Good morning and welcome to today's report. Let's see what the newswires have in store for us today.

Today's report is now complete.

Spreadsheet accompanying this report: link (last updated to: 10th November).

Companies Reporting

| Name (Mkt Cap) | RNS | Summary | Our View (Author) |

|---|---|---|---|

| Unilever (LON:ULVR) (£109bn | SR52) / Magnum Ice Cream NV (LON:MICC) | Completion of demerger of Ice Cream Business | Trading in Magnum Ice Cream NV (LON:MICC) shares will begin at 8am on the LSE. A consolidation of Unilever shares will take place after market close today to maintain the comparability of the Unilever share price pre- and post-demerger. | (Roland - I hold) [no section below] I took an in-depth look at the new listing of Magnum Ice Cream (ticker MICC) in a Stock Pitch last week. One point worth following up is that my attempt to calculate the likely price of Magnum shares when they started trading seem to have fallen wide of the market. From what I can see, the valuation for Magnum shares has come in somewhat lower than expected - the initial valuation of c.€7.8bn is well below the levels I was hypothesising (and which had also been suggested in commentary elsewhere). We'll have to see where things settle out and what the consolidation ratio is for Unilever shares (to be published later today). |

Smith & Nephew (LON:SN.) (£10.7bn | SR69) | Upgraded FY25 guidance, trading margin now to be “at least 19.5%” w/ free cash flow of c.$800m. $200m inventory provision as part of portfolio rationalisation. Looking ahead, exp 6-7% rev growth w/ 9-10% trading profit CAGR. RH note: previous FY25 margin guidance was “between 19.0% and 20.0%”, so today’s upgrade is only slight. The free cash flow upgrade is more significant, up from c.$750m in November and prior to that, >$600m. | AMBER (Roland) [no section below] This medical technology company specialises in replacement joints and wound care products. It always seems to be in a turnaround phase and continues to trade well below pre-pandemic levels. Today we have news of an upgrade to 2025 expectations (see left) and a new set of strategic and financial targets for 2028. The main gist of the new targets seems to be that the company is aiming to scale through improved operational execution, while streamlining its product portfolio somewhat to reduce SKUs and reduce gross inventory by c.$500m. As part of this process, the company will recognise a $200m inventory impairment in its 2025 accounts. For me, this has always felt like a business that should be more profitable and successful than it is. I don't know much about this sector, but my tentative conclusion would be that S&N is missing some element of scale, product fit, pricing power or market share. The stock's 8% ROCE emphasises the average quality metrics - and the lack of the kind of strong profitability that might be needed to create attractive value for shareholders. This isn’t a stock we normally cover, but the lack of any market reaction to today's news suggests to me that a neutral view might be appropriate ahead of the 2025 results. A StockRank of 69 also seems to support this conclusion, in my view. | |

Fermi (LON:FRMI) (£6.98bn | SR1) | Signed contract for supply of <200MW of electrical capacity to Fermi’s 11GW Project Matador Campus. | ||

Harbour Energy (LON:HBR) (£2.96bn | SR72) | Sale of Harbour’s operated interests in Natuna A (28.7%) and Tuna (50%) for $215m cash to Prime Group, an Indonesian oil and gas business. Prime already has a 25% interest in Natuna Sea Block B. | ||

Oxford Nanopore Technologies (LON:ONT) (£1.2bn | SR43) | Oxford Nanopore Tech - Appointment of Francis Van Parys as CEO | New CEO will join on 2 Mar 26. He has >20yrs experience in life sciences and is currently President & CEO of acute care diagnostics specialist Radiometer (part of Danaher). | |

| SDCL Efficiency Income Trust (LON:SEIT) (£683m | SR n/a) | Interim Results | SP -17% to 52p NAVps down 3.3% to 87.6p (vs March 25). Gearing at 71.9% of NAV, FY26 dividend guidance of 6.36p per share unchanged. | No view (Roland) The trust’s managers warn that gearing has exceeded SEIT’s policy limit, constraining the managers’ ability to fund any more growth capex without disposals. Comments such as “A buyers’ market” emphasise the difficult conditions in the listed infrastructure sector at the moment. I think there may be some bargains on offer in this market, but I don’t know enough about SEIT’s portfolio assets to say whether the stock’s 40% discount to NAV is likely to represent an opportunity or a risk. I’m not taking a view today, but I might see this as worthy of further research if I had a keen interest in this sector. |

