Good morning! We're expecting a busy day for company news in advance of tomorrow's Budget.

We've added arrows to our colour system, to show if we've upgraded or downgraded our perspective on each stock. I hope this is a nice little improvement for you!

Out of time for now, see you on Budget Day!

Spreadsheet accompanying this report: link (last updated to: 10th November).

Companies Reporting

| Name (Mkt Cap) | RNS | Summary | Our View (Author) |

|---|---|---|---|

Compass (LON:CPG) (£41.6 | SR68) | Revenue +8.7%, underlying operating profit +11.7% ($3.3bn). “For 2026, we expect underlying operating profit growth of around 10% driven by organic revenue growth around 7.0%, around 2% profit growth from M&A (including Vermaat) and ongoing margin progression.” | ||

Next (LON:NXT) (£16.8bn | SR61) | The sale generates net cash proceeds after costs of £54.1 million and an exceptional profit of £16.3m. Would increase special dividend (£3.10) by 45p in the absence of any acquisitions or share buybacks. | AMBER/GREEN = (Graham holds) [no section below] This disposal is little more than a tidying-up exercise, and at a near-£17bn market cap, an additional £54m makes no real difference to the investment case. But of course it’s the right thing to sell land that the company no longer intends to use, and it’s also the right thing to add the funds raised into the planned special dividend (which is expected to be paid at the end of January). The company has been intelligently prioritising dividends while its share price is too high to make buybacks attractive. We are moderately positive on NXT, for many reasons including the expert capital allocation skills of management. That said, I have no hesitation in acknowledging that the valuation here is now very high for a retailer (the ValueRank is only 26, and the PER is 18x). While I still view this as a fine long-term hold, I would be open to selling my position to invest in a stock where I have more conviction in the value currently on offer. | |

Zegona Communications (LON:ZEG) (£10.3bn | SR47) | AXA IM Alts acquires 40% of FiberPass & Interim Financial Report | “In just 18 months since the Vodafone acquisition, we have delivered on every major element of our strategy.” H1 revenue €1.8bn, loss €28m. | |

Intertek (LON:ITRK) (£7.5bn | SR73) | YTD revenue growth 4.6%. “On track to meet earnings expectations for the full year, with mid-single digit LFL revenue growth at constant currency, strong margin progression and excellent cash generation.” | ||

Beazley (LON:BEZ) (£5.2bn | SR80) | Written premiums +1%, net written premiums +4%. Premium rates on renewals down 4%. Growth running at low end of guidance, but combined ratio guidance upgraded. | ||

Kingfisher (LON:KGF) (£5.0bn | SR99) | SP +5% Underlying LfL sales +0.9%. Upgrades full year adjusted profit before tax guidance to c.£540m to £570m (previously upper end of c.£480m to £540m). | GREEN = (Roland) Today’s Q3 update shows stable trading and continued operational execution to improve the business. The upgrade is equivalent to a c.9% increase in pre-tax profit, which I estimate could equate to a c.6% rise in adjusted earnings. The ongoing buyback is also likely to deliver attractive returns, in my view. However, there’s no denying that external conditions are difficult, while profitability remains subdued as a result of the slowdown that’s followed the pandemic boom. I’ve decided to maintain my positive view today as the boxes are all ticked – high StockRank, repeated earnings upgrade, and reasonable valuation. But the shares aren’t quite as cheap as they were and I can see that I may need to moderate my view soon if revenue performance doesn’t improve. | |

easyJet (LON:EZJ) (£3.6bn | SR37) | FY25 headline EBIT of £703 million, +18%. FY25 headline PBT of £665 million, +9%. Outlook: capacity to grow c. 7%. Holidays customers planned to grow up to 15%. Q1 is 81% sold, Q2 is 26% sold. | ||

Cranswick (LON:CWK) (£2.7bn | SR60) | Positive H1 trading momentum has continued into Q3 ahead of peak Christmas trading period. “...we remain mindful of current market and wider economic and geopolitical conditions and so our outlook for the current financial year… remains in line with the Board's expectations.” | ||

