Good morning!

It's Mello London this week, and several of us will be there! If you are thinking of going, I believe a few tickets are still available - we have been given a 25% discount code: STOCKOPEDIA25. This will make a 1 day ticket £74.25 (instead of £99) or a 2 day ticket £126.75 (instead of £169).

Tickets can be bought here and the programme is here.

Spreadsheet accompanying this report: link (last updated to: 10th November)

12.30: Today's report is now complete. Thank you for reading and commenting; we hope to see some of you at Mello over the next couple of days!

Companies Reporting

| Name (Mkt Cap) | RNS | Summary | Our View (Author) |

|---|---|---|---|

DCC (LON:DCC) (£4.9bn | SR91) | Will return £600m by acquiring up to 11,952,191 shares (c.12.3% of sharecount). Shareholders invited to tender in a pricing range of £50.20 to £53.20 per share. | ||

HICL Infrastructure (LON:HICL) (£2.26bn | SR74) | Renewables Infrastructure (LON:TRIG) will be wound up and shareholders will receive new HICL shares and/or cash. Offer valued at approx 0.714173 HICL shares for each TRIG share. Combined group will target 9p | PINK (AMBER) (Roland - I hold TRIG) | |

Ninety One (LON:N91) (£1.98bn | SR95) | AUM +19% to £152.1bn w/ net inflows of £4.3bn (incl. Sanlam UK). Adj op profit +12% to £98.8m, interim dividend +11% to 6.0p. | GREEN (Graham) [no section below] Roland covered the last set of full-year results from N91 here. Today’s interim results highlight continued inflows and growth, plus there has been a marginal increase in the percentage of N91 stock held by employees, which has ticked up slightly to 32.7% (previous results: 32.6%). This is quite unusual when it comes to listed fund managers: in my view, it is undoubtedly a positive and is also going to be a factor when it comes to dividend decisions. This year, we have a 13.2p dividend forecast vs. 17.6p EPS forecast, with a yield on the current share price of over 6%. N91’s founder remains in position as CEO. On balance I am inclined to take a more positive stance on this one, noting that (like Polar Capital) this is a Stockopedia Super Stock, and its key differentiation is its focus on international/emerging markets. | |

Sirius Real Estate (LON:SRE) (£1.50bn | SR82) | Rent roll +15.2% to €242.5m, EPRA NTA per share -1.4% to 115.94c. PBT down 6% to €57.5m due to forex loss, EPRA EPS -28.8% to 2.84c.Outlook: trading in line with exps. | ||

Genuit (LON:GEN) (£885m | SR67) | PW: Rev +7.1% in 4mo to 31 Oct (+3.7% LFL). Seeing “subdued market conditions”. Now expect FY adj op profit to be £92m to £95m (prev. consensus £95m to £99m). | BLACK (AMBER) (Roland) I’m going to take a chance and remain neutral on this plumbing and ventilation business (formerly Polypipe). The stock has de-rated significantly over the last year, despite the company only reporting a small decline in 2024 profits. Today’s downgrade is similarly small at under 4% and the company’s commentary doesn’t seem too alarming to me. The risk is that Budget uncertainty is being used as an excuse and that further downgrades will follow. However, as things stand management appears confident of improved profitability in H2 and stable (adjusted) profits this year. On a P/E of 13, I think our neutral view can still be justified. | |

Polar Capital Holdings (LON:POLR) (£557m | SR99) | AUM +25% to £26.7bn, with net outflows of £690m during the period. Core op profit down 8% to £25.1m, adj EPS -8% to 21.9p. Outlook: market uncertain but Polar is “well positioned”. | AMBER/GREEN (Graham) I retain my very positive impression of this fund manager and its capabilities, but I’m not more positive on it now than I was in July, at a lower share price. The StockRank is 99: let’s hope the momentum lasts, especially in the tech sector which accounts for more than half of Polar’s AUM. | |

Gulf Keystone Petroleum (LON:GKP) (£381m | SR60) | First lifting of Kurdistan crude produced by GKP and other IOCs has been completed in Turkey from the Sept/Oct pipeline allocation. Payment is expected within 30 days. | ||

Metals Exploration (LON:MTL) (£360m | SR97) | On Friday 14 November, mains power was restored to the Runruno site, earlier than forecast. There was a five day pause in gold production. | (Graham) [no section below] | |