Avacta (LON:AVCT) (£345m | SR36) | Expects to announce initial Faridoxorubicin Phase 1b data in the salivary gland cancer indication on 17 Dec 25. A presentation will be held on IMC for private investors. | ||

Mears (LON:MER) (£293m | SR80) | Traded strongly in H2 expects FY25 adj pre-tax profit to be at the top end of market guidance. Panmure Liberum updated forecasts: FY25E: adj EPS 52.6p (prev. 50.4p) FY26E: adj EPS 42.6p (unch.) FY27E: adj EPS 40.2p (unch.) | AMBER/GREEN = (Roland) Today’s trading update is clearly positive, but the near-total lack of detail means that investors without access to broker notes may struggle to guess at the expected impact on profits. With thanks to broker Panmure Liberum, we learn that this outperformance is being driven mainly by higher-than-expected revenues from the ongoing asylum programme. However, expectations for a significant decline in earnings as this programme tapers off in 2026 remain unchanged. I am inclined to take a neutral view but I respect the momentum of repeated upgrades and can see the potential for further outperformance if this government spending proves stickier than expected. For this reason, I’m leaving Graham’s previous more positive view unchanged today. | |

Big Technologies (LON:BIG) (£186m | SR23) | New wins in Lithuania, Latvia and Washington state (USA). Agreed Buddi partnership with a US rehabilitation specialist. Trading in line with market expectations. | AMBER/RED = (Mark) Contract wins and an inline trading statement address one of the key risks here. Namely, that all the issues surrounding the legal action against the company and subsequent management changes, would impact trading. However, some huge uncertainties remain, not least the scale of the damages that they will need to pay former Buddi shareholders. The company only looks cheap if those damages are less than the possible £70m in damages sought plus costs, or are offset by a successful similar claim against former CEO, Sara Murray. While I see the attraction of taking a contrarian bet on this, resolution of these issues could go into 2027 if it goes to court. In the meantime, shareholders are exposed to great uncertainty, and a Momentum Rank of just 4 making it too soon to upgrade Roland’s previous, mostly negative view. | |

Beeks Financial Cloud (LON:BKS) (£156m | SR27) | £1.9m/5yr contract win with South African bank and £2m extension with “large FX broker”, bringing total for this client to £6m/5yr. Broker forecasts unchanged. Canaccord Genuity forecasts: | AMBER = (Roland) [no section below] Existing consensus revenue forecasts show Beeks’ top line growing by >10% per year. Against this backdrop, it’s clear that expectations are for the company to deliver a mix of contract wins and renewals/extensions. Today’s RNS (and others recently) appear to be no better than in line with these expectations, so I see this as a business-as-usual RNS. Having said that, it’s always encouraging to see growth companies delivering on forecasts. This update suggests the company is expanding its share of spend with one existing client and successfully securing new customers elsewhere. Using the 16% operating margin implied by today’s (unchanged) Canaccord Genuity forecasts for FY26, these contracts could equate to around £635k of additional operating profit. At least some of this will be spread over five years, but it’s still a useful amount for a company forecast to generate £6.7m of EBIT this year. My main concern with this business remains that it’s quite capital-intensive and has not yet demonstrated the ability to generate tech-style high returns - ROCE remains resolutely under 10%. In essence, a lot of what Beeks does seems to be equipment leasing. On that view, the rolling forward P/E of 25 and in-line performance mean I can’t get higher than AMBER. | |

