Good morning and welcome to today's report, which is coming to you live from the Mello conference in Chiswick. We're looking forward to meeting many of you over the next couple of days!

Spreadsheet accompanying this report: link (last updated to: 10th November)

Today's report is now complete - a little earlier than usual. Thanks for reading and commenting!

Companies Reporting

| Name (Mkt Cap) | RNS | Summary | Our View (Author) |

|---|---|---|---|

Imperial Brands (LON:IMB) (£25bn | SR95) | Tobacco and NGP net revenue growth 4.1% (at constant currency), reported revenue -0.7%. Adjusted EPS +9.1%. “Expectations for the coming year are in line with the medium-term guidance.” | AMBER/GREEN (Roland - I hold) [no section below] A solid set of results that are in line with expectations and highlight the continued strong cash generation from this business. I view this as an income play and would argue that the forward yield of 5.1% is at the lower end of what I’d expect for a mature business of this type. However, today’s guidance suggests the stock’s free cash flow yield could remain above 8% this year, providing support for a further £1.45bn buyback in FY26 - which is accretive to earnings and reduces future dividend costs - plus the generous dividend. Against this backdrop I’m happy to maintain a moderately positive view, but the shares would have to be considerably cheaper for me to be fully positive on this business. | |

Bodycote (LON:BOY) (£10.5bn | SR62) | “Core” organic revenue +2.2%, group organic revenue +0.3%. “Operating profit in H2 is expected to be ahead of H1 and broadly similar to the level seen in H2 2024.” | ||

Diploma (LON:DPLM) (£7.1bn | SR73) | “Very strong organic revenue growth of 11%, ahead of expectations.” Adjusted EPS +21% (176p). “Positive start to new year.” FY26 guidance: organic revenue growth 6%, operating margin c.22.5% | ||

Londonmetric Property (LON:LMP) (£4.5bn | SR62) | Acquired £51.1 million portfolio (logistics warehouse at East Midlands airport and a hotel at Manchester airport). £22.1 million of disposals (five former Urban Logistics REIT assets). | ||

Softcat (LON:SCT) (£2.9bn | SR50) | Double-digit year-on-year growth in gross profit and underlying operating profit. ”The Board is pleased with progress to date, which is consistent with the outlook provided in our full year results announcement.” | AMBER/GREEN (Roland) [no section below] | |

Great Portland Estates (LON:GPE) (£1.31bn | SR30) | Portfolio valuation £3.1 billion, up 1.5%. EPRA NAV/NTA per share 504p, up 2% since March 2025. “...we reiterate our rental growth guidance for the financial year, with portfolio-wide growth of 4.0% to 7.0%.” | ||

Firstgroup (LON:FGP) (£1.13bn | SR88) | Adjusted EPS +16% (9.9p), supported by share repurchases. “On course to deliver modest growth in adjusted EPS for the full year, with H2 2026 set to benefit from completed business restructuring.” | ||

Greencore (LON:GNC) (£992m | SR84) | Binding agreement to sell Bristol site to Compleat & Full Year Results Statement | Disposal is next step for CMA approval of Bakkavor acquisition and completion in early 2026. Results: revenue +7.7%, adj. operating profit +28.9%. “Trading in early FY26 has started positively and we look forward to another year of profitable growth.” | PINK |

CVS (LON:CVSG) (£806m | SR54) | Four-month period: sales +5.7%. LfL sales +2.5%. Engaging with CMA. 2026 outlook in line. | ||

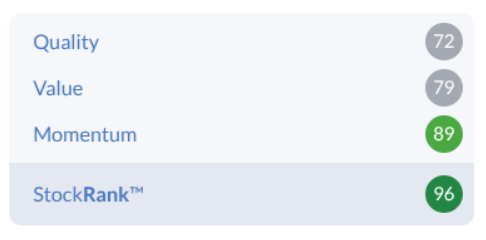

Pollen Street (LON:POLN) (£497m | SR96) | AuM +9.9% to £6.7bn in Q3. Fee-paying AUM +9.7%. “Progressing well towards medium-term AuM target of £10 billion… and continues to trade in line with expectations.” | GREEN (Graham) Once again I find very little to dislike here. The stock does trade at a premium to book value but I think that makes sense. A large majority of its AUM is 3rd-party, fee-paying AUM, earning higher fee rates than conventional fund managers. | |

