Good morning!

Today's report is now complete - thank you for reading and commenting. We'll be back in the morning!

Spreadsheet accompanying this report: link (last updated to: 10th November).

Companies Reporting

| Name (Mkt Cap) | RNS | Summary | Our View (Author) |

|---|---|---|---|

| Smiths (LON:SMIN) (£7.9bn | SR75) | Sale of Smiths Detection | Agreed sale to CVC (private equity) for £2.0bn, equivalent to 16.3x FY25 adj operating profit of £122m. | |

Big Yellow (LON:BYG) (£2.1bn | SR55) | Budget changes mean that BYG expects its annual property rates will increase by £1.8m or 8.5% to £22.9m. Notes that this may be reduced following ongoing rateable value appeals. | PINK | |

Greencoat UK Wind (LON:UKW) (£2.1bn | SR n/a) | UKW Investment Mgr Schroders Greencoat responds, highlighting potential disadvantages of current RO proposals and its opposition to the options being proposed. | ||

Paragon Banking (LON:PAG) (£1.64bn | SR82) | Pre-tax profit +1.1% to £256.5m, with adj EPS +8.5% to 109.7p (Stocko consensus: 104.5p) RoTE stable at 17.5%. Impairment charges +71% to £41.9m (FY24: £24.5m), mainly due to underperforming pre-2022 property development loans. | AMBER ↓ (Roland) Today’s results look fairly decent, as I hoped when I took a fairly positive view on the interim results in June. However, today’s results have highlighted a couple of headwinds that could put pressure on profitability over the coming year. Are the shares cheap enough to reflect this risk? Today’s results show tangible net asset value up by 7% to 655p. At 798p, the stock still trades at a 22% premium to TNAV. I think that’s probably fair given the bank’s 17% return on tangible equity, but as a non-expert, I am inclined to take a neutral view until we see credit losses and margins start to level out. | |

MONY (LON:MONY) (£989m | SR73) | Reports growth in revenue and adj EBITDA during July-Nov. FY25 expectations remain unchanged, with consensus for adj EBITDA of £142.7m. | ||

Spire Healthcare (LON:SPI) (£900m | SR57) | SP -15% Rev +3.6% in July-Oct, but lower volumes of NHS work mean FY25 adj EBITDA to be at lower end of guidance for £270-285m. FY26 outlook “broadly in line or slightly ahead of 2025”. Proposed NHS Payment Scheme prices for 26/27 are said to be below inflation. | PINK/BLACK (AMBER/RED ↓) (Roland) [no section below] In September, Spire reported that it was holding discussions with a number of parties about possible options, including a sale. In the announcement, management effectively complained that Spire’s share price was too low. At the time, I commented that this business might have some valuable freehold assets, but profitability was extremely low while leverage was relatively high. Today’s update highlights weak revenue growth and appears to cut guidance for both FY25 and FY26; broker forecasts have previously suggested that FY26 was expected to be a much stronger year for earnings. I can’t help feeling that this business may be overly dependent on a supply of NHS work to subsidise its slow-growing private medical business – this year's H1 results showed NHS revenue up 16.2%, but revenue from private payors rose by just 0.8%. Given that today’s downgrade affects both FY25 and FY26, I’m going to move down one notch and adopt a more cautious view. | |

ZIGUP (LON:ZIG) (£779m | SR85) | Rev +2.9%, adj EBIT +11.5% to £81.7m. Confident FY26 profit to be “at least at top of current range of expectations. Expectations are given as being for adjusted PBT of £150-155m. | AMBER/GREEN = (Roland) This looks like a fairly solid set of results to me, supported by good underlying growth in the rental business, especially in Spain. While rising leverage and modest returns on capital suggest to me that the current valuation could be about right, I have to respect the evidence of positive momentum and am encouraged by signs that cash generation should now start to strengthen. On balance, I’m happy to maintain Graham’s previous AMBER/GREEN view today. | |