Stelrad (LON:SRAD) (£216m | SR93) | SP -12% | BLACK (AMBER) (Roland) [no section below] This is one of two profit warnings from companies in the building materials sector today (see Genuit, above). Stelrad, which is a leading manufacturer of radiators, warns us that “ongoing RMI [repair, maintenance and improvement] and new build” activity has “remained subdued since the half year”. The company is taking measures to manage costs and focus on higher added value products. This is expected to result in an increased contribution per radiator relative to last year, but won’t be enough to fully offset a decline in volumes. As a result, profit guidance has been trimmed slightly today. The company notes that leverage is still expected to fall this year and my sums suggest the shares are probably trading on 10-11x forecast earnings after today’s downgrade. I’ve previously had a broadly positive view of this business, which has CEO ownership and strong quality metrics. Despite today’s (slight) downgrade I’m struggling to be too negative, so I’m going to take a chance and retain our previous neutral view today. | |

Jubilee Metals (LON:JLP) (£95m | SR47) | South African Competition Tribunal has unconditionally approved the sale of the South African Chrome and PGM Operations to One Chrome. Approval of the South African Reserve Bank is still required. | ||

Batm Advanced Communications (LON:BVC) (£55m | SR74) | Received an order for its 10G Carrier Ethernet and aggregation solutions. The order is worth $670k and is to be delivered in the current year. | ||

James Cropper (LON:CRPR) (£32m | SR90) | Full year expectations for adjusted EBITDA are unchanged. H1 revenue +3.7% to £51.8m and adjusted EBITDA +52% to £4.1m. Trading since the period-end has been “robust”. FY March 2026 revenues anticipated at similar levels to FY25. - FY26E adj EPS: 34.1p (prev. 26.5p) | AMBER (Roland) [no section below] In July, Mark took a neutral view on Cropper's FY25 results and noted that “the good part of the business continues to subsidise the poor part”. We see that again in today’s half-year results, with revenue down slightly on flat volumes in the paper business, which generated a reduced loss of £0.7m (H1 25: £(1.0)m). This legacy business drags on the faster growing and profitable Advanced Materials business, where H1 revenue rose by 13.4% to £19m and adjusted EBITDA climbed 34% to £5.5m. | |

Cirata (LON:CRTA) (£25m | SR2) | $6.7m, 3-year Data Integration software contract with IBM for a financial services customer, under IBM's existing OEM sales agreement for the Big Replicate platform. | ||

Cordel (LON:CRDL) (£14m | SR34) | Contract with V/Line for an eight week data capture program on the V/Line Northern and Western Corridors (820kms of mainline track and passing loops). | ||

Eden Research (LON:EDEN) (£12m | SR21) | The temporary approval in Italy enables Eden to sell Ecovelex while waiting for full EU-wide authorisation. | ||

IXICO (LON:IXI) (£10m | SR42) | Contract with a global pharma company to provide imaging services for Phase 3 clinical trial in Huntington's Disease (HD). Value: >£3.5m over four years. |

Graham's Section

Polar Capital Holdings (LON:POLR)

Unch. at 544.5p (£548m) - Interim Results - Graham - AMBER/GREEN

We already had the Q2 AUM update (to September) last month, which showed that Q2 net flows were close to breakeven. Overall, AUM rose very nicely due to market movements/fund performance.

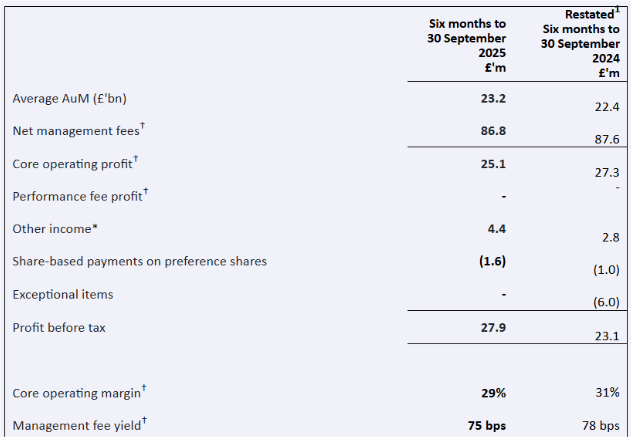

Today’s interim results show us how the AUM progression translated into profits:

“Core operating profit” down 8% to £25.1m

PBT +21% to £27.9m

Noteworthy that statutory PBT rose while the company’s preferred measure of adjusted earnings fell (“core operating profit”).

It’s all explained here:

In summary:

Erosion of management fee yield leading to lower management fees this year.

Also, higher operating costs in H1 this year (£61.7m vs. £60.3m).

But there are no exceptional items (£6m in H1 last year), so we get a cleaner conversion into PBT.

Personally, I tend to place a high emphasis on clean accounts, so I’m happy enough with this year’s H1 result. But it’s also a perfectly valid choice to ignore last year’s impairment charge and say that last year’s result was better.