Treatt (LON:TET) (£126m | SR70) | Interim CFO will be promoted to Interim Group Managing Director, with Group FD and IR lead taking responsibility for finance function. This management structure will remain in place until a new CEO is appointed. | AMBER = (Mark) [no section below] Given all the ongoing takeover news, where a decent-premium bid was blocked by a German ingredients group increasing their holding to 28%, we haven’t really commented on the business recently. Perhaps unsurprisingly once the recommended bid was blocked, the CEO fell on his sword. Today’s announcements give some leadership continuity. However, I can’t help feeling that changes of titles aren’t going to see any significant change in business prospects in the short-term. They also suggest that a new CEO appointment will take some time. Trading is undoubtedly difficult, and the risk is that there is a further short-term profits warning. Even without this, a 16x forward P/E doesn’t look compelling. However, the shares have fallen back following the failure of the takeover offer, and are now at 0.9xTBV. This, plus the willingness of two industry players to either buy shares or the whole business at a significant premium to today’s price, suggests that there is value here for those willing to take a longer-term view. My pre-offer, neutral view, reflecting this mix of short-term risk but long-term value remains. | |

Journeo (LON:JNEO) (£83.3m | SR91) | Recently acquired subsidiary, Crime and Fire Defence Systems, has received initial purchase orders totalling £2.3 million. Work has already commenced, and all three sites are scheduled for completion in 2026. | AMBER/GREEN = (Mark) [no section below] | |

Pulsar Helium (LON:PLSR) (£56.3m | SR17) | Jetstream 5 well: gas was encountered at 255m and 451m depth, with a preliminary bottom-hole pressure reading of ~662 psi, indicating a strongly pressurized system. | ||

Lendinvest (LON:LINV) (£53.5m | SR36) | FuM +14% y-o-y to £5.3bn. Net operating income +29% to £21.5m, mainly due to higher interest income. PBT £1.2m (25H1: £2.4m LBT), EPS 0.6p (25H1: -1.3p). Experienced some temporary slowdown in property purchase activity ahead of the November Budget, but performance for the full year is expected to remain in line with market expectations. | ||

Iqe (LON:IQE) (£49.1m | SR20) | A multi-year extension to its strategic agreement with Lumentum to use IQE's VCSEL expertise has advanced 3D Sensing technologies across Lumentum's broad photonics product portfolio. | ||

Helium One Global (LON:HE1) (£35.9m | SR11) | Commenced operations in southern Rukwa ahead of further testing using an Electrical Submersible Pump which is expected to arrive in Tanzania mid to late December. | ||

Hercules (LON:HERC) (£33m | SR86) | £4.2 million awarded within the Thames Water region £2 million awarded within the Anglian Water region To start in Q1 FY2026 and last for 6 months. | AMBER/GREEN = (Mark) | |

Medpal AI (LON:MPAL) (£29.9m | SR8) | An enhanced journal feature now supports AI-powered analysis of uploaded documents and lab results. The update also introduces German language support. | ||

Wishbone Gold (LON:WSBN) (£20.3m | SR27) | Three diamond drill holes have now been processed with assay results pending. Access road applied for. | ||

Sound Energy (LON:SOU) (£18.2m | SR22) | Initial commissioning activities for the TE-5 Horst development project (20% Sound Energy) has had first gas entered the gas gathering system in preparation for long term gas production into the micro-LNG plant. | ||

Mila Resources (LON:MILA) (£17.1m | SR32) | Gold intercepts returned from the first diamond drill hole include 5m @ 2.78 g/t from 183 m. | RED (Mark) | |

Frontier IP (LON:FIPP) (£12.7m | SR27) | NAV/share down 23% to 61p, partly due to fund raise. LBT £6.3m (2024: £1.3m). Loss per share 10.1p. Cash 30 Jun £2.6m. | ||

Rockfire Resources (LON:ROCK) (£11m | SR23) | Drill results so far in hole HMO-010 are reading high grades of zinc, silver, and lead. Between 97.55m and 98.20m depth, individual spot readings peak at 13.9% Zn, 1.48% Pb and 133ppm Ag. | ||

Kropz (LON:KRPZ) (£10.2m | SR26) | Related parties, Elandsfontein and ARC have loaned ZAR 250 million (US$ 14.4m) at an interest rate of South African prime overdraft interest rate (currently 10.25%) plus 6%). Funding ongoing losses. |

Roland's Section

Mears (LON:MER)

Up 4.5% to 371p (£321m) - Trading Update - Roland - AMBER/GREEN

Today’s update is short and sweet:

Mears Group PLC, the leading provider of housing services to the public and regulated sectors in the UK has traded strongly in the second half to date and anticipates that adjusted profit before tax for the financial year ended 31 December 2025 is expected to be at the top end of market guidance issued on 7 August 2025.

