Good morning and welcome to Friday's report.

Today's report is now complete (12.30).

Spreadsheet accompanying this report: link (updated to 16th December).

Companies Reporting

| Name (Mkt Cap) | RNS | Summary | Our View (Author) |

|---|---|---|---|

Rio Tinto (LON:RIO) (£101bn | SR78) | Rio Tinto confirms it has been discussing a potential combination with Glencore, which could include an all-share merger. Current expectations are that any merger would be effected by Rio acquiring Glencore. | ||

Glencore (LON:GLEN) (£49bn | SR34) | As above from Rio Tinto. | ||

Halma (LON:HLMA) (£13.8bn | SR79) | Acquired Safetec Srl, an Italian fire and gas safety business that designs solutions for large industrial projects. Cash paid €72.5m, Safetec 2025 revenue was c.€30m. | ||

J Sainsbury (LON:SBRY) (£7.5bn | SR90) | Q3 LFL sales +3.4%, with grocery +5.4% LFL. Won market share over Christmas. FY26 retail free cash flow now exp to be >£550m (previously >£500m). Shore Capital forecasts unchanged. | AMBER/GREEN ↓ (Roland) I can’t really fault this update, except to point out that LFL sales growth was slightly below reported grocery price inflation for December. The economics of this business remain tough. My feeling is that any increase in volumes and market share came from more competitive pricing. Today’s upgrade only applies to cash flow, with broker forecasts unchanged. I remain broadly positive on this well-run business, but I am starting to think the re-rating over the last year has left the valuation up with events. Sainsbury’s currently trades on a FY26E P/E of 14 and at a premium to book value. Given the historic profitability of the business, that seems high enough to me. I’m moderating our view by one notch today. | |

Unite (LON:UTG) (£2.8bn | SR48) | Trading update and Q4 Fund Valuations & Launch of £100m share buyback programme | YTD sales progress is “consistent” with guidance for occupancy of 93-96% and rental growth of 2-3% in 26/27 academic year. FY25 guidance unchanged for adj EPS of 47.5-48.25p. | AMBER (Roland) [no section below] Pricing in student property has come under pressure and today’s update confirms the company is using “price adjustments” to secure income in markets with lower occupancy. However, interest rates appear to be on a downward trend and Unite is a large player in this sector in the UK – soon to become larger with the acquisition of Empiric. With the shares trading at a c.45% discount to their last-reported book value, the £100m buyback launched today should be accretive to NAVps, generating value for shareholders. A forecast dividend yield of 6.7% is also attractive, if it proves sustainable. The StockRanks style this specialist REIT as Contrarian and I think Unite could be worth a closer look. While the sector faces challenges including slower sales cycles and a reduction in Chinese overseas students, I think it’s possible that performance is stabilising. I haven’t done enough research to form a strong conviction, so I’m going to take a neutral view today. |

Clarkson (LON:CKN) (£1.2bn | SR85) | Underlying pre-tax profit for 2025 is now expected to be “not less than £90m” following a strong H2. (Panmure Liberum forecast was previously £87.7m). Panmure Liberum forecasts upgraded:- FY26E adj EPS: 219.3p (prev. 213.3p) - FY27E adj EPS: 242.1p (prev. 241.9p) | AMBER/GREEN ↑ (Roland - I hold) Profits have proved resilient after a downgrade in May prompted by the introduction of US tariffs. I think the market-leading global scale of this shipbroker should help it remain successful and continue to generate attractive shareholder returns. While the company’s exposure to geopolitical events and market cycles will always be a risk, these can bring opportunities too. With a high QualityRank and rising MomentumRank, I think Clarkson could grow into a High Flyer profile. While the near-term valuation is probably up with events, I think it has longer-term potential. For these reasons, I’ve upgraded my view by one notch today. | |

Amedeo Air Four Plus (LON:AA4) (£162m | SR65) | Emirates has exercised an option to allow it to return an A380 in minimum ‘half life’ condition with a cash sum, as opposed to delivery in full life condition when its lease expires in August 2027. Does not preclude a lease extension or sale of aircraft to Emirates or others. | ||

