Good morning!

That's all for today - thanks for reading and commenting.

Spreadsheet accompanying this report: link.

Companies Reporting

| Name (Mkt Cap) | RNS | Summary | Our View (Author) |

|---|---|---|---|

AstraZeneca (LON:AZN) (£215bn | SR70) | Revenue up 9% to $58.7bn, adj EPS up 12% to $9.16. 2026 outlook: mid-high single digit revenue growth, low double-digit % EPS growth. | ||

GSK (LON:GSK) (£88bn | SR93) | Accepted for review. If accepted would be first RSV vaccine in China for adults over 60. RSV affects 6m over-60s in China each year. | ||

BP (LON:BP.). (£75bn | SR91) | Underlying RC profit -16% to $7.5bn, adj EPS -12% to 48.02c. Net debt $22.2bn. Buybacks suspended to strengthen balance sheet. | AMBER = (Roland) In this review I highlight the way BP has failed to generate much shareholder value from several years of intensive buybacks, in contrast to FTSE peer Shell. A new focus on debt reduction now is welcome, but it looks like more draconian measures will be needed than previously thought to hit the group’s 2027 targets. While performance has been underwhelming at BP, today’s profit figures are broadly in line and the stock still offers a useful 5% yield. I am going to maintain my previous neutral view ahead of the arrival of the group’s new CEO in April. | |

Barclays (LON:BARC) (£67bn | SR59) | Income +9% to £29.1bn, pre-tax profit +13% to £9.1bn, EPS of 43.8p. RoTE of 11.3% and TNAV per share 409p (2024: 357p). 2026 targets: RoTE >12%, income c.£31bn, cost: income ratio in high 50s%. 2028: targeting RoTE >14%. | ||

Standard Chartered (LON:STAN) (£43bn | SR87) | CFO leaves with immediate effect to pursue an external opportunity. Replaced on an interim basis by Peter Burrill, who is Group Head, Central Finance and Deputy CFO. | ||

BT (LON:BT.A).A (£20bn | SR63) | Katie Milligan is promoted from Deputy CEO of Openreach to CEO, Openreach. The current Openreach CEO, Clive Selley, will become CEO of BT International. | ||

Coca Cola HBC AG (LON:CCH) (£16bn | SR84) | Revenue +7.9% to €11.6bn, with organic revenue per case +5.1% and 2.8% volume growth. Adj EBIT +13.8% to €1.4bn, adj EPS +14.9% to €2.589. 2026 outlook: organic revenue +6%-7%, EBIT +7% to 10%. | ||

Bellway (LON:BWY) (£3.0bn | SR73) | H1 completions +2.7% to 4,702, avg selling price c.£322k (2025: £310,581). Forward order book on 31 Jan of 4,442 homes (£1,241.6m), down from 4,726/£1,311.5m a year earlier. Outlook: signs of improving demand, in line to deliver full-year volume of c.9,200 homes with underlying operating margin of c.11%. | ||

Dunelm (LON:DNLM) (£1.9bn | SR58) | Revenue +3.6% to £926.3m, pre-tax profit -7.5% to £114.0m. Adj EPS -7.3% to 41.7p, net cash £13.3m. Outlook: after softer Q2, have seen stronger sales growth in Q3. Expect FY26 PBT to be in line with consensus. | AMBER/GREEN = (Roland - I hold) A solid set of figures leaving expectations unchanged and demonstrating Dunelm’s usual strong cash generation. However, sales growth was relatively weak in H1 (primarily Q2) and while management report a stronger performance so far in Q3, guidance has been left unchanged for now. In my review below I speculate on growing pains in Furniture and review the new CEO’s initial priorities for the business. While I’m inclined to see value here on a P/E of 12, Dunelm’s MomentumRank is low and it’s not that long since the company cut its profit guidance for this year. While the quality of this business remains high, in my view, near-term growth looks less certain and I think it makes sense to leave our AMBER/GREEN view unchanged for a little longer. | |

