Good morning! I'm making good headway on bringing our spreadsheet up to date again, with the reports up to 7th October now reflected on it. I hope that's helpful!

Signing out there, thanks everyone.

Spreadsheet accompanying this report: link (last updated to: 7th October).

Companies Reporting

| Name (Mkt Cap) | RNS | Summary | Our view (Author) |

|---|---|---|---|

AstraZeneca (LON:AZN) (£193bn) | EU has approved use of Tezspire as an add-on therapy for treatment of CRSwNP. | ||

GSK (LON:GSK) (£67bn) | Positive data for low carbon version Ventolin MDI & Latozinemab data read out | Ventolin: phase III data confirms equivalence and safety for new low carbon formulation of this widely-used inhaler. Latozinemab: did not show benefit on clinical co-primary endpoint or secondary endpoints for treating FTD-GRN (dementia). | |

Barclays (LON:BARC) (£51bn) | Q3: PBT +13% to £7.3bn. RoTE 12.3% (Q3 24: 11.5%). FY25 RoTE now exp >11% (prev. c.11%). £500m buyback. Motor FInance Update: has increased provision from £90m to £325m, will reduce CET1 by 0.05%. | ||

Reckitt Benckiser (LON:RKT) (£39.7bn) | LFL sales +7% in Q3, +3.3% YTD. Volume growth in core brands. FY25 outlook unchanged. | ||

Fresnillo (LON:FRES) (£16bn) | Silver production -6.6% to 11.7moz vs Q2, gold -4.1% to 151.3koz vs Q2. Production guidance unchanged. | ||

Aberdeen (LON:ABDN) (£3.7bn) | AUMA +6% to £542.4bn, net outflows of £0.5bn. ii customers +14% to 492k. Outlook in line. FY 2026 adjusted operating profit target over £300m, net capital generation c. £300m. Transformation programme on track for annualised savings of £150m by the end of this year. | GREEN (Graham) [no section below] I was GREEN on this in April (at 148p). The absence of serious outflows, its enormous scale, and the inclusion of a quality platform business (Interactive Investor) all suggest to me that this is more interesting than the average fund manager I cover. Today’s update shows that net outflows remain very small: £0.5bn in Q3, bringing year-to-date net outflows to only £1.4bn. For context, AUMU are an incredible £542 billion (i.e. half a trillion!). If we strip out Interactive Investor and the “Advisor” segment, focusing only on the “Investments” segment, then the net outflow in Q3 (£1.8bn) was less than half of one percent of AUMA. These assets are “sticky” compared to other fund managers. A single £4.5bn redemption is expected in Q4, but this is from a “very low margin quants mandate”, so the effect on overall profitability should be minimal. Meanwhile, Interactive Investor continues to grow well, with 10% organic growth in customers (excluding the recent acquisition of Jarvis), and brand awareness has increased from 25% in Q4 2024 up to 32%. I don’t see why I should change my positive stance here even after some good gains that have pushed the valuation higher (forward P/E now 14x). | |

Softcat (LON:SCT) (£3.1bn) | Rev +51.5%, op profit +12.2% to £172.9m. Driven by very large, low margin deals. FY26 outlook unch. | ||

ITV (LON:ITV) (£2.8bn) | SP -8% Liberty Global has halved its position to 5%, selling 193m shares for gross proceeds of c.£135m (c.70p per share). Liberty has agreed not to sell any more shares for at least 60 days. | AMBER (Roland - I hold) [no section below] After a decade as ITV’s largest shareholder, it looks like Liberty Global founder John Malone is running out of patience. ITV’s share price has fallen by around 70% over this period, so this has not been an outstanding investment for the Cable Cowboy. I feel his pain. Fortunately, I have not held ITV shares quite as long as Liberty. But my position is a hangover from a previous portfolio that no longer really fits within my holdings. I’ve stubbornly held onto my ITV shares as I’ve believed that the Studios business is deeply undervalued by the market, while I think the overall group is moving in the right direction. But while ITV has been the subject of repeated takeover rumours in recent years, none of these have come to fruition. I suspect it might also prove difficult to separate the content and television businesses entirely. On paper I still think ITV looks cheap, but the market refuses to recognise this and my conviction is weakening, so I am going to leave Megan’s previous neutral view unchanged today. | |

