Good morning! Let's see what the market has in store for us today... and we have a new takeover offer!

Spreadsheet accompanying this report: link (last updated to: 21st October).

Companies Reporting

| Name (Mkt Cap) | RNS | Summary | Summary |

|---|---|---|---|

Shell (LON:SHEL) (£166bn | SR63) | Q3 income $5.3 billion (+48%) “reflected higher trading and optimisation margins, higher sales volumes and favourable tax movements, partly offset by higher operating expenses”. | ||

Standard Chartered (LON:STAN) (£34.6bn | SR93) | “We now expect to deliver an underlying return on tangible equity of around 13% in 2025, hitting our target a year earlier than planned.” Q3 adjusted operating income $5.1bn, up 5%. | ||

HALEON (LON:HLN) (£30.7bn | SR56) | Q3 organic revenue growth 3.4%. Reiterating FY 2025 guidance. High single digit organic operating profit growth. | ||

Prudential (LON:PRU) (£27.1bn | SR66) | Q3 new business profit was $705 million, up 13 per cent. “Firmly on track to achieve our 2025 guidance and our 2027 financial objectives." | ||

Vodafone (LON:VOD) (£21.7bn | SR97) | Skaylink is “a leading full-service cloud, digital transformation and security specialist with offices throughout Germany and across Europe.” Price: €175m. | ||

Spectris (LON:SXS) (£4.08bn | SR58) | Sales £335.6 million, 11% higher on a reported basis and 4% higher on a like-for-like basis. Full year adjusted operating profit to be in line with management expectations. | ||

WPP (LON:WPP) (£3.89bn | SR55) | Q3 revenue down 8.4% YoY. YTD performance at low end of expectations. FY organic growth guidance revised to -5.5% to -8.0%. Strategic review underway. | ||

Computacenter (LON:CCC) (£2.91bn | SR91) | Mindful of uncertain geopolitical and macroeconomic backdrop. Encouraged by progress year to date. Continues to expect full year adjusted operating profit in FY 2025 to be ahead of the prior year. | ||

Drax (LON:DRX) (£2.51bn | SR96) | Agreement to acquire three battery energy storage system ("BESS") projects. Drax to pay £157.2 million in staged payments between 2025 and 2028. | ||

Seplat Energy (LON:SEPL) (£1.8bn | SR95) | “In 9M 2025 we delivered further production growth, underpinning FY2025 guidance, which we narrow to the upper half of the range at 130-140 kboepd.” | ||

Coats (LON:COA) (£1.6bn | SR58) | Coats has completed the acquisition of OrthoLite, the global market leader in premium insoles. Trading through the third quarter at both Coats and OrthoLite is in line with expectations. | ||

PPHE Hotel (LON:PPH) (£594m | SR26) | 5.2% revenue and 2.7% RevPAR growth. Strong occupancy-led and rate performance from UK hotels. Current trading is in line with expectations, outlook unchanged. | ||

Filtronic (LON:FTC) (£311m | SR67) | SP -6% Healthy sales pipeline, increased customer engagement and robust order book leave Filtronic in a good position to meet market expectations for the full year, despite FX headwinds. | AMBER (Graham) This is a standard High Flyer offering little value but plenty of momentum. The SpaceX order in August didn't move forecasts, and forecasts are again unchanged today. The fact that the market is reacting so negatively today to an in-line update is consistent with our view that the valuation is potentially overheated, and the fact that the very large SpaceX order didn't change forecasts shows just how much good news already got priced in here. | |

Essentra (LON:ESNT) (£304m | SR42) | SP -6% Given the strength of Essentra's operations in Turkey, which generate lower margins, overall gross margin was slightly weaker than expected and this is likely to continue. Full year adjusted operating margin now expected to remain consistent with the first half of the year. | BLACK (AMBER/RED) (Graham) Turkey (with its devalued currency) has been strong, but other EMEA revenue streams haven’t been very good. This means that the overall geographic revenue mix has deteriorated, leading to lower overall margins and what I believe is a c. 10% cut to the profit forecast. I might possibly have kept my neutral stance were it not for the fact that the company does carry a net debt position and has been buying its own shares well above the current valuation. Combine those elements with a profit warning, and I think some additional caution is warranted. | |