Telecom Plus (LON:TEP) (£1.4bn | SR88) | “We are confident in meeting FY26 guidance of around 25% total customer growth (including the customers transferred from TalkTalk), with low double digit organic customer growth and £132-£138m of adjusted pre-tax profit.” H1 revenue +6.7% to £744.5m, adjusted pre-tax profit -29.5% to £32.5m. | GREEN = (Roland) [no section below] There’s an inevitable seasonal bias to results from this utility reseller, so I am not too worried about the decline in H1 profit reported today. The company has previously said that rephasing of certain industry costs means that profits will have more of a H2-weighting than in the past. These results are consistent with that and full-year expectations are unchanged. Underlying business growth appears to remain strong, with 11% annualised organic customer growth contributing to a total of nearly 1.4m, plus continued upselling into broadband customers acquired from TalkTalk. I generally have a positive view of this unusual business. TEP generates high returns and hasn’t cut its dividend for 18 years. The market is going against me at the moment, but I’m inclined to remain positive today. In my view, a forward P/E of 13x and a 6% dividend yield could represent an attractive entry point. I note the StockRank has also been rising recently as momentum has improved. | |

Molten Ventures (LON:GROW) (£742m | SR69) | 724p NAV per share up 7.9% last 6 months, 12% last 12 months. | ||

Renew Holdings (LON:RNWH) (£723m | SR73) | Revenue +5.6%, adj. operating profit +1.7% (£72m). Record order book gives “confidence in delivering against our FY26 expectations.” | ||

Dominos Pizza (LON:DOM) (£658m | SR43) | CEO steps down “by mutual agreement” and “with immediate effect”. He is thanked. COO becomes interim CEO. | ||

AO World (LON:AO.). (£572m | SR70) | Revenue +14%, PBT +10% (£18m). Trading slightly ahead of our previous expectations. Given continued positive trading, upgrades FY26 PBT guidance to be around the top of the range (£45 - 50m). | AMBER/GREEN ↑ (Roland) [no section below] Personally, I’d still be reluctant to pay a high multiple for this business. But as with Kingfisher (see above), momentum and fundamental performance seems positive under the leadership of founder John Roberts. I’m going to take a chance and move my view up one notch to AMBER/GREEN.. | |

GB (LON:GBG) (£566m | SR67) | H1 revenue +1.8% at constant currencies. Confident in delivering H2 growth acceleration. FY26 expected in line with current market expectations. | AMBER ↓ (Graham) | |

Hilton Food (LON:HFG) (£434m | SR73) | CEO leaves with immediate effect but is thanked. “Now is the right time to search for a new leader to take the business forward.” Chair becomes Exec Chair. | ||

Caledonia Mining (LON:CMCL) (£415m | SR93) | Decision to proceed with the Bilboes Gold Project following completion and publication of the feasibility study. Summary of proven and probable: 1.749 Moz of gold at 2.26 g/t. The project has a peak funding requirement of US$484m. Majority of funding is expected from non-recourse senior debt. | ||

Marstons (LON:MARS) (£317m | SR96) | LfL sales +1.6%, ahead of the market. Underlying PBT +71% (£72m). LfLs for last 8 weeks tracking in line with prior year. Christmas bookings strong. Remains firmly on track to deliver further strategic progress and achieve the targets set out at the CMD. | AMBER/GREEN ↑ (Roland) Solid results showing improved profitability, debt reduction and deleveraging. Management reiterate previous guidance and expect to be able to resume shareholder returns when leverage drops below 4.0x. If this can be paired with a return to modest revenue growth, I think the stock’s re-rating could still have further to go, so I’ve upgraded my view by one notch today despite the risk I may have missed a big chunk of the gains. | |

Henry Boot (LON:BOOT) (£299m | SR79) | Sale of a site with planning to Persimmon resulted in ungeared IRR of 25% p.a. “This latest transaction provides further momentum towards achieving our 2025 sales target.” | ||