Life Science Reit (LON:LABS) (£137m | SR44) | Portfolio valuation down 7.8% to £332.6m in Dec 25 (June 25: £360.6m). NAVps -13% to 57.7p. Seeing higher vacancy rates. | ||

Pulsar Helium (LON:PLSR) (£94m | SR24) | The Jetstream #5 appraisal well has encountered “additional pressurized gas influx” at 871m, the highest yet recorded at Topaz. Testing planned in February 2026. | ||

InvestAcc (LON:INAC) (£93m | SR16) | CFO Vinoy Nursiah has left the company with immediate effect after less than a year. The board remains “entirely confident” in the company’s financial controls. FY results to be in line with expectations. | ||

1Spatial (LON:SPA) (£76m | SR25) | Acquisition talks remain ongoing with VertGIS. Deadline for firm offer extended to 30 January 2026. | ||

Quadrise (LON:QED) (£51m | SR5) | A non-exec has stepped down as a result of late notifications of sharedealings. | ||

Strategic Minerals (LON:SML) (£33m | SR28) | “Exceptional drill results” from 3/9 drill holes completed on Redmoor Tungsten-Tin-Copper project. On target to release updated Mineral Resource Estimates by the end of Q1 26. Cash $780k at end Dec 25. | ||

Eden Research (LON:EDEN) (£16m | SR16) | Fungicide Novellus+ has been approved in Chile for use in wine and table grapes. |

Roland's Section

J Sainsbury (LON:SBRY)

Down 5.9% at 310p (£7.0bn) - Trading Statement - Roland - AMBER/GREEN

Sainsbury’s has released a relatively strong third-quarter update today and upgraded its full-year free cash flow guidance by 10%. But the market has reacted by marking the stock down by c.5%.

This is a repeat of the downbeat reception received by Tesco’s Christmas update yesterday – as Mark commented, it seems investors were expecting more from the UK’s two largest supermarkets.

Market share statistics from Kantar Worldpanel certainly suggest both should be enjoying positive momentum. Both have gained share over the last year, mainly at the expense of struggling third-placed Asda:

Tesco +0.2% to 28.7%

Sainsbury’s +0.3% to 16.3%

Asda -1% to 11.4%

Let’s take a look at today’s update from Sainsbury’s:

Total retail sales (exc. fuel) rose by 3.9% during the 16 weeks to 3 January 2026, or 3.4% on a like-for-like basis. That’s very similar to Tesco, which reported 3.1% Q3 LFL yesterday.

There was a slightly smaller 3.3% rise in retail sales over the six-week Christmas period.

However, sales in the core Grocery business outperformed this figure, offset by a drag from non-food sales:

Q3 Grocery +5.4% (Christmas: +5.1%)

Q3 General Merchandise + Clothing: -1.1% (Christmas: -1.0%)

Q3 Argos: -1.0% (Christmas: -2.2%)

At first glance this suggests General Merchandise and Argos were a drag on the group’s results, but this may not be (entirely) true. In line with the group’s successful food-first strategy. Sainsbury’s is reallocating space from general merchandise (GM) to Grocery.

This helps to explain the segmental sales figures I’ve listed above; Grocery sales benefited from new space while General Merchandise was restricted by “space reallocation”.

Notably, the company says that sales of its Tu clothing ranges “outperformed the clothing market by 10 percentage points”. I think this is one of the more differentiated parts of the GM business.

At Argos, falling sales appear to reflect pressure on consumer spending. Management say volumes were up, but average selling prices were lower due to “subdued spending on higher ticket items” and “a weak gaming market”. Argos is said to have gained market share in Homewares, Electricals and Toys in Q3.

Outlook & Estimates:

The big news from today’s update is that retail free cash flow is expected to be around 10% higher than previously:

Retail free cash flow now expected to be “more than £550m” (previously more than £500m)

I’d say the only slight disappointment here for me is that this improvement is said to be due to “strong working capital performance”, rather than any improvement in profitability.