Empire Metals (LON:EEE) (£243m | SR30) | Gross proceeds of £7 million raised at 40p. “Funds will be used to maintain momentum across key workstreams.” | ||

CLS Holdings (LON:CLI) (£239m | SR39) | New CFO from January 2026. Most recently Commercial Finance Director at SEGRO. | ||

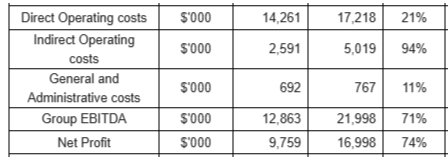

Sylvania Platinum (LON:SLP) (£221m | SR96) | Q1 4E production +16% on Q4 to 24.5koz. Q1 EBITDA +71% on Q4 to $22.0m. Cash +3% on Q4 to $62.7m. | AMBER/GREEN (Mark) | |

Seeing Machines (LON:SEE) (£174m | SR14) | HORUX Latam has ordered a minimum of 1,300 Guardian units for delivery in FY2026. The initial shipment of 600 units is expected to be fulfilled in October 2025. | ||

TT electronics (LON:TTG) (£169m | SR45) | 100 pence in cash, and 0.0028 New Cicor Shares, representing 155p at current share price. 64% premium to last night’s close. |

PINK (Mark) | |

Helios Underwriting (LON:HUW) (£158m | SR49) | 3.052m shares repurchased at 238p (3.9% of capital), excess tenders scaled back. | ||

Solid State (LON:SOLI) (£81m | SR40) | Initial order valued at US $10.8 million under Project CAIN, a major defence programme, scheduled for delivery in the first half of 2026. | ||

Orosur Mining (LON:OMI) (£78.9m | SR27) | Three drill holes hit mineralisation: PEP065 - 33.3m @ 2.84g/t Au, PEP065B - 33.8m @ 2.79g/t Au, PEP066 (met hole) - 112m @ 5.25g/t Au from surface. | ||

Cavendish (LON:CAV) (£39.7m | SR83) | Revenue +3% to £28.5m, Adj. PBT +5% to £2.0m. Cash £19.8m (24H1: £17.2m), Adj. EPS flat at 0.4p, Interim dividend held at 0.3p per share. Solid start to the second half, with a pipeline of both public and private transactions. | AMBER/GREEN (Mark) | |

iomart (LON:IOM) (£24.4m | SR46) | H1 Revenue +25% to £77.7m, incl £21.7m from acquisition of Aztech, 10% organic decline in revenue. H1 Adj. EBITDA -25% to £12.7m. Adj. LBT £2.3m (24H1: Adj. PBT £4.3m). Net debt £109.5m (31 Mar: £101.9m). Expects improved H2 performance in line with current market expectations due to cost savings. Further cost savings to come. | ||

Rome Resources (LON:RMR) (£21.9m | SR17) | Combined Inferred Mineral Resource:10.6 kt Sn | 46.9 kt Cu | 86.2 kt Zn | 1.46 Moz Ag | ||

Bezant Resources (LON:BZT) (£17.6m | SR49) | PFS for Hope and Gorob mining project indicates NPV10 of $46.2m. No sensitivity analysis given for a more reasonable discount factor. | ||

Provexis (LON:PXS) (£14.5m | SR14) | Revenue +61% to £1.29m, u/l Op. Loss £278k (FY24: £469k). Cash £708k but this is 31st March. No up to date cash figure given, but flags the need for further equity or debt. |

Graham's Section

Essentra (LON:ESNT)

Down 6% to 100p (£285m) - Q3 2025 Trading Update - Graham - AMBER/RED

A Q3 update:

Essentra plc, a leading global provider and manufacturer of essential components and solutions, today issues a trading update for the third quarter, covering the thirteen weeks ended 27 September 2025

This company rarely gets mentioned here - the last time was in August 2023, when the share price was 155p and I was neutral.