| International Personal Finance (LON:IPF) (£519m | SR94) | Adjournment of Court Meeting and General Meeting | Following shareholder feedback, meetings to vote on the takeover are being postponed until 11 March, after the company’s FY25 results are published on 25 Feb. The meetings were previously scheduled for 11 Feb. | PINK (Graham) [no section below] I sold my position in IPF on 29th December, when the offer for IPF at 235p (plus the 9p dividend) was formalised. I had said repeatedly that I wanted the deal to fall through, as it likely undervalued the company, but I noted that “IPF’s major shareholders are various mainstream fund managers - a category of investor that is often amenable to a takeover offer.” Well done to Artemis for standing up and being counted, telling the media that “it was concerned that UK‑listed businesses continue to be bought out at what it sees as depressed valuations”. They own nearly 14% of IPF and so they do pose a threat to a scheme of arrangement takeover, as it requires 75% of shares voted to be in favour. In principle I would still like this deal to fall through, to prove that shareholders in London will not agree to any takeover at a c. 30% premium. The offer from BasePoint has always struck me as highly speculative and one that BasePoint did not ever think would be accepted, as they did not have the funds ready to move forward when IPF management agreed to it. |

S&U (LON:SUS) (£286m | SR98) | Improvements seen in December have continued. Net receivables c.£495m vs £436m one year earlier. Advantage motor finance is gaining market share, while Aspen Bridging “has delivered a record year”. | GREEN = (Graham) No reason to change my positive stance on this after another confident update. It's no longer a "bargain", but historically it has often traded at a higher premium to book value than the current level. So I don't have any major valuation concerns, and much of the risk has been removed by the motor finance redress decisions in the Courts, with S&U's remaining exposure likely to be very small. | |

Aptitude Software (LON:APTD) (£132m | SR38) | Revenue to be c.£65m (FY24: £70m), broadly in line. Expects to report “profit performance in line with expectations” and improved margins. Outlook: confident in strategic direction. | ||

Ramsdens Holdings (LON:RFX) (£131m | SR96) | “FY26 profits expected to be ahead of market expectations”, which were previously £18.6m. Precious metals segment continues to benefit from high gold price, with strong volumes also. Jewellery is also doing well, while pawnbroking momentum has “been maintained”. FX volumes flat. | GREEN ↑ (Graham) I'm taking us back up to a fully positive stance here despite the fact that this "ahead of expectations" update is once again driven by the gold price. I think that for those who are still bullish on gold, they could do a lot worse than check this one out. For those who are not bullish on gold, this might still be of interest, but there's no guarantee that the current level of profitability is sustainable. When the gold price was boring, I found it much easier to take a view on this one. | |

AFC Energy (LON:AFC) (£127m | SR15) | Signing of a Joint Development Agreement with Komatsu Ltd. and Industrial Power Alliance Ltd, a Komatsu affiliate. AFC and Komatsu will work together to design and integrate AFC Energy's proprietary ammonia cracking technology with a Komatsu industrial internal combustion diesel engine to assess the feasibility of a new ammonia fuelled engine platform capable of scaled production. Contract value of up to c. US$ 2 million, subject to milestones. | ||

Eleco (LON:ELCO) (£124m | SR46) | Buys Kivue, a UK-based provider of Project Portfolio Management SaaS software and associated services, for an enterprise value £2.3m (£1.84m cash and £0.46m equity). 12 months to October 2025: Kivue recognised £1.5m in revenue and Adjusted EBITDA of £0.2m. | ||

Gaming Realms (LON:GMR) (£104m | SR40) | FY25 revenue of approximately £31.4 million, up 10% and adjusted EBITDA of £15.0 million, up 15%. FX had a negative impact of £0.6m on revenue and £0.4m on adjusted EBITDA. Early trading in 2026 has been encouraging. | ||

Zanaga Iron Ore (LON:ZIOC) (£70m | SR31) | Strategic transaction with Red Arc Minerals Inc: proposed strategic investment by RAM in the Zanaga Iron Ore Project. Tranche One of up to $25m. Tranche Two of $125m. Royalty granted to ZIOC. Non-dilutive to ZIOC shareholders. | ||

Batm Advanced Communications (LON:BVC) (£52m | SR68) | Sale of Laborator A.M.S, which was formed to hold the laboratories of another business being sold. $1m in cash. | ||