Bloomsbury Publishing (LON:BMY) (£402m | SR54) | Will combine Bloomsbury’s publishing expertise with AI tech including NotebookLM, Vertex AI and Gemini. Hopes to show how AI can help “increase the discovery and sales of books”. | AMBER/GREEN = (Roland) [no section below] Bloomsbury is paying Google to provide a range of advanced AI services for use internally. The company says the cost of this investment has been factored into existing spending plans. I’m not sure how significant this is likely to be – in some ways, I think it could be seen simply as an IT upgrade. To be honest, this RNS seems a bit promotional to me and I’m not inclined to attach any value to it. Given the fall in Bloomsbury’s share price over the last year, I’m happy to leave Graham’s previous view unchanged today ahead of the peak festive trading season. I’ll be interested to see if there’s any revision to full-year guidance when the company updates in the New Year. | |

Judges Scientific (LON:JDG) (£373m | SR29) | Acquiring remaining 18% of Geotek do Brasil for £1.9m plus earnout of up to £0.7m. Initial consideration payable in 60x £45k monthly instalments. | ||

NextEnergy Solar Fund (LON:NESF) (£308m | SR38) | NAVps -6.6% to 88.8p, mainly due to lower power price forecasts. Cash income of £48m (HY25: £45m). Dividend unch. at 4.21p. Strategic review ongoing, new chair appointed who is former Drax CFO. | ||

Victorian Plumbing (LON:VIC) (£239m | SR61) | Rev +5%, adj PBT -6% to £21.8m. Net cash £17.7m. Gained share in bathrooms, relaunched MFI brand. Outlook in line with market expectations. | ||

Beeks Financial Cloud (LON:BKS) (£147m | SR26) | Signed 3yr, $1.5m Private Cloud contract with Canadian bank. Also signed £2m Proximity Cloud extension to existing deal with “large FX broker”, taking total contract value to £4m/5yrs. | ||

SDI (LON:SDI) (£78m | SR85) | FY26 expected to be in line with market expectations. H1 revenues +10.1% (£34m). H1 adjusted PBT +21.7% (£3.8m). | ||

Fevara (LON:FVA) (£68m | SR49) | £5m Brazilian acquisition, plus £0.8m-£1.9m of deferred consideration in March 2028. Macal is a leading provider of minerals and supplements, offering a wide range of products across several branded lines for cattle, sheep and horses. | ||

Gear4music (HOLDINGS) (LON:G4M) (£60m | SR97) | SP +7% Very strong sales momentum highlighted in previous updates continued over Black Friday. Sufficient confidence to again raise expectations for FY March 2026. EBITDA to be not less than £16.7m (previously £15.2m). | AMBER/GREEN = (Roland) [no section below] Cyber Monday marked “the highest revenue day in our history”, with over 14,000 orders dispatched. FY26 EBITDA guidance has been lifted a further 10%. Taking a longer view, EBITDA expectations for FY26 have now risen by more than 50% (from c.£11m in April 2025) – an impressive turnaround. I’ve been AMBER/GREEN on this stock for some time now, most recently in November when I was reassured by evidence of underlying growth and market share gains. However, I also noted the rising cost base (including a new warehouse) and this year’s one-off benefit from selling bankruptcy stock acquired at below book value. One related point management is keen to emphasise is that the competitive environment has improved for them this year, thanks to the failure of some competitors. This is expected to reduce the level of aggressive discounting in the sector and should help to sustain a higher level of market share for G4M. I’m happy to maintain my previous view today, but I don't see enough value to consider an upgrade until there's more clarity on the outlook for next year. | |

Ondo InsurTech (LON:ONDO) (£42m | SR13) | H1 revenues +26% to £2.1 m. Full-year revenues will be £4.5m to £5m, EBITDA loss £5m to 5.5m. Cash £0.6m at end of H1. Proposed equity fundraising for £2.2m. | ||

Solvonis Therapeutics (LON:SVNS) (£16m | SR30) | SVN-015, targeting methamphetamine and cocaine use disorders, has been accepted into the US National Institute on Drug Abuse's Addiction Treatment Discovery Program. NIDA will fund and conduct early preclinical evaluation. | ||