It seems to offer at least 45,000 different products - everything from caps and plugs to locks, latches and hinges, and fasteners and fixings.

Revenue and orders are growing:

Revenue +5.9% at constant currency, on a like-for-like basis.

New order intake +5.6%, Softer trading in July and August, and then September returned to the levels of Q2.

But within that, trading in EMEA (Europe, Middle East & Africa), excluding Turkey, seems to be problematic:

Consistent with H1 2025, EMEA revenue performance during the period was mixed. The region returned to year-on-year growth against soft prior-year comparatives, further supported by a strong relative performance in Turkey, which continues to benefit from faster-growing end-markets, the implementation of pricing initiatives and local currency devaluation. EMEA ex-Turkey experienced subdued demand across the quarter, particularly in higher margin UK and Western European geographies. The Americas maintained its year-on-year growth momentum, delivering revenue in the period in line with Q2 levels.

Note that Turkey “benefited” from currency devaluation - but is this really a benefit? Turkish inflation is running at around 33%. Is it really a good thing to get paid in a devalued currency?

Leverage: expected to remain within the medium-term target range of 0.5x-1.5x, which strikes me as a pretty reasonable range.

Outlook

It turns out that weak profit margins in Turkey are an issue:

Given the strength of Essentra's operations in Turkey, which generate lower margins compared to the rest of EMEA, the Group's overall gross margin was slightly weaker than expected in the period and this effect is likely to continue into the final quarter of the year. As such, management now anticipates that the full year adjusted operating margin will remain consistent with the first half of the year.

But I don’t like how this is phrased. It reads as if the company’s strength in Turkey is the problem, when actually the problem is that other EMEA revenue streams haven’t been very good. This means that the overall geographic revenue mix has deteriorated, leading to lower overall margins.

Checking the H1 result, I find an adjusted operating margin of 10.8% (down from 13.7% in H1 2024).

In the medium-term, they are targeting c. 18% by 2030. They still have time to achieve this - but it’s ambitious.

For the current year I would pencil in adjusted operating profits of about £32m, after applying the H1 profit margin to the current-year revenue forecast. While I don’t currently have access to a broker note, I believe that this is a cut of about 10% to forecasts.

Graham’s view

Adding insult to today’s profit warning, I note that the company has been buying back its own shares since March 2023. In the interim results, they disclosed that they had spent nearly £30m on this, at an average share price of 173p (today’s share price: 100p).

The 3-year chart:

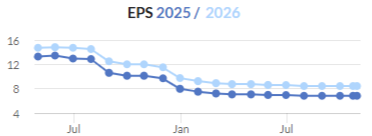

The question for me is whether I should leave our stance on this at AMBER, or downgrade it to AMBER/RED. On the basis that profit warnings tend to be followed by more profit warnings, I will cautiously downgrade it today, noting that its EPS forecasts have tended to follow a downward trend:

I might possibly have kept my neutral stance were it not for the fact that the company does carry a net debt position and, as I’ve just noted, has been buying its own shares well above the current valuation. Combine those elements with a profit warning, and I think some additional caution is warranted.

Filtronic (LON:FTC)

Down 6% to 132.9p (£292m) - AGM Trading Statement - Graham - AMBER

Roland was neutral on this in August, despite the announcement of a large SpaceX order ($62.5m).

His caution is apparently justified for the time being, as the share price now is lower than it was then.

Year-to-date chart:

Today’s update reads fine, but the market isn’t impressed - the curse of high expectations and a high valuation, which means that “in line” sometimes isn’t enough.

Key takeaway from this AGM statement:

Overall, the Group's healthy sales pipeline, increased customer engagement with both new and existing clients across key markets and robust order book leave Filtronic in a good position to meet market expectations for the full year, despite headwinds from weakness of the US dollar against sterling.

They remind us of the SpaceX order, “for the company’s next-generation proprietary Gallium Nitride E-band product, the first major order utilising this technology”.

I don’t understand much of this, but the point of the product is to enable very fast communications with “more power and lower energy loss, which is critical to technological advancements in satellite communication”.

Teasing us with the potential for more good news, Filtronic notes that “collaboration between the two companies [i.e. with SpaceX] has also broadened into new areas.”