New CEO comment: points out that the H1 outflows were concentrated in Q1 and included one particularly large outflow:

While industry headwinds persisted and we recorded net outflows of £690m, alongside a £280m one-off return of capital following an investment trust corporate action - these were heavily weighted in the first quarter. Second quarter net outflows were £58m versus £632m in the first quarter….

They remain ambitious:

Looking ahead, the macro environment is uncertain and likely to remain volatile, but our plan is clear: scale where we are strongest, apply targeted fixes where needed, diversify selectively, and leverage distribution - particularly in the US. The environment is unpredictable, but our focus is on converting gross demand into durable net flows and maintaining margin discipline.

Tech exposure

Mark made some good points on this one last time, including the risk that a tech sector sell-off could make life difficult for Polar.

This H1 report acknowledges that Polar’s “meaningful technology exposure was a significant tailwind”.

The “Technology” strategy is responsible for 51% of Polar’s AUM, ahead of Healthcare (14%) and EM/Asia (13.5%).

And in probably the most bullish/speculative sector of the market - artificial intelligence - Polar’s funds have built significant exposure:

…early, high-conviction exposure to AI supported strong absolute and benchmark-relative returns from the Polar Capital Global Technology Fund, Polar Capital Technology Trust plc and Polar Capital Artificial Intelligence Fund, all rebounding sharply after a weak first quarter.

This has helped to generate good performance:

Across the Polar Capital UCITS fund range, which represents 75% of the Group's total AuM, 68% of AuM is in the top two quartiles of the appropriate Lipper peer group over one year to 30 September 2025. 67% of AuM is in the top two quartiles over three years, 85% over five years and 100% since inception.

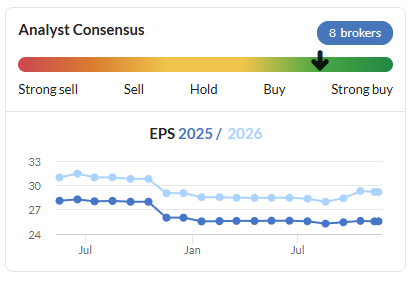

Estimates

Paul Bryant at Equity Development has published a lengthy piece this morning on Polar. With the company enjoying higher average AUM than previously expected, he raises his revenue forecast for FY26 from £27m to £28.4m, and for FY27 from £28.9m to £30.3m.

The PBT forecast for FY26 moves from £71.2m to £76.9m, and for FY27 from £70.2m to £78.2m.

Mr. Bryant is forecasting “small positive flows” in FY27, with net flows building gradually after that. Of course the evolution of AUM is the key unknown variable here, and very difficult to predict - a combination of investor sentiment, Polar’s performance and macro market movements.

Based on the FY26 EPS forecast, the stock is currently trading at 9.3x earnings. In terms of forward PER, it currently seems to be trading at around the same level as IPX, but more expensively than LIO.

It’s cheaper than ASHM, but that’s a special case where ASHM has enormous balance sheet value.

Polar’s balance sheet has £126n of net assets, with no intangibles. Nearly all assets are “current”.

Graham’s view

This is the bit where I have to decide if the stock is worth an upgrade to our stance, considering it has a 99 StockRank:

I’m going to let the value investor in me say no, it’s not worth an upgrade.

What’s holding me back is that Polar’s growth has been market-driven, rather than driven by flows.

And the market growth it has enjoyed is in the areas where I’m currently most nervous about valuations and the long-term outlook.

Let’s put it this way. If flows had been stronger this year, and AUM had been held back only by poor stock market returns, then I’d be looking forward to a stock market recovery to boost performance.

Instead, we have neutral/weak flows which have been camouflaged by surging tech sector valuations.

Don’t get me wrong: I still have a very positive impression of Polar, and I don’t regret putting it on my 2025 watchlist.

The last time I reviewed this stock, I was AMBER/GREEN on it, in July (at a share price of 466p).

With the share price currently at 544p, I still like the story, but I’m not more positive on it now than I was in July, at a lower share price.

Roland's Section

HICL Infrastructure (LON:HICL) & Renewables Infrastructure (LON:TRIG)

HICL: Down 8.9% at 107p (£2.06bn) - Combination of HICL and TRIG - Roland - PINK (AMBER)

TRIG: Up 2.6% at 74p (£1.77bn) - PINK (AMBER)

(At the time of publication, Roland has a long position in TRIG.)

Renewable energy investment trusts have had a difficult time over the last couple of years, thanks to a combination of falling power prices and unfavourable wind conditions in the UK. At the same time, their ability to raise funds for new projects has been severely limited by the persistent discount to net asset value of their shares – a legacy of the return to normal interest rates in 2022/23.