Impax Asset Management (LON:IPX) (£221m | SR92) | The auditor has requested more time to complete its standard procedures. Results will now be published on 1 Dec 25, instead of the previously planned date of 26 Nov 25. | AMBER/GREEN = (Graham holds) [no section below] Is this a red flag announcement? I'm sure someone could argue that it is. However, as a shareholder, its doesn't bother me too much; it's only a 5-day delay to the publication of full-year results, or 3 business days. And it's very late in the process: we are told KPMG need more time for "the internal reviews that represent the final element" of their standard audit procedures. Given that this is a Big 4 accounting firm, I think I'm going to sleep easy between now and next Monday (famous last words!). | |

Supreme (LON:SUP) (£197m | SR90) | Rev +17% to £132.6m, pre-tax profit -5% to £12.2m. Adj EPS -18% to 9.1p. Drinks businesses contributed the majority of sales growth. Outlook: expects FY26 trading to be in line with market exps. | ||

Begbies Traynor (LON:BEG) (£176m | SR86) | Acquired Network Auctions, a property auctioneer in SE England. Revenue c.£0.6m. BEG is paying £0.5m upfront, with a further £0.5m contingent on revenue growth targets. | ||

Brickability (LON:BRCK) (£167m | SR67) | Rev +4.9%, adj PBT -1.9% to £21.0m. H1 in line despite “persistent headwinds” in housebuilding and construction. Outlook: FY26 trading in line with expectations. Company to be renamed BRCK Group. | ||

Accsys Technologies (LON:AXS) (£158m | SR44) | Rev +5.4% (+21% inc JV), adj EBITDA +160% to €10.4m. Net debt €39.8m. Own sales volumes +0.7%, total inc JV +22.4%. FY26 adj EBITDA to be in line with exps. | ||

Treatt (LON:TET) (£124m | SR69) | CEO David Shannon will step down on 31 Dec 25. He is thanked. Search for new CEO is underway. | ||

Software Circle (LON:SFT) (£92m | SR27) | Rev +15%, adj EBITDA +44% to £2.3m. Operating loss of £848k (HY25: op profit £1.4m), due mainly to depreciation/amortisation. Expect transition into positive net earnings as business scales. Outlook: expect annualised revenue of £24m and adj EBITDA margin of 25%. | ||

Intercede (LON:IGP) (£76m | SR34) | Rev -4%, PBT -26% to £1.3m. Software and support revenue rose, but professional services revenue was lower. Outlook: board believes it will meet current market forecasts for FY26. Announces $4.2m of new contract wins and renewals. | ||

Spectra Systems (LON:SPSY) (£62m | SR66) | Launching $350,000 buyback programme from today. Shares will be cancelled. Buyback will end by 5 Dec 25 at the latest. | AMBER ↓ (Graham) [no section below] Mark covered the (covert) profit warning at this one in September, in good detail. Today's announcement is just a tiny share buyback and I'm sorry but I'm inclined to take a dim view of this sort of thing. When a FTSE-100 company decides to repurchase 0.5% of its shares, I can understand why they might want to do that. But when a small company chooses to buy back a few hundred thousand dollars of stock, I'm really not sure why they bother. It looks to me like potentially an excuse to put out an RNS describing "the cash generative nature of the business and the surplus cash the Company holds". And they say the buyback "is also consistent with the Board's desire to increase shareholder value/ returns". I'd still be concerned about the knock-on effects and lack of visibility implied by September's profit warning, so for me a neutral stance makes more sense here. Also, the choice of 135p as the upper limit of the buyback is interesting - and seems to suggest that the shares offer excellent value only up to that level? Latest share price 126.75p. | |

Triad (LON:TRD) (£48m | SR49) | H1 revenue £12m (last year: £10.2m), PBT £0.82m (last year: £0.75m). “We are very well placed in terms of robustness and resilience to handle any challenges with which events may confront us.” | ||

Strategic Minerals (LON:SML) (£36m | SR44) | “These results highlight downhole intersections of impressive length and grade, up to 15.00 m at nearly 1% WO3, and significant single sample zones reaching 7.19% WO3 - amongst the top 10 sample intervals by grade recorded at Redmoor to date by the Company.” | ||