| Hercules (LON:HERC) (£42m | SR94) | Update on Final Results | FY September 2025: Revenue will be ahead of market expectations at approximately £121m. Adjusted EBITDA and adjusted Profit Before Tax for FY25 remain in line with market expectations. Expectations: revenue £118/4, adjusted EBITDA £6.1m, adjusted PBT £3.3m. “The Company advises that PBT for FY25 is expected to be approximately £0.8 million, which will reflect the net effect of the non-underlying and exceptional items.” | AMBER/GREEN = (Graham) [no section below] £0.8m of “real” PBT means that the non-underlying and exceptional items are going to eat most of the company’s “adjusted” PBT. These items include “amortisation of acquisition related intangibles, all share-based charges and exceptional acquisition related items, extended ERP system implementation costs and business development expenditure”. I’m inclined to think that some of these are genuinely worth adjusting out but that some of them are not. This relates to another problem: that it’s taking so long to publish these results - as previously announced, these September 2025 results are “expected to be released in March 2026”. I was willing to give the company the benefit of the doubt last time as it did carry out various acquisitions last year, which could complicate the accounting process. And these acquisitions are also going to bring various exceptional and non-underlying items with them. So I’ll continue to give Hercules the benefit of the doubt and retain our moderately positive stance, though I am once again tempted to go back to neutral. |

Sanderson Design (LON:SDG) (£35m | SR85) | FY Jan 2026: The Group traded in line with management expectations for the full year. Revenue £99.5m (previous year: £100.4m). Adjusted underlying profits at least £5m (previous year: £4.4m), which “reflects the Board's continued focus on strategic cost-saving initiatives”. Outlook: “As we begin the new financial year, there is increasing momentum in the business, particularly in the US, manufacturing and DTC, although UK trading conditions remain subdued.” | AMBER/GREEN = (Roland) A solid full-year update from this luxury interior design group confirms sales growth in the US and continued weakness in the UK. While group revenue for the year is down, profits are expected to be in line with forecasts thanks to cost savings – a situation Mark discussed in detail in October. The declining performance in the UK remains a concern, but US growth seems encouraging, as do early results from DTC sales. Given the strength of the balance sheet and modest rating, I think our broadly positive view remains fair ahead of April’s FY26 results and updated FY27 guidance. | |

One Health (LON:OHGR) (£30m | SR59) | H2 remains strong; business on track to deliver revenue and underlying EBITDA growth for FY March 2026 in-line with market expectations (revenue to range from £29.2m to £29.6m, underlying EBITDA £2.3m), and at the higher end of the consensus revenue range. FY26 trading will show continued growth across all operational and financial KPIs. | ||

Tekcapital (LON:TEK) (£25m | SR90) | £1.5m gross raised at 8p (last night’s close: 10.4p). “The placing proceeds will strengthen the Company's balance sheet and support the continued execution of its investment strategy across both existing and new portfolio companies, with a particular emphasis on opportunities in generative artificial intelligence.” | ||

Medpal AI (LON:MPAL) (£22m | SR6) | The company's strategy has evolved from being centred on the MedPal app to integrating it with an AI driven triage system and prescribing service. The vertically integrated UK platform is fully operational. | ||

Goldplat (LON:GDP) (£22m | SR95) | The two recovery operations achieved a combined operating profit in Q2 of £2,696,000 (Q2 last year £1,169,000) and in H1 of £4,791,000 (H1 last year £2,498,000). Excludes listing and head office costs, finance costs, FX. Interim dividend 0.14638p. | ||

Wishbone Gold (LON:WSBN) (£20m | SR19) | Wishbone has won a contested ballot for 67 square km of mineral title on crown land, 25km north-west of Telfer, which was applied for by multiple parties. | ||

Europa Oil & Gas (Holdings) (LON:EOG) (£15m | SR22) | Intention to raise £3.5m in a placing at 1.2p. 20% discount to yesterday’s closing bid price. Investors to also receive a warrant at 2p for every four placing shares. A retail offer is also to be announced shortly. | ||

Zambeef Products (LON:ZAM) (£13m | SR82) | An EGM is being arranged for independent shareholders to decide to waive their rights under a mandatory takeover offer (MTO). An MTO would otherwise be triggered if preference shares are converted by British International Investment. |

Graham's Section

S&U (LON:SUS)

Down 3% to £22.80 (£277m) - Trading Statement and Notice of Results - Graham - GREEN =

S&U PLC, the specialist motor and property financier, today issues its trading update for the period from its statement of 11th December 2025 to its year end on 5th February 2026. S&U's full year results will be announced on 21st April 2026.

We’ve been consistently positive on this one, and it has a StockRank of 98. Thankfully, this update is unlikely to change my view.

Key points:

“The upsurge in S&U's fortunes predicted in December has continued strongly.”