A more detailed update is promised in January. What would have been more helpful for investors today would have been if the company had included a little more detail, both on existing expectations and the reasons for today’s upgrade.

Turning back to August’s interim results does not provide a clear answer, either. While the company did provide guidance on the range of revenue and operating margin expectations, pre-tax profit guidance was for a “range of outcomes derived from revenue and margin guidance above”.

Broker update: fortunately in this case, I am able to access the additional insight provided by broker coverage, with thanks to Panmure Liberum on Research Tree.

PanLib’s note today tells us:

The upgrade is driven by both revenue and margins;

Additional revenue has mainly come from the Asylum Accommodation and Support Contract (where Mears is involved in providing accommodation such as hotels);

FY25 adjusted pre-tax profit forecasts is upgraded by 4.5% from £58 to £61m

It’s a shame Mears chose not to provide this information in its RNS, so it could have been equally available to all market participants.

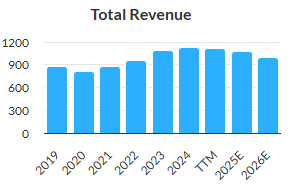

Outlook & Estimates: PanLib’s earnings estimates for 2025 have increased today, with outer years remaining unchanged ahead of January’s more detailed update:

FY25E adj EPS: 52.6p (+4.4% vs 50.4p previously)

FY26E adj EPS: 42.6p (unch)

FY27E adj EPS: 40.2p (unch)

Today’s upgraded forecasts put Mears on a 2025 forecast P/E of 7, but investors need to beware of falling earnings forecasts for the following two years.

Asylum work is tapering off: the underlying story here is that Mears has done very well from its government contracts to provide accommodation for asylum seekers. However, this is now tapering off. The company says that the government intends to end the use of hotel accommodation in 2026, resulting in a hit to earnings for Mears.

The more detailed guidance provided with the half-year results showed that revenues from the Management business, which includes the asylum contract, are expected to fall by £100m in FY25 and by a further £125m in FY26.

While the Maintenance side of the business is expected to maintain 5%-9% revenue growth over the medium term (vs 8%-9% in FY25), brokers are clearly not yet convinced that Mears can make up the shortfall that seems likely to follow the tapering of the asylum-related work:

The market will be looking for Mears’ management in January to provide more clarity on the pipeline of new contracts and recent wins. This could help to firm up the valuation, potentially.

The other possibility, given the nature of this work and the complexity of the situation, is that winding down the use of hotel accommodation and providing suitable replacement accommodation where needed will take longer and cost [the taxpayer] more than currently expected. That isn’t impossible and could be beneficial for Mears.

Roland’s view

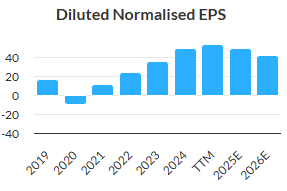

While quality metrics for this business have improved significantly in recent years, I think it’s worth noting the extent to which Mears has become a property leasing business. This is reflected in the rise in statutory net debt (which includes lease liabilities):

I don’t follow Mears all that closely and am surprised by the scale of the leasing liabilities the business has built up. From what I understand, the majority of this relates to the company securing accommodation under the scope of its asylum contract. In addition, there’s also some exposure to other government-backed areas such as MoD housing and criminal justice (housing newly-released prisoners).

The general idea, from what I can see, is that Mears leases properties with durations/break clauses that are matched to the relevant contracts. This is intended to minimise the risk the company will be left with empty properties on which it is still making lease payments.

I don’t know how bulletproof these arrangements might be, but for me, the politically-charged nature of much of this work is a potential concern, due to the risk of unexpected changes to prevailing policies.

The numbers are certainly significant. While Mears reported net cash of £81m excluding lease liabilities at the end of June 2025, the group’s balance sheet showed £300m of lease liabilities at that time. Around three-quarters of these are classed as non-current (i.e. due in more than 12 months’ time), so I would guess the typical duration of these leases might be 3-5 years.

My working assumption is that any unexpected disruption to sub-letting cash flows could have a material impact on the profitability of a company generating c.£70m of operating profit.