Quilter (LON:QLT) (£2.4bn) | Q3 core net inflows of £2.2 billion. Year to date core net inflows of £6.7 billion. | ||

Plus500 (LON:PLUS) (£2.2bn) | Plus500 will exclusively provide clearing and technology infrastructure for Topstep, a leading US-based trading education and evaluation platform. | ||

Playtech (LON:PTEC) (£824m) | Response to statement by Evolution AB (yesterday at 1.08pm) | SP -23% yesterday | AMBER (Graham) I’m not picking sides in the dispute involving Evolution, Black Cube and Playtech. From an investment perspective, the risk associated with a multi-billion-dollar damage claim is not really possible for me to quantify, so I’m neutral on the stock. But I am a fan of the Playtech business and I’d be happy owning shares in it at some point - perhaps this episode will help to create a useful entry point. |

Serica Energy (LON:SQZ) (£723m) | Due to recently announced M&A activity, it is not possible to move in 2025. Move expected to occur at the earliest opportunity following publication of Serica's audited FY 2025 accounts. | ||

International Personal Finance (LON:IPF) (£468m) | “BasePoint is making constructive progress in raising finance for the potential cash offer and BasePoint has therefore asked the Board for more time to bring this to a conclusion.” TU: “on track to deliver full-year results in line with the guidance provided.” | PINK (GREEN) (Graham holds) I'm still GREEN on IPF as it's undervalued, but I'm a little frustrated with IPF management for recommending an offer that was too cheap in my view, and from an unprepared buyer. Today's trading update confirms that management continue to do an excellent job at managing and growing the business, which is why I invested here in the first place. | |

Puretech Health (LON:PRTC) (£322m) | Phase 2b trial data shows the favorable safety and efficacy profile of deupirfenidone was consistent across age groups, including in patients aged 75 years and older. | ||

Halfords (LON:HFD) (£300m) | LfL sales growth 4.1%. Gross margin expansion and strong cash generation. Full year outlook unchanged (consensus adj. PBT: £36.0 - 39.8m). | AMBER/GREEN (Graham) [no section below] Roland upgraded our stance on this in April (at 138p) and so far there is nothing to suggest that this was the wrong call. New CEO Henry Birch says he looks forward to sharing their plans for the future at the interim results next month, which will be worth a read. For now, the company continues to perform adequately, with moderate like-for-like revenue growth and cost savings to protect margins. We've been worried about the impact of tax changes on the cost base, but for now the company continues to target underlying PBT of up to £39.8m in the current financial year - so they could still beat this year's £38.4m result (FY June 2025). That would be a fine achievement! Given the modest rating on which the shares are trading, I'm happy leave our moderately positive stance unchanged. | |

Public Policy Holding (LON:PPHC) (£274m) | Q3 revenue +23.8%. Organic growth 4.5%. Q3 adjusted EBITDA +14.8%. Outlook: continues to see strong demand. | ||

LBG Media (LON:LBG) (£204m) | Revenue and profit in line. Rev +10%, adj. EBITDA +2%. Net cash £30.1m. Outlook: confident of the growth outlook. | ||

SRT Marine Systems (LON:SRT) (£204m) | Rev +426% (£78m). Adj. PBT £4.9m. £325m of contracts. Cash £13.6m as of Sep 2025, up from £4.3m at June. Outlook very positive, and growing. | AMBER (Roland) Today’s results seem to be in line with expectations and highlight terrific sales growth over the last year. Broker forecasts for the next two years are also unchanged, supporting the growth story. However, such rapid growth can be difficult to manage. Today’s accounts include an auditor going concern comment that flags up the risk of a cash crunch as SRT waits for its sovereign customers to pay for completed projects. On balance I think the situation may be manageable, but I wouldn’t entirely rule out the risk of a further placing. With the stock trading on 20x forward earnings, I think the shares are up with events so am remaining neutral | |

