightly to £69.2m from £68.7m, although £10.7m of that is Intangibles, and £2.2m is a pension surplus which is largely an accounting fiction as they continue to make payments to the scheme in excess of the pension charge. This gives £56.3m tangible book value if we assume the pension scheme deficit is zero, or £51.3m if we take my guess of £5m for the buyout costs of the remaining scheme. This compares favourably to the c.£37m market cap today.

While value investors, such as myself, tend to focus on tangible assets, I don’t think the intangible assets here are worthless. After all, intangibles are generating something in the region of £10m high-margin revenues each year. The big question is how soon can the tangible assets be made productive again?

Forecasts:

The company say that “We remain on track to deliver results in line with the Board's expectations for the full year." However, £102m revenue consensus with £48.3m in H1 leaves £53.7m to do in H2. That’s 8.5% higher than 25H2 and 11.1% higher than 26H1. It is clear that they will need sales to accelerate beyond the 5% CCY so far in H2 if they want to reach that figure. So its is perhaps unsurprising that research provider Progressive say they have “trimmed back top-line forecasts”. They now have £101.2m, for a perhaps more reasonable 6.9% H2 growth in sales. Perhaps more importantly they say:

Our FY26E and FY27E underlying adjusted PBT forecasts remain unchanged following these interim results, at £5.0m and £5.7m, respectively. Likewise, our year-end net cash forecasts remain unchanged at £8.5m and £11.8m, respectively.

This means that these valuation figures remain valid:

Which makes them look good value. Especially as I don’t see why they won’t return to double-figure EPS in better market conditions:

Mark’s view

Having gone through all of the aspects of the business, these results seem in line with recent trends. Strong licensing and US sales offset weakness elsewhere, but the real financial recovery comes from cost-cutting. While cost-cutting can only get a company so far, it does place them in a good position when sales recover. Ultimately I don’t see anything to change my view that this is exposed to the housing market cycle, and when general market conditions improve, so will their financial results. In the meantime they have a strong balance sheet and are generating cash, so have time on their side. A slight downgrade in revenue forecasts is disappointing, but understandable. However, it is profitability that matters and even on depressed sales this looks cheap. Partly this is due to continued strong high-margin licensing sales, but I continue to believe that the licensing side alone is probably worth more than the current market cap. I keep our AMBER/GREEN view.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.