Graham was AMBER/GREEN on Mears following the company’s half-year results in August and a string of earnings upgrades earlier in the year:

My inclination is to be a little more conservative, given the forecast decline in earnings. But I think the company's continuing near-term momentum justifies leaving our moderately positive view unchanged today, ahead of January’s full-year update.

SDCL Efficiency Income Trust (LON:SEIT)

Down 17.5% to 52p (£565m) - Interim Results - Roland - No view

We don’t normally cover investment trusts in detail, but today’s interim results from SEIT have made it the biggest faller in the FTSE All-Share index. I thought it might be interesting to take a brief look at this trust, which appears to offer a tempting 10%+ dividend yield.

SIET’s investments are focused on the “energy efficiency sector” and include projects in the UK, Europe and North America. These include solar projects, a gas distribution network and services to improve the energy efficiency of two steel mills in the US.

Today’s results have been received like a lead balloon, despite SEIT only reporting a fairly modest decline in net asset value and leaving its dividend target unchanged.

H1 26 headline results summary (6 months to 30 Sept 25):

Net asset value (NAV) per share down 3.3% to 87.6p

Portfolio valuation of £1,172m at 30 Sept 25 (£1,117m at 31 March 25)

Investment cash flow from portfolio of £58m (Sept 24: £48m)

H1 dividends of 3.18p per share, FY26 dividend target unchanged at 6.36p per share

Gearing at 71.9% of NAV, above Investment Policy limit

Disposal progress includes sale of ON Energy at 18.75% premium to NAV and “exclusivity agreed on a further disposal expected around year end”

Outlook & Market Commentary

Outlook commentary today is focused on issues that are widespread across the infrastructure and renewable energy trust sector, but appear to be affecting SEIT more seriously than some rivals. Here’s a summary of the key points, as I see them:

Deep share price discounts to NAV mean that the only option to raise funds for growth is through debt or asset disposals;

Unfortunately, SEIT has run out of borrowing headroom and its investment manager has been instructed not to draw down any further debt;

While growth capex remains unavailable, there’s a risk that asset valuations could be downgraded where those valuations already price in growth plans;

Management are working on asset disposals to reduce leverage, but current market conditions “can be categorised as favouring buyers”.

High levels of infrastructure equity dry powder, coupled with pent-up supply from oil & gas majors disposing non-core assets, and extended holding periods driven by limited exit opportunities, have contributed to falling valuations and smaller deal sizes. Boston Consulting Group notes that average deal sizes in infrastructure are 40% below their 2021 peak, with volumes down by 8%, while Roland Berger confirms a 14% drop in 2024 continuing into 2025.

Roland’s view

It’s clear that potential buyers will be aware of the company’s need to sell and able to strike attractive bargains. The slow pace of disposals in 2025 here (and at other trusts) illustrates the company’s point about it being a buyers’ market at the moment. Clearly, competition to buy such assets is not all that strong right now.

In my view, this leaves SEIT in an uncomfortable position. It’s overgeared, unable to raise equity (due to the discount to NAV) and unable to borrow more.

I am not surprised the shares have fallen sharply today.

However, this isn’t necessarily a lost cause, in my view. As I write, the shares are trading at a 40% discount to today’s net asset value. If enough of SEIT’s assets are profitable and cash generative, with viable futures, then this collection of assets could offer genuine value potential at current levels – even if the dividend is eventually cut.

I should stress that I don’t know much about SEIT’s assets at all; this isn’t a stock I follow. It’s possible that they are all good assets, with viable business models and growth potential. Equally, it's possible that they are not so good and deserve to be de-rated.

For me, the big picture here is that SEIT and other such trusts built portfolios based when interest rates were much lower. The impact of rising rates has left many trading at a discount and caught in a Catch-22 situation. Higher funding costs, changes in energy pricing and political factors are all extra complications, as we saw with the failure of the TRIG/HICL deal (disc: I hold TRIG) last week.

In some cases, I suspect we’ll find that the numbers for some of these projects simply don’t add up any more. In others, I think it will gradually become apparent that there is decent value on offer.

I don’t have sufficient insight on SEIT to take a view, but if I was a keen investor in this sector I would probably take some time to learn more about the underlying assets here.