Macfarlane (LON:MACF) (£138m) |

“2025 adjusted operating profit now expected to be 20% to 25% below market expectations.” | BLACK (AMBER/RED) (Roland) | |

Novacyt SA (LON:NCYT) (£28m) | Expects an improvement in EBITDA loss for 2025 compared to the loss reported in FY24 of £9.1m. Improved gross margin and smaller cash outflow in H2 vs. £8.8m cash outflow in H1. | ||

System1 (LON:SYS1) (£27m) | Full year guidance unchanged. Rev for FY26 to be broadly in line with £37m achieved in FY25, adj. PBT in a range £2.0 - 2.5m. | ||

Virgin Wines UK (LON:VINO) (£25m) | SP +8% Revenue flat, profitability lower year-on-year but ahead of expectations: adj. EBITDA £2.3m vs. £2.2m expected, PBT £1.6m vs. £1.3m expected. Trading so far in FY26 is in line. Q1: 29% increase in customer acquisition, 134% rise in revenues at Warehouse Wines. Long-term plan is for £100m in revenue at an adjusted EBITDA margin of 7% within five years. | AMBER (Graham) [no section below] Perhaps generously I'm going to remove our negative stance on this, but today's update is ahead of expectations and that's not the only reason for optimism. Revenues are flat and profits are lower but the company is profitable with earnings per share of 2.3p (last year: 2.4p). I also note net cash of £9m which means the real enterprise value here is only about £18m today (or 35p per share). So in cash-adjusted terms, the trailing P/E ratio becomes 15x. The company has been buying its own shares rather than paying dividends, a rare combination in the UK which to my eyes signals high confidence that the business is undervalued. Partnerships with Ocado, Moonpig, WH Smith etc., are paying offwith a 24% growth in Commercial partnerships revenue (which must be offset by weakness elsewhere given the overall resuts). The focus on adjusted EBITDA gives me "the ick" but the company is genuinely profitable: the cash flow statement shows £2m of cash flowing in from operating activities, or let's call it £1.4m after lease payments. Elsewhere, bank interest received on the cash pile was able to fund most of the company's capex needs. I like what I see but it might be a little too surn to take a more positive stance. For now, I'm happy being neutral. |

Graham's Section

Playtech (LON:PTEC)

Down 23% to 270p (£824m) - Response to statement by Evolution AB - Graham - AMBER

Some dramatic news in the gambling sector yesterday as Playtech fell 38% at the low in response to being named in a lawsuit.

From Alliance News:

Evolution said the Douglas, Isle of Man-based gambling software company hired intelligence firm Black Cube, which produced a dossier that alleged Evolution operated in "grey markets" where gambling is prohibited…

Evolution said Playtech paid Black Cube more than GBP1.8 million for its work in 2021…

Evolution said: "It is deeply disturbing to learn that one of our competitors has gone to such extraordinary lengths to damage our business and reputation by hiring Black Cube... to fabricate a report they knew would have extremely harmful repercussions."

Black Cube has been described as “the ‘Mossad’ of the business world”.

In response, Playtech confirms that its subsidiary, Playtech Software Limited, “commissioned an independent business intelligence firm to investigate credible and repeated concerns raised by operators, suppliers and regulators about Evolution's activities in prohibited and sanctioned markets, and its supply to unlicensed operators in regulated markets.”

They don’t sound particularly repentant, defending the report that was subsequently published and standing by their decision to commission it:

Playtech welcomes court examination of the report and its findings. Playtech is confident that these proceedings will confirm the credibility and legitimacy of the investigation and the importance of the issues it seeks to address.