IntelliAM AI (OFEX:INT) (£21m | SR22) | Rev +158% to £2.4m, w/ 48% organic growth. Adj EBITDA loss of £461k reflecting increased headcount. Outlook: “the Board remains comfortable with estimates provided to the market at year end”. Announces £250k of new contracts today. | ||

Transense Technologies (LON:TRT) (£19m | SR43) | YTD revenue approximately +20% excluding Bridgestone iTrack reduction. Sales doubled at SAWsense but broadly flat at Translogik. FY exps are based on revenue growth ex-iTrack of 50%. Board considers that this “remains achievable”. | ||

Sosandar (LON:SOS) (£16m | SR38) | Revenue +15% to £18.7m, loss before tax £1.1m. Expecting H2 profitability. Trading in line with Full Year expectations for revenue and PBT. M&S trading resumed following cyber incident. | ||

Parkmead (LON:PMG) (£14m | SR22) | Net profit up 49% to £7.35m, EPS +49% to 6.72p. Net assets +38% to £27m (25p/share), including £13.2m cash. Renewable projects progressing, gas production continues. | ||

Safestay (LON:SSTY) (£12m | SR57) | Sold to a private investor for £3.125m cash. Net proceeds will be used to repay debt and provide working capital. |

Graham's Section

GB (LON:GBG)

Up 7% to 253p (£589m) - Half Year Results - Graham - AMBER ↓

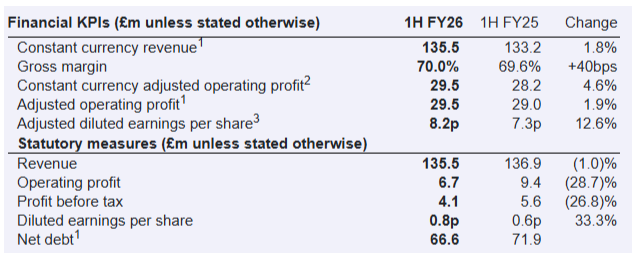

Today, GBG, a global identity technology business enabling safe and rewarding digital lives, announces its unaudited results for the six months ended 30 September 2025.

Let’s see if these results can get us more excited than previous updates have been able to.

Once again, we have modest growth for a software business, with constant currency revenue growth of less than 2%.

On the bright side:

Strong and slightly improved gross margins (70%), as you’d expect.

Adjusted profits growing faster than revenues.

Adjusted EPS growing even faster (although this is not very meaningful as it’s influenced by variable interest rates and a volatile tax charge).

On the negative side, the statutory measures are looking very poor, with PBT down by 27%.

Also note that the adjustments are very large, and larger than last year: operating profit is only £6.7m, versus adjusted operating profit of nearly £30m!

Let’s figure out what is going on with the adjustments in this report:

Amortisation: very large item (£16.5m), but smaller than H1 last year (£17.4m).

Share-based payments £2.7m, higher than H1 last year (£2.2m).

Exceptional items £3.6m (last year: zero).

Regular readers will know that I’m ok with ignoring amortisation so long as we write intangibles down to zero on the balance sheet.

As for the other items, I do not believe that it’s ok to leave them out of the analysis.

Share-based payments are a real cost borne by shareholders. They are actually worse than a cash cost in my view, as they create permanent dilution (until/unless the company eventually buys back these shares - and I'll be talking about the buyback here soon).

As for the "exceptional" items:

Exceptional items of £3.6 million (1H FY25: £nil), of which £2.2 million were incurred to drive transformation initiatives to accelerate our growth and remove complexity, in addition to £1.4 million in costs incurred by 30 September related to our move from AIM to the Main Market.

I can accept that the £1.4m costs of moving from AIM to the Main Market are unlikely to ever occur again, so in that sense I agree that they are exceptional.

But the other £2.2m? I’m not sure. We cover many companies who spend big on transformation - and in my experience it’s not a “one and done” type of cost. Even if it goes away for a year or two, something else often crops up before too long.