I think it’s inevitable we’ll see some liquidations and some consolidation in the infrastructure trust sector. While it’s not without risk, owning deeply-discounted assets in such a scenario could be a profitable strategy.

Mark's Section

Hercules (LON:HERC)

Up 8% at 44p - New Major Contract Awards in the Water Sector - Mark - AMBER/GREEN

When I looked at Hercules following their Half-year results at the start of October, I liked that they were growing at a reasonable pace without requiring much additional capital, and were on a modest multiple. However, I also had several concerns:

Their disclosures look poor, as they didn’t include a breakdown of their adjustments or segmental reporting at the half year.

We didn’t see a significant increase in forecasts following their major acquisition of NRG. This led me to question whether they overpaid or there is weakness in their core business that is being masked.

Looking at the segmental reporting, almost all of their growth comes from labour supply not civil projects, meaning that they were increasingly looking like a recruiter, not a civil engineering business.

That last concern may be partially assuaged by today’s announcement:

Civils Projects division has been awarded a series of new sub-contract packages from its clients in the UK water sector to start in Q1 FY2026. The new agreements total c.£6.2 million in value and are expected to be delivered in the next six months.

£6.2m doesn’t immediately seem material compared to a £129m forecast revenue. However, Civil Projects had a gross margin of 21% in 2024, compared to 13% for Labour Supply. If these contracts deliver similar margins, they add about £1.3m additional gross profit in 2026. Segmental admin costs seem to largely track inflation, but there may be some incremental cost associated with these wins. Still, this has the ability to add somewhere between £0.5m-£1m of additional PAT. Which is material to the current c.£3m forecasts.

The contracts are split across two water companies:

These clients are delivering crucial upgrades and increased capacity at clean and wastewater treatment sites across the UK. Hercules will manage and deliver projects in the following regions:

● c.£4.2 million awarded within the Thames Water region

● c.£2 million awarded within the Anglian Water region

Those who live in a Thames water area will no doubt be hoping these works help reduce the amount of raw sewage that is being discharged into their rivers! Hercules are certainly hopeful that these contract wins are the first of many in the current AMP8 5-year regulatory cycle:

Hercules is a strategic supplier to contractors operating within the following UK water regions: Anglian Water, Thames Water, Southern Water, Severn Trent Water, Wessex Water, United Utilities, Welsh Water, and Yorkshire Water…As a result, the Board of Hercules expects to continue to secure additional contracts and deliver a wide range of projects over the coming years as AMP8 builds momentum.

Unfortunately, I cannot see any updated broker coverage which would confirm if these wins have already been included in forecast growth.

Mark’s view:

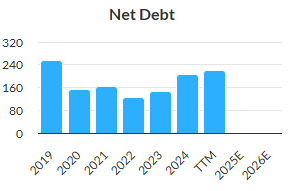

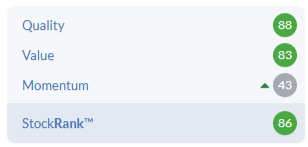

If my calculations are correct and these wins are not already in forecasts, this makes the current forward P/E around 8, after today’s rise. This looks modest compared to the potential for further Civils Project wins. This will also have a positive impact on the Momentum Rank, which is currently the weakest of the three:

Despite my first two concerns remaining, this news means I’m happy to keep my broadly positive AMBER/GREEN view even at the current higher share price.

Big Technologies (LON:BIG)

Up 5% at 66p - Trading Update - Mark - AMBER/RED

I wanted to take a look at this company today, as a friend commented that it may be cheap despite (or perhaps because of) recent litigation woes. Roland reviewed these allegations in detail here. The most damning of those appear to be that:

[Former CEO] Sara Murray had… improperly diverted or extracted significant sums of money (currently thought to be in excess of £19 million) from the Company and/or members of its Group to herself or persons connected with her

And:

Additional matters have now come to light which further materially adversely impact the position of the Company and Buddi in the Buddi Litigation…These matters centre on the forgery or deliberate falsification by Sara Murray of various documents, including board minutes of Buddi and emails which, on their face, purported to: (i) be sent by certain shareholders in Buddi; and (ii) show their agreement to sell their shares in Buddi to the Company for cash.

