Good morning! Another busy day.

Calling it a day there, thank you.

Spreadsheet accompanying this report: link (updated to 16th December).

Companies Reporting

| Name (Mkt Cap) | RNS | Summary | Our View (Author) |

|---|---|---|---|

BP (LON:BP.). (£68.3bn | SR94) | Production was broadly flat in Q4, but trading profits weakened. The company expects to book $4-5bn in impairment charges relating to the gas and low carbon energy segment. Net debt is expected to fall to $22-23bn, following $3.5bn of disposal proceeds. | ||

Diploma (LON:DPLM) (£7.5bn | SR77) | Organic revenue growth of 14%, “very strong” performance. Four acquisitions completed for £75m. FY26 guidance unchanged for organic revenue +6% and op margin c.22.5%. | AMBER/GREEN = (Roland) [no section below] Diploma shares have risen by nearly 10% since our last view on this value-added parts distributor in July 2025. I’m relieved to see I took a broadly positive view at that time. Today’s pre-AGM update is brief but pleasing, with strong organic growth in Q1 (Oct-Dec). Diploma also made four bolt-on acquisitions during the quarter, extending its reach into markets such as aerospace and defence. The company says it’s now spent £130m on acquisitions over the last two quarters and expects to generate an annualised operating profit of c.£20m from this spending. That represents a pre-tax return of 15%, suggesting to me that Diploma isn’t overpaying. FY26 guidance is unchanged today and looks very satisfactory to me. My view of this business remains unchanged; I think it’s an excellent and well-run company, but somewhat expensive on c.29x forward earnings. For these reasons, I’m leaving our AMBER/GREEN view unchanged today. | |

Pearson (LON:PSON) (£6.8bn | SR74) | 2025 results to be in line with guidance, revenue +4%, adj operating profit up c.6% to £610-615m. Medium-term guidance unchanged. | ||

Vistry (LON:VTY) (£2.2bn | SR82) | Adj pre-tax profit to be c.£270m, in line with exps. Completions -9% to 15,700. Net debt c.£145m, in line. Forward sales c.£4.0bn (Dec 24: £4.4bn), market conditions uncertain, hopeful about SAHP. | AMBER = (Roland) Today’s FY25 results update is (just) in line with expectations, despite a drop in volumes last year. The main risk now seems to be that expectations for 2026 will need to be downgraded, with expected growth pushed back into 2027. Having said that, I do think that the short-term headwinds affecting Vistry are likely to ease on a medium-term view, as the government’s £39bn affordable housebuilding programme gets underway. Vistry’s move to a capital-light partnership model also has the potential to drive a re-rating as its capital requirements fall. With the shares now trading c.10% below tangible net asset value, I’m tempted to move up to AMBER/GREEN, but the group’s stubbornly daily net debt position means I’m going to maintain my previous neutral view for a little longer. | |

Atalaya Mining Copper SA (LON:ATYM) (£1.28bn | SR90) | FY25 copper production +10.6% to 51,139t, in line with guidance (49-52kt). | AMBER/GREEN = (Roland) [no section below] Today’s update has prompted a mild upgrade from broker Canaccord. Production appears to be at the top end of the guidance range, while profits should be supported by the recent strength in the price of copper, which has risen by 40% over the last 12 months. Atalaya’s share price is now up by c.150% over the last year. While the shares are still only trading on c.12x 2026 forecast earnings, I think it’s more significant to note the stock is now trading at c.2.6x its book value. My sums suggest this valuation could be justified at current copper prices – indeed, I think there could still be further upside. But at this level, I think the company’s valuation is now directly linked to copper prices in a way it probably wasn’t 12-18 months ago. Any weakness in the red metal could cause the stock to deflate. It’s impossible to predict when this might happen, but general sentiment towards copper still seems very strong at the moment. Market forecasts suggest tight supply in the years ahead and mega-miners Rio Tinto and Glencore are currently considering merging to become the world’s largest copper producer. The market will peak at some point, of course, but I think it could still have further to run. With the caveat that this is becoming a more speculative situation, I am leaving my previous view unchanged today. | |

GlobalData (LON:DATA) (£903m | SR28) | 2025 revenue +13% to c.£322m (+1% organic). Adj EBITDA to be c.£110m. Contracted forward revenue +6%, margins to expand in 2026. | ||