Net receivables £495m, up 13% year-on-year

Growing market share at Advantage Finance

Another record year at Aspen Bridging

As is typical, Anthony Coombs casts a critical eye on the government and the broader regulatory backdrop, hoping for “a more pragmatic, proportionate and less costly regulatory approach”.

While the motor finance redress scheme has not yet been finalised, I don’t expect any serious impact at S&U. Its exposure is limited only to customer relationships that might be deemed by the law “unfair”. The company has previously said that any such unfair relationships would be “minimal”.

Advantage Finance: there has been “an improvement in customer quality, arrears and therefore in overall margins”. Collections are at 93% of due vs. 87% last year. This is the division where its ability to collect was impacted by FCA intervention.

And in an unusual bonus, some written-off accounts have been sold for £3.4m.

I do find it slightly frustrating that they’ve given the number today for “Capital Receivables” at Advantage Finance, which is calculated before impairments.

The standard number given to measure the size of the business is Net Receivables. I suppose we’ll get that one before too long.

For what it’s worth, net receivables started the financial year in January 2025 at £284m. It had risen to £318m by the time of the trading update in early December.

Aspen Bridging: only 19 deals out of 243 are “beyond term”, and they remain bullish on their ability to collect. The “Capital Receivables” figure is up 21% year-on-year.

Funding: the company's RCF was increased by £50m (to £280m) in January, but longer-term facilities are being arranged.

Second dividend: is increased from 30p to 35p.

Graham’s view

I have nothing but admiration for what S&U has achieved for the many years I’ve been tracking it.

After a strong run up over the past year, it would be reasonable to ask if it might be overvalued? But the long-term chart (10 years!) says that there is nothing special about this valuation:

Indeed, it still has a ValueRank of 79. Pre-Covid and pre-FCA interventions, the share commanded a healthy premium to book.

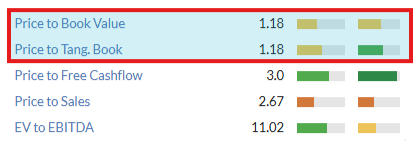

The current premium to book is moderate, in my view:

I’m therefore inclined to leave my GREEN on this untouched, without a very strong valuation concern. It’s no longer a “bargain”, but the regulatory situation is almost fully settled - and that was a big part of what made it such a bargain in the first place.

Ramsdens Holdings (LON:RFX)

Up 9% to 440.3p (£142m) - Trading Update - Graham - GREEN ↑

I explained our moderately positive stance on this in some detail last month. In summary: I continue think this is a fine business, and one that I would be happy to own shares in, but I’m wondering if the current valuation, and current performance, might have become overly reliant on the gold price? Although I guess this won’t be a problem if gold keeps rising!

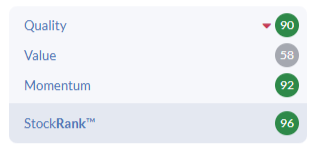

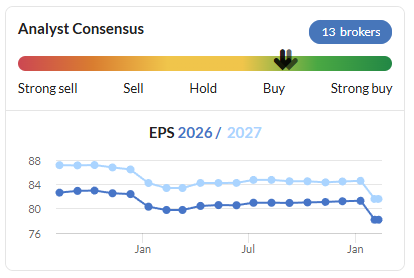

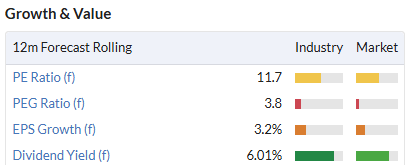

The StockRanks love it almost without reservation. I note the ValueRank is the soft spot, which is consistent with my line of thought:

Today’s update is ahead of expectations:

The Group continues to benefit from the high gold price with profits from the purchase of precious metals segment significantly ahead of expectations. This, supported by good performances across the Group's other income streams, means that the Group now expects profit before tax for FY26 to be more than £21m (FY25: £16.2m), which is ahead of current market expectations.

PBT expectations are helpfully provided at £18.6m.

I wonder if some customers might have cashed in their gold coins and jewellery in recent weeks without realising just how high the live gold price had risen?

Of course it’s not just the margin on each ounce of gold, but it’s also the volume of gold that matters: “...the volume of gold purchased has been very strong in the new financial year, particularly since the start of 2026.”

Other activities - jewellery retail, pawnbroking and FX - all appear to be doing well, although not as spectacularly as the gold purchasing segment.