According to Evolution, the New Jersey Superior Court already “determined that the defamatory report was untruthful and lacked veracity”.

Graham’s view

Disclosure: I own shares in Evoke (LON:EVOK), which uses Playtech services such as live casinos.

The gambling world has always been a little murky, although as time passes it has gradually improved - with more of the global industry becoming regulated and above-board (rather than operating in the shadows or in a legal vacuum).

So it wouldn’t surprise me if everyone here could be at fault: Evolution for allegedly operating in an unregulated manner; Black Cube for using underhanded tactics to create its report and for presenting Evolution in the worst possible light; Playtech for secretly funding the report and keeping its role hidden, when it has a vested interest.

So I wouldn’t waste time trying to work out who is good and bad, right and wrong in this dispute. I would just assume that there are no truly good actors and that everyone is out for themselves.

From an investment perspective, Evolution is claiming “multi-billion dollar damage” from the report, a claim that obviously puts Playtech at risk.

Personally, I’ve always been more interested in the gambling brands rather than Playtech’s B2B operations, but I could be tempted to take a closer look at it if I perceive that the shares are “on sale”. Playtech is likely to have very high market share in many countries in its niche B2B services (player management, casino games, live casino, etc.). These services enable the gambling brands to focus more on marketing and less on the nuts and bolts of their offerings.

At the new share price and market cap, the shares are trading at a forward PER of about 16.5x. It has a net cash position and has been buying back its own shares above the current share price.

Given the risk around this lawsuit, I’m happy with an AMBER stance for now, but on fundamentals and value I would be AMBER/GREEN or maybe even GREEN if this lawsuit went away. That, however, could take some time. The wheels of justice always move slowly.

International Personal Finance (LON:IPF)

Down 3% to 207.54p (£455m) - Extension of PUSU deadline & Trading Update - Graham - PINK

(At the time of publication, Graham has a long position in IPF.)

Let’s get the trading update out of the way first, before getting into the takeover situation.

Trading update - in line.

Key points:

Lending up 14%

Net receivables also up 14%, to £1,007m.

Impairment rate goes from 8.3% to 9.8%, “reflecting an acceleration in growth”.

As we’ve discussed before, IPF’s impairment rate has been consistently below their expectations, as they expect growth (especially in Mexico) to push their impairment rate higher over time. Given that long-standing trend, I’m not especially concerned by a 1.5% increase in the impairment rate.

Above all, IPF is a highly profitable organisation where I believe it does have the margin to absorb the higher impairment rates that go along with growth in riskier markets.

Indeed, today’s update also confirms that their “digital” growth in Mexico is running at 40%. Australian “digital” is up by 25%, and Romanian home credit is up by 20%. With growth rates like that, I’d expect the impairment rate to pick up.

Overall, they say that “customer repayment behaviour remains excellent across all our markets”.

Their cost-income ratio has reduced slightly to 61.4% (the lower the better), and they are targeting 49-51% in the medium-term.

CEO comment:

We continue to see good demand from consumers for our expanded product set alongside excellent repayment performance and robust credit quality, all of which underpin our strong financial position. With this strong progress, we remain on track to deliver full-year results in line with the guidance provided at the half-year…

Balance sheet - it’s perfectly normal for small lenders such as this to need to use debt in order to fund growth, and they are “planning on returning to debt capital markets shortly”. They are still overcapitalised, having an equity to receivables ratio of 52% vs. their target of 40%.

Outlook: “We enter the fourth quarter with strong momentum across the Group, excellent credit quality and a robust balance sheet.”

Graham’s view: this trading update underscores the quality of the company, in my view, and why I invested in it in the first place.

Which brings us to…

Extension of PUSU deadline: we had a takeover offer here in July at 220p, that was improved to 235p in September.

I’ve not been impressed by these bids and would be happy enough continuing to own my IPF shares, although I’m also unsure as to why IPF management were happy to recommend these bids.