Hays (LON:HAS) (£815m | SR34) | Net fees -10% YoY, with Germany -14%. Expect H1 adj op profit to be c.£20m, in line with exps. Progressing £45m cost saving plan, £15m already secured. | ||

Caledonia Mining (LON:CMCL) (£473m | SR83) | FY25 gold production of 76,213oz was within guidance and broadly flat YoY. FY26 guidance 72-76.5koz, with AISC $2,100-$2,300/oz. | ||

Ferrexpo (LON:FXPO) (£416m | SR73) | Q4 production -29% and below plan due to increased attacks on Ukraine infrastructure disrupting power and logistics. 2025 production -9% to 6.14Mt. | ||

Nichols (LON:NICL) (£369m | SR60) | 2025 trading in line with market expectations. Rev +1.3% to £175m, net cash £55.8m. 2026: confident in the outlook. | AMBER/GREEN ↑ (Roland) [no section below] Mark took a neutral view on this soft drinks business in July, commenting that the valuation did not reflect the persistent lack of growth. Today’s full-year update confirms the near-total lack of growth last year, which saw revenue rise by just 1.3%. I share Marks’ concern about the lack of top line growth, but Nichols’ share price has fallen by 25% since the end of July 2025. Meanwhile, forecasts for the year ahead suggest a slight improvement in revenue growth and stable mid-teens margins. The shares are now trading with strong quality metrics and a cash-adjusted forward P/E of around 12. At this level, I think it’s fair to take a more positive view, so I’ve moved up one notch to AMBER/GREEN today. | |

Ecora Resources (LON:ECOR) (£321m | SR61) | Changing name from Ecora Resources to Ecora Royalties to “better reflect the Company’s core business”. | ||

MS International (LON:MSI) (£231m | SR56) | Overall performance “relatively flat”. Revenue £55.8m (2024: £54.7m) and pre-tax profit £8.5m (2024: £8.8m). CEO believes: “medium to long term prospects are better than at any time in the Company’s history” | GREEN = (Graham)

We’ve been GREEN on this and I’m happy to leave that unchanged today. But please note that this is really a call on the integrity and judgement of management, rather than any real insight into prospects of the company’s defence division. | |

Frontier Developments (LON:FDEV) (£174m | SR96) | H1 revenue +26% to £59.6m, adj op profit +76% to £9.7m. Full year outlook upgraded: revenue c.£100m and adj op profit c.£11m (prev. c.£94m, £9.5m). | GREEN = (Roland) A strong H1 performance and good December sales have driven another upgrade for this video game developer. While there’s always a risk that future releases will flop, this business seems to be in a good place at the moment and is also delivering strong financial returns. Although the stock has doubled over the last year, stripping out £40m of net cash also suggests to me that the valuation could still be quite reasonable. I’m leaving our positive view of this Super Stock unchanged today. | |

Liontrust Asset Management (LON:LIO) (£156m | SR83) | SP +3% Q3 net outflows £1 billion. AuMA £21.5 billion. Institutional inflows £330m in the period. “We have a good potential pipeline and are focused on securing further mandates and returning to positive net inflows for the UK's wholesale and retail markets.…” | AMBER/GREEN = (Graham) [no section below] This Q3 update continues the trend of outflows that has been in place for many years. I'm happy to hold my hands up and say that I got it wrong: based on the share price action here, I was wrong and I should have reverted to neutral before now. But that's increasingly difficult when the company is still profitable, has a P/E multiple of only 6x and a StockRank of 83. While I think other fund managers have a more straightforward investment case, Liontrust is still interesting to me. As pointed out by CEO John Ions today, they are rated the 4th best asset manager by advisers in the UK, and the 8th best by wealth managers. So they might not be "best in class" (and generally speaking their fund returns don't stand out), but surely there would be strategic value to an acquirer at this very cheap valuation? Buyers at the current share price get a remarkable £136 of AUM for every £1 invested in the stock. Other fund managers have certain competitive advantages when it comes to sector specialisation, but even a generalist fund manager deserves a reasonable earnings multiple. Unless, of course, it truly is headed for extinction. | |