That last point sounds like the company will almost certainly have to pay damages to former Buddi shareholders who are suing the company, and the company has pretty much said as much in their latest litigation update. Understandably, these revelations have led to various boardroom changes. Obviously Ms Murray is fired as CEO, but there has also been a change of Non-Exec Chairman and the COO lost their board position, some of these changes appear to have been forced upon them by major shareholders. The company are seeking to recover damages from Murray, while she remains the company’s largest shareholder with 26.7% of the equity. Overall, this just looks a mess.

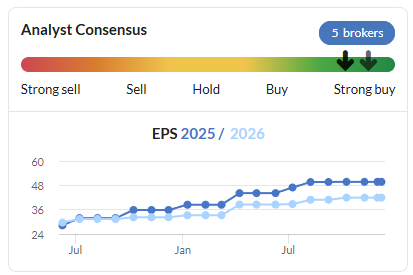

An initial look at the StockRanks is also not promising:

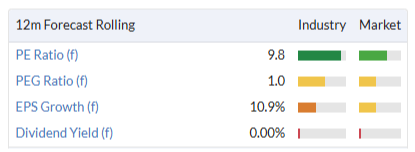

However, in keeping with the academic research on the value anomaly, the Value Rank is based on the historical figures only, and things look better on a forward basis:

Therefore, today’s update is key when it confirms:

The Group expects to release its full year trading update at the end of January 2026 and new contract wins underpin confidence in the Group's trading in line with market expectations.

Helpfully, they give these expectations:

current market forecasts for 2025 revenue to be in the range of £48.5m to £49.5m, with a consensus of £49.1m, and for adjusted EBITDA to be in the range of £23.7m to £24.5m, with a consensus of £24.1m.

The broker’s note we have access to, Zeus’s, comes in at consensus for adj. EBITDA which they turn into 6p of EPS, for a forward P/E of 11. This doesn’t look immediately attractive, given the events of the last year. However, they also forecast £96.1m of net cash at the year end, which is half the market cap. Importantly, Zeus also forecast that cash balance to rise going forward and reach almost £130m at the end of 2027, as earnings largely convert to free cash flow.

There are several large unknowns remaining, and given my lack of legal expertise, I’ve asked ChatGPT a few questions:

How much will the Buddi litigation cost them? ChatGPT says: “the former-Buddi shareholders appear to be seeking about £70.1m (plus “damages”) and, if they win, total payout to them could easily exceed that number once interest and costs are added — conceivably pushing the ultimate bill into the low-to-mid-£70–100m range under some plausible outcomes.”

How much of that claim can they recover from Ms Murray? I believe that Murray has provided undertakings not to dissipate assets up to £320m, meaning there are assets available to make restitution. ChatGPT: “Practically, the most recoverable slice will be money Murray is shown to have personally received or controlled (e.g. the alleged £19m). Recovering the entire £70.1m headline from one person is possible legally but fact-dependent and unlikely unless her assets or receipts directly correspond to that scale.”

What the company intends to do with the cash balance? For us to consider a cash-adjusted valuation, we need to know they will put that cash to good use or return it to shareholders. They haven't paid a dividend since listing. There was a share buyback program started in September 2024, but this ended after Ms Murray was dismissed. In May’s results statement they said they had “made good progress in identifying an acquisition in the strategically important US market. However, as a result of the ongoing litigation, we have paused these plans to maintain our financial strength.” While there may not be an immediate ability to grow via acquisition, it looks like this is where they will deploy cash when they know how much they have left after damages and costs are known.

Are there any more skeletons in the closet? In my experience, when alleged misrepresentations are found at the core of a company, it often takes more than a change of management to remedy the situation. While in this case, the allegations appear to have been addressed with integrity by the board, they can only deal with the information they have. I have no doubt that there is a real, cash-generative business here, but I am aware how little we can actually know as outside investors.