CEO comment:

We're making good progress in expanding our estate and are on track to open between eight and 12 new stores this year. Whilst there remain uncertainties in the wider macroeconomic backdrop, our diversified business model and strong foundations give the Board every confidence in Ramsdens' opportunities to continue to grow and deliver for all stakeholders."

Graham’s view

I’m in two minds about this.

On the one hand, this is an “ahead of expectations” update, and we are supposed to be positive on companies that are beating expectations. Ramsdens has been doing this over the past year:

On the other hand, the main reason for the ahead of expectations performance is the gold price, which now appears to be the main source of risk. The reliance on the higher gold price is exactly why I’ve been slightly cautious.

On balance, I’m going to keep it simple and upgrade this to GREEN ↑, with the very explicit disclaimer that I can’t predict the gold price and therefore I don’t know if the current level of profitability is sustainable.

When the gold price was boring, it was a different story: all we needed to assume was that there would not be an unexpected collapse. But now we are dealing with a much more volatile situation.

Here' s a three-year chart from royalmint.com:

The gold price started 2025 at £2,100, and finished the year at nearly £3,400. It then topped out at over £4,000 in January 2026.

While my personal bias is strongly pro-gold, I obviously have no idea where it will be a year from now. It seems just as likely to be £5,000 as it is to be £2,000.

So with that disclaimer out of the way, I’ll put our stance on RFX back to GREEN.

As I said last time, the valuation is a little high compared to where the company has traded in the past - but maybe it's worth it, especially if you're still bullish on gold?

Roland's Section

Sanderson Design (LON:SDG)

Up 11% at 53p (£40m) - Full Year Trading Update - Roland - AMBER/GREEN =

Although today’s full-year update from luxury interior design group Sanderson is in line with expectations and broker forecasts are unchanged, the company’s shares saw double-digit share price gains in early trading this morning:

My initial feeling is that this morning’s share price gains are probably a reflection of the more positive tone of today’s trading commentary, which suggests sales momentum in the key US market may be improving.

Key points:

Revenue for y/e 31 Jan 26 down 1% to £99.5m;

Adjusted pre-tax profit to be “at least £5 million” (FY24: £4.4m);

Net cash at 31 Jan was £9.8m, up from £7.8m at the half-year, driven by “further planned inventory reductions”.

FY27 outlook: “increasing momentum in the business, particularly in the US, manufacturing and DTC, although UK trading conditions remain subdued”.

Thanks to Progressive Research, we can see that FY26 forecasts were for revenue of £101.2m and pre-tax profit of £5.0m. So these figures are pretty much in line, albeit with sales slightly lower than expected.

It’s worth noting that Progressive trimmed its FY26 revenue forecast from £103.1m in August to £101.2m in October, while profit forecasts have remained unchanged. This pattern suggests to me that profit forecasts have been hit by cost-cutting to offset weaker sales, rather than by a recovery in sales. Management confirm this in today’s update:

This strong growth in profitability reflects the Board's continued focus on strategic cost-saving initiatives.

Trading commentary: today’s update highlights a poor performance in the UK last year, partially offset by quite strong growth in the US. There’s also encouraging commentary on progress with Sanderson’s new Direct-to-Consumer sales strategy (all % at constant currency):

Total Brand product revenue down 1% to £70.1m

UK down 9% to £30.0m

North America up 10% to £22.3m

Total Manufacturing revenue down 6% to £29.7m

Licensing revenue down 5% to £10.5m

I would guess that high-margin Licensing revenue has helped to underpin profits despite lower product volumes.

In an effort to reach new customers, all of Sanderson’s brands are now also being sold through new direct-to-consumer (DTC) websites (e.g. here). A new Group Digital & Innovation Director has also been recently appointed to drive efforts in this area.

Early results for the core Morris & Co brand seem encouraging:

DTC sales in the year ended 31 January 2026, which are primarily from Morris & Co., were £1.8 million, up from £0.4 million in the prior year, with a substantial amount of the growth coming from the US from new customer audiences.

Roland’s view

When Mark reviewed Sanderson’s interim results in October, he discussed Sanderson’s sales trends and cost saving efforts in more detail. His conclusion was that the recovery in profitability seen in FY26 was being driven by cost-cutting.

Today’s update doesn’t change this view, but commentary on US sales and “increasing momentum” does perhaps suggest that shareholders can hope for an increase in sales this year.

Rising sales against a backdrop of improved margins could deliver a sharp recovery in profits, so a return to sales growth could justify a useful share price re-rating. I suspect this hope lies behind today’s share price gains.