More GaN-related products are due to be launched in 2026.

And there is broad optimism for the future:

Over the longer term, customers are expressing a growing need for high-frequency, secure, and resilient communications infrastructure across many platforms which provide the Group with supportive structural growth drivers across its key markets. We believe we have exciting products and capabilities to match this growing need.

Estimates: thanks to Cavendish for publishing on this today and reiterating that they expect FY May 2026 revenues of £54m and adj. PBT of £8.3m. For FY 2027, they forecast revenues of £60m and adj. PBT of £10m.

Graham’s view

I have a well-ingrained value bias, so it’s tricky for me to get behind a £300m+ valuation for Filtronic.

This is a standard High Flyer offering little value but plenty of momentum:

Referring back to Roland’s analysis of the SpaceX order in August, he observed that it was unclear at the time whether the new order was included in estimates for FY May 2027.

I do now have a Cavendish research note from August that commented on this - and it left both FY 2026 and FY2027 estimates unchanged. Cavendish said simply that “the latest order provides a good level of visibility for FY27E”.

While Filtronic’s MomentumRank is still strong, I do think its momentum score could come under pressure after today’s update and sell-off. A High Flyer with weakening momentum can be a dangerous place to invest.

While I admit that my value bias is very strong, and I often miss out on exciting growth companies, I do think that our ongoing caution is justified here.

Mark's Section

TT electronics (LON:TTG)

Up 58% at 150p - Recommended Offer for TT Electronics Plc - Mark - PINK

When I took a detailed look at TT’s Half-Year report at the end of September, I kept our neutral view, saying:

If they do hit forecasts, then they look cheap, especially as the H2 momentum will carry into next year. The debt reduction means that the risk of solvency issues is also decreasing, but remains a possibility if the NA turnaround is not successful or other regions face issues. Given that there is still work to do to make their NA operations break-even and hence turnaround the group finances, I am going to keep our neutral AMBER rating. However, I can see what may attract an acquirer or shareholder with a long-term view.

Perhaps I should have been a little braver as it was clear that industry players were sniffing around here; when Volex made a cash and shares offer priced around 140p in November last year, the board rejected a higher offer saying:

The TT Electronics Board also announces that it has recently received and rejected an all-cash indicative proposal from another party at a significantly higher value than the Volex Proposal. There are no ongoing discussions with this party.

Today’s offer is higher, but like the possible Volex bid, it is not all in cash, being 100p in cash plus 0.0028 New Cicor Shares. The company calculates that this represents a 155p offer at the last close of Cicor shares, and 150p at the three-month VWAP for the acquiror.

Cicor Technologies is a Swiss-listed electronics designer and manufacturer with a focus on PCBs, hybrid and printed circuits. They had a £864m market cap at last night’s close. However, you can see why they may be keen to make an acquisition using their equity rather than an all-cash offer; their share price has gone up 4x this year:

The algorithms rate Cicor a High Flyer with an 88 StockRank:

This may give TT holders reason to want to hold Cicor equity. However, while their EPS has been rising, it has gone up nowhere near as fast as their share price this year:

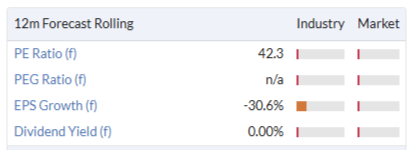

This puts them on a very punchy rating:

Although perhaps one that is justified if they can keep their historical mid-20’s percentage EPS growth rate up in the medium term. However, this is perhaps not the type of investment that TT holders are looking for where the metrics looked like this at yesterday’s close:

So far, the Swiss market thinks that Cicor are getting a good deal with the shares up a couple of per cent in early trading. This is the opposite to when Volex mulled an offer, where the market marked their shares down by around 15%. Given the size of the premium…

· a premium of approximately 64 per cent. to the Closing Price of 95 pence per TT Share on 29 October 2025 (being the Latest Practicable Date);

· a premium of approximately 53 per cent. to the volume-weighted average price of 102 pence per TT Share for the three-month period ended 29 October 2025 (being the Latest Practicable Date); and

…I suspect this will be a done deal, despite them only having approximately 10% irrevocable undertakings so far. They say there will be a “Mix and Match Facility” which will allow shareholders to “vary the proportions in which they receive New Cicor Shares and cash in respect of their TT Shares.” However, taking more cash would require other shareholders to prefer a greater proportion of Cicor shares. This will likely only be attractive to those with large amounts of capital gains to shield and given the long-term TT share price chart, there will be very few of those holders!