Supermarkets benefit from negative working capital as customers pay for goods before the retailer’s suppliers need to be paid. This means that managing supplier payments and stock levels carefully can support strong cash generation, even from low-margin businesses. Strong financial controls and stock management are certainly good to have, but they're not the same as rising profits.

Broker forecasts: house broker Shore Capital has published a new note today on Research Tree – many thanks.

While bullish, Shore’s analysts have left their FY26 profit forecasts unchanged. This essentially confirms my view above – stronger cash generation than expected is coming from good financial controls and stock management, not from any improvement in underlying trading or profitability.

Shareholder returns: strong cash generation is not to be sniffed at and Sainsbury’s CEO Simon Roberts is keen to return cash to shareholders. He confirms today that he expects to hand back more than £800m in FY26, through ordinary dividends, a £250m special dividend and a £250m buyback.

Roland’s view

The UK grocery market is highly competitive and very mature. There’s not really much room for growth except by taking market share from rivals. The last few years have seen Tesco and Sainsbury’s easing further ahead and securing their position as the two largest supermarkets.

However, the intense competition from Asda, Morrisons, Aldi and Lidl means that margins will always be under pressure. I think we can see that in today’s update and yesterday’s statement from Tesco.

Both companies reported Q3 LFL growth of over 3%, but this is lower than grocery price inflation, which “eased to 4.3%” in December, according to Reuters. This suggests to me that gains in share or volumes will largely have come from more competitive pricing – a view supported by this statement in today’s update:

We have made balanced choices to invest and sustain the strength of our competitive position through the most important trading period of the year.

Remember that for a retailer, "invest" is usually code for cutting prices.

Graham was GREEN on Sainsbury’s in November, reflecting the company’s previous upgrade and its Super Stock status. I could hang onto this view today, but I’m not quite sure it’s justified.

Today’s upgrade doesn’t affect profits and the share price trend appears to be weakening following a sustained re-rating last year:

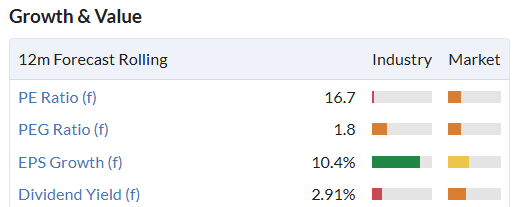

The stock’s valuation looks comfortably up with events to me, with the shares on a FY26 P/E of 14 and a dividend yield of 4.7%, excluding this year’s special.

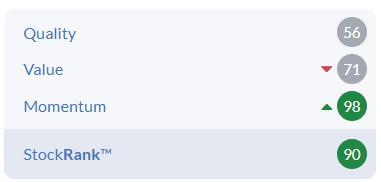

Sainsbury’s StockRank has declined since November and the StockRank Style is now Neutral, rather than the more bullish Super Stock styling we saw for much of last year. Momentum is still strong, but other measures have weakened slightly:

I note also that long-time major shareholder the Qatar Investment Authority recently sold 83.6m shares, cutting its holding from 10.1% to 6.8%. Perhaps they are keen to take some money off the table while the shares are trading at 10-year highs.

I don’t think there’s anything wrong here. But Sainsbury’s return on equity last year was only 6% and the shares are now trading at a modest premium to book value. At its core, this is a fairly low-return business. Personally, I’d want to find a cheaper opportunity to buy in. For this reason, I’m moving our view down by one notch to AMBER/GREEN today.

Clarkson (LON:CKN)

Up 4.6% at 4,170p (£1.3bn) - Trading Statement - Roland - AMBER/GREEN

(At the time of writing, Roland has a long position in CKN.)

Today’s update from this leading global shipping broker is short but positive:

Clarkson PLC, the world's leading provider of integrated shipping services, is pleased to announce that underlying profit before tax for the year ended 31 December 2025, subject to audit, is now expected to be not less than £90m, reflecting stronger results in the second half of the year.