Another important reason I don’t exclude “transformation” costs is their potential vagueness. While most companies and most management teams are trustworthy, I think it’s smart to avoid a situation where a CEO could lump various miscellaneous costs into the exceptional category, simply in order to present a better picture to investors (for the avoidance of doubt, I’m not saying that is what has happened here - it’s just my general approach).

I would calculate H1 operating profit at GBG as:

Statutory operating profit £6.7m

Plus amortisation £16.5m (with the assumption that all intangibles on the balance sheet are worthless)

Plus £1.4m costs to move from AIM to the Main Market.

Final figure: £24.6m (vs. adjusted figure £29.5m).

Last year, the same calculation would give an operating profit of £26.8m.

So from my perspective, adjusted operating profit is lower this year than last.

Let’s sense-check again cash flow: there was £18.7m of (pre-tax) cash generated from operations. This is so much lower than the operating profit figure because of a large (£9m) drag from working capital, which also happened in H1 last year.

Balance sheet: £568m of net assets but it’s deeply negative (minus £86m) if intangible assets are written down to zero.

It’s interesting that the company is buying back its own shares despite having £66m of net debt and a deeply negative balance sheet position. A fresh £10m buyback has been announced today on top of an existing £35m commitment for the current financial year. It seems that they are happy to funnel profits straight through to selling shareholders at the current share price.

CEO comment:

"We are pleased with our operational execution, which delivered a first half financial performance reflecting underlying momentum and strong profitability and built an improved sales pipeline. We are firmly focused on driving shareholder value with good progress achieved to create a scalable global organisation well-positioned to achieve sustainable growth….

Outlook is in line with current market expectations.

…Underlying momentum, including continued improvement in Americas, underpins the Board's confidence GBG will achieve an acceleration of second half constant currency revenue growth to a mid-single-digit percentage to deliver our FY26 financial performance in line with current market expectations.

Graham’s view

The share price is up today but I’m even tempted to downgrade GBG on the back of these results.

My reasons are that

a) I don’t think H1 adjusted profits are an improvement on last year (see above),

b) the buyback strategy looks a little aggressive to me, given the net debt and balance sheet position.

c) constant currency revenue growth remains modest (<2%)

d) they must achieve an improved revenue trend in H2 in order to meet full-year forecasts - but how likely is this?

At least they have already seen two months of H2, so they have some information on their likely H2 result.

Constant currency revenue growth has been modest for a while now, e.g. 3% at the last set of full-year results. I’ll be impressed if they make it back to 5%+.

Overall, despite the share price increasing today, I think I’m within my rights to take us back to a neutral stance on this one.

I’ll add a reminder that the company’s EPS forecasts have been shaky this year:

The StockRanks are neutral, too:

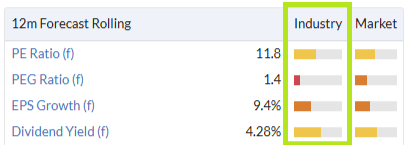

The P/E ratio is “only” 12x but that’s on adjusted numbers with which I don’t entirely agree, and P/E also excludes any balance sheet considerations.

GBG is not excessively leveraged - the leverage multiple is only going to be around 1x EBITDA at the end of the year. But to reflect the typical risks when a low-growth company needs to grow revenue faster in order to meet its full-year forecasts, and also when a company with negative tangible equity and net debt is pouring money into share buybacks, I think a neutral stance is sensible.

Roland's Section

Kingfisher (LON:KGF)

Up 5% to 307p (£5.3bn) - Q3 Trading Update - Roland - GREEN =

Upgrading full year profit guidance

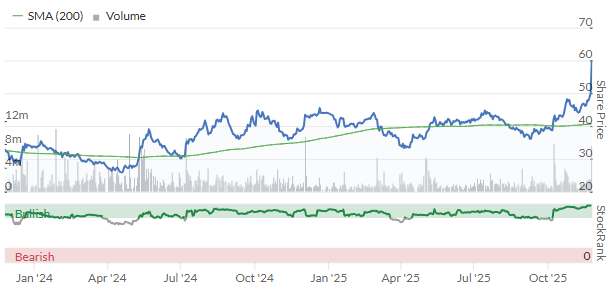

B&Q and Screwfix owners Kingfisher may seem an unlikely choice as a Super Stock, but it’s been a decent performer this year.