Tatton Asset Management (LON:TAM) (£435m | SR76) | Rev +18.6% to £25.7m, adj op profit +20.4% to £13.1m. AUM/I +29.6% to £25.8bn. Confident FY results will be in line with expectations. | AMBER/GREEN (Graham) [no section below] In April 2024, at 585p, I said “some investors may wish to take profits here, but I could see it continuing to run.” The same could be said today, at 708p! The stock remains highly-rated but with good justification, considering strong double digit growth across all key metrics. Tatton provides a discretionary wealth management service for IFAs, mortgage advice, and other IFA support services. Looking forward, I note that £3.5bn of AUM is about to leave with the conclusion of a strategic relationship, and on that basis I’m going to be a little cautious and downgrade our stance to a moderately positive stance. Although the loss of this AUM is not news, it does mean that growth may be more limited over the next few years; they are targeting £30bn of AUM by the end of March 2029, which would represent 16% growth over the next 3 years. They have every chance of outperforming that target but merely hitting it would mean 5% AUM growth compounded annually. For a stock trading at over 20x earnings and with a ValueRank of 17, the market may demand more. This takes nothing away from the impressiveness of what Tatton has achieved; the company continues to be run by its founder and largest shareholder, which I view as a major green flag. | |

Crest Nicholson Holdings (LON:CRST) (£420m | SR57) | SP -7% PW: FY25 adj PBT to be at low end or marginally below guidance range of £28-38m, reflecting subdued housing market. FY25 completions of 1,691 (guidance: 1,700-1,900). “Tightened our grip on inventory and cost control”, and made progress on land sales, to finish the year with net debt at the lower end of guidance. Proposed the closure of one divisional office. Adjustment to inventory of c.£8m after profits were overstated in a regional development. | BLACK (AMBER/RED) (Graham) [no section below] We’ve been oscillating between AMBER/RED and AMBER on this one, and I’m going to have to bring it back down to AMBER/RED today on foot of a profit warning. The good news is that the company is still earning a reasonable adjusted PBT margin (earning c. £28m of PBT on forecasted revenues of £609m). Also, net debt is going to be at “the better end of the guidance range” (£40 to £90m - note the very wide range!). The bad news, in my view, is that the company remains financially accident-prone. Earnings forecasts tend to move in one direction only (downwards) and when I check the last set of interim results, I find another going concern warning relating to interest cover. The combination of a profit warning and a going concern warning means that I automatically have to be negative on this today, but I’ll take a moderately negative stance as I acknowledge that a) it is only a minor profit warning, and b) a covenant waiver from the company’s bank could probably be achieved, if it was even necessary. Crest shareholders may feel that there is no need to panic and they may be right, but a disciplined approach requires us to maintain scepticism at this time. | |

Costain (LON:COST) (£400m | SR79) | 5yr/£75m contract extension to provide project control services at EDF’s eight UK nuclear power stations. | ||

Thor Explorations (LON:THX) (£394m | SR99) | Production +12% to 22,617oz, rev +74% to $69.9m, net profit +146% to $43.1m. Net cash $81m. FY25 production guidance narrowed to 90-95koz, AISC $900-$1,000/oz. | ||

TT electronics (LON:TTG) (£252m | SR68) | Cicor Technologies has made an improved final offer of 150p in cash or 0.0084 New Cicor Shares (prev. 100p and 0.0028). New offer represents 58% premium to 29 Oct 25 closing price. | PINK | |

Kenmare Resources (LON:KMR) (£249m | SR46) | Wet Concentrator Plant A project update and 2025 guidance update | WCP A commissioning has faced some delays but should be “substantially complete” by the end of 2025. FY25 Ilmenite production guidance cut to 870-950t (prev. 930-1,050t) | |

Trifast (LON:TRI) (£99m | SR88) | Rev -7%, adj PBT flat at £4.6m. Good progress in target markets, rebalancing away from automotive. FY26 expectations unchanged. | ||

Gear4music (HOLDINGS) (LON:G4M) (£68m | SR87) | Rev +31%, PBT £2.7m (HY 25: £(1.2)m. Strong trading. FY outlook ahead of recently upgraded consensus, FY26 EBITDA to be not less than £15.0m. | AMBER/GREEN (Roland) Today’s half-year results look solid and showcase improved underlying profitability, with an added boost from discounted stock purchased earlier this year from rivals’ insolvencies. Forecasts for this year have been upgraded substantially, but the outlook for FY27 remains more subdued. Plans to open a new warehouse in the UK are likely to result in a substantial increase in the group’s cost base – so this year’s momentum needs to be maintained in order to justify this expense. I’m maintaining my AMBER/GREEN view out of respect for today’s upgrade, but I’m moving towards taking a neutral view to reflect the increasingly elevated valuation. | |