Mark’s view

This looks a good deal for shareholders given the size of the premium on offer. That the Cicor share price has held up will strengthen this offer. There may be the option of receiving a greater proportion of cash, but given the high rating of Cicor shares I wouldn’t bank on it. Individual investors who don’t want to hold a Swiss “High Flyer” can get around 150p to sell in the market in cash. This is still a very nice premium versus recent prices. If I’d been brave enough to hold, I think that’s the option I’d take today.

Cavendish (LON:CAV)

Up 5% at 10.7p - 2026 Interim Results - Mark - AMBER/GREEN

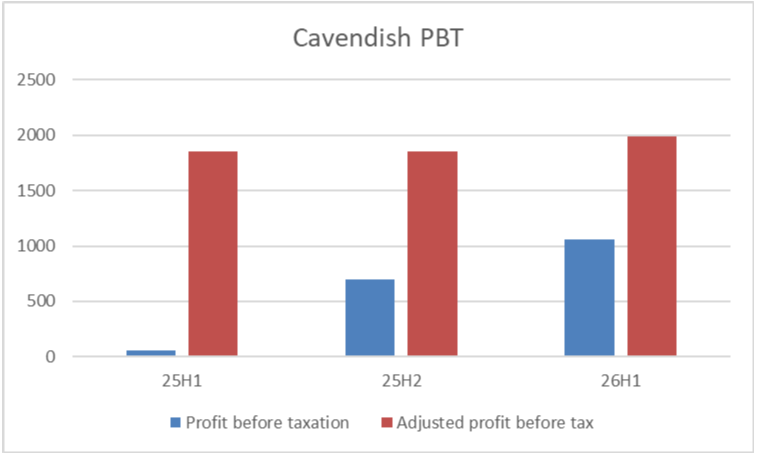

Cavendish gave us a Half-year trading statement at the start of the month, but it didn’t really tell us much. The title of that statement, “Profitable first half”, left a very wide range of outcomes! In terms of revenue, today’s £28.5m reported figure comes in slightly ahead of their £28m guidance, although this is still only 3% up on last year’s H1.

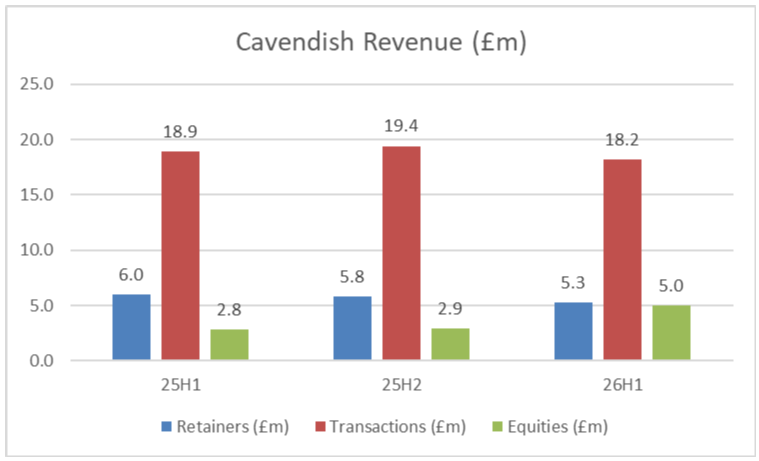

In the trading statement, they said their revenue was “underpinned by continued equity issuance in the public markets and a steady flow of private M&A mandates.” While Transactions remain their biggest source of revenue by quite some margin, this doesn’t really seem to be the full story in this half year:

Retainers continue their slow decline (no doubt driven by takeovers and delistings). Transactional revenues are down, and it is a strong performance from their equities division (mainly market-making). They don’t give a lot of detail on this, merely saying this “reflects better market conditions coupled with the strength of our experienced team and disciplined capital management.”