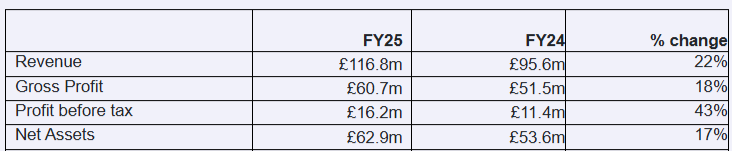

Ramsdens Holdings (LON:RFX) (£136m | SR97) | FY Sep 2025: Revenue +22%, PBT +43% (£16.2m). Q1 FY26: gold purchasing very strong, momentum in pawnbroking. Currently expecting profit before tax for FY26 to exceed £18m. | AMBER/GREEN = (Graham) I think Roland’s AMBER/GREEN stance continues to make sense here. I view Ramsdens as a quality business and I would be happy to own shares in it, but perhaps it’s not all that far off fair value here, given the risks? It's trading at a PER of 10x, which is somewhat high for UK pawnbrokers. The gold price has been doing a lot of the heavy lifting in terms of offsetting higher expenses faced by the company, particularly when it comes to wages. | |

Eco (Atlantic) Oil & Gas (LON:ECO) (£86m | SR30) | Engaged in ongoing, constructive discussions with the Ministry of Natural Resources, Government of Guyana, regarding the continuation of Eco's appraisal and exploration programme on the Orinduik Block area. | ||

Xaar (LON:XAR) (£81m | SR34) | FY25 revenue +16.6% on a like-for-like basis. Full year adjusted profits to be marginally ahead of expectation. Year-end net cash £4.8m. | ||

Mulberry (LON:MUL) (£74m | SR39) | SP +5% Q3 total sales +5.3%, retail and digital LfL sales +11%. "We have delivered a strong performance during the festive period.” | AMBER/RED (Graham) [no section below] I was AMBER/RED on this a year ago when the market cap was £68m. Since then the company has posted another large annual loss for FY March 2025, and it's expected to remain loss-making for FY 2026 and FY 2027. At least there are green shoots in terms of revenue, which might have hit a bottom now? Existing forecasts assume that revenue continues to decline for the next few years. They say that their product "is resonating positively with the UK consumer", as they have managed to eke out a little growth in the domestic market (+3.5%). Perhaps my moderately negative stance is harsh but I can only assume that the company will remain loss-making for the foreseeable future, which makes me reluctant to upgrade. They raised funds last summer; that £20m cash injection should at least keep the wolf from the door for the time being, but they did still report a net debt position for September. | |

DP Poland (LON:DPP) (£68m | SR21) | System sales growth 11.3% in 2025. Pre-IFRS 16 EBITDA £2.6m (2024: £1.1m), in line with market expectations. Anticipates double-digit system sales growth in 2026. | ||

Real Estate Investors (LON:RLE) (£57m | SR62) | Transactional paralysis in H2 ahead of Budget. Made £8m of sales in 2025. Reduced total drawn debt to £34m at Dec 2025. Year-end occupancy 78.7%. Contracted rental income at year-end reduced from £9m to £8.3m. Open to the potential sale of the entire portfolio. | (Gradually winding down as part of a 3-year plan.) | |

PROCOOK (LON:PROC) (£42m | SR69) | Year-to-date revenue +24.1%, LfL revenue +12.3%. Net cash £7.8m. Full-year revenue and cash generation anticipated to be slightly ahead of market expectations. Operating profit and PBT, excluding FX movements, anticipated to be in line with market expectations. | ||

Jersey Oil and Gas (LON:JOG) (£34m | SR26) | Cash £11m. Cash running cost reduced by c. 50%, total cash expenditure for 2025 expected to be c. £1.5m. 20% share of Buchan project expenditure fully carried by two JV partners. | ||

Cirata (LON:CRTA) (£26m | SR5) | Anticipated annualized opex run-rate of approximately $12-13m in FY26. Targeting cash flow positive in Q1. Planning for cash break-even for FY26 overall. Dec 2025 cash position $4m. | ||

M Winkworth (LON:WINK) (£25m | SR86) | Conditions softened more than expected in H2. Company revenues in H2 broadly in line with H2 FY24. FY25 adjusted PBT expected to be c. £2.1m (FY24: £2.35m), 20% below current market expectations. | BLACK |

Graham's Section

Ramsdens Holdings (LON:RFX)

Down 3% to 409p (£132m) - Annual Results - Graham - AMBER/GREEN =

We have sparkling results for FY September 2025 and a strong Q1 update.