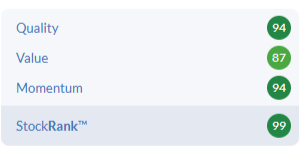

Today’s upgrade to full-year guidance is the second such uplift in three months, following September’s upgrade. The StockRanks remains exceptionally high, at 99:

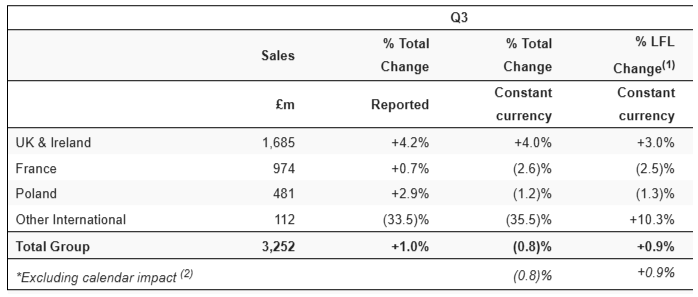

Let’s see what the company has to say about its third quarter, which covers the period from August to October.

Q3 trading

This snapshot of sales shows that Q3 trading mirrored the pattern seen for the year to date, with only the UK providing enough momentum to leave the group in positive territory for the period:

I think the big drop in Other International sales reflects the disposal of the Romanian business earlier this year, so isn’t a concern.

Trading commentary: turning back to the core UK business, I’m pleased to see that both B&Q and Screwfix made progress, with like-for-like (LFL) sales growth of 2.8% and 3.3%, respectively. Screwfix has been a reliable growth engine for some time, but B&Q’s performance has been more variable.

In France, both the Castorama and Brico Dépôt brands continued to struggle, but performance was stronger in Iberia with LFL sales up by almost 10%.

Customer demand seems to have focused on home repairs and improvements, with “continued growth in core and big-ticket” items. However, seasonal sales were said to have been soft – perhaps in part due to weather patterns?

Share buyback: £175m has been purchased to date, the company expects to complete the current £300m programme by March 2026.

Outlook

Unlike some big caps, Kingfisher provides clear and useful guidance in its RNS updates (my bold):

Our performance to date, progress in strategic initiatives and our cost and margin discipline, despite softening market conditions in the UK and Poland in Q3, gives us the confidence to upgrade our full year adjusted profit before tax guidance to c.£540m to £570m (previously upper end of c.£480m to £540m). We maintain our free cash flow target guidance c.£480m to £520m, reflecting the newly planned acquisition of a B&Q freehold property in Q4.

Taking the mid-point of the profit guidance above suggests today’s upgrade is equivalent to a c.9% increase in profit expectations.

Using this revised guidance, I estimate that we could see EPS forecasts rise by around 6% to 23.8p per share, at the mid-point. Today’s c.5% share price rise suggests the market is pricing in a similar increase.

That would put Kingfisher on a FY26E P/E of around 13.

In terms of free cash flow, which is always important to me, the mid-point of today’s guidance suggests Kingfisher may currently be trading with a FY26E free cash flow yield of c.9.5% – potentially quite reasonable value.

Roland’s view

My view on Kingfisher previously has been that it’s doing the right things in fairly unfavourable market conditions. I don’t see anything to change that view today.

I’m also comfortable with the share buybacks. My sums suggest they should deliver a pre-tax return of perhaps 10% at current levels, and of course will also be earnings accretive.