As for the New York-based buyer, my initial take on them back in July was: “Their website is mysterious but they do have a presence on LinkedIn and I must presume that they are capable of this takeover.”

Now I have reason to doubt that they are capable of this takeover:

As noted in the Revised Possible Offer Announcement, BasePoint has completed its due diligence, and the Revised Possible Offer remains subject to satisfaction or waiver of a number of customary pre-conditions, including approval by the BasePoint board. The Board understands that BasePoint is making constructive progress in raising finance for the potential cash offer and BasePoint has therefore asked the Board for more time to bring this to a conclusion.

Graham’s view

I would expect that if a company makes a takeover offer in July, it should have the finance in place and approval from its own Board to go ahead with the offer by October. These are basic steps to get the deal done.

When it comes to BasePoint, there is little public information.

One of the few estimates available to me is from LeadIQ, which suggests that BasePoint’s annual revenue is <$10m.

However, this likely understates BasePoint’s activities.

They were in the news last year when it emerged that they funded a bridging company that ended up getting sued for alleged illegal lending.

The hook that the media focused on was the link between BasePoint and Goldman Sachs billionaire Leon Cooperman.

If it is BasePoint’s intention to buy IPF, it seems to me that they did not expect that their offer would be accepted - or else they should have had the finance ready in good time. Which goes back to my point that the price offered was far too low.

I’m GREEN on IPF as I still think it’s undervalued, but I’m also a little frustrated with IPF management for recommending an offer that was a) too cheap, and b) from an unprepared buyer. I personally don’t have any objection to BasePoint as a buyer, but I believe the price should be significantly higher, and that BasePoint should be ready to pull the trigger already.

If it turns out that they can’t arrange financing and/or they do not actually want to go ahead with the deal, then the whole thing will turn out to be an enormous waste of time - but with lots of free publicity generated for BasePoint!

Roland's Section

Macfarlane (LON:MACF)

Down 17% at 72p (£114m) - Trading Update - Roland - BLACK (AMBER/RED)

Today’s profit warning from this packaging group has an unusually sad overtone, as it has been partly prompted by a plant shutdown following a fatality at Macfarlane’s Pitreavie packaging factory in Cumbernauld, Scotland. This was widely reported in the press, for example here.

Since the announcement of the Group's H1 2025 Results there has been a tragic incident at Pitreavie, acquired by the Group in January 2025.

The financial impact of this, combined with slower improvements in trading in Distribution, are the key contributors to a reduction in the Group's estimated full year ("FY") 2025 Adjusted Operating Profit, now expected to be 20% to 25% below market expectations.

Note: The Pitreavie Group was acquired by Macfarlane in January this year for a total potential consideration of up to £18m. It has four plants and specialises in supplying customers in the food and drink, energy, electronics and industrial sectors, primarily in Scotland.

Trading update

Today’s warning has two main elements – Pitreavie and the group’s distribution business:

The Pitreavie FY 2025 performance will be materially below previous management expectations. This is as a consequence of the recent fatal incident at one of the Pitreavie sites, which has resulted in a temporary suspension of operations at that facility. Any additional impact of the Pitreavie incident will only become clear when the authorities have completed their investigation.

The H2 2025 improvement in Distribution sales and gross margin has been slower than expected, with market conditions still challenging.

Fortunately, the group’s higher-margin Manufacturing business (excluding Pitreavie) is still said to be performing “robustly”.

Pitreavie: this business generated adjusted pre-tax profit of £1.3m in 2024, prior to its acquisition. The equivalent figure for Macfarlane in 2024 was £25.0m, so a loss of profit at Pitreavie is material but should not be existential.

Helpfully, house broker Shore Capital has published a note today, providing additional detail not included in the trading update.

Shore’s analyst suggests that Pitreavie operations are not expected to return to normal for at least another two weeks, suggesting a period of >4 weeks of reduced capacity, “during its busiest trading period”. The broker says Macfarlane is working with partners to outsource Pitreavie production to ensure the group maintains its market share and retains customers. Products are being sold at cost.