FY25 results first:

While Ramsdens is well diversified with a range of activities beyond gold purchasing, its gold purchasing segment has played a big role with gross profit surging 52% to £17.9m (£11.8m), i.e. gold purchasing has generated 29% of its total full-year profits.

Here’s a five-year chart of the gold price in GBP:

The other divisions at Ramsdens also did fine: pawnbroking gross profit up 9%, jewellery retail up 18%, FX conversion down 3%.

Store count: unchanged.

Dividend: 9p ordinary plus 2p, so that the total payout (16p) is up significantly on last year (11.2p).

Turning to the Q1 update, key points:

Precious metals purchasing gross profit up 50% (GN note: and that will be against a strong comparator)

The pawnbroking loan book has increased from £11.4m in Sep 2025 to £12.8m now, only lending 55% of gold value.

Jewellery retail revenue up 20% while FX gross profit down again, due to the move online where margins are lower.

The outlook section is key so let’s quote it extensively:

As with many other businesses, the Group faces rising operating costs in 2026. The main increase is in employment costs as the Board sees investment in its people as crucial to the Group's future success and is committed to paying the Real Living Wage (RLW) as our entry level pay. The RLW has increased by 6.7% and will be paid from April 2026. We will also maintain the hourly rate differentials across our pay grades which will lead to an increase in employment costs ahead of inflation. In addition, FY26 will bear the full year costs of the changes to the rate and thresholds relating to employer's national insurance.

Despite these increased costs, the high gold price is helping to maintain their strong profitability and Ramsdens expects PBT of over £18m in FY26. I believe that this is ahead of expectations and a note from Cavendish confirms this. More to follow.

CEO comment: confirms that the FY25 result was “marginally ahead” of expectations.

"We have a highly relevant customer proposition and are looking forward to opening eight to 12 new stores in the year ahead whilst also continuing to strengthen our online proposition, which is offering more customers opportunities to use our trusted services… We look forward to another year of good progress in FY26."

Estimates: thanks to Cavendish for posting on this today. In light of the new guidance, they have upgraded their FY26 PBT forecast by 15%, to £18.6m.

Graham’s view

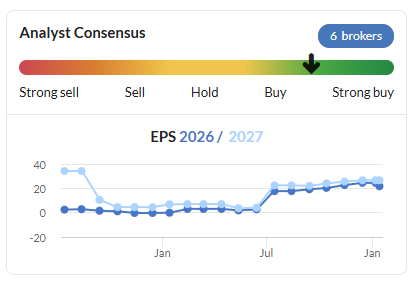

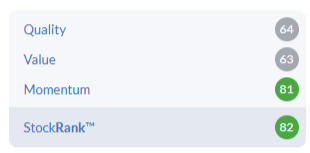

We’ve been quite positive on Ramsdens in the past, and I think for good reason. The StockRank remains very encouraging:

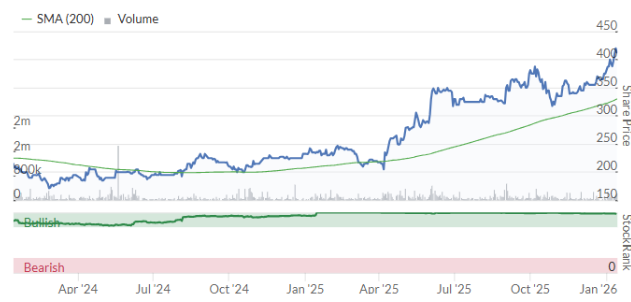

Checking the archives, I see that Roland downgraded our stance by one notch in October.

Interestingly, that day saw the share price down 5% even though the update was ahead of expectations.

It’s a similar story today: expectations are raised, but the share price has fallen slightly.

How to interpret this? Perhaps the bull thesis is getting a little exhausted at these higher levels, especially considering how much it has been driven by the gold price?