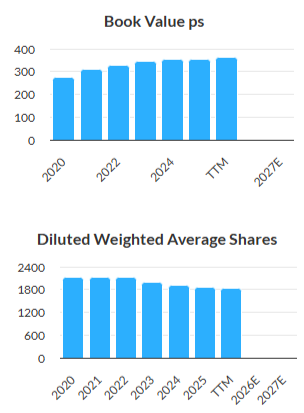

It’s also worth noting the buybacks are being carried out below book value, so each purchase should increase the book value per share of the remaining stock. The StockReport charts show us that this theory has been playing out in practice, too:

However, while I’m encouraged by today’s upgrade, this business is both cyclical and low margin – not a stock I’d want to place on a high multiple. The shares now look a little more expensive versus their sector than they did when we covered Kingfisher in September:

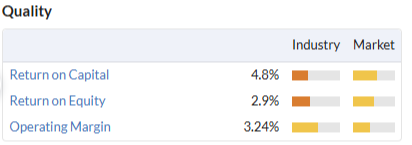

Profitability has also dipped sharply since the pandemic boom – ROCE of under 5% means Kingfisher is unlikely to be earning a positive return on its cost of capital (hence why share buybacks make sense):

I think the business has the potential to become more profitable as operating improvements are made and (if/when) external conditions improve. But I don’t know how soon this might happen.

I’m going to maintain my positive view on Kingfisher today because I think the signals are all green – stable trading, decent management, a very high StockRank, multiple earnings upgrades and a reasonable valuation.

But I can see a time in the not-too-distant future when we might need to moderate this view unless revenue growth starts to improve.

AO World (LON:AO.)

Up 5% to 104.5p (£602m) - Interim Results - Roland - AMBER/GREEN ↑

In The Week Ahead, I speculated about whether this update would allow us to switch from a neutral to positive view on AO. My weekend washing machine purchase actually went to Marks Electrical (LON:MRK) (perhaps worryingly for Marks’ shareholders, it was slightly cheaper than AO!), but I would certainly rather own shares in AO at the moment.

While AO remains a very low margin business, today’s profit upgrade is the third since June. The business is cash-generative and in a net cash position. Sales are growing comfortably ahead of inflation, with market share gains reported “across all key categories” today. AO’s post-pay mobile operation is now said to be profitable as well, while a new contract offering on the latest iPhone could help to boost customer stickiness by locking in loyalty club membership.

The only slight niggle I’d flag up in these results is that AO’s operating margin actually dipped slightly in H1, from 3.2% to 3.0%. However, there’s a strong seasonal H2 weighting to this business. I’m not inclined to draw too strong a conclusion until the full-year results are available.

Can I upgrade my view on AO? Personally, I’d still be reluctant to pay a high multiple for this business. But as with Kingfisher (see above), momentum and fundamental performance seems positive under the leadership of founder John Roberts. I’m going to take a chance and move my view up one notch to AMBER/GREEN.

Marstons (LON:MARS)

Up 18% to 59p (£374m) - Preliminary Results - Roland - AMBER/GREEN ↑

This pub chain is one of the top risers on the UK market today, after issuing full-year results that show a significant improvement in profitability, continued deleveraging and genuine cash generation.

In October I opted to stay neutral and await today’s results to see if a more positive view was justified. It looks like I may have been too cautious. Marson’s shares have now doubled over the last two years – congratulations to investors who spotted this turnaround opportunity:

Let’s take a look at some of the main points from today’s results.

Marston’s FY25 highlights

Revenue -0.1% to £897.9m

LFL revenue +1.6%

Underlying EBITDA +6.5% to £205.1m

Underlying operating profit up 8.6% to £159.9m

Net debt (exc leases) down 5.2% to £837.5m

Net asset value per share up 21.4% to 125p

The only number that didn’t move in the right direction last year was the one at the top.

Marston’s revenue was flat during the year to 27 September 2025, perhaps pointing to the pressures on consumer spending in the UK economy at present.

Fortunately, the company was able to make changes that resulted in gains from “labour efficiency, procurement gains and energy management”.

While top-line growth will eventually be essential, I think it’s reassuring to see the business placing itself on a more sustainable and viable footing even in more difficult trading conditions.

I think there are a few points worth highlighting from these results.