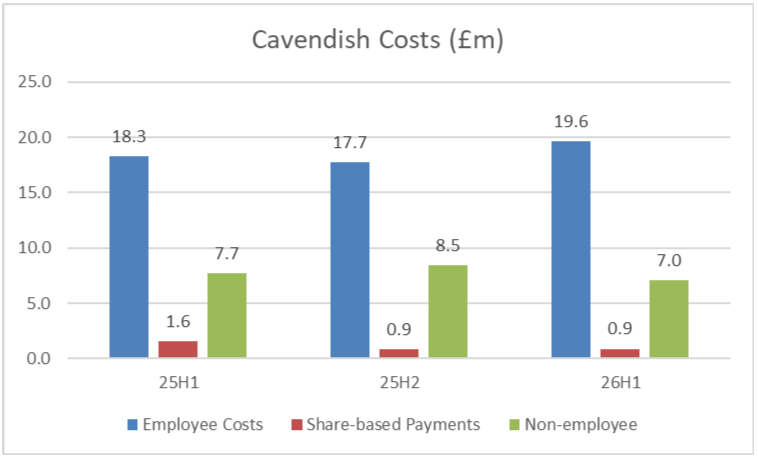

Profitability is aided by lower Shared-Based Payments and tight control on non-employee costs:

I guessed that Adj. PBT would be around £1.9m, so this comes slightly ahead of that guesstimate. The gap between Adjusted and Statutory figures is narrowing, which is good to see. (This half saw just 36k of exceptionals, compared to over £200k per half for the previous year.) However, share-based payments are removed from the adjusted figures, and the gap remains large due to this:

At the very least, I think investors should be using the 358m diluted share count, not the 338m basic share count, in any valuation.

Balance sheet

They choose to highlight that net cash has risen:

Cash balances at 30 September 2025 of £19.8m, an increase of 15% vs the same date last year (H1'25: £17.2m)

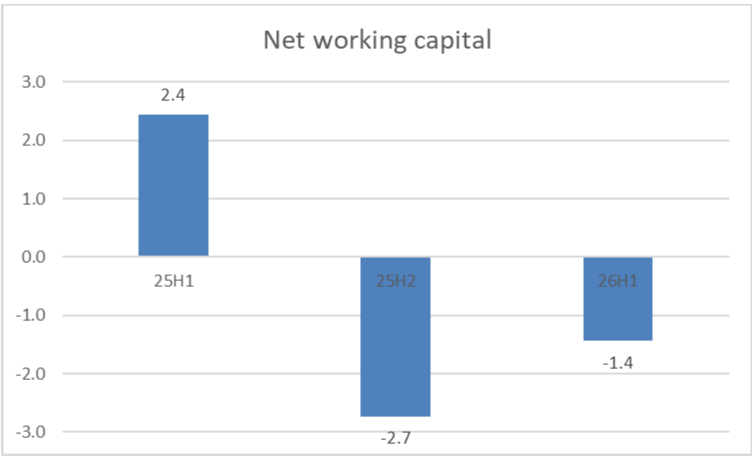

However, this glosses over the fact that the balance has declined from the year-end when it stood at £21.2m. It is also notable that working capital swings have been favourable to the tune of £3.8m since last year (I’ve included current assets/liabilities held at fair value in here as these tend to be securities held as part of their market-making activities):