Mark’s view

Putting all of these together, one could argue that even if the eventual award to the Buddi former shareholders is £70+costs, and the recovery from Ms Murray is negligible, the valuation is not that expensive. However, there will no doubt be huge disruptions to the business from all that is going on here, and a risk that further issues surface. Today’s trading statement, confirming that trading is in line with expectations helps mitigate some of those risks, and I can see why the market has been slightly re-assured by this today. However, I can’t help feeling that a better strategy may be to wait until the eventual outcome of the litigation is known. Investors may end up paying a higher price, but they avoid being stuck in a stock with a Momentum Rank of 4. After all, if the Buddi litigation goes to court, then we may not get a final judgement until sometime in 2027. Until then, or if we have confirmation that Buddi former shareholders are happy to settle, or explore mediation, there will remain an uncertainty that will weigh on the share price. Hence I share Roland’s AMBER/RED view for the moment.

Mila Resources (LON:MILA)

Down 15% at 2.2p - Yarrol Project - Mark - RED

The recent gold price strength has encouraged many smaller gold explorers to pursue more active drilling campaigns. Management of these companies are almost always incredibly excited by their drill results. While I don’t want to pick on Mila Resources (LON:MILA) as it seems not to have been excessively enthusiastic in management comments today, they chose to RNS drill results on a quiet news day on the DSMR:

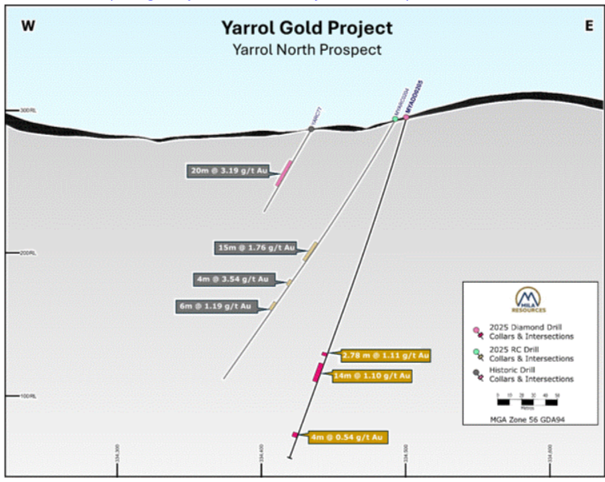

Significant gold intercepts returned from the first diamond drill hole MYADD0205, including:

o 5 m @ 2.78 g/t from 183 m

▪ including 1 m @ 6.89 g/t Au

▪ and including 1m @ 6.39 g/t Au

o 2.19 m @ 1.1 g/t from 170.44 m

o Allowing for greater dilution of lower grade material between intercepts returns an interval of 14 m @ 1.14 g/t from 178 m

They describe these as “significant”. However, it is worth having a think about what these drill results actually mean. Grams/tonne is effectively parts per million. Mila has only intersected in two 1m sections above 5 g/t. In comparison, Serabi, with a producing underground mine at Palito, has a Reserve Grade (2P) of 7.2 g/t, and Resource Grade (M&I) of 9.6 g/t. Their Cut-off Grade of what they consider economic is 3.70 g/t for underground operations.

What Mila are reporting today, is made clearer by their drill map:

Their highlighted intersections are around 200m underground! That would require a huge open pit, or an extensive underground development. I’m not a sector expert but I see almost no sign from these results that they have identified mineralisation that could be economically developed given these grades and depths. Of course, they may find such mineralisation in the future. However, this hasn’t stopped investors piling into the junior gold explorers this year, as Mila’s share price chart shows:

The other factor with this and similar companies is the time it takes to build a mine. Mila’s photo on their website accompanying the Yarrol project may be more prescient than they intended, as it is two men looking far into the distance!

With a huge amount of drilling still required to show a viable resource (if it is actually there), raise funds and build a mine, any mine is likely to become operational just as the gold price cycle turns and heads south again. While the timing of any such cycle is unpredictable, the capital market cycle that allows companies such as Mila to raise funds for exploration is almost certain.

Mark’s view

While I look at Mila today as it reported drilling results, my view encompasses almost all of the smaller companies that are only just starting drilling prospects today. They may announce drill results with great fanfare, but when I look at the details, I see unimpressive grades at great depths. My view is that the vast majority of such projects will never reach production. Given the time to build a mine, the ones that are in the initial exploration phase today that do become mines will likely become operational in a much lower gold price environment given the capital market cycle. The likely lack of economic returns to shareholders makes this and similar companies RED for me.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.