SysGroup (LON:SYS) (£13m | SR40) | Revenue -3% (£9.9m). Adj. EBITDA £0.2m. Loss before tax £1.6m. Cybersecurity now 47% of revenue. AI delivering measurable ROI. Headcount reduction from 111 (FY23) to 80 (FY26). Full-year performance is expected to be in line with expectations. | ||

Oxford Biodynamics (LON:OBD) (£11m | SR3) | (OBD share price fell and rebounded in the last few days.) The UK National Screening Committee’s draft recommendation on prostate cancer screening has no direct impact on OBD or its PSE test. |

Roland's Section

ZIGUP (LON:ZIG)

Up 12% to 383p (£883m) - Interim Results - Roland - AMBER/GREEN

When Graham last covered van hire and incident management group Zigup in September, he summed up the situation with this pithy comment:

I’m leaning towards the conclusion that everyone is right: the company is right to borrow heavily, Roland is right to be careful, and yet there is an opportunity if nothing goes wrong. So let’s give this an upgrade by one notch […]

It looks like Graham was right to highlight the opportunity and take a more positive AMBER/GREEN view than the neutral view I’d previously held. Today’s results from Zigup look fairly strong to me and have prompted management to nudge full-year guidance a little higher:

… we now expect our full year underlying PBT to be at least at the top of the £150-155m range of analysts' expectations.

The share price has also reacted favourably and has now round-tripped back to the level it was at a year ago:

Let’s take a look at the numbers and some of the changes announced by the company today.

H1 results summary

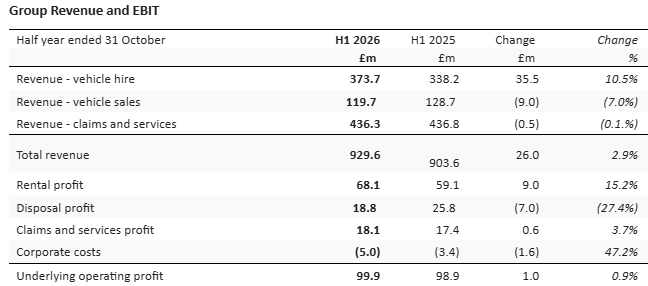

These results cover the six months to 31 October 2025:

Revenue up 2.9% to £929.6m

Reported pre-tax profit up 15.8% to £65.0m

Underlying pre-tax profit -0.4% to £81.7m

Underlying earnings down by 1.8% to 27.6p per share

Interim dividend unchanged at 8.8p

The company’s segmental reporting shows some significant differences in trading across the business:

Vehicle hire: trading during the half year appears to have been particularly strong in Spain, where vehicle hire revenue rose by 16.3% as the company’s fleet expanded, aided by “a major rail maintenance fleet win”.

In the UK, vehicle hire revenue rose by 6.5% due to “a combination of product and vehicle mix alongside pricing actions”. However, the average number of vehicles on hire in the UK fell slightly “as we restructured our broker channel approach”.

In total, Zigup’s hire fleet rose by c.2,500 to “over 135,000 vehicles” at the end of October.

Vehicle sales: selling ex-rental vehicles is an integral part of the vehicle hire business model, so I tend to view this as part of the hire business. However, Zigup likes to split out the two in order to highlight underlying operational growth in the rental business.

What these figures show is that the post-2023 decline in vehicle disposal revenue and profit is continuing as new vehicle availability normalises:

FY24 disposal profits: £61.9m

FY25 disposal profits: £52.5m

HY26 disposal profits £18.8m (HY25: £25.8m)

I’d expect this process to bottom out fairly soon as the company’s fleet replacement programme normalises and the backlog of older vehicles is cleared.

Claims & Services: Zigup’s claims management and repair operation increasingly targets contracts with insurers. For H1, the company reports a multi-year renewal with Tesco Insurance and a new contract with broker Howden Insurance during the half year.