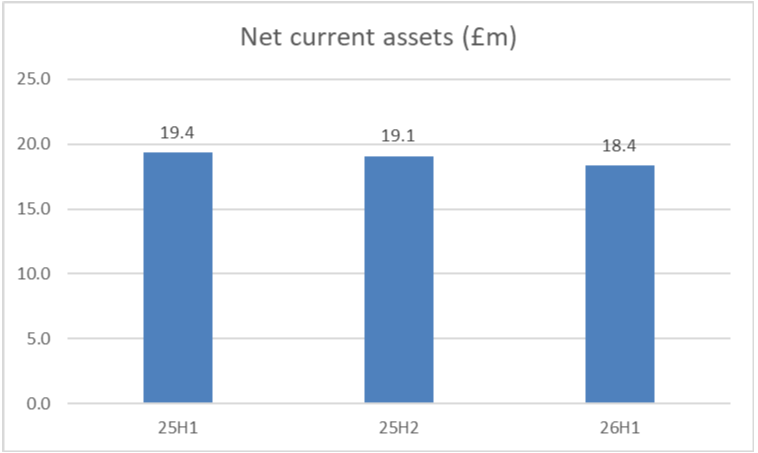

Receivables are up, but payables are up even more. There is no note explaining what these are, but they can often include bonuses that are accrued but paid after period end. Overall, net current assets declined slightly:

The other factor they don’t mention is that a chunk of that cash will be held as regulatory capital and will not be distributable, even if it reflects cash levels throughout the year.

Overall, the balance sheet looks in reasonable shape, and I don’t see any cause for concern on the solvency front. However, without them providing any guidance on what average cash balances are and what their regulatory capital requirements are, I’m not sure we should be using the cash balance to make valuation judgments.

Valuation:

There is a weird phenomenon where listed brokers tend to lack breadth of broker research. This is because they can’t write research on themselves, and they don’t want to pay a competitor to write it. The way around this is for them to commission a third-party research provider, which, in Cavendish’s case, is Hardman. Following these H1 results, they forecast 0.83p EPS for the full year, with 0.8p paid out as a dividend, saying

Following the interim results, we have made only modest tweaks to our numbers. Revenue for FY’26E comes down from £58.3m to £55.6m, but costs fall too from £57.0m to £54.2m, leaving reported PBT slightly improved at £1.4m (£1.2m) and adjusted net income down from £3.1m to £2.8m (the adjustment – share-based payments – is lower) leading to fully diluted EPS of 0.33p.

This works out to be around 13x earnings, not particularly cheap for this type of business. Especially as we need to make our own adjustments for dilution, or choose to include the SBP charge. Things look better for FY27, where Hardman also only make tweaks to their forecasts:

For FY’27E, the changes are similar: revenue comes down from £63m to £60m, but costs fall too from £59m to £56m, leaving reported PBT unchanged at £4.0m and adjusted net income down from £5.2m to £5.1m, leading to fully diluted EPS of 0.94p.

This works out to be 1.51p underlying EPS and 0.9p dividend for FY27. This is more like a 7x P/E and an 8% yield, making them look much better value (although, again tempered by any dilution). As Hardman are keen to point out, their figures are highly sensitive to the revenue and costs assumptions made.

Outlook:

Many UK investors will already be aware of these trends:

There are encouraging indications that sentiment toward UK equities may be gradually improving. During the period, the FTSE 100 reached record highs, and since the reversal of the 'Trump tariffs,' the UK has ranked among the best-performing global equity markets. We are also seeing anecdotal evidence of increased allocations from global investors into the UK, initially directed toward the largest and most liquid companies. However, this trend has yet to extend meaningfully to small and mid-cap equities, where valuations remain highly attractive in the context of long-term trends.

They also mention uncertainty due to the upcoming budget as a significant factor. Overall, I think there are reasons for medium-term optimism, but short-term risks.

Mark’s view

The shares aren’t particularly cheap on this year’s earnings, and I don’t think investors can rely on the reported cash balance being either the normal position during the year nor distributable in order to use Enterprise Value measures. While these are nowhere near the boom times, there are signs that equity issuance has returned to the small-cap market. However, this is offset by a lack of IPOs and a continuing trend for takeovers and delistings, which are harming longer-term prospects.

This means the near-term investment case largely hinges on investors’ views of FY27. Those who expect the strength of UK large cap shares to trickle down to the smaller end of the market, with a subsequent return of high-fee-generating IPOs, will see significant value here. However, those who think that the upcoming budget will cast a longer shadow on UK market sentiment will struggle to see any near-term upside from the current valuation.