Calnex Solutions (LON:CLX) (£50m | SR57) | Rev +9%, pre-tax loss reduced to £(939)k. Cash of £10m and no debt. Early traction in US defence contracts. Telecoms market stable. Expect H2 to close in line with FY exps. | ||

CML Microsystems (LON:CML) (£47m | SR56) | Rev -27% to £9.2m, adj PBT of £2.52m (HY 25: £0.8m). Net cash £10.7m. H2 Outlook: expect material revenue growth vs H1 and improved profitability. | ||

| Nanoco (LON:NANO) (£20m | SR19) | Preliminary Results | Rev -4% to £7.6m, adj EBITDA +25% to £1.5m. Cash £14.0m. Aiming to breakeven in 2027 with revised strategy. |

Graham's Section

Pollen Street (LON:POLN)

Down 1% to 874p (£526m) - Q3 2025 Trading Statement - Graham - GREEN

We’ve given this private equity/private credit group some positive coverage this year, so let’s catch up with their Q3 trading statement.

AUM: continues to impress. Unlike the conventional fund managers we cover in this report, which have struggled to generate inflows, there is apparently still plenty of demand for private equity and private credit funds. This makes some sense, considering that there aren’t cheap alternatives when it comes to investing in private assets.

AUM +9.9% in the quarter to £6.7 billion

Fee-paying third-party AUM +9.7% in the quarter to £5.1 billion.

Growth in fee-paying AuM reflected strong deployment in Private Credit and in Private Equity as well as the final close of Private Equity Fund V in the period.

Please note that in private equity, it’s normal for it to take years for committed capital to be fully deployed by the manager.

Private Credit: this strategy is enjoying “strong investor demand and high levels of deployment”. Fund commitments for Pollen’s Private Credit Fund IV have surpassed the original target and reached £1.1 billion, with one more close coming in Q1 2026.

Private Equity: more mature, this strategy is engaged in portfolio “optimisation”, deployment, bolt-on acquisitions and disposals.

Investment company (using Pollen’s own balance sheet assets to co-invest): their underlying portfolio return is 9.1% year-to-date, before some adjustments, which is likely to be a good measure of how Pollen’s customers are faring. Pollen’s investment assets now stand at £331m.

Outlook:

Pollen Street continues to accelerate fundraising momentum, supported by a deep and diversified investor base, high-performing strategies, and sustained market demand for private capital solutions. The Group is progressing well towards its medium-term AuM target of £10 billion, driven by continued scaling in fundraising and deployment across both strategies, and continues to trade in line with expectations.

Graham’s view

Once again I am struggling to find anything to dislike here. I’ve been positive on it before and I see little alternative but to be positive on it again.

Stockopedia likes it too, calling it a Super Stock.

Value metrics include a PER of 10x and a dividend yield of 6.5% (according to the StockReport).

It might be worth adding that although the chart only goes back to 2024, I don’t consider this to be a recent IPO, and therefore in a higher-risk category, as I normally would. POLN was created by the merger of Pollen Street with Honeycomb Investment Trust (in 2022), and Honeycomb had been listed since 2015.

POLN chart:

The stock does trade at a premium to tangible book but I think that’s fair, given that it offers both a £330m investment portfolio and a growing fund management business.

In a world where conventional fund managers seem to be going extinct, maybe private equity/private credit fund managers are where we should be focusing our efforts?

Roland's Section

Gear4music (HOLDINGS) (LON:G4M)

Up 3% to 325p (£68m) - Interim Results - Roland - AMBER/GREEN

As a result of these factors, we are again in a position to upgrade our expectations with current year EBITDA now expected to be not less than £15.0m.

I’m reassured to see we’ve been positive on musical instrument retailer Gear4Music in recent months, as the company has repeatedly upgraded its forecasts. By my reckoning, today marks the fourth upgrade since May. The shares have responded by doubling over the same period:

Well done to investors who spotted this turnaround opportunity earlier in the year.

Half-year results highlights

Today’s half-year results show impressive revenue growth, with improved margins and some positive operational metrics.