However, overall Claims & Services revenues and margins were said to have been flat, due to lower claims volumes.

Profitability: there’s a sharp divide in the profitability of the two halves of this business. Combining rental profit and disposal profit gives me an underlying operating margin of 17.6% in H1.

In contrast, the Claims & Services business generated an equivalent margin of just 4.1%, with guidance suggesting a figure of c.5% in H2.

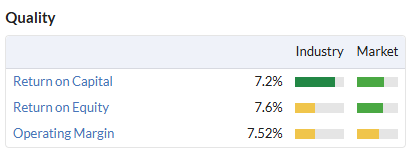

Of course, margins only provide a partial picture, especially for a capital intensive business. A more relevant metric for me is return on capital employed. Zigup reports an underlying ROCE figure of 11.9% for H1, down from 12.8% for the same period last year.

My calculation using statutory figures suggest a trailing-12-month ROCE of 7.2%, consistent with the StockReport metrics for last year:

For a capital-intensive business with this level of profitability, I’d argue that a valuation of somewhere close to 1x tangible book value makes sense.

In today’s results, Zigup reports net assets of 480p per share (FY25: 473p) and net tangible assets of 393p per share (FY25: 381p).

At today's share price of c.383p, I'd argue the business is fairly valued or perhaps slightly below fair value. The long-term share price chart suggests to me that the market may share this opinion:

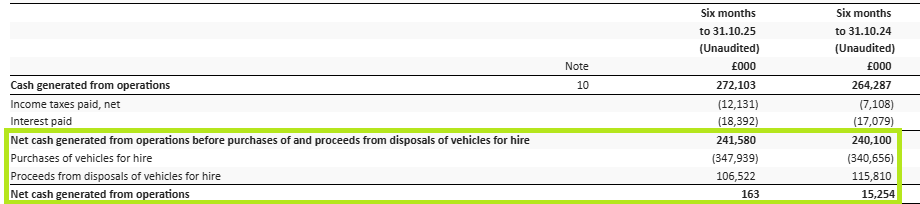

Cash flow & Balance sheet: running a big rental fleet inevitably requires a fair level of debt. My rule of thumb with hire businesses is that I prefer to see borrowing limited to around 50% of the rental assets' value.

By this metric Zigup still appears to be just about within my comfort zone, albeit at the outer edge.

The group’s net debt rose by £156.8m in H1 (versus April 2025), while the value of the company’s rental assets rose from £1,511m to £1,683m over the same period. Based on these assets alone, net debt was 55% of the value of the rental fleet – a little high for me.

However, it’s probably reasonable to view net debt in the context of the whole group. Adding in £174m of other fixed assets gave a net book value of £1,857m at the end of H1, giving a net debt/net asset ratio of 51%.

Using the company’s preferred measure, net debt/EBITDA leverage was 1.9x, up from 1.8x at the end of April 2025 (and 1.6x in October 2024).

Rising debt suggests weaker cash flow. A quick look at the cash flow statement shows that operating cash flow fell to almost zero in H1. This was due to a combination of higher fleet capex and reduced proceeds from disposals:

Commenting on capex in today’s report, the company says that steady state cash flow is expected to increase in coming periods.

My reading of this is that growth and replacement capex may ease as the fleet age and size stabilises at the desired level. This should help to improve operating cash generation and limit any further growth in leverage – I wouldn’t want to see this rise above 2x EBITDA.

Organisation structure: Zigup was formed in 2020 by the merger of Northgate (UK & Spain van hire) and Redde (UK claims management and repair).

I was never entirely convinced about the potential for merging these two rather different businesses. It now seems as though the company may also be coming round to my point of view. Today’s results include a comment on the “continuing evolution of the UK&I operating model":

This autumn we commenced a new phase of simplification and transformation, with workstreams encompassing a further evolution of the UK&I operating model into two operating businesses focused on each of Rental and Repair. It is fully aligned with our strategic framework and will enhance the competitive advantages of our integrated platform.