Personally, the current malaise in UK small caps has gone on far longer than I ever thought possible, so perhaps I am not best placed to judge exactly when we will see a return to boom times. However, it seems likely that sentiment will return at some point; while market conditions may change, investor psychology remains the same. When IPOs and equity raises for growth capital return in force, Cavendish will no doubt be a big beneficiary, so it makes sense to maintain our broadly positive view of AMBER/GREEN.

The Stock Ranks largely back us up on this with a strong 83 Rank overall. The modest and declining Momentum Rank underlines the questions over timing:

Sylvania Platinum (LON:SLP)

Up 1% at 86p - First Quarter Operations Report - Mark - AMBER/GREEN

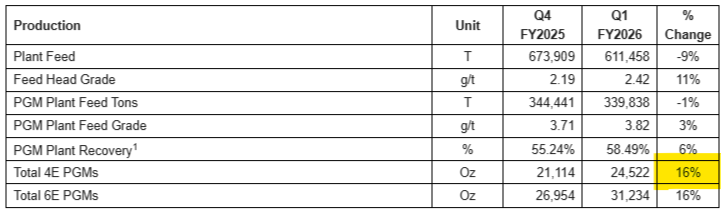

Plant feed is down, but grade improvements and higher recovery sees them increase production by an impressive 16% quarter-on-quarter:

This is 29% of the mid-point of their full year guidance so this is an encouraging start:

Following an impressive quarter, guidance for FY2026 remains unchanged at 83,000 to 86,000 4E PGM ounces with chromite concentrate target of 100,000 to 130,000 tons.

Although this announcement is billed as a production report, Sylvania have always produced quarterly financials as well, which helps assess the investment case. EBITDA has increased materially:

Group EBITDA for the Quarter from SDO rose to $22.0 million (Q4 FY2025 $12.9 million), which is a significant 71% increase quarter-on-quarter. The increase is mainly due to higher production and the increased PGM basket price during the Period.

This combination of a 4E basket price some 20% higher in US Dollars at $1,953/oz, with the higher production, transforms their profitability. Although costs are also on the rise, also driven by the commissioning of their Chrome/PGM JV, the net profit impact is still significant:

However, that big rise hasn’t positively impacted the cash balance which is only up 3% quarter-on-quarter to $62.7m from $60.9m. These are the reasons:

Tax-related outflows: $1.2m net

Capital outflows: $4.3m Thaba JV, $3.7m sustaining/improvement, $0.1m exploration.

Additional JV loan: $4.3m contributed to Thaba JV partner loan.

Share buybacks: $0.7m (employee and tax-related).

Net working capital outflow: $7.6m

FX impact: $0.8m profit from ZAR appreciation vs USD.

Several of these should be timing-related, but it is a reminder that EBITDA isn’t always a great measure for companies such as this.

The other big question is, if the share price chart looks like this, is the big rise in PGMs already in the price?

After all, this is a $300m market cap company and if we annualise Q1’s Net Profit we get $68m for the full year which is 4.4x earnings or 3.5x on an EV basis. This is still reasonable value compared to many companies in the market. However, it wouldn’t stand out compared to say, Tharisa Mining. Plus, this is a company that has traded at 1xEV/FCF in the past PGM boom.

The big factor here is that the current spot price which I calculate is probably around R40k/oz.

Overall, my model suggests that future quarters are not as good due to the lower production guidance. Still, this is trading on a forward P/E of around 6. What this doesn’t include is any contribution for the Thaba JV, which seems hard to quantify at the moment, but will not be immaterial. Plus the Q1 production suggests that we could see an upgrade in SDO production guidance later in the year if everything goes well operationally.

Mark’s view

Modelling the impact of higher PGM prices means that the forward rating is modest here, despite a recent share price rise. On top of this should be contributions from their Thaba JV and the chance of increased production guidance. However, the current forward rating, even on recently much-improved PGM pricing, doesn’t stand out in the sector and is actually higher than it was during the last PGM boom. Given that the multiple is in single figures and it remains a SuperStock it makes sense to keep our mostly positive view, tempered by the usual risk warnings that come with the sector/geography.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.