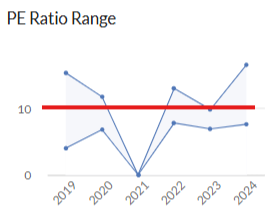

In valuation terms the stock is trading at a PER of 10x, based on the latest Cavendish EPS forecast for FY26 (41.1p) and the current share price.

Given the sector, this isn’t particularly cheap: in my experience watching H&T (before it was bought out) and Ramsdens, it’s quite normal for these stocks to trade below 10x.

I’ve highlighted the line below which shows when Ramsdens has traded under 10x earnings:

So the current valuation is a little high, and it’s consistent with the fact that the share price has been weak despite very strong updates in recent months: the market has correctly anticipated these strong results, and some investors have likely been taking profit when they have been published.

Checking the balance sheet to see things from another angle, net assets are £63m, almost fully tangible and highly liquid (current assets £73.6m, current liabilities £20.9m).

That is good asset backing for sure, but again from a historical perspective I’ve found that UK pawnbrokers tend to trade cheaply, and it’s unusual that I would find one trading at 2x book value, that level at which Ramsdens is currently trading.

I do think that the market was overly sceptical of the pawnbroking sector in the past, and it makes sense to me that this would be rectified with a punchier rating for Ramsdens now.

At the same time, I think we have to acknowledge that the incredibly strong gold price has done a lot of the heavy lifting here, even managing to offset the impact of rising wage costs and other rising expenses. If the gold price were to fall, the impact of these higher expenses would be more keenly felt.

As the gold price is not something over which the company has any control, and as I don’t claim to have any ability to forecast it, I think Roland’s AMBER/GREEN stance continues to make sense here. I view Ramsdens as a quality business and I would be happy to own shares in it, but perhaps it’s not all that far off fair value here, given the risks?

MS International (LON:MSI)

Down 2.5% to £13.70 (£225m) - Half-year Report - Graham - GREEN =

A long preamble is followed by “relatively flat” headline numbers:

As expected, our overall performance has been relatively flat with profit before tax amounting to £8.47m (2024 - £8.77m) on revenue of £55.81m (2024 - £54.72m).

In accordance with accounting rules, “revenue is only recognised when performance obligations are satisfied - we’ve noted that the outlook statements have been rather lukewarm here in recent announcements, and this is no different.

This share hasn’t participated in the new year rally that assisted other defence stocks:

Let’s try to summarise how each division is faring.

Defence and Security:

…we are enjoying great success in the 'Naval Systems' market with the US Navy and other navies, as well as opening up opportunities in the much larger market for our 'Land Systems'. The MSI profile continues to grow and, combined with the considerable investment we have made in the global defence market, it augers well for our future.

Forgings: market conditions are “mixed”.

While short-term demand in the UK and US remains subdued, the pipeline of opportunity in America is strong.

Petrol Station Superstructures and Branding (this was created by merging two divisions).

The strong performance demonstrated last year by the Group's petrol station 'Petrol Station Superstructures' and 'Branding' divisions, has carried forward into the current trading period, driven by large-scale service station transformation, modernisation and re-imaging programmes by large, well-disciplined independent forecourt retailers.

So far, so good.

If you’re like me, you’re slightly puzzled as to the synergies that may exist between these divisions! But it’s been this way for a long time, and I can’t argue against MSI’s track record.

Shareholder communications

This stock has never had research coverage from the brokers before, but it sounds like this might change? ShoreCap have “been given a more extensive and proactive brief to reflect the increased investor interest” in MSI.

Historically, this was a company that never took much interest in its share price, for typical reasons: it had a limited free float, and didn’t need to raise fresh capital.

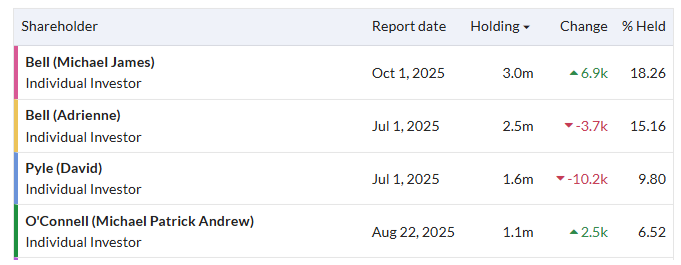

Michael Bell is the current Chair, and David Pyle is a former director. You can see how the top holders have locked up a decent proportion of the shares, with nearly 50% held by these four individuals:

Outlook is positive, while also refusing to promise very much in the short-term:

We enter another significant calendar year for the business as we look to focus on the 'Defence and Security' division. In an increasingly uncertain world, it is difficult to predict our pace of growth, but I cannot remember a time when we have had so much interest in our products.