By way of example, Progressive Research’s current FY27E forecasts suggest that a 4% rise in sales could drive a 14% increase in pre-tax profit, to £5.7m.

These forecasts will be updated in April when Sanderson publishes its FY26 results, so we’ll have to wait until then to see if expectations have changed.

In the meantime, I think Sanderson’s modest rating and discount to tangible net asset value continue to justify our broadly positive view. AMBER/GREEN.

BP (LON:BP.)

Down 4% at 459p (£71.7bn) - 2025 results - Roland - AMBER =

BP is one of the top fallers in the FTSE 100 this morning, after announcing plans to cut capital expenditure and suspend its share buyback programme in order to aid debt reduction. This is a contrast to FTSE peer Shell, which announced a further $3.5bn buyback programme with its 2025 results last week.

Profits at the group fell last year, reflecting lower oil and gas prices, but were in line with expectations (underlying replacement cost profit is an industry measure of adjusted after-tax earnings):

Underlying replacement cost (RC) profit down 16% to $7,485m

Underlying RC earnings per share down 11.7% to 48.02 cents

Consensus adj EPS: 48.6 cents

Dividend up 5.4% to 32.96 cents per share

Consensus dividend 32.1 cents per share

What seems disappointing to me – and presumably the market – is that disposal efforts to date have failed to have much impact on borrowing levels.

Despite realising $5.3bn from asset sales last year, net debt only fell by $0.8bn to $22.2bn in 2025.

Although the company has now also agreed to sell a 65% shareholding in Castrol that’s expected to generate proceeds of $6bn, interim CEO Carol Howle appears to believe further efforts are needed to meet the company’s target for net debt of $14-$18bn at the end of 2027.

To this end, she’s announced the following plans today:

2026 capital expenditure to be $13-13.5bn, at the lower end of previous guidance for $13-$15bn. This is a significant reduction from recent years (2025: $14.5bn, 2024: $16.2bn);

Share buybacks are suspended and guidance for shareholder returns to be 30%-40% of operating cash flow is “retired”;

Target for structural cost savings increased to $5.5 to $6.5bn by the end of 2027 (previously $4 to $5bn)

Buyback failure? BP spent $4.5bn on share buybacks last year and $7.1bn in 2024. Similar buybacks were made in several years previously.

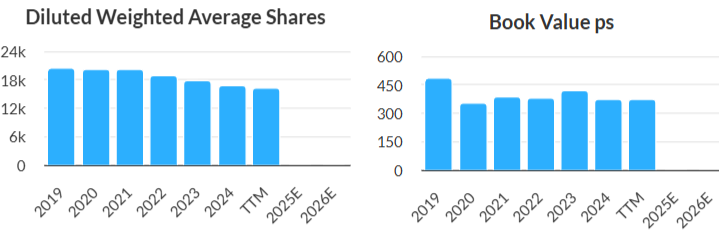

These are big numbers, but I’m not convinced they have delivered all that much shareholder value. Consider these charts for BP and Shell, respectively.

BP’s share count has fallen by 20% since 2020, but the group’s book value per share has fallen by 4% to c.340c over the same period, using today’s 2025 accounts:

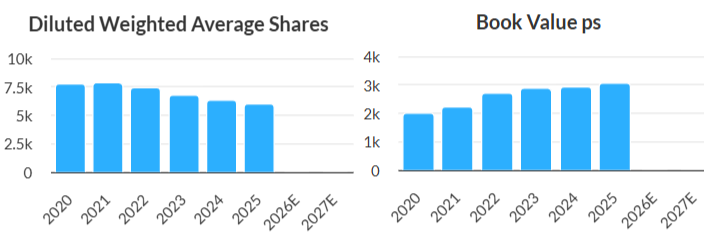

Buybacks at Shell have created a much more pleasing result. The average share count has fallen by 24% since 2020, supporting a 53% increase in book value per share over the same period:

Roland’s view

BP’s book value has not been helped by the $4bn impairment charge reported today. This primarily applies to biogas and offshore wind assets. This write-off contributed to a $6bn drop in shareholder equity last year, to $53.0bn.

The company’s new stronger focus on reducing net debt is welcome, but it would have been better if disposal proceeds and strong cash flow from higher oil prices had been used more prudently previously to strengthen the balance sheet and create value for shareholders. Making the same cuts now – against a backdrop of lower oil prices – may be more difficult and painful.