Given the nature of the situation and the timing of this incident, I would assume Pitreavie is likely to report a loss this year.

Distribution: the shortfall in the Distribution business is not necessarily a complete surprise.

Macfarlane’s half-year results showed adjusted operating profit from distribution down by 48% to £4.8m, with sales flat against a backdrop of rising costs – clearly the company had not been unable to fully pass on higher labour and input costs to its distribution customers.

At the time, the company blamed “weak customer demand across most sectors” and said new business wins were being held back by “delays in customer decision-making”. Market pricing was said to be competitive and one of the group’s suppliers went into administration.

Mark took a neutral view at the time, flagging the risk of a further profit warning “unless everything goes right” and highlighting reduced capacity for more acquisitions due to the debt incurred on recent deals such as Pitreavie.

His comments seem prescient now. I note Macfarlane emphasises today that its net bank debt “remains well within the Group’s £40m facility”, but doesn’t choose to disclose what net debt actually is.

Outlook

The focus for the remainder of 2025 is on stabilising the Pitreavie business and continuing to implement performance improvement actions in the Distribution business.

As a result of the Pitreavie incident and underperformance in Distribution, Macfarlane expects adjusted operating profit to be 20% to 25% below market expectations (previously £24.7m).

Shore Capital has also made updated forecasts available on Research Tree – many thanks – and has cut its estimate of 2025 adjusted operating profit by 23%, to £19m.

Earnings forecasts have been cut by 29% for 2025 and by 26% for 2026 and 2027, to reflect market conditions, pricing headwinds and weak new business momentum:

FY25E adj EPS: 7.0p (prev. 9.8p)

FY26E adj EPS: 7.6p (prev. 10.4p)

FY27E adj EPS: 8.5p (prev. 11.6p)

With the stock trading at c.72p as I type, these forecasts put Macfarlane on a FY25E P/E of 10.

Shore has also cut its dividend forecasts by c.40% to 2.2p in order to maintain a strong level of cover and (presumably) free up cash flow to address debt repayment and exceptional costs.

Roland’s view

Macfarlane has a strong track record of combining acquisitive and organic growth. But market conditions are tougher at the moment and the acquisition of Pitreavie – a relatively expensive deal for the company – is now going to take longer than expected to deliver positive returns.

The business has already issued two profit warnings over the last year and as Mark commented in August, a further cut reflecting disappointing H2 trading would not have been a surprise, even without the tragic incident at Pitreavie:

Macfarlane shares are now trading just below the company’s June 2025 book value of 76p per share. Although this figure might fall slightly in the year-end accounts, I think the stock might well offer some value at this level, on a medium-term view.

However, weaker trading conditions and the potential outcome and cost of the situation at Pitreavie mean I need to take a more cautious view for now. Updated forecasts from broker Shore today also seem to indicate that the timeframe for a recovery will be much longer than previously hoped.

I’m cutting our view to AMBER/RED today, but will continue to follow this business with interest.

SRT Marine Systems (LON:SRT)

Up 8% at 87p (£213m) - Final Results - Roland - AMBER

This maritime domain awareness (MDA) specialist has finally rewarded patient shareholders over the last 18 months, after remaining more-or-less rangebound for 20 years:

As we can see from the chart above, the StockRanks have never had a very favourable view of this business – and even now, the stock’s Momentum Trap styling and low StockRank highlight the speculative nature of the situation:

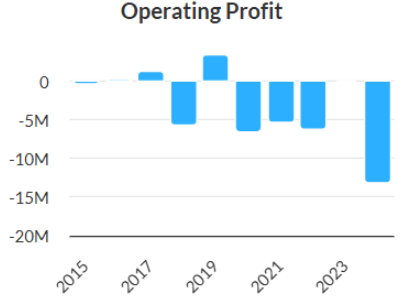

However, I think today’s FY25 results may change these rankings when the numbers are digested by Stocko’s algorithms. These accounts certainly contain some remarkable numbers that seem to suggest the business may finally be reaching meaningful profitability, after many years of losses:

Let’s take a look at the figures.