Many of the world's economies are challenged so, whilst a desire to increase defence spending remains high, the ability to do so quickly will vary by country. I believe we are very well placed to benefit once this desire is converted into a firm commitment to spend. This benefit will accrue over the many years to come. As I stated earlier, our medium to long term prospects are better than at any time in the Company's history.

Graham’s view

This is one of those slightly eccentric companies, which has often acted like a private business rather than one that is publicly-listed.

With the market cap near record highs, perhaps that’s about to change? The initiative with ShoreCap suggests so.

We’ve been GREEN on this and I’m happy to leave that unchanged today. But please note that this is really a call on the integrity and judgement of management, rather than any real insight into prospects of the company’s defence division.

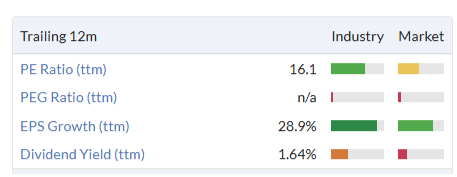

Please note this is a trailing P/E, there is no forward P/E due to the lack of estimates:

Management are excited about their prospects both with the US Navy and what they call the “US Land Defence” market. With Trump at the steering wheel and US defence spending likely to increase for years to come, I wouldn’t want to bet against MSI getting a piece of the pie.

Roland's Section

Frontier Developments (LON:FDEV)

Up 6% at 498p (£185m) - Excellent H1 Results & full year outlook upgraded - Roland - GREEN =

Ed covered Frontier Developments in our 12 Stocks of Christmas series, noting that “brokers are now revising estimates upwards [...] and the re-rating may have further to run”. In his article, Ed discussed some alternative information sources that might have given investors an early heads-up that today’s update was likely to be strong.

Today’s interim results provide a post-Christmas update and suggest a bullish view may still make sense.

After strong sales of new release Jurassic World Evolution 3 (JWE3), Frontier has upgraded its guidance for the full year. This has prompted a further earnings upgrade from broker Panmure Liberum.

Let’s take a look.

H1 trading update

Game producers are in the hit business. They depend on new launches to drive growth, while hoping for a sustained tail of income from reliable long–term performers. Today’s half-year numbers show what happens when both of these factors kick in at once:

H1 revenue up 26% to £59.6m

Adjusted operating profit up 76% to £9.7m

Reported operating profit up 73% to £7.8m

Net cash up 47% to £40.1m

Trading commentary highlights strong recent sales momentum. Sales of Creative Management Simulation (CMS) games – Frontier’s core offering – rose by 52% compared to the comparative period and contributed 90% of H1 revenue.

This growth was largely driven by October’s release of JWE3. While the company’s half-year ended on 30 November, management says JWE3 achieved “excellent sales” in December and a Frontier record for Christmas Day sales of an individual game.

Alongside this, the company’s back catalogue performed well, supporting revenue and positioning key franchises well for planned new releases:

H1 sales for Planet Coaster franchise were “slightly ahead of expectations”, aided by recent new content;

Planet Zoo made “an excellent revenue contribution” and became Frontier’s highest-grossing individual game by revenue. “This bodes well for its sequel, coming in FY27”;

Revenue from Elite Dangerous rose by 50% compared to the prior period;

A new “unannounced game” is on track in development and scheduled for FY27.

Financial review: turning to the accounts, the picture is also positive.

Frontier’s H1 operating margin improved to 13.1%, from 9.6% for the same period last year, helped by good control of costs. The main increase in operating costs was driven by accrual for staff profit-sharing bonuses, which I view as a good thing in this context.

On an adjusted basis, the H1 operating margin rose from 11.6% to 16.3%. While I don’t have any particular concerns about the adjusted profit measure, I don’t see much benefit in it either. The reported figures map well onto cash and seem fine to me.