Against this backdrop some funds – like TRIG – have been buying back shares and selling selected assets in order to try and bolster their balance sheet and narrow their shares’ discount to NAV. However, this has also amounted to a slow-motion liquidation process and has not really addressed any of the underlying issues, in my view.

Some of the big dividends in this sector have come under strain as a result of this situation. While I think TRIG has been quite well run, with decent assets, my impression is that dividend affordability has become very stretched this year. Given this, I’m not entirely surprised to see TRIG as the target of a consolidation deal today.

HICL - TRIG combination

Today’s deal will see TRIG combine with HICL Infrastructure, which is one of the oldest and largest listed infrastructure investment trusts on the London market.

This transaction is billed as a merger, although I can’t help feeling that it’s closer to a takeover for TRIG. Let’s take a look at the main points:

Transaction will create the UK’s largest listed infrastructure investment company, with net assets “in excess of £5.3bn”;

Combined business will have an initial dividend target of 9p and will target NAV total return of over 10% “over the medium term”;

TRIG will be wound up, with TRIG’s assets transferred to HICL in exchange for new HICL shares and up to £250m in cash;

HICL and TRIG are both managed by InfraRed Capital Partners and InfraRed will continue to manage the combined business;

InfraRed’s parent company, SunLife, has agreed to purchase £100m of shares following the completion of the combination.

Transaction is expected to complete in Q1 2026

How much will TRIG shareholders receive?

TRIG shareholders will receive new shares and will have a partial cash option of up to £250m, priced at a 10% discount to the 30 Sept 25 TRIG NAV of 109.7p per share – so the cash option will be priced at c.98.7p;

New HICL shares: will be issued on a formula asset value-for-formula asset value basis, using the Sept 25 NAV of each stock to determine the exchange ratio (remembering that both trade at substantial discounts to NAV);

As things stand, we are told that an illustrative exchange ratio would be approximately 0.714173 HICL shares for each TRIG share;

At the time of writing, that implies a value of 77.6p per TRIG share

Dividend cut?

We are told the combined business will target a 9p per share annual dividend. Does this represent a dividend increase or reduction for either party?

HICL currently pays a dividend of 8.25p per share, so its existing shareholders can reasonably look forward to a c.9% pay rise;

TRIG currently pays a dividend of 7.5p per share. However, we need to offset the increased per share payout from the new HICL shares with the reduced number of shares former TRIG shareholders may own.

All else being equal, my sums suggest former TRIG shareholders may see a c.14% reduction to their annual dividend income.

E.g. 1,000 TRIG shares today would pay c.£75 in annual dividends. If they are exchanged for 714 new HICL shares at the ratio above, they will pay around £64 in dividends annually.

Roland’s view

As a TRIG shareholder, my impression this year has been that asset sales have been slower than planned, leaving the company unable to repay its group-level credit facility as quickly as hoped for.

This has left dividend cover looking marginal at best, due to lower-than-hoped-for cash flows from its wind farms.

The likelihood that TRIG shareholders will face a dividend cut following the merger seems to be a recognition of this, in my view; HICL’s payout was expected to be covered comfortably this year, while TRIG’s was not.

While this might be disappointing for TRIG shareholders, I can’t really argue with this – the payout was beginning to look unaffordable, in my view.