Debt & cash flow: the elephant in the room here is the company’s debt burden, which has previously been seen as a risk to the equity. Today’s results show some progress.

Marson’s has reported a “recurring free cash flow” of £53.2m for the year, up from a comparable figure of £43.6m last year.

This is essentially an underlying figure that excludes proceeds from property sales and one or two other non-trading items.

My sums suggest a standard free cash flow figure of c.£49m, which is pretty close.

Both of these numbers correlate nicely to the £46m reduction in net debt last year.

There was also a useful reduction in debt costs, with interest paid falling to £86.6m (FY24: £101.9m). This accounts for half the increase in underlying pre-tax profit last year.

Leverage & shareholder returns: perhaps even more important than absolute debt levels are leverage.

Marston’s net debt/EBITDA leverage fell from 5.2x to 4.6x last year and the company is targeting further reductions – I think this is significant:

the Group remains committed to reducing leverage to less than 4.0x and expects to recommence shareholder returns at this point

I would speculate that achieving these milestones could make Marston’s shares eligible for a wider range of institutional funds than at present, potentially providing a catalyst for a continued re-rating.

The loan-to-value profile of the company’s property portfolio is also starting to look less risky to me. Net debt of £837.5m represents 38.1% of the £2.2bn valuation of the “predominantly freehold estate”. This is down from a LTV of 42% at the end of FY24.

Capex: pub chains can be cash generative businesses, as they collect cash upfront from customers before paying their suppliers on trade terms.

However, pubs also get a lot of wear and tear and require regular capital expenditure to keep them fresh and attractive. Marston’s accounts illustrate this – the depreciation charge in today’s accounts was £45m, in line with the prior year.

However, capital expenditure was stepped up to £61.2m last year (FY24: £46.2m), reflecting spending on “new pub formats and wider estate upgrades”.

Profitability: the acid test is whether this large property business can actually generate an attractive trading return from its assets. Here are some numbers I’ve calculated from today’s results:

Underlying operating margin: 17.8%

Underlying return on capital employed: 7.7%

Underlying return on equity: 6.8%

I’ve used the underlying profit figures as I think they’re close to cash generation in this case. The main non-underlying item in the FY25 results is a non-cash gain from the reversal of previous property impairments following a revaluation.

To put these return figures in context, the company says the weighted average interest rate being paid on the majority of its debt is 6.4%.

I’d argue that Marston’s is close to generating a positive economic return from the capital employed in the business, but needs a little more deleveraging to achieve this in a meaningful way.

As things stand, I don’t think the business is sufficiently profitable to justify trading at its net asset value of 125p.

Outlook

I thought today’s outlook was a little vague. As rmillaree pointed out in the comments, this phrasing seems needlessly obscure:

LFL sales for the 8 weeks to 22 November are tracking in line with the prior year

Checking back to last year’s results, I find the following:

Like-for-like sales in the first six weeks grew by 3.9% marking a strong start to the year and demonstrating continued growth ahead of the market

Based on this, I’m assuming that LFL sales so far in FY26 are up by a low-single-digit percentage.

Looking ahead, Marston’s says Christmas bookings are 11% ahead of the same time last year and points out that the 2026 World Cup could also be positive for trading in the coming year.

Cost pressures are said to “remain manageable”.

Fortunately, we have access to an updated note from broker Panmure Liberum which translates this guidance to earnings forecasts.

This tells us that today’s outlook is effectively in line with existing expectations:

FY26E adj EPS: 9.0p (unchanged)

FY27E adj EPS: 10.1p (prev. 10.0p)

FY28E adj EPS: 11.4p (new forecast)

Roland’s view

I’m encouraged by today’s update from Marston’s and am inclined to think that the shares could see a further re-rating if the company can hit targets for continued debt reduction and modest revenue growth – the PanLib forecasts suggest LFL revenue growth of c.2.5% in each of the next two years.

There’s a risk I’ve missed the easiest part of the re-rating here, but I am going to upgrade my view by one notch to AMBER/GREEN today to reflect the lower risk profile and my broadly positive view.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.