Adding H1 profits onto last year’s H2 profit gives a trailing 12-month return on equity of 17%. While that’s slightly below the 19% shown on the StockReport for FY25, my guess is that this will improve with the full-year results (which will include peak Christmas trading).

Frontier’s cash generation was also excellent, highlighting the quality of the business. My sums show almost 100% conversion from net profit of £8.0m to free cash flow of £7.8m. This net inflow was offset by £10m of share buybacks during the period, meaning that Frontier ended the half year with net cash of £40m, down from £42m at the end of FY25 (May ‘25).

Outlook & Updated Estimates

Frontier Development has provided a clear update on its FY26 guidance today:

Based on Frontier's financial performance in the first seven months of the financial year, the Board are now upgrading FY26 financial guidance to revenue of around £100 million and Adjusted Operating Profit of around £11 million.

With thanks to Panmure Liberum for publishing on Research Tree today, we can see how this upgrade translates into new 2026 forecasts:

Revenue: £100m (prev. £93.9m)

Adjusted operating profit: £11.0m (prev. £9.5m)

Adj EPS: 27.3p (prev. 23.6p)

Panmure has also increased its FY27 forecasts, lifting its EPS estimate by 25% to 33.4p (prev. 26.6p).

These estimates put Frontier on a FY26E P/E of 18, falling to a FY27E P/E of 15.

However, it may be worth noting that Panmure has cut its FY28 EPS forecast from 33.6p to 25.4p. This reflects the broker’s expectation that revenue growth could slow in FY28 after a boost from two expected releases in FY27. I don’t see this as a concern now, but it’s something to watch going forward.

Roland’s view

I can’t find much to dislike about these figures. Frontier appears to be delivering successfully on its strategy to focus on CMS games and its latest release, JWE3, appears to have been a success. Meanwhile, other core franchises continue to tick over healthily.

Today’s earnings upgrade extends a run of positive momentum:

The big unknown is whether the current momentum will be maintained. No one quite knows if a game will be a hit ahead of its release. There also seems to be some risk that the pipeline of new releases will be thinner in FY28, after a strong FY27.

For these reasons, I’d argue it’s difficult to estimate a fair value for Frontier Developments shares. However, it’s worth remembering that net cash of c.£40m accounts for more than 20% of the c.£180m market cap. As far as I can see, a good part of this could be returned to shareholders if management chose.

Stripping out net cash gives me a cash-adjusted FY26E P/E of 14, falling to a P/E of 12 in FY27.

This doesn’t seem expensive to me for a business of this kind that’s performing well. With the caveat that this probably isn’t a stock to buy-and-hold forever, I’m comfortable leaving Graham’s GREEN view from November unchanged today.

Vistry (LON:VTY)

Down 7% at 636p (£2.0bn) - Trading Update - Roland - AMBER =

Today’s full-year update from housebuilder Vistry has received a downbeat reception from the market, despite confirming that adjusted pre-tax profit should be in line with expectations.

My impression is that the company’s 2025 financial performance is probably in line with expectations, but that investors are disappointed with the company’s shrinking order book and uncertain 2026 outlook.

2025 trading update

Here are the key figures for last year:

Group revenue “broadly flat” at £4.2bn (FY24: £4.3bn)

Group adjusted pre-tax profit is expected to be around £270m (FY24: £263.5m), “in line with expectations”

Full-year operating margin of 8.4% (FY24: 8.3%)

Total completions down 8.9% to c.15,700 (FY24: 17,225)

Net debt reduced to c.£145m (FY24: £180.7m)

Average daily net debt was c.£730m (FY24: £698m), reflecting project delays and the high opening debt level at the start of the year.

As usual, I think it pays to compare today’s results with prior guidance.

Vistry has said repeatedly that it expects to deliver a year-on-year increase in profit, and this appears to be true, albeit adjusted PBT is only up by c.2.5%.

Guidance for a reduction in net debt has also been met, on paper at least. However, today’s commentary suggests to me that the reduction is smaller than originally hoped for. Note that Vistry did not manage to reduce the much higher figure of average daily net debt last year. I view this as a more meaningful measure of indebtedness, as it’s much harder to manipulate and reflects year-round operating conditions.