Clarkson’s underlying pre-tax profit for the first half of the year was £39.4m, which tells us that the equivalent figure for the second half should be over £50m. An H2 profit weighting is common with this business, so not a particular concern.

Of course, the key piece of information missing from today’s trading update is the level of previous expectations.

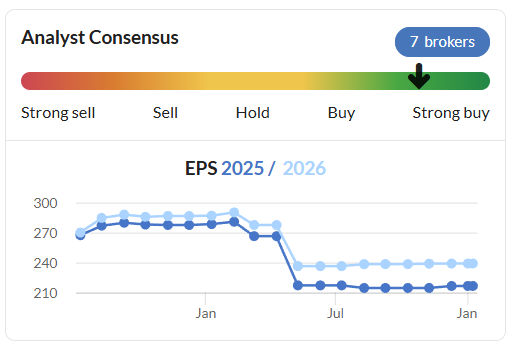

Updated Estimates: checking for broker coverage, I’m grateful to Panmure Liberum for publishing an updated note on Research Tree this morning. From this I can see that the previous forecasts for 2025 pre-tax profit was £87.7m.

Thus we can see today’s upgrade is relatively modest. PanLib helpfully provides the following updated earnings estimates:

FY25E adj EPS: 219.3p (prev. 213.3p)

FY26E adj EPS: 242.1p (prev. 241.9p)

FY27E adj EPS: 280.6p (prev. 280.4p)

Roland’s view

Clarkson’s issued a major profit warning in May last year when it looked like the introduction of US tariffs could throw a spanner in the works for global trade:

Today’s updated forecasts remain well below pre-tariff levels, but I see today’s upgrade as highlighting the resilience of this company, which has been in business since the 1850s.

Clarkson is considered the leading global shipbroker and operates across all major shipping segments, giving it access to a deep pool of data and relationships. I’m biased, as a shareholder, but I believe this gives the business a somewhat durable competitive advantage.

One criticism that’s often levelled at the firm is the large size of the bonus pool allocated to top-performing brokers. This includes CEO Andi Case, who is seen as the company’s top broker and took home an £11m bonus last year.

Bonuses are indeed large but this kind of profit-share arrangement is typical in this industry (most shipbrokers are privately held). The reason for this is that a large part of the value generated by such experts comes from the relationships they have. This is made explicitly clear in the annual report in the discussion of Case’s remuneration.

Personally, I don’t have an issue with this, as long as shareholder returns remain attractive. In my view, this is true.

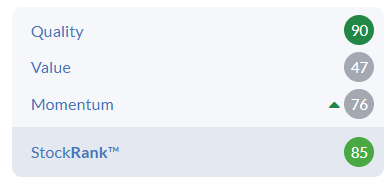

Quality metrics are quite strong, with double-digit returns on equity:

… and Clarkson shares have delivered an annualised total return of 9% per year for the last 20 years, during which the dividend has never been cut:

My main concerns as a long-term shareholder are:

Future leadership might be less successful – Case has been CEO since 2008;

Geopolitical events could create dislocations that reduce Clarkson’s addressable share of the global shipping market. An example of this is the volume of oil that’s now transported by Russia’s so-called dark fleet of tankers. Previous commentary from the company has suggested to me that this has had a measurable impact on Clarkson’s activities in the legitimate tanker market.

Graham downgraded Clarkson to AMBER/RED when the company warned on profits in May. I upgraded this view to AMBER when guidance was reiterated in August and Panmure Liberum made a small upgrade to its forecasts.

The shares have risen by 15% since August and aren’t obviously cheap:

My choice today is whether to stick with our neutral view or upgrade one notch to AMBER/GREEN.

The StockRanks apply a Neutral style but highlight strong quality and improving momentum.

With a recovery in earnings forecast from 2026 onwards, I think there’s a chance this stock could be restyled as a High Flyer. I’m going to stick my neck out today and go with AMBER/GREEN.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.