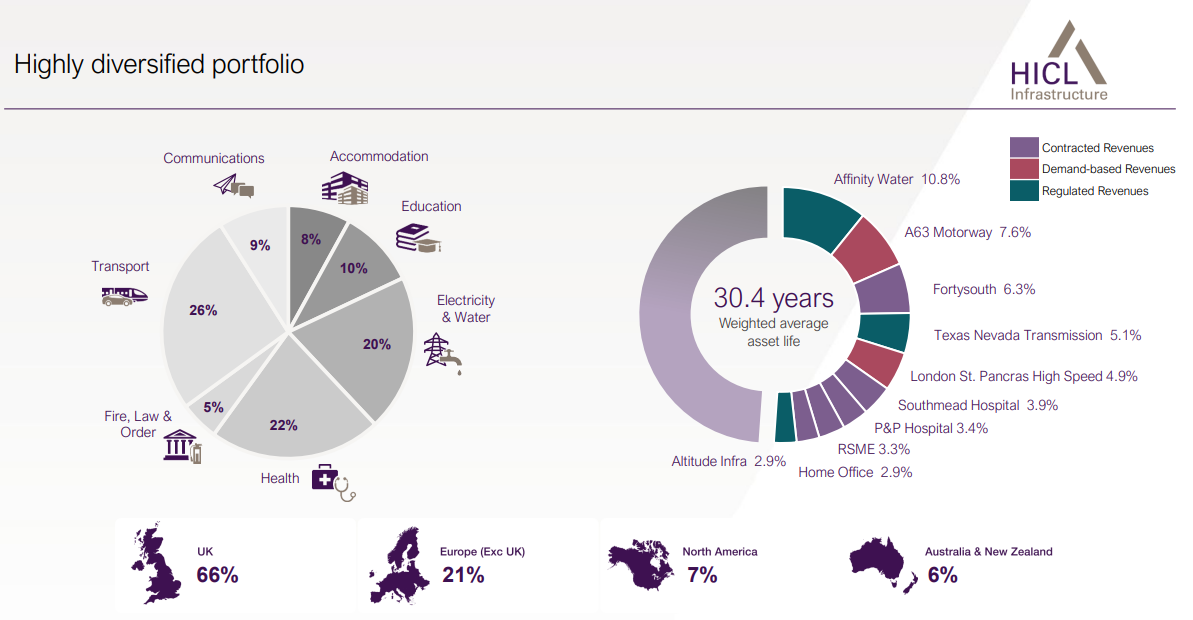

Combining TRIG with HICL looks like a logical move to me. HICL’s more diverse portfolio of infrastructure assets means adverse trends in any single sector should have less impact:

Source: HICL FY25 presentation

Adding TRIG’s 2.3GW of renewable capacity to HICL’s Electricity & Water portfolio will also help HICL with the ongoing process of reducing its dependency on a legacy portfolio of PFI and PPP projects. These have been highly cash generative but are starting to near the end of their contractual lifespans.

The combined group’s greater scale should also support more competitive financing costs and management fees. Both companies are already managed by InfraRed and we are told in today’s statement that new (lower) fees have been agreed, with a similar reduction in fees for operational management of TRIG’s renewable assets.

On balance, I think this transaction is partly borne out of necessity for both parties, but is a sensible and logical combination.

While noting that the new dividend policy could leave HICL shares with an attractive 8%+ dividend yield, I suspect that many shares in this sector are likely to continue trading at a discount to NAV for the foreseeable future.

For this reason and because we don’t normally cover investment trusts in any depth, I’m going to adopt a neutral view on both HICL and TRIG today.

Genuit (LON:GEN)

Down 12% at 313p (£779m) - Trading Update - Roland - BLACK (AMBER)

We haven’t covered this water and ventilation solutions business (previously known as Polypipe) since August 2024. The shares have fallen by around 30% since then, but last year’s results only showed a slight fall in (adjusted) sales and profits, leaving the stock looking cheaper than it did at that time:

Prior to today, expectations were for last year’s profit drop to reverse this year with a return to growth.

Today’s revised guidance for underlying operating profit to be £92m to £95m suggests to me that full-year underlying operating profit may only be very slightly higher than last year’s figure of £92.2m.

This new guidance represents a mid-point reduction of 3.6% from previous consensus estimates of £95m to £99m.

Outlook & Trading commentary

The company blames the usual suspects for today’s downgrade, noting a “moderation in market volumes” ahead of November’s long-awaited Budget.

Revenue growth of 7.1% reported for the four months to 31 October is lower than the 9.3% reported in H1. This appears mainly to be due to a weaker performance in the Water Management Solutions division, where revenue was only 3.3% higher (0.7% LFL) for the four months ended 31 October. Perhaps that wasn’t enough to fully offset this year’s higher costs.

Looking ahead, management still expects some improvement in profitability in H2:

The Group continues to expect underlying operating margins to increase sequentially in H2 2025 as a result of price increases, productivity gains from the Genuit Business System and other cost efficiencies.

I don’t have access to any updated broker forecasts today, but would guess that today’s revised guidance might equate to a 2025 adjusted EPS forecast of perhaps 24-25p (current Stocko consensus 25.6p).

On this basis, the stock could be trading on a FY25E P/E of c.13 after this morning’s drop.

Roland’s view

My decision here is whether to maintain our previous neutral view or downgrade one notch to AMBER/RED.

As with Stelrad (see table), I am inclined to remain neutral here. It’s possible that I’m being too sanguine, but I’m encouraged by LFL sales growth this year and am inclined to think that this remains a reasonable business and a reasonable price.

Having said that, I don’t have a strong conviction on Genuit and would imagine that results will remain slightly underwhelming until market conditions improve. Whether that will happen following November’s Budget or take longer to materialise remains unclear – if it doesn’t, then I think there’s some risk of a further downgrade here. AMBER.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.