There are some potential bright spots, though. The partial sale of Castrol will bring in much needed cash. Meanwhile, the company’s initial estimates suggest that last year’s Bumerangue discovery off the coast of Brazil could potentially have 8bn barrels of liquids in place. Freeing up cash to invest in the group’s upstream portfolio could help to drive reliable long-term returns for shareholders.

We should know more about the group’s strategy and financial plans after new CEO Meg O’Neill takes charge in April.

Although I suspect chairman Albert Manifold is actively driving strategy at the moment, Ms O’Neill (a former Exxon exec and until recently the CEO of Woodside Energy) has deep industry experience which Manifold lacks. I would hope that O’Neill can bring new clarity and discipline to BP’s strategy and operations.

Until that time, the situation is neither good enough nor bad enough to tempt me to change my previous neutral view on this FTSE 100 stalwart. BP shares also continue to offer a useful 5%+ dividend yield. AMBER.

Dunelm (LON:DNLM)

Up 0.6% at 943p (£1.93bn) - Interim Results - Roland - AMBER/GREEN =

(At the time of publication, Roland has a long position in DNLM.)

Dunelm’s share price fell by almost 20% in a day in January, when the company warned that full-year results were likely to be at the lower end of expectations.

Today’s half-year results show the expected weakness following disappointing Q2 trading but full-year guidance remains unchanged, as I’d expect less than a month after January’s update.

In this review I’ll look at today’s half-year numbers and consider any potential concerns. I’ll also consider new CEO Clo Moriarty’s inital plans for the business.

H1 2025 results summary

Dunelm has a reputation for strong margins and good cash generation. Both of these traits are on display here, despite weak H1 sales performance and a fall in half-year profits:

Sales up 3.6% to £926.3m

Gross margin up 0.6% to 53.4%

Operating margin: 12.9% (HY25: 14.4%)

Pre-tax profit down 7.5% to £114m

Free cash flow +1.7% to £171.4m

Adjusted earnings down 7.3% to 41.7p

Dunelm’s gross margins improved during the period thanks to FX gains and stable pricing, but the group’s operating margin fell as weaker Q2 sales failed to offset higher costs. A couple of specific factors are highlighted by management:

Weaker Q2 sales: the period in question is Oct-Dec, when Black Friday and heavy pre-Christmas discounting occurs in the wider retail market. Dunelm doesn’t tend to participate much as the company holds its two main sales in January and June. However, this is the third year in a row where Q2 has seen lower growth. The company now says it’s “reviewing the role our Q2 trading approach plays for customers and the impact on our business”.

Net operating costs +9.2% to £375m: in addition to wage growth and expansion costs, this included £11m of “volume related costs” attributed to logistics and performance marketing relating to digital sales.

Dividends: negative working capital (customers often pay Dunelm before the company pays its suppliers) helps to support excellent conversion from profit to free cash flow.

Shareholders are rewarded with an increase to the ordinary dividend and another special dividend, albeit smaller than last year:

Ordinary dividend up 3% to 17.0p

Special dividend: 25p (HY25: 35p)

Dividend payouts are managed to keep leverage within a range of 0.2x to 0.6x leverage and to maintain dividend cover between 1.75x and 2.25x. Dunelm’s family ownership means it prefers special dividends to buybacks. This is an approach I strongly agree with as a long-term shareholder.

Furniture - growing pains? One of Dunelm’s growth initiatives in recent years has been an expanded move into the furniture market. While this is logically adjacent to Dunelm’s core homewares market, competing in furniture does also expose the group to a new cohort of strong competitors (e.g. Next, Ikea, DFS) and supply chain challenges.

I am starting to get the impression that the expansion into furniture may be bringing some growing pains. Several points are highlighted in today’s commentary:

Subdued consumer spending and heavy Black Friday discounting in Q2 have “generally impacted” furniture sales;

Also… “the forecasting and ordering of a small number of key product lines did not match up to customer demand, resulting in availability shortfalls for those products.”

This sounds to me as though sales slowed for some products and were lost for others, due to stock shortfalls. Not an ideal scenario, but one that should be fixable.

Some brief AI research also suggests that customer reviews reflect the relatively immaturity of the furniture business. While customers generally appear to like the furniture products and pricing, there are more mixed comments about quality, availability and customer service for furniture-specific issues.

In contrast, AI summarises customer feedback on the core homewares business as being more positive.