Financially, all the numbers are moving in the right direction. After reporting an H1 loss last year, the company has returned firmly to H1 profitability, with strong growth in the UK and overseas:

Revenue +31% to £80.7m

UK revenue +28% to £49.6m

European and RoW revenue +35% to £31.1m

Gross profit +38% to £22.7m

Gross margin +1.5% to 28.2%

Pre-tax profit: £2.7m (H1 25: £(1.2)m

To its credit, the company has reported the contribution made to these H1 results by the stock it acquired out of the insolvencies of two competitors earlier this year. As Megan discussed in April, this stock was purchased below book value so might be making an above-average contribution to profits.

In today’s results, Gear4Music says it generated £1.9m of revenue and £1.1m of gross profit from the insolvency inventory in H1. Stock with a carrying value of £1.4m remains.

With a gross margin of 58%, we can see that the margin on these sales was double the group’s overall gross margin. Nice business.

Stripping this revenue and profit out of the H1 results gives me the following adjusted figures:

Revenue exc insolvency sales up 27.7% to £78.8m

Gross profit up 30.9% to £21.6m

Gross margin up 0.7% to 27.4%

So we can see that half the 1.5% increase in gross margin in H1 was driven by sales of cheap stock. I’ve previously wondered if this discounted stock might be making a disproportionate contribution to profits, but I’m broadly reassured by these figures. I’m comfortable G4M’s underlying trading is still improving, without this one-off tailwind.

Overheads also appear to be under control. Administrative expenses rose by c.14% in H1, comfortably behind the pace of revenue growth. This helped to support an increase in operating margin to 4.2% (FY25: 2.2%).

However, overheads could be set to rise – the company says today it is planning to open a second UK warehouse to meet increased demand, as its current York facility is running at capacity.

Net debt & cash flow: one concern we’ve had previously was that borrowing levels were a little high for a low margin retailer. Arguably, this could remain true.

Net bank debt rose by £1.6m to £16.0m during the half year, which the company says was due to a £10m increase in inventory to support stock availability and bring stock into its distribution centres earlier ahead of peak season.

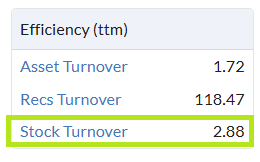

Stripping out working capital movements, the H1 cash flow statement shows operating cash flow of £6.8m for H1, more than double the £2.7m generated during the same period last year. That gives me some confidence stock is being converted into cash, although inventory still seems relatively slow moving. My sums suggest stock turnover take more than four months, on average – a figure also reflected on the StockReport:

Outlook & Updated Estimates

Gear4Music says it now expects full-year adjusted EBITDA to be at least £15.0m (previously £13.7m).

With thanks to commissioned research provider Progressive, we can see how this translates into updated earnings forecasts:

FY26E adj EPS: 22.7p (prev. 18.1p)

FY27E adj EPS: 12.4p (new forecast)

Today’s upgrade means that FY26 forecasts have now risen above the level they were at prior to the profit warning at the start of this year:

It’s notable that FY27 forecasts are still a long way below FY26 figures. This seems to suggest that Progressive (and thus G4M) are not yet confident the momentum and profitability being enjoyed this year will be sustainable.

Next year’s lower forecasts also reflect the expected “double running costs” and funding for the new warehouse, which is expected to increase G4M’s UK distribution capacity by 2.5x.

Roland’s view

Today’s half-year results look pretty positive to me overall. Assuming peak season trading is in line with expectations, the company looks like it is positioned to deliver a strong set of FY26 results.

However, it looks like at least some of this year’s outperformance may have been driven by the insolvencies of two substantial rivals, GAK and PMT – in today’s results, management say these failures created “a UK market opportunity estimated at up to £63 million”.

In this context, the c.£11m increase in UK revenue reported today looks less of a surprise – and highlights the ongoing competitive pressures in this sector.

Other factors to consider are the expected increase in overheads from adding a second UK distribution centre and this year’s one-off profit boost from the insolvency stock. Both factors could weigh on profits next year and may explain why Progressive’s forecasts for FY27 seem quite cautious relative to their FY26 estimates.

The market has reacted cautiously to today’s upgrade and I am inclined to share this view. Gear4Music is now trading on around 15x FY26E forecasts, but this multiple increases to c.25x in FY27.

I would argue that there’s some scope for a FY27 upgrade if momentum is maintained, but even so I am starting to feel that the share price might be up with events.

The StockRanks view this as a High Flyer and I would agree with this:

Out of respect for today’s earnings upgrade, I’m going to leave our AMBER/GREEN view unchanged. But I am getting close to taking a neutral view here.

I would personally be reluctant to open a new position until there’s more visibility on FY27 trading. After all, Gear4Music has been through boom and bust cycles previously.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.