Turning to output, Vistry’s new home completions fell by nearly 10% last year.

While management guidance in March 2025 suggested “similar” volumes to those achieved in 2024, completions fell by 12% in H1. Following this, Vistry altered its volume guidance to suggest only that there would be a “substantial increase” in volumes in H2.

Today’s figures have met that revised guidance:

H1 2025 completions: 6,889

H2 2025 completions: 8,811 (+28% vs H1)

As with Persimmon yesterday, the blame for this year’s softer volumes has mostly been placed on the Government. Vistry flags up both Budget uncertainty in the autumn and the impact of June’s Spending Review. These are said to have led to reduced demand from its partnership and build-to-rent customers. Refinancing is also mentioned as a delaying factor in the build-to-rent sector.

Vistry’s strategy of focusing on bulk sales and working with partners means that – in theory – it has the potential to become a more capital-light and cash-generative business. Essentially, a specialist construction group. Executing on this strategy and exiting the group’s remaining own-build projects is at the core of the investment case – Jamie Ward discussed this at November’s Mello BASH.

However, Vistry’s 2025 performance also highlights the risk in this strategy; the group is probably more heavily exposed to government policy and spending decisions than housebuilders with a greater focus on the private buyer market.

2026 outlook

The company has high hopes for the Government’s 10-year Social and Affordable Homes Programme (SAHP), which will run from 2026-2036 and is expected to provide £39bn of funding. Vistry expects bids to be invited in H1 and is “hopeful” that early allocations commence “by the half year or in early Q3”.

Perhaps I’m too cynical, but I am not sure I’d rely on speedy progress with a major government spending programme to underwrite forecasts for this year.

However, CEO Greg Fitzgerald’s efforts to talk up the SAHP are understandable – Vistry’s forward order book at the end of last year was £4.0bn, 9% below the £4.4bn reported at the end of 2024.

Fitzgerald claims this order book provides “strong coverage for 2026 delivery”. I think a more objective assessment would be that coverage for the year ahead is weaker than it was a year ago.

After all, build cost inflation continued last year and average selling prices rose slightly. This means that a 9% drop in the value of the forward order book is likely to translate into a >9% decrease in forward volumes.

Broker forecasts ahead of today were for a 23% rise in earnings to 69.4p per share in 2026. I don’t have access to any updated forecasts today, but it will be worth watching in the coming days to see if the consensus figures shown on the StockReport change.

Roland’s view

Despite the tone of my comments above, I am actually cautiously optimistic about the investment case here, on a medium-term view. I think the arguments for improved profitability and a re-rating could stack up if Vistry can achieve a return to more stable and rising order volumes.

However, I think there’s also a risk 2026 forecasts will end up being downgraded, with hoped-for earnings growth pushed back into 2027.

As things stand after today’s share price drop, the stock is now trading about 10% below its last-reported tangible book value of £2.4bn (735p per share).

While the near-term dependence on Government actions makes me a little nervous, I do think social housing and build-to-rent are likely to remain important and growing sectors over the coming decade.

CEO Greg Fitzgerald is also a sector specialist, with a long and quite successful record in UK housebuilders.

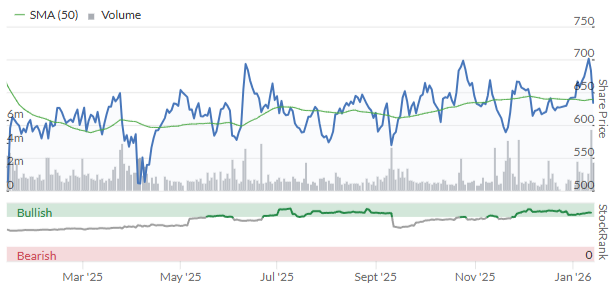

If Vistry’s average daily net debt was a little lower, I would probably upgrade my view to AMBER/GREEN today. I notice the StockRanks have also turned positive since November’s update, with upgrades to both the StockRank (70-82) and styling (Neutral -> Super Stock).

I’d like to upgrade my view. But the combination of relatively high (daily average) debt levels and potential delays to expected growth mean that I’ve decided to stay neutral for a little longer.

I’ll hope to be able to turn positive in the coming months, if Vistry can show signs of a recovery in demand.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.