FY25 results summary (y/e 30 June 2025)

The growth in sales over the last year is certainly impressive, as are headline (adjusted) profits:

Revenue up 426% to £78.0m

Operating profit: £6.4m (FY24: loss of £13.2m)

Adjusted pre-tax profit: £4.9m (FY24: loss of £14.4m)

Statutory pre-tax profit: £1.4m (loss of FY24: £14.4m)

I think it’s worth revisiting the big picture to understand what’s been happening over the last year.

Growth over the last year has been driven by the group’s MDA business, which has won five contracts with sovereign customers (such as national coastguards) to implement systems that provide “AI driven insight and intelligence”.

SRT’s legacy navigation safety (transceivers) business generated revenue of just £9.5m in FY25, down from £13.3m in FY24. MDA system sales generated revenue of £68.5m last year and are the growth engine of the business.

At the end of the year, SRT had £325m of outstanding systems contracts. The company has since won a further contract with a new sovereign customer for “a substantial maritime surveillance system” that is expected to be worth around $200m.

These are clearly very impressive figures. If SRT can convert these contracts into sustainable profits and positive cash flow, it could be transformative for a company with a market cap of c.£200m.

However, when I see a manufacturing business in this kind of situation, I tend to think about all the things that can go wrong! Even if the technology is proven and factory and staffing capacity are adequate, actually building, shipping and supporting this much extra product is often complex and difficult.

Working capital growth: perhaps the most immediate issue in this case is how SRT is financing the huge increase in working capital needed to build and ship these orders. This topic is also the focus of a going concern note from the company’s auditor today (my bold):

The going concern uncertainty is due to the current rapid growth phase and the possibility of a mismatch between customer receipts and supplier payments which could require bridging finance. Whilst the Group has an extensive track record of securing such facilities and has a secured loan note programme with sufficient capacity, there are loan notes repayments which fall due within the next 12 months and there is no guarantee of such financing.

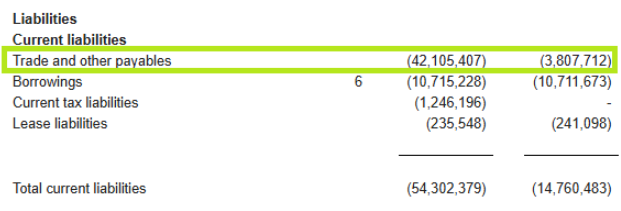

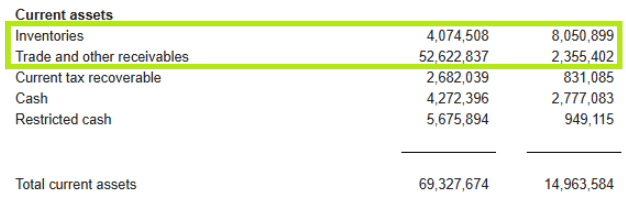

If we turn to the balance sheet we can see the scale of the outflows that have been required over the last year to scale up manufacturing – payables have risen to £42m, equivalent to 78% of full-year cost of sales:

This has been mirrored by a corresponding increase in receivables, as invoices issued to customers have stacked up:

I believe the mis-match referred to by the auditors is whether these receivables will be paid quickly and reliably enough to support the company’s cash outflows to suppliers.

The scale of revenue growth over the last year makes it hard to estimate average payment times. But the numbers for H2 alone suggest to me that customers may be paying in around 150 days, on average.

The equivalent calculation for payables suggests to me that SRT may be paying its suppliers in a similar time frame, suggesting payment terms are being stretched to the maximum.

Given that supplier orders must be placed some time before invoices for completed products can be issued to customers, the potential for a mis-match is clear, especially if suppliers start demanding more prompt payment.