CEO strategy comments: CEO Clo Moriarity has now been in the role since October. In these results she’s summarised her initial thoughts and priorities for the business. Some of the points that stand out to me are:

Brand awareness is c.90%, but “consideration to buy” is lower, providing opportunities for improved conversion of awareness into sales.

While Textiles is a particular strength, Dunelm doesn’t perform so well against customers’ purchasing criteria in some other areas, providing an opportunity for growth.

Customer loyalty: one-third of customers generate two-third of sales. See opportunities for further sales growth from loyal customers.

Product choice: have over 100,000 SKUs, providing excellent choice. But the “vast majority” of sales come from “only half the products we sell”. Sees opportunities to make product ranges “clearer and simpler”.

Physical and digital reach: stores support 70% of sales, but only 60% of the UK population live within a 15-minute drive of a Dunelm store. Sees opportunities for new locations “without significant risk of cannibalisation”. In Digital, sees opportunities to expand presence in AI-driven search results and social media – both are important areas for lead generation and sales.

Customer satisfaction: sees opportunities for improvement “by fulfilment channel”. Home Delivery is highlighted as an area for improvement.

Ms Moriarty sums up by suggesting that with a combined market share of 7.9% (homewares and furniture), Dunelm’s market share in its sectors is much lower than some other leading retailers.

While I think this is a fair point, I would like to see market share split out into homewares and furniture. I wonder if this might suggest a greater level of saturation in the core homewares business.

Outlook: guidance for the remainder of the year sounds confident and suggests some recovery in trading since Christmas:

Following a softer Q2, we have seen stronger sales growth in Q3 to date, more in line with H1 as a whole

The consumer environment remains challenging, with variable trading patterns

We remain confident in our plans for the second half, with the full launch of our app planned for spring and furniture availability recovery plans in place

We expect PBT for FY26 to be in line with current consensus expectations

Consensus expectations are stated as for FY26 pre-tax profit of £214m, within a range of £210 to £221m. That’s reasonably narrow, suggesting to me that analysts are fairly confident in the company’s guidance at this stage in the year.

Roland’s view

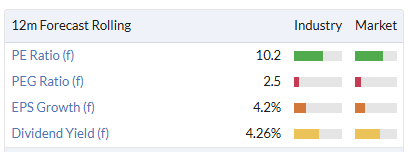

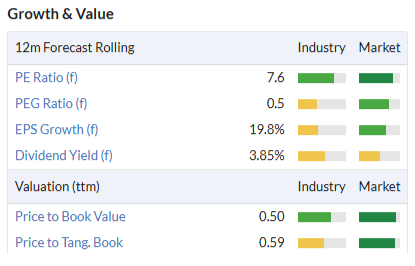

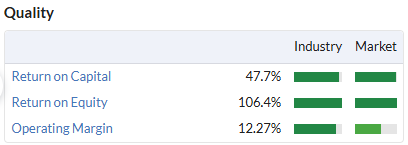

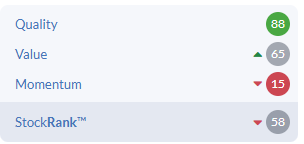

While I’m obviously biased as a shareholder, I view Dunelm as one of the higher-quality listed UK retailers. Its capital-light business model consistently translates into excellent quality metrics:

These factors support strong cash generation and generous dividends. Consensus forecasts currently suggest a total payout of c.55p per share for FY26, giving a forward yield that’s close to 6%.

I am inclined to think that the company’s position and market share in its core homewares market is fairly secure. However, after many years of expansion, I think it’s fair to be a little more cautious about the group’s growth potential.

New store openings may need to cater for smaller or less concentrated populations, while the move into furniture appears to be bringing its own challenges.

In October, Mark argued that the stock’s mid-teens valuation was probably one factor behind the large share price fall in response to a modest downgrade. Dunelm’s share price has been fairly flat since then, meaning the valuation is now more modest on c.12x earnings:

The StockRanks view the shares with a Contrarian styling and I am tempted to agree that there is some value on offer here. However, I am a little wary about the low MomentumRank given the short time that’s elapsed since January’s downgrade:

Weak momentum and Dunelm’s heavy exposure to subdued UK consumer spending mean I’m going to leave our AMBER/GREEN view unchanged today. However, with the shares trading under £10, I would probably be inclined to turn positive if signs emerge of stronger sales growth.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.