To me, “two operating businesses focused on Rental and Repair” sounds a bit like Redde and Northgate before they merged! Management expects this restructuring programme to take up to 18 months and provide £20m of annualised cost savings by FY28.

Outlook

Strong performance across the business, especially in Spain, provides confidence that full-year performance will be “at least at the top of the range of analysts’ expectations”.

These are given as being for an adjusted pre-tax profit range of £150-155m.

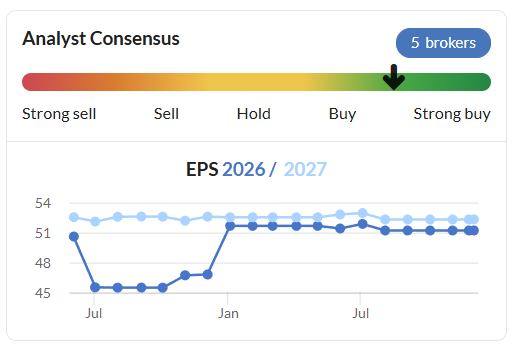

I don’t have access to any broker notes today, but this morning’s 12% share price rise suggests to me that perhaps some brokers have upgraded following these results.

Here’s how consensus expectations looked for the business prior to any changes today:

Assuming a 5% upgrade to consensus earnings forecasts would give a figure of around 54p per share. That would put Zigup on a forward P/E of 7, with a 7% yield.

Roland’s view

In my view, this is a capital-intensive business that’s always likely to generate somewhat average returns on capital. Zigup’s leverage is now also at the top end of what I’d want to see.

I’m also amused to see that the company now appears to be planning at least a partial reverse of the 2020 Redde - Northgate merger. The low-margin Claims & Services business has never seemed very attractive to me.

Having said that, I do remain a fan of the core Northgate business, which has good scale and has been a market leader in its sector for a long time, delivering reliable results.

On balance, I think the valuation remains reasonable here given the momentum implied by today’s upgrade. While I would personally prefer to purchase the shares at a discount to tangible net asset value, I think it’s appropriate to leave Graham’s AMBER/GREEN view unchanged today.

Paragon Banking (LON:PAG)

Down 6% to 795p (£1.55bn) - Final Results - Roland - AMBER ↓

Today’s results look fairly decent, as I hoped when I took a fairly positive view on the interim results in June.

- Pre-tax profit +1.1% to £256.5m, with adj EPS +8.5% to 109.7p (Stocko consensus: 104.5p)

- RoTE stable at 17.5%.

- Net Interest Margin 3.13% (FY24: 3.16%)

- Net loan book +4% to £16.3bn

However, today’s results have highlighted a couple of headwinds that could put pressure on profitability over the coming year:

- Motor finance provision increased from £6.5m to £25.5m based on the FCA’s consultation paper.

- Impairment charges +71% to £41.9m (FY24: £24.5m), mainly due to underperforming pre-2022 property development loans.

This appears to lave prompted a mild sell-off today.

One issue is that the performance of pre-2022 property development loans still appears to be worsening. At the end of the year, Stage 3 loans (where borrowers are not expected to make a full repayment) accounted for £104m (11%) of the development finance portfolio. The company blames this on cost inflation and higher interest rates since 2022, but these bad debts are still being worked through the books.

Paragon’s impairment charges have now risen from just £14.0m in 2022 to £41.9m in 2025 – a threefold increase that’s a useful reminder of cyclical risks in lending.

Higher motor finance provisions are another possible headwind, although the final outcome of the FCA proposals isn’t yet known.

The end result from all of this appears to be that Paragon’s net interest margin could remain under pressure next year, potentially falling below 3% according to the newswire.

Are the shares cheap enough to reflect this risk? Today’s results show tangible net asset value up by 7% to 655p. At 798p, the stock still trades at a 22% premium to TNAV. I think that’s probably fair given the bank’s 17% return on tangible equity, but as a non-expert, I am inclined to take a neutral view until we see credit losses and margins start to level out.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.