The company has bridged this gap with a number of financing arrangements over the last year:

Equity placing: SRT raised £9.5m through an equity placing during the year.

Loan notes: £13.6m (FY24: £7.8m) - these have a term of three years and an interest rate of 8%-12%, repayments are staggered with the next being due in March 2026, according to the FY24 annual report.

This borrowing is referred to by the auditors and is clearly essential, but it’s also expensive. And if I’ve understood correctly, some of it will need to be rolled over to new borrowing over the coming year.

Equipment loan: £3.0m - this loan was issued in FY24 with quarterly repayments over 3 years. But the loan was increased during FY25 by £625k. It carries a 4% interest rate.

Ocean Infinity loan: this company is the group’s largest shareholder, at 15%. In October 2024, Ocean Inifnity provided a $21.3m guarantee to allow SRT to issue a performance bond. It also took part in a £7.5m placing at that time. The performance bond has been repaid over the year and the guarantee has been replaced by a combination of SRT’s cash and a UK Export Finance guarantee.

In return for this service, Ocean Infinity has been granted 20m warrants at a strike price of 35p, with an exercise period of 3 years. That’s equivalent to dilution of c.8% – presumably these will be exercised at some point, given they are now well in the money. These warrants have given rise to a £3.5m non-cash finance charge in today’s accounts – this is the main adjusting item to profits. I think it’s okay to ignore this. When/if the warrants are exercised it will result in a cash inflow to SRT, albeit at the expense of further dilution for other shareholders.

Net debt: it looks like the Ocean Infinity loan is now off the books, leaving SRT with net debt of £12.2m, excluding lease liabilities.

The majority of this is from the loan notes – finance costs totalled £1.9m last year, or 29% of operating profit. This is not necessarily unsupportable, if it’s backed by cash flow.

Cash flow: unfortunately today’s cash flow statement suggests to me that cash conversion lagged badly behind profits this year.

Net cash from operating activities was just £1.0m, while I estimate a free cash outflow of £5.8m.

This compares to a reported net profit for the year of £2.0m.

Negative cash flow isn’t surprising when a manufacturer is ramping up its output in this way. But I think this is a clear demonstration of the mis-match risk the auditors are warning about.

The situation isn’t necessarily unsustainable if cash flows from customers gradually improve and (perhaps) working capital starts to stabilise. But given that SRT already has a material net debt position, I think there’s still some risk of a cash crunch before the company reaches that point.

Outlook

The commentary from SRT today is relentlessly positive, as we might expect. But the outlook for FY26 is unchanged today, according to an updated broker note from Cavendish – many thanks:

FY26E revenue / adj EPS: £116m / 4.1p

FY27E revenue / adj EPS: £123m / 4.4p

These forecasts price SRT on a FY26E P/E of 21, falling to a P/E of 20 in FY27.

Roland’s view

My feeling at the moment is that SRT is still engaged in a juggling act, trying to finance its supplier costs while hoping for timely payment on completed orders. From my perspective – certainly on an initial review – I don’t see any way to be sure which way things will turn out.

Assuming completed orders continue to be converted into cash, then the main risk might be that a further equity placing is needed to provide bridging cash flow. Given the elevated valuation, that might not be too much of a worry.

Personally, if I was a shareholder I would be more worried about the possibility that one or more of the company’s big contracts would run into problems of some kind – the company faced corruption allegations in the Philippines earlier in the year, for example.

Based on Cavendish forecasts, growth is expected to slow over the next couple of years and cash generation is expected to improve and support deleveraging. If the company can deliver on this it could be in a much stronger position in 12 months. But for now, I think the shares are up with events on a P/E of 20.

Graham took a neutral view on SRT in June and I am going to leave this unchanged today. In my view, this could be a great success story, but there are still some clear risks, especially for equity holders. I would like to see more evidence of successful payment collection and stable